What is JPYC and How Does It Work? Japan Approves First Yen-Backed Stablecoin

JPYC has just made history by winning final approval to be Japan’s first yen-pegged stablecoin. After months of talks, the Japan Financial Services Agency (FSA) gave the green light, confirming that JPYC can trade on Japan’s regulated platforms. The token stays true to the yen, meaning one JPYC equals one Japanese yen. Being yen-backed, the stablecoin holds the currency that the Japanese public already trusts.

What sets JPYC apart from the thousands of crypto tokens out there is its narrow focus. It wasn’t built for moonshot speculation, but for fast, daily digital payments. Whether you’re buying a cup of iced coffee, onboarding a new trade partner, or making a cross-border payment, JPYC promises a straightforward, yen-coherent solution—no currency conversion or conversion risk slowing you down.

For Japanese and worldwide crypto consumers, it is an epoch-making moment; the first time in history, a private yen stablecoin enjoys the endorsement of a regulator and a legal footing. For early adopters, existing products like Bitget Wallet offer a way to hold, exchange, test on, and store JPYC Prepaid, thereby shattering the isolation between the blockchain world and real-world finance.

Key Takeaways

- JPYC is Japan’s first FSA-approved yen stablecoin, offering legal clarity and strong consumer protections under the Payment Services Act.

- Bitget Wallet enables users to securely hold, swap, and spend JPYC for payments, e-commerce, and DApps, bridging blockchain with real-world finance.

- JPYC’s regulated, yen-pegged model reduces FX risk for Japanese users and sets a benchmark for stablecoin adoption and innovation in Japan.

Japan Approves First Yen-Backed Stablecoin

August 2025 marked a historic turning point for Japan's digital finance environment. As of August 18, 2025 reports confirmed that the Financial Services Agency (FSA) approved JPYC Inc., making JPYC the country's first yen-backed stablecoin to operate with the authorized approval of a regulator.

JPYC still was not included in the most recent FSA registry update (7/31/2025), however, industry observers anticipate its inclusion in the next Funds Transfer Service registry update. If that happens, JPYC will attract status as a federal-regulated funds-transfer stablecoin away from being a prepaid payment instrument.

This approval presents JPYC with level of legal clarity that no previous yen token has had. For users, it means an additional layer of trust, transparency and stability in an ecosystem problematic with past scandals like the Mt. Gox collapse or the Coincheck hack.

Source: CCN.Com

Why Is FSA Approval a Milestone for Stablecoins in Japan?

Japan has earned a reputation for being home to one of the strictest crypto regulatory environments globally. Following the 2014 Mt. Gox collapse and the 2018 Coincheck hack, the FSA established frameworks that emphasize consumer protection, secure custody, and transparency.

By approving JPYC, the FSA is sending a strong message that stablecoins can safely thrive with appropriate supervision. This balance of innovation and regulation may position Japan as a global benchmark for stablecoin policy, while other nations like the US are still stuck in regulatory discussions about USDT and USDC. Japan has already established clear paths forward.

When Will JPYC Officially Launch Under FSA Oversight?

Noritaka Okabe, the CEO, has confirmed the official release of JPYC under FSA registration will happen soon after the registry is updated. Industry insiders believe after the registry is updated, the official release of JPYC could happen in Fall 2025. This aligns with the anticipated blockchain mega-events in Tokyo like WebX 2025, where both stablecoins and digital yen are also expected to be discussed quite extensively.

For now, there is still user interaction with JPYC Prepaid, which is still on Ethereum, Polygon, Avalanche, and Astar as was stated previously. This version is already demonstrating utility of JPYC for real-world payments and represents the bridge to the fully regulated stablecoin coming out sometime this year.

Source: Coindeck

What is JPYC the Stablecoin?

JPYC Japanese yen-positioned stablecoin is exactly what it sounds like - stable in price at ¥1 for it's token value by fiat reserves legally structured to comply in accordance with law. JPYC's price stability makes it perfect for payments, remittances , and e-commerce - unlike cryptocurrencies whose prices dramatically fluctuate in both:

JPYC is unlike any "crypto asset" legally in Japan since JPYC is classified under the Payment Services Act as a prepaid payment instrument. JPYC doesn't behave or have the identity of a "crypto asset," but is clearly a digital version of the yen that is non-speculative.

Is JPYC Legally Considered a Cryptocurrency?

In Japan, JPYC is not classified as a cryptocurrency. Where a token would qualify as "crypto assets" under a legal framework… for example Bitcoin and Ethereum, JPYC is classified legally as prepaid digital currency which is recognized under the Payment Services Act. This legally defined status has many benefits derived from its legal and regulatory definition both for users and businesses.

To be clear, these are the key takeaways about JPYC’s legal status:

- Regulatory and compliant: JPYC is regulated under Japanese law which provides users with protections built into law for users to understand regulatory compliance.

- Stable value: JPYC value is pegged to the Japanese yen at 1:1 so it is not subject to the market volatilities prevalent in the cryptocurrency assets, commonly seen in tokens like bitcoin and ethereum.

- Pre-paid digital currency that can be used just like electronic money: JPYC provides functionality both for payments, or card usage, or online and digital payments because juridical jurisdiction is electronic currency for use as a means of payment.

- JPYC is not classified as crypto-assets, consequently, JPYC does not exist in the market of speculative digital assets, and is leaning toward a financial payment infrastructural product with a legal regulation required for financial service providers.

This ductility of JPYC as a domestic Japanese offered, secured, yen backed digital asset is so urgently important especially to Japanese residents and businesses looking for a compliant national digital currency. The act of JPYC using Bitget Wallet as an electronic asset and means to hold, swap, or spend does not appear to require to comply with international or complex regulatory compliant laws for cryptocurrency.

How Is JPYC Different from CBDC (Digital Yen)?

JPYC should not be confused with a Central Bank Digital Currency (CBDC). While both are yen-based digital assets, their issuers and purposes differ:

- JPYC is created by a private company (JPYC Inc.), approved by the FSA.

- CBDC (Digital Yen) would be issued by the Bank of Japan, carrying the status of legal tender.

In essence, JPYC is a regulated private solution, while the digital yen would be a sovereign public solution. The coexistence of both could strengthen Japan’s role in the digital economy.

Why Is JPYC Described as a Prepaid Digital Currency?

JPYC operates on a prepaid model. Users deposit yen in advance, and JPYC Inc. issues tokens equivalent to that amount. These tokens can then be used for:

- Online shopping through JPYC Apps.

- Exchanging into gift cards such as giftee Box.

- Peer-to-peer transfers between wallets.

This prepaid system ensures that every JPYC in circulation is backed by fiat reserves, providing trust and stability to both consumers and businesses.

Read more: What is Stablecoin? A Beginner’s Guide to Price-Stable Cryptocurrencies

How Is JPYC Different from Other Stablecoins?

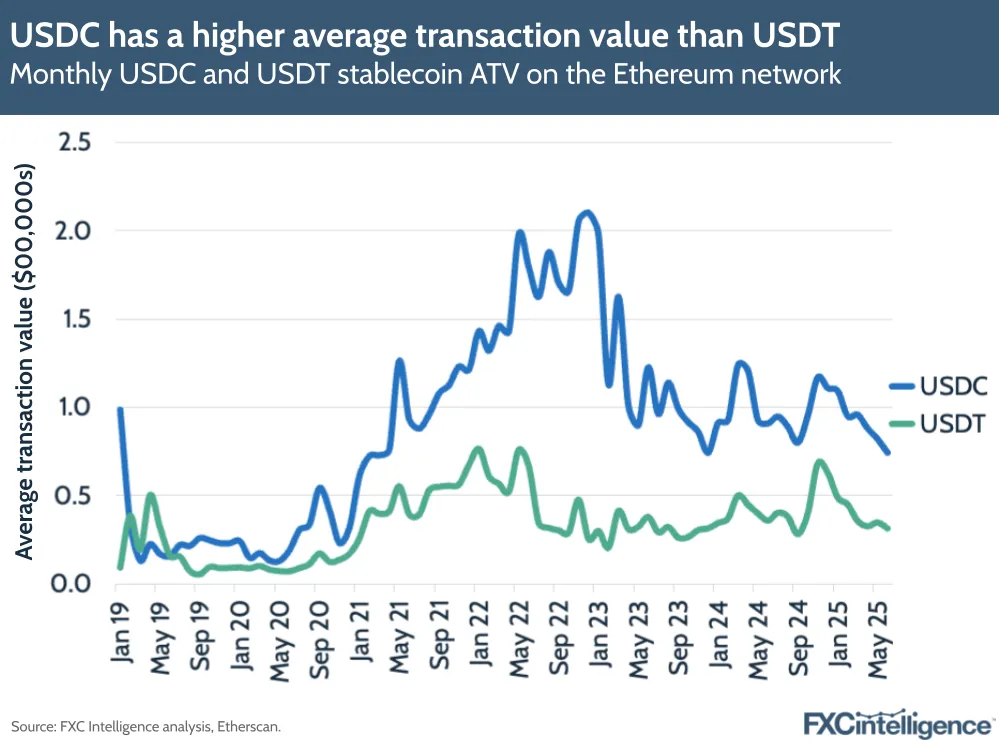

Globally, stablecoins are dominated by dollar-pegged tokens such as USDT (Tether) and USDC (Circle). These coins serve as the backbone of DeFi and crypto trading, but they also expose Japanese users to foreign exchange (FX) risk, since they are tied to the U.S. dollar.

JPYC, however, is pegged to the yen, making it inherently more useful for domestic users. It allows Japanese investors and businesses to stay within their native currency ecosystem, avoiding USD fluctuations.

- Currency peg: JPYC is pegged to the Japanese yen, eliminating FX risk for local users.

- Domestic utility: Ideal for payments, gift cards, and B2B settlements within Japan.

- Regulatory compliance: JPYC operates under Japan’s Payment Services Act, while USDT/USDC face fragmented or overseas regulation.

- Stable usage: JPYC functions as a prepaid digital currency, making it suitable for everyday transactions without the volatility of crypto markets.

What Makes JPYC More Suitable for Japanese Users?

Japanese users benefit from JPYC’s design in multiple ways:

- Price stability in yen means no FX risk when moving funds between crypto and fiat.

- FSA regulation ensures compliance with consumer protection standards.

- Integration with local e-commerce systems makes JPYC usable beyond speculation.

In contrast, using USDT or USDC in Japan often requires currency conversion, creating both costs and risks.

Could JPYC Compete Globally with USDT and USDC?

While JPYC may initially serve primarily Japanese users, its influence could expand regionally. Asian markets with strong trade ties to Japan could adopt JPYC as a cross-border settlement tool, especially for B2B transactions.

Source: Bitget

Still, challenges remain: USDT and USDC enjoy massive liquidity and entrenched global networks. JPYC’s success abroad will depend on whether Japan’s model of regulated stablecoins becomes attractive to other governments.

| Feature | JPYC (Yen) | USDT / USDC (USD) |

| Regulation | FSA, Payment Services Act | Fragmented across countries |

| Currency Peg | 1 JPYC = ¥1 | 1 USDT/USDC = $1 |

| Adoption Focus | Japan, Asia payments | Global DeFi, trading |

| Consumer Protection | Strong domestic safeguards | Uncertain jurisdictionally |

Read more: USDC vs USDT: What’s the Difference? Investor’s Guide for 2025

What Are the Features and Benefits of JPYC?

JPYC’s strengths go beyond its peg. For consumers, it is a low-volatility asset that can be used in daily life. For businesses, it opens new doors for efficient settlements.

One of the most innovative features is JPYC’s integration with gift card systems. Through partnerships with services like giftee Box, JPYC can effectively be spent at millions of Visa merchants worldwide. This bridges the gap between blockchain assets and real-world commerce.

Additionally, JPYC is supported across multiple blockchains, ensuring accessibility for different ecosystems, whether Ethereum-based DeFi or Polygon-based apps.

Can JPYC Be Used for Everyday Shopping?

Yes, although indirectly. By converting JPYC into gift cards, users can shop at regular merchants, from convenience stores to e-commerce giants. This process demonstrates how JPYC operates as a practical digital yen rather than a speculative asset.

What Makes JPYC Attractive to Businesses?

Businesses value JPYC for:

- Faster settlements than bank transfers.

- Lower fees, especially for cross-border remittances.

- Programmable payments, enabling smart contracts for payroll or B2B automation.

For example, a Japanese tech company could use JPYC to pay contractors in Asia instantly, avoiding bank delays and foreign currency fluctuations.

Read more: What Are Crypto Payments? Crypto PayFi vs. Traditional Payments

What Are the Risks and Challenges of JPYC?

Despite its advantages, JPYC faces hurdles. The largest is competition from bank-backed stablecoins such as DCJPY and Progmat Coin, which may leverage existing financial networks to capture market share.

Technical risks also exist. JPYC is issued on multiple chains, making it vulnerable to outages or bridge exploits. Liquidity fragmentation across decentralized exchanges could lead to slippage when trading.

Could JPYC Lose Its Market Share?

JPYC currently dominates the yen stablecoin market, holding more than 99% of market share in Japan. Its early adoption and regulatory compliance give it a strong first-mover advantage, but the landscape may change as other players enter the market.

Source: FXC

Factors that could affect JPYC’s market position:

- Competition from banks: Upcoming yen-backed stablecoins from financial institutions may attract users seeking traditional bank guarantees.

- User preferences: Businesses and individuals might shift to alternatives offering lower fees or additional features.

- Need for expanded utility: JPYC must continue integrating with e-commerce, DApps, and gift card platforms to maintain relevance.

- Regulatory updates: Future changes in Japan’s crypto laws or prepaid digital currency regulations could influence adoption.

What Technical Issues Should Users Watch Out For?

While JPYC is a stable and regulated yen stablecoin, users should remain aware of certain technical risks that can affect transactions and usability. Staying informed and using trusted platforms like Bitget Wallet helps mitigate these issues.

Key technical considerations for JPYC users:

- Network outages: Temporary downtime on supported chains like Polygon or Ethereum can delay transactions.

- High gas fees: Congested networks may lead to elevated transaction costs when swapping or transferring JPYC.

- Bridge vulnerabilities: The official JPYC Prepaid Bridge ended in April 2025 to reduce security risks, so relying on third-party bridges is unsafe.

- Slippage and liquidity: On decentralized exchanges (DEXs), low liquidity can cause slippage when swapping JPYC for other tokens.

What Is the Future Outlook for JPYC?

Japan’s government has made clear its intention to lead in stablecoin regulation and adoption. JPYC fits directly into this strategy, offering both a domestic payment tool and a model for international frameworks.

The future may see salary payments in JPYC, enabling employees to receive stable, digital yen directly into wallets. Businesses could also adopt JPYC for settling supplier contracts or international trade.

Can JPYC Become the Standard for Yen Stablecoins?

With its first-mover advantage and expected approval from Japan’s Financial Services Agency (FSA), JPYC is strongly positioned to become the benchmark yen stablecoin for both retail and institutional users. Its compliance with domestic regulations enhances trust, while its adoption across multiple blockchain ecosystems strengthens its network effect.

Factors supporting JPYC as the leading yen stablecoin:

- Regulatory backing: FSA recognition boosts credibility and user confidence.

- Network adoption: JPYC is available on multiple public chains, including Ethereum, Polygon, and Avalanche.

- Partnerships: Integration with DApps, e-commerce platforms, and gift card services increases real-world utility.

- Brand recognition: As Japan’s first yen-backed stablecoin, JPYC enjoys strong market awareness and loyalty.

These advantages make it challenging for competitors, including bank-issued yen stablecoins, to quickly surpass JPYC. For users in Japan, leveraging Bitget Wallet ensures seamless access, secure storage, and easy swapping of JPYC as it continues to grow.

How Could JPYC Shape Japan’s Digital Finance Future?

If widely adopted, JPYC has the potential to redefine digital finance in Japan. As a yen stablecoin with regulatory backing, it can streamline payments, reduce costs, and integrate blockchain technology into everyday commerce for both individuals and businesses. Its practical applications extend beyond retail, impacting B2B settlements, remittances, and online services.

Ways JPYC could influence Japan’s digital finance landscape:

- Instant, low-cost transfers: Enables faster payments compared to traditional banking systems.

- Integration with commerce: Can be used for online shopping, gift cards, and digital services.

- Regulatory model for other countries: Japan’s FSA-backed framework could serve as a blueprint for stablecoin regulation globally.

- DeFi and DApp adoption: Encourages developers to build blockchain applications with a regulated, yen-backed currency.

By supporting JPYC through secure wallets like Bitget Wallet, users and businesses can participate in this evolving digital ecosystem while safely leveraging its features. JPYC’s role in bridging JPYC crypto, e-commerce, and regulatory compliance positions it as a key player in Japan’s financial innovation.

How Can You Use JPYC in Bitget Wallet Today?

JPYC can now be used directly inside Bitget Wallet, giving users access to smooth swaps, payments, and DApp integrations. Whether you’re holding JPYC as a prepaid stablecoin or looking to spend it, Bitget Wallet provides multiple features to maximize its utility.

Key Ways to Use JPYC in Bitget Wallet

-

Hold and Receive JPYC Prepaid

Store JPYC securely across supported chains and easily receive transfers in your Bitget Wallet.

-

Swap JPYC ↔ USDT/USDC on Polygon (QuickSwap)

Instantly exchange JPYC for leading stablecoins like USDT or USDC using Polygon’s QuickSwap integration.

-

Use GetGas for Transaction Fees

Pay network fees without needing native tokens. GetGas allows you to cover fees directly with JPYC, making transactions faster and simpler.

-

Access JPYC Apps via DApp Browser

Redeem JPYC in ecosystem apps, including gift cards, e-commerce services, and more — all accessible through the built-in DApp browser.

Can Users Still Bridge JPYC?

In the past, JPYC provided an official bridging service that allowed users to move JPYC across different blockchains. However, this option is no longer available. The JPYC Prepaid Bridge officially ended on April 30, 2025 (ref4), and all related services were discontinued.

This means that if you still see older tutorials or third-party instructions about bridging JPYC, you should avoid using them. Many of these outdated services may no longer function properly, and relying on them could expose your assets to unnecessary risks.

Instead of bridging, JPYC holders can take advantage of the built-in tools inside Bitget Wallet. The wallet’s Swap feature lets you exchange JPYC directly on Polygon for other stablecoins such as USDT or USDC. Additionally, the DApp browser in Bitget Wallet provides direct access to official JPYC Apps, including prepaid card and gift card services.

Conclusion

What is JPYC is more than just a technical question—it represents Japan’s unique approach to digital money. Unlike global stablecoins, JPYC was born as a JPYC prepaid digital currency under Japan’s Payment Services Act, giving it a prepaid treatment that makes it stand out among other yen stablecoin options. As a JPYC stablecoin, it keeps a fixed value of 1 JPYC = ¥1, making it simple for users to trust and use in payments, swaps, and decentralized apps.

In summary, What is JPYC is best answered as a regulated, prepaid, and practical JPYC stablecoin that helps Japan experiment with digital money while staying compliant. For users who want to explore its utility, the safest way is to manage and swap JPYC within Bitget Wallet, where you can trade it with other stablecoins, access DApps, and use gift card integrations securely.

Sign up Bitget Wallet now - grab your $2 bonus!

FAQs

1. Is JPYC Safe?

Yes, JPYC is considered safe for users in Japan because it is issued as a JPYC prepaid digital currency under the Payment Services Act. Unlike unregulated cryptocurrencies, it maintains a stable value pegged to the Japanese yen and is supported by regulated wallets like Bitget Wallet. However, users should always avoid outdated services, such as the JPYC Prepaid Bridge, which ended in April 2025.

2. How to Buy JPYC in Japan?

To buy JPYC safely, you can use Bitget Wallet or regulated Japanese exchanges that support the token. The process is simple: fund your wallet, select JPYC, and swap it for yen or other stablecoins like USDT/USDC. This ensures you are compliant with Japanese regulations and can access JPYC Apps seamlessly.

3. JPYC vs USDT: What’s the Difference?

JPYC is a yen stablecoin, while USDT is a USD-backed stablecoin widely used globally. The main difference is that JPYC is regulated in Japan and designed for domestic transactions, e-commerce payments, and prepaid services, whereas USDT is primarily used in global trading and DeFi liquidity. Users who want a legal yen-backed token in Japan often prefer JPYC for lower FX risk.

Risk Disclosure

Please be aware that cryptocurrency trading involves high market risk. Bitget Wallet is not responsible for any trading losses incurred. Always perform your own research and trade responsibly.