What Is EdgeX (EDGEX): Inside the Circle-Backed Protocol Powering Decentralized Derivatives

What Is EdgeX (EDGEX)? EdgeX (EDGEX) goes beyond being a conventional digital asset—it represents the evolution of decentralized derivatives trading while encapsulating the core principles of decentralized finance (DeFi): transparency, self-custody, and high-performance execution. By integrating institutional-grade trading infrastructure with blockchain-based settlement, EdgeX aims to bridge the efficiency of centralized exchanges with the security of on-chain systems.

Backed by Circle Ventures, EdgeX is building beyond short-term hype. With native USDC and CCTP integration on EDGE Chain, it aims to improve liquidity and cross-chain efficiency. This article breaks down EdgeX (EDGEX), its decentralized perpetual and spot model, and what its potential token launch could mean while noting that Bitget Wallet supports secure stablecoin storage, hot memecoin trading, and seamless cross-chain access.

Key Takeaways

- EdgeX is a decentralized perpetual and spot trading protocol, designed to combine high-performance order-book execution with on-chain settlement and self-custody principles.

- Circle Ventures has invested in EdgeX, with plans to bring native USDC and Cross-Chain Transfer Protocol (CCTP) integration to the EDGE Chain, strengthening liquidity and cross-chain capital efficiency.

- The anticipated EDGEX token is linked to the exchange ecosystem, but investors should verify official token generation event (TGE), listing details, and confirmed ticker information before making decisions.

What Is EdgeX and Why It Matters?

EdgeX is a decentralized perpetual and spot trading protocol built to deliver high-performance derivatives trading while preserving self-custody and on-chain settlement. It aims to combine centralized exchange–level speed and order-book depth with DeFi transparency, and has gained strategic backing from Circle Ventures, with plans to integrate native USDC and Cross-Chain Transfer Protocol (CCTP) on the EDGE Chain.

Why It Matters

EdgeX matters because it targets one of DeFi’s key gaps: scalable, capital-efficient derivatives trading without sacrificing asset control. With institutional-grade infrastructure design and planned USDC liquidity integration, it positions itself as a potential bridge between centralized exchange performance and decentralized security in the evolving crypto derivatives market.

Source: X

EdgeX (EDGEX) Listing: Key Details and Trading Schedule

1. Key Listing Information

Here are the important details about the EdgeX (EDGEX) listing:

- Exchange: To be announced

- Trading Pair: EDGEX/USDT

- Deposit Available: To be announced

- Trading Start: To be announced

- Withdrawal Available: To be announced

Don’t miss your chance to start trading EdgeX (EDGEX) on exchanges and be part of this groundbreaking journey.

- Please refer to the official announcement for the most accurate schedule.

EdgeX (EDGEX) Price Prediction and Outlook 2026

The value of EdgeX (EDGEX) will largely be shaped by overall crypto market conditions, derivatives trading demand, and the success of its ecosystem expansion following Circle Ventures’ backing. If the Token Generation Event (TGE) proceeds as anticipated and exchange liquidity is strong, EDGEX could initially trade within a speculative range of $0.20–$0.60, depending on circulating supply and market sentiment. Should EdgeX successfully expand perpetual and spot trading adoption while integrating native USDC and CCTP on the EDGE Chain, the token could trend toward a $0.80–$1.20 longer-term range in a favorable 2026 market environment.

Key Factors Impacting EdgeX (EDGEX) Price

Several aspects influence the potential price movement of EdgeX (EDGEX):

- Market Conditions: Broader crypto cycles, Bitcoin dominance, derivatives volume growth, and macroeconomic liquidity directly affect risk appetite for new exchange tokens.

- Adoption & Utility: Real trading activity on the EdgeX platform, USDC liquidity depth, fee incentives, staking mechanisms (if introduced), and ecosystem utility will determine sustainable token demand.

- Project Expansion: Integration of Circle’s USDC and Cross-Chain Transfer Protocol (CCTP), new exchange listings, ecosystem partnerships, and derivatives market share growth could materially impact valuation.

Future Price Outlook

As EdgeX (EDGEX) positions itself within the decentralized derivatives sector, increased platform usage and capital inflow may strengthen token demand. If the protocol successfully captures meaningful perpetual trading volume and leverages Circle-backed liquidity infrastructure, the token could trend toward the upper range of projected scenarios. However, investors should evaluate tokenomics transparency, unlock schedules, exchange liquidity conditions, regulatory developments, and broader market volatility before making investment decisions.

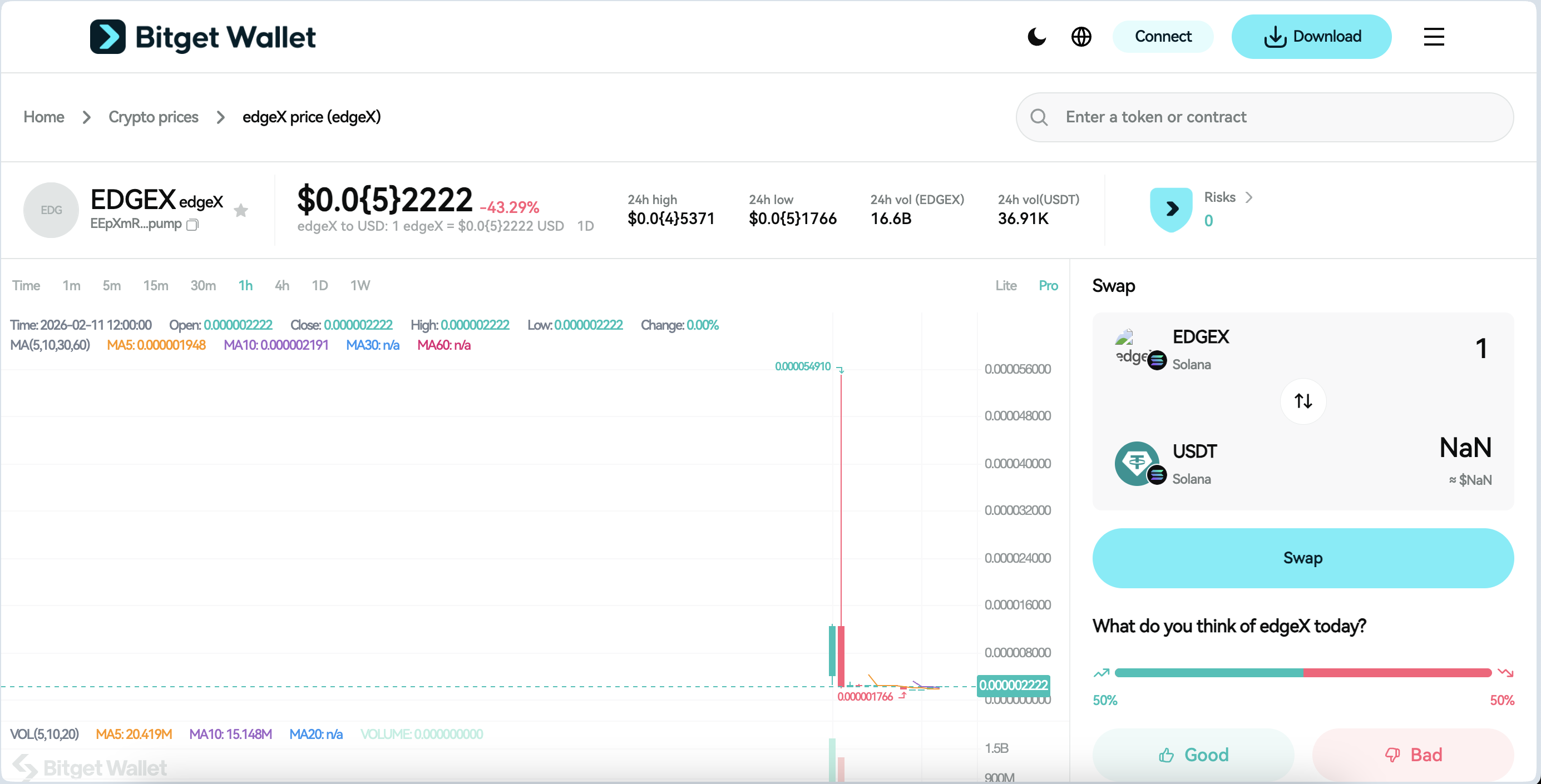

Source: Bitget Wallet

EdgeX (EDGEX) Features: What Sets It Apart?

The standout features of EdgeX (EDGEX) include:

1. High-Performance Order-Book Trading

EdgeX is designed to deliver centralized exchange–level performance while maintaining decentralized custody. Unlike many AMM-based derivatives platforms, it utilizes an order-book model optimized for low latency, tighter spreads, and deeper liquidity—making it attractive to professional and high-frequency traders seeking capital efficiency.

2. Native USDC & CCTP Integration (EDGE Chain)

With strategic backing from Circle Ventures, EdgeX plans to integrate native USDC and Circle’s Cross-Chain Transfer Protocol (CCTP) on the EDGE Chain. This enables regulated stablecoin settlement and seamless cross-chain capital movement, improving liquidity access and reducing friction for traders operating across multiple blockchain ecosystems.

3. Decentralized Settlement with Self-Custody

EdgeX aims to combine high-speed matching infrastructure with on-chain settlement, allowing users to maintain control of their assets. This hybrid structure bridges centralized exchange performance with DeFi transparency, reducing custodial risk while preserving trading efficiency.

How EdgeX (EDGEX) Works and Delivers Value?

The architecture of EdgeX is structured to combine high-performance trading infrastructure with decentralized settlement, enabling scalable derivatives trading while preserving self-custody principles.

1. Blockchain Infrastructure

EdgeX operates on the EDGE Chain, a specialized Layer-2–style infrastructure optimized for high-throughput derivatives trading. The system is designed to deliver low latency, efficient order matching, and scalable execution while settling transactions on-chain for transparency and security. Planned integration of native USDC and Circle’s Cross-Chain Transfer Protocol (CCTP) enhances cross-chain liquidity movement and reduces capital fragmentation across networks.

2. Token Utility

The anticipated EDGEX token is expected to serve as a core utility asset within the ecosystem. Potential functions may include fee discounts, staking incentives, liquidity rewards, governance participation, and ecosystem alignment mechanisms. If structured similarly to other exchange tokens, EDGEX could also play a role in incentivizing trading activity, supporting liquidity programs, and strengthening long-term platform engagement.

Governance & Community Engagement

Holders of $EDGEX may gain participation rights in governance decisions such as protocol upgrades, fee structure adjustments, ecosystem expansion initiatives, and incentive program allocations (subject to final tokenomics confirmation). Community engagement is expected to play a role in aligning trader incentives with platform growth, reinforcing decentralized participation within the EdgeX trading ecosystem.

The Team Behind EdgeX (EDGEX): Experts Driving Innovation

The Team

While EdgeX has not publicly disclosed a fully detailed executive roster, the project positions itself as being built by professionals with backgrounds in derivatives trading infrastructure, exchange architecture, and blockchain engineering. Its strategic direction reflects a focus on high-performance order-book systems combined with decentralized settlement design.

Key elements supporting the project include:

- Vision: Building a decentralized perpetual and spot trading protocol that combines centralized exchange performance with on-chain transparency and self-custody.

- Partnerships: Strategic backing from Circle Ventures, with planned native USDC and CCTP integration on the EDGE Chain to enhance liquidity and cross-chain capital efficiency.

- Infrastructure Focus: Development of a high-throughput trading environment optimized for derivatives markets.

Expert Insights

Industry observers view EdgeX’s positioning within the decentralized derivatives sector as strategically aligned with growing demand for scalable, capital-efficient trading platforms. The integration of regulated stablecoin infrastructure (USDC) and cross-chain settlement capabilities signals an attempt to bridge institutional liquidity standards with DeFi execution models. If execution matches roadmap expectations, EdgeX could compete within the evolving landscape of performance-driven decentralized exchanges.

Key Use Cases of EdgeX (EDGEX): How It’s Transforming the Decentralized Derivatives Industry

EdgeX (EDGEX) serves multiple practical functions within the decentralized derivatives ecosystem. It enables perpetual futures trading with leveraged long and short positions, supports spot market execution with performance-oriented order-book infrastructure, and aims to enhance capital efficiency through planned native USDC and Cross-Chain Transfer Protocol (CCTP) integration on the EDGE Chain. By combining self-custodial trading with scalable liquidity access, EdgeX positions itself as a platform designed for active traders seeking both execution quality and decentralized security.

How EdgeX (EDGEX) Is Transforming the Decentralized Derivatives Industry

EdgeX is contributing to the evolution of decentralized derivatives by emphasizing infrastructure performance rather than purely automated market maker models. Through exchange-style execution, planned USDC liquidity integration, and on-chain settlement, it attempts to narrow the gap between centralized exchange efficiency and DeFi transparency. If adoption expands and liquidity deepens, EdgeX could strengthen the structural foundation of performance-driven decentralized trading platforms.

EdgeX (EDGEX) Roadmap: Key Milestones and Future Developments

The roadmap for EdgeX (EDGEX) outlines a structured path focused on infrastructure scaling, liquidity expansion, and ecosystem integration within the decentralized derivatives sector:

| Quarter | Roadmap |

| Q1 2026 | Token Generation Event (TGE) preparation, finalization of tokenomics structure, expanded beta testing of perpetual and spot markets, and liquidity partner onboarding. |

| Q2 2026 | Native USDC deployment on the EDGE Chain, initial integration of Circle’s Cross-Chain Transfer Protocol (CCTP), and expansion of trading pairs. |

| Q3 2026 | Advanced trading features rollout (risk engine upgrades, margin optimization tools), institutional liquidity programs, and strategic ecosystem partnerships. |

| Q4 2026 | Governance module activation for $EDGEX holders, cross-chain liquidity enhancements, and potential multi-exchange token listings to broaden market access. |

These developments highlight the practical value of $EDGEX within the decentralized derivatives industry, particularly in enhancing capital efficiency, expanding stablecoin-based liquidity, and strengthening performance-driven DeFi trading infrastructure.

How to Buy EdgeX (EDGEX) on Bitget Wallet?

Trading EdgeX (EDGEX) is easy on Bitget Wallet. Follow these simple steps to get started:

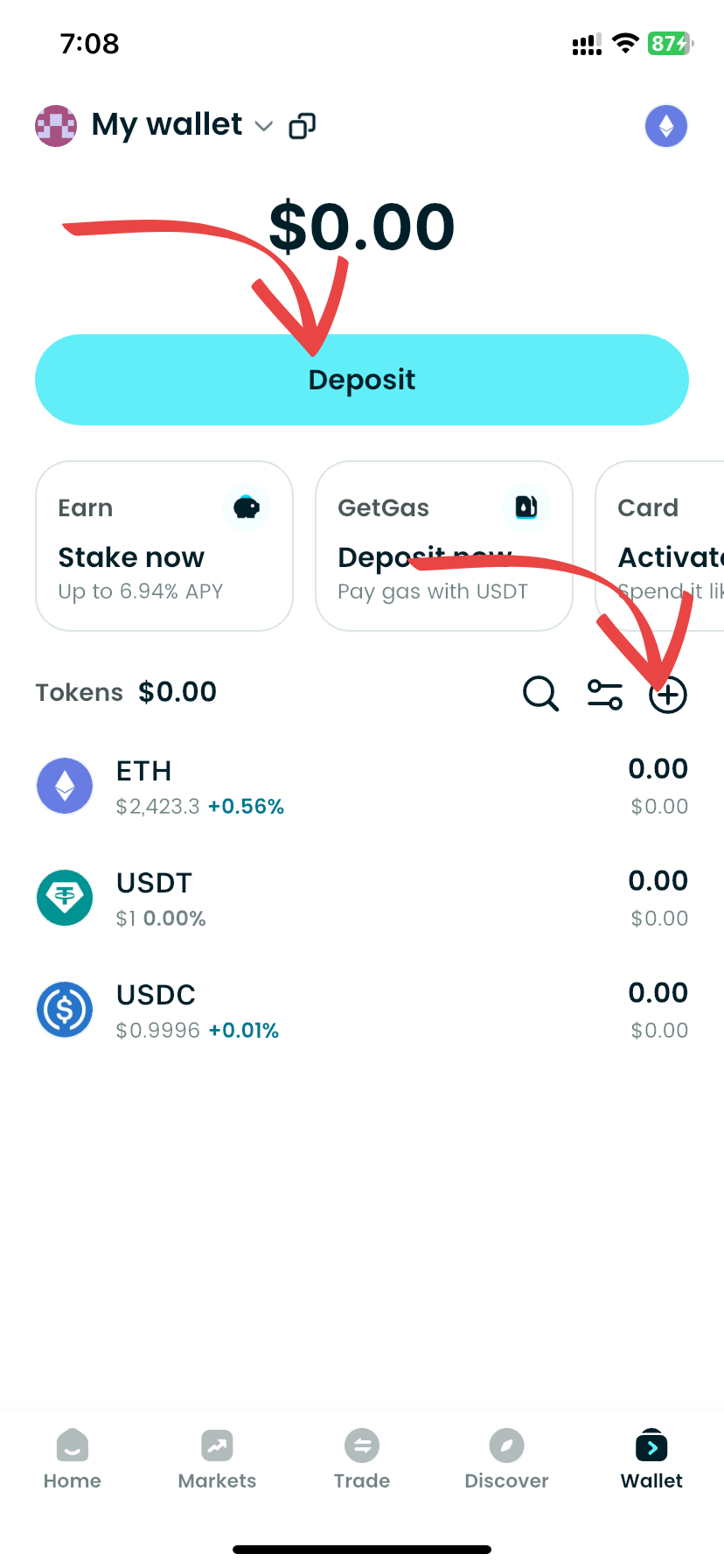

Step 1: Create an Account

If you don't currently have an account, install the Bitget Wallet app. Register by inputting the required details and confirming your identity.

Step 2: Deposit Funds

After setting up an account, you must deposit money. You can do this by:

- Transferring Cryptocurrency: Transfer crypto from a different wallet.

- Purchasing Crypto: Utilize a credit or debit card to buy crypto directly from Bitget Wallet, making sure you have sufficient capital for trading EdgeX (EDGEX).

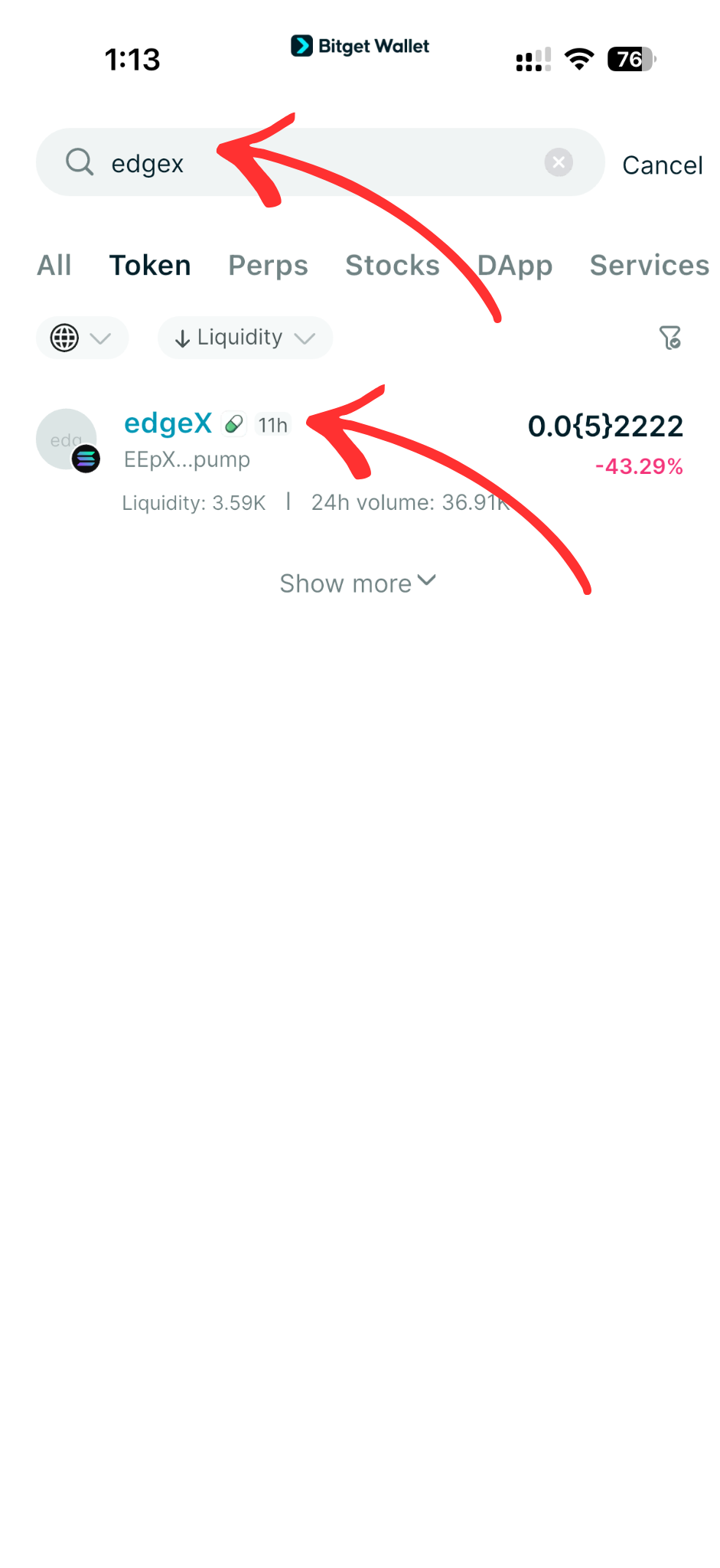

Step 3: Find EdgeX (EDGEX)

On the Bitget Wallet platform, go to the market area. Search for EdgeX (EDGEX) using the search function. Click on the token to access its trading page.

As this token has not been listed yet, please look at the last contract address sent by the project team upon listing of the token.

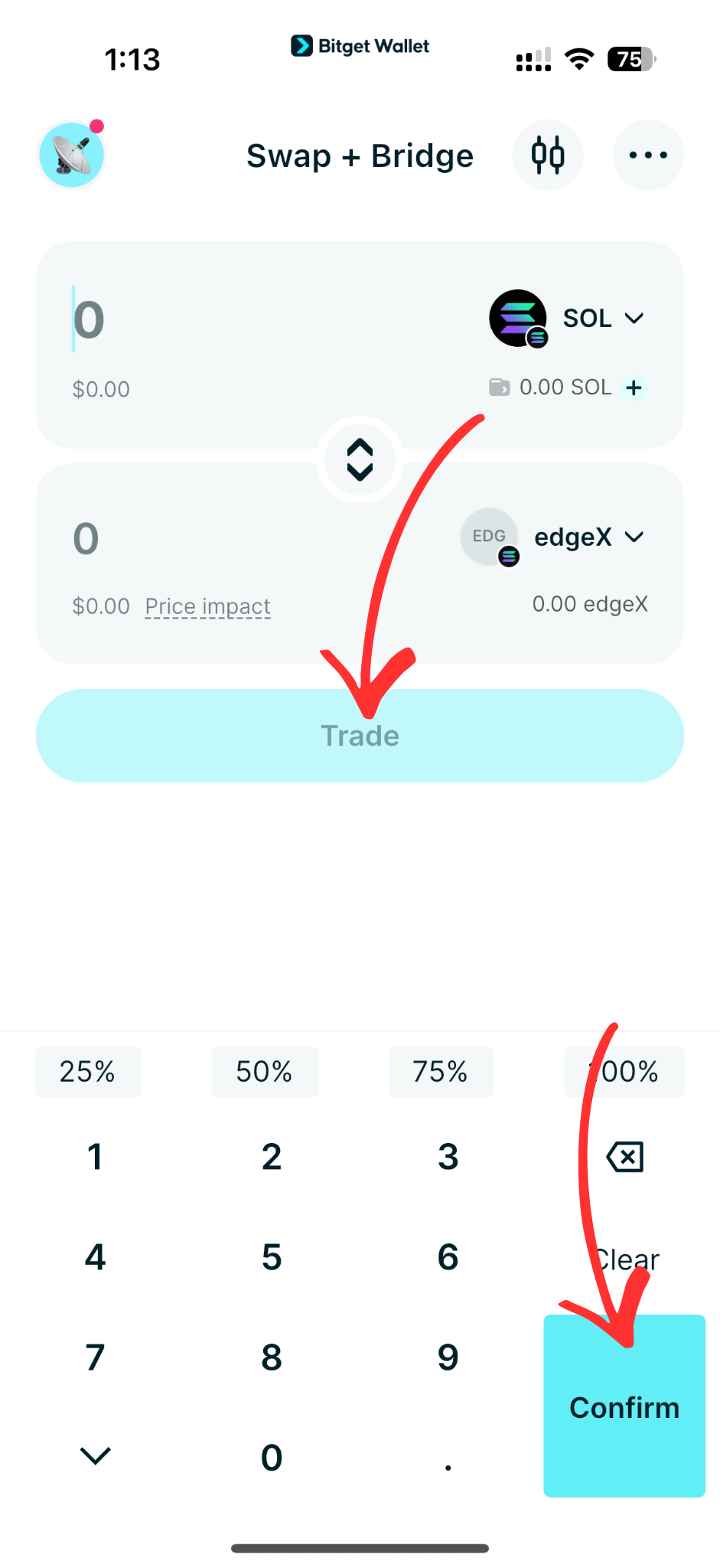

Step 4: Choose Your Trading Pair

Select your trading pair you would like to deal with, for instance, EDGEX/USDT.

By doing this, you will be able to exchange EdgeX (EDGEX) for USDT or any other cryptocurrency.

Step 5: Place Your Order

Choose whether to carry out a market order—either buy or sell at the prevailing rate—or place a limit order at your desired price. Fill in the amount of EdgeX (EDGEX) you want to exchange, then proceed to confirm in order to complete the trade.

Step 6: Monitor Your Trade

Once you have ordered, you can track the status of your order under "Open Orders." Upon completion of the order, you can view your balance to see the newly purchased EdgeX (EDGEX).

Step 7: Withdraw Your Funds (Optional)

If you want to transfer your EdgeX (EDGEX) or any other cryptocurrency to another wallet, go to the withdrawal section, provide your wallet address, and confirm the transaction.

Conclusion

EdgeX is positioning itself as a high-performance decentralized perpetual and spot trading protocol, backed by Circle Ventures and strengthened by planned USDC and CCTP integration on the EDGE Chain. If execution matches its roadmap, $EDGEX could benefit from growing derivatives demand and deeper stablecoin liquidity within the DeFi ecosystem.

For users looking to access $EDGEX once listed, Bitget Wallet offers a practical advantage with multi-chain support, smooth swaps, and full self-custody. Features like Stablecoin Earn Plus (up to 10% APY) and zero-fee trading on selected assets help improve capital efficiency while maintaining flexibility in fast-moving markets.

Manage all your tokens in one beginner-friendly app – download Bitget Wallet today.

Sign up Bitget Wallet now - grab your $2 bonus!

FAQs

1. What is EdgeX?

EdgeX is a decentralized perpetual and spot trading protocol designed to deliver high-performance derivatives trading while maintaining on-chain settlement and self-custody. It aims to combine centralized exchange–level execution speed with DeFi transparency.

2. Is EdgeX (EDGEX) a token or an exchange?

EdgeX primarily refers to a decentralized exchange platform. The anticipated native token, commonly referred to as $EDGEX, is expected to support ecosystem functions such as incentives or governance, subject to official confirmation.

3. How does EdgeX work?

EdgeX operates using performance-focused trading infrastructure combined with blockchain-based settlement. It supports perpetual futures and spot markets and plans to integrate native USDC and cross-chain liquidity mechanisms on the EDGE Chain.

4. Who invested in EdgeX?

EdgeX has received strategic backing from Circle Ventures, the venture arm of Circle (issuer of USDC). The partnership includes plans to bring native USDC and Cross-Chain Transfer Protocol (CCTP) integration to the EDGE Chain.

5. Is EdgeX a good investment?

Whether EdgeX is a good investment depends on factors such as tokenomics structure, market conditions, adoption growth, and derivatives trading volume. Investors should evaluate official documentation, liquidity conditions, and overall crypto market risk before making decisions.

Risk Disclosure

Please be aware that cryptocurrency trading involves high market risk. Bitget Wallet is not responsible for any trading losses incurred. Always perform your own research and trade responsibly.