What Is Polymarket (POLY): The Blockchain-Based Prediction Market Backed by ICE and NYSE Parent Company with $9B Valuation

What is Polymarket (POLY)? Polymarket (POLY) is turning everyday café conversations into tradable markets. Imagine not just predicting who will win an election but also earning profits from your insight. That’s the appeal of Polymarket — a platform that merges the spirit of a global “betting council” with the unmatched transparency of blockchain technology.

Polymarket’s defining moment came when it gained support from financial titan Intercontinental Exchange (ICE), the parent company of the New York Stock Exchange (NYSE). This backing is not just a powerful vote of confidence — it signals a future where collective forecasting could evolve into a serious financial asset class. In that vision, the POLY token will play a central role as the core of all transactions, governance, and reward mechanisms.

This article explores Polymarket’s evolution, the significance behind the POLY token tease, and how this development could reshape the future of global prediction markets and blockchain adoption.

Key Takeaways

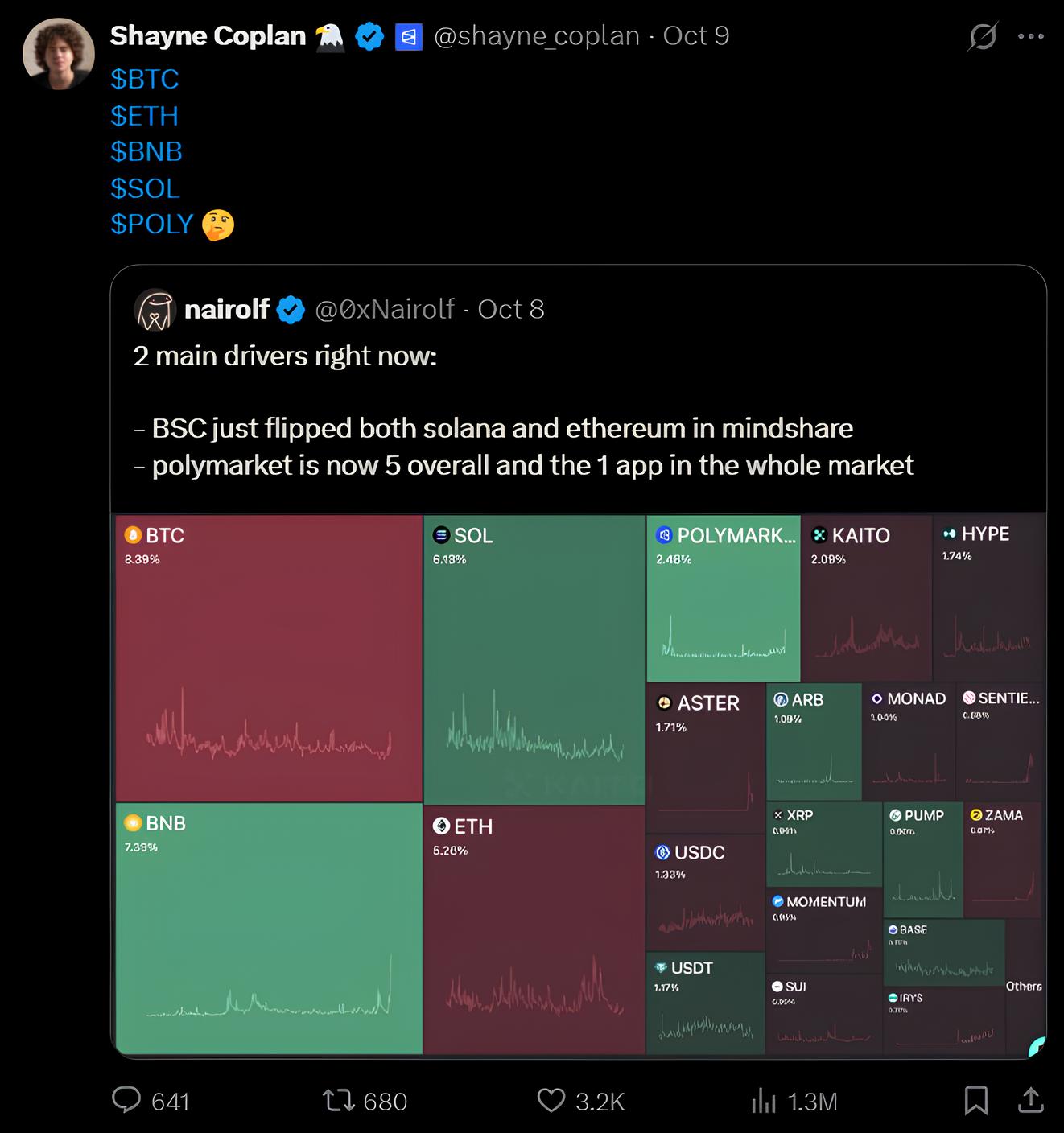

- Shayne Coplan, founder of Polymarket, teased the launch of the POLY token via a cryptic tweet featuring “$BTC $ETH $BNB $SOL $POLY 🤔”.

- Polymarket has raised funding from Intercontinental Exchange (ICE), boosting its valuation to approximately $9 billion and signaling institutional confidence.

- The upcoming POLY token is expected to power governance, liquidity pools, and incentive mechanisms within the ecosystem.

A Deep Dive into Polymarket: What Is $POLY?

Polymarket (POLY) is a decentralized prediction market protocol built on Polygon that allows users to speculate on real-world events using crypto assets. It reflects the evolution of collective intelligence and decentralized information exchange through blockchain technology.

The project embodies the following core values:

- Transparency: All market outcomes and liquidity flows are recorded on-chain for public verification.

- Accessibility: Anyone can create or trade on markets related to current events, sports, or politics.

- Decentralization: Governance and market creation are driven by community participation rather than centralized control.

With the teased POLY token, Polymarket seeks to expand beyond a prediction platform — evolving into a tokenized ecosystem for truth, data, and financial insight.

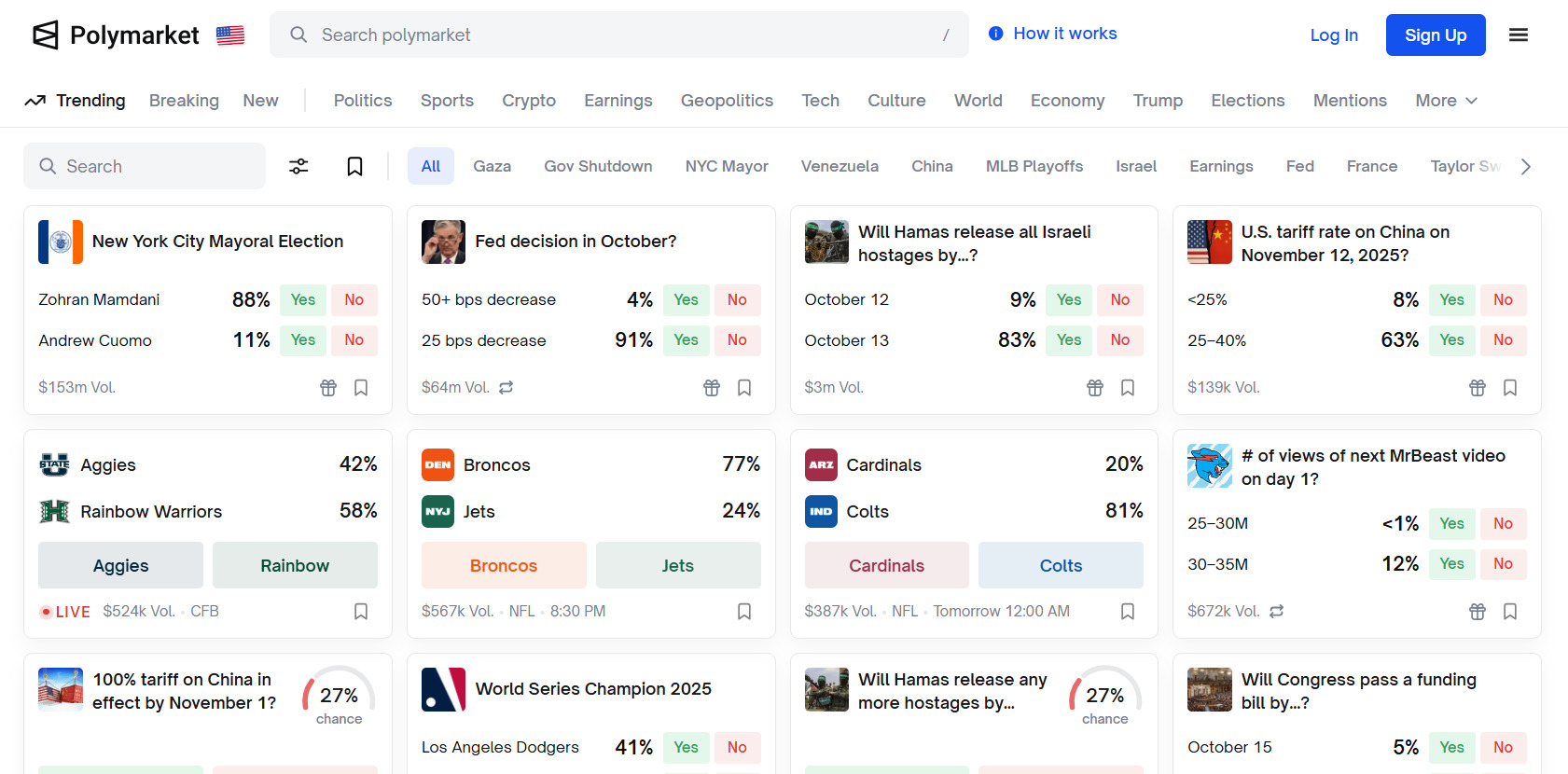

Source: Polymarket.com

Polymarket Sparks Frenzy After Shayne Coplan’s Tweet Hints at POLY Token Launch

On September 9, 2025, the crypto community was suddenly set ablaze by a cryptic tweet from Shayne Coplan, founder of Polymarket: “$BTC $ETH $BNB $SOL $POLY 🤔.” With just a few short characters, the message was enough to send investors into a frenzy, fueling speculation that the long-awaited POLY token launch was imminent. The move is seen as a pivotal step marking Polymarket’s new expansion phase—especially after the CFTC (U.S. Commodity Futures Trading Commission) granted legal clearance for the platform to resume operations in the U.S. on September 3 via a no-action letter for its two subsidiaries, QCX and QC Clearing.

Polymarket is currently the world’s largest decentralized prediction market platform, with an accumulated trading volume exceeding $180 million and over 500,000 active monthly users as of Q3 2025. Its leading position was further solidified following a remarkable funding round led by Intercontinental Exchange (ICE) — the financial giant that owns the New York Stock Exchange (NYSE) — which boasts a market capitalization of $70 billion.

According to Financial Times, ICE has committed to investing up to $2 billion in Polymarket, raising the startup’s valuation from $8 billion to around $9 billion. In its official statement, ICE emphasized a joint vision to “advance tokenization initiatives,” sparking speculation that POLY will play a central role in the upcoming development strategy of both entities.

Analysts believe that once launched, POLY could emerge as the new liquidity standard for global prediction markets — much like UNI did for Uniswap. With Polymarket’s acquisition of QCX and QC Clearing, both licensed derivatives settlement entities, and its internal valuation estimated at $1.2 billion prior to the ICE deal, all indicators point to POLY becoming a major catalyst in the 2025–2026 growth cycle.

The combination of strong regulatory backing, massive financial resources, and a clear tokenization roadmap has led many to view POLY as the “missing piece” that could usher the prediction market industry into a new era of global decentralized finance.

Source: Shayne Coplan on X

Polymarket (POLY) Listing Details and Launch Date

Here are the important details about the Polymarket (POLY) listing:

- Exchange: To be announced

- Trading Pair: POLY/USDT

- Deposit Available: Q4 2025

- Trading Start: Q4 2025

- Withdrawal Available: Q4 2025

Don’t miss your chance to start trading Polymarket (POLY) on exchanges and be part of this groundbreaking journey.

- Please refer to the official announcement for the most accurate schedule.

Polymarket (POLY) Price Prediction for 2025: What to Expect?

Overall, the price of POLY in the coming year will largely depend on three key factors: market performance, project fundamentals, and community trust. Backed by strong institutional support and rising interest in the prediction market sector, POLY is expected to trade around [NA]. If the tokenization wave truly takes off, its price could potentially reach [NA], positioning it as one of the standout names in the space.

What Could Drive POLY’s Price?

- Market Conditions: Once the crypto market recovers and institutional “whales” enter the scene, demand for POLY is likely to surge significantly.

- Adoption: The more users Polymarket attracts and retains, the stronger the real demand for POLY becomes.

- Technology: Integrations with oracles and networks like Arbitrum will enhance performance, drawing more participants to the ecosystem.

Future Outlook

If Polymarket continues to expand its ecosystem within DeFi and prediction markets, increasing demand could push its price higher. Many experts believe that with a solid development roadmap and strategic partnerships, POLY has the potential to reach [NA], further cementing its position as a bridge between traditional finance and the emerging blockchain-based prediction economy.

Polymarket (POLY) Key Innovations: Top Reasons to Watch

The standout features of Polymarket (POLY) include:

-

Decentralized Prediction Infrastructure

Polymarket operates as a non-custodial prediction market built on blockchain technology, allowing users to trade outcomes of real-world events—ranging from elections, crypto prices, to sports results—without intermediaries. This ensures transparency, fairness, and censorship resistance in all market outcomes.

-

Data-Driven Liquidity and Market Creation

The platform integrates automated market-making (AMM) models to maintain liquidity across thousands of micro-markets. Anyone can create and participate in a market by supplying liquidity and earning trading fees, similar to the mechanism of Uniswap but applied to prediction events.

-

Token-Centric Future (POLY Token)

The anticipated POLY token is expected to serve multiple utilities: market governance, liquidity incentives, staking for market validity, and fee reduction. It positions POLY as the next-generation governance and utility asset driving the prediction economy.

Understanding Polymarket (POLY): The Technology Behind It

Polymarket (POLY) is the world’s leading decentralized prediction market platform, allowing users to trade on the outcome of real-world events using blockchain technology. Built to make information markets transparent, censorship-resistant, and accessible to anyone, Polymarket transforms opinions into tradable assets.

By leveraging smart contracts on Polygon, the platform enables users to buy, sell, and resolve outcome shares seamlessly using USDC stablecoin, ensuring trustless settlement and transparency. Below is a clear overview of how the Polymarket ecosystem operates:

| Step | Process | Benefit |

| 1. Choose a Market/Event | Users browse live markets — e.g., “Will Candidate A win?” or “Will Bitcoin surpass $100K by year-end?” | Provides access to real-time prediction markets on politics, crypto, sports, and global trends. |

| 2. Buy Outcome Shares (Yes/No) | Participants purchase “Yes” or “No” shares using USDC. The price of each reflects the market’s implied probability — e.g., $0.70 means a 70% chance. | Allows anyone to profit from being right about real-world events while providing continuous liquidity. |

| 3. Trade Shares Freely | All transactions are peer-to-peer through smart contracts; Polymarket doesn’t bet against users. Traders can sell shares anytime before the event concludes. | Creates an open market driven by supply, demand, and crowd intelligence. |

| 4. Event Resolution via Oracles | After an event ends, Polymarket uses external data oracles to verify outcomes accurately and impartially. | Ensures fairness and transparency without centralized control. |

| 5. Payout & Profit Distribution | Holders of correct shares receive $1 per share; incorrect ones lose value. Polymarket may charge a small success fee. | Provides automated, trustless settlements and immediate payouts. |

| 6. Market Creation | Users or approved creators can propose new markets; once verified, these are published for community participation. | Encourages community-driven growth and broadens the scope of on-chain information markets. |

Who Leads Polymarket (POLY) - Team & Key Partnerships

Founding Team

Polymarket was founded by Shayne Coplan, an entrepreneur with a clear vision for decentralized information markets. He launched the project in 2020 with a mission to bring “markets of truth” — collective intelligence systems reflecting beliefs about future events — into the blockchain era.

The core team includes engineers and product developers with experience at leading institutions such as Coinbase, ConsenSys, and Jane Street. This blend of deep technical expertise and financial market experience forms the foundation for Polymarket’s goal: redefining how the world aggregates and values expectations through incentive-based blockchain mechanisms.

Key Partnerships

Polymarket stands out with a major strategic partnership with Intercontinental Exchange (ICE) — the parent company of the New York Stock Exchange (NYSE) — reportedly involving an investment of up to $2 billion.

In addition, technology partners such as Arbitrum (scalability), Chainlink (oracle data), and Fireblocks (security infrastructure) empower Polymarket to merge the stability of traditional finance with the transparency and innovation of DeFi, strengthening its position as a bridge between the two worlds.

The Role of Polymarket (POLY) in Prediction Economy: Use Cases Explained

1. Key Use Cases of POLY Token

$POLY serves a variety of purposes, including:

- Market Governance Token holders can propose and vote on parameters such as fee models, listing priorities, and dispute resolutions.

- Liquidity Mining Participants providing liquidity to active prediction markets can earn POLY rewards proportional to trading volume.

- Staking for Integrity Validators stake POLY to verify and secure event outcomes, ensuring reliable resolution mechanisms.

- Fee Reductions Traders holding or staking POLY benefit from lower trading fees, incentivizing long-term participation.

- Cross-Market Utility POLY could serve as collateral or a settlement asset across Polymarket’s partner platforms in the DeFi ecosystem.

These applications highlight the practical value of $POLY in advancing a transparent, decentralized, and scalable prediction finance industry.

2. How POLY Is Transforming the Prediction Economy

By integrating blockchain transparency with institutional backing, Polymarket is bridging the gap between traditional finance (TradFi) and decentralized prediction ecosystems. The launch of POLY could standardize liquidity across markets, enabling faster settlement, improved capital efficiency, and cross-chain interoperability.

In essence, POLY isn’t just another token — it represents the tokenization of human belief, transforming data-driven speculation into a legitimate, regulated financial layer for the future of decentralized truth markets.

Polymarket (POLY) Roadmap Explained: What’s Coming Next?

The roadmap for Polymarket (POLY) outlines a clear path for growth and innovation:

| Quarter | Roadmap |

| Q3 2025 | NA |

| Q4 2025 | NA |

| Q1 2026 | NA |

| Q2 2026 | NA |

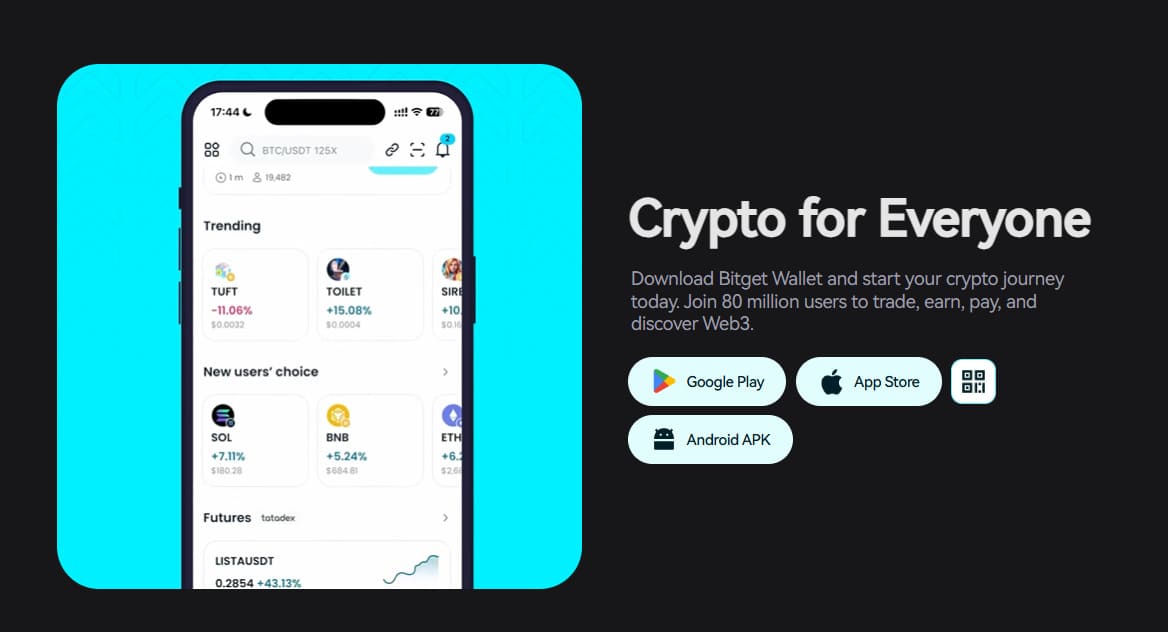

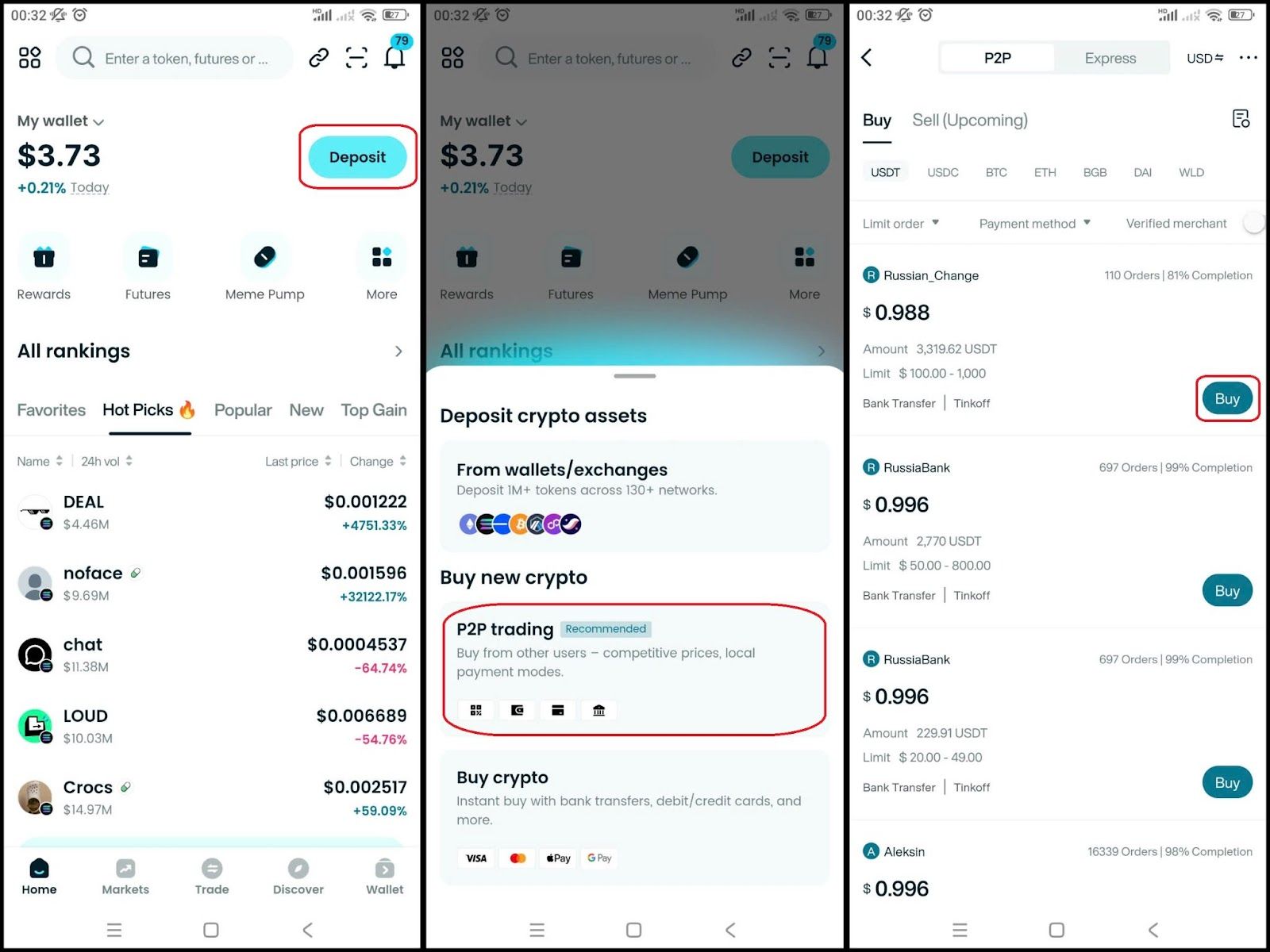

How to Buy Polymarket (POLY) on Bitget Wallet?

Buying Polymarket (POLY) on Bitget Wallet is easy! Just follow these simple steps:

Step 1: Create a wallet

- If you don't have a wallet, download Bitget Wallet app now.

- Register with your phone number or email, verify quickly and you can use it right away.

Step 2: Deposit money into your wallet

Once you have finished your wallet, you just need to deposit money into it. You can:

- Transfer coins from other wallets: Send BTC, ETH or any coin you have from an external wallet.

- Buy directly with a card: Use a bank card or credit card to buy USDT or ETH right in the app and then exchange it for USDC.

Step 3: Find Polymarket (POLY)

- In the main interface of the wallet, go to Market, type "POLY" in the search bar.

- Select Polymarket (POLY) to see the trading page.

Since this token has not been listed yet, please refer to the final contract address provided by the project team after the token is officially listed.

Step 4: Select the trading pair

Select the pair you want to trade, for example POLY/USDT. So you can use USDT to buy Polymarket (POLY), or vice versa.

Step 5: Place an order

Enter the amount of Polymarket (POLY) you want to buy, check carefully and confirm the order.

Step 6: Check the order

After buying, you can check your POLY in the Wallet section.

Step 7: Withdraw (if needed)

Once you have Polymarket (POLY), if you want to withdraw to another wallet, go to Withdraw, fill in the receiving wallet address, check the blockchain network and the amount carefully, then confirm.

▶Learn more about Polymarket (POLY):

- What is Polymarket (POLY)?

- Polymarket (POLY) Airdrop Guide

- Polymarket (POLY) Listing Date and How to Buy It

- MetaMask vs Bitget Wallet: Which Is Better in 2025?

- Trust Wallet vs Bitget Wallet: Which One Is Better in 2025?

- Phantom vs Bitget Wallet: Which One Is Better?

Conclusion

The rise of Polymarket (POLY) marks a defining moment for decentralized prediction markets, bridging the gap between institutional finance and blockchain transparency. With strong regulatory backing from the CFTC and strategic investment from Intercontinental Exchange (ICE), Polymarket is poised to lead a new era where truth, data, and financial incentives converge. The upcoming POLY token is not just a governance asset — it represents a new standard for liquidity, decentralization, and credibility in prediction-based finance.

For investors looking to join this momentum, Bitget Wallet provides the ultimate gateway. Its secure, user-friendly interface, cross-chain trading support, and built-in DeFi integration make it the ideal platform to buy, store, and manage POLY. By using Bitget Wallet, users can easily participate in Polymarket’s ecosystem, enjoy low fees, and stay connected to real-time market opportunities — all within one trusted app. As the decentralized prediction economy expands, managing POLY through Bitget Wallet ensures investors remain at the forefront of innovation and profit potential.

Sign up Bitget Wallet now - grab your $2 bonus!

FAQs

1. What is Polymarket (POLY)?

Polymarket (POLY) is a decentralized prediction market protocol that allows users to trade on real-world events using blockchain technology. It empowers individuals to speculate on politics, economics, and cultural trends while ensuring transparency and censorship resistance.

2. When will Polymarket (POLY) be launched?

The official POLY token launch is expected in Q4 2025.

3. What is the utility of the POLY token?

$POLY will serve as the backbone of the Polymarket ecosystem — powering governance, liquidity mining, staking, and fee reductions for traders. It is designed to enhance liquidity and reward active participation across prediction markets.

Risk Disclosure

Please be aware that cryptocurrency trading involves high market risk. Bitget Wallet is not responsible for any trading losses incurred. Always perform your own research and trade responsibly.