USDC Yield vs Traditional Savings: How Stablecoin Earn Plus Structures Passive Income?

USDC Yield vs Traditional Savings is a growing comparison among investors seeking predictable passive income in both crypto and traditional finance. While savings accounts generate bank-controlled interest, USDC yield is driven by decentralized lending demand and real-time liquidity conditions, which directly affect the APY on USDC.

For those exploring stablecoin-based returns, Stablecoin Earn Plus offers a structured way to access DeFi yield through Bitget Wallet’s non-custodial interface. In this article, we’ll break down how USDC yield works, how it compares to traditional savings, and how Stablecoin Earn Plus structures access to passive income opportunities.

You can explore Stablecoin Earn Plus by downloading Bitget Wallet and reviewing how USDC yield is structured in practice.

Key Takeaways

- USDC Yield vs Traditional Savings differs primarily in how returns are generated: USDC yield is market-driven through decentralized lending activity, while traditional savings rely on bank-controlled interest models.

- Stablecoin interest is earned when USDC is supplied to DeFi lending markets, where borrowers pay interest based on liquidity demand and utilization rates.

- APY on USDC is variable and adjusts in real time depending on borrower demand and overall liquidity conditions, unlike bank savings rates that are periodically set by financial institutions.

- Traditional savings accounts offer predictable but typically lower returns, influenced by central bank policy, inflation conditions, and institutional lending frameworks.

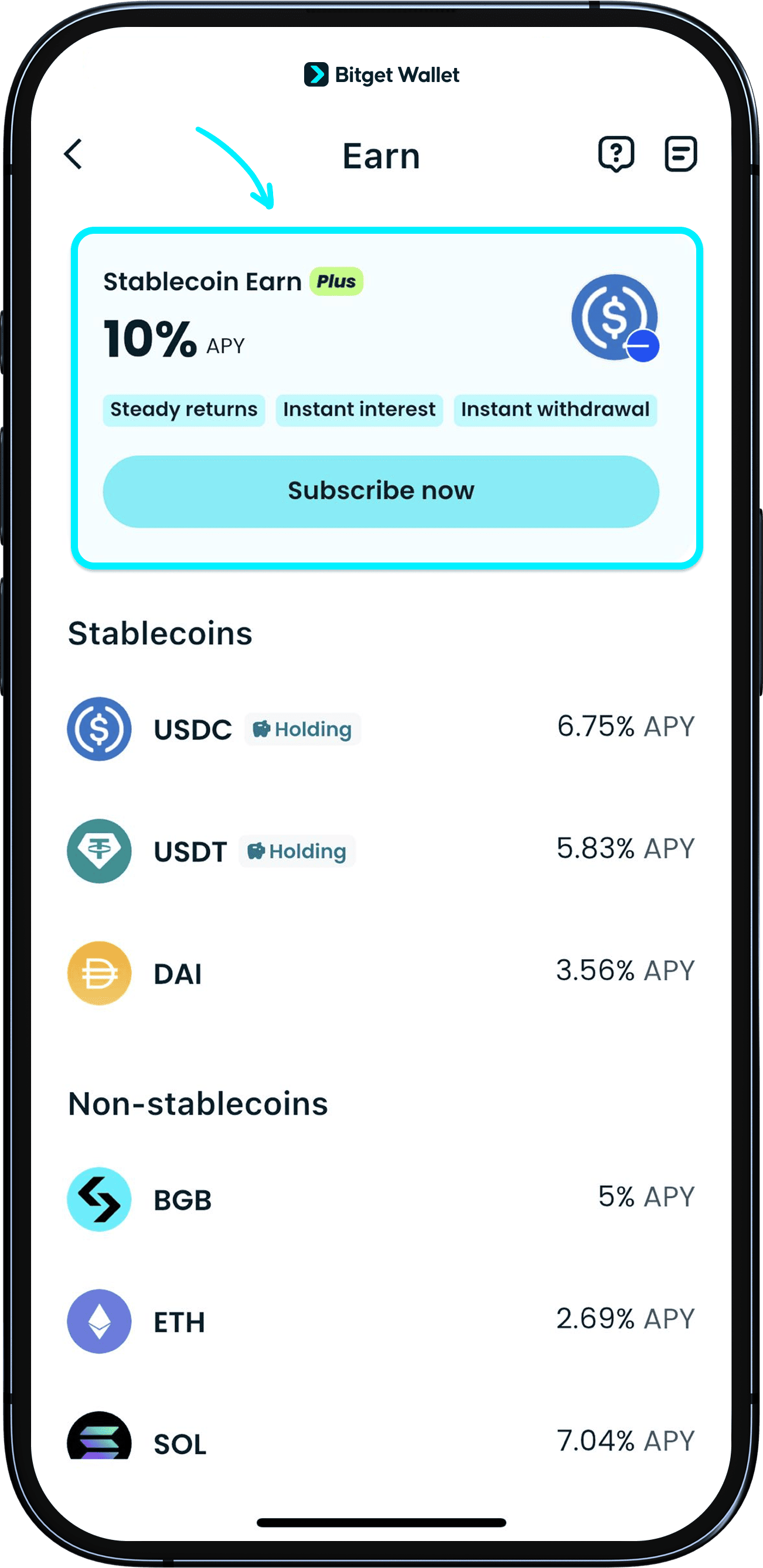

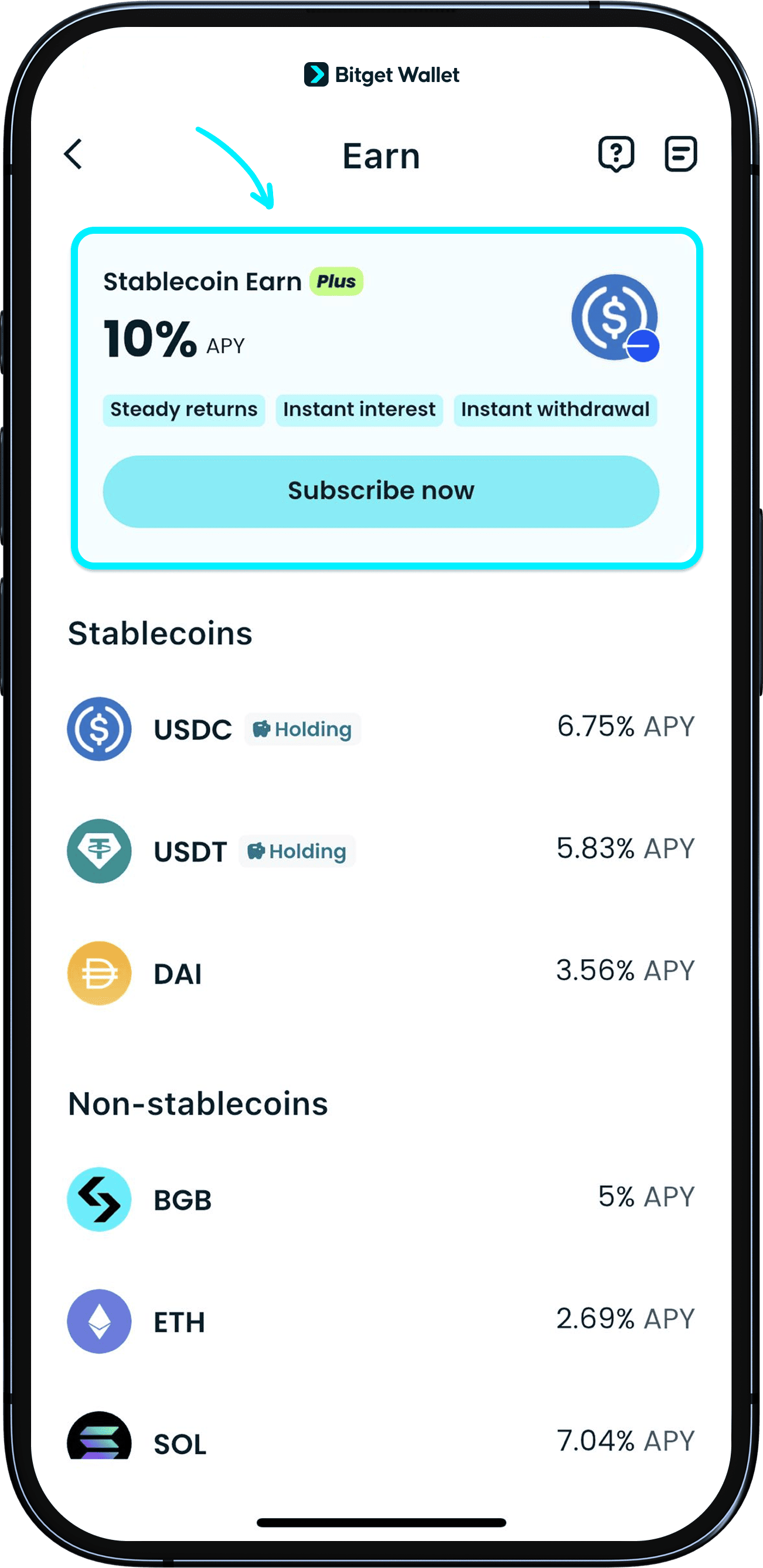

- Stablecoin Earn Plus provides a structured way to access DeFi yield within Bitget Wallet, helping users monitor APY on USDC and manage passive income positions through a simplified interface.

What Is USDC Yield and How Does USDC Yield Work?

USDC yield refers to the interest earned by supplying USDC to decentralized lending markets. Unlike traditional savings accounts that offer fixed or institution-set rates, USDC yield is market-driven, meaning returns fluctuate based on real-time liquidity demand and DeFi protocol activity.

Definition of USDC Yield and Stablecoin Interest

USDC yield is generated when users deposit USDC into DeFi lending protocols. These protocols lend the supplied USDC to borrowers who pay stablecoin interest for access to liquidity. That interest is then distributed proportionally to lenders, forming the core mechanism behind DeFi yield.

Because USDC is a stablecoin, the yield is earned without exposure to typical crypto price volatility — though the rate itself remains variable.

What Determines APY on USDC?

APY on USDC is influenced by several key factors:

- Borrower demand: Higher borrowing demand increases interest rates.

- Liquidity utilization: When more of the pool is borrowed, yields typically rise.

- Market conditions: DeFi activity levels and capital inflows affect rates.

- Supply-demand balance: Excess liquidity can compress returns.

As utilization increases, APY on USDC generally rises. When demand falls, yields adjust downward.

How Does USDC Yield Work?

If you're asking how does USDC yield work, the simplified process looks like this:

Deposit USDC → Allocated into a lending protocol → Borrowers pay interest → Interest distributed to lenders.

Returns accrue dynamically and update in real time based on protocol utilization rather than fixed banking schedules.

How to Earn Passive Income with USDC

Investors can earn passive income with USDC by supplying liquidity to decentralized lending markets where borrowers pay stablecoin interest. Returns are variable and depend on real-time demand, rather than fixed banking schedules.

How Investors Earn Passive Income with USDC

Investors earn passive income with USDC by depositing their stablecoins into DeFi lending pools. Borrowers access this liquidity and pay interest, which is distributed back to lenders.

Because APY on USDC is variable, returns adjust dynamically based on utilization rates and borrowing demand.

Where Stablecoin Earn Plus Structures Access

Stablecoin Earn Plus provides a simplified way to allocate USDC into DeFi yield strategies. Through Bitget Wallet, users can subscribe, monitor APY on USDC, and manage redemptions without directly interacting with underlying protocols.

USDC Yield vs Traditional Savings: Comparing Returns and Risk

USDC Yield vs Traditional Savings comparisons highlight differences in rate determination, liquidity flexibility, transparency, and risk structure.

Comprehensive Comparison Table

| Category | USDC Yield | Traditional Savings |

| Return Source | Stablecoin interest from DeFi lending markets | Bank lending using deposited funds |

| APY Determination | APY on USDC fluctuates based on utilization and borrower demand | Rates set by banks and influenced by central bank policy |

| Rate Stability | Variable and market-driven | Generally stable and adjusted periodically |

| Liquidity Access | Flexible redemption (protocol dependent) | May include withdrawal limits or lock-ups |

| Transparency | On-chain visibility of lending activity | Internal bank operations not publicly visible |

| Custody | Often non-custodial via wallets like Bitget Wallet | Custodial banking model |

| Risk Type | Smart contract, liquidity, stablecoin risk | Credit risk, bank solvency, inflation |

| Regulatory Protection | Limited formal insurance | Often covered by deposit insurance (jurisdiction-based) |

USDC Yield vs Traditional Savings Return Structure

In a USDC Yield vs Traditional Savings comparison, the return structure is fundamentally different. USDC yield is market-driven, with APY on USDC adjusting in real time based on borrower demand and liquidity utilization within DeFi lending markets.

Traditional savings accounts, by contrast, offer institution-controlled interest rates determined by banking policy and macroeconomic conditions. While typically lower, these rates are more stable and adjusted periodically rather than continuously.

Liquidity Differences Between USDC Yield and Traditional Savings

USDC yield generally provides flexible redemption, subject to protocol liquidity conditions and on-chain settlement mechanics. Funds can often be withdrawn without fixed lock-up periods, though gas fees and network activity may affect timing.

Traditional savings accounts may include withdrawal limits, tiered structures, or early withdrawal penalties depending on the product type. Liquidity is mediated by banking rules rather than decentralized protocol mechanics.

Risk Comparison: Is USDC Yield Safe?

When evaluating is USDC yield safe, the key question is not whether risk exists, but how risk is distributed and managed.

With USDC yield, risk is protocol-based and market-dependent. Returns fluctuate with liquidity conditions, and capital exposure depends on the integrity of smart contracts and lending activity. There is no centralized institution absorbing operational risk; instead, risk is embedded in code execution and decentralized market dynamics.

Traditional savings accounts operate under an institutional risk model. Banks manage credit exposure internally, and deposit insurance frameworks provide defined protection limits. However, depositors remain exposed to inflation risk and systemic financial stress beyond insured thresholds.

The difference is structural:

USDC yield carries decentralized protocol and liquidity risk, while traditional savings concentrate risk within regulated banking institutions.

How Stablecoin Earn Plus Structures USDC Yield?

Stablecoin Earn Plus structures access to USDC yield by organizing DeFi lending exposure into a simplified interface. It connects deposited USDC to underlying lending markets while providing visibility into APY on USDC and redemption mechanics.

Structured DeFi Yield Allocation

Stablecoin Earn Plus allocates deposited USDC into established DeFi lending protocols where borrowers pay stablecoin interest. Instead of requiring users to interact directly with protocol contracts, the product structures the allocation process within a guided environment.

This model allows users to participate in DeFi yield generation while reducing operational complexity.

Liquidity Management and APY Transparency

Because APY on USDC is variable, visibility is critical. Stablecoin Earn Plus displays current yield rates and position details within the interface, helping users understand how liquidity utilization and borrower demand affect returns in real time.

This transparency supports informed decision-making when allocating capital.

Simplifying Passive Income for Beginners

For users looking to earn passive income with USDC, Stablecoin Earn Plus provides guided subscription and redemption flows inside Bitget Wallet. This reduces technical friction while maintaining access to decentralized lending exposure.

The result is structured access to USDC yield without requiring direct protocol interaction.

Is USDC Yield Safe Compared to Traditional Savings?

When evaluating whether USDC yield is safe, the comparison is not about risk versus no risk — but decentralized protocol risk versus regulated institutional risk. Each model carries distinct structural exposures.

DeFi-Specific Risks

When asking is USDC yield safe, investors should consider risks inherent to decentralized systems:

- Smart contract vulnerabilities: Code-level flaws or exploits may impact lending protocols.

- Liquidity volatility: Sudden shifts in borrowing demand can affect redemption timing or yield stability.

- Stablecoin market risks: While USDC is designed to maintain a 1:1 peg to USD, market stress events can introduce temporary instability.

These risks are technical and market-driven rather than institution-based.

Traditional Savings Risk Model

Traditional savings accounts operate under a custodial structure where banks control deposited funds. Key risks include:

- Custodial control: Depositors rely on institutional management and internal risk practices.

- Bank solvency exposure: Financial instability within a bank can affect deposit safety.

- Regulatory protection limits: Deposit insurance provides coverage only up to defined thresholds.

In both systems, capital is exposed to risk — but the source of that risk differs fundamentally in structure and governance.

Who Should Consider USDC Yield?

USDC yield may suit investors who understand variable returns and are comparing USDC Yield vs Traditional Savings as part of a broader passive income strategy.

1. Investors Seeking Higher Passive Income

Investors aiming for returns above traditional savings rates may consider USDC yield, especially in periods where APY on USDC exceeds bank-controlled interest rates. However, higher return potential comes with variable yield behavior and decentralized risk exposure.

2. Users Comfortable with DeFi Yield Exposure

Individuals familiar with DeFi yield mechanics — including liquidity utilization, smart contract execution, and fluctuating APY structures — may be better positioned to assess how USDC yield works and manage associated risks.

3. Diversified Portfolio Builders Looking for Stable Returns

Investors building diversified portfolios may allocate a portion of capital to USDC yield as an alternative to traditional savings. While stablecoin-based returns avoid crypto price volatility, they still require monitoring of liquidity conditions and protocol risk.

Comparison Table: Stablecoin Earn Plus vs Traditional Bank Savings

| Feature | Stablecoin Earn Plus | Traditional Bank Savings |

| Yield Source | DeFi lending markets where borrowers pay stablecoin interest, plus structured bonus yield component | Bank lending activities using deposited customer funds |

| APY Type | Variable APY on USDC driven by liquidity utilization and borrower demand | Fixed or periodically adjusted interest rates set by the institution |

| Return Stability | Market-driven and can fluctuate in real time | More predictable and adjusted based on monetary policy cycles |

| Custody Model | Non-custodial structure via Bitget Wallet; users retain private key control | Custodial model; bank holds and manages deposits |

| Transparency | On-chain lending activity is publicly verifiable | Internal balance sheet operations are not publicly transparent |

| Liquidity Access | Flexible redemption depending on protocol conditions; network gas fees apply | Withdrawal rules depend on account type; may include limits or penalties |

| Interest Accrual | Continuous accrual based on protocol activity | Calculated on defined banking cycles (daily/monthly) |

| Risk Exposure | Smart contract risk, liquidity risk, stablecoin peg risk | Credit risk, bank solvency risk, inflation risk |

| Regulatory Protection | No traditional deposit insurance; platform safeguards may apply | Often protected by government-backed deposit insurance (jurisdiction-dependent limits) |

| Capital Efficiency | Can integrate into broader DeFi strategies | Generally isolated savings product |

Why Use Bitget Wallet for USDC Yield and Stablecoin Earn Plus?

Bitget Wallet serves as the non-custodial access layer for Stablecoin Earn Plus, allowing users to manage USDC yield exposure while retaining direct control over their assets.

Bitget Wallet provides the infrastructure required to access Stablecoin Earn Plus without relying on centralized custody. Instead of depositing funds into an exchange account, users interact through a wallet-controlled environment.

- Full private key control: Users retain ownership of their assets, reducing counterparty custody risk associated with centralized platforms.

- Integrated Earn dashboard: Stablecoin Earn Plus is accessible directly within the wallet interface, allowing users to allocate capital, monitor positions, and manage redemptions in one place.

- Real-time APY visibility: Users can view current APY on USDC and track how yield adjusts based on liquidity demand and protocol conditions.

- Multi-chain stablecoin management: Bitget Wallet supports stablecoin management across multiple networks, enabling broader portfolio flexibility alongside USDC yield exposure.

This structure allows investors to participate in DeFi yield generation while maintaining non-custodial asset control.

How to Get Started with Stablecoin Earn Plus in Bitget Wallet

To start earning USDC yield through Stablecoin Earn Plus, users need to access the Earn module in Bitget Wallet, allocate USDC, confirm the subscription, and monitor APY on USDC within the dashboard.

Step 1: Access the Earn Section

Open the Bitget Wallet app and navigate to the Earn section from the main interface.

Select Stablecoin Earn Plus to view available USDC yield products, including current APY on USDC and applicable tier information.

Step 2: Select Your Stablecoin

Choose USDC as the subscription asset.

Carefully review:

- Current APY on USDC

- Yield structure (variable rate)

- Any tiered or bonus conditions

This ensures you understand how returns are generated before allocating capital.

Step 3: Subscribe with Your Desired Amount

Enter the amount of USDC you wish to deposit into Stablecoin Earn Plus.

Confirm the transaction within Bitget Wallet to authorize the subscription.

Once confirmed, your USDC is allocated into the structured DeFi yield strategy and begins accruing stablecoin interest.

Step 4: Track and Redeem Your Position

You can monitor your holdings and earnings inside the Earn dashboard, where total balance and accrued yield are displayed.

Read More: Stablecoin Earn Plus

Related Reading on USDC Earn

If you're exploring USDC earn opportunities — from understanding APY mechanics to evaluating liquidity and smart contract exposure — these guides will help you assess yield potential and risks more clearly.

🔹 Understanding USDC & Stablecoin Basics

🔹 USDC Earn Explained

- USDC Earn Explained: A Complete Guide to Yield, APY, and Risk

- USDC Earn Returns: How to Evaluate APY, Liquidity, and Smart Contract Exposure

- USDC Yield: How to Earn Yield on USDC Safely in 2026?

- Best USDC Yield Strategies: How to Earn Stablecoin Interest?

- USDC Yield and Passive Income: How Much Capital Do You Need?

- USDC Yield vs Traditional Savings: How Stablecoin Earn Plus Structures Passive Income?

🔹 Stablecoin Earn Plus & Yield Options

- Stablecoin Earn Plus: What USDC Earn Is and How to Start Generating Yield

- Stablecoin Earn Plus: Earn Up to 10% APY with Flexible Withdrawal

Conclusion

USDC Yield vs Traditional Savings ultimately comes down to how investors evaluate risk, liquidity, and return expectations. USDC yield generates stablecoin interest through decentralized lending markets, with APY on USDC fluctuating based on borrower demand and liquidity utilization. In contrast, traditional savings accounts provide institution-controlled rates that are generally lower but more stable and supported by regulatory frameworks.

Stablecoin Earn Plus structures access to USDC yield within Bitget Wallet, offering a simplified way to participate in DeFi yield strategies while maintaining non-custodial asset control. For investors seeking passive income alternatives beyond traditional savings, understanding how returns are generated — and where risks originate — is essential before making allocation decisions.

Download Bitget Wallet today and start earning USDC yield through Stablecoin Earn Plus with real-time APY on USDC and structured DeFi access.

Sign up Bitget Wallet now - grab your $2 bonus!

FAQs

1. What is USDC yield?

USDC yield is the return earned by supplying USDC to decentralized lending markets. When borrowers access liquidity, they pay stablecoin interest, which is distributed to lenders. Unlike traditional savings, USDC yield is market-driven and fluctuates based on demand and utilization rates.

2. How does USDC yield work?

USDC yield works by depositing USDC into DeFi lending pools. Borrowers take loans from these pools and pay interest, which accrues to lenders over time. The APY on USDC adjusts dynamically based on liquidity demand rather than remaining fixed like bank interest rates.

3. Is USDC yield safe?

Whether USDC yield is safe depends on risk tolerance and understanding of decentralized finance. Key risks include smart contract vulnerabilities, liquidity fluctuations, and stablecoin peg stability. Unlike traditional savings accounts, USDC yield does not rely on institutional deposit insurance frameworks.

4. What is the difference between USDC yield vs savings account?

In a USDC yield vs savings account comparison, the primary difference lies in return structure and risk exposure. USDC yield offers variable, market-driven returns through DeFi lending, while savings accounts provide bank-controlled interest rates that are typically lower but more stable.

5. How can you earn passive income with USDC?

You can earn passive income with USDC by allocating it to DeFi lending products such as Stablecoin Earn Plus. Through platforms integrated with Bitget Wallet, users can subscribe, monitor APY on USDC, and manage redemptions in a structured, non-custodial environment.

Risk Disclosure

Please be aware that cryptocurrency trading involves high market risk. Bitget Wallet is not responsible for any trading losses incurred. Always perform your own research and trade responsibly.

- USDC Yield: How to Earn Yield on USDC Safely in 2026?2026-02-19 | 5mins