USDC Yield: How to Earn Yield on USDC Safely in 2026?

USDC Yield has become a core strategy for investors seeking dollar-denominated stablecoin income in 2026. Unlike traditional savings accounts, USDC yield depends on lending demand, real-world asset backing, and smart contract infrastructure rather than central bank policy.

However, sustainable stablecoin yield is not about chasing the highest APY. Investors must evaluate USDC yield rates, liquidity flexibility, and structural exposure before allocating capital. This guide explains what is USDC yield, how to earn yield on USDC safely, and whether the highest USDC yield is worth the trade-off.

Key Takeaways

- USDC Yield enables investors to earn stablecoin yield through lending markets, structured earn programs, or real-world asset-backed strategies.

- Sustainable USDC yield rates depend on borrower demand, liquidity structure, and smart contract design — not just headline USDC APY.

- To earn yield on USDC safely, investors must balance return with capital preservation, liquidity flexibility, and risk-adjusted evaluation.

What Is USDC Yield and How Does It Work?

USDC Yield refers to the return generated when USD Coin is deployed into lending pools, structured earn programs, or treasury-backed strategies. Investors earn yield on USDC through borrower interest, protocol revenue, or short-term asset backing while maintaining dollar stability.

In simple terms, what is USDC yield? It is income earned when stablecoins are deployed into lending or structured income mechanisms.

What Is USDC and Why Can It Generate Yield?

USDC is a fully reserved stablecoin backed by dollar-denominated assets. Because it serves as a base asset in lending markets, institutions and traders borrow USDC to fund trading, liquidity provision, or working capital needs. That borrowing demand creates a market-driven USDC interest rate. Unlike idle cash, USDC deployed into lending markets can generate lending yield through structured supply-demand mechanics.

Where Does USDC Yield Come From?

USDC yield can originate from:

- DeFi lending demand (borrower interest paid to suppliers)

- Institutional borrowing via centralized or structured platforms

- Real-world asset backing, such as short-term treasury-linked strategies

- Incentive-based USDC APY programs

The sustainability of USDC yield rates depends on whether returns are borrower-driven or subsidized by incentives.

How Is USDC Yield Different from Staking?

USDC staking yield differs from traditional proof-of-stake rewards. USDC does not secure a blockchain through validators. Instead, investors earn yield on USDC through lending or structured income mechanisms. Yield fluctuates based on utilization rather than token emissions.

Unlike proof-of-stake rewards, USDC staking yield is derived from lending utilization and borrower demand rather than validator emissions.

How to Earn Yield on USDC Safely in 2026?

Understanding how to earn yield on USDC safely requires evaluating liquidity, smart contract exposure, and sustainable yield structure.

To earn yield on USDC safely in 2026, investors must evaluate yield source transparency, liquidity flexibility, and smart contract exposure before allocating capital. Sustainable USDC yield is built on structure and risk management — not just headline APY.

Step 1: Identify the Yield Model

Before allocating capital, understand how the USDC yield is generated. Not all yield models are structurally equal. Some depend on organic borrower demand, while others rely on short-term promotional incentives.

Ask:

- Is the yield borrower-driven or incentive-subsidized?

- Is the USDC interest rate fixed or variable?

- Is the USDC APY sustainable long term?

Understanding the yield model prevents overexposure to temporary highest USDC yield promotions and helps you assess whether returns are market-based or artificially boosted.

Step 2: Evaluate Liquidity Terms

Liquidity flexibility directly impacts capital preservation. Even high USDC yield rates can become problematic if funds are inaccessible during market stress.

Review:

- Lock-up duration

- Redemption windows

- Withdrawal queues during utilization spikes

Flexible liquidity ensures you can exit positions when needed. Strong USDC yield strategies prioritize accessibility alongside return.

Step 3: Assess Smart Contract Exposure

Smart contract risk is one of the primary structural risks in stablecoin yield markets. Yield is generated through programmable infrastructure, and vulnerabilities can lead to loss.

Evaluate:

- Audit transparency and frequency

- Historical exploit exposure

- Governance framework and upgrade control

Higher USDC yield rates often imply higher smart contract risk. Sustainable yield balances return with protocol security.

Step 4: Compare Risk-Adjusted Yield

The best USDC yield is not necessarily the highest USDC yield. Investors should analyze returns relative to structural exposure and liquidity risk.

Compare:

- Yield vs liquidity flexibility

- Stablecoin yield vs savings account return

- Yield stability across market cycles

Risk-adjusted USDC yield — not maximum APY — is the foundation of long-term strategy.

Step 5: Access USDC Yield via Stablecoin Earn Plus

After completing your risk evaluation, structured access to USDC yield can simplify execution.

Stablecoin Earn Plus inside Bitget Wallet provides integrated, non-custodial access to USDC yield with transparent tiered APY and flexible participation.

How to subscribe:

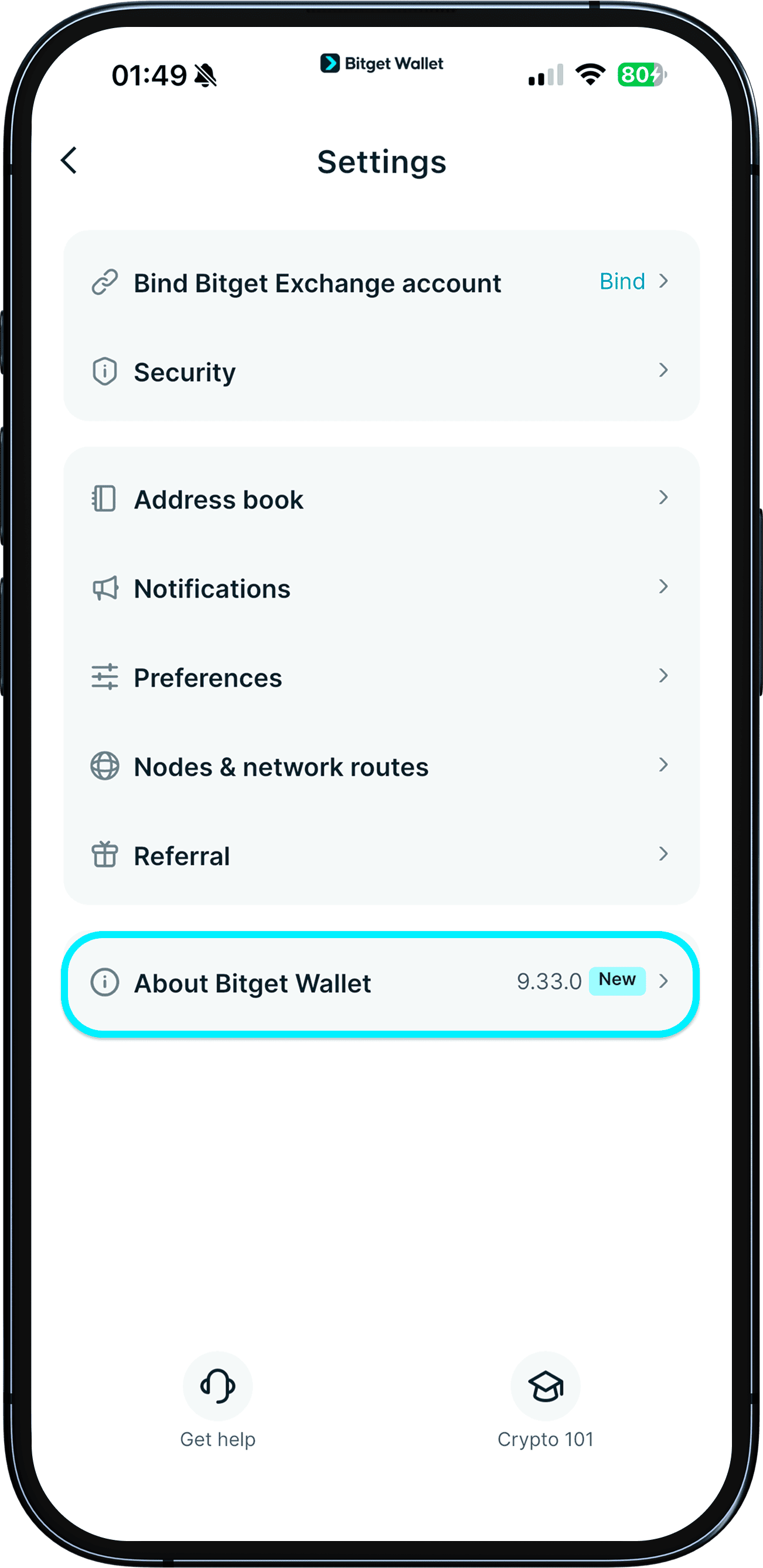

- Update Bitget Wallet app

Visit "Home" > "Settings" > "About Bitget Wallet" > "App version".

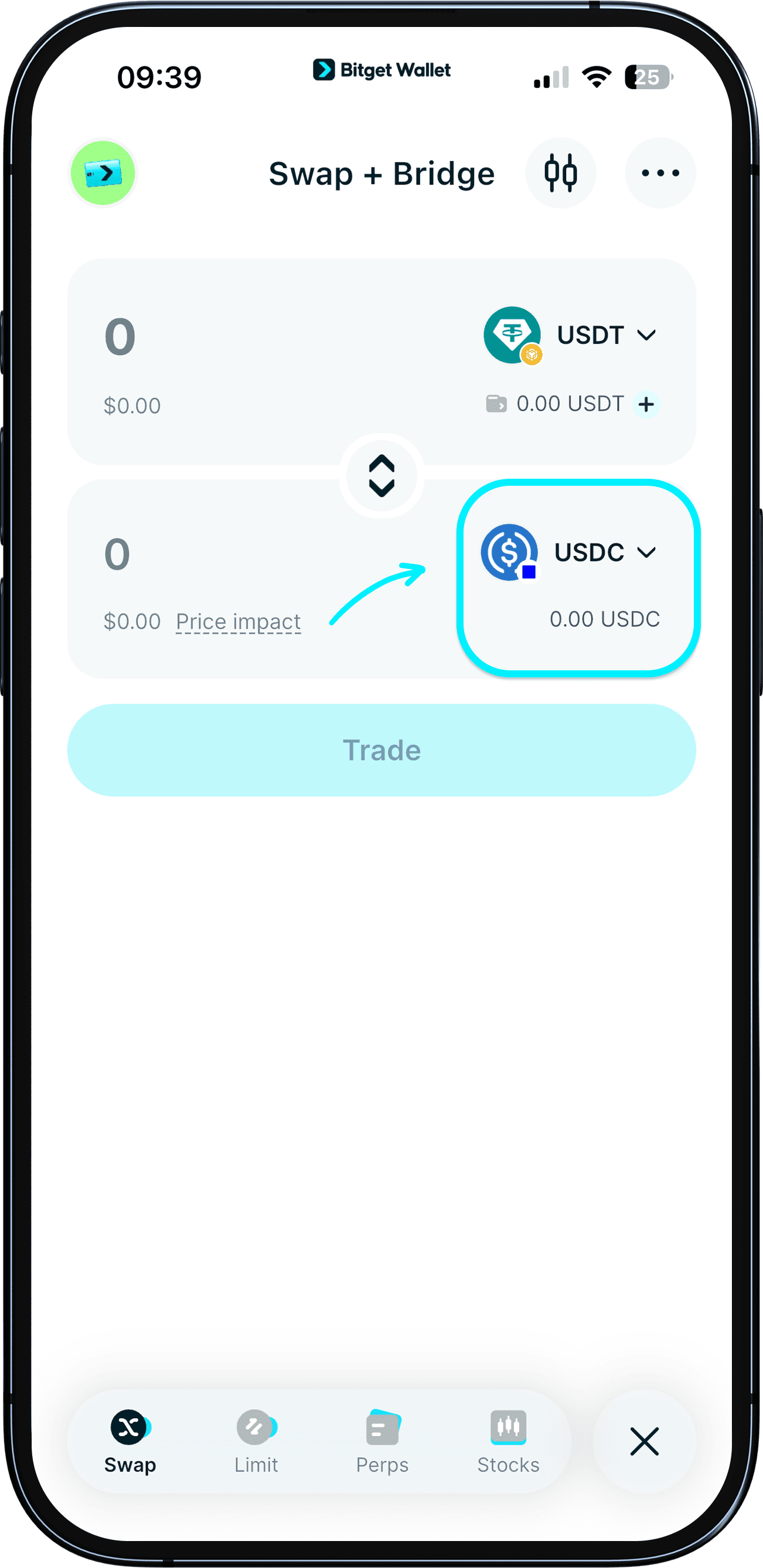

- Swap for USDC on the Base network

Stablecoin Earn Plus currently only supports USDC on the Base network.

You can visit "Trade" to swap any token you have in your wallet to USDC on the Base network.

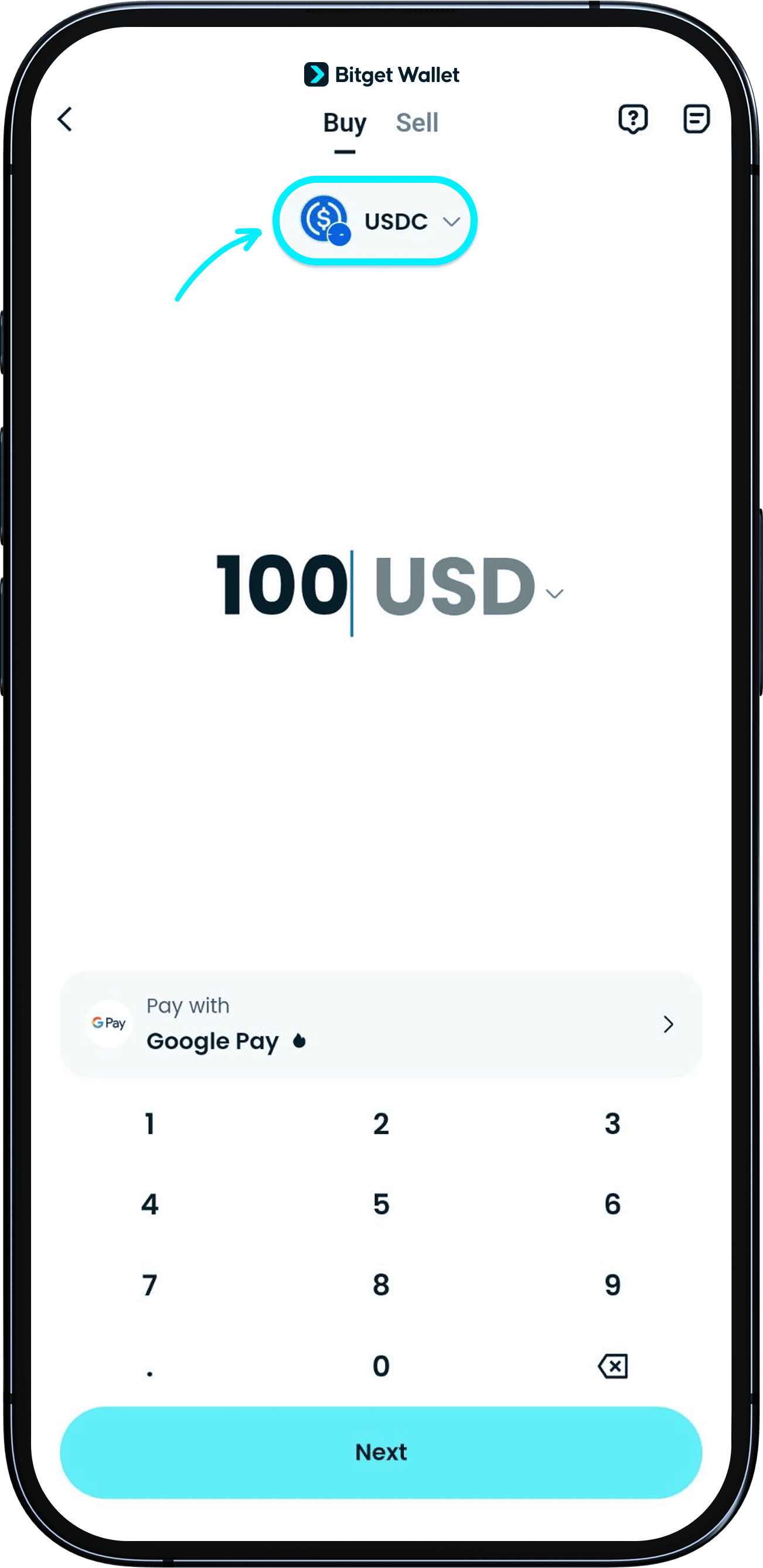

- Depositing USDC on the Base network

You can also top up USDC on the Base network directly. On the Home screen, tap "Add funds" then choose to transfer from an exchange, buy using your local currency, or buy via P2P.

Note: Be sure to select USDC on the Base network when topping up or buying.

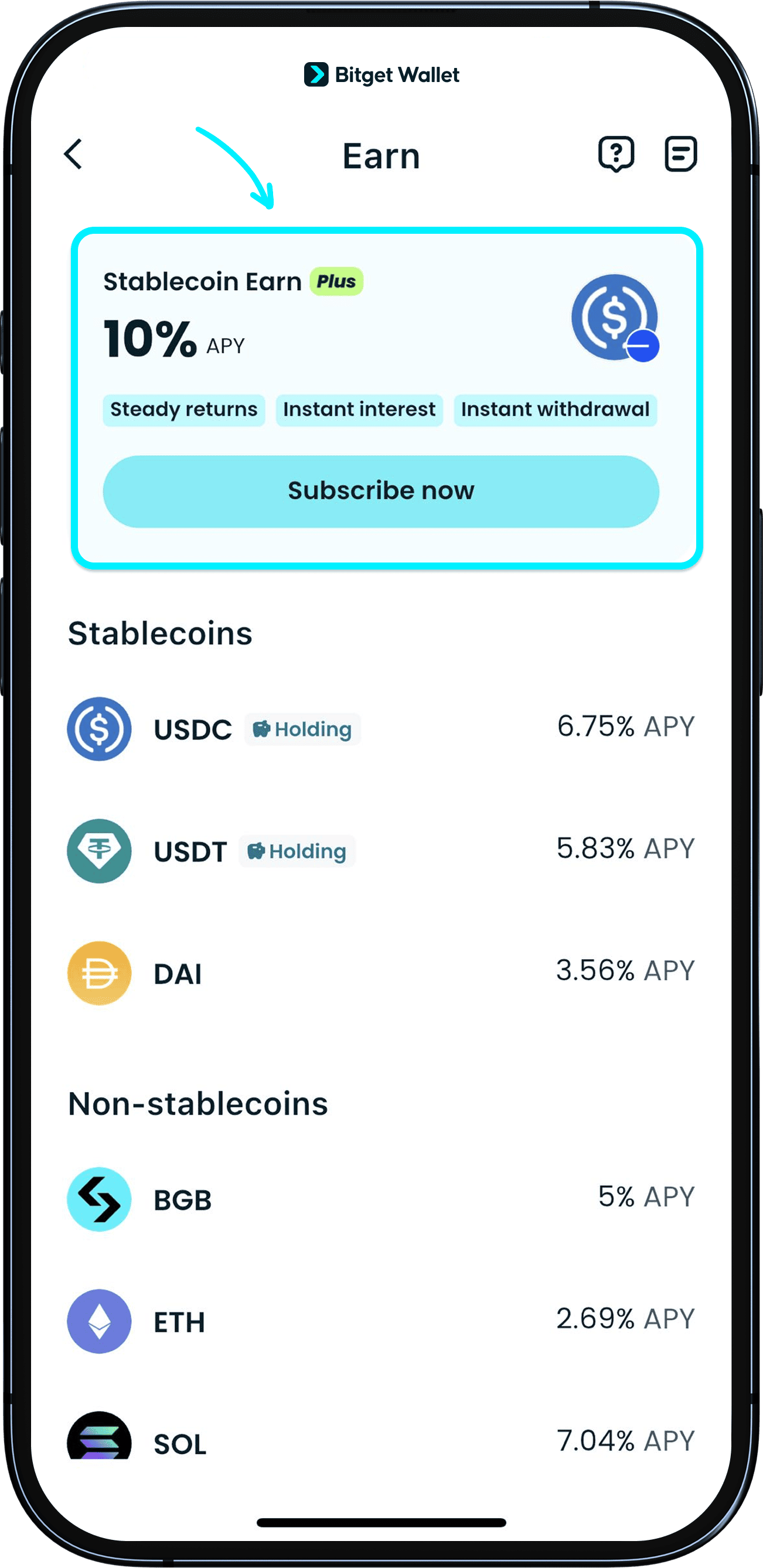

- Invest now

Next, in "Wallet", tap "Earn" > "Stablecoin Earn Plus" > "Subscribe now".

Note: Only one wallet per device can subscribe to this product.

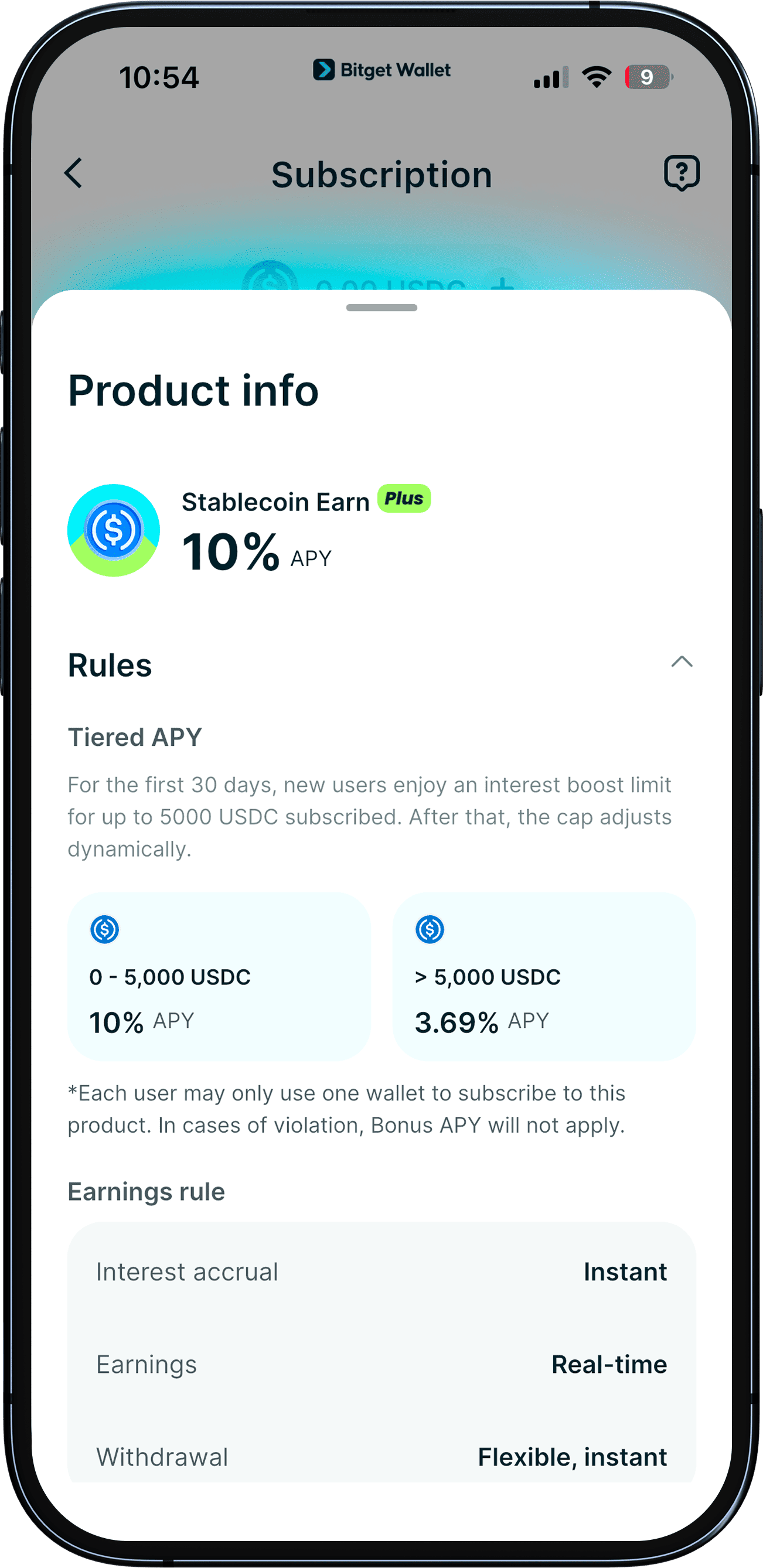

- Check product details

Tap on the product name to check the product details, understand the tiered APY, learn more about where your interest comes from, and other market information.

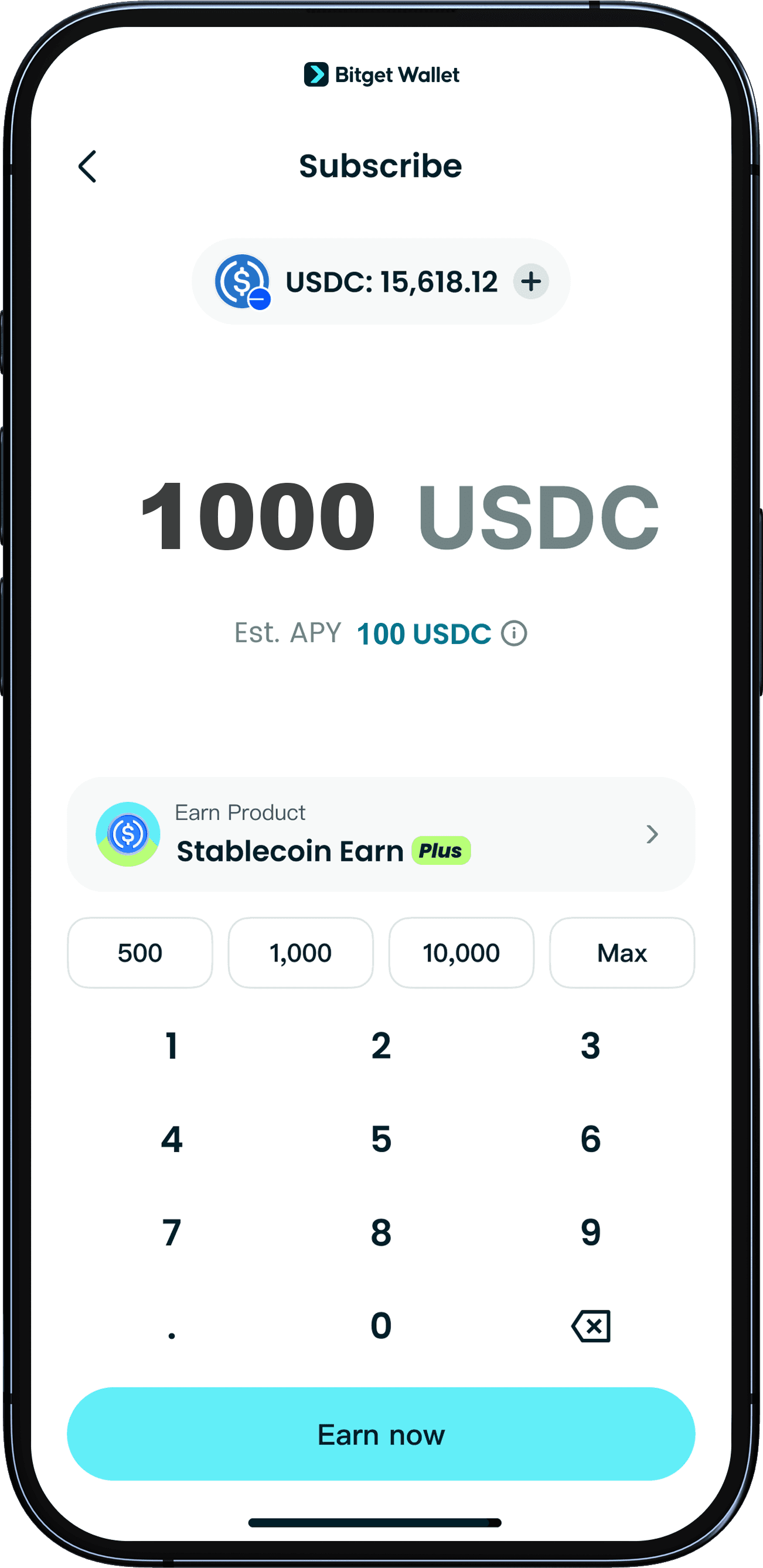

- Enter amount to invest

Here, you will enter the amount of USDC on the Base network you want to invest. Once you have entered an amount, you will also see an estimate of the interest you will be receiving in a year.

Next, tap "Subscribe".

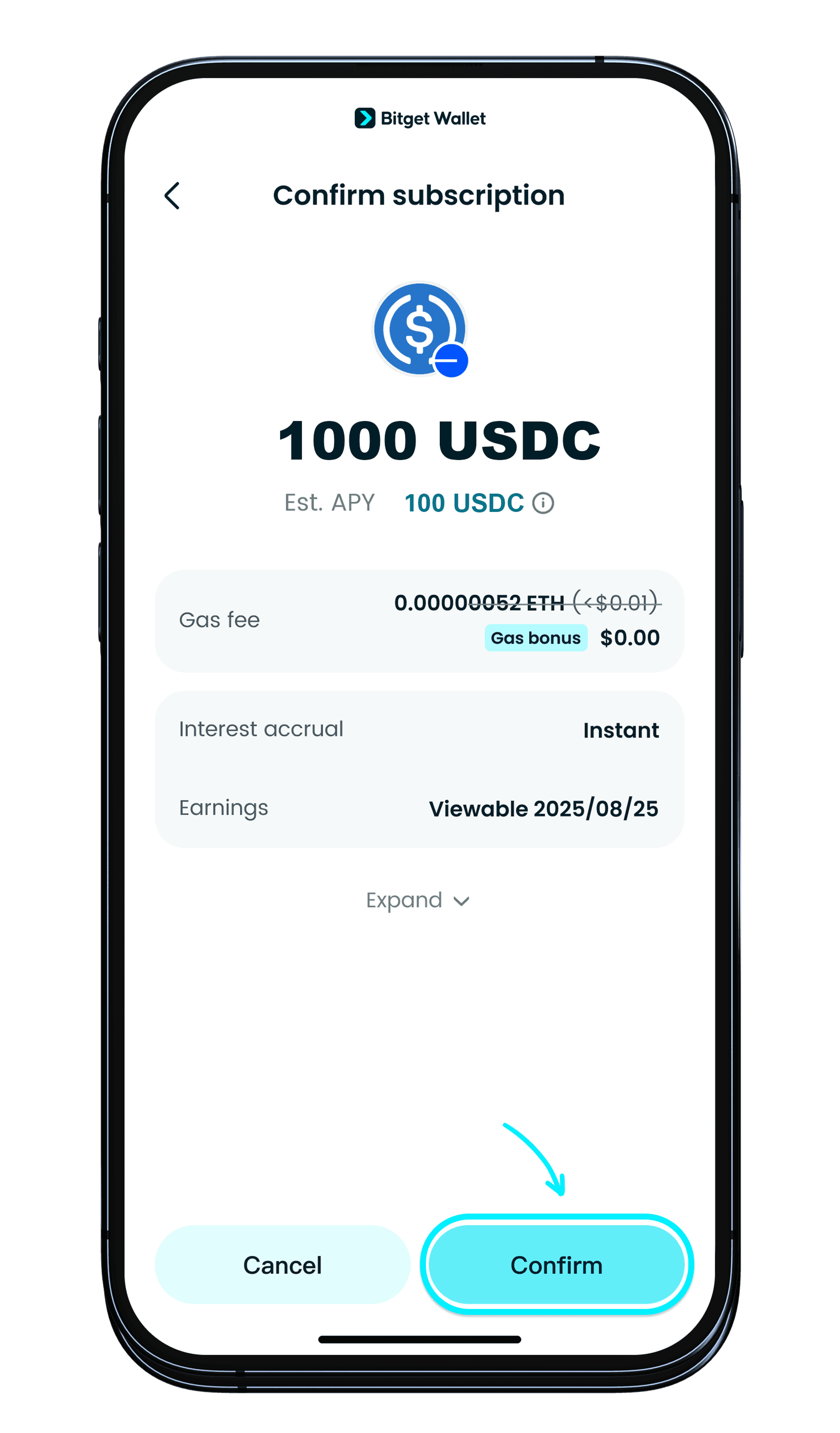

- Confirm subscription

Review the details of your subscription again, and when you are sure, tap "Confirm". You will then be asked for your signature on the transaction via biometric identification or PIN code.

Once subscription is successful, interest will start accruing immediately.

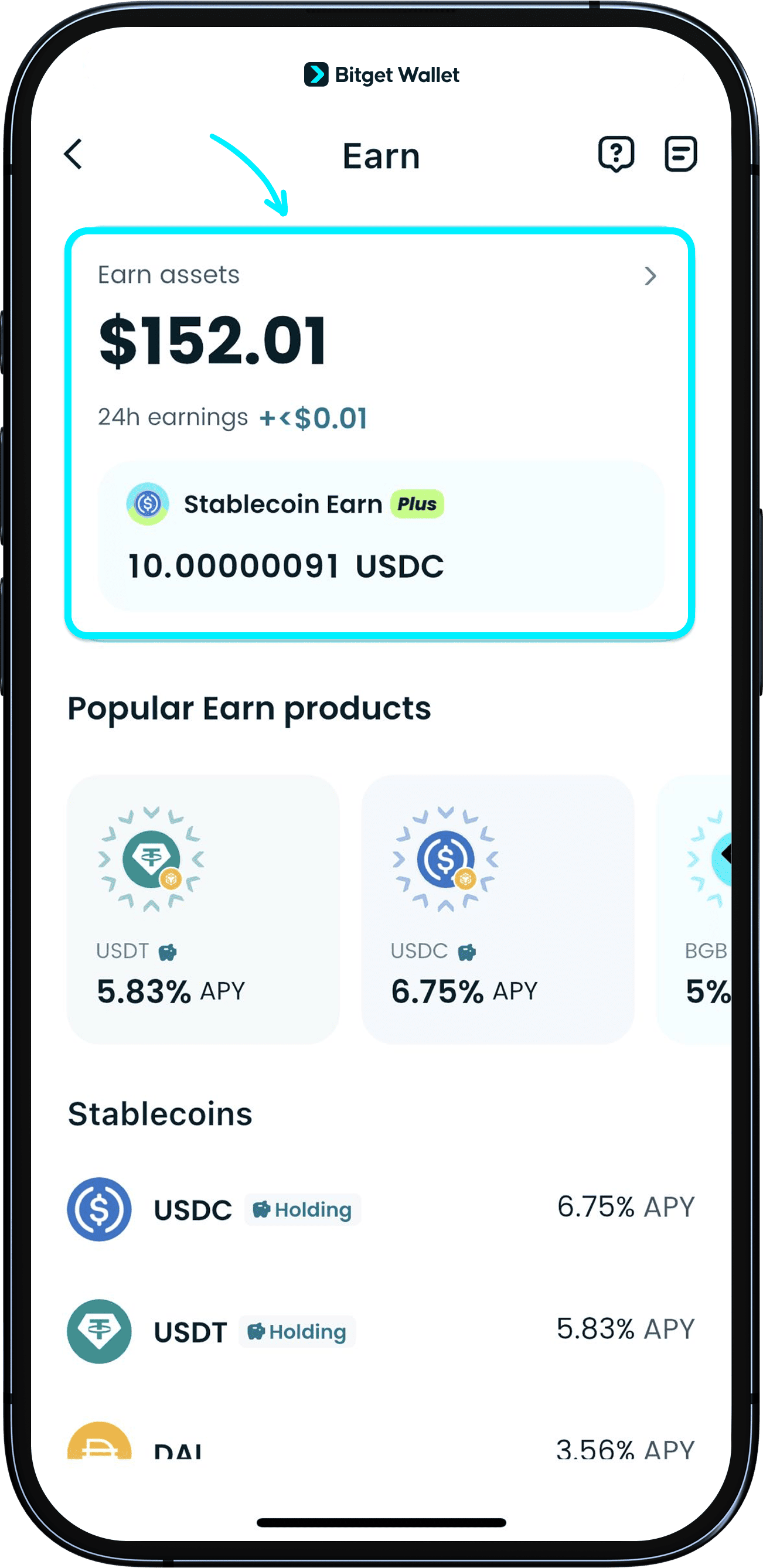

- View your positions

On the "Earn" home, tap "Earn Assets" to view your holdings. Your "Stablecoin Earn Plus" holdings are shown separately.

Once confirmed, interest begins accruing according to the product structure.

USDC Yield Rates: What Determines APY?

USDC yield rates are driven by supply–demand dynamics in lending markets, macro interest rate conditions, and protocol-level liquidity utilization. Headline USDC APY may appear attractive, but sustainable USDC yield depends on structural demand and risk pricing rather than temporary incentives.

Why Do USDC Yield Rates Change?

USDC yield rates are not fixed. They fluctuate based on real-time capital flows within stablecoin lending ecosystems.

Key drivers include:

- Borrower utilization cycles – When trading activity or leverage demand rises, borrowing increases, pushing USDC yield rates higher.

- Market volatility – During volatile periods, stablecoins become collateral assets, increasing demand to borrow USDC.

- Global interest rate conditions – Macro rate environments influence both DeFi and institutional lending benchmarks.

When borrowing demand rises, USDC yield expands. When excess liquidity enters the market, yields compress. This cyclical structure explains why USDC yield rates rarely remain stable long term.

USDC APY vs USDC Interest Rate – What’s the Difference?

Investors often confuse the base USDC interest rate with the effective annual return. While both relate to USDC yield, they measure different aspects of performance and can materially affect how USDC yield rates are interpreted across platforms.

- USDC interest rate refers to the base lending rate before compounding.

- USDC APY reflects compounded annual return.

- The actual USDC yield earned depends on compounding frequency, distribution schedule, and platform fees.

For example, daily compounding produces a higher USDC APY than simple interest at the same base rate. Understanding this distinction prevents overestimating real yield when comparing USDC yield rates across platforms.

What Drives the Highest USDC Yield Offers?

The highest USDC yield is rarely random; elevated USDC yield rates typically reflect specific structural conditions within lending markets. Common drivers include:

- Incentive emissions – Token rewards temporarily boosting effective APY.

- Elevated liquidity risk – Smaller pools requiring higher yield to attract capital.

- Promotional campaigns – Short-duration APY spikes to increase deposits.

Sustainable USDC yield tends to align with transparent, borrower-driven income rather than aggressive marketing incentives. The best USDC yield strategy prioritizes durability and capital preservation over short-term yield maximization.

USDC Yield Risks: Smart Contract and Liquidity Exposure

USDC yield introduces structural risk beyond simply holding a stablecoin. Before allocating capital, investors must evaluate smart contract risk, liquidity risk, and overall capital preservation within stablecoin yield markets.

What Is Smart Contract Risk in USDC Yield?

Smart contract risk refers to vulnerabilities in the code that powers USDC yield protocols and stablecoin yield markets. In practice, smart contract risk may include:

- Reentrancy exploits

- Oracle manipulation

- Governance attacks

Even audited platforms carry smart contract risk, and higher USDC yield rates often compensate investors for increased protocol-level exposure.

What Is Liquidity Risk in USDC Yield Markets?

Liquidity risk arises when USDC yield capital cannot be redeemed quickly under stress conditions. In stablecoin yield markets, liquidity risk may occur when:

- Lock-ups restrict withdrawals

- Utilization spikes delay redemptions

- Market stress triggers capital flight

Higher USDC yield rates frequently correlate with elevated liquidity risk and reduced flexibility.

Can You Lose Money With USDC Yield?

Yes, investors can lose money with USDC yield. Loss may result from smart contract risk, counterparty insolvency, or extreme liquidity risk during systemic market events. Although USDC is designed to maintain a dollar peg, participating in USDC yield introduces additional structural risk beyond simply holding the stablecoin.

How Bitget Wallet’s Stablecoin Earn Plus Enables Secure Access to USDC Yield?

After understanding USDC yield mechanics, USDC yield rates, and associated smart contract risk and liquidity risk, infrastructure quality becomes critical. Secure custody, transparent USDC APY structure, and flexible liquidity reduce operational exposure when participating in stablecoin yield strategies.

Stablecoin Earn Plus inside Bitget Wallet provides:

- Structured USDC yield access

- Flexible participation without forced long-term lock

- Cross-chain USDC management

- Non-custodial asset control

- Transparent tiered USDC APY display

👉 Download Bitget Wallet to securely access structured USDC Yield opportunities.

Is the Highest USDC Yield Worth the Risk?

The highest USDC yield frequently reflects elevated risk or temporary incentives. Sustainable USDC yield prioritizes transparency and capital preservation.

Highest USDC Yield vs Sustainable Yield

The highest USDC yield often reflects elevated risk or temporary incentives, while sustainable USDC yield emphasizes stability, liquidity flexibility, and capital preservation. The table below outlines the structural differences.

The best USDC yield is not defined by headline APY alone, but by structural transparency and liquidity resilience.

| Factor | Highest USDC Yield | Sustainable USDC Yield |

| APY Level | Elevated or promotional | Moderate and stable |

| Yield Source | Incentives or thin liquidity | Borrower-driven income |

| Liquidity Risk | Higher | Lower |

| Smart Contract Risk | Often elevated | More established protocols |

| USDC Yield Rates Stability | Volatile | Consistent over time |

| Capital Preservation | Secondary focus | Primary objective |

Yield Maximization vs Capital Preservation

Yield maximization focuses on capturing the highest USDC yield available, while capital preservation prioritizes sustainable USDC yield and controlled liquidity risk. The table below highlights the structural differences between these two stablecoin yield approaches.

| Factor | Yield Maximization Strategy | Capital Preservation Strategy |

| Target Return | Highest USDC yield | Sustainable USDC yield |

| Risk Tolerance | Higher smart contract risk | Controlled smart contract risk |

| Liquidity Risk | Often elevated | Lower and more flexible |

| APY Stability | Volatile USDC yield rates | Consistent USDC yield rates |

| Diversification | Concentrated allocation | Diversified across yield models |

| Core Objective | Maximize nominal APY | Protect capital and maintain liquidity |

How USDC Yield Fits Into a Modern Fixed-Income Strategy?

USDC yield can function as a short-duration digital fixed-income allocation, offering dollar-denominated return potential with liquidity flexibility. In a higher-rate environment, USDC yield rates are increasingly evaluated alongside traditional short-term fixed-income instruments.

For conservative investors, USDC yield can complement traditional instruments when structured around capital preservation rather than yield maximization.

USDC Yield vs Traditional Bonds

From a duration perspective, USDC yield typically behaves like a floating-rate, short-duration instrument rather than a long-term bond. Compared to traditional bonds:

- USDC yield has shorter effective duration

- Lower mark-to-market price volatility

- A floating USDC interest rate structure

However, unlike sovereign bonds or insured deposits, USDC yield introduces smart contract risk and liquidity risk that do not exist in traditional fixed-income products. Risk-adjusted USDC yield must therefore be evaluated differently than bond coupon income.

Stablecoin Yield as Treasury Allocation

For corporate or institutional treasury allocation, stablecoin yield can improve capital efficiency while maintaining dollar exposure. USDC yield offers:

- Working capital optimization

- Inflation-adjusted income potential

- Global, 24/7 liquidity access

Rather than replacing bonds, sustainable USDC yield is increasingly positioned as a complementary allocation within diversified fixed-income portfolios, particularly for short-duration liquidity management.

Conclusion

USDC Yield provides dollar-denominated stablecoin income, but sustainable participation requires disciplined evaluation of yield rates, USDC APY structure, liquidity risk, and smart contract risk. The highest USDC yield is not always the best USDC yield — long-term allocation should prioritize capital preservation and risk-adjusted return over maximum advertised APY.

For structured access and secure custody, Bitget Wallet offers non-custodial infrastructure with integrated stablecoin yield tools designed to support transparent and flexible USDC yield participation. Stablecoin Earn Plus enables users to earn up to 10% APY on their holdings while maintaining flexible participation and full asset control.

Start earning structured USDC yield today — download Bitget Wallet and access Stablecoin Earn Plus to put your stablecoins to work with transparent APY and secure custody.

Sign up Bitget Wallet now - grab your $2 bonus!

FAQs

1. Is USDC yield safe in 2026?

USDC yield safety depends on smart contract audits, liquidity structure, and counterparty exposure. Higher USDC yield rates typically imply higher structural risk.

2. What is the average USDC yield rate right now?

Average USDC yield rates typically range between 4% and 8%, depending on market utilization and lending demand.

3. Why is USDC yield higher than a savings account?

USDC yield reflects market-based borrowing demand rather than central bank-controlled deposit rates.

4. How often does USDC yield compound?

Most programs accrue yield daily and distribute weekly or monthly, depending on platform structure.

5. Can USDC yield decrease over time?

Yes. USDC yield rates fluctuate with macro interest rates and borrowing demand.

6. Is USDC yield taxable?

In many jurisdictions, yield earned on USDC is treated as taxable income at the time it is received or accrued. Tax treatment depends on local regulations, and investors should consult a qualified tax advisor to understand reporting obligations.

7. What is the best USDC yield strategy?

The best USDC yield strategy balances sustainable APY with capital preservation and liquidity flexibility.

Risk Disclosure

Please be aware that cryptocurrency trading involves high market risk. Bitget Wallet is not responsible for any trading losses incurred. Always perform your own research and trade responsibly.