How to Buy USDT: A Step-by-Step Guide for Beginners and Advanced Users

How to buy USDT is often presented as a simple transaction. In reality, USDT can be acquired through multiple paths, including exchanges, peer-to-peer trades, payment gateways, or on-chain swaps, each with very different implications for custody, fees, privacy, and long-term control.

What most guides fail to explain is that buying USDT is only the first and least risky step. The real challenge begins after the purchase. This article explains the full decision-making process behind buying, storing, and using USDT safely, without treating any single platform as the default answer. For users who want to take control after buying, a non-custodial crypto wallet such as Bitget Wallet can help manage USDT securely on-chain.

Key Takeaways

- There is no single best way to buy USDT; the right method depends on user goals, location, and risk tolerance.

- Buying USDT and storing USDT are separate decisions that require different tools and safeguards.

- Most USDT-related risks occur after purchase, including custody exposure, withdrawal freezes, and network errors.

How to Buy USDT Safely: Key Methods and Trade-Offs

Buying USDT safely is not about choosing the “right” platform, but about understanding how to buy USDT through different methods and what trade-offs each involves. Centralized exchanges, peer-to-peer markets, payment gateways, and on-chain swaps all differ in custody, fees, regulatory exposure, and post-purchase control. How to buy USDT safely ultimately depends on who controls the private keys, how USDT is executed on-chain, and where USDT is stored after the transaction.

- Custody – who controls the private keys

- Execution method – exchange, P2P, gateway, or on-chain

- Post-purchase storage – where USDT ultimately resides

Safety is determined by how these three factors interact, not by brand recognition or purchase speed.

What Should You Know Before Buying USDT?

Before deciding how to buy USDT, users must understand what USDT actually represents, how it behaves across different blockchains, and where risks commonly arise. Many mistakes associated with buying USDT safely occur not during the transaction itself, but due to misunderstandings about token mechanics, network selection, and custody assumptions after users buy USDT.

What Is USDT and How Does It Actually Work?

USDT (Tether) is a fiat-backed stablecoin designed to maintain a value close to one U.S. dollar. It is issued by a centralized entity and widely used for trading, payments, and DeFi. When users buy USDT, they are acquiring a token whose value stability depends on issuer management, reserves, and regulatory conditions—not on decentralized consensus.

Price stability, however, does not mean zero risk. USDT carries issuer risk, regulatory exposure, and operational dependencies that users should understand before buying USDT safely or relying on it for long-term use.

Why Does USDT Exist on Multiple Blockchains?

USDT exists on multiple blockchains to support different transaction environments and ecosystem demands. When users buy USDT, the blockchain version they receive—such as ERC20 on Ethereum, TRC20 on Tron, or versions on Solana or BNB Chain—directly affects how USDT can be transferred, stored, and used after purchase.

Chain choice directly affects:

- Transaction fees

- Transfer speed

- Ecosystem compatibility

One of the most common beginner mistakes when buying USDT is sending tokens on the wrong network, which can lead to permanent and irreversible loss.

What Risks Are Commonly Overlooked When Buying USDT?

Many users focus on how to buy USDT quickly, while overlooking risks that appear after the purchase is completed. These risks are rarely emphasized on pages that explain where to buy USDT, yet they represent the most common sources of user loss and confusion.

Commonly overlooked risks include:

- Fake or phishing USDT contract addresses

- Address-copy and clipboard attacks

- Regulatory changes affecting withdrawals or access

- Overconfidence in custodial platforms as long-term storage

Understanding these risks before buying USDT safely is essential to avoiding preventable mistakes.

How Do Exchanges and Crypto Wallets Differ When Buying and Holding USDT?

When users evaluate how to buy USDT, the most important distinction is not price or speed, but where USDT is held after purchase. Exchanges and crypto wallets serve different roles when buying and holding USDT, especially in terms of custody, control, and long-term access.

What Is the Difference Between Custodial and Non-Custodial Buying?

Custodial buying means USDT is held by an exchange on the user’s behalf after buying USDT is complete. Non-custodial buying places USDT in a crypto wallet, where ownership is enforced on-chain through private keys rather than account permissions.

On exchanges, USDT is held custodially. Users see an account balance, but do not control the private keys.

In a crypto wallet, USDT exists on-chain and ownership is enforced cryptographically. Control is determined by who holds the keys—not by account permissions.

Why Do Many Users Buy USDT on Exchanges but Store It in Crypto Wallets?

Many users buy USDT on exchanges for convenience, but store USDT in crypto wallets to reduce long-term custody risk. This separation reflects a common security practice when buying USDT: using exchanges for execution and crypto wallets for ownership.

- Withdrawal risk – exchanges can delay or suspend withdrawals

- Platform dependency – access tied to account status and jurisdiction

- Security best practice – long-term custody is safer under self-control

The Costs Exchanges Don’t Emphasize

The cost of buying USDT on exchanges extends beyond trading fees. Many costs and risks emerge only after the transaction is complete, affecting how USDT can be accessed, used, and secured over time.

Hidden costs

- Withdrawal fees

- Network fees passed through inefficiently

- Opaque conversion spreads

Opportunity costs

- No direct access to DeFi

- Limited yield or earning options

- Reduced on-chain flexibility

Risk concentration

- Single-platform custody exposure

- Account-level freezes

- Regulatory disruption risk

When Does a Crypto Wallet Actually Become Necessary?

A crypto wallet becomes necessary when users move beyond buying USDT and need direct control over how USDT is stored and used. True ownership requires a crypto wallet that enforces access through private keys rather than platform accounts.

- On-chain usage

- DeFi participation

- Payments and swaps

Using a non-custodial wallet such as Bitget Wallet, users can move immediately from purchase to self-custody—reducing exposure time and platform risk while enabling direct on-chain control.

What Are the Main Ways to Buy USDT Today?

There are multiple ways to buy USDT today, but each method affects custody, fees, and control differently after the purchase. Understanding where to buy USDT matters less than understanding how ownership changes once USDT is acquired—because long-term safety depends on control, not checkout speed.

How Do Centralized Exchanges Sell USDT?

Centralized exchanges are the most common way users buy USDT, offering liquidity and familiar interfaces. However, buying USDT on exchanges also means accepting custodial control and account-level restrictions that can affect access after purchase.

- KYC requirements

- Trading and withdrawal fees

- Withdrawal limits

Risks: account freezes, withdrawal suspensions, custodial dependency.

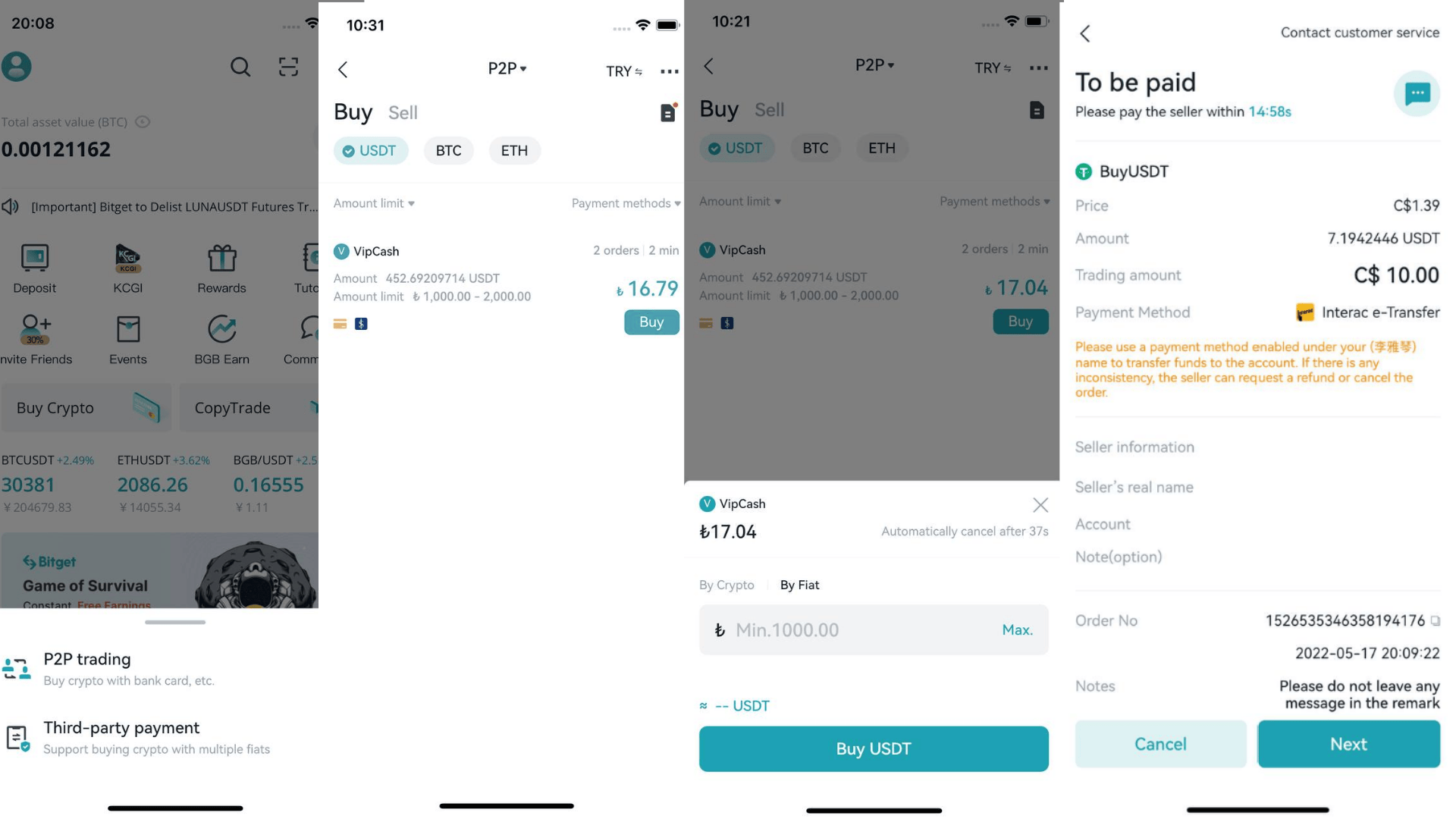

How Does Peer-to-Peer (P2P) USDT Buying Work?

Summary Block

Peer-to-peer platforms allow users to buy USDT directly from other individuals using local payment methods. While flexible, P2P USDT buying shifts more responsibility to the user and introduces higher execution and counterparty risk.

- Direct buyer-seller matching

- Local payment rails

Risks: scams, chargebacks, limited recourse. P2P is unsuitable for many beginners.

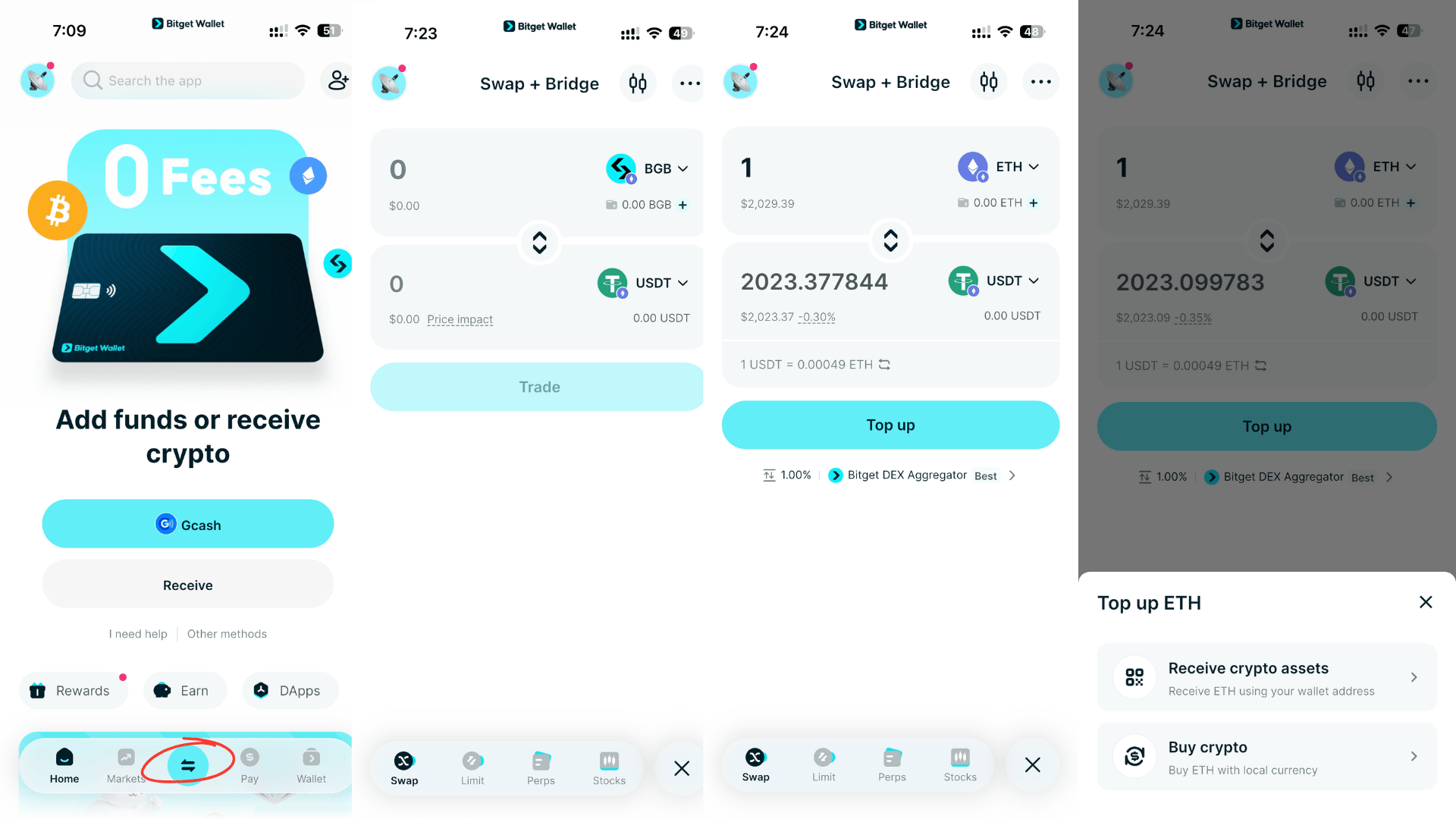

How Can You Buy USDT On-Chain Using a DEX?

Summary Block

On-chain buying allows users to swap crypto assets for USDT directly through decentralized exchanges. This method removes custodial intermediaries but requires users to manage wallet interactions, fees, and execution risk themselves.

- Swap another crypto asset for USDT

- Wallet signs transactions

Risks: slippage, gas fees, smart-contract exposure.

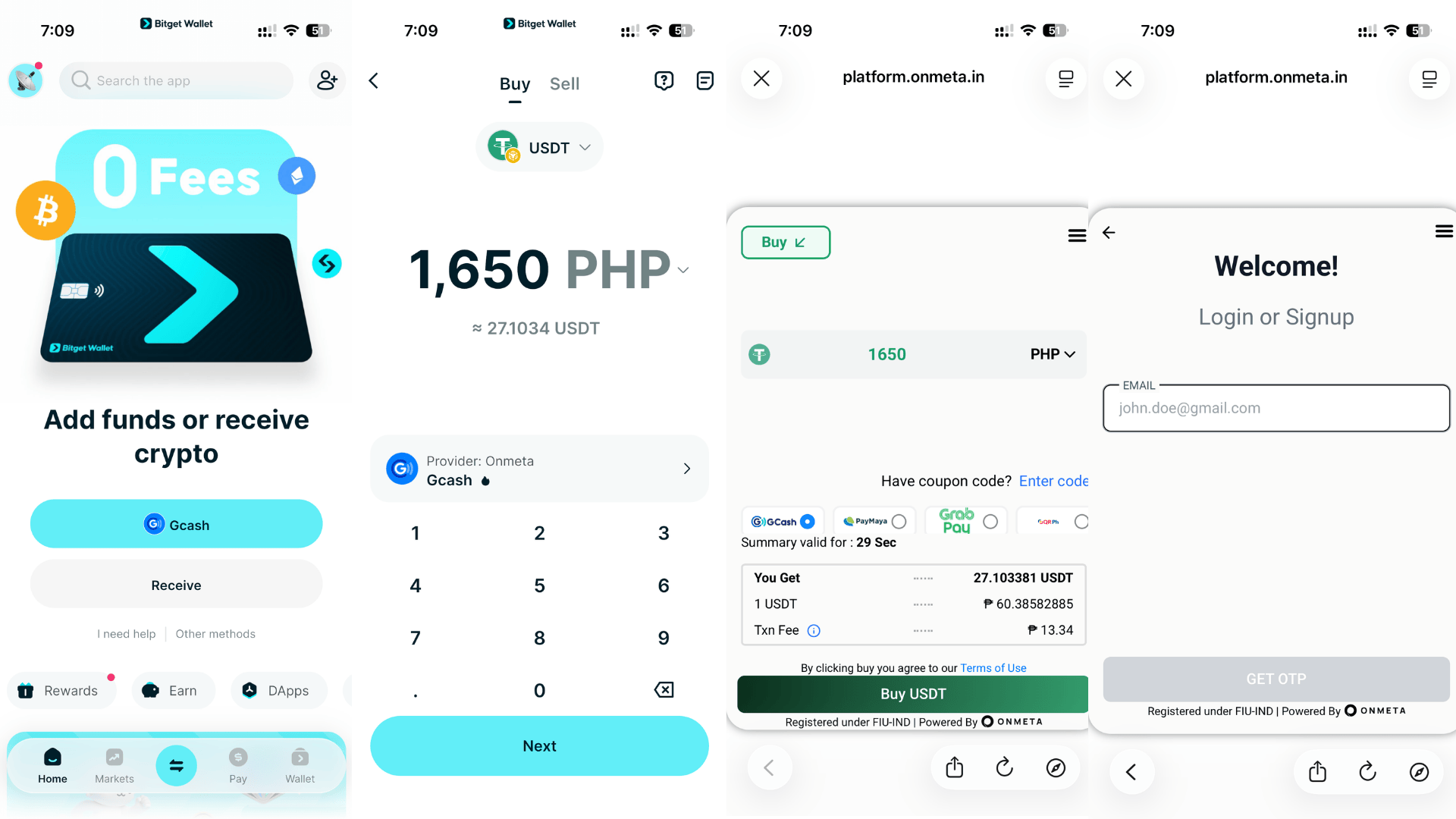

How Do Payment Gateways Let Users Buy USDT?

Summary Block

Payment gateways simplify how users buy USDT by integrating card and bank payments. The convenience comes with trade-offs in cost, regional availability, and reduced control over post-purchase custody.

- Card or bank integration

- High convenience

Trade-off: higher fees and regional restrictions.

Why Is OTC USDT Buying Risky for Most Users?

Summary Block

OTC USDT buying is designed for large-volume transactions and specialized users. For most buyers, the complexity, compliance exposure, and counterparty risk outweigh any pricing advantage.

- Compliance uncertainty

- Counterparty risk

- Limited relevance outside high-net-worth use cases

How Should You Store and Use USDT After Buying?

How USDT is stored after purchase has a greater impact on security than how it is bought. This stage determines who controls the asset, how easily it can be accessed, and whether USDT remains usable across on-chain applications over time.

Why Is Storing USDT on an Exchange Risky?

Leaving USDT on an exchange exposes users to custodial and operational risks that increase over time. While exchanges are efficient for buying and selling, they are not designed for long-term asset storage or self-sovereign control.

- Custody exposure

- Single point of failure

- Withdrawal dependency

Exchanges are optimized for execution—not long-term storage.

How Do You Transfer USDT to a Crypto Wallet Safely?

Transferring USDT from an exchange to a crypto wallet is the most critical step after buying USDT. Errors made during this process are often irreversible, making careful execution essential for protecting funds.

Secure USDT Transfer Checklist:

| Step | What to Check | Why It Matters |

| Network match | Sending and receiving networks are the same (ERC20, TRC20, etc.) | Prevents permanent loss |

| Test transfer | Send a small amount first | Confirms address and network |

| Address verification | Double-check the pasted address | Avoids clipboard attacks |

| Fee awareness | Review withdrawal and network fees | Prevents unexpected deductions |

How Do Non-Custodial Wallets Protect USDT?

Non-custodial wallets protect USDT by enforcing ownership directly on-chain rather than through platform permissions. This model reduces third-party dependency and allows users to store, transfer, and use USDT across multiple networks and on-chain applications without relying on custodial accounts.

Using a non-custodial wallet such as Bitget Wallet, users can move USDT from purchase to self-custody quickly—reducing custodial exposure while supporting payments, swaps, and DeFi participation.

Read more: What Is a Rug Pull? How Crypto Scams Work and How to Protect Yourself

How Can USDT Be Used Once It’s in a Crypto Wallet?

Once USDT is held in a crypto wallet, it becomes an on-chain asset that can be actively used rather than passively stored. This enables payments, swaps, and DeFi participation that are not available when USDT remains inside custodial exchange accounts.

How Is USDT Used for Payments and Transfers?

USDT is widely used for payments and transfers because its stable value reduces volatility during transactions. When stored in a crypto wallet, USDT can be sent directly between users or used for cross-border payments without relying on intermediaries.

- Stable-value peer-to-peer transfers

- Cross-border payments

Example with Bitget Wallet

USDT payments can be executed through QR-based wallet transfers, allowing merchants and recipients to receive stable-value payments directly on-chain.

How Do On-Chain USDT Swaps Work?

On-chain swaps allow users to exchange USDT for other crypto assets using decentralized liquidity pools. These swaps are executed through a crypto wallet, where users sign transactions and manage fees and slippage in real time.

- Decentralized liquidity routing

- Fee and slippage awareness

Example with Bitget Wallet

USDT swaps can be routed through built-in DEX aggregation, enabling access to decentralized liquidity across multiple pools and networks.

How Is USDT Used in DeFi?

USDT plays a central role in DeFi as a lending and yield-generating asset across multiple protocols. Accessing these opportunities requires a crypto wallet that can connect directly to smart contracts while exposing users to protocol-level risk.

- Lending and yield strategies

- Protocol-level risk

Example with Bitget Wallet

USDT can be deployed into DeFi protocols such as Aave through wallet-based connections that allow direct interaction with on-chain lending markets.

How Do You Choose the Right USDT Buying Method for Your Situation?

Choosing how to buy USDT is less about finding a universally “best” option and more about aligning the method with your experience level, risk tolerance, and intended use. Different buying methods optimize for simplicity, control, privacy, or cost, and each comes with trade-offs that affect long-term ownership.

Which Method Is Best for Beginners?

For beginners, the safest way to buy USDT prioritizes simplicity and regulatory clarity over flexibility. Methods with clearer compliance requirements and fewer execution steps help reduce early mistakes when buying USDT for the first time.

- Simplicity

- Compliance

- Lower operational risk

Which Method Is Best for Advanced or Privacy-Focused Users?

Advanced or privacy-focused users often choose methods that emphasize self-custody and on-chain execution. These approaches offer greater control and flexibility, but require a higher level of technical understanding when buying and managing USDT.

- On-chain execution

- Wallet-based flows

How Do Fees, Speed, Privacy, and Risk Compare?

Each method for buying USDT involves trade-offs between fees, speed, privacy, and risk. Some options prioritize fast execution and convenience but introduce higher custodial exposure, while others reduce third-party dependency at the cost of complexity and on-chain fees.

There is no universal answer when choosing how to buy USDT—only better alignment with user goals, experience level, and how USDT will be stored and used after the purchase.

Does Buying USDT Differ by Country or Region?

Yes, buying USDT can differ significantly by country or region due to regulatory frameworks, platform availability, and compliance requirements. While the core principles of how to buy USDT remain the same, the methods and constraints users face often depend on where they are located.

Buying USDT in the US or EU

In the US and EU, buying USDT is largely shaped by regulatory oversight and compliance standards. Most users rely on regulated exchanges, and tax considerations often apply when buying, holding, or transferring USDT.

- Regulated exchanges dominate

- Tax considerations apply

Buying USDT in Asia

In many parts of Asia, users have access to a wider range of platforms and payment options when buying USDT. Peer-to-peer trading is more prevalent, offering flexibility but also requiring greater caution and user responsibility.

- Strong P2P presence

- Broader platform access

What If USDT Buying Is Restricted in Your Region?

When buying USDT is restricted, users should focus on lawful and compliant options rather than workarounds. Attempting to bypass regional rules often increases financial and security risk without improving long-term access or control.

Adapt legally and compliantly. Avoid circumvention strategies that introduce unnecessary risk.

Related Reading on Buying Crypto

If you’re looking to better understand how to buy crypto safely and efficiently, the following guides can help:

- What is Stablecoin? A Beginner’s Guide to Price-Stable Cryptocurrencies

- What is Tether USDT: A Complete Guide to the World’s Leading Stablecoin

- What Are Crypto On-Ramps and Off-Ramps

- USDT On-Ramp Complete Guide: How to Buy Tether (USDT) with Fiat?

- How to Buy USDT: A Step-by-Step Guide for Beginners and Advanced Users

- USDC vs USDT: What’s the Difference? Investor’s Guide for 2026

Conclusion

How to buy USDT is an entry skill—but secure ownership and control are the real differentiators. Buying methods change by region and platform, and access rules may shift over time, but ownership principles remain constant. Long-term safety depends on understanding custody, minimizing post-purchase risk, and treating control of assets as a responsibility rather than a convenience.

To put that mindset into practice, users need tools designed for self-custody that support secure storage and on-chain usage of USDT beyond the point of purchase. Download Bitget Wallet to move from purchase to self-custody and manage USDT safely and confidently over time.

Sign up Bitget Wallet now - grab your $2 bonus!

FAQs

1. How to buy USDT safely?

To buy USDT safely, users should focus on custody, fees, and post-purchase storage rather than speed or convenience. The safest approach to buying USDT involves understanding who controls the private keys and moving USDT to secure storage after the transaction is complete.

2. How can I verify a real USDT contract?

To verify a real USDT contract, users should check official blockchain explorers and compare the contract address with issuer documentation. Verifying the USDT contract address before interacting with tokens helps prevent losses from fake or phishing contracts.

3. What if an exchange suspends USDT withdrawals?

If an exchange suspends USDT withdrawals, users may temporarily lose access to their funds even though they hold an account balance. This risk highlights why many users withdraw USDT to a crypto wallet immediately after buying USDT to retain on-chain ownership and control.

4. What is the minimum amount of USDT I can buy?

The minimum amount of USDT you can buy depends on the platform, payment method, and region. Exchanges, payment gateways, and on-chain swaps each impose different minimum limits and fee thresholds when buying USDT.

5. What should I do if I send USDT on the wrong network?

Sending USDT on the wrong network can result in permanent loss if the receiving wallet does not support that blockchain. Always verify the USDT network before transferring tokens, as recovery options are often limited or unavailable.

6. Can a non-custodial wallet like Bitget Wallet buy USDT directly?

A non-custodial wallet such as Bitget Wallet does not sell USDT directly or function as an exchange. Instead, it supports secure storage, transaction signing, and on-chain usage of USDT after users buy USDT through an exchange or other buying method.

Risk Disclosure

Please be aware that cryptocurrency trading involves high market risk. Bitget Wallet is not responsible for any trading losses incurred. Always perform your own research and trade responsibly.