How to Buy ESP in 2026: A Beginner’s Step-by-Step Guide to Espresso

How to buy ESP is becoming a common question as Espresso expands its role as a shared sequencing and confirmation layer for Ethereum rollups. Whether you are researching where to buy ESP or evaluating its risk profile, understanding its blockchain, liquidity venues, and custody options is essential before executing any trade.

ESP trades across multiple environments depending on listings and bridge deployments, so buyers must verify the correct contract and chain before interacting. If you are exploring how to buy ESP responsibly, start with security-first execution and disciplined sizing.

In this article, you’ll learn where to buy ESP, how to verify its contract address, and how to approach ESP volatility in 2026.

Key Takeaways

- ESP is the native token associated with Espresso’s shared sequencing / confirmation infrastructure for rollups.

- Where to buy ESP depends on exchange listings and on-chain liquidity across Ethereum and Arbitrum.

- Buying ESP safely requires verifying the official contract, monitoring liquidity depth, and choosing the right custody model.

What Is Project Name ESP?

Espresso (ESP) is the native token associated with Espresso Systems, a shared sequencing and confirmation layer designed to support rollups in the Ethereum ecosystem. Rather than being a meme token, ESP is positioned as an infrastructure and governance token within a broader network focused on improving transaction ordering and cross-rollup coordination.

ESP exists on multiple networks, including Ethereum (ERC-20) and Arbitrum, and trades through both centralized exchanges and on-chain liquidity pools.

Source: espressosys.com

What makes Espresso (ESP) different from utility tokens?

- Narrative vs utility: ESP is not a meme token. It functions as an ecosystem and governance asset tied to network security, staking, and decentralization incentives.

- Price driver: ESP price volatility is influenced by sentiment, token unlock schedules, exchange listings, and liquidity depth — not external asset backing.

- Where it trades: ESP trades primarily on Ethereum (ERC-20) and Arbitrum. Liquidity is typically found on major CEX listings and Ethereum-based DEX pools.

Is Espresso (ESP) a scam or just high-risk?

So, Espresso (ESP) isn’t some random meme coin or an anonymous rug-pull. It’s actually tied to a real project called Espresso Systems, which is working on tech to help rollups share data better. They’ve raised money through proper funding rounds and even been covered by major crypto news sites — so it’s got more legitimacy than those tokens that pop up and disappear in a week.

That said, like a lot of early-stage crypto projects, ESP’s price can be all over the place — especially when it hits new exchanges or when big token unlocks happen. But that volatility isn’t necessarily a red flag; it’s more about the market figuring out the price, liquidity building up, and more people jumping in. By 2026, we’re already seeing more exchange listings and trading activity, which shows interest is growing.

If you’re trying to figure out how to buy ESP without getting wrecked, don’t just panic — focus on the practical stuff:

- Double-check the official contract address before you hit "buy"

- Stick to well-known exchanges or trusted DEX aggregators

- Watch the liquidity and slippage so you don’t overpay

- Keep up with what the team is actually building

Honestly, calling ESP "high-risk" might be a bit harsh. It’s more like an early-stage infrastructure play — yeah, there’s potential upside, but prices are gonna swing. If you know how to verify contracts, handle your own wallet, and read a liquidity chart, you’ll be in a way better spot to get involved without the fear factor.

Where to Buy ESP?

When users ask “where to buy ESP,” they usually mean the best mix of execution quality, safety, and convenience. The real decision is the custody model: custodial platforms hold assets for you, while on-chain swaps let you trade directly from your own wallet.

ESP is available on selected centralized exchanges and through on-chain swaps on Ethereum and Arbitrum. What’s available depends on current listings and liquidity conditions, so always confirm whether you are buying the correct network version before executing a transaction.

Comparison of ESP Buying Methods

| Buying Method | Custody Model | Execution | Control | Recommended For | Main Risks |

| On-chain Swap (DEX via Wallet) | Non-custodial | User-controlled, on-chain | High | Self-custody, DeFi users | • Contract impersonation • Price slippage • Gas fee volatility |

| On-chain UEX (via Exchange) |

Custodial | Platform-managed, on-chain | Medium | Users who want on-chain exposure without wallet management | • Custodial exposure • Withdrawal limits • Platform dependency |

| Centralized exchange (CEX) | Custodial | Platform-managed | Low | Beginners, high-liquidity traders, fiat on-ramps | • Custodial risk • Withdrawal delays • Regional or national regulatory restrictions |

Why Many Users Buy ESP With Bitget Wallet?

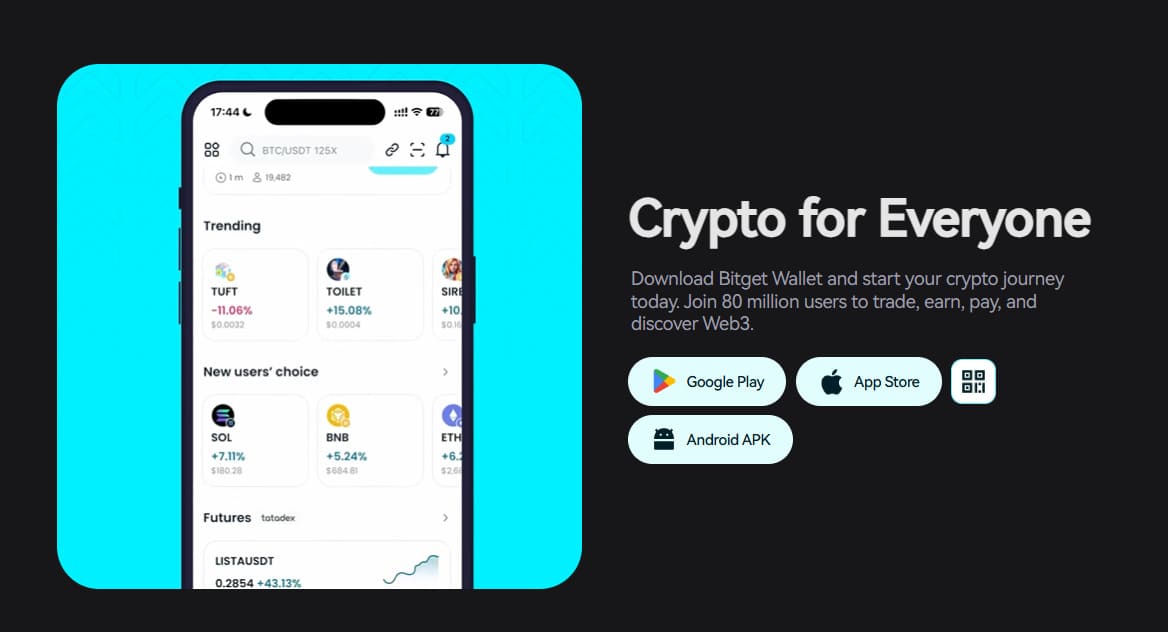

If Espresso (ESP) liquidity is mainly on-chain, a non-custodial wallet helps you swap while keeping control of assets. Bitget Wallet also supports cross-chain access and helps reduce common beginner mistakes like interacting with impersonation tokens.

What Bitget Wallet Helps With?

✅ Self-custody and asset control Users retain full ownership of private keys and funds, reducing exposure to custodial and platform-related risks.

✅ On-chain swaps with transparent execution Explore over 1M tokens with real-time in-app rankings—discover trending assets early and stay ahead of the market.

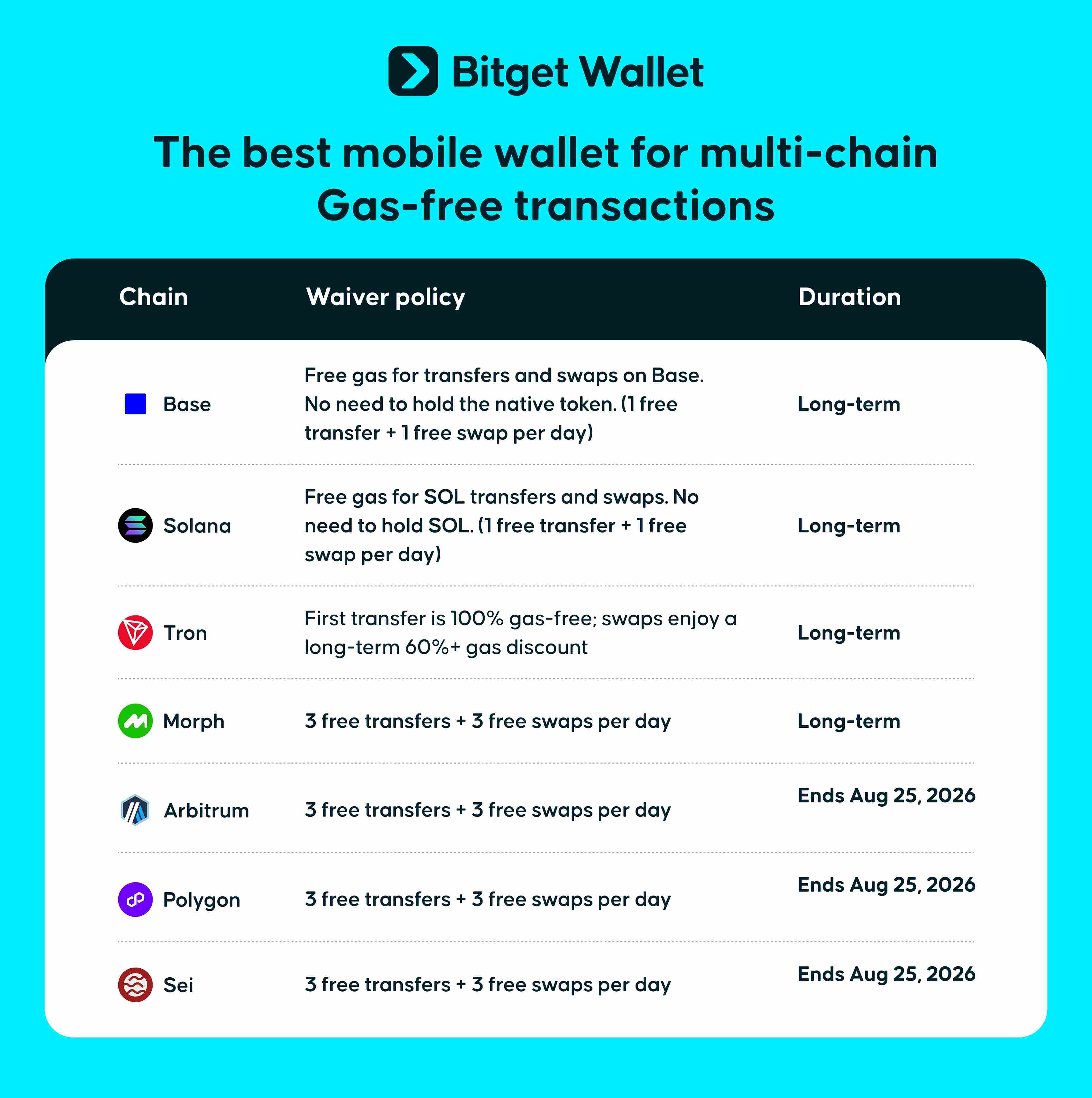

✅ Multi-chain access with cost-efficient execution Bitget Wallet supports 130+ blockchains, including 7 major networks such as Solana, Base, Arbitrum, Polygon, Tron, and more. This allows users to buy, hold, and manage [Ticker] across different ecosystems without being locked into a single chain environment.

On supported networks, users can also benefit from gas-free transactions or long-term gas discounts, helping reduce execution costs when swapping, transferring, or managing assets across chains—an advantage for users who trade frequently or operate across multiple ecosystems.

✅ Flexible post-purchase asset management After buying ESP, users can hold, transfer, or manage assets freely across supported chains without withdrawal limits or third-party restrictions, making it easier to adapt to changing liquidity or market conditions.

Sign up Bitget Wallet now - grab your $2 bonus!

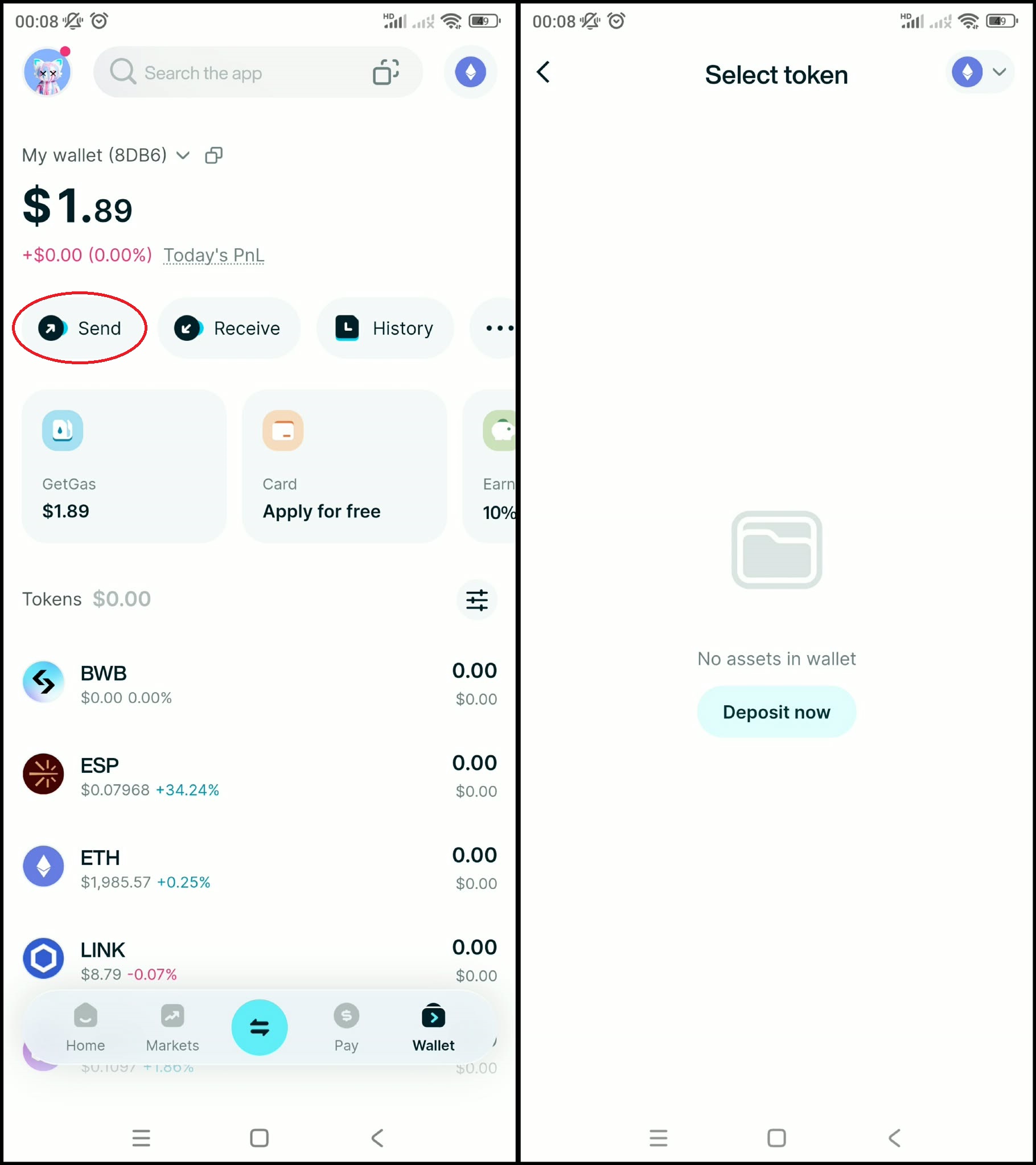

How to Buy ESP on Bitget Wallet?

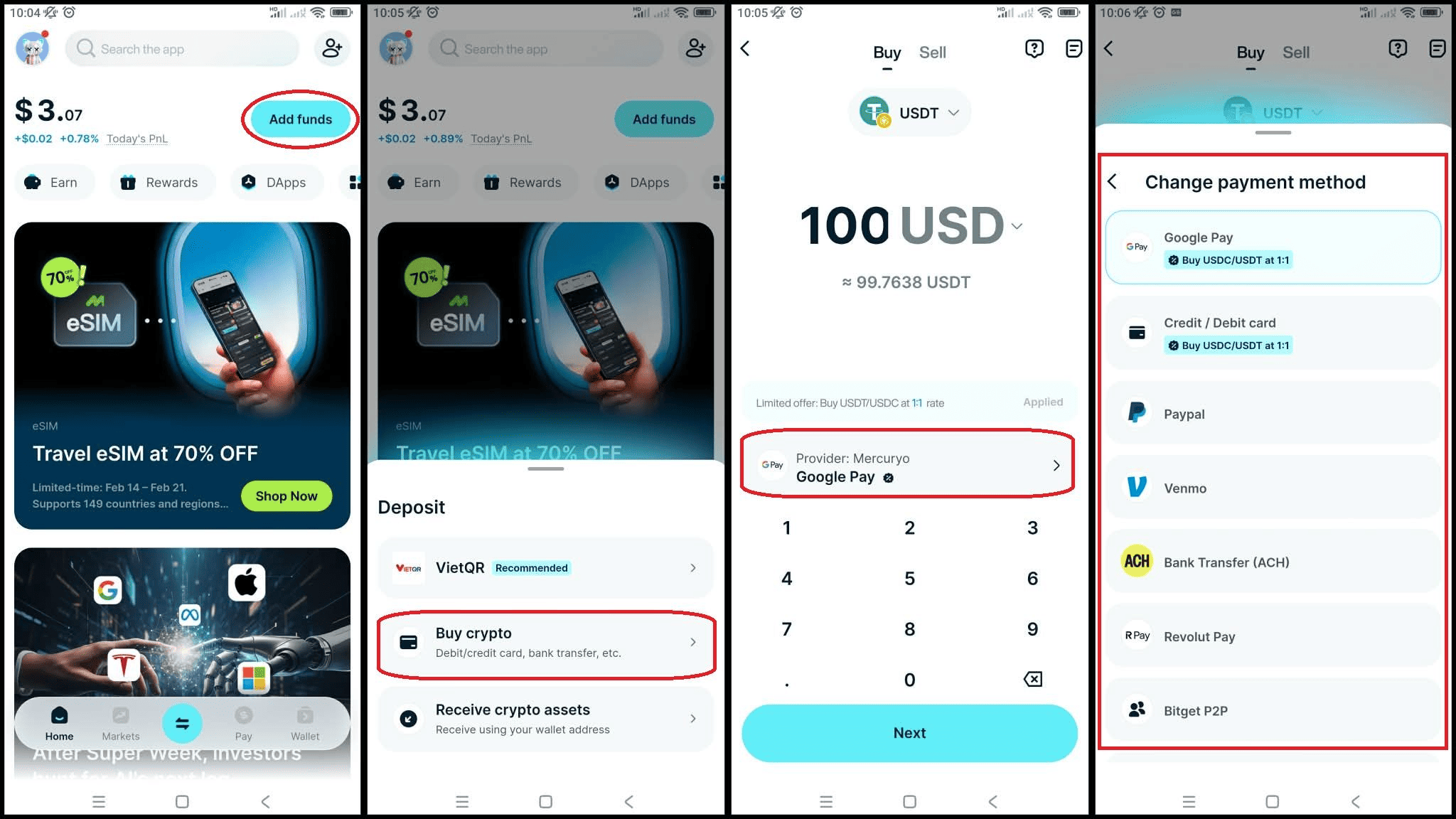

Buying Espresso (ESP) on Bitget Wallet is easy! Just follow these simple steps:

Step 1: Create a wallet

- If you don't have a wallet, download Bitget Wallet app now.

- Register with your phone number or email, verify quickly and you can use it right away.

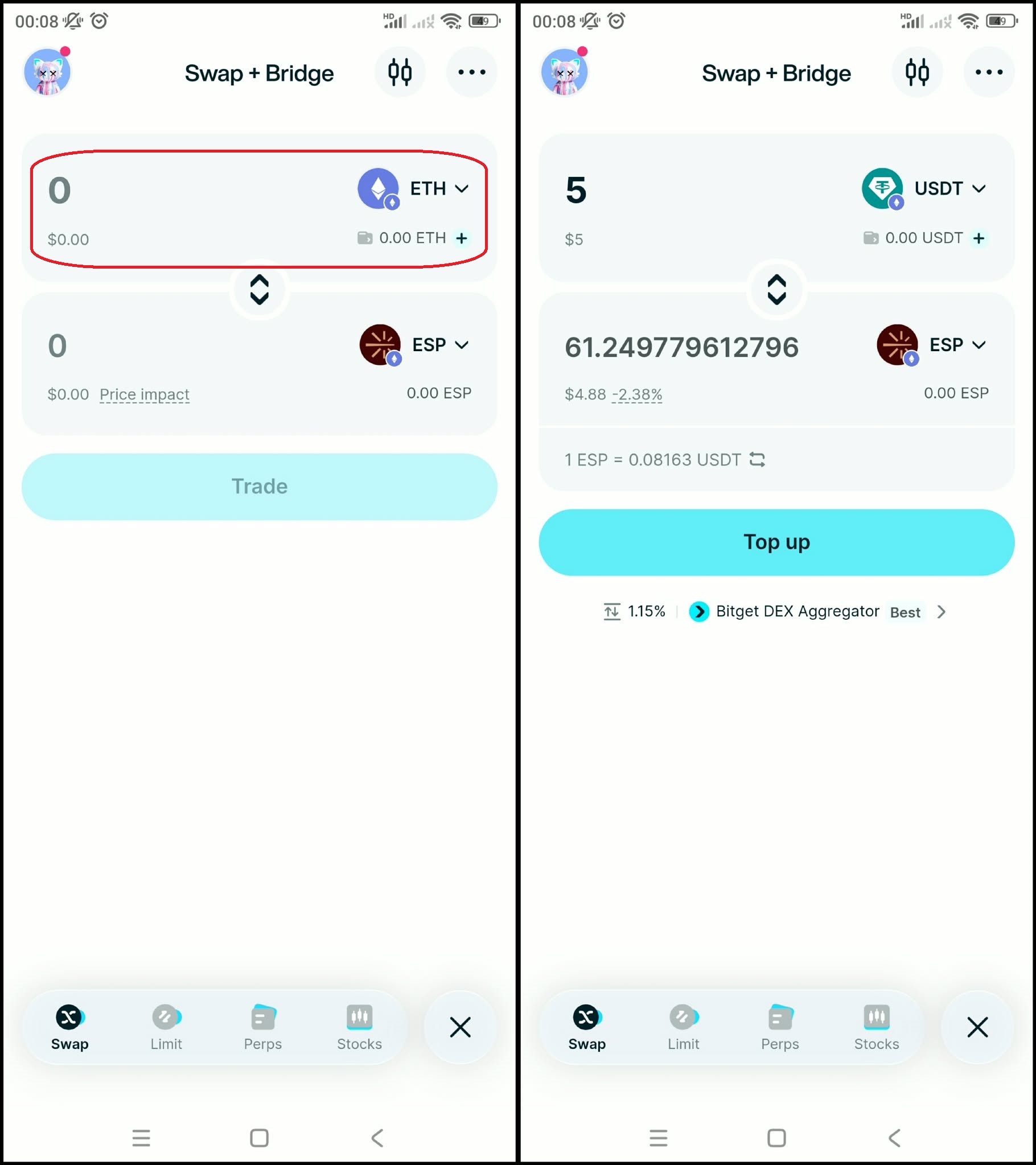

Step 2: Deposit money into your wallet

Once you have finished your wallet, you just need to deposit money into it. You can:

- Transfer coins from other wallets: Send BTC, ETH or any coin you have from an external wallet.

- Buy directly with a card: Use a bank card or credit card to buy USDT or ETH right in the app and then exchange it for USDC.

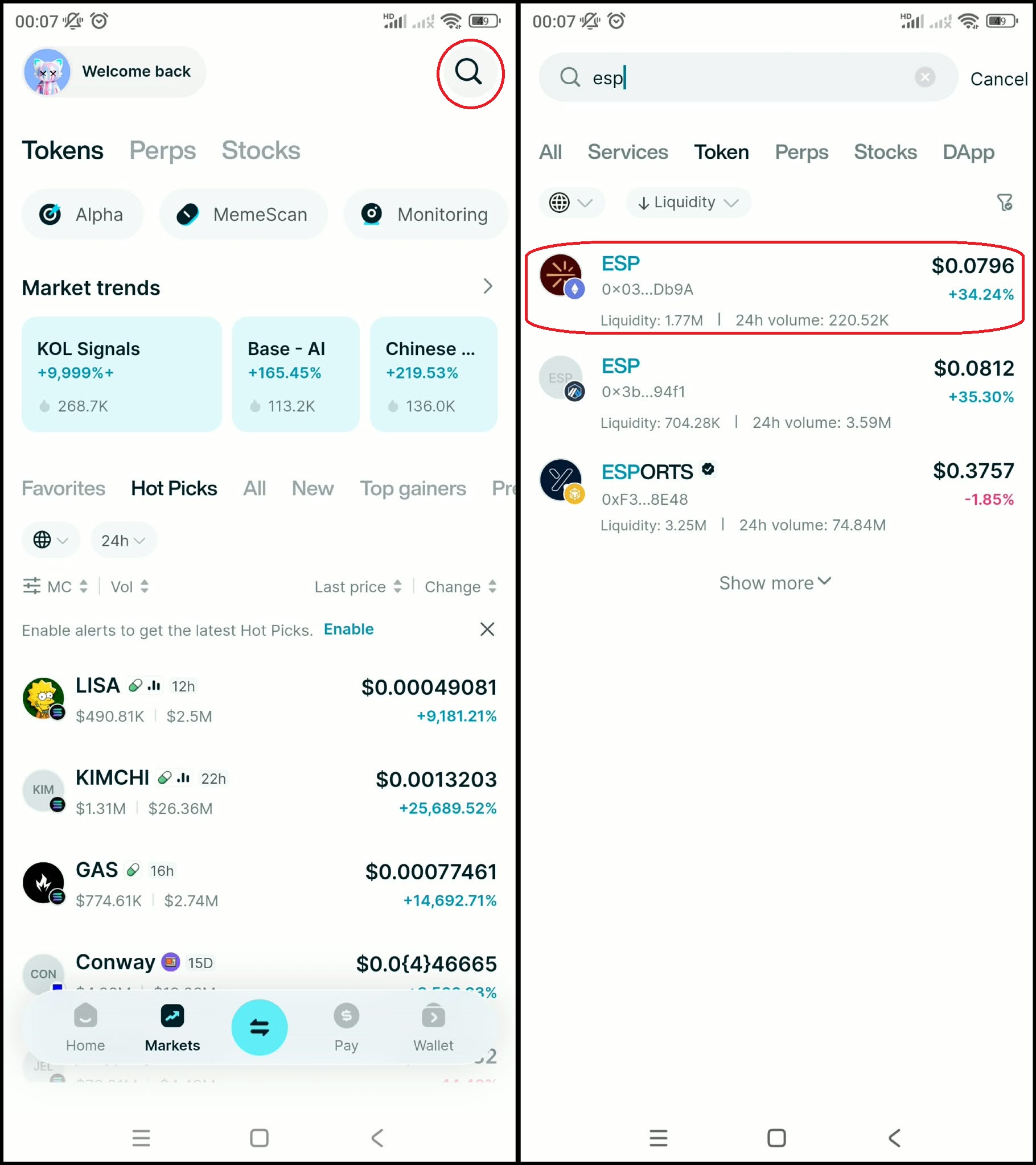

Step 3: Find Espresso (ESP)

- In the main interface of the wallet, go to Market, type "ESP" in the search bar.

- Select Espresso (ESP) to see the trading page.

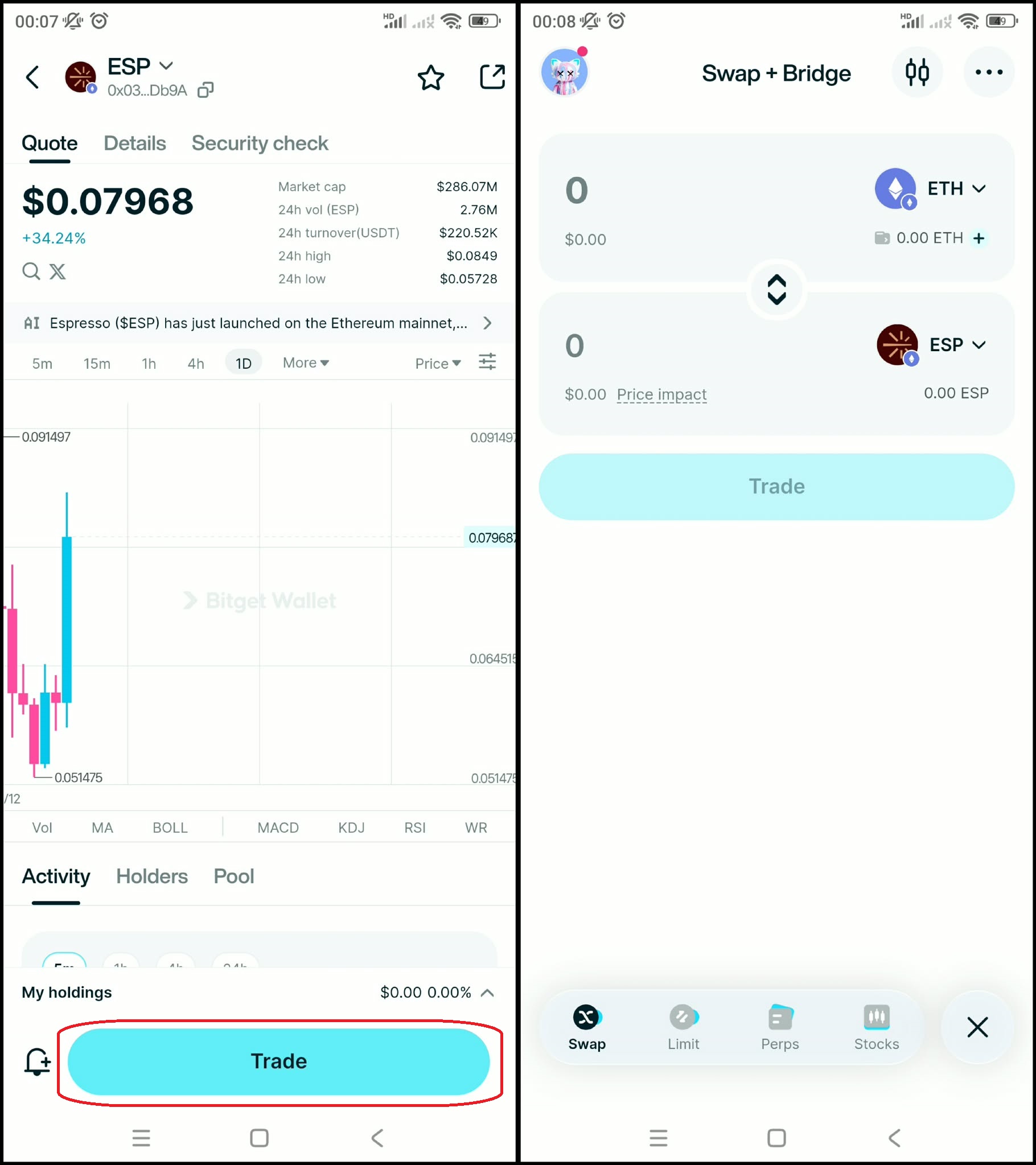

Step 4: Select the trading pair

Select the pair you want to trade, for example ESP/USDT. So you can use USDT to buy Espresso (ESP), or vice versa.

Step 5: Place an order

Enter the amount of Espresso (ESP) you want to buy, check carefully and confirm the order.

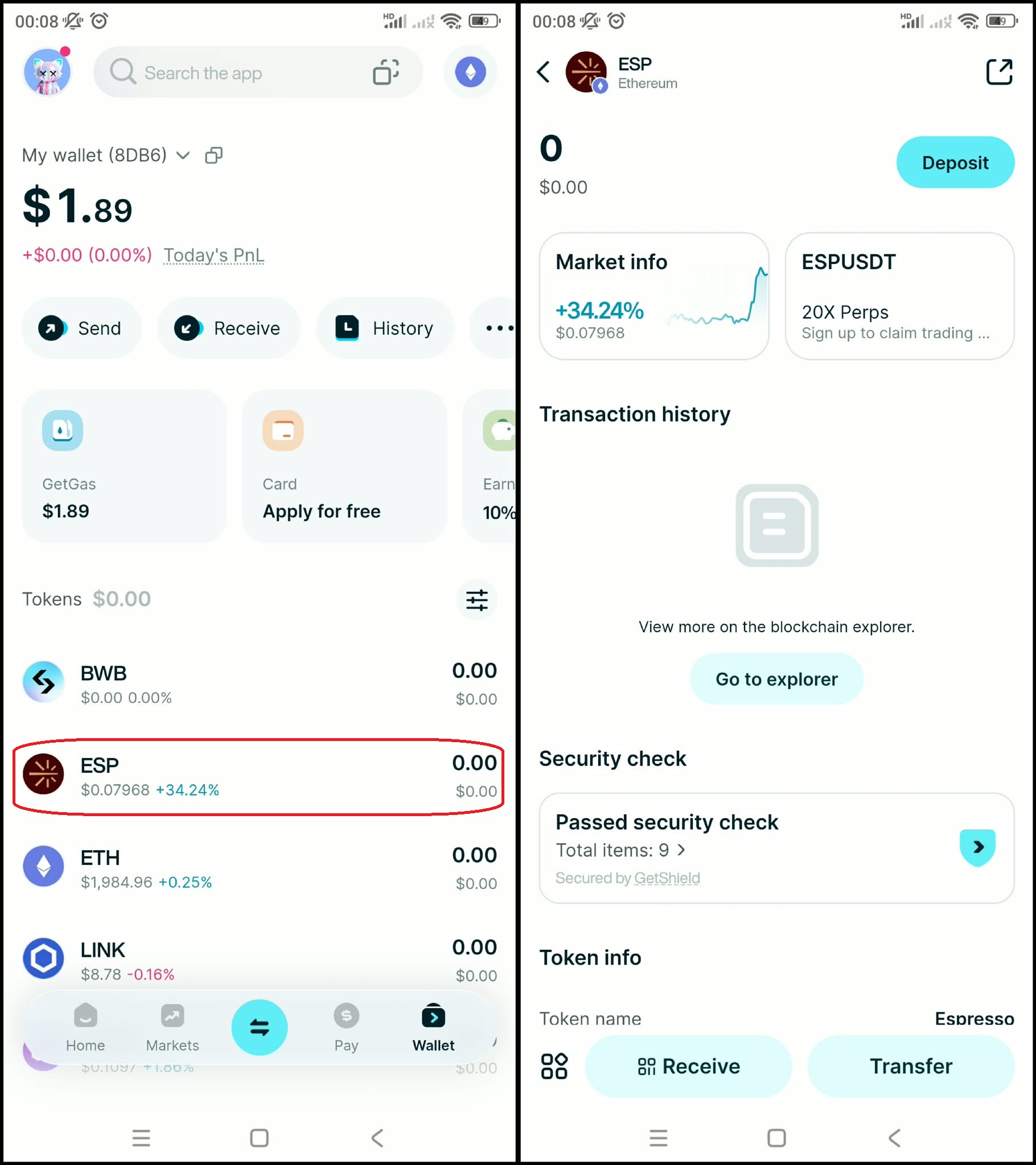

Step 6: Check the order

After buying, you can check your ESP in the Wallet section.

Step 7: Withdraw (if needed)

Once you have Espresso (ESP), if you want to withdraw to another wallet, go to Withdraw, fill in the receiving wallet address, check the blockchain network and the amount carefully, then confirm.

▶Learn more about Espresso (ESP):

- What is Espresso (ESP)?

- Espresso (ESP) Airdrop Guide

- Espresso (ESP) Listing Date and How to Buy It

- MetaMask vs Bitget Wallet: Which Is Better in 2025?

- Trust Wallet vs Bitget Wallet: Which One Is Better in 2025?

- Phantom vs Bitget Wallet: Which One Is Better?

What Should You Know About ESP Price Volatility?

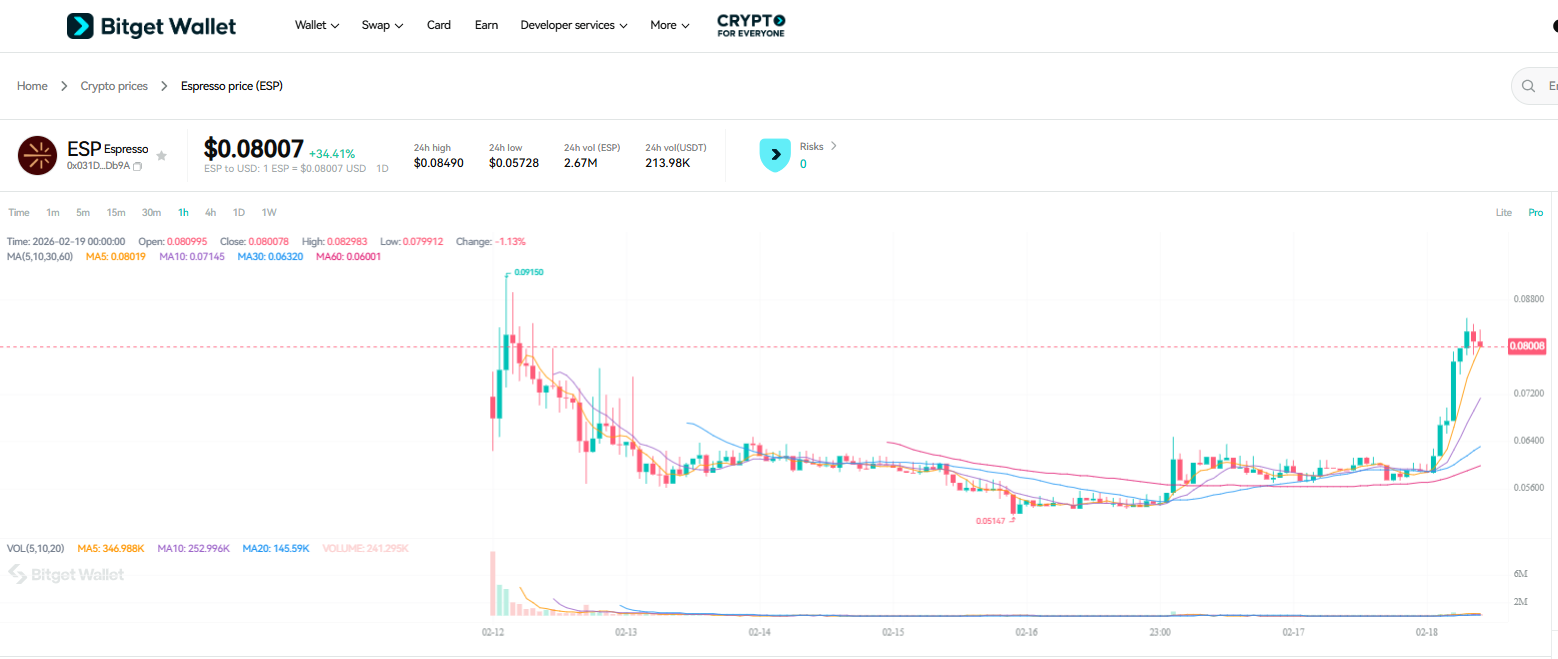

ESP is an early-stage infrastructure token, tied to the Espresso network (a type of "shared sequencer"). Therefore, the current price fluctuations are mainly due to the market settling into its normal trajectory, and don't yet reflect stable cash flow or revenue.

ESE's price volatility is primarily driven by factors such as low liquidity and fluctuating crowd sentiment based on news (especially regarding listings, token unlocks, or ecosystem news). Sometimes, a single hot news item online can cause a surge in trading volume, but this is usually driven by short-term traders who then move on to other topics, rather than actual revenue.

In general, the rapid price changes of early-stage tokens like ESP are normal – it's part of the inherent risk structure of this asset class. Don't immediately assume volatility is an opportunity; consider it a factor to carefully assess before investing.

ESP Price Prediction: How High Can Espresso Go?

Predicting the price of any cryptocurrency relies on market trends, project fundamentals, and community adoption. With strong backing and unique cultural value, Espresso (ESP) is expected to stabilize within the range of 0,081 $.

If the project maintains its development trajectory and expands its applications in the Ethereum ecosystem, the value of Espresso (ESP) could rise to 0,099 $.

Source: kraken.com

Source: Bitget Wallet

Is ESP Crypto Safe to Invest In?

When evaluating whether ESP is “safe,” the focus should shift from the asset to user behavior. How to buy ESP safely depends on contract verification, position sizing, and liquidity awareness rather than assumptions about price direction.

Key Risks to Consider

- Fake tokens or incorrect ESP contract address: Name collisions can occur across chains. Always verify the official ESP contract address before executing any ESP swap.

- Liquidity depth risk: Thin liquidity can magnify slippage during ESP trading pair execution.

- Unlock and distribution risk: Early token allocations and future incentives can influence circulating supply.

- Overexposure risk: Allocating too much capital to a single high-volatility asset increases portfolio instability.

- Execution errors: Sending assets to the wrong network or interacting with malicious contracts when attempting to buy ESP on-chain.

No speculative crypto asset is risk-free. ESP crypto safety depends on disciplined execution, verified information, and controlled exposure rather than market timing.

How to Approach ESP Volatility With a Smarter Strategy?

Instead of focusing on rapid gains, a smarter framework emphasizes education, liquidity awareness, and controlled exposure. Learning how to buy ESP safely and how to check ESP liquidity creates durable decision-making habits

- Observe on-chain liquidity behavior: Before executing an ESP swap, review liquidity pool depth and slippage tolerance.

- Use small position sizes: Limit exposure while understanding ESP price volatility patterns.

- Set clear capital limits: Define maximum allocation before you buy ESP on-chain.

- Prioritize secure execution: Double-check network selection, ESP contract address, and wallet confirmations when using the best wallet to buy ESP.

Over time, disciplined execution builds transferable Web3 skills—contract verification, liquidity assessment, and capital management—that remain valuable regardless of short-term ESP trading conditions.

Conclusion

How to buy ESP responsibly begins with understanding where to buy ESP, verifying the correct ESP contract address, and executing trades with disciplined risk control. Whether you choose a centralized exchange or buy ESP on-chain, structured execution and liquidity awareness are more important than short-term market noise.

If you plan to buy ESP with Bitget Wallet, you gain a non-custodial environment designed for secure stablecoin storage, hot memecoin trading, and a seamless cross-chain experience. Be the first to trade trending tokens in a beginner-friendly interface with Bitget Wallet. Bitget Wallet also supports Stablecoin Earn Plus (up to 10% APY) and zero-fee trading on memecoins and selected RWA U.S. stock tokens.

Download Bitget Wallet now to buy ESP securely and trade with confidence in a controlled, non-custodial environment!

Sign up Bitget Wallet now - grab your $2 bonus!

FAQs

1. How to buy ESP safely as a beginner?

To understand how to buy ESP safely, use Bitget Wallet directly. Verify the official ESP contract address, select the correct network (such as Ethereum for ERC-20), then execute your ESP swap inside Bitget Wallet. Keep position sizes small and confirm every transaction before signing.

2. Where can I buy ESP?

You can buy ESP with Bitget Wallet by accessing on-chain liquidity and executing the swap securely in a non-custodial environment. This allows you to maintain full control of your assets while verifying the correct ESP contract address before trading.

3. Do I need KYC to buy ESP?

Whether KYC is required depends on the purchase method. Centralized exchanges (CEXs) typically require KYC, as users trade through custodial accounts managed by the platform.

In contrast, buying ESP through on-chain swaps using a non-custodial wallet like Bitget Wallet does not require KYC. Users interact directly with decentralized liquidity from their own wallet, without submitting identity information. However, this also means users are fully responsible for security, contract verification, and transaction execution.

4. Is ESP crypto high risk?

ESP crypto is considered high risk due to early-stage volatility, liquidity fluctuations, and token distribution dynamics. ESP price volatility should be approached as a risk factor rather than a guaranteed opportunity.

5. How to avoid fake ESP tokens?

To avoid fake ESP tokens, always verify the official ESP contract address on reputable block explorers, confirm the correct blockchain network before executing a swap, and avoid interacting with unsolicited token links or unknown trading pairs.

Risk Disclosure

Please be aware that cryptocurrency trading involves high market risk. Bitget Wallet is not responsible for any trading losses incurred. Always perform your own research and trade responsibly.

- Zama Listing Launch Date: What Investors Should Know Before TGE2026-02-05 | 5mins