WLFI Token Unlock Schedule: Key Dates, Vesting Periods, and Price Impact

WLFI Token Unlock. In essence, each unlock event is far more than just a simple “token release” into the market. It represents a truthful reflection of three core dynamics — value, liquidity, and community confidence — as once-locked assets gradually re-enter circulation. For WLFI investors, understanding the unlock schedule is like holding a strategic roadmap: it helps you anticipate market shifts, seize opportunities, and make informed decisions ahead of every key phase.

As WLFI becomes increasingly integrated into the USD1 stablecoin ecosystem, every unlock milestone carries meaning that goes beyond mere token numbers. It stands as proof of the project’s transparency, governance strength, and long-term vision. While short-term volatility is inevitable, a clear and well-planned vesting schedule forms the foundation of trust and sustainable growth.

That’s why tracking the WLFI Unlock Schedule and managing your assets securely and proactively has never been more important. At this point, Bitget Wallet stands out as a reliable choice — a secure, multi-chain wallet fully supporting WLFI and USD1 across Ethereum, BNB Chain, and Solana, allowing investors to easily monitor unlock progress with just a few taps.

So, what makes the WLFI Token Unlock one of the most anticipated events of 2025? And how might it influence the broader trend of decentralized finance in the years ahead? Let’s dive deeper and uncover the full picture in this article.

What You Need to Know About the WLFI Token Unlock in 2025

A token unlock releases portions of a project’s total supply over time according to its vesting plan. In WLFI’s case, this process was engineered to protect early investors while ensuring long-term alignment between contributors, holders, and the ecosystem itself.

- Native token: WLFI powers the World Liberty Financial platform — a hybrid DeFi ecosystem linked to the Trump Crypto Project and supported by the USD1 stablecoin.

- Tokenomics Model: Follows a transparent 24-month schedule aimed at maintaining price equilibrium and preventing sudden dilution.

Unlocks also serve as public checkpoints: each event updates circulating supply metrics, reinforcing trust among traders and institutions.

How Do Unlocks and Vesting Schedules Work in WLFI?

WLFI’s vesting separates allocations for founders, investors, advisors, and community rewards. Tokens remain locked in a Lockbox smart-contract system, automatically releasing when vesting conditions are met.

This “Lockbox Model” ensures incentive alignment—teams earn tokens progressively, discouraging early dumping while encouraging long-term development.

When Are the Key WLFI Token Unlock Dates and Periods?

The WLFI Unlock Schedule spans from Q1 2023 to Q4 2026. The first major unlock occurred on September 1, 2025, releasing 20% of early-investor tokens—approximately 5% of total supply. Each subsequent quarter continues unlocking portions across stakeholder groups.

| Category | Allocation % | Vesting Period | Unlock Start Date | Notes |

| Core Team | 18 % | 24 months | Jan 2024 | Linear monthly unlocks |

| Early Investors | 25 % | 18 months | Sep 2025 | First 20 % released |

| Advisors | 7 % | 12 months | Jun 2025 | Quarterly release |

| Community Rewards | 20 % | 36 months | Jan 2024 | Continuous distribution |

| Public Sale | 10 % | Immediate | Jul 2023 | Fully circulating |

| Treasury & Liquidity | 20 % | 30 months | Jul 2024 | Controlled disbursement |

Unlocks typically occur every quarter, maintaining predictable circulation updates.

What Exchanges Support WLFI Unlock Tracking?

WLFI can be monitored on major venues such as Binance, OKX, and Bitget.

Among these, Bitget Wallet offers the most seamless multi-chain experience—allowing users to view unlock calendars, price charts, and USD1 pair liquidity within a single interface.

How Does the WLFI Token Unlock Affect Price and Market Behavior?

Token unlocks directly influence the supply-demand balance. Before large releases, traders often anticipate increased liquidity, causing temporary dips or speculative surges.

Based on recent on-chain and market data, the last WLFI unlock was preceded by a $4.6 billion derivatives-volume spike and followed by a $1.4 million buyback and burn aimed at stabilizing price action. Treasury movements indicated resilience, maintaining WLFI’s $0.20 support–resistance range, while the token sustained strong on-chain activity despite the increased float.

Source: finance.yahoo.com

Will WLFI’s Buyback Program Offset Selling Pressure?

Yes—partially. WLFI’s governance-approved buyback and burn mechanism continuously removes tokens from circulation. As of October 2025, 7.89 million WLFI have been burned, with 3.06 million pending on Solana.

Funded by 100% of protocol liquidity fees, this initiative offsets supply expansions from unlocks and reflects proactive treasury management.

How Does WLFI Compare With Other Token Unlock Models in the Industry?

Compared with peers, WLFI’s 24-month vesting strikes a balanced midpoint—more gradual than Alpha’s 12 months yet more agile than Beta’s 36 months. This pacing minimizes market shocks while preserving liquidity for ecosystem growth.

Furthermore, WLFI’s structured release has attracted institutional interest and underpins its ambitions in RWA (real-world asset) tokenization, bridging DeFi yield with tangible collateral.

What Can Investors Learn From WLFI’s Tokenomics Design?

Key insights include:

- Transparent, contract-based unlocks enhance market trust.

- Gradual vesting ensures fair valuation discovery.

- Community governance and treasury buybacks stabilize volatility.

External analytics—Coinglass, CoinGecko, and Nansen—confirm consistent open-interest growth and steady circulation trends. As always, investors should conduct due diligence before engaging in WLFI-related trades.

How to Track WLFI Token Unlocks and Price Movements Easily?

For convenience, several reliable tools aggregate WLFI’s unlock data:

| Platform / Tool | Function |

| WLFI Official Website | Unlock calendar & project announcements |

| Dune Analytics Dashboard | On-chain unlock metrics & charts |

| Binance & OKX Listings | Real-time price data |

| Bitget Wallet | Integrated unlock tracking & portfolio alerts |

Can You Receive Unlock Alerts or Notifications?

Yes. Bitget Wallet users can enable real-time alerts for unlock events, price thresholds, and vesting milestones. The app’s multi-chain compatibility—Ethereum, BNB Chain, and Solana—lets holders synchronize WLFI and USD1 assets seamlessly.

How Is USD1 Stablecoin Linked to WLFI’s Unlock and Ecosystem Growth?

The USD1 stablecoin forms the liquidity backbone of World Liberty Financial. Integrated with Solana, Raydium, Kamino, and Upbit, USD1 ensures consistent trading pairs and liquidity depth.

Each WLFI Token Unlock expands available staking and lending capacity, indirectly supporting USD1’s stability. However, transparency remains crucial—recent concerns over attestation reports and BitGo custody emphasize the need for continual audits and disclosures.

Does USD1 Influence WLFI’s Price and Investor Confidence?

Absolutely. WLFI and USD1 operate symbiotically: WLFI’s utility drives USD1 demand, while USD1’s liquidity anchors WLFI market confidence. Future regulations, such as the 2027 GENIUS Act, could shape compliance frameworks but may also legitimize this stablecoin-linked model further.

How to Trade and Store WLFI Safely Using Bitget Wallet?

Bitget Wallet is an officially listed provider within the World Liberty Financial (WLFI) ecosystem, offering a secure, convenient way to store, trade, and track WLFI Token Unlock events. It supports multi-chain management across Ethereum, BNB Chain, and Solana, ideal for both WLFI and USD1 stablecoin holders.

Beyond storage, Bitget Wallet delivers real-time unlock tracking, price monitoring, and portfolio insights, letting users view unlock schedules and vesting timelines directly in-app.

Key Benefits of Using Bitget Wallet for WLFI

- Real-Time Unlock Tracking: Stay updated with WLFI Token Unlock data, supply changes, and price impact.

- Cross-Chain Management: Swap WLFI and USD1 across multiple networks seamlessly.

- Low-Fee Swaps: Access aggregated DEX liquidity and optimized gas fees.

- Institutional-Grade Security: MPC protection, non-custodial control, and biometric verification.

- User-Friendly Interface: Intuitive design with unlock alerts and transaction history.

Bitget Wallet also integrates smoothly with Binance and OKX, simplifying transfers for unlock-related trading without complex setup.

CTA: Download Bitget Wallet to track WLFI unlocks, manage your USD1 stablecoins, and trade cross-chain with ease.

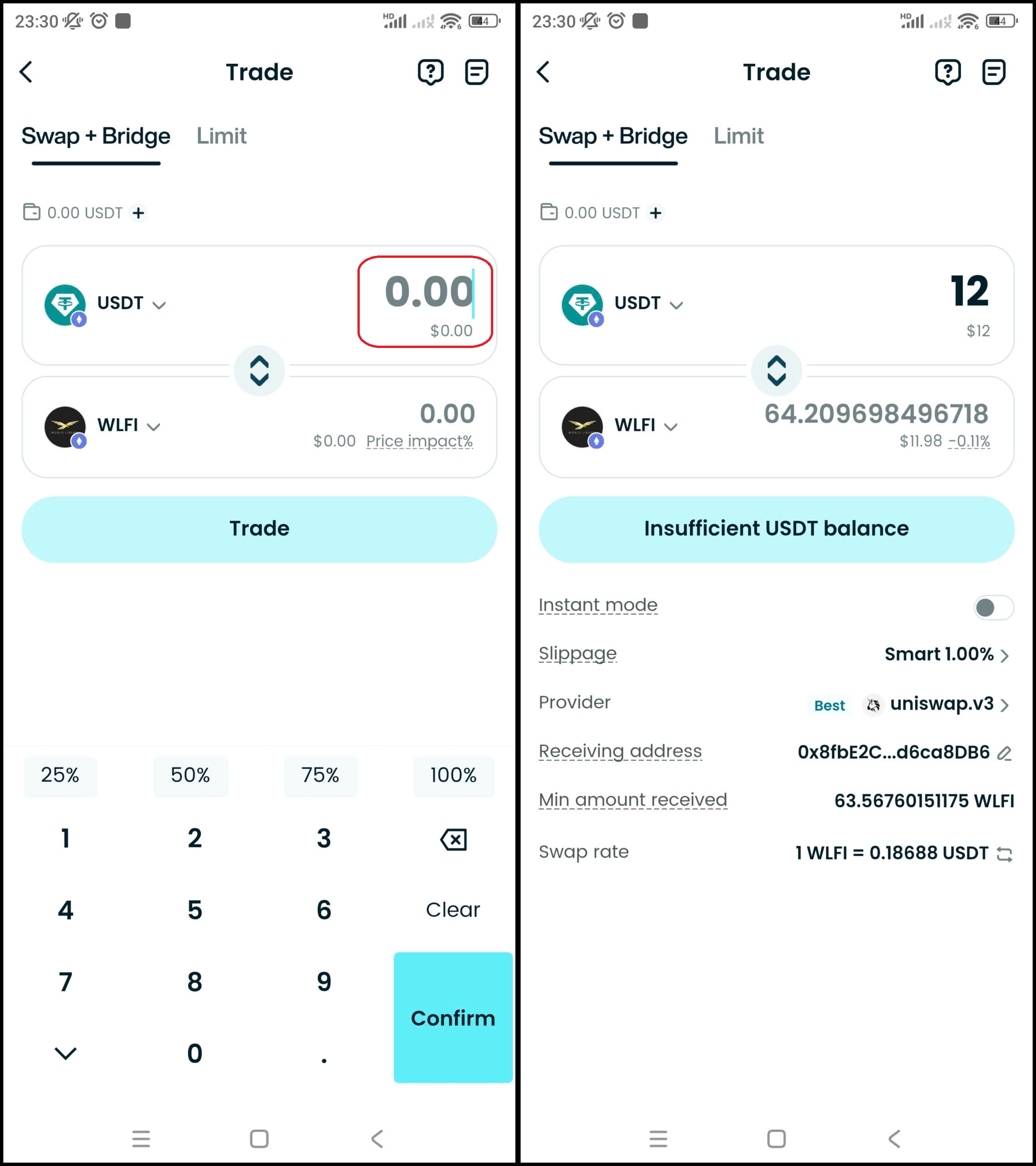

How to Buy World Liberty Financial (WLFI) on Bitget Wallet?

How to Buy World Liberty Financial (WLFI) on Bitget Wallet is easier than ever in 2025. WLFI powers DeFi, NFTs, and Web3 apps, and Bitget Wallet lets you buy, store, and swap it securely — all in one non-custodial app trusted by 80M+ users.

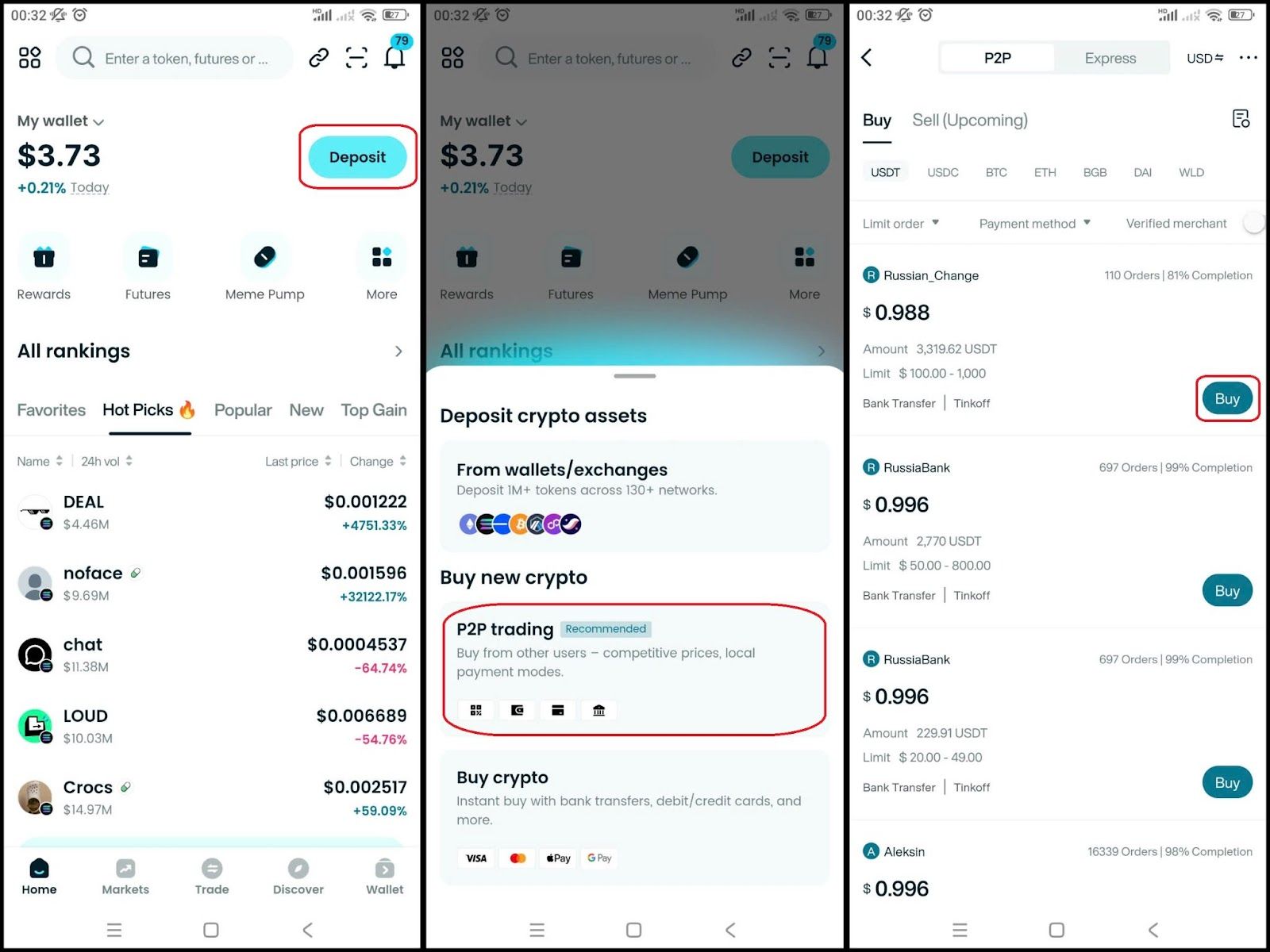

Step 1: Create a wallet

- If you don't have a wallet, download Bitget Wallet app now.

- Register with your phone number or email, verify quickly and you can use it right away.

Step 2: Deposit money into your wallet

Once you have finished your wallet, you just need to deposit money into it. You can:

- Transfer coins from other wallets: Send BTC, ETH or any coin you have from an external wallet.

- Buy directly with a card: Use a bank card or credit card to buy USDT or ETH right in the app and then exchange it for USDC.

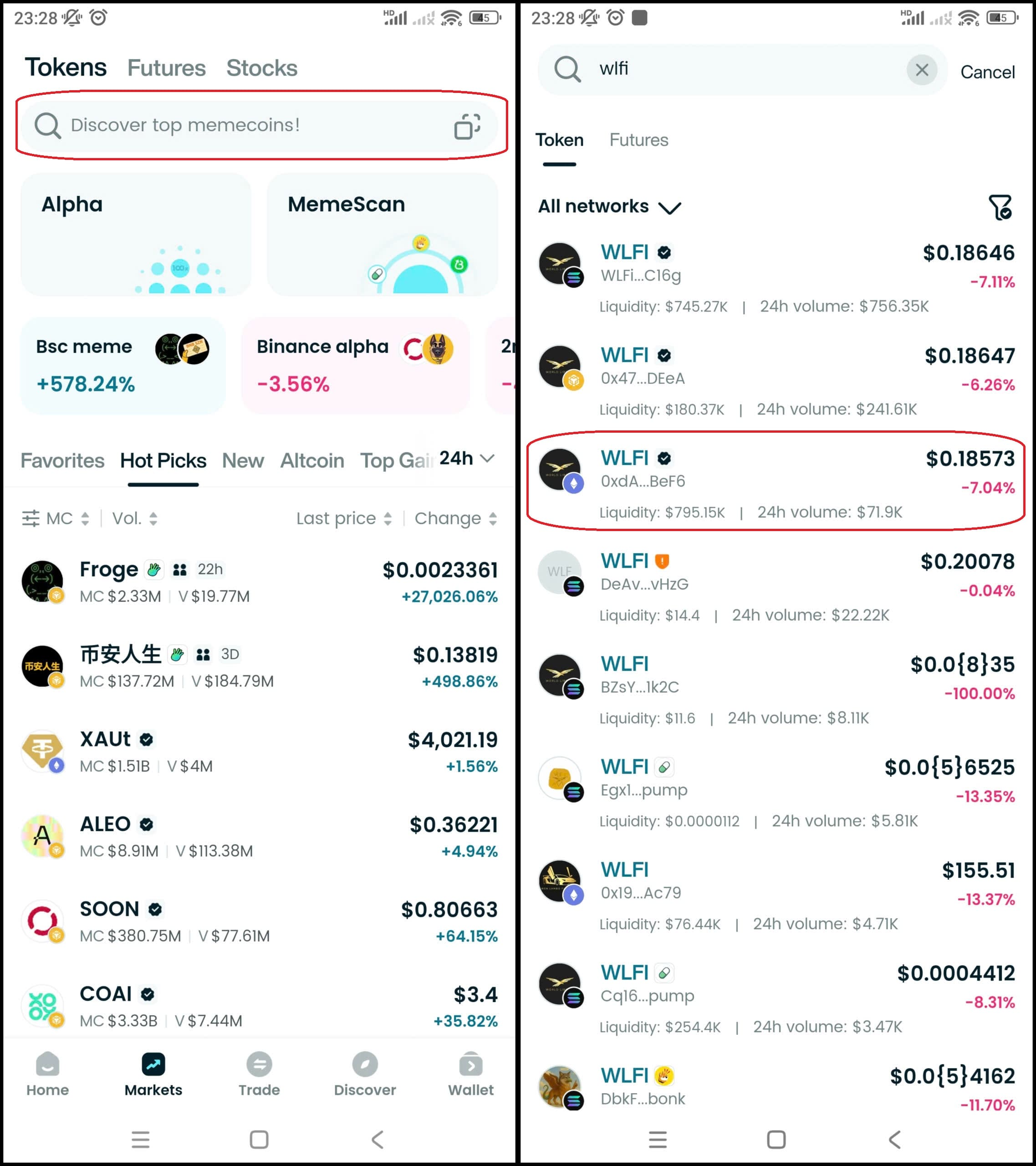

Step 3: Find World Liberty Financial (WLFI)

- In the main interface of the wallet, go to Market, type "WLFI" in the search bar.

- Select World Liberty Financial (WLFI) to see the trading page.

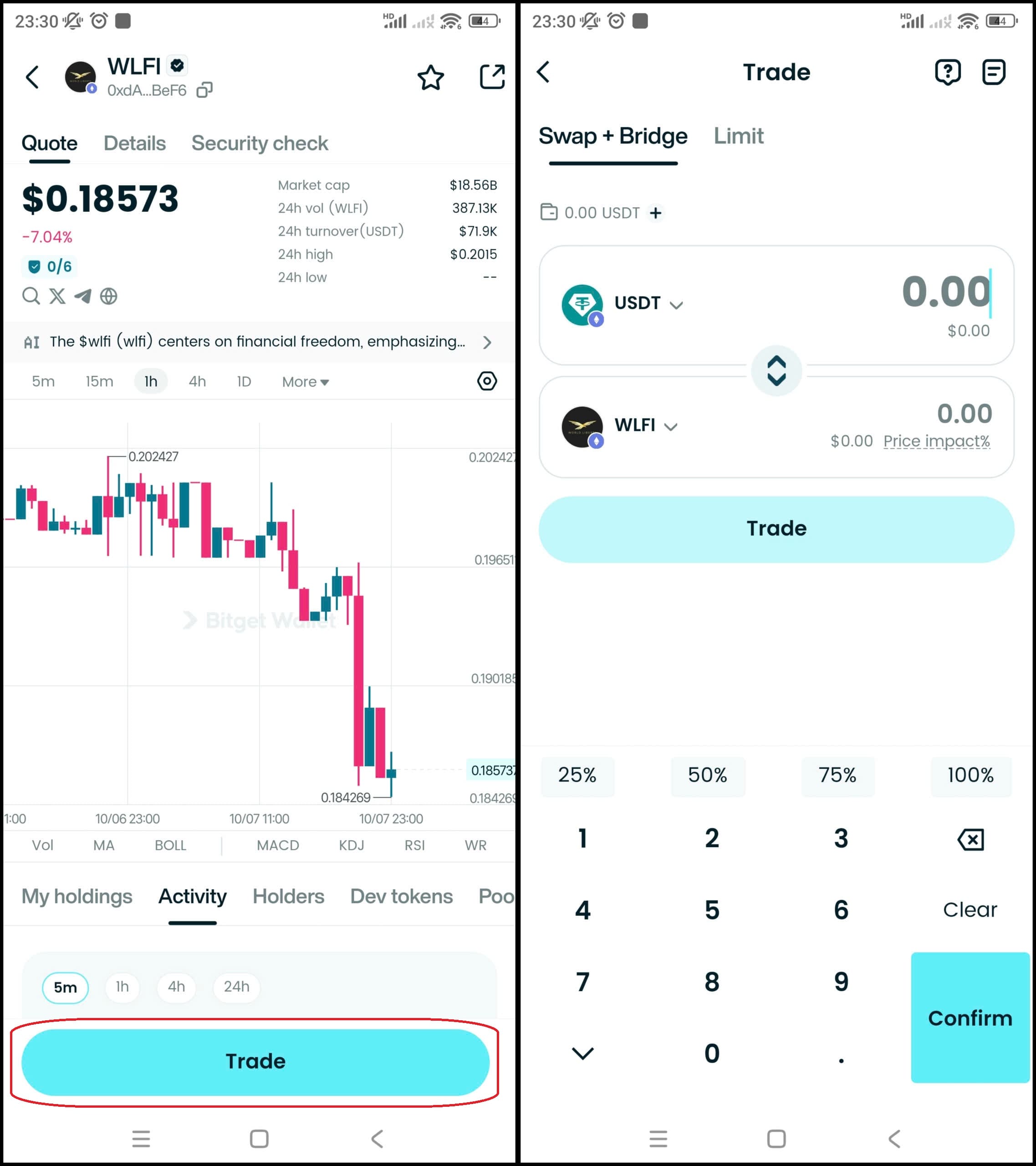

Step 4: Select the trading pair

Select the pair you want to trade, for example WLFI/USDT. So you can use USDT to buy World Liberty Financial (WLFI), or vice versa.

Step 5: Place an order

Enter the amount of World Liberty Financial (WLFI) you want to buy, check carefully and confirm the order.

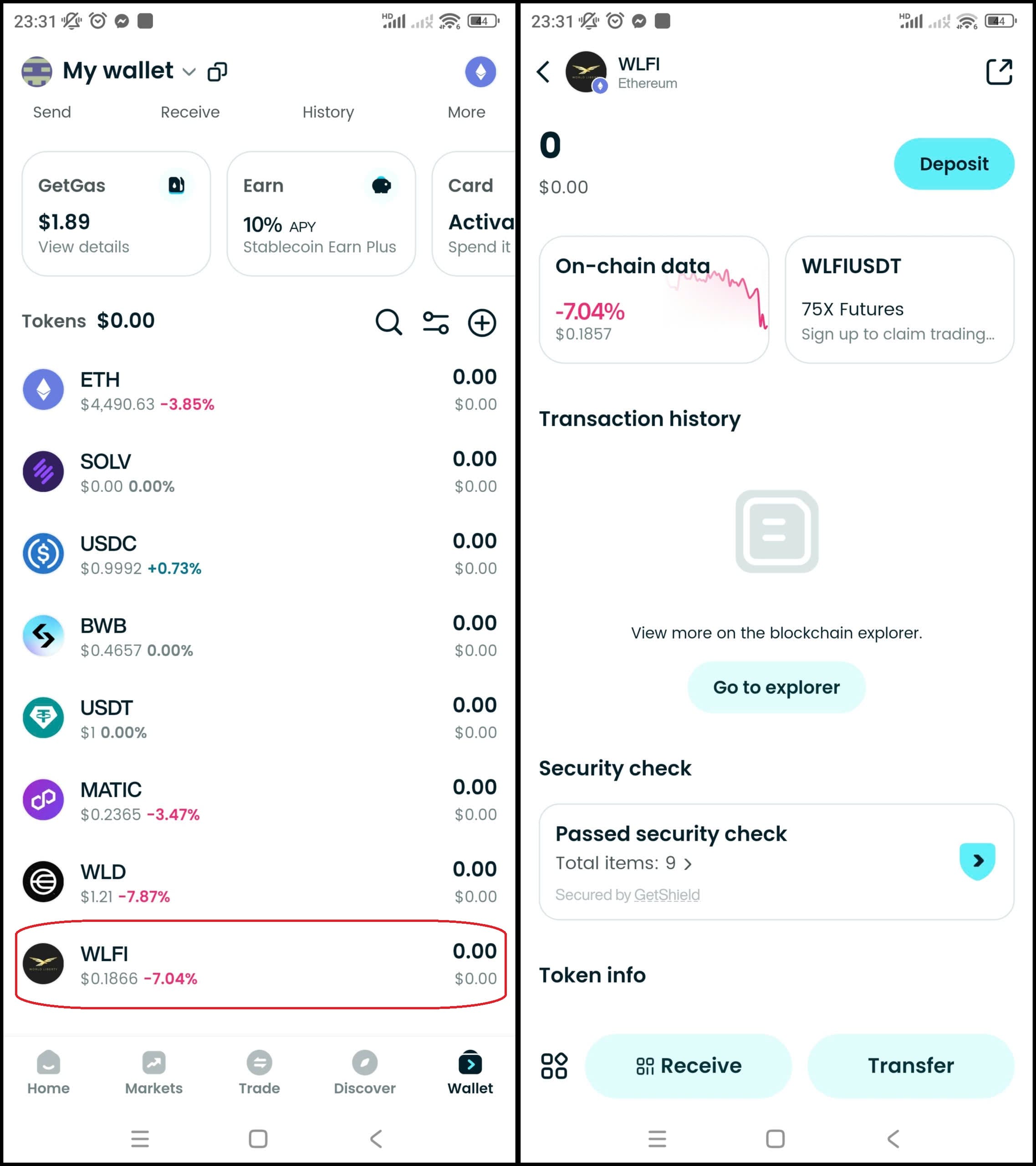

Step 6: Check the order

After buying, you can check your WLFI in the Wallet section.

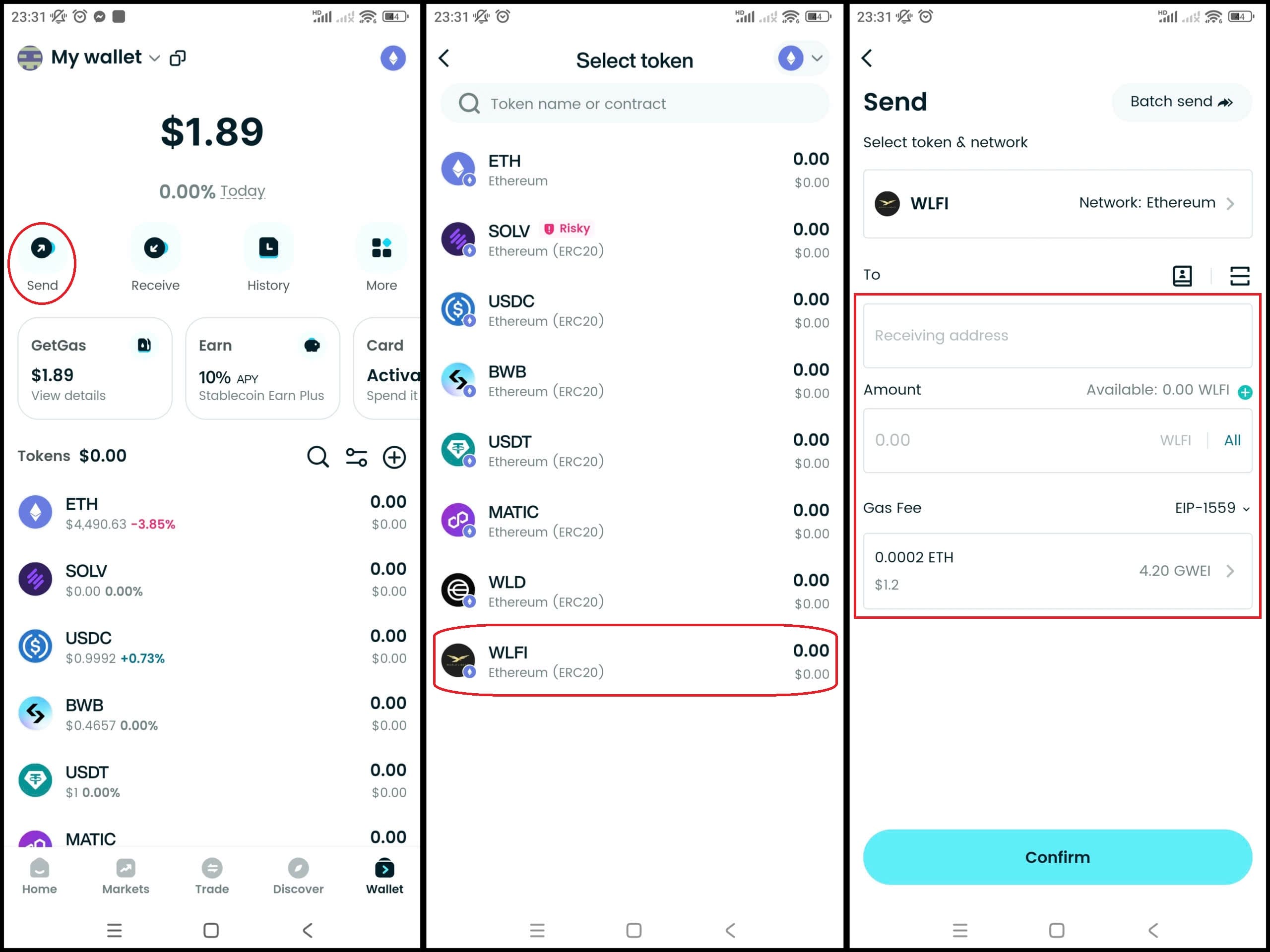

Step 7: Withdraw (if needed)

Once you have World Liberty Financial (WLFI), if you want to withdraw to another wallet, go to Withdraw, fill in the receiving wallet address, check the blockchain network and the amount carefully, then confirm.

▶Learn more about World Liberty Financial (WLFI) :

- MetaMask vs Bitget Wallet: Which Is Better in 2025?

- Trust Wallet vs Bitget Wallet: Which One Is Better in 2025?

- Phantom vs Bitget Wallet: Which One Is Better?

- What is World Liberty Financial (WLFI)?

- World Liberty Financial (WLFI) Listing Date and How to Buy It

- What is USD1 Stablecoin

Conclusion

Understanding the WLFI Token Unlock Schedule is essential for anyone following World Liberty Financial’s roadmap. Each unlock period reshapes token circulation, liquidity, and investor confidence—core drivers of WLFI’s evolving price dynamics.

Through a mix of structured vesting, buyback programs, and USD1 integration, WLFI demonstrates a deliberate strategy to balance growth and stability. Its transparent vesting model and multi-chain architecture set a precedent for responsible DeFi governance.

For traders and holders alike, staying informed is the best defense against volatility. Tools such as Bitget Wallet make it effortless to monitor unlock calendars, manage cross-chain assets, and react promptly to market events.

Manage your WLFI and USD1 in one secure, multi-chain app — download Bitget Wallet today to stay ahead of the next unlock.

Sign up Bitget Wallet now - grab your $2 bonus!

FAQs

1. When is the next WLFI Token Unlock date?

The next scheduled unlock is projected for December 1, 2025, releasing 10 % of the remaining investor allocation.

2. How many WLFI tokens are still locked?

Roughly 62 % of total supply remains locked under the Lockbox system until 2026.

3. Does the buyback program reduce circulating supply permanently?

Yes. All burned tokens are sent to a verifiable null address on Solana and Ethereum.

4. Where can investors track official updates?

Follow WLFI’s official site, Dune dashboards, and Bitget Wallet’s in-app notifications for real-time updates.

Risk Disclosure

Please be aware that cryptocurrency trading involves high market risk. Bitget Wallet is not responsible for any trading losses incurred. Always perform your own research and trade responsibly.