What Is the Best USD Stablecoin: Top Choices, Yields, and How to Buy Stablecoins Safely?

What are the best USD stablecoins in 2025? Potential options include USDT and USDC, which provide cryptocurrency users with digital assets pegged to the U.S. dollar. This removes the wild price swings seen in Bitcoin and Ethereum.

Stablecoins balance safety with risks as institutions use them for money storage and global payments. New projects include Trump-backed USD1, possible Amazon and Walmart coins, and yield products like Bitget Wallet's Stablecoin Earn Plus offering up to 18% APY.

This in-depth guide explores top USD stablecoin choices, yield opportunities, and secure purchasing methods through platforms like Bitget Wallet for both beginners and experienced crypto investors.

What Is the Best USD Stablecoin?

Stablecoins function as digital currencies engineered to maintain consistent purchasing power through various stabilization mechanisms. These cryptocurrencies operate using three primary approaches: fiat-backed, crypto-backed, and algorithmic systems.

The best USD stablecoin picks prioritize the U.S. dollar because it acts as the world's reserve currency. It provides the most liquid and widely-accepted standard for international commerce.

How Do USD-Pegged Stablecoins Maintain Stability?

USD-pegged stability mechanisms vary significantly depending on the underlying stablecoin architecture and reserve management approach.

| Stablecoin Type | Description | Example |

| Fiat-backed Stablecoin | Maintains 1:1 USD reserves in bank accounts and Treasury securities | USDC, USDT |

| Crypto-backed Stablecoin | Uses over-collateralized cryptocurrency deposits (typically 150% backing ratio) | DAI |

| Algorithmic Stablecoin | Employs smart contracts and supply adjustments to maintain price stability | Ampleforth (AMPL) |

Reserve transparency differs across providers, with USDC publishing monthly audited attestations and Tether providing quarterly reserve disclosures through independent accounting firms.

Why Are USD Stablecoins Safer Than Volatile Cryptocurrencies?

USD stablecoins provide three fundamental safety advantages that address the practical limitations of traditional cryptocurrencies.

-

Store of Value:

USD stablecoins preserve purchasing power while Bitcoin faces daily price swings over 10%, making them good for salary payments and regular buys.

-

Volatility Hedge:

These digital assets serve as portfolio stabilizers during market turbulence, unlike Ethereum which can depreciate 70% over six-month periods during bear markets.

-

Everyday Usage:

Cross-border remittances through stablecoins cost about $0.75 compared to traditional banking fees averaging 6.5% globally, hence facilitating practical applications.

Which Are the Most Popular USD Stablecoins in 2025?

The stablecoin list rankings reflect adoption patterns, market capitalization growth, and utility across different blockchain ecosystems.

Is Tether (USDT) Still the Market Leader?

Tether (USDT) maintains strong market dominance with a $159-billion market cap, handling daily trading amounts over $137 billion across multiple blockchain networks.

This market leadership stems from exceptional liquidity and widespread exchange integration. USDT serves over 400 million users globally, though transparency concerns about reserve composition continue affecting investor confidence despite quarterly attestations.

Read more: What is Tether USDT: A Complete Guide to the World’s Leading Stablecoin

Source: Bankrate

Why Do Investors Trust USD Coin (USDC)?

USD Coin (USDC) earns institutional confidence through Circle's monthly audited attestations and rigorous regulatory compliance across multiple jurisdictions including the United States and European Union.

Circle's June 2025 CRCL stock listing on NYSE raised $1.1 billion and was 25 times oversubscribed, demonstrating massive investor confidence. The BlackRock partnership managing Circle Reserve Fund provides additional institutional-grade oversight that appeals to conservative investors.

Read more:

- What Is USDC the Stablecoin? Circle’s Dollar-Pegged USD Coin Explained for Crypto Investors

- USDC vs USDT: What’s the Difference? Investor’s Guide for 2025

Source: DeFi Guide

What Makes DAI Unique Among Stablecoins?

DAI functions as the top decentralized stablecoin, using crypto backing mechanism through MakerDAO's voting system where MKR token holders control protocol choices and parameter changes.

This decentralized setup removes single points of failure and censorship risks. DAI serves as DeFi's backbone, letting lending and borrowing occur without traditional banking needs while keeping algorithmic stability through smart contract methods.

Read more: What is Dai the Stablecoin (DAI)? Complete Guide to MakerDAO’s Decentralized Dollar-Pegged Asset

Source: TransFi

What Role Do Newcomers Like USD1 and PYUSD Play?

Emerging USD stablecoin options address specific market segments through political backing and mainstream financial integration strategies.

-

**USD1 (Trump-backed):**

World Liberty Financial's stablecoin achieved a $2.4-billion market cap within four months, securing Binance and Coinbase listings with full Treasury backing.

-

**PYUSD (PayPal Integration):**

PayPal's consumer-focused approach offers 3.7% annual yield and seamless spending through existing PayPal infrastructure, targeting mainstream adoption beyond crypto users.

Read more:

- What is USD1 Stablecoin: Multi-Chain Stablecoin Backed by U.S. Treasuries for Web3 Payments

- What Is PayPal Pay with Crypto? Fees, PYUSD, and Merchant Guide 2025

Source: BitKE

What Are the Benefits and Risks of Using USD Stablecoins?

USD stablecoin investments require understanding both significant utility advantages and potential risks that could impact portfolio performance.

How Do Stablecoins Provide Stability, Liquidity, and Utility?

Stablecoins deliver three fundamental advantages that make them essential tools for modern digital finance applications.

-

Price Stability:

USD stablecoins maintain $1.00 peg with minimal deviation, unlike Bitcoin's 10% daily price swings, making them practical for salary payments and regular transactions.

-

Cross-Border Efficiency:

International transfers settle in minutes with fees under $1, compared to traditional banking systems requiring 3-5 days and averaging 6.5% in global remittance costs.

-

DeFi Integration:

Stablecoins provide approximately 45% of decentralized exchange liquidity, enabling lending, borrowing, and yield generation without traditional banking intermediaries or volatility concerns.

-

24/7 Operations:

Digital payments process continuously without banking hours or holiday restrictions, supporting global business operations and freelancer payments across time zones.

What Risks Should Investors Watch Out For?

Stablecoin regulation and market dynamics create several risk categories that require careful evaluation before investment decisions.

-

Centralization Risks:

USDC lost 13% of its value when Silicon Valley Bank collapsed in March 2023, demonstrating counterparty risks from reserve banking dependencies.

-

Algorithmic Failures:

TerraUSD's May 2022 collapse wiped out $40 billion in market value, showing how algorithmic mechanisms can create catastrophic death spirals during stress events.

-

Regulatory Uncertainty:

Changing rules like the US GENIUS Act and EU MiCA create compliance costs and limits that could affect stablecoin accessibility.

-

Liquidity Constraints:

Large cash-outs during market stress can face delays when reserves are held in long-term assets, possibly causing confidence drops and market runs.

How Can You Earn Yield with USD Stablecoins?

USD stablecoin investments function as income-generating tools, offering yields between 3-18% annually while maintaining dollar-pegged stability that traditional cryptocurrencies cannot provide.

How Do DeFi Protocols Like Aave and Compound Generate Returns?

Decentralized lending protocols connect stablecoin holders with borrowers through automated smart contracts that eliminate traditional banking intermediaries.

-

Lending Pools:

Users deposit stablecoins into shared liquidity pools that borrowers access using over-collateralized cryptocurrency.

-

Interest Generation:

Borrowers pay 10-25% APY rates for stable dollar liquidity, creating sustainable stablecoin DeFi yield for lenders.

-

Yield Farming:

Advanced strategies combine lending with liquidity provision, potentially generating 15-40% returns through governance token rewards.

-

Real-Time Payments:

Interest accrues continuously and compounds automatically, with yields fluctuating based on borrowing demand dynamics.

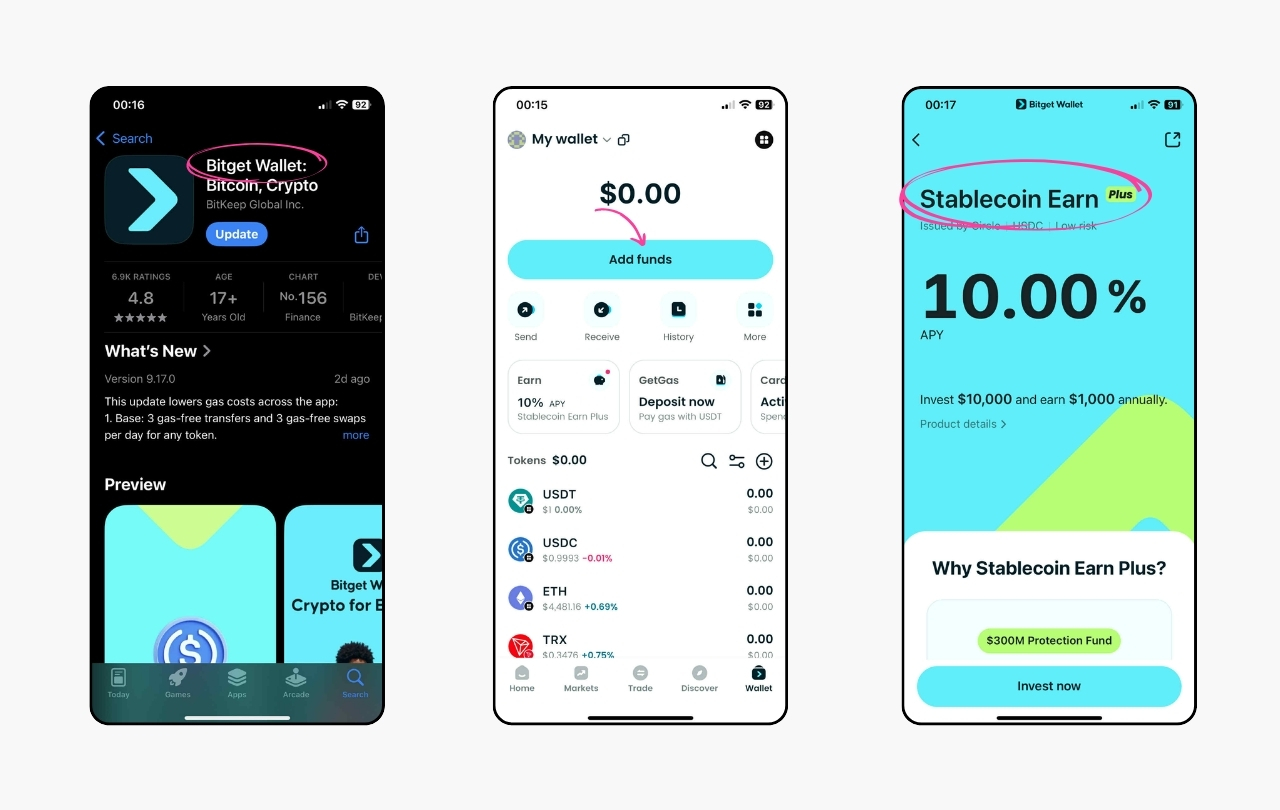

What Is Bitget Wallet's Stablecoin Earn Plus?

Bitget Wallet's Stablecoin Earn Plus delivers 10% base stablecoin APY with early bird bonuses reaching 18% during promotional periods through Aave protocol integration.

The product offers instant T+0 withdrawals with non-custodial security, maintaining user control of private keys while providing $300M Protection Fund coverage for enhanced safety.

How Do Yields Compare to Bank Savings or Bonds?

Traditional financial products deliver significantly lower returns than modern stablecoin yield opportunities available through DeFi platforms.

| Product | Annual Yield | Risk Level | Liquidity |

| Bank Savings | ~1.0% | Very Low | Instant |

| US Treasuries | 3-5% | Low | Business Hours |

| Money Market Funds | 4-5% | Low | Same Day |

| Bitget Earn Plus | 10-18% | Medium | 24/7 Instant |

How Can You Buy the Best USD Stablecoin?

This comprehensive guide provides step-by-step instructions for purchasing USD stablecoins safely through trusted platforms and secure storage methods.

Where Can You Buy Stablecoins Safely?

Trusted cryptocurrency exchanges like Coinbase, Binance, and Bitget offer user-friendly interfaces with competitive fees for purchasing USDT, USDC, and other leading stablecoins.

Besides, direct purchases through stablecoin issuers provide maximum transparency and eliminate exchange counterparty risks. Circle offers USDC through bank transfers while Tether facilitates institutional USDT purchases.

How Do You Store Stablecoins Securely?

Non-custodial wallets like Bitget Wallet provide the highest security by giving users complete control over private keys rather than relying on exchange custody.

Bitget Wallet enhances security through its $300 million Protection Fund and supports stablecoins across multiple blockchains, including Ethereum, BNB Chain, Base, and Solana networks.

What Are the Steps to Get Started with Bitget Wallet?

Learning how to buy stablecoins with Bitget Wallet involves three straightforward steps that enable immediate yield generation through the integrated Earn Plus feature.

-

Step 1 (Download Application):

Install Bitget Wallet from official app stores, create a secure wallet using biometric protection and backup seed phrases.

-

Step 2 (Fund Your Wallet):

Transfer USDC or USDT from exchanges to your wallet address, ensuring correct network selection for successful deposits.

-

Step 3 (Access Earn Plus):

Navigate to Stablecoin Earn Plus within the app, deposit minimum 1 USDC to start earning guaranteed yields immediately.

Download Bitget Wallet to manage stablecoins securely and explore trending tokens across multiple chains with beginner-friendly tools for seamless multi-chain trading experiences.

Conclusion

The best USD stablecoin in 2025 stays a key tool for investors seeking stability and safe onchain returns. USDC clarity, USDT liquidity, and DAI decentralization provide various choices while institutional adoption accelerates through DeFi integration and Bitget Wallet's yield products.

Future stablecoin growth will be driven by Amazon and Walmart corporate adoption speculation, USD1 political momentum, and evolving regulatory frameworks across major jurisdictions establishing clearer operational guidelines.

Download Bitget Wallet today to manage stablecoins securely, earn up to 18% APY with Stablecoin Earn Plus, and explore DeFi yields in one beginner-friendly app.

Sign up Bitget Wallet now - grab your $2 bonus!

Frequently Asked Questions (FAQs)

1. Which USD Stablecoin Is the Safest in 2025?

Which stablecoin is safest depends on transparency priorities, though USDC leads through Circle's monthly Big Four audits, weekly reserve disclosures, and regulatory compliance across multiple jurisdictions including the United States.

2. Can Stablecoins De-Peg Like TerraUSD Again?

Major fiat-backed stablecoins can experience brief de-pegging during extreme stress events like USDC's March 2023 Silicon Valley Bank incident, though robust reserve practices make algorithmic-scale collapses unlikely.

3. How Do I Earn APY with Stablecoins?

Stablecoin APY up to 18% becomes accessible through DeFi lending protocols like Aave paying borrower interest, or simplified products like Bitget Wallet's Stablecoin Earn Plus guaranteeing returns with instant withdrawals.

4. Is Bitget Wallet Safe for Stablecoin Storage?

Bitget Wallet maintains non-custodial security where users control private keys, routes funds into audited Aave pools, and provides $300 million protection fund coverage against platform failures.

5. What Stablecoin Is Backed by Gold?

PAX Gold (PAXG) and Tether Gold (XAUt) function as gold-backed stablecoins, with each token maintaining 1:1 backing by physical gold bars stored in secure, audited vaults.

Risk Disclosure

Please be aware that cryptocurrency trading involves high market risk. Bitget Wallet is not responsible for any trading losses incurred. Always perform your own research and trade responsibly.