What Is USAD: Understanding the Privacy-First USD Stablecoin on Aleo

What Is USAD (USAD)? USAD (USAD) carries the value of financial privacy and dollar stability, blending regulatory-aligned stablecoin infrastructure with zero-knowledge innovation in the blockchain industry. USAD (USAD) uses blockchain technology on the Aleo network to bring confidential, USD-pegged transactions into the digital asset space. Blending traditional dollar stability with privacy-preserving cryptography unlocks new possibilities for secure onchain payments. It both upholds the reliability of fiat-backed stablecoins and modernizes digital asset applications through encrypted transaction design.

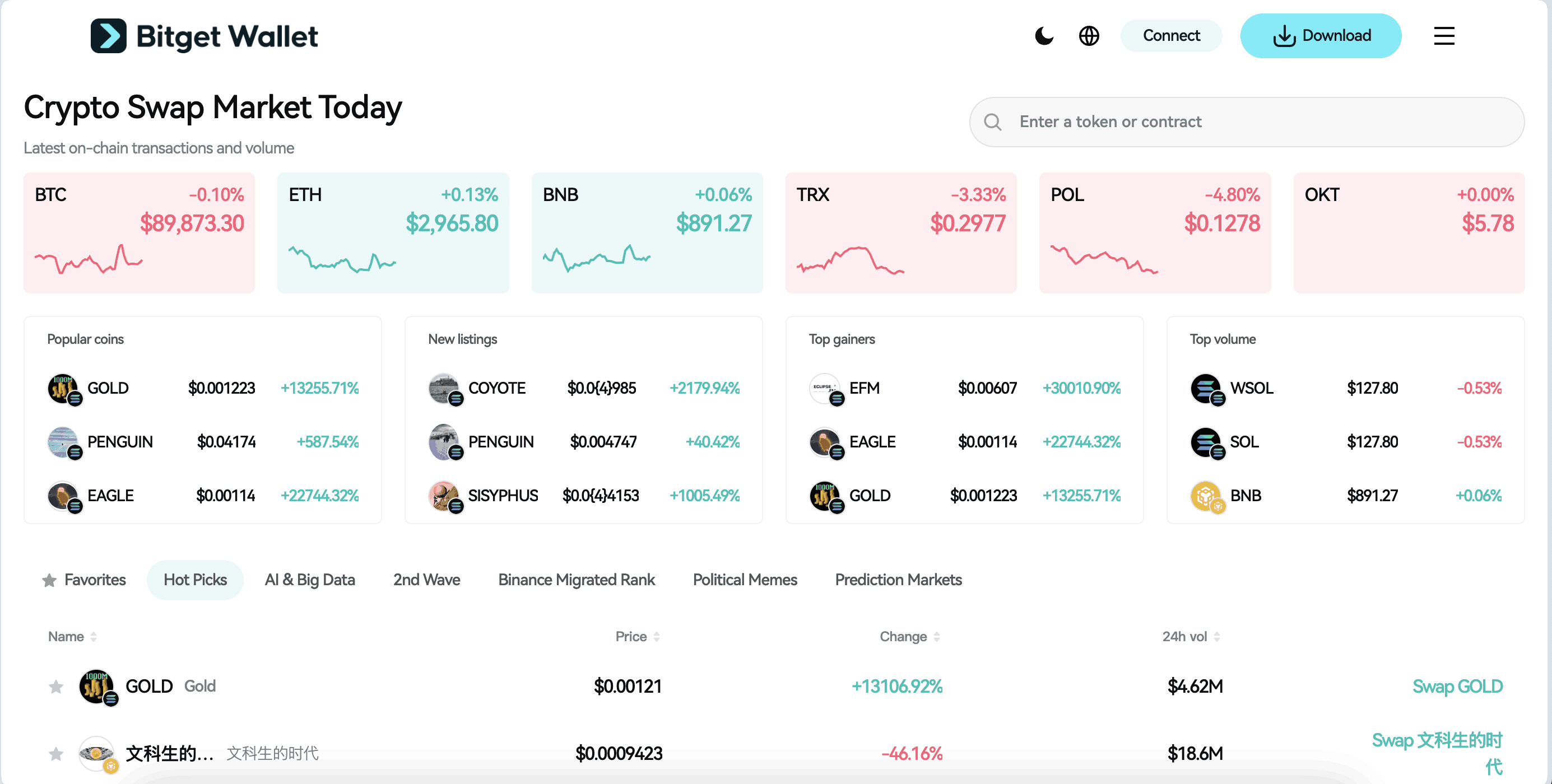

With strong backing from the Aleo ecosystem and its infrastructure partners, USAD (USAD) powers privacy-enabled digital payments and confidential DeFi settlement on Aleo, serving as a core stablecoin within a zero-knowledge blockchain environment, and when accessed through Bitget Wallet = Secure Stablecoin Storage + Hot Memecoin Trading + Seamless Cross-chain Experience, users benefit from non-custodial control, cross-chain flexibility, and integrated DeFi access in one unified platform.

This article breaks down USAD (USAD), covering its mission, key features, and potential expansion within the privacy-first blockchain sector. If you're looking to understand its role in zero-knowledge ecosystems, evaluate its practical utility, or stay informed about its market positioning, this guide has you covered.

Key Takeaways

- USAD (USAD) is a USD-pegged stablecoin on the Aleo blockchain, combining fiat-backed stability with zero-knowledge privacy technology.

- Its core advantage is confidential transactions, enabling private onchain transfers while maintaining compliance flexibility when required.

- USAD functions as a settlement asset within the Aleo ecosystem, supporting private payments, DeFi activity, and enterprise-level blockchain use cases.

What Is USAD (USAD): Overview and Key Features

USAD (USAD) is a U.S. dollar-pegged stablecoin built on the Aleo blockchain, designed to combine fiat-backed stability with zero-knowledge privacy technology. It aims to modernize digital dollar usage by enabling confidential onchain transactions within a privacy-first infrastructure.

USAD functions as a settlement asset within the Aleo ecosystem, supporting decentralized applications, private transfers, and enterprise-level blockchain use cases. By integrating privacy-preserving cryptography with stablecoin design, it bridges traditional financial reliability with next-generation blockchain innovation.

Key Features

- USD-Pegged Stability – Maintains a 1:1 value alignment with the U.S. dollar to reduce volatility risk.

- Zero-Knowledge Privacy – Built on Aleo’s cryptographic architecture, enabling confidential transaction execution.

- Confidential Onchain Payments – Supports private transfers, treasury management, and DeFi activity within the Aleo ecosystem.

- Ecosystem Integration – Designed to function natively with privacy-focused applications built on Aleo.

- Compliance-Oriented Structure – Balances transaction privacy with regulatory-aligned capabilities when required.

USAD (USAD) Listing: Key Details and Trading Schedule

1. Key Listing Information

Here are the important details about the USAD (USAD) listing:

- Exchange: To be announced

- Trading Pair: USAD/USDT

- Deposit Available: To be announced

- Trading Start: To be announced

- Withdrawal Available: To be announced

Don’t miss your chance to monitor upcoming announcements and be prepared to trade USAD (USAD) once exchange support is officially confirmed.

- Please refer to the official exchange and project announcements for the most accurate and updated schedule.

USAD (USAD) Future Price Outlook: 2026 and Beyond

Market structure, stablecoin reserve integrity, and ecosystem adoption influence a stablecoin’s stability and liquidity profile. As a USD-pegged asset, USAD (USAD) is designed to trade within the $0.99–$1.01 range under normal market conditions. If reserve backing, redemption mechanisms, and Aleo ecosystem usage remain strong, USAD is expected to maintain its long-term $1.00 peg rather than appreciate like speculative tokens.

What Affects USAD (USAD) Price?

Several factors influence the stability and short-term deviations of USAD (USAD):

- Investor Sentiment:

Confidence in the issuing structure, transparency, and peg reliability directly impacts short-term trading stability. Stablecoins typically fluctuate slightly during high volatility periods if liquidity tightens.

- Adoption & Demand:

Increased usage within the Aleo ecosystem — including private DeFi, payments, and enterprise settlements — strengthens liquidity depth and peg resilience.

- Regulatory Influence:

Stablecoins are highly sensitive to regulatory developments. Clear compliance frameworks can support growth, while restrictive policies may affect issuance or exchange accessibility.

Future Price Prospects

Because USAD is a fiat-pegged stablecoin, its objective is price stability, not price appreciation. If USAD continues expanding within privacy-focused blockchain finance and maintains transparent reserve management, it is expected to hold close to $1.00 long term.

However, temporary deviations (e.g., $0.98–$1.02) may occur during liquidity stress, broader crypto market volatility, or exchange supply-demand imbalances. Investors and users should monitor liquidity, reserve disclosures, and ecosystem growth rather than speculative upside potential.

Source: Bitget Wallet

Core Features of USAD (USAD) and Why They Matter?

The standout features of USAD (USAD) include:

- USD-Pegged Stability

USAD is designed to maintain a 1:1 peg with the U.S. dollar, reducing volatility risk compared to traditional cryptocurrencies. This stability makes it suitable for payments, settlements, and treasury management, where predictable value is essential.

- Zero-Knowledge Privacy Infrastructure

Built on the Aleo blockchain, USAD leverages zero-knowledge cryptography to enable confidential transactions. Unlike transparent public ledger transfers, transaction details can remain encrypted, enhancing financial privacy while supporting controlled compliance where required.

- Confidential Onchain Settlement Utility

USAD functions as a settlement asset within the Aleo ecosystem, supporting private peer-to-peer transfers, DeFi applications, and enterprise-level use cases. This expands the practical utility of stablecoins into privacy-focused blockchain environments where confidentiality is a core requirement.

How USAD (USAD) Operates and What Benefits It Delivers?

How USAD (USAD) Works?

- Built on the Aleo blockchain, enabling privacy-preserving and secure transactions using zero-knowledge cryptography.

- Utilizes Aleo’s zero-knowledge proof-based architecture to validate transactions while keeping sensitive data encrypted by default.

- Supports private payments, DeFi applications, treasury operations, and enterprise-level settlements within the Aleo ecosystem.

Key Benefits

- Stable Value Protection – As a USD-pegged stablecoin, USAD minimizes volatility exposure, making it suitable for payments, capital preservation, and onchain settlement.

- Confidential Transaction Execution – Zero-knowledge infrastructure allows users to transfer value without publicly exposing transaction details, enhancing financial privacy.

- Ecosystem Utility Expansion – USAD serves as a core settlement asset within privacy-focused decentralized applications, supporting sustainable growth of Aleo-based financial infrastructure.

The Companies and Organizations Supporting USAD (USAD)

The Companies

USAD (USAD) is supported by infrastructure contributors within the Aleo ecosystem, including collaboration with regulated stablecoin issuance expertise through Paxos Labs. Paxos brings experience in reserve-backed digital assets and regulatory-aligned stablecoin frameworks, strengthening USAD’s credibility as a USD-pegged asset.

The Aleo Network Foundation plays a central role in supporting the underlying Layer-1 infrastructure, ensuring that USAD operates within a privacy-first blockchain environment powered by zero-knowledge cryptography.

The Organization’s Partnerships

USAD’s development is closely tied to the broader Aleo ecosystem, including developers, infrastructure providers, and privacy-focused application builders. These partnerships enable integration into:

- Privacy-enabled DeFi protocols

- Enterprise settlement systems

- Confidential payment solutions

- Onchain treasury management tools

As the Aleo ecosystem expands, USAD benefits from network-level adoption and application-layer growth.

How They Work Together?

USAD functions as a settlement layer within Aleo’s zero-knowledge architecture. Paxos Labs contributes stablecoin issuance and reserve management expertise, while the Aleo ecosystem provides privacy-preserving infrastructure and smart contract capabilities.

Together, these components create a system where:

- Stable fiat backing supports price reliability

- Zero-knowledge cryptography ensures transaction confidentiality

- Ecosystem integration drives practical utility

This coordinated structure positions USAD (USAD) as a privacy-focused, compliance-aware stablecoin within the evolving blockchain financial landscape.

How USAD (USAD) Is Used: Practical Benefits

USAD (USAD) is used as a USD-pegged settlement asset within the Aleo ecosystem, enabling private and stable onchain value transfers. It supports confidential peer-to-peer payments, decentralized finance (DeFi) activity, and enterprise-level financial operations where transaction privacy is important.

Within privacy-focused decentralized applications, USAD can serve as a medium of exchange, a liquidity asset, or a treasury management tool. Its stability reduces exposure to crypto volatility, while its zero-knowledge infrastructure protects sensitive transaction data.

USAD (USAD)’s Benefits

- Stable Digital Dollar Utility – Maintains a 1:1 USD peg, making it suitable for payments and settlement.

- Confidential Transactions – Built on Aleo’s zero-knowledge framework, enabling encrypted transfers onchain.

- Ecosystem-Level Integration – Functions natively within privacy-first decentralized applications and financial infrastructure on Aleo.

USAD (USAD) Roadmap 2026: Key Milestones and Expansion Plans

The roadmap for USAD (USAD) outlines a structured path focused on ecosystem integration, liquidity growth, and privacy-driven financial infrastructure development:

| Quarter | Roadmap |

| Q1 2026 | Expansion of USAD liquidity within the Aleo ecosystem; integration into additional privacy-enabled DeFi applications and wallet infrastructure. |

| Q2 2026 | Strengthening reserve transparency frameworks and compliance alignment; onboarding enterprise payment pilots leveraging confidential settlement. |

| Q3 2026 | Broader developer adoption through SDK/tooling improvements for privacy-first financial applications using USAD as a settlement layer. |

| Q4 2026 | Ecosystem scaling initiatives, including cross-application interoperability within Aleo and expanded institutional use-case exploration. |

These developments highlight the practical value of $USAD in privacy-focused blockchain finance, particularly in confidential payments, DeFi settlement, and enterprise-grade onchain financial operations.

How to Buy USAD (USAD) on Bitget Wallet?

Trading USAD (USAD) is easy on Bitget Wallet. Follow these simple steps to get started:

Step 1: Create an Account

If you don't currently have an account, install the Bitget Wallet app. Register by inputting the required details and confirming your identity.

Step 2: Deposit Funds

After setting up an account, you must deposit money. You can do this by:

- Transferring Cryptocurrency: Transfer crypto from a different wallet.

- Purchasing Crypto: Utilize a credit or debit card to buy crypto directly from Bitget Wallet, making sure you have sufficient capital for trading USAD (USAD).

Step 3: Find USAD (USAD)

On the Bitget Wallet platform, go to the market area. Search for USAD (USAD) using the search function. Click on the token to access its trading page.

As this token has not been listed yet, please look at the last contract address sent by the project team upon listing of the token.

Step 4: Choose Your Trading Pair

Select your trading pair you would like to deal with, for instance, USAD/USDT.

By doing this, you will be able to exchange USAD (USAD) for USDT or any other cryptocurrency.

Step 5: Place Your Order

Choose whether to carry out a market order—either buy or sell at the prevailing rate—or place a limit order at your desired price. Fill in the amount of USAD (USAD) you want to exchange, then proceed to confirm in order to complete the trade.

Step 6: Monitor Your Trade

Once you have ordered, you can track the status of your order under "Open Orders." Upon completion of the order, you can view your balance to see the newly purchased USAD (USAD).

Step 7: Withdraw Your Funds (Optional)

If you want to transfer your USAD (USAD) or any other cryptocurrency to another wallet, go to the withdrawal section, provide your wallet address, and confirm the transaction.

Conclusion

USAD (USAD) combines USD stability with Aleo’s zero-knowledge privacy, offering a confidential onchain settlement asset rather than a speculative token. Its strength lies in maintaining a reliable $1 peg while enabling private payments and DeFi activity within a privacy-first blockchain environment.

Using USAD via Bitget Wallet gives users secure non-custodial control, seamless asset management, and access to yield tools like Stablecoin Earn Plus (up to 10% APY). With added benefits such as zero-fee trading on memecoins and RWA U.S. stock tokens, Bitget Wallet enhances both flexibility and capital efficiency.

Manage all your tokens in one beginner-friendly app – download Bitget Wallet today.

FAQs

1. What is USAD?

USAD is a USD-pegged stablecoin built on the Aleo blockchain. It is designed to maintain a 1:1 value with the U.S. dollar while enabling privacy-preserving transactions using zero-knowledge technology.

2. What blockchain is USAD built on?

USAD operates on the Aleo Layer-1 network, which uses zero-knowledge cryptography to support confidential smart contracts and private transactions.

3. How does USAD maintain its $1 peg?

USAD is structured as a fiat-backed stablecoin, meaning it is designed to be backed by U.S. dollar reserves or equivalent assets to maintain price stability around $1.00.

4. What makes USAD different from other stablecoins?

Unlike most stablecoins that operate on fully transparent public blockchains, USAD leverages Aleo’s privacy infrastructure to enable encrypted transaction execution while maintaining compliance flexibility.

5. What is USAD used for?

USAD is primarily used for confidential onchain payments, DeFi settlement, treasury management, and stable-value transfers within the Aleo ecosystem.

Risk Disclosure

Please be aware that cryptocurrency trading involves high market risk. Bitget Wallet is not responsible for any trading losses incurred. Always perform your own research and trade responsibly.