What is Plasma (XPL): Stablecoin-Native Blockchain Explained with Tokenomics and Cross-Chain Trading

What is Plasma (XPL) is the question many crypto users are asking as the network positions itself as a global infrastructure for stablecoin payments. Plasma is an EVM-compatible Layer-1 blockchain built specifically to make USD-pegged stablecoins (like USDT) usable as everyday money: instant settlement, dramatically lower friction, and the ability for users to send value without first buying a native token.

Plasma’s unique features include zero-fee USDT transfers via a paymaster, support for custom gas tokens, a roadmap for confidential payments, and a trust-minimized Bitcoin bridge that mints pBTC for native BTC use in smart contracts. Market traction has been strong: Plasma’s mainnet launched on Sept 25, 2025, with > $2B of stablecoin liquidity on day one, rapid exchange listings, and native integration with Bitget Wallet (you can add the Plasma mainnet, send/receive $XPL, and stake USDT in Bitget Wallet).

In this article we break down how Plasma works, why stablecoin payments are its core use case, the XPL tokenomics, the Bitcoin bridge mechanics, and — step-by-step — how to access Plasma via Bitget Wallet.

Key takeaways

- Plasma is a stablecoin-first Layer-1 with paymaster-enabled gasless USDT transfers and EVM compatibility.

- The network relies on PlasmaBFT + Reth for sub-second finality and high throughput, while pBTC enables native Bitcoin use.

- XPL secures the chain (staking & rewards) and the ecosystem shows early traction: mainnet launch liquidity, wallet integrations, and DeFi partnerships.

What is Plasma (XPL) and why does it matter for stablecoins?

What is Plasma (XPL) in plain terms: a Layer-1 blockchain purpose-built to move stablecoins at scale. Unlike general-purpose chains such as Ethereum, Solana, or Tron, Plasma optimizes for payment UX and economic models needed by merchant rails and remittances. That focus yields practical advantages: cheaper microtransactions, fast settlement for merchant acceptance, and the ability to pay gas in the same stable asset users already hold.

Problems Plasma addresses include:

- High on-chain fees that kill micro-payments.

- Fragmented liquidity across chains and wrapped token complexity.

- Poor UX for mainstream users who don’t want to acquire a native token before sending value.

By solving these, Plasma aims to turn stablecoins into practical digital cash rather than speculative tokens.

Source: plasma.to

Plasma Officially Launches Mainnet: A Market Earthquake

On September 25, 2025, the stablecoin ecosystem witnessed a historic turning point as Plasma officially launched its global mainnet. The event was not only a technical milestone but also an immediate market catalyst, sparking massive attention across the crypto industry:

- Massive inflows: Over $2 billion in stablecoins poured into the Plasma ecosystem within the first 24 hours.

- Rapid growth: The market capitalization of XPL tokens surged to $2.4 billion, propelling Plasma into the ranks of the fastest-growing blockchains ever.

- Explosive price rally: The XPL token peaked at $1.54, recording a gain of more than 50% on launch day.

- Ecosystem momentum: Plasma’s DeFi protocols surpassed $1 billion in liquidity, underscoring the ecosystem’s strong early adoption.

- Strategic partnership: Plasma announced a key collaboration with Bitget Wallet, unlocking seamless stablecoin experiences for millions of users through native mainnet integration, cross-chain USDT transfers, and yield farming opportunities — all aligned with the vision of #Crypto4Everyone.

“As a launch partner for Plasma, Bitget Wallet is helping bring stablecoin-native infrastructure into the hands of everyday users,” said Jamie Elkaleh, Chief Marketing Officer at Bitget Wallet. “This integration supports our broader mission to simplify digital asset use and expand access to efficient, low-cost crypto finance.”

These milestones make it clear: Plasma is not just another Layer-1 blockchain. It is actively reshaping how stablecoins function in payments and DeFi, with a sharp focus on frictionless user experience, lightning-fast transactions, and near-zero fees.

How Does Plasma XPL Work at the Infrastructure Level?

Plasma (XPL) is a Layer 1 blockchain purpose-built for stablecoin payments, designed on high-performance infrastructure to support billions of financial transactions worldwide. Instead of positioning itself as an “Ethereum killer,” Plasma focuses on solving a very specific problem: making stablecoins function as seamlessly as real digital cash.

What is PlasmaBFT and Why is It Different?

The core consensus technology of Plasma is PlasmaBFT, an enhanced variant of HotStuff BFT. Its highlights include:

- Pipelined consensus that processes multiple blocks in parallel.

- Sub-second finality where transactions are confirmed in under one second.

- Throughput exceeding 1,000 TPS, rivaling traditional payment networks like Visa and MasterCard.

This makes PlasmaBFT one of the fastest and most efficient BFT mechanisms available, ideally suited for high-frequency stablecoin transactions.

How is Plasma Compatible with Ethereum (EVM)?

Plasma uses the Reth client written in Rust, ensuring optimized performance and full compatibility with Ethereum.

- Developers can directly deploy Solidity smart contracts.

- Popular tools such as MetaMask, Hardhat, and Truffle work seamlessly.

- End-users don’t need to learn an entirely new ecosystem—Plasma is an EVM compatible blockchain with a user-friendly experience.

This lowers the barrier for Web3 developers, enabling them to migrate to Plasma without rewriting entire codebases.

How Does the Bitcoin Bridge Work on Plasma?

Plasma introduces a trust-minimized bridge for Bitcoin integration:

- Users send BTC, and the system mints pBTC on Plasma.

- When redeeming, pBTC is burned and the original BTC is released back.

- A decentralized network of verifiers secures this process, avoiding the centralization risks of wrapped BTC (WBTC).

This enables a new DeFi ecosystem for Bitcoin, combining transparency with stronger security. This distinction is key when discussing the Plasma Bitcoin bridge explained.

What Are Plasma’s Core Features for Stablecoin Users?

Plasma (XPL) is optimized for stablecoin payments, delivering an experience that makes using USDT feel like using cash without technical barriers.

Why Are Zero-Fee USDT Transfers a Game-Changer?

Through its Paymaster system, Plasma enables Plasma gasless USDT transfers:

- Users don’t need to hold XPL to pay gas.

- Fees can be sponsored by dApps or paid directly in USDT.

- The UX is extremely beginner-friendly, especially for users transitioning from Web2.

This is one of the killer features that makes Plasma stand out from Ethereum, Tron, or Solana.

Can Users Pay Gas with Custom Tokens?

Beyond USDT, Plasma allows gas fees to be paid with multiple tokens in the ecosystem.

- Users can pay in USDC, DAI, or even native dApp tokens.

- This eliminates the friction of pre-purchasing gas tokens.

- It greatly accelerates onboarding for mainstream users.

What is Confidential Payments on Plasma?

Plasma is developing a privacy payments module that supports confidential transactions:

- Transaction details such as amounts and recipients can be hidden.

- Compatibility with wallets and UX is maintained.

- This is a significant step in merging blockchain transparency with the privacy users expect in personal payments.

What is the XPL Token and How Does Tokenomics Work?

While Plasma enables gasless transfers with USDT, the XPL token remains the backbone of the network.

What is the Role of XPL in the Plasma Network?

Plasma XPL serves multiple functions:

- Gas payments (in cases where Paymaster isn’t used).

- Staking, securing the network and rewarding validators.

- Governance, enabling community proposals and votes.

- Ecosystem incentives for developers and contributors.

How Are XPL Tokens Distributed?

Plasma’s tokenomics are designed to balance ecosystem growth with investor protection.

- Total supply: 10 billion XPL.

- Allocation: 40% Ecosystem & Growth, 25% Team, 25% Investors & Partners, 10% Public Sale.

- Lockups & vesting: team and investor allocations are locked; U.S. public sale tokens have a 12-month lockup.

These mechanics are key to understanding Plasma XPL tokenomics.

How Does Inflation and Fee Burning Sustain Plasma?

Plasma applies a dual mechanism for sustainability:

- Inflation begins at 5% annually, gradually tapering by 0.5% per year until it stabilizes at 3%.

- Soft slashing, where validators lose rewards (but not staked capital) for misbehavior.

- Fee burning, modeled after EIP-1559, to regulate long-term supply.

This approach incentivizes validators while ensuring long-term scarcity for XPL.

How Is Plasma Different from Ethereum, Solana, or Tron?

Plasma (XPL) stands out because it was designed specifically for stablecoin payments, unlike Ethereum, Solana, or Tron which are general-purpose blockchains.

Comparison Table: Plasma vs Ethereum vs Solana vs Tron

| Feature | Plasma (XPL) | Ethereum | Solana | Tron |

| TPS | 1,000+ | ~15 (L1) | 2,000–3,000 | ~2,000 |

| Finality | < 1s | 15s+ | 2–3s | ~3s |

| Gas Fees | USDT gasless / Paymaster | ETH required | SOL required | TRX required |

| Focus | Stablecoin-first | Smart contracts | DeFi + NFTs | USDT dominance |

| BTC Bridge | Yes (pBTC) | External bridges | External bridges | Limited |

| Privacy | Confidential payments (roadmap) | Very limited | None native | None native |

With its stablecoin-first architecture, Plasma positions itself as the “default transport layer” for stablecoins, rather than trying to compete with Ethereum, Solana, or Tron across all verticals.

What Is Plasma One and How Does It Expand Use Cases?

Plasma (XPL) goes beyond blockchain infrastructure with Plasma One, a neobank app designed to make stablecoins usable in everyday life.

What Is the Plasma One Neobank App?

Plasma One is an all-in-one neobank app, combining a crypto wallet + payment card + banking features.

- Cashback: earn up to 4% cashback when spending with Plasma One card.

- Yield: earn 10%+ APY on stablecoin deposits directly in-app.

- Global Payments: seamless transfers and payments powered by stablecoins.

The Plasma One neobank app bridges the gap between blockchain and real-world usage, making stablecoins act as true digital cash.

How Does Plasma One Support Real-World Payments?

- Integrated across 150+ countries and accepted by 150M+ merchants.

- Enables USDT and other stablecoins to be spent like cash.

- Powers cross-border remittances and financial inclusion at scale.

- Backed by Plasma’s core infrastructure: cross-chain liquidity, Paymaster, and on/off-ramps.

What Are Plasma’s Strengths and Challenges?

Plasma combines innovation with real adoption potential, but faces important challenges.

Main Strengths of Plasma (XPL)

- Gasless USDT transfers make it extremely user-friendly.

- Sub-second finality + 1,000+ TPS suitable for micro-payments.

- EVM compatible, supporting Solidity contracts and wallets (e.g., MetaMask).

- Bitcoin bridge (pBTC) brings BTC liquidity into Plasma’s DeFi.

- Privacy roadmap for confidential stablecoin payments.

- Strong backers: supported by Tether, Bitfinex, and Founders Fund (Peter Thiel).

Challenges of Plasm (XPL)

- Ecosystem is still early with limited apps and adoption loops.

- Token unlock pressure may weigh on XPL price in the first year.

- Paymaster reliability needs to prove scalability in production.

- Cross-chain bridge risks, a historically hack-prone area.

- Regulatory uncertainty around stablecoins remains a key concern.

- Intense competition from Solana, Tron, Base, and Ethereum L2s.

Plasma shows breakthrough advantages, but its long-term success depends on ecosystem growth, adoption, and regulatory clarity.

Where Can You Buy or Access Plasma (XPL)?

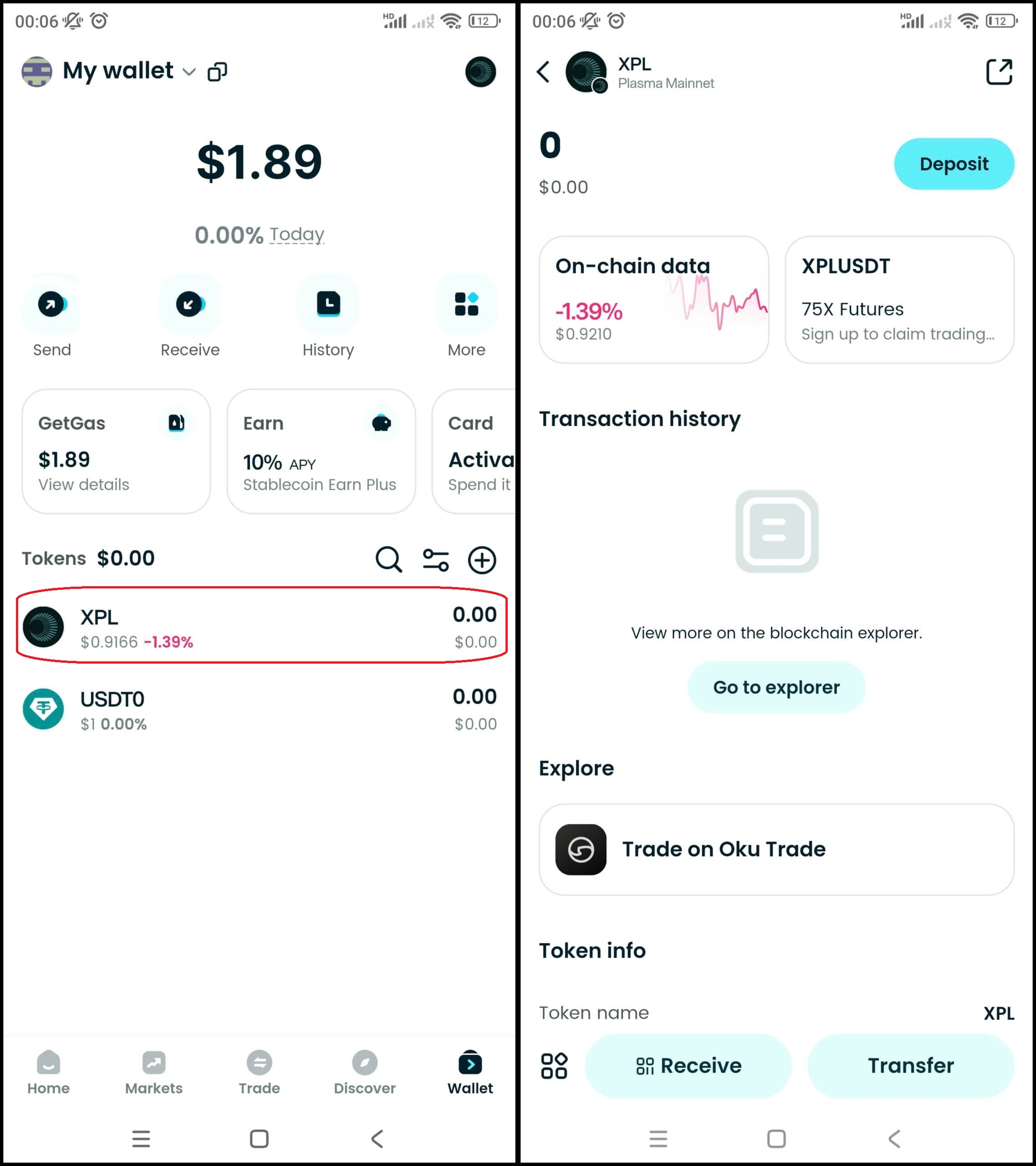

If you want to experience Plasma (XPL) — the Layer 1 blockchain purpose-built for stablecoin payments — you have several options. However, the fastest and most convenient path right now is Bitget Wallet, where everything is integrated in one app.

Bitget Wallet — the simplest and most optimized gateway

Bitget Wallet was the official partner at Plasma’s mainnet launch (Sept 25, 2025) and has supported native Plasma integration from day one. It is the safest, most convenient, and most direct option to buy, bridge, and use $XPL or USDT on Plasma.

Key features with Plasma in Bitget Wallet:

- ✅ Native Plasma Support – Add Plasma network in one step, send/receive $XPL instantly.

- 💰 One-Click Cross-Chain USDT – Bridge USDT from Ethereum, BNB Chain, Base, Tron… into Plasma seamlessly within the app.

- 🔗 Integrated DeFi Hub – Access Aave, Veda, and other protocols to stake USDT, farm, and earn stable yields.

- ⚡ Gasless USDT Transfers – Enjoy nearly zero-fee stablecoin payments thanks to Plasma’s native mechanism.

- 🌍 Stablecoin Infrastructure – Roadmap includes card issuance, compliance-ready rails, and global on/off-ramps for real-world payments.

With over 80M users worldwide, support for 130+ blockchains, and a $300M User Protection Fund, Bitget Wallet combines high security with user-friendly UX. More importantly, it embodies the Crypto for Everyone vision — bringing stablecoin adoption to 1 billion people.

Other available channels

Besides Bitget Wallet, you can also access Plasma (XPL) through:

- Bitfinex – Buy XPL directly with fiat (USD) or crypto (USDT), then withdraw to a personal wallet (Bitget Wallet, OneKey) to stake or use on Plasma.

- Cross-chain Bridges & DEXs – Use deBridge or LayerZero (upcoming) to move USDT into Plasma and swap within native DEXs.

- Advanced DeFi – Plasma supports pBTC (Bitcoin bridge), enabling BTC as collateral or for DeFi trading, plus broader liquidity protocols like Aave and Veda.

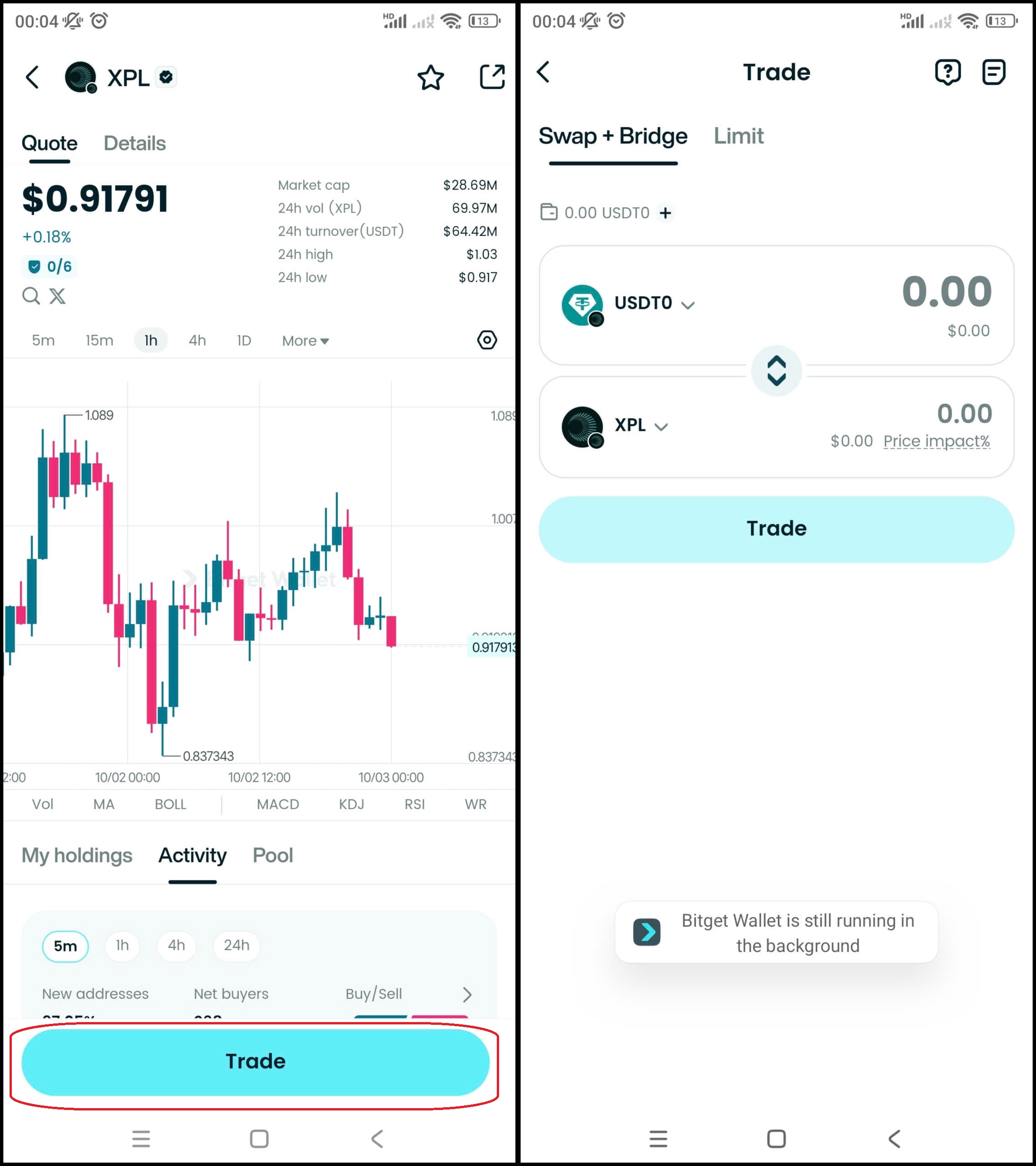

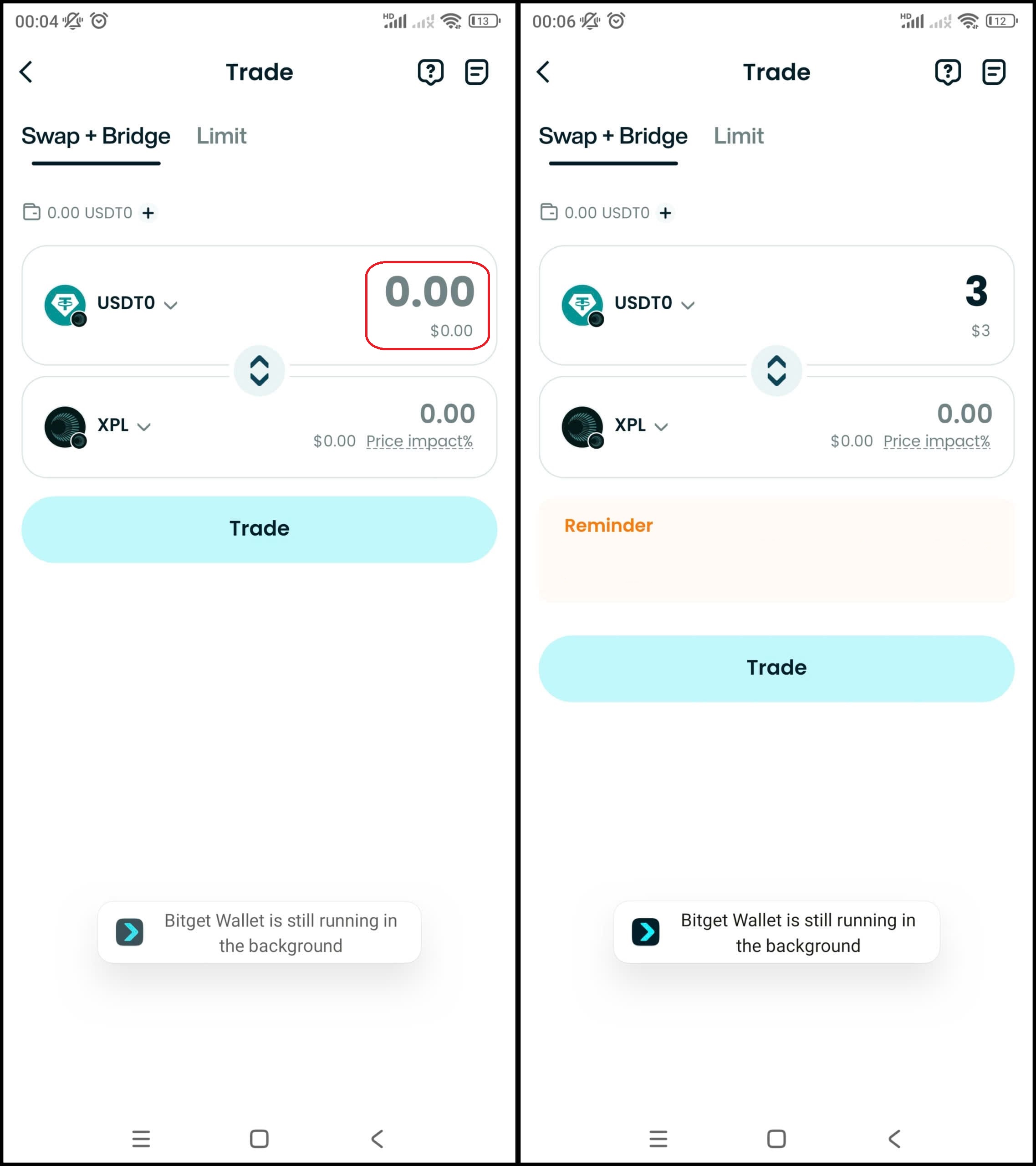

How to Buy Plasma (XPL) on Bitget Wallet?

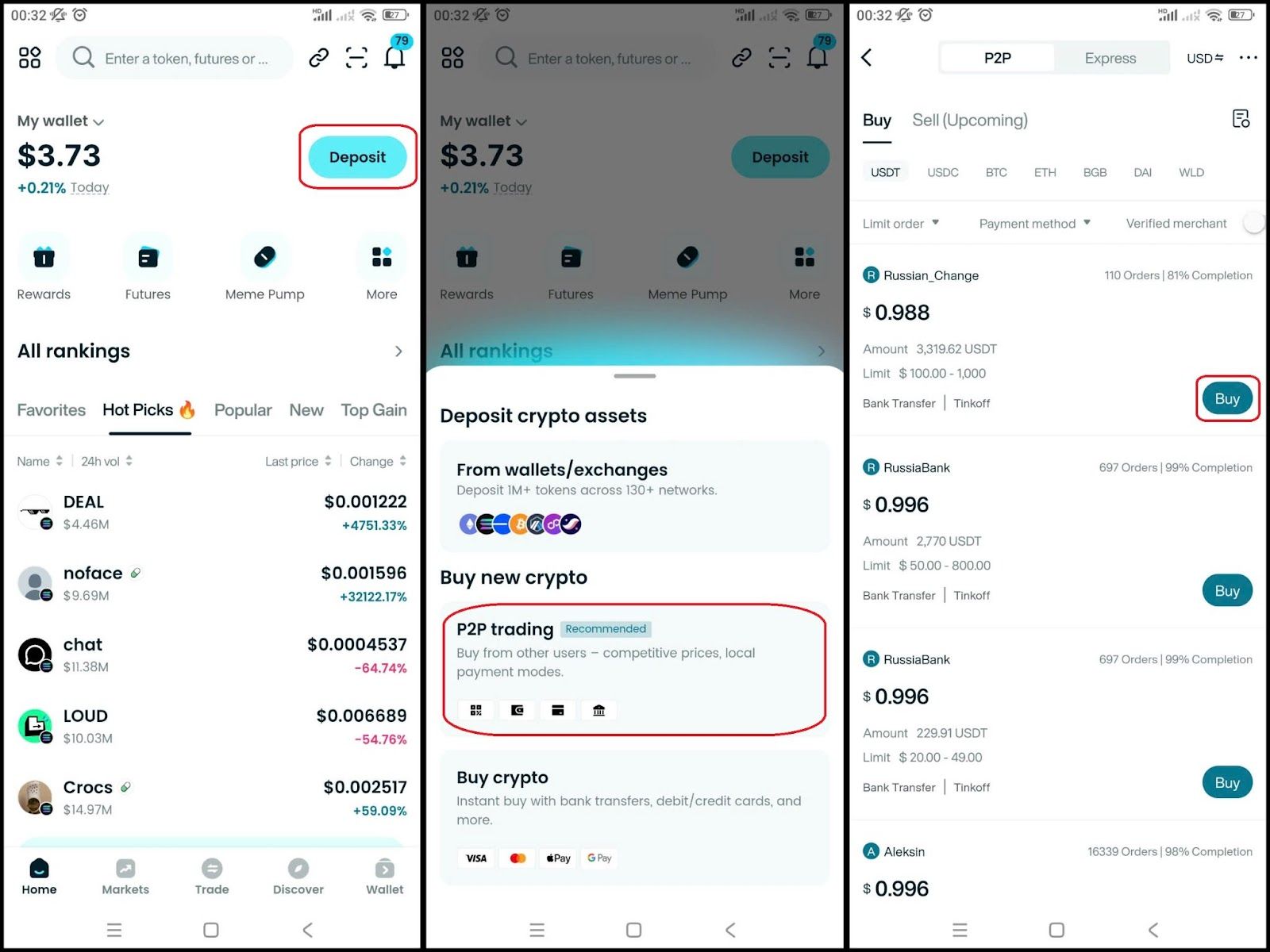

Buying Plasma (XPL) on Bitget Wallet is easy! Just follow these simple steps:

Step 1: Create a wallet

- If you don't have a wallet, download Bitget Wallet app now.

- Register with your phone number or email, verify quickly and you can use it right away.

Step 2: Deposit money into your wallet

Once you have finished your wallet, you just need to deposit money into it. You can:

- Transfer coins from other wallets: Send BTC, ETH or any coin you have from an external wallet.

- Buy directly with a card: Use a bank card or credit card to buy USDT or ETH right in the app and then exchange it for USDC.

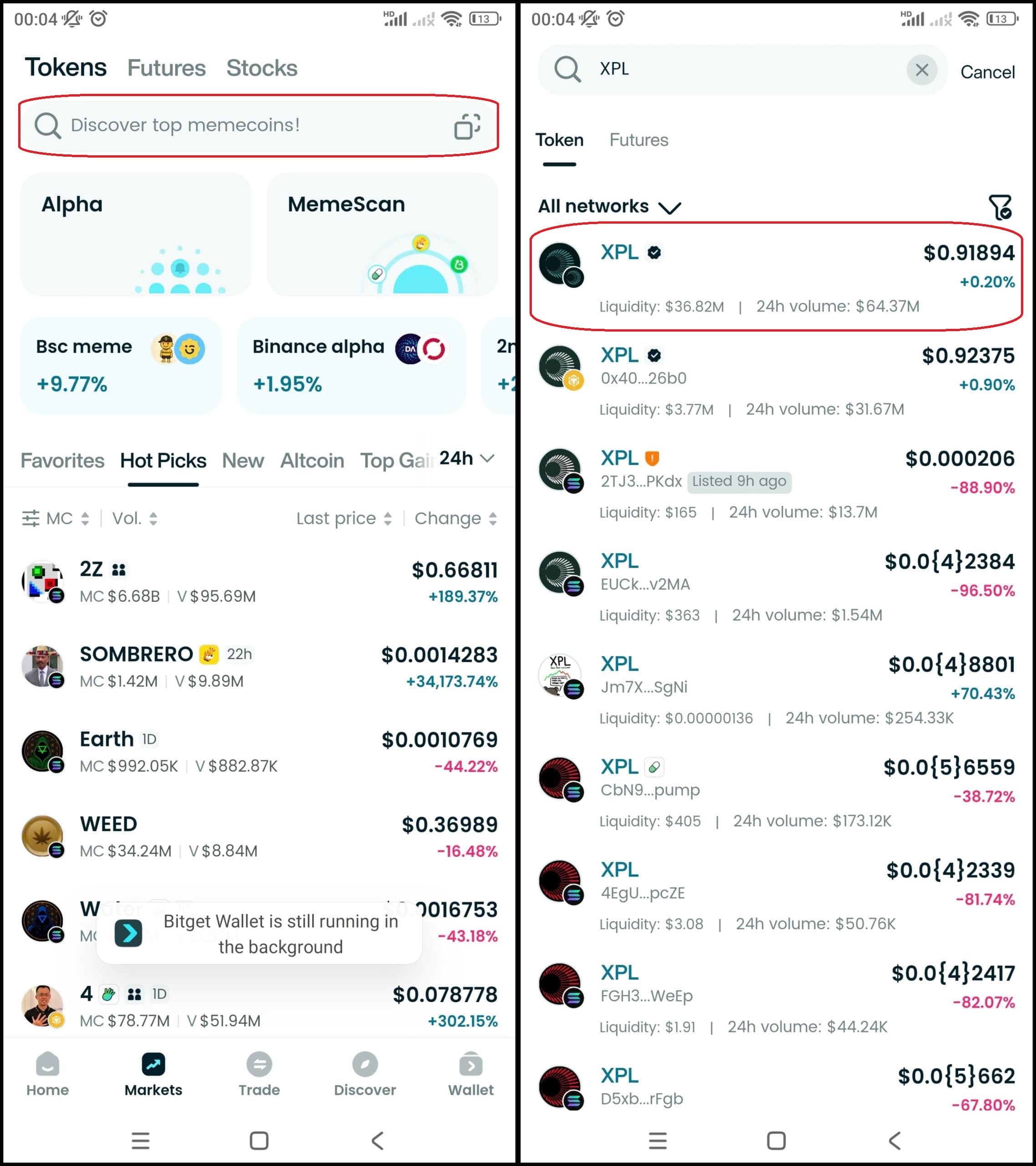

Step 3: Find Plasma (XPL)

- In the main interface of the wallet, go to Market, type "XPL" in the search bar.

- Select Plasma (XPL) to see the trading page.

Step 4: Select the trading pair

Select the pair you want to trade, for example XPL/USDT. So you can use USDT to buy Plasma (XPL), or vice versa.

Step 5: Place an order

Enter the amount of Plasma (XPL) you want to buy, check carefully and confirm the order.

Step 6: Check the order

After buying, you can check your XPL in the Wallet section.

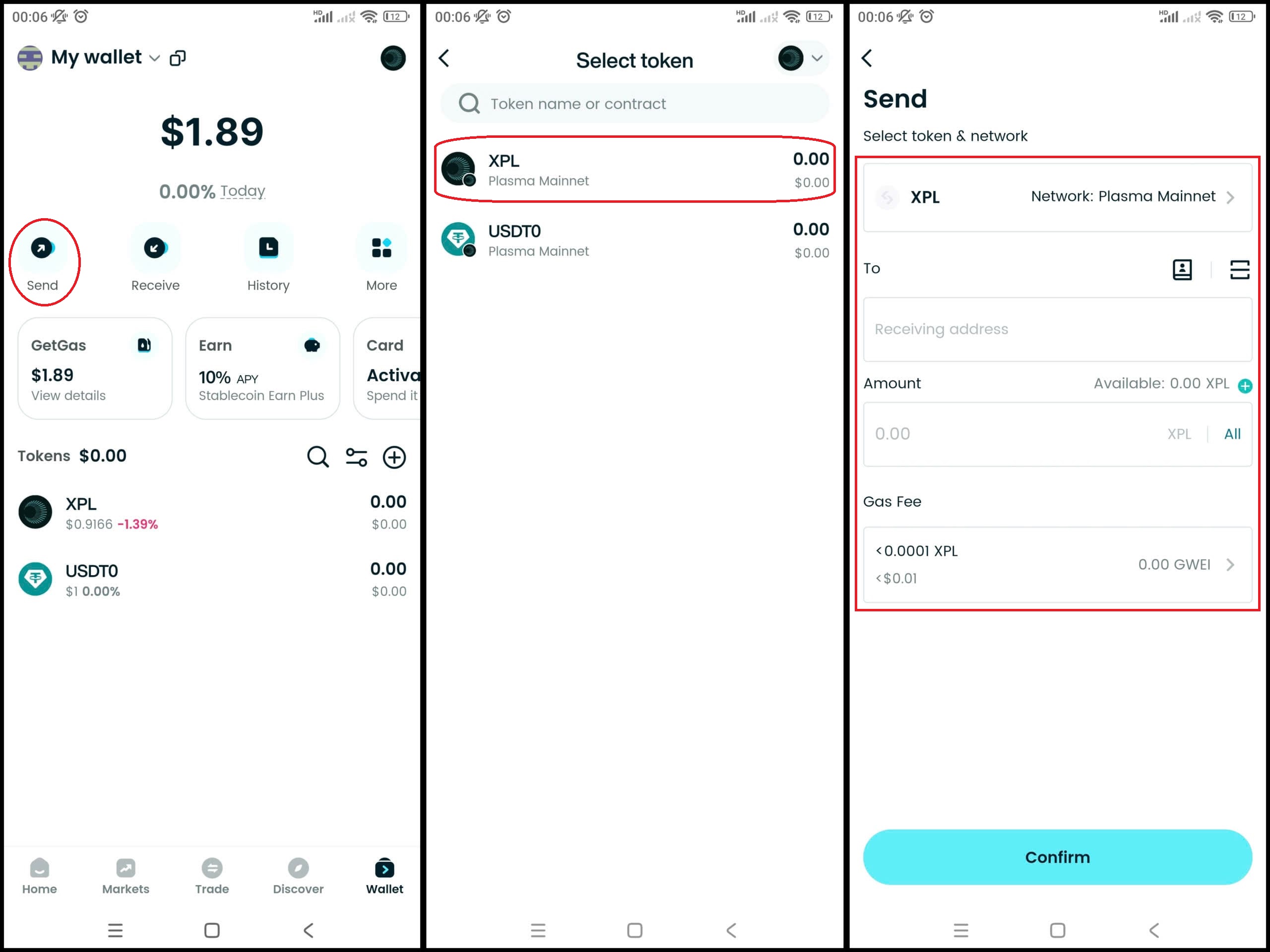

Step 7: Withdraw (if needed)

Once you have Plasma (XPL), if you want to withdraw to another wallet, go to Withdraw, fill in the receiving wallet address, check the blockchain network and the amount carefully, then confirm.

▶Learn more about Plasma (XPL):

- What is Plasma (XPL)?

- Plasma (XPL) Airdrop Guide

- Plasma (XPL) Listing Date and How to Buy It

- What Is Lithos (LITH): Plasma DeFi Protocol With Community Revenue Sharing and Long-Term Price Forecast

- MetaMask vs Bitget Wallet: Which Is Better in 2025?

- Trust Wallet vs Bitget Wallet: Which One Is Better in 2025?

- Phantom vs Bitget Wallet: Which One Is Better?

Conclusion

Plasma (XPL) is proving that a blockchain purpose-built for stablecoins can truly break down the barriers preventing digital money from reaching the masses. Instead of requiring users to hold a complex token for fees, Plasma enables gasless USDT transfers from day one. Its architecture is designed to process transactions with high speed and near-instant finality. Together with a Bitcoin bridge and secure payment solutions, Plasma is expanding the frontiers of stablecoin adoption. The distribution model of the XPL token is carefully balanced to incentivize staking and governance participation while ensuring long-term ecosystem growth. Its early success, marked by massive stablecoin inflows and strong price momentum, stands as clear evidence of the market’s confidence in Plasma.

To experience this seamlessly, Bitget Wallet—Plasma’s official partner—is the key. With just a few simple steps to connect to the Plasma Mainnet, you can instantly transfer USDT, stake for yields, and explore the world of cross-chain DeFi securely. Bitget Wallet is the crucial link that transforms Plasma from an infrastructure blockchain into a true global stablecoin ecosystem.

👉 Download Bitget Wallet to manage stablecoins like USDT on Plasma, stake to earn rewards, and unlock the gateway into cross-chain DeFi. With Bitget Wallet, you don’t just have a crypto wallet—you gain a stablecoin vault, a memecoin trading hub, and a cross-chain gateway, giving you access to over 1 billion future Web3 users.

Sign up Bitget Wallet now - grab your $2 bonus!

FAQs

1. What is Plasma (XPL) used for?

Plasma (XPL) is used for stablecoin payments, governance, staking, and DeFi interactions, with optional gas paid in USDT.

2. Is Plasma good for stablecoins?

Yes, Plasma is purpose-built for stablecoin infrastructure, offering gasless USDT transfers, sub-second finality, and seamless adoption.

3. How do I bridge USDT to Plasma?

You can bridge USDT to Plasma via Bitget Wallet one-click cross-chain bridge, powered by protocols like deBridge and soon LayerZero.

4. What is Plasma’s launch liquidity?

Plasma launched on September 25, 2025 with $2B stablecoin inflows, $2.4B circulating market cap, and strong trading demand.

5. Does Bitget Wallet support Plasma?

Yes, Bitget Wallet natively integrates Plasma mainnet, enabling users to send/receive $XPL, stake USDT, and access DeFi yield products.

Risk Disclosure

Please be aware that cryptocurrency trading involves high market risk. Bitget Wallet is not responsible for any trading losses incurred. Always perform your own research and trade responsibly.