What Are Crypto Off-Ramp: How to Convert Crypto to Fiat in 2026?

What Are Crypto Off-Ramp solutions really doing in 2026? They turn crypto holdings into usable fiat money—paid out to a bank account, card, or cash-like rail—so investors can realize gains, fund expenses, and reduce volatility exposure without friction. The key is treating off-ramping as an execution problem: price, fees, compliance, timing, and counterparty risk all matter.

Demand is rising as stablecoins expand into payments, payroll, travel spend, and cross-border settlement. But “cash out” options are not equal—each method behaves differently by region, transaction size, and compliance rules.

In this article, we’ll explain what crypto off-ramps are, how they work, which crypto-to-fiat routes make sense in 2026, what to compare before converting, the biggest risks to avoid, and a step-by-step workflow you can follow using Bitget Wallet.

Key Takeaways

- Crypto off-ramp services convert crypto to fiat through bank transfers or card payouts, with fees, KYC requirements, limits, and settlement times varying by provider and region.

- Choosing a crypto off-ramp to convert crypto to fiat is an investor decision driven by spread, FX rate, settlement time, and compliance risk—not just UX.

- Before using a crypto off-ramp to convert crypto to fiat, verify network, confirm payout details, review fees, and run a small test withdrawal to reduce risk.

What Are Crypto Off-Ramp?

A crypto off-ramp is a service or mechanism that converts cryptocurrency into fiat currency such as USD, EUR, or local currency—then delivers that fiat through traditional rails (bank transfer, card payout, or merchant settlement). For investors, What Are Crypto Off-Ramp options really about? They’re the liquidity “exit door” that turns on-chain value into real-world spending and portfolio rebalancing.

Source: ramp.network

What does it mean to off-ramp crypto?

Off-ramping means moving value from the crypto system back into the fiat system. Common outcomes include:

- Bank payout (local transfer rails, SEPA-like systems, or SWIFT-like wires)

- Card payout or card-linked spend (conversion at checkout or top-up models)

- Cash-like liquidity paths (region-dependent, often via intermediaries)

Off-ramping is the reverse of on-ramping (fiat → crypto). Once you touch regulated rails, identity verification and transaction monitoring are normal in 2026.

How does off-ramp access affect risk and timing?

If What Are Crypto Off-Ramp choices are limited in your region, you typically face trade-offs:

- Timing risk: faster rails may cost more (spread + processing).

- Execution risk: illiquid routes increase slippage and failed settlement.

- Compliance risk: larger cash-outs can trigger review holds or proof-of-funds requests.

How Do Crypto Off-Ramps Work?

Crypto off-ramps function as a bridge between two separate systems: on-chain settlement and regulated fiat payout rails. In practice, What Are Crypto Off-Ramp flows built from? Usually four components: identity checks, pricing/quotes, custody handoff (sending crypto), and fiat payout.

Source: p100.io

What are the typical 3 steps most off-ramps follow?

Most off-ramps follow a standard execution pattern:

- Create a sell/conversion order (asset, amount, target fiat).

- Add a withdrawal method (bank details or card details).

- Transfer/confirm crypto and receive the fiat payout once processed.

Some providers abstract steps 2–3 into a single UX, but the underlying sequence is the same.

What data and compliance checks should users expect in 2026?

In 2026, many off-ramps operate with tiered verification:

- Basic KYC: name, ID, selfie checks (often required for meaningful limits)

- AML screening: transaction monitoring and sanctions checks

- Proof-of-funds triggers: especially for larger withdrawals or irregular activity

- Region constraints: supported fiat currencies, banking rails, and payout rules differ across EU/UK, LATAM, and APAC

This is why What Are Crypto Off-Ramp decisions are not purely about speed—they’re also about predictable compliance outcomes.

Which Crypto-to-Fiat Methods Should You Use?

Choosing a crypto-to-fiat method depends on your transaction size, your urgency, and your risk tolerance. What Are Crypto Off-Ramp methods best in 2026? The answer changes if you’re exiting a large position, funding monthly expenses, or operating in a restricted banking environment.

| Method | Best For | Speed | Risk Level | Investor Suitability |

| OTC Desk | Large exits, structured portfolio withdrawals | Medium | Low–Medium (regulated, but heavy compliance) | Best for high-value positions and minimizing slippage |

| P2P Marketplace | Flexible local currency access | Fast–Variable | Medium–High (counterparty risk) | Suitable for small-to-mid conversions in restricted regions |

| Crypto Debit Card | Daily spending & lifestyle liquidity | Instant at POS | Low (network-backed rails) | Ideal for recurring expenses, not optimal for large exits |

1. OTC desk off-ramp

OTC (Over-the-Counter) is designed for large transactions where minimizing slippage and market impact matters.

- Best for: high-value cash-outs and structured exits

- Pricing: negotiated quotes, often more stable than open-market execution

- Pros: reduced slippage, better control for block trades

- Cons: heavier onboarding and stricter compliance; may not fit small users

If you’re asking What Are Crypto Off-Ramp solutions for serious capital extraction, OTC desks often sit at the institutional end of the spectrum.

2. P2P marketplace off-ramp

P2P marketplaces match buyers and sellers, sometimes with escrow features.

- Best for: small-to-medium conversions, flexible local currency access

- Pricing: peer-negotiated; spreads can widen in volatile periods

- Pros: can work in regions where traditional bank integration is limited

- Cons: counterparty risk (payment reversal, fraud attempts), variable reliability

P2P can be functional, but for investors, What Are Crypto Off-Ramp risks here are usually higher than with regulated payout rails.

3. Crypto debit card off-ramp

Crypto debit cards function as spend-oriented crypto off-ramp tools, converting crypto to fiat at the point of purchase or through a preloaded balance.

- Best for: recurring or smaller transactions such as travel, subscriptions, and daily spending

- Speed: typically instant at point-of-sale

- Costs: monitor FX spreads, network processing fees, and spending limits

- Investor framing: efficient for lifestyle liquidity, but not always optimal for large portfolio exits

Unlike traditional bank wire withdrawals, card-based crypto off-ramps prioritize convenience and real-time settlement. Some providers, including the Bitget Wallet Card, integrate crypto-to-fiat conversion directly into global card networks, enabling everyday spending without initiating a separate bank withdrawal.

For many users, What Are Crypto Off-Ramp tools in daily life increasingly resemble card rails rather than bank transfers, reflecting a shift from cash-out strategy to seamless spending utility.

What Fees, FX Rates, and Settlement Times Should You Compare Before Cashing Out?

Before you cash out, evaluate total conversion cost, not just a headline fee. The real cost of What Are Crypto Off-Ramp execution often includes: spread + network fees + payout fees + FX markup + potential compliance delays.

Source: coin98.net

Which fees matter most for small vs large withdrawals?

A simple comparison table helps writers keep this investor-style:

| Withdrawal Size | Biggest Cost Driver | What to Watch |

| Small | Network fees + minimum fees | High fixed fees can erase value |

| Medium | Spread + payout fee mix | Compare quotes across methods |

| Large | Spread/slippage + compliance friction | Prefer stable quotes, clean documentation |

How do settlement times vary by method and region?

Typical patterns in 2026:

- Card-based: faster access, but often higher embedded FX/spread

- Bank transfers: can be cheaper, but slower—banking hours and intermediaries matter

- Regional rails: local networks can be quick; cross-border wires can add delay

If you’re optimizing What Are Crypto Off-Ramp outcomes, treat settlement time as a risk variable: the longer it takes, the more price moves can affect your realized value.

What Are the Biggest Risks When Converting Crypto to Fiat?

Converting crypto to fiat introduces both on-chain and off-chain exposure. Most failures happen during the “handoff” between blockchain settlement and traditional payout rails. If you want to understand What Are Crypto Off-Ramp pitfalls, use this structured risk checklist.

1. Fraud Risk

Fraud thrives when users feel pressure to “withdraw now.”

- Fake support accounts and cloned checkout pages

- Phishing KYC links and spoofed domains

- P2P payment reversals or fake transfer receipts

Control principle: Slow down. Use official channels only. Never share seed phrases or 2FA codes. Verify domains carefully. If using P2P, rely on escrow and verified merchants.

2. Counterparty Risk

Every off-ramp requires short-term trust in a provider.

- Downtime during volatility

- Withdrawal pauses or limit changes

- Irreversible transfers once crypto leaves your wallet

Control principle: Keep order IDs and tx hashes. Monitor payout status. Test new routes with a small withdrawal before increasing size.

3. Compliance Holds

Off-ramps sit at the edge of regulatory enforcement.

- Large or unusual withdrawals

- Identity mismatches

- Source-of-funds verification requests

Control principle: Keep identity details consistent across wallet, provider, and bank. Avoid third-party payouts. Maintain clean documentation.

4. Operational Errors

Most off-ramp losses are self-inflicted.

- Wrong network selection

- Incorrect token contract

- Missing memo/tag

- Bank detail mismatches

Control principle: Double-check chain → token → amount → payout details. Always test with a small transaction when using a new bank or route.

5. Slippage & Quote Risk

Execution quality depends on liquidity and confirmation speed.

- Price moves between quote and approval

- Multi-step swaps increase spread

- Quote expiry forces worse rates

Control principle: Convert illiquid tokens into a liquid base first. Confirm quickly. Avoid peak volatility windows.

6. Hidden Fee Layers

Costs are rarely visible in one place.

- Network and bridging fees

- Conversion spread

- FX markups and payout charges

Control principle: Compare the net fiat received, not just advertised fees.

7. Account Security

Attackers target withdrawals.

- SIM swaps

- Compromised email resets

- Clipboard malware

Control principle: Use authenticator-based 2FA, unique passwords, updated devices, and verify all details before approval.

8. Verification Discipline

Professionals use a repeatable system.

- Two-pass verification before confirming

- Save receipts and tx hashes

- Maintain tax and cost-basis records

Execution rule: Treat every new provider, chain, or bank as new risk. Start small. Confirm end-to-end settlement. Then scale with confidence.

How Can You Cash Out Crypto Into Fiat Step-by-Step Using Bitget Wallet?

Converting crypto into fiat requires more than simply clicking “sell.” Investors need a structured workflow that minimizes operational mistakes, ensures compliance, and protects capital during the transition from on-chain assets to traditional banking rails.

Within Bitget Wallet, users can manage assets directly on-chain before initiating fiat withdrawal. The wallet integrates with MoonPay, a regulated fiat payout provider, allowing supported cryptocurrencies to be converted into fiat currencies via bank transfer or card networks. This structure separates asset control (wallet layer) from regulated payout processing (fiat layer), creating a clearer and more compliant crypto-to-fiat workflow.

Rather than treating off-ramping as a single transaction, experienced investors approach it as a three-stage process: preparation, execution, and verification.

How Can You Convert Crypto to Fiat in Bitget Wallet Step by Step?

Once your assets are ready, you can initiate the crypto off-ramp flow directly inside Bitget Wallet through its integrated fiat withdrawal feature powered by MoonPay.

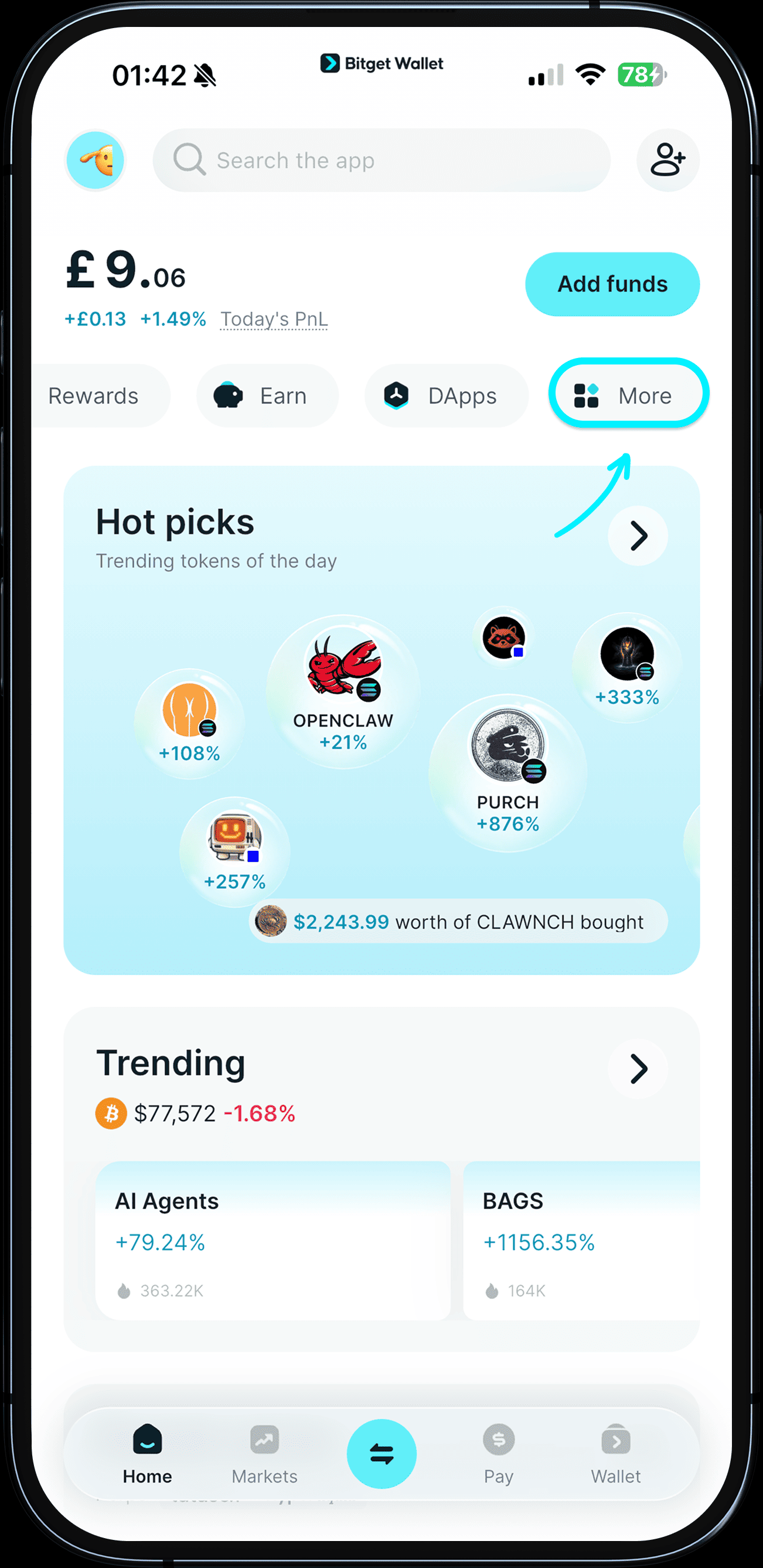

Step 1: Access the Sell Crypto Feature

Update the Bitget Wallet app to the latest version (v9.8 or above).

Go to Home → More → Sell Crypto to start the crypto-to-fiat withdrawal process.

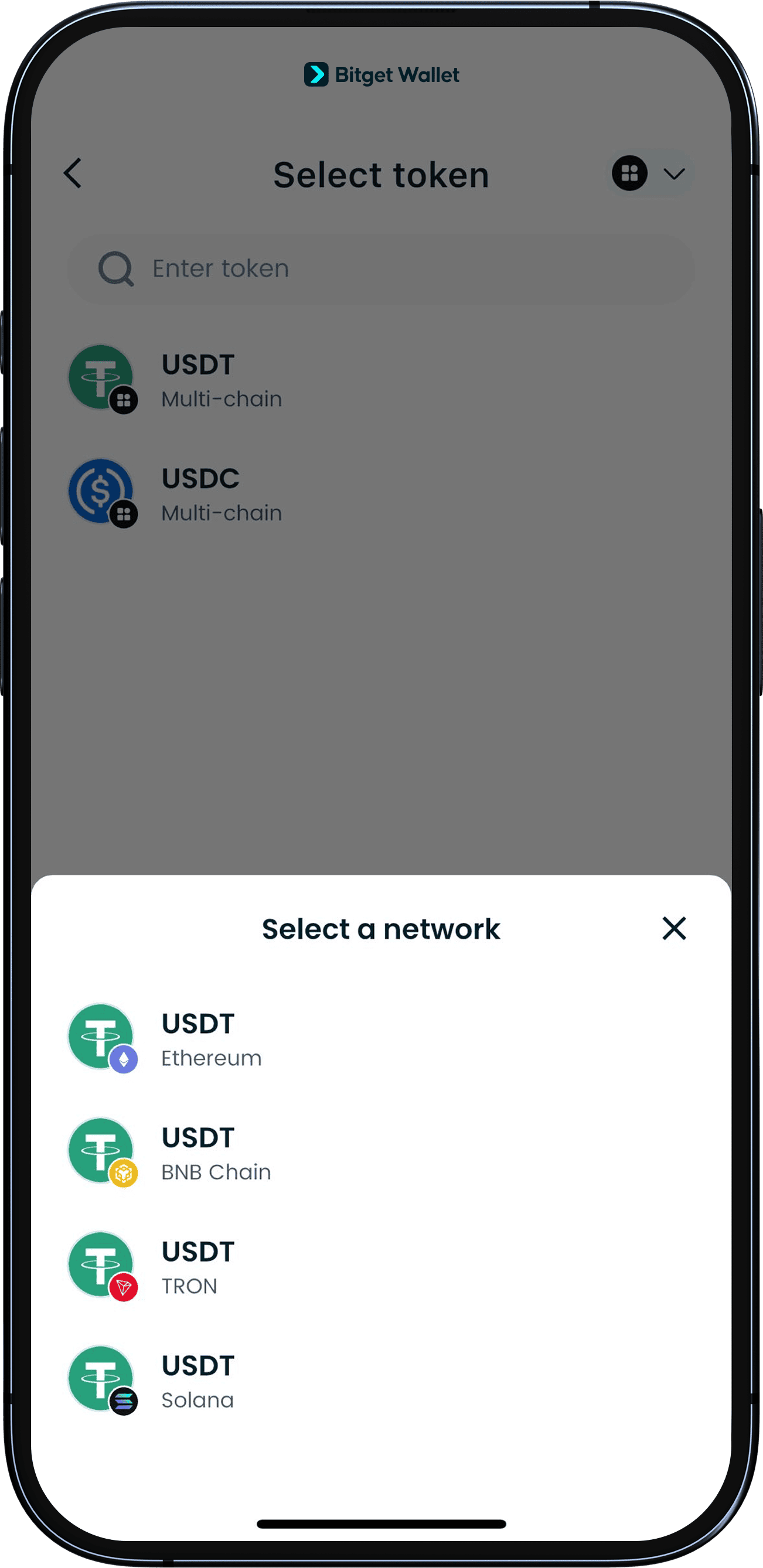

Step 2: Select Network and Token

Choose the blockchain network and supported token you want to sell.

Currently supported: USDT and USDC on Ethereum, Solana, BNB Chain, Base, and Tron.

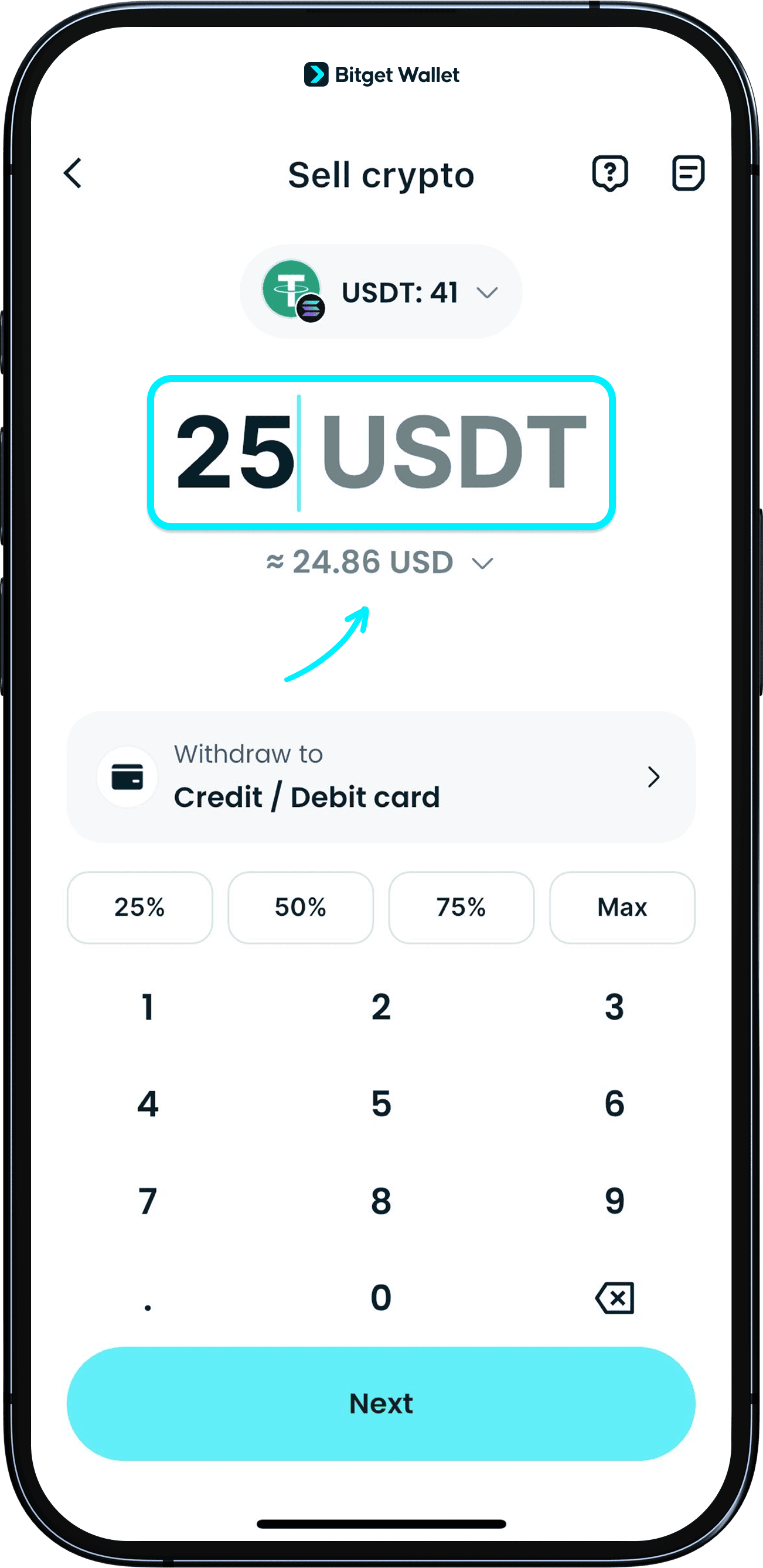

Step 3: Enter the Withdrawal Amount and Choose Fiat Currency

Input the amount of USDT or USDC you want to convert.

You’ll see a real-time fiat quote and can switch between 25+ supported fiat currencies, including USD, EUR, GBP, AUD, and MXN.

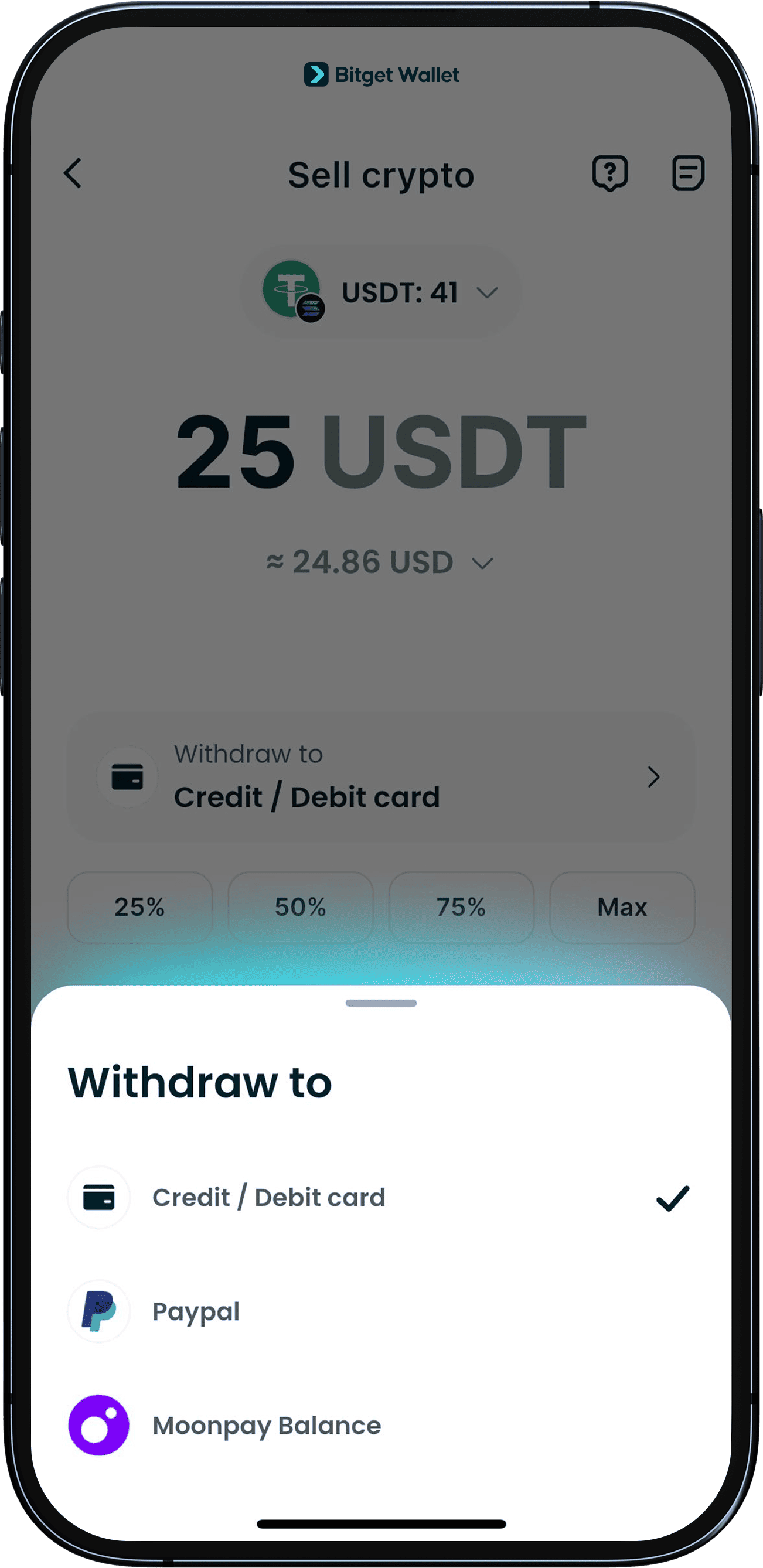

Step 4: Choose Your Payout Method

Select how you want to receive your fiat funds:

- Visa or Mastercard debit/credit card

- PayPal

- Venmo

- MoonPay balance

Step 5: Complete Verification (If Required)

If it’s your first time using MoonPay, you’ll be redirected to complete account registration and KYC verification, including ID submission and facial recognition. Approval is typically fast.

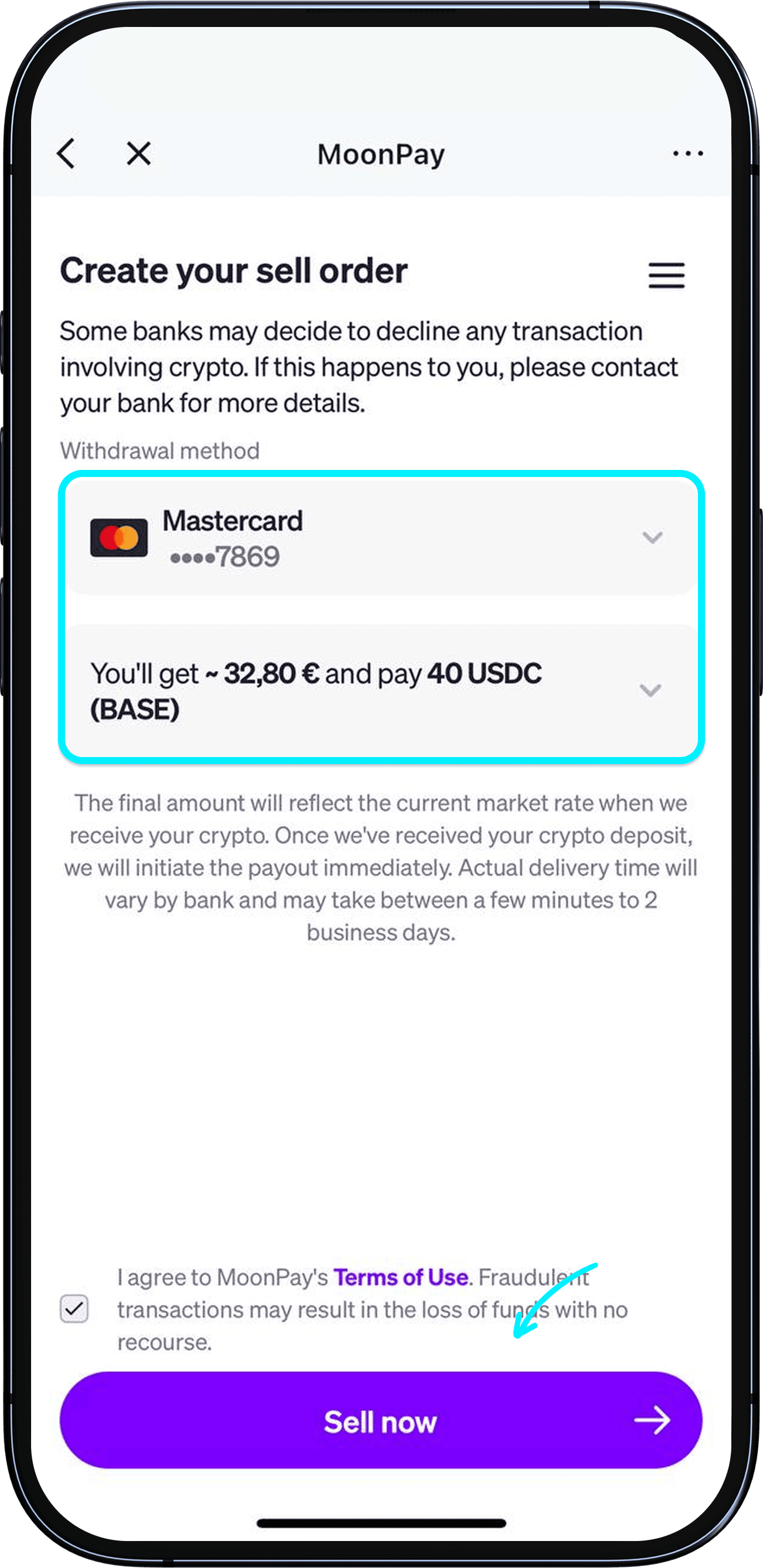

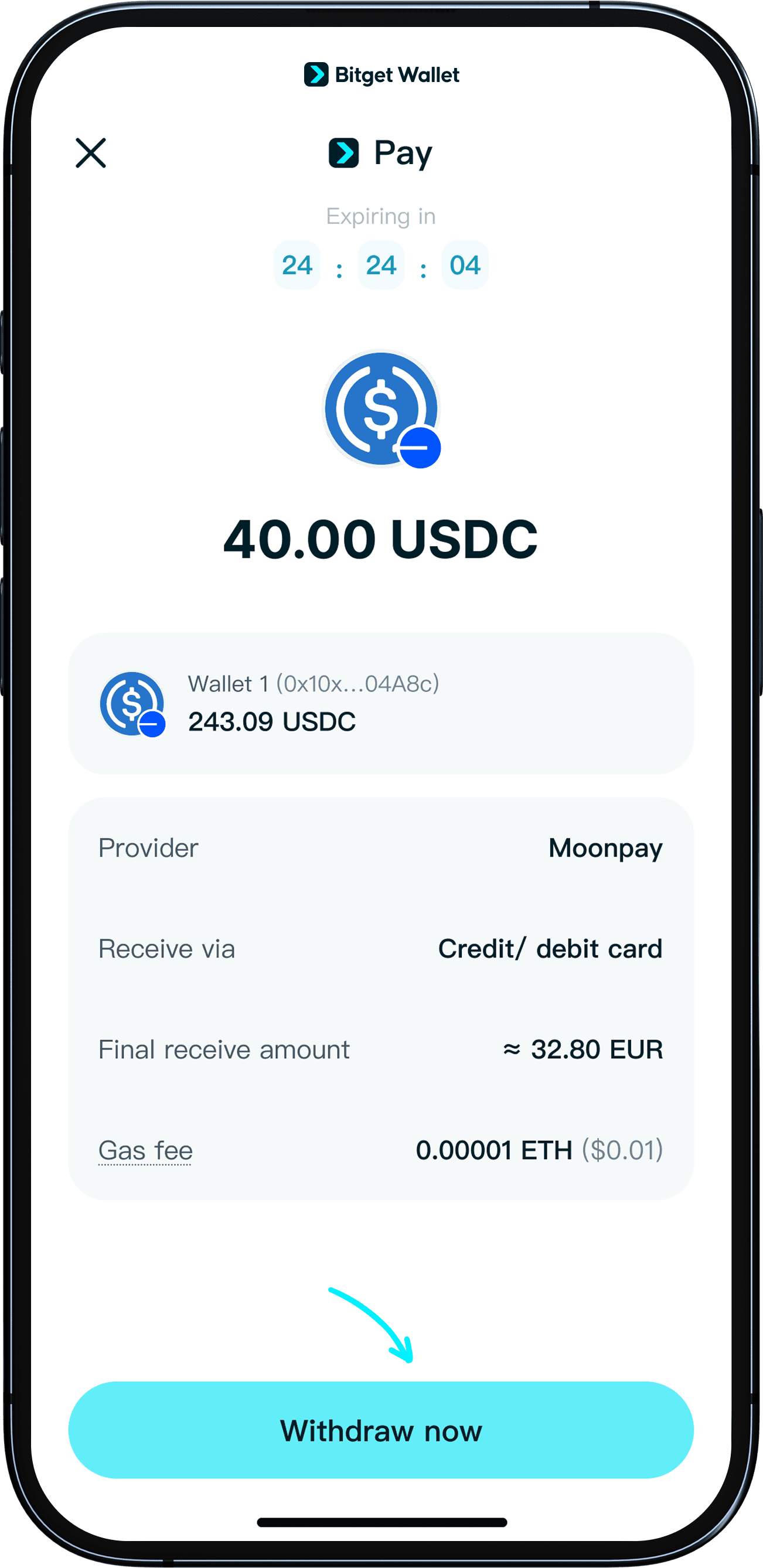

Step 6: Confirm and Submit Withdrawal

Review the quoted rate and fees carefully.

Tap Withdraw Now to submit your order.

Most withdrawals are processed within minutes, although some cases may take 1–3 business days, depending on your payout method and banking provider.

Tips to avoid common fiat withdrawal issues:

- Pending/processing too long: bank hours, weekends, or compliance review queues can delay payout.

- Rejected payout: name mismatch, incorrect IBAN/account number, unsupported bank/card region.

- Stuck transfer: wrong network selection or incorrect memo/tag fields (where applicable).

Off-ramping is about execution discipline. By managing assets inside Bitget Wallet and converting through regulated fiat rails, you gain clearer cost visibility, stronger operational control, and a safer cash-out experience.

Download Bitget Wallet today and follow a structured, checklist-based workflow to convert crypto to fiat with greater confidence and reduced risk.

Conclusion

What Are Crypto Off-Ramp solutions in 2026? They’re the infrastructure that converts on-chain value into fiat currency, letting investors realize gains, pay real expenses, and reduce volatility exposure. The best route depends on your region, size, urgency, and how much compliance friction you can tolerate—so compare total cost, settlement time, and risk before you execute.

To make conversion more consistent, treat cashing out as a checklist process, not a one-click action. Bitget Wallet helps investors manage assets across chains first—swap or bridge only when needed—then follow a structured crypto-to-fiat workflow with clear quote review, verification discipline, and transaction tracking.

If you want a cleaner way to prepare and execute, start your off-ramp plan inside Bitget Wallet and cash out with more control!

Sign up Bitget Wallet now - grab your $2 bonus!

FAQs

1. What Are Crypto Off-Ramp?

A crypto off-ramp converts cryptocurrency into fiat currency (USD/EUR/local currency) and pays it out via bank transfer, card payout, or merchant settlement rails.

2. What is the fastest way to cash out crypto into fiat in 2026?

Card-based routes and spend-focused crypto cards are often fastest, but may include higher FX/spread than bank transfers.

3. Which is cheaper for converting crypto to fiat?

Bank transfers can be cheaper on fees, but total cost depends on spread, FX markup, and network fees—always compare the all-in quote.

4. Do crypto off-ramps require KYC and proof of address?

Many do, especially for meaningful limits. Higher tiers and larger withdrawals are more likely to trigger proof-of-address or proof-of-funds checks.

5. What are the main risks when using a crypto off-ramp provider?

Fraud, compliance holds, operational transfer errors, slippage, fee misreads, and account security gaps are the most common risk categories.

6. Can I prepare my assets in Bitget Wallet before withdrawing crypto to fiat?

Yes. You can consolidate holdings, verify networks/contracts, and reduce unnecessary hops before starting a crypto-to-fiat cash-out flow.

Risk Disclosure

Please be aware that cryptocurrency trading involves high market risk. Bitget Wallet is not responsible for any trading losses incurred. Always perform your own research and trade responsibly.