What is USD1: Trump-Backed Stablecoin Explained with Risks, Listings, and Market Outlook

What is USD1 and why has it become one of the most talked-about stablecoins in 2025? USD1 is a newly launched, Trump-backed stablecoin created by World Liberty Financial (WLFI). Unlike traditional stablecoins such as USDT or USDC, USD1 positions itself as an institutional-first asset, backed by U.S. Treasuries and cash reserves while being securely custodied by BitGo, one of the most trusted digital asset custodians in the market.

What sets USD1 apart is not only its political spotlight but also its early momentum. In its first month of circulation, USD1 reached over $2.1 billion in market cap, largely fueled by the high-profile $2B Binance–MGX deal and the perception that it could serve as a strategic alternative to existing stablecoins. This mix of political ties, financial backing, and institutional adoption makes USD1 an asset worth watching closely.

In this guide, you’ll learn why USD1 matters, how it’s reshaping the stablecoin landscape, and why Bitget Wallet empowers investors with the most secure and comprehensive way to hold, swap, and manage USD1.

Key Takeaways

- USD1 is the first Trump-backed stablecoin, launched by World Liberty Financial (WLFI).

- USD1 is fiat-backed, with reserves in U.S. Treasuries and USD deposits, and secured by BitGo custody.

- USD1 quickly reached a $2.1B market cap, fueled by the Binance–MGX institutional deal.

What is USD1 Stablecoin and Who Created It?

USD1 (USD1 stablecoin) was launched by World Liberty Financial (WLFI) in 2025 and marketed with prominent political associations to the Trump family. WLFI acts as the issuer and governance entity overseeing issuance, compliance, and reserve management. Below are the key structural and strategic characteristics that define USD1.

- Issuer: World Liberty Financial (WLFI) — handles issuance, reserve management, and compliance.

- Political positioning: Branded with Trump-family ties and promoted as a “pro-American” stablecoin, which can create both domestic appeal and international skepticism.

- Institutional strategy: Designed for bank, fund, and regulated market adoption rather than pure retail volume; emphasis on custody, trust, and partnerships.

- Custody & trust: BitGo Prime provides custodial services for USD1 reserves, offering multi-sig security, regulated trust arrangements, and insurance layers.

- Global impact: Messaging seeks adoption among U.S.-aligned institutions and jurisdictions; political alignment may limit adoption in some markets.

Source: News.bitcoin.com

Read more: How to Buy World Liberty Financial Coin and What is the $WLFI Token?

How is World Liberty Financial (WLFI) Linked to USD1?

World Liberty Financial (WLFI) acts as the central governing entity behind USD1, blending financial oversight with political influence. This unique structure makes USD1 both credible and controversial.

- Governance: WLFI manages issuance, reserves, and compliance with U.S. standards.

- Trump Ties: Reported family links reinforce its political positioning.

- Institutional Credibility: Centralized governance appeals to banks and funds.

- Geopolitical Impact: Could accelerate adoption in U.S.-aligned regions while facing resistance elsewhere.

Read more: What is Stablecoin? A Beginner’s Guide to Price-Stable Cryptocurrencies

How Does USD1 Stablecoin Work?

At its core, USD1 functions as a fiat-backed stablecoin that maintains a 1:1 price relationship to the U.S. dollar by holding high-quality liquid assets (short-term Treasuries, cash equivalents, and USD deposits) in custody. Those reserves are independently custodied by BitGo Prime, which aims to provide institutional-grade security, insurance, and operational transparency.

Unlike algorithmic stablecoins (which rely on code and tokenomics to maintain a peg), USD1 follows a conservative, asset-backed model that appeals to institutions looking for predictability and audited collateral.

Source: BItget Wallet

1. What Reserves Back USD1?

USD1’s reported reserve composition includes:

- Short-term U.S. Treasury bills (primary liquid collateral),

- Cash equivalents and bank USD deposits held in regulated financial institutions, and

- Custodial oversight by BitGo Prime (multi-sig wallets, institutional custody, and insurance cover).

Those reserve choices are intended to provide both liquidity (for redemptions) and security against depeg events.

2. Why Does BitGo Custody Matter for USD1?

BitGo’s custody matters because it is a recognized institutional custodian in crypto markets. Benefits include:

- Security: Multi-signature custody, hardened key management, and enterprise procedures.

- Insurance & protections: Coverage against certain theft and security incidents.

- Institutional credibility: Recognition by regulated market participants and alignment with KYC/AML processes.

For institutional investors, BitGo custody strengthens USD1’s positioning as a regulated, bank-grade instrument bridging traditional finance and digital assets.

How is USD1 Stablecoin Different from USDT and USDC?

When comparing USD1 against USDT and USDC, the key differences lie in peg design, transparency, and adoption strategy. While USDT (Tether) and USDC (Circle) dominate retail and institutional markets with massive liquidity, USD1 is marketed as an “institutional-first” stablecoin, leveraging political ties and exclusive deals to accelerate its entry.

- USDT (Tether): Broad retail usage, but criticized for opaque reserves.

- USDC (Circle): Trusted by institutions with monthly attestations.

- USD1 (WLFI): Positioned as “pro-American,” backed by Treasuries and BitGo custody, but with limited third-party attestations.

1. What Makes USD1 Institutional-First?

USD1 is built to attract large-scale institutions rather than retail users.

- Adoption Strategy: Prioritizes liquidity partnerships and institutional deals.

- Flagship Move: The $2B Binance–MGX deal boosted USD1 liquidity at launch.

- Market Signal: Represents a shift toward high-volume, institution-driven adoption.

2. Does USD1 Offer More Transparency than Competitors?

Transparency is where USD1 faces its toughest questions.

- USDC Model: Publishes monthly reserve attestations for investor confidence.

- Tether Model: Provides quarterly breakdowns, though often criticized.

- USD1 Model: Claims reserves in BitGo custody but lacks a set audit schedule, relying on custodian trust rather than published attestations.

Source: Digitaltoday.co.kr

Read more: USDT Guide, USDC Guide, USDC vs USDT Comparison

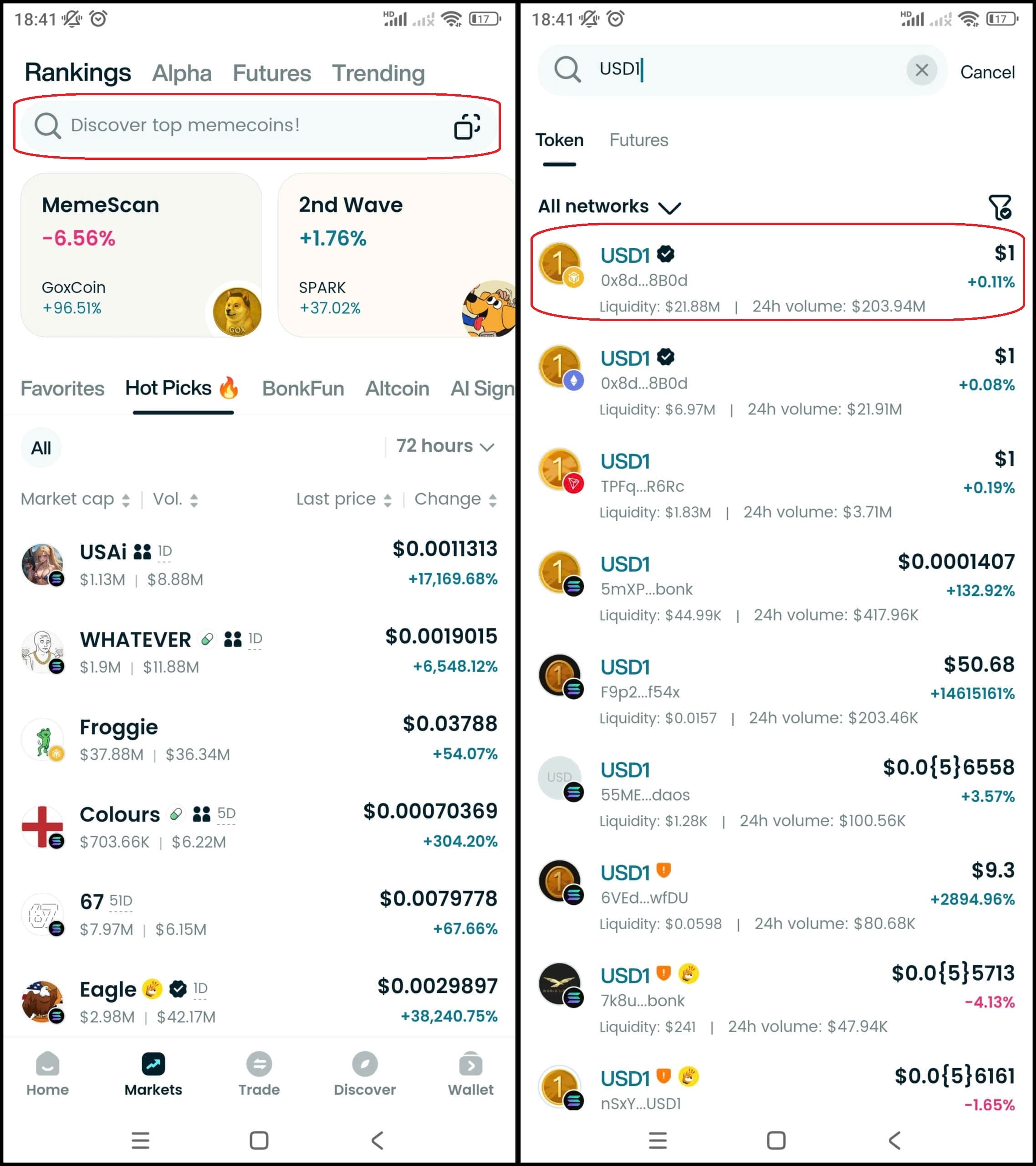

Where is USD1 Listed and How Can You Buy It?

As of now, USD1 is officially listed on Bitget Exchange and supported on Bitget Wallet. The token, also known as USD One (WLFI stablecoin), has quickly secured high-profile listings thanks to its strong institutional backing and political branding.

1. How to Buy USD1 on Bitget?

Buying USD1 on Bitget Exchange follows a familiar process:

- Create or log into your Bitget account.

- Complete KYC verification to enable fiat deposits.

- Deposit USDT, USDC, or fiat via card/bank transfer.

- Search for the USD1/USDT trading pair.

- Place a market or limit order to buy USD1.

- Withdraw to Bitget Wallet for self-custody.

2. Can You Buy USD1 on DEXs like Bitget Wallet?

Yes. USD1 can be purchased directly on Bitget Wallet, which supports one-click swap from stablecoins like USDT or USDC into USD1. With its cross-chain capabilities, Bitget Wallet makes USD1 accessible across multiple networks without going through centralized order books.

3. What’s the Difference Between Buying USD1 on Bitget vs Bitget Wallet?

Both Bitget Exchange and Bitget Wallet support USD1, but the usage differs:

- Bitget Exchange → Best for spot traders. It offers deeper liquidity, order book trading, and advanced features for professional investors.

- Bitget Wallet → Best for self-custody and flexibility. Users gain OTC fiat on-ramps, one-click swaps to USD1, and complete asset control across DeFi ecosystems.

| Feature | Bitget Exchange | Bitget Wallet |

| Best For | Active traders, institutional-style strategies | Self-custody, DeFi, beginner-friendly swaps |

| Liquidity & Trading | Deep liquidity, order book trading, advanced charting tools | One-click swaps, OTC fiat on-ramps, cross-chain support (130+ networks) |

| Custody | Custodial – exchange-managed | Non-custodial – full user asset control |

| Security | Exchange-grade protections, compliance oversight | MPC security + $300M Protection Fund |

| Extra Features | Fast market access, seamless fiat-to-USD1 trades | DeFi & NFT integration, flexible multi-chain usage |

Value angle: Use Bitget Exchange if you want professional trading with liquidity depth. Use Bitget Wallet if you prefer secure storage, beginner-friendly swaps, and cross-chain DeFi access.

Source: Bitget

Read more: Bitget Wallet vs Exchange Guide

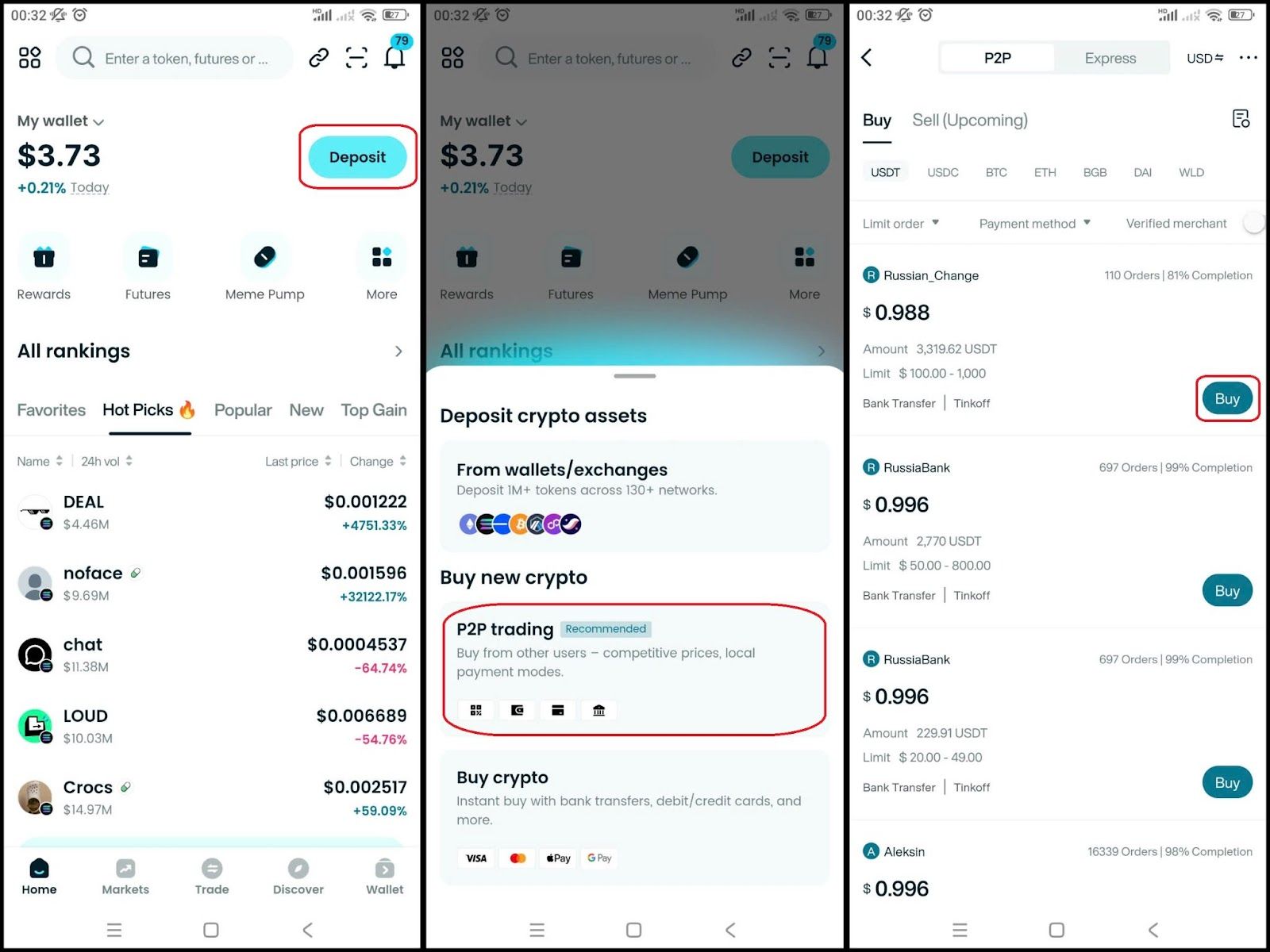

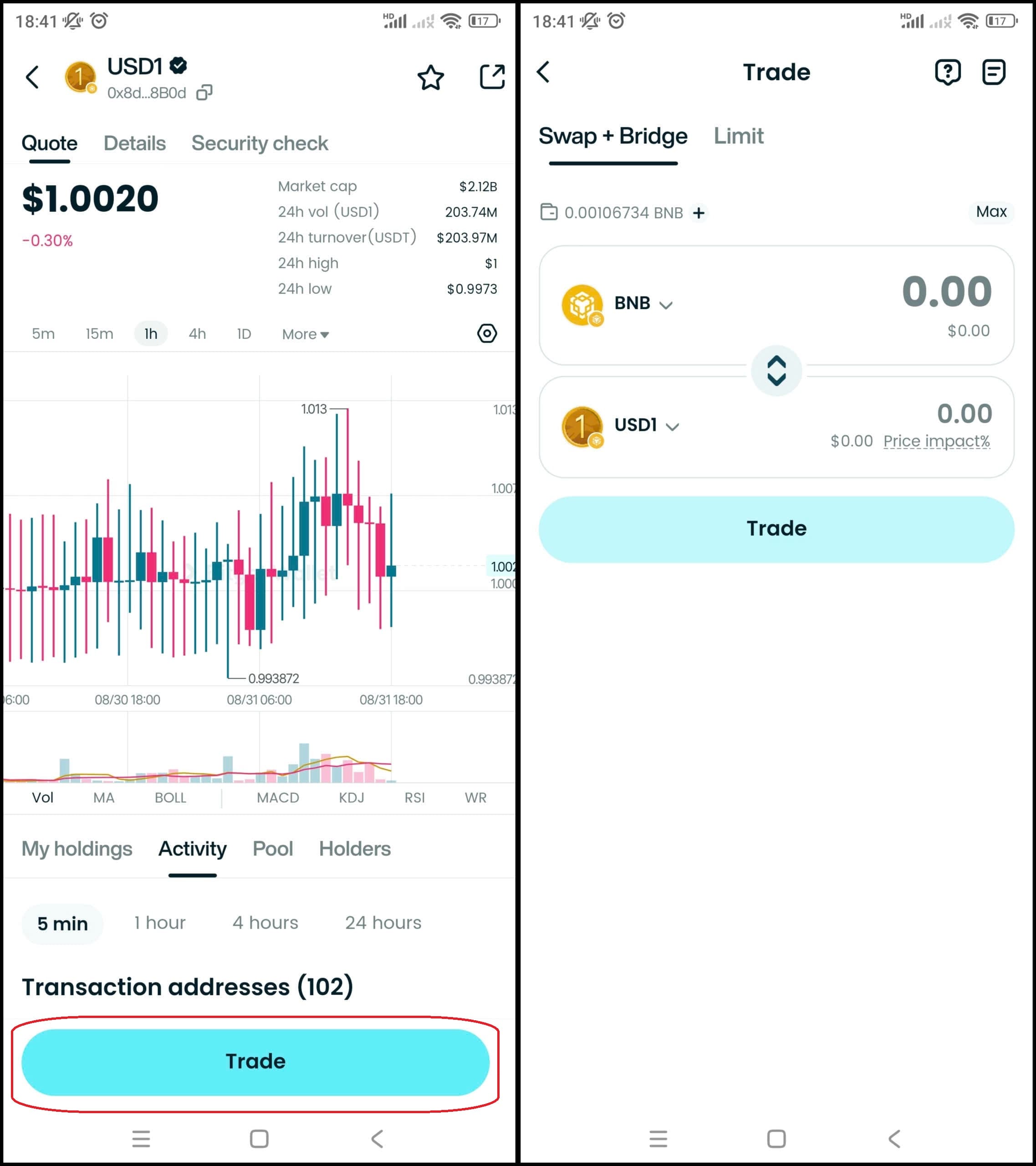

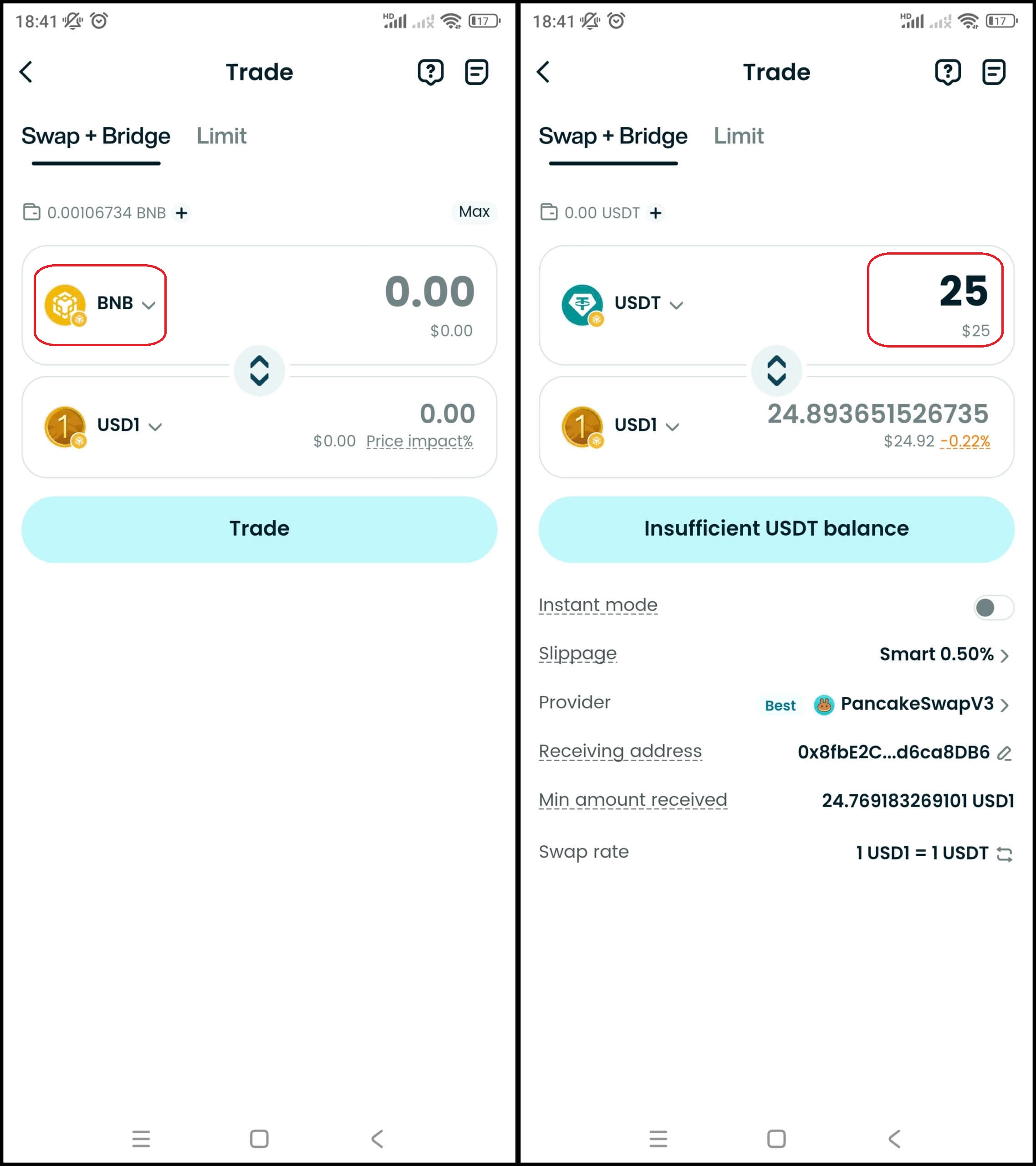

How to Buy USD1 on Bitget Wallet?

Buying USD1 on Bitget Wallet is easy! Just follow these simple steps:

Step 1: Create a wallet

- If you don't have a wallet, download Bitget Wallet app now.

- Register with your phone number or email, verify quickly and you can use it right away.

Step 2: Deposit money into your wallet

Once you have finished your wallet, you just need to deposit money into it. You can:

- Transfer coins from other wallets: Send BTC, ETH or any coin you have from an external wallet.

- Buy directly with a card: Use a bank card or credit card to buy USDT or ETH right in the app and then exchange it for USDC.

Step 3: Find USD1

- In the main interface of the wallet, go to Market, type "USD1" in the search bar.

- Select USD1 to see the trading page

Step 4: Select the trading pair

Select the pair you want to trade, for example USD1/USDT. So you can use USDT to buy USD1, or vice versa.

Step 5: Place an order

Enter the amount of USD1 you want to buy, check carefully and confirm the order.

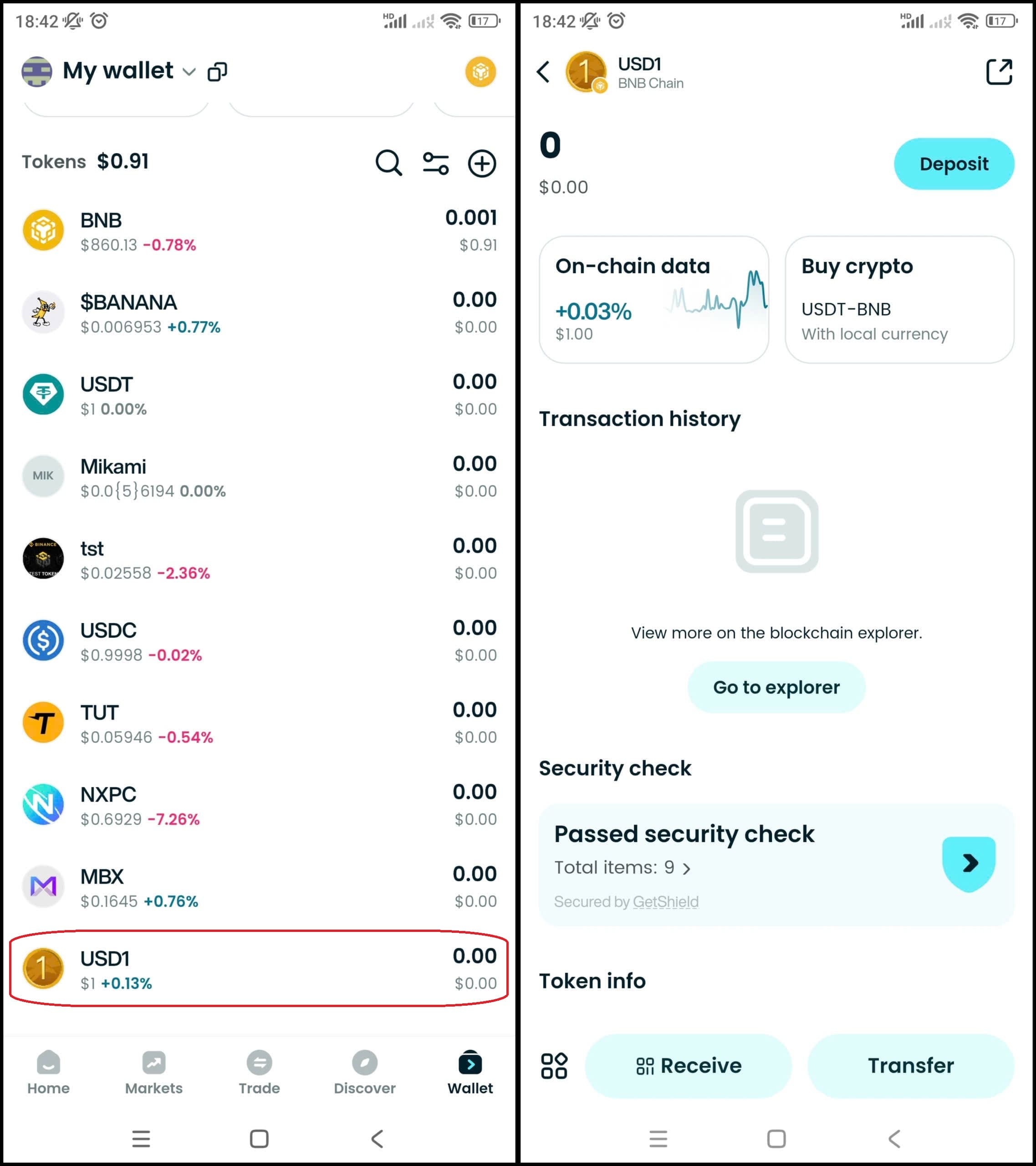

Step 6: Check the order

After buying, you can check your USD1 in the Wallet section.

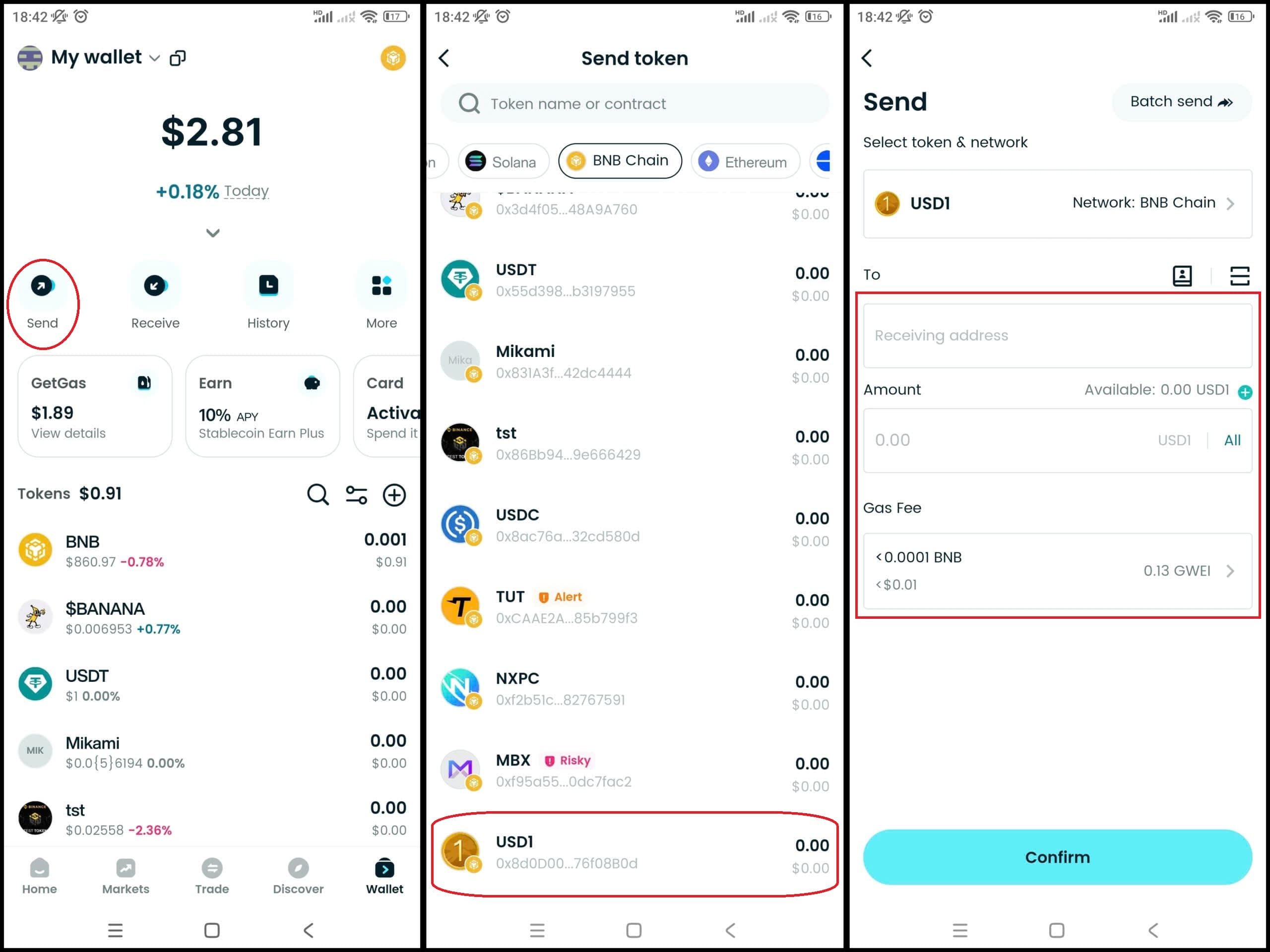

Step 7: Withdraw (if needed)

Once you have USD1, if you want to withdraw to another wallet, go to Withdraw, fill in the receiving wallet address, check the blockchain network and the amount carefully, then confirm.

▶Learn more about USD1:

- What is USD1?

- USD1 Airdrop Guide

- USD1 Listing Date and How to Buy It

- MetaMask vs Bitget Wallet: Which Is Better in 2025?

- Trust Wallet vs Bitget Wallet: Which One Is Better in 2025?

- Phantom vs Bitget Wallet: Which One Is Better?

What are the Risks of USD1?

While USD1 has quickly gained traction, every stablecoin carries inherent risks. This backed USD1 stablecoin explained section highlights three major concerns: reserve transparency, political bias, and liquidity. Unlike USDT or USDC, USD1’s disclosures remain limited, leaving uncertainty about the depth and frequency of independent attestations. Furthermore, its explicit ties to former President Trump create both institutional appeal and political skepticism. Finally, USD1’s liquidity depends heavily on market makers, which may pose risks during high volatility.

1. Why Does Reserve Transparency Matter for USD1?

- Core Concern: Stablecoin credibility depends on verifiable reserves.

- Current Gap: USDC publishes monthly audits, while USD1 has not matched this cadence.

- Investor Impact: Without regular attestations, trust in its U.S. Treasuries and cash backing remains uncertain.

2. Can Political Bias Hurt USD1 Adoption?

- Political Branding: Trump affiliation attracts U.S. institutions but raises global skepticism.

- Adoption Risk: If perceived as partisan, retail and regulators outside the U.S. may resist adoption.

- Market Effect: Could limit USD1’s reach compared to neutral stablecoins like USDC.

3. What About USD1 Liquidity Issues?

- Liquidity Backbone: Stablecoin usability relies on market makers such as Wintermute and DWF Labs.

- Concentration Risk: Dependence on a few providers exposes USD1 to selloff vulnerabilities.

- Future Need: Expanding liquidity partners will be critical for resilience.

Read more: How to Buy OFFICIAL TRUMP (TRUMP) Guide

What is the Market Performance and Outlook for USD1?

USD1 recorded extraordinary early growth — a reported $2.1B market cap in its first month — driven primarily by institutional liquidity provisioning and political momentum. Below we summarize triggers, competition, and scenarios.

1. What drove USD1’s market cap growth?

- The $2B Binance–MGX liquidity provision was the immediate catalyst, giving USD1 order-book depth and signaling market support.

- Political attention and BitGo custody statements encouraged institutional flows.

2. Can USD1 compete with USDT and USDC long term?

- USDT/USDC dominate retail and international flows due to broad liquidity and entrenched integrations.

- USD1 is positioned differently: targeting institutional counter-parties, tailored custody, and a political value proposition. If USD1 secures continued institutional partnerships, attestation cadence, and broader chain support, it can carve a durable niche but likely will not displace USDT’s retail dominance rapidly.

What is the Future of USD1 in the Stablecoin Ecosystem?

USD1 is both a product and a political statement: its trajectory will depend on regulation, reserve transparency, multichain expansion, and market adoption.

1. Will stablecoin regulation impact USD1?

Evolving U.S. legislation (proposals discussed in 2024–2025) could formalize reserve, redemption, and custody requirements for stablecoins. That legalization could favor regulated, custodied tokens — a potential structural tailwind for USD1 — but might also impose compliance costs and operational constraints on WLFI.

2. Could USD1 expand to more blockchains?

USD1 is currently available on Ethereum and BNB Chain and has announced intentions to expand to Tron and other settlement networks. Multichain availability would enhance utility, liquidity and competitive parity with USDT.

Conclusion

What is USD1 and why does it matter for the future of stablecoins? USD1 is a Trump-backed stablecoin developed by World Liberty Financial (WLFI), designed to capture both political attention and institutional trust. With its fiat-backed reserves, BitGo custody, and early success from the $2B Binance–MGX deal, USD1 has quickly become one of the fastest-growing assets in the digital dollar market.

However, investors should remain cautious. Like all stablecoins, USD1 carries risks related to reserve transparency, redemption mechanisms, and regulatory oversight. While its political ties and institutional positioning may fuel adoption, market participants should weigh these benefits against potential liquidity challenges.

For users seeking a safe way to explore USD1, Bitget Wallet offers an all-in-one platform. It provides secure stablecoin storage, hot memecoin trading, and seamless cross-chain experiences—making it ideal for both newcomers and professionals.

👉 From storing USD1 securely to trading trending memecoins, Bitget Wallet gives you an all-in-one, beginner-friendly solution. Download today and own your Web3 journey.

Sign up Bitget Wallet now - grab your $2 bonus!

FAQs

1. What is USD1 used for?

USD1 is primarily used for payments, trading, and cross-border settlements. Its stable value makes it a reliable option for both retail and institutional investors.

2. Is USD1 safe?

USD1 is backed by U.S. Treasuries and USD reserves, with custody handled by BitGo. While this provides institutional-grade security, transparency and liquidity risks still apply.

3. Where can I buy USD1?

USD1 is available on major exchanges such as Binance and through trusted self-custodial platforms like Bitget Wallet, which allows direct storage and trading.

4. How does USD1 compare to other stablecoins?

Unlike USDT or USDC, USD1 emphasizes institutional adoption and political backing, thanks to World Liberty Financial’s Trump connections. Its reserves and custody arrangements are designed to appeal to large-scale investors.

5. Can USD1 be redeemed for US dollars?

Yes, USD1 holders can redeem tokens for U.S. dollars through authorized channels, subject to liquidity and regulatory conditions.

Risk Disclosure

Please be aware that cryptocurrency trading involves high market risk. Bitget Wallet is not responsible for any trading losses incurred. Always perform your own research and trade responsibly.