What Is USDC the Stablecoin? Circle’s Dollar-Pegged USD Coin Explained for Crypto Investors

What Is USDC the stablecoin? USDC is a “digital dollar” issued by Circle, backed 1:1 by cash and US Treasury bonds, making it extremely stable in price. Thanks to its transparency and global reputation, USDC has become one of the most trusted stablecoins, helping users make instant transactions, stable prices, and seamless integration with DeFi applications or exchanges.

In this article, we will thoroughly explore every aspect of USDC from its origin to its future development potential. At the same time, we will guide you on how to store, transfer, and manage USDC easily with Bitget Wallet - The most comprehensive Web3 wallet today.

Key Takeaways

- USD Coin (USDC) is a U.S. dollar–backed stablecoin, maintaining a 1:1 peg with the U.S. dollar.

- The stablecoin offers fast, low-cost transactions, cross-border transfers, and interoperability across 15+ blockchains.

- With deep adoption in DeFi, payments, and trading, USDC is among the most reliable digital dollars in circulation.

What Is USDC the Stablecoin and How Does It Work?

USD Coin (USDC) is a tokenized U.S. dollar, meaning every token in circulation is backed by real-world assets. As a stable digital currency, it was created to provide the speed and programmability of crypto while eliminating volatility risks found in assets like Bitcoin or Ethereum.

The stablecoin works on a 1:1 peg mechanism:

- When a user deposits U.S. dollars into Circle’s system, new USDC tokens are minted.

- When a user redeems USDC for fiat, the tokens are burned, reducing supply.

This issuance and redemption process ensures USDC always remains tied to the U.S. dollar. With Circle’s strong compliance framework, monthly attestations by independent auditors, and oversight of the Circle Reserve Fund (USDXX), USDC has become one of the most transparent and trusted stablecoins globally.

Who Created USDC?

USDC was launched in 2018 by Circle and Coinbase through the Centre Consortium. Today, Circle manages it independently, emphasizing global reach, transparency, and regulatory alignment.

Circle has received backing from major financial institutions including Goldman Sachs and Breyer Capital, which strengthened its credibility and accelerated adoption.

Source: USDC on X

How Does USDC Stay Pegged to $1?

The peg is maintained by reserves held in cash and short-term U.S. Treasuries, which are securely custodied and reported through the Circle Reserve Fund (USDXX). This design ensures that each USDC in circulation can be redeemed for one U.S. dollar.

However, market conditions sometimes cause minor fluctuations:

-

ATH:

$1.19 during 2019 liquidity imbalances.

-

ATL:

$0.877 in 2023 during the SVB collapse.

-

2025:

trading close to $1, maintaining trust in its peg.

Despite short-term deviations, redemption and collateralization mechanisms restore parity quickly.

Read more: What Is a Stablecoin? A Beginner’s Guide

Source: USDC.com

What Blockchains Support USDC in 2025?

When it launched, USDC was exclusive to the Ethereum network as an ERC-20 token. But now Circle has expanded USDC to more than 15 different large and small blockchains. This makes USDC extremely compatible with many pieces of the crypto world, from the DeFi ecosystem, NFT marketplaces to CEXs. Thanks to this multi-chain strategy, users can now experience USDC with much cheaper fees, lightning-fast transaction speeds, and importantly, access to more platforms than ever before.

USDC Supported Blockchains in 2025

| Blockchain | Standard / Format | Key Benefits |

| Ethereum (ETH) | ERC-20 | Highest adoption, deep DeFi liquidity |

| Solana (SOL) | SPL | Ultra-fast, low fees, NFT integrations |

| Tron (TRX) | TRC-20 | Popular for payments, low-cost transfers |

| Polygon (MATIC) | ERC-20 on L2 | Scalable, Ethereum-compatible |

| Avalanche (AVAX) | ARC-20 | Low fees, high throughput |

| Base (Coinbase L2) | Optimistic Rollup | Native support, fast bridging |

| Arbitrum (ARB) | L2 rollup | DeFi-heavy ecosystem |

| Optimism (OP) | L2 rollup | Low fees, Ethereum security |

| Stellar (XLM) | Native asset | Cross-border payments |

| Algorand (ALGO) | ASA standard | Fast settlement, institutional focus |

| Hedera (HBAR) | HTS | Enterprise adoption |

| Near Protocol (NEAR) | NEP-141 | Sharding scalability |

| Cosmos / Noble | IBC | Cross-chain interoperability |

| Polkadot / Acala | Substrate | DeFi expansion |

| Flow (FLOW) | Native | NFT-heavy ecosystem |

This wide support makes USDC one of the most interoperable stablecoins, bridging traditional finance with multiple blockchain networks.

Is USDC Available on DeFi and dApps?

Yes — USDC crypto is deeply integrated into the DeFi ecosystem. Its stability and liquidity make it a preferred asset for:

-

Lending & Borrowing:

Protocols like AAVE, Compound allow users to deposit USDC as collateral or earn yields.

-

Staking & Liquidity Pools:

DEXs such as Uniswap, Curve, and PancakeSwap use USDC pairs for stable trading.

-

Payments & Cross-Border Transfers:

Many apps use USDC coin for near-instant, low-cost global payments.

-

NFT Marketplaces:

Platforms like Magic Eden and OpenSea support USDC payments for NFTs.

Read more: How to Use dApps Securely with Bitget Wallet

With Bitget Wallet, users can seamlessly connect to these dApps, manage USDC token holdings, and execute transactions across multiple chains securely.

Why Do People Use USDC?

USDC stablecoin has become one of the most trusted digital dollars because it combines price stability with blockchain efficiency. Here are the main reasons why users and businesses adopt USDC coin:

-

Hedging against volatility:

Protect funds during crypto market swings.

-

Cross-border transfers:

Send money globally in minutes with lower fees.

-

Everyday payments:

Pay for goods, services, and even in-game assets.

-

DeFi and staking:

Widely accepted as collateral and liquidity across dApps.

-

Institutional trust:

Backed by regulated reserves and transparent audits.

Is USDC Good for Hedging Volatility?

Yes. In crypto markets known for high price swings, USDC acts as a safe haven by holding its peg close to $1. Traders often convert BTC, ETH, or altcoins into USDC during downturns to preserve value.

Compared with Tether (USDT), USDC is considered more transparent due to regular auditing and U.S. regulatory oversight. However, USDT remains more liquid in some markets, so both play complementary roles.

Can You Use USDC for Cross-Border Payments and Remittances?

Absolutely. USDC payments offer:

-

Speed:

Settlement in seconds to minutes, compared to days with traditional banking.

-

Low Cost:

Minimal fees versus expensive remittance services.

-

Transparency:

On-chain tracking of every transaction.

-

Financial Inclusion:

Especially valuable in countries with unstable local currencies or limited access to dollars.

This makes USDC crypto an efficient tool for freelancers, migrant workers, and businesses handling international payments.

How Is USDC Used in Everyday Payments?

USDC is increasingly accepted in everyday life. Specifically:

- Gaming & Metaverse: In-game shopping is easier with USDC – from skins, items, NFTs to account upgrades, all paid for quickly with stablecoins.

- Online shopping: Many e-commerce sites, crypto exchanges and online services have accepted USDC. You can buy goods and pay for services without going through a bank.

- Peer-to-peer (P2P) money transfers: Send money to friends and relatives across borders in seconds, with extremely low fees, without the need for an intermediary or a bank account.

Read more: Types of Stablecoins and Which One Should You Use

Is USDC Safe and What Are Its Risks?

While USDC stablecoin is one of the most regulated and audited digital currencies, it is not without risks.

-

Regulatory Compliance:

Circle adheres to U.S. money-transmission laws and undergoes monthly reserve attestations.

-

Transparency:

Reserves are held mainly in cash and short-term U.S. Treasuries, reducing exposure to risky assets.

-

Risks to Consider:

-

Dollar Inflation:

-

As USDC is pegged to USD, it inherits fiat’s inflation risk.

-

Centralization:

Circle controls minting, redemption, and has the authority to freeze assets.

-

Counterparty Risk:

Banking failures (e.g., SVB collapse in 2023) can temporarily impact reserves.

-

Regulatory Shifts:

Future U.S. or global policies could affect USDC’s usage.

-

Is USDC Always $1?

Generally, USDC holds its peg within $0.99–$1.01, thanks to its reserve backing and redemption mechanism.

- In March 2023, during the Silicon Valley Bank collapse, USDC briefly depegged to $0.877 before recovering.

- Such events show that while stable, USDC is not risk-free, but its mechanisms have proven resilient.

What Are the Downsides of USDC Compared to Other Stablecoins?

USDC offers many advantages, but investors should be aware of certain limitations compared to other stablecoins:

-

Centralization:

Unlike decentralized alternatives like DAI, USDC is fully controlled by Circle.

-

Transparency Limits:

While audited, reserve reports may not provide full real-time visibility.

-

Counterparty Banking Risks:

Reserves depend on partner banks and custodians, exposing USDC to systemic risks.

-

Regulatory Exposure:

Heavy compliance may limit censorship resistance compared to other stablecoins.

Read more: Top Stablecoins to Watch in 2025

What Are the Differences Between USDC and USDT?

Both USDC (USD Coin) and USDT (Tether) are stablecoins pegged 1:1 to the USD, but they differ significantly in terms of transparency, reserve mechanisms, and regulatory compliance.

Which Stablecoin Has Greater Transparency?

- USDC is issued by Circle and is backed entirely by cash and short-term US government bonds.They also publish regular monthly audit reports, demonstrating transparency and clarity in their reserves.

- Tether’s USDT has faced criticism for its transparency in the past. They have improved a lot recently, but are still far behind Circle in terms of detail and clarity.

Which Stablecoin Is More Widely Used?

- USDT still leads in terms of capitalization and is the most actively traded, almost the main coin to anchor prices on CEXs.

- Meanwhile, USDC scores in the DeFi segment, licensed platforms and the US market. It is considered a reliable choice for those who prefer safety and compliance.

Is USDC or USDT Safer for Investors?

- If you are cautious, prefer transparency and want legal certainty, USDC is clearly the brighter choice. However, like most stablecoins, it is still centrally managed - meaning that in some cases, your account can still be frozen.

- USDT has extremely high liquidity, is convenient to use everywhere, but due to its somewhat controversial history, some investors are still cautious.

Read more: USDC vs USDT: Investor Guide for 2025

USDC or USDT Comparison

To provide a clear visual comparison between USDT and USDC, the table below highlights their key differences:

| Feature | USDC | USDT |

| Issuer | Circle | Tether Limited |

| Launch Year | 2018 | 2014 |

| Transparency | Monthly audited reserves | Limited disclosure |

| Reserves | Cash + U.S. Treasuries | Mixed (historically included commercial paper) |

| Popularity | Strong in DeFi & U.S. | Strong in global CEX trading |

| Regulatory Oversight | U.S.-regulated, audited | Offshore jurisdiction |

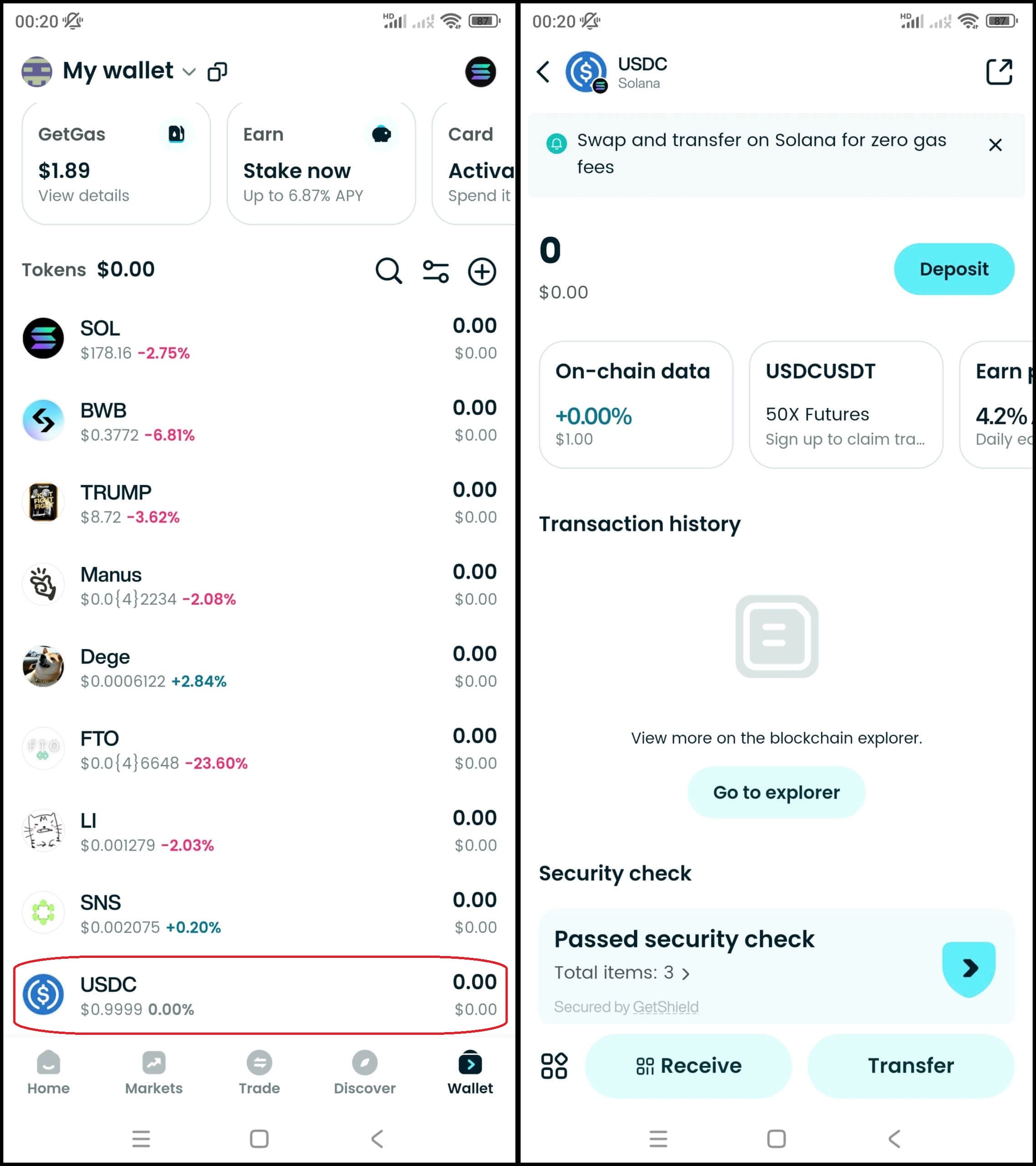

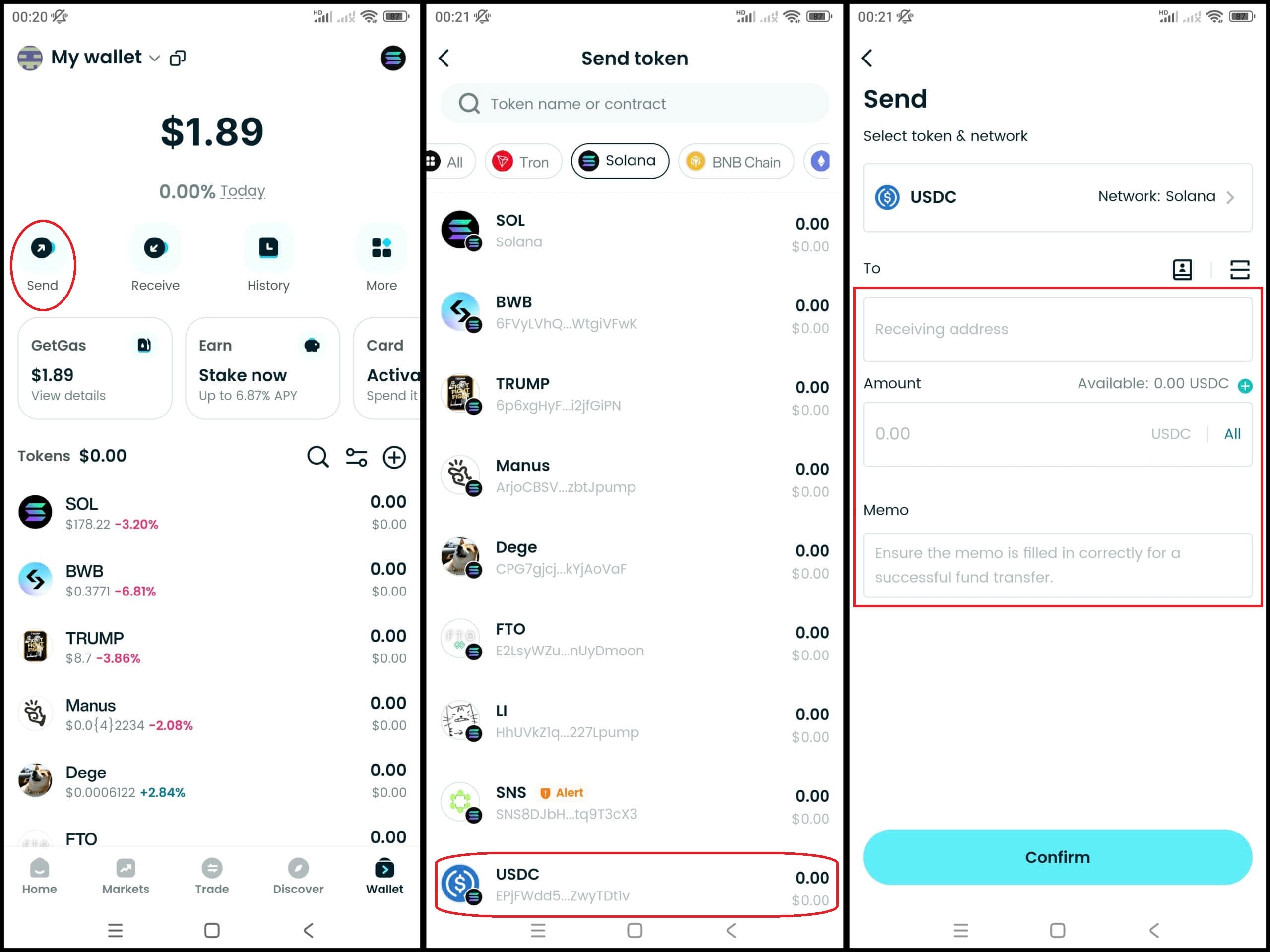

How to Buy USDC on Bitget Wallet?

Buy USDC on Bitget Wallet is easy! Just follow these simple steps:

Step 1: Create a wallet

-

If you don't have a wallet, download Bitget Wallet app now.

Register with your phone number or email, verify quickly and you can use it right away.

Step 2: Deposit money into your wallet

Once you have finished your wallet, you just need to deposit money into it. You can:

-

Transfer coins from other wallets: Send BTC, ETH or any coin you have from an external wallet.

-

Buy directly with a card: Use a bank card or credit card to buy USDT or ETH right in the app and then exchange it for USDC.

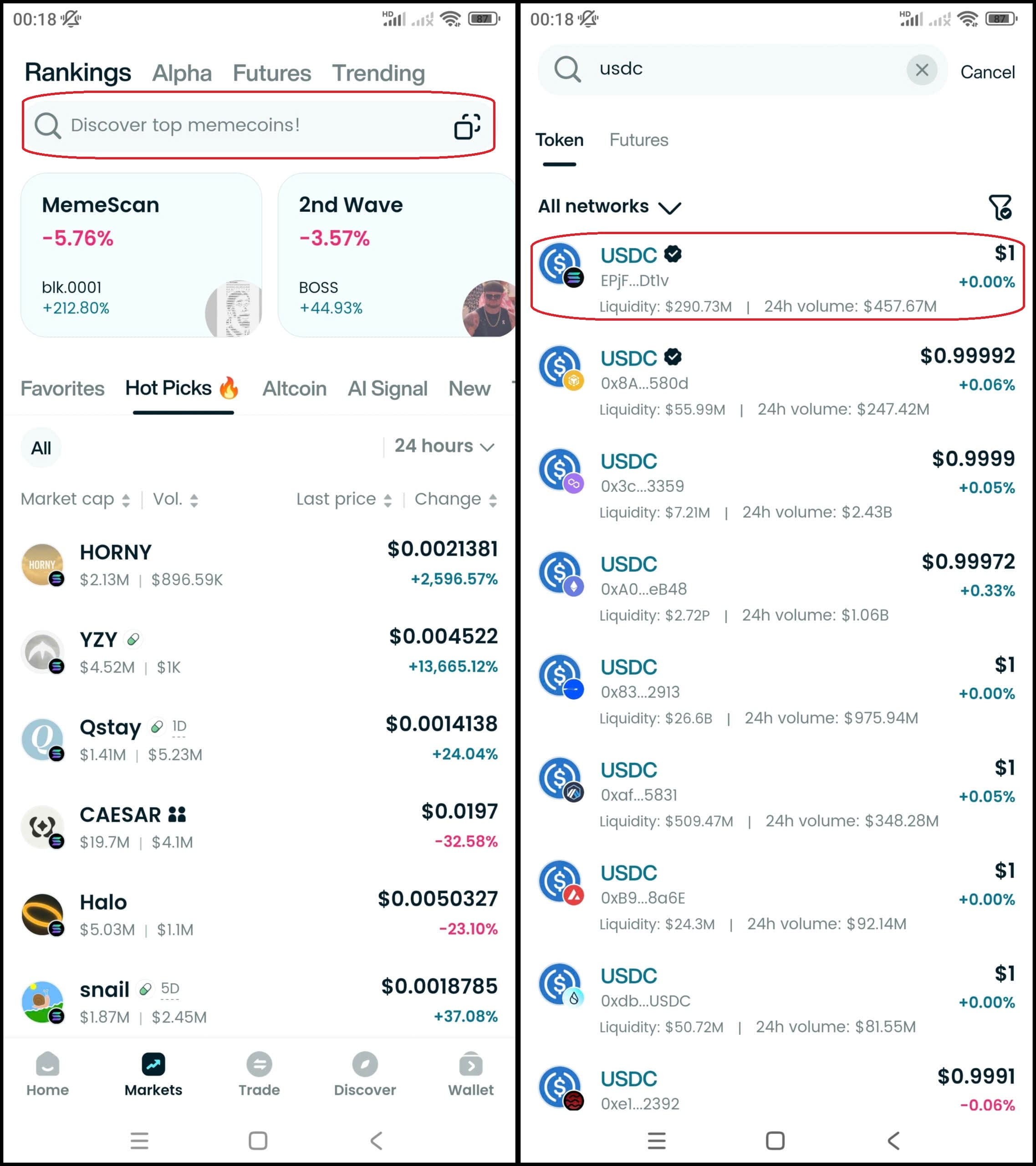

Step 3: Find USDC

- In the main interface of the wallet, go to Market, type "USDC" in the search bar.

- Select USDC to see the trading page.

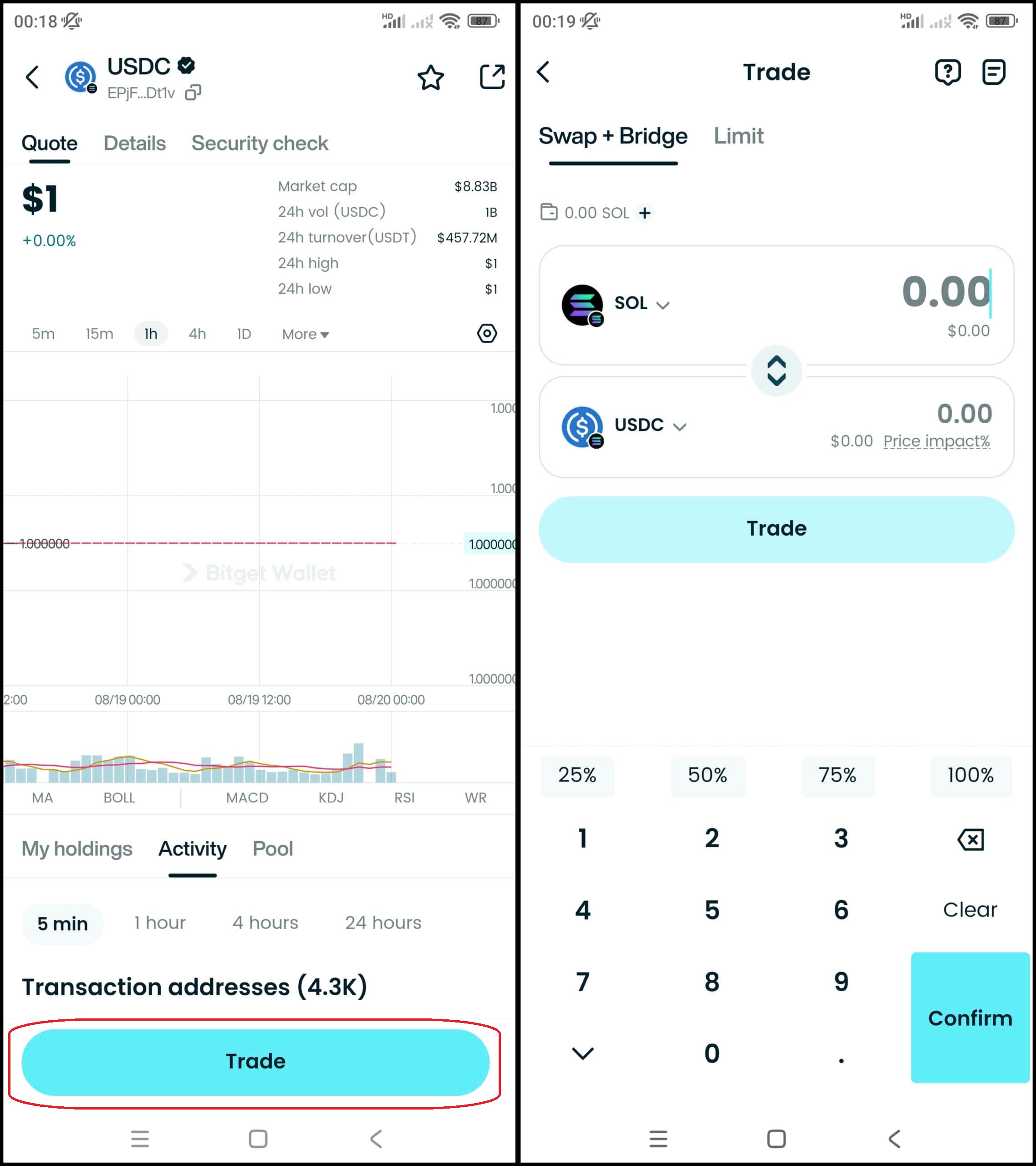

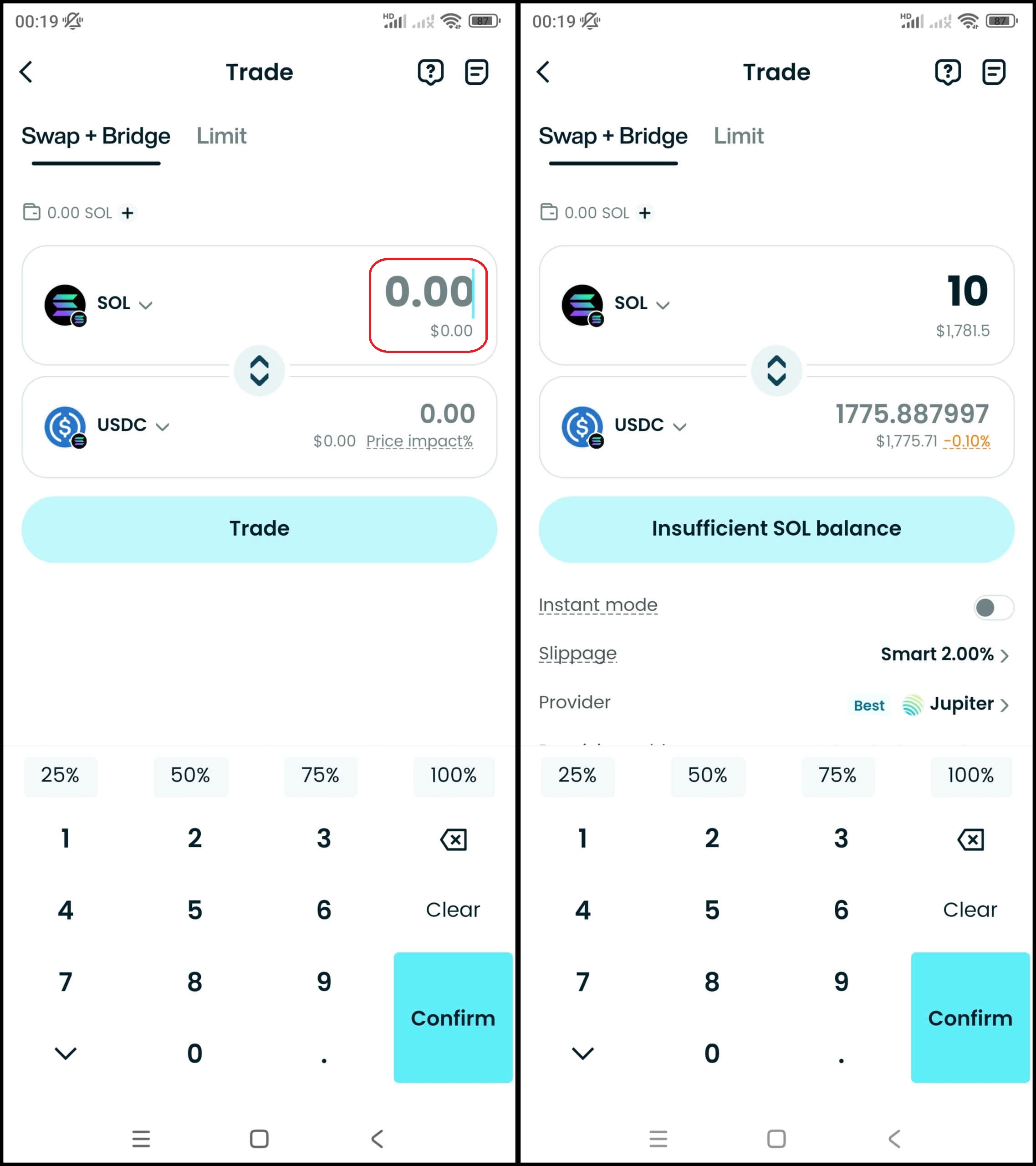

Step 4: Select the trading pair

Select the pair you want to trade, for example USDC/SOL. So you can use SOL to buy USDC, or vice versa.

Step 5: Place an order

Enter the amount of USDC you want to buy, check carefully and confirm the order.

Step 6: Check the order

After buying, you can check the your USDC in the Wallet section.

Step 7: Withdraw (if needed)

Once you have USDC, if you want to withdraw to another wallet, go to Withdraw, fill in the receiving wallet address, check the blockchain network and the amount carefully, then confirm.

▶Learn more about USDC:

- What is USDC?

- MetaMask vs Bitget Wallet: Which Is Better in 2025?

- Trust Wallet vs Bitget Wallet: Which One Is Better in 2025?

- Phantom vs Bitget Wallet: Which One Is Better?

What Is the Future of USDC in 2025 and Beyond?

Despite accounting for only about 19% of the stablecoin market share and facing continued competitive pressure from USDT and new competitors, USDC still holds an important position. Circle's expansion of multi-chain support to more than 15 blockchains has strongly strengthened USDC's role in DeFi, cross-border payments, and the crypto asset market.

Looking ahead, USDC will be a key player in the global payment system, as more financial institutions and fintechs choose it to replace traditional remittance methods that are slow and expensive. Deep penetration into Web3 ecosystems also helps USDC firmly maintain its position in the future of decentralized finance.

Will USDC Keep Growing in Global Adoption?

Yes — USDC adoption is projected to grow, driven by:

-

Institutional trust:

Circle’s compliance-first approach attracts banks, fintechs, and corporate treasuries.

-

Tokenization use cases:

USDC is increasingly used in crowdfunding, tokenized assets, and real-world payments.

-

DeFi integration:

With strong presence in lending, staking, and liquidity protocols, USDC remains central to the Web3 economy.

Read more: Complete Guide to DAI Stablecoin & MakerDAO

Conclusion

USDC (USD Coin) is a stablecoin pegged to the US Dollar, maintaining a stable and solid 1:1 exchange rate, bringing trust to the crypto market. Issued by Circle and fully transparent thanks to its cash and short-term Treasury bonds, USDC plays a pivotal role in payments, DeFi protocols, and cross-border remittances. Although it is not without some risks—such as centralization or transient exchange rate fluctuations—its strict compliance and transparency have clearly made it a top choice for both institutions and individuals.

Ready to experience smooth USDC cash flow? Download Bitget Wallet now to store, transfer, and swap USDC securely on 15+ blockchains, and explore the full multi-chain DeFi world with ease.

FAQs

Is USDC safe to hold?

Yes. USDC is fully backed by cash and U.S. Treasuries, with Circle publishing monthly audits. However, like all centralized stablecoins, it carries custodial risks.

Can USDC lose its $1 peg?

USDC is designed to stay at $1, but has experienced minor deviations (e.g., $0.877 in 2023). Market trust, reserves, and Circle’s redemption mechanism keep it stable.

How can I buy USDC?

You can purchase USDC directly within Bitget Wallet using the swaps option.

Risk Disclosure

Please be aware that cryptocurrency trading involves high market risk. Bitget Wallet is not responsible for any trading losses incurred. Always perform your own research and trade responsibly.