What is USDH: Hyperliquid Stablecoin Explained with Benefits and Yield Sharing

What is USDH and why is it important? USDH is Hyperliquid’s native fiat-pegged stablecoin, created to capture yield revenue for the Hyperliquid ecosystem while reducing reliance on external stablecoins. Hyperliquid currently dominates ~70% of the DeFi perpetuals market, with monthly derivatives volumes approaching US$400 billion and revenues over US$100 million.

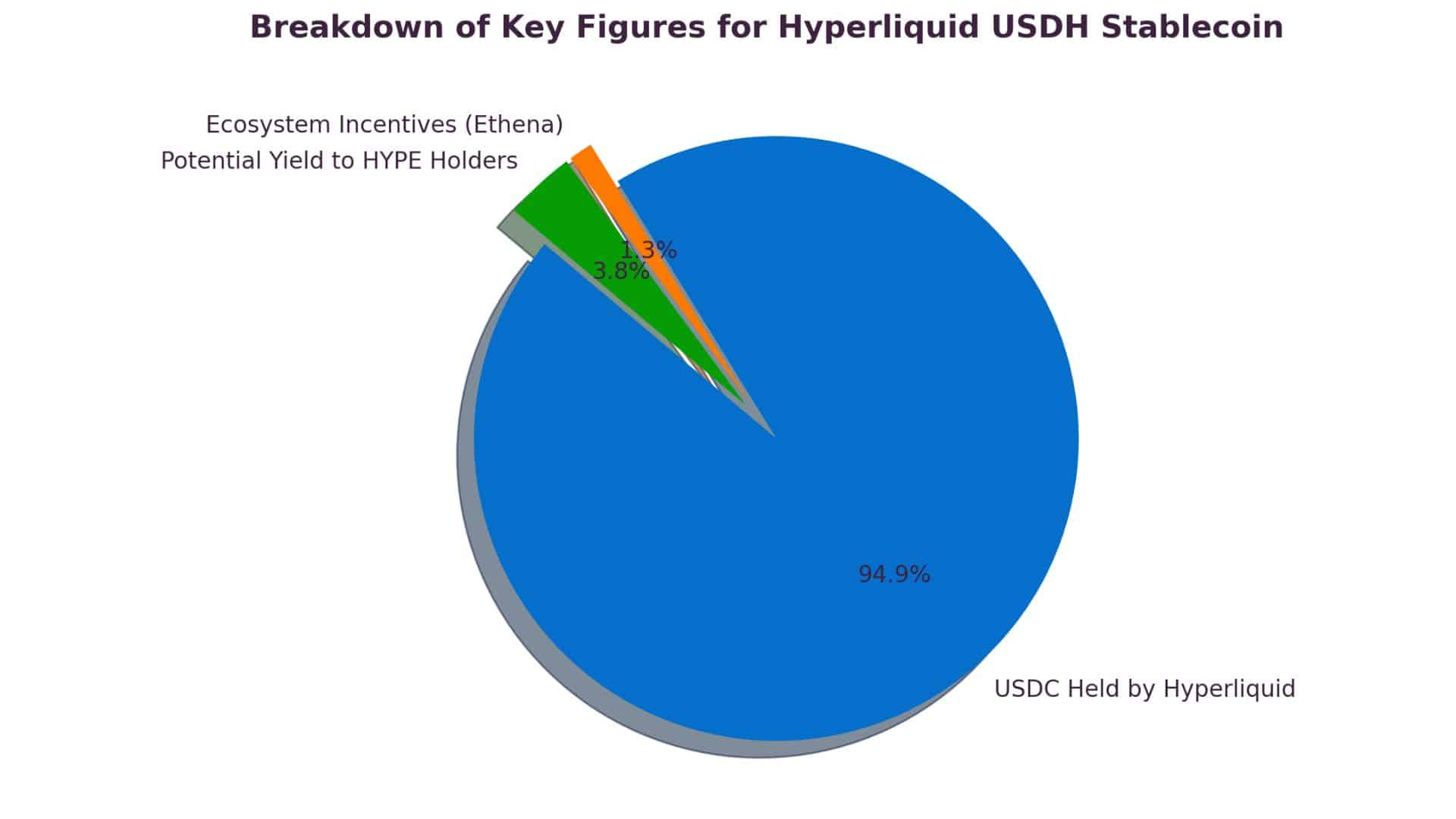

Much of Hyperliquid’s liquidity—estimated at US$5.6 billion—is held in stablecoins, 95% of which is USDC issued by Circle. This dependency causes value leakage (yield going to USDC issuer), censorship & risk exposure, and bridge/security concerns. USDH was introduced to solve these.

On September 15, 2025, Native Markets won the validator vote to become the issuer of USDH. For users seeking secure storage and seamless management of USDH and other stablecoins, Bitget Wallet offers a trusted solution within the evolving DeFi landscape.

This article walks you through how USDH works, the selection & governance, comparison with other stablecoins, its risks, and what it means for Hyperliquid and DeFi.

What is USDH and Why Did Hyperliquid Create It?

USDH is Hyperliquid’s planned stablecoin, designed as a Hyperliquid-first, Hyperliquid-aligned, fiat-collateralized stablecoin. The project was open to proposals—several established issuers competed to build and manage it.

What Problem Does USDH Solve for Hyperliquid?

USDH was born to fix several challenges:

- Revenue leakage: With over $5.6 billion in deposits, Hyperliquid currently leans on USDC. The yield from those reserves — U.S. Treasuries and cash — flows back to Circle, not Hyperliquid. A Hyperliquid stablecoin like USDH ensures that part of this income stays within the ecosystem.

- Censorship and sovereignty: Relying on Circle’s USDC exposes traders to centralized risks, including freezing or blacklisting. Hyperliquid USDH gives the platform more control.

- Bridge dependence: Using wrapped tokens across chains introduces extra risk. USDH, built directly into Hyperliquid and its HyperEVM, reduces reliance on external bridges.

How Does USDH Support Hyperliquid’s Ecosystem Growth?

USDH isn’t just a defensive move; it’s an engine for expansion:

- Yield sharing for the community: Unlike USDC, where all returns go to Circle, USDH revenue sharing sends value back into the ecosystem. Validators and token holders benefit via HYPE buybacks and growth funds.

- Native liquidity: By making USDH the default stablecoin on HyperEVM, traders get deeper liquidity, tighter spreads, and easier margin collateral.

- Validator alignment: Validators voted to approve Native Markets USDH as the official issuer, choosing alignment over short-term profit. This governance model reinforces community trust.

- DeFi expansion: With USDH as a building block, developers can integrate stable liquidity into new Hyperliquid DeFi apps, from lending markets to trading pairs.

How Was USDH’s Issuer Selected?

When people first ask “What is USDH?”, the answer usually starts with its unique origin story. The USDH token wasn’t just launched by one company out of the blue — it was the result of a community-driven governance process inside Hyperliquid. The goal was to make sure the new Hyperliquid stablecoin would be built and managed by the team that best aligned with the ecosystem, not simply the one promising the biggest revenue share.

What Was the Validator Vote Process for USDH?

The vote to decide who would issue USDH took place between September 11 and 15, 2025. It wasn’t a casual poll, it was an on-chain, stake-weighted vote where Hyperliquid validators used their HYPE tokens to signal their choice.

This process gave real weight to the validator community. Instead of private deals behind the scenes, everything happened transparently, and even prediction markets like Polymarket tracked the odds in real time. By the end of the week, it was clear which way the ecosystem was leaning.

Which Teams Competed to Issue USDH?

Several big names in the stablecoin world wanted the chance to issue the USDH token:

- Paxos – Known for its compliance-first approach, Paxos put forward a plan with strong regulatory backing and generous revenue sharing.

- Ethena – Initially a strong contender, but eventually pulled out of the race and publicly backed Native Markets.

- Frax – Proposed tying USDH closely to its own frxUSD, offering a 1:1 model with high yield return.

- Sky (formerly MakerDAO’s USDS issuer) – Offered a multichain approach with a smaller yield share.

- Agora and BitGo – Also submitted proposals, adding to the competitive landscape.

It was a crowded field, with most competitors trying to win votes by promising 95–100% of reserve yield back to the ecosystem.

Why Did Native Markets Win Despite Lower Revenue Sharing?

In the end, Native Markets secured the mandate to issue USDH. Interestingly, they offered only a 50/50 split of reserve yield — far less than what others had on the table. So why did they win?

- Ecosystem alignment – Native Markets is deeply connected with Hyperliquid’s core team, which gave validators confidence that the USDH token would be managed with the platform’s long-term health in mind.

- Community trust – Validators valued insider knowledge and execution over short-term incentives. Trust outweighed the lure of maximum yield.

- Prediction market confidence – On Polymarket, Native Markets USDH was favored by more than 90% of traders, showing strong consensus before the final vote.

- Regulatory readiness – Their proposal included fiat reserves, tokenized treasuries, and partnerships with custodians like BlackRock and Superstate, offering a safer, more sustainable model for a Hyperliquid stablecoin.

This outcome showed that the community didn’t just want quick profits — they wanted a stablecoin issuer aligned with Hyperliquid’s vision.

Source: C98

How Does USDH Work in Practice?

Now that you understand What is USDH and why Hyperliquid created it, let’s dive into how the USDH token is meant to function in real life—how people mint and redeem it, the rollout plan, and how it plugs into HyperEVM and DeFi apps.

How Are USDH Tokens Minted and Redeemed?

- USDH is built using Stripe’s Bridge platform, which handles fiat on-ramps and off-ramps. That means when someone puts in real dollars, the system mints USDH to match, and when someone redeems USDH, it converts back to dollars. This makes USDH redeemable 1:1 with cash and U.S. Treasuries.

- The reserves backing USDH are split between off-chain institutions (initially managed by BlackRock) and on-chain components (handled by Superstate) via the Stripe-owned Bridge. That dual system is intended to balance institutional security with blockchain transparency.

- For example: during the testing phase, minting or redeeming will be capped (around USD $800 per transaction) to ensure everything works correctly before scaling up.

What Is the Phased Rollout Plan for USDH?

Because USDH is a Hyperliquid stablecoin and carries a lot of expectations, the launch is being done in stages to safeguard users and the network.

- Phase 1 – Testing with caps: A smaller group of users will be able to mint/redeem up to about $800 per transaction. This helps check for bugs, peg stability, infrastructure performance, and makes sure the USDH token’s minting and burning logic works without stress.

- Phase 2 – Spot trading pair: Once testing is stable, USDH/USDC spot trading pair opens. This means people can trade USDH against USDC. It improves liquidity and gives people more options within Hyperliquid’s markets.

- Phase 3 – Full availability: After successful testing and spot trading, USDH mints/redeems without caps. At this point, USDH becomes fully usable in more parts of the ecosystem, plugged into various DeFi apps, and available at scale.

How Will USDH Integrate With HyperEVM and DeFi Apps?

The USDH token is designed to be more than just another stablecoin; it's meant to be the native stablecoin inside Hyperliquid, especially via its HyperEVM network.

- USDH will be issued natively on HyperEVM, which means lower friction for users—faster transactions, lower fees, and reduced dependence on bridging external stablecoins.

- It will serve as collateral for margin and settlement in trading (both perpetual futures and spot markets). In short, many “core plumbing” uses in Hyperliquid will lean on USDH.

- As the USDH token is adopted, more DeFi applications built on HyperEVM should integrate itliquidity pools, lending, yield farms, other apps will be able to leverage USDH’s stability and native backing. That means the value stays more in the Hyperliquid stablecoin ecosystem instead of leaking out to external issuers.

Source: Hyper EVM

How Does USDH Compare With Other Stablecoins?

Below is a grand comparison table that helps answer the question “What is USDH” by showing where the USDH token stands among other major stablecoins like USDC, USDT, DAI, Frax, Sky, and Ethena. It highlights issuers, collateral backing, yield distribution, transparency, adoption, and risks, so you can see how the Hyperliquid stablecoin differs from existing players.

| Feature / Question | USDH (Native Markets) | USDC (Circle) | USDT (Tether) | DAI (MakerDAO) | FRAX (frxUSD / Frax) | Sky | Ethena |

| What is it / Issuer | What is USDH? It is the Hyperliquid-native stablecoin, issued by Native Markets after winning the validator vote. | Circle — centralized issuer of USD Coin. | Tether Ltd. — issuer of the largest stablecoin by market cap. | MakerDAO — decentralized protocol issuing DAI. | Frax protocol — hybrid, algorithmic + collateralized model. | Sky — proposed ecosystem-backed stablecoin, rebranded from MakerDAO team. | Ethena — synthetic model with unique incentive structures. |

| Backing / Collateral | Fiat + U.S. Treasuries, tokenized via Stripe’s Bridge; managed with BlackRock (off-chain) & Superstate (on-chain). | Cash + cash-equivalents / T-bills; managed in Circle Reserve Fund. | Mixed: cash, loans, other assets; often criticized for opacity. | Over-collateralized crypto assets (ETH, stETH, etc.). | Hybrid: TradFi assets + DeFi mechanisms; custodians + tokenization. | Proposed $8B balance sheet with 4.85% yield. | Synthetic mechanics + protocol-driven collateral model. |

| Revenue / Yield Sharing | 50% of reserve yield → HYPE buybacks & ecosystem fund (a unique USDH stablecoin model). | None — Circle captures all reserve yield. | None — Tether retains all yield. | Fees flow to MakerDAO governance treasury. | Long-term revenue alignment & protocol fee switches. | Sky bid included 4.85% direct yield to holders. | Revenue-sharing and incentive pools proposed. |

| Transparency & Audits | Institutional custodians + on-chain proofs via Superstate; early stage, yet to prove reporting track record. | Daily attestations & public reserve reporting. | Scrutinized for lack of clear audits in the past. | Fully transparent on-chain, smart contract-based. | Variable — depends on custodians & governance. | Public balance sheet disclosures in proposal. | Docs outline incentive and collateral models, but early. |

| Adoption / Liquidity (today) | New — staged rollout, liquidity starting on Hyperliquid. | Widely used in DeFi & CeFi; deep global liquidity. | Most traded by volume; dominant but contested transparency. | Strong in Ethereum DeFi, over-collateralized use case. | Niche integrations, growing adoption. | Not yet a standalone issuance; bid team in USDH race. | Specialized, smaller adoption footprint. |

| Best fits for | Hyperliquid settlement, margin collateral, validator-aligned yield sharing. | General cross-chain usage, payments, and liquidity. | High-volume trading and global exchange rails. | DeFi users seeking transparent, on-chain collateralization. | Users who want both TradFi exposure and DeFi features. | Ecosystem revenue contributors seeking regulated setup. | Projects that prefer synthetic incentives. |

| Major risks | Execution risk, reliance on custodians/bridges, must build trust vs USDC dominance. | Regulatory scrutiny & centralization risks. | Transparency & reserve composition concerns. | Collateral volatility & smart contract risk. |

Read more: USDC vs USDT: What’s the Difference? Investor’s Guide for 2025

How Does USDH Differ From USDC?

When exploring what is USDH compared to established stablecoins like USDC, there are a few key differences worth noting:

- Issuer: USDH is issued by Native Markets, while USDC comes from Circle, a long-standing player in the stablecoin market.

- Yield: With USDH, up to 50% of the ecosystem yield is shared back with holders, whereas USDC directs 100% of the yield to the issuer.

- Adoption Risk: USDH is still relatively new and growing, while USDC already enjoys widespread adoption and regulatory recognition.

These contrasts highlight how USDH is designed to redistribute value back to users, offering an alternative model in the stablecoin landscape.

How Does USDH Stack Against Frax, Sky, and Ethena?

To better understand what is USDH and how it compares with other innovative stablecoins, it’s helpful to look at its position against Frax, Sky, and Ethena:

- Revenue-Sharing Promises: Unlike many competitors, USDH emphasizes returning ecosystem revenue to users, creating a more community-aligned incentive model.

- Synthetic vs Fiat-Collateralized Models: Projects like Ethena lean on synthetic strategies, while Frax and Sky experiment with mixed models. By contrast, USDH maintains a clear fiat-collateralized structure combined with its unique yield distribution.

This approach positions USDH as a hybrid alternative in the stablecoin ecosystem—bridging trust, collateralization, and user incentives.

Read more What is Tether USDT: A Complete Guide to the World’s Leading Stablecoin

What Are the Risks and Challenges of USDH?

When exploring what USDH is and its potential role in the stablecoin ecosystem, it’s equally important to weigh its risks and challenges. While the project introduces innovative yield-sharing and ecosystem incentives, several uncertainties remain.

What Are the Centralization Risks of USDH?

Although many ask what is USDH in terms of decentralization, the reality is that some aspects remain centralized:

- Reliance on Stripe’s Bridge for fiat tokenization adds an external dependency.

- Custodianship through BlackRock means collateral is managed off-chain by a traditional financial institution, which may limit decentralization benefits.

How Difficult Is It to Migrate Liquidity From USDC to USDH?

Part of understanding what USDH is also involves adoption challenges:

- USDC’s dominance on Hyperliquid, over $5.6B in active liquidity, creates a significant barrier for USDH.

- Even with incentives, shifting liquidity from a trusted, established player like USDC requires overcoming user confidence and network effects.

Source: from coinstats

What Regulatory Risks Could Affect USDH?

For those wondering what USDH is from a compliance perspective, regulatory risks are key:

- USDH’s design includes GENIUS Act compliance via Stripe’s Bridge, which could be both a safeguard and a restriction.

- As U.S. and global regulators tighten stablecoin rules, USDH may face stricter oversight compared to decentralized models like DAI or Frax.

Read more: What is Dai the Stablecoin (DAI)? Complete Guide to MakerDAO’s Decentralized Dollar-Pegged Asset

What Impact Could USDH Have on DeFi and Stablecoin Markets?

As more traders search *what is USDH* and its role in DeFi, the discussion shifts from what USDH is today to what it could become tomorrow. Designed as a Hyperliquid-native stablecoin, USDH is not just another dollar-backed token — it could disrupt existing stablecoin economics and influence how issuers share yield with users.

How Might USDH Affect Circle’s Market Share?

One of the biggest questions in the what is USDH debate is its effect on USDC’s dominance. Estimates suggest Circle could face an annual yield loss of $150–220 million if liquidity flows into USDH.

Circle’s likely defense strategy involves deploying native USDC contracts on Hyperliquid and expanding its Cross-Chain Transfer Protocol (CCTP) to strengthen interoperability.

How Could USDH Influence Stablecoin Issuance Models?

Answering what is USDH also means understanding its unique design:

- Unlike USDC or USDT, where issuers capture 100% of yield, USDH introduces a revenue-sharing model, returning 50% of yield to the ecosystem.

- This shifts stablecoins from being pure financial products into service-like models where issuers must align with validator and community incentives.

- Competing projects like Frax, Sky, and Ethena may feel pressure to adapt similar ecosystem-aligned structures.

What Does USDH Mean for Hyperliquid’s Future?

From a broader perspective, what is USDH ties directly to Hyperliquid’s vision:

- Building a multi-billion-dollar native settlement layer for on-chain trading.

- Creating validator-aligned incentives, where revenue flows back to those securing the chain.

- Establishing a governance precedent for how stablecoin issuers collaborate with ecosystems rather than extract from them.

How Does Yield Sharing Work for USDH?

When people ask what is USDH, one of the core things they want to understand is how its yield sharing model works. Yield sharing isn’t just a side note — it's central to the USDH token and what sets it apart from many stablecoins today.

What Is the Revenue Model of USDH?

- USDH is built so that 50% of reserve yield goes into HYPE token buybacks, helping support the native Hyperliquid ecosystem. The other 50% supports ecosystem growth — that means things like developer grants, liquidity incentives, and platform improvements. This split is part of what makes the USDH stablecoin more aligned with its users and validators.

- The reserves backing USDH are fiat-collateralized, using cash and U.S. Treasuries, tokenized via Stripe’s Bridge. Management is split: some off-chain via BlackRock, some on-chain through a system called Superstate. This ensures there’s both institutional security and blockchain transparency.

How Does USDH’s Yield Sharing Compare to Other Stablecoins?

- Other major stablecoin issuers like Paxos, Frax, and Agora offered 95–100% of reserve yield sharing in their proposals during the USDH race. They were trying to attract validator votes by promising to return almost all the yield. USDH (via Native Markets) offered less in percentage but made up for it in trust, alignment, and native integration.

- Sky’s proposal included a 4.85% direct yield to holders or ecosystem parts, which was generous but came with trade-offs.

- Ethena’s proposal was synthetic/incentive-heavy — using mechanisms beyond purely fiat reserves to create incentives for holders and validators. They too offered high revenue sharing in their bid.

Why Did Validators Choose Alignment Over Higher Yield?

- Validators saw that revenue share alone isn’t everything. When asked what is USDH, many believed ecosystem trust, alignment, and long-term governance mattered more than the highest immediate yield. Native Markets’ team (which includes people already embedded in Hyperliquid) scored high on those dimensions.

- Also, validators weighed proposals based on whether the issuer was “Hyperliquid-first.” That means proposals that promised native integration on HyperEVM, using tools like Stripe Bridge + Superstate, and being committed to transparent reserve management had advantages. USDH’s winning proposal offered that.

- Finally, governance precedent played a big role, validators wanted to send a signal that alignment and protocol values matter. So they preferred Secure, Aligned, Not Just Max-Yield. That formed part of why Native Markets won, even though they didn’t offer the very highest yield share.

How Can You Earn Stablecoin Yields with Bitget Wallet?

If you’re wondering what is USDH and how it might compare to existing stablecoins, one practical way to think about value is yield. With Bitget Wallet, there are clear pathways to earn steady returns on stablecoins, including USDC, with features designed for both new and experienced users.

What Are the Benefits of Bitget Wallet’s Stablecoin Earn?

When exploring stablecoin yield options, Bitget Wallet’s Stablecoin Earn stands out for its mix of high returns and flexibility. Here are the key benefits:

-

✅ Steady returns with transparent APY rates

Bitget Wallet’s Stablecoin Earn Plus offers around 10% APY on USDC, with an early-bird bonus up to 18% in the first week.

-

✅ Real-time APY tracking inside the app

Unlike platforms where you wait days to see interest, Bitget Wallet lets you track yield growth live in the app.

-

✅ Instant withdrawal for flexibility

Funds are redeemable 24/7, giving you control to move or use your stablecoins anytime without lock-ups.

-

✅ Low entry requirements

You can start with as little as 1 USDC, making Stablecoin Earn beginner-friendly and accessible to all users.

This combination of competitive yields, transparency, and flexibility positions Bitget Wallet as a top choice for stablecoin earning strategies.

Which Stablecoins Are Supported?

If you’re wondering which stablecoins are supported on Bitget Wallet, the platform currently provides a strong mix of leading options. Each stablecoin comes with attractive APY rates, giving both beginners and experienced users the ability to earn steady passive income:

- USDT (Tether) – One of the most widely used stablecoins in crypto, USDT on Bitget Wallet offers up to 10% APY, making it an accessible choice for users who want stability and liquidity.

- USDC (USD Coin) – Backed by Circle and widely recognized in global markets, USDC also earns up to 10% APY. This option is often preferred by traders looking for transparency and regulatory oversight.

- DAI – A decentralized stablecoin built on Ethereum, DAI allows users to earn up to 10% APY while supporting a trustless ecosystem.

- SyrupUSDC – A promotional stablecoin offer available exclusively on Bitget Wallet, with yields reaching up to 13% APY, perfect for users seeking higher short-term returns.

By supporting a mix of centralized stablecoins (USDT, USDC) and decentralized alternatives (DAI), Bitget Wallet gives users the flexibility to diversify their holdings. Combined with promotional options like SyrupUSDC, the platform ensures that everyone—from cautious investors to yield seekers—can find the right fit.

🔗 Start earning with Stablecoin Earn on Bitget Wallet today

Why Choose Bitget Wallet?

When it comes to earning yields on stablecoins, many users ask: why choose Bitget Wallet over other platforms? The answer lies in its balance of security, flexibility, and ease of use.

- Non-custodial security – Unlike centralized exchanges, Bitget Wallet is non-custodial, meaning you keep full control of your private keys and assets at all times.

- Cross-chain support – Manage and earn on stablecoins like USDT, USDC, and DAI across multiple blockchains, without juggling separate wallets.

- Beginner-friendly interface – Even if you’re new to DeFi, Bitget Wallet makes it simple to start earning with just a few taps—no complex staking or manual yield farming required.

Choosing Bitget Wallet means combining safety, convenience, and competitive stablecoin yields in one platform designed for both new and experienced crypto users.

Conclusion

*What is USDH represents more than a stablecoin, it is Hyperliquid’s step toward financial independence.* Unlike traditional stablecoins such as USDC, USDH is designed with validator alignment at its core, aiming to reduce reliance on centralized issuers like Circle. This move not only strengthens Hyperliquid’s ecosystem but also sets a precedent for how native assets can support network stability.

With issuance managed by Native Markets and backed by validator approval, USDH introduces a new kind of trust model in DeFi. Its yield-sharing mechanism, splitting reserve returns between HYPE buybacks and an ecosystem growth fund, marks a shift from profit extraction toward community value. That said, users and investors must weigh potential risks, including centralization pressures, liquidity migration, and evolving regulatory landscapes.

If adoption grows, USDH could influence how stablecoins are designed and distributed, reshaping incentives in DeFi. Instead of value flowing solely to issuers, USDH demonstrates how stablecoins can redistribute yield to strengthen ecosystems.

For those interested in exploring this new model, tools like Bitget Wallet make it easy to securely store USDH, manage stablecoins across chains, and access DeFi opportunities.

👉 Download Bitget Wallet today to explore USDH securely, manage your assets seamlessly, and start experiencing the next phase of decentralized finance.

Sign up Bitget Wallet now - grab your $2 bonus!

FAQs

What is USDH?

USDH is a new stablecoin issued on Hyperliquid by Native Markets. Unlike USDC, it shares yield with the ecosystem and validators, making it a community-aligned stablecoin.

Who issues USDH and how is it backed?

USDH is issued by Native Markets with validator approval. Its reserves are managed through the Stripe Bridge and held by institutions like BlackRock and Superstate.

How can I mint or redeem USDH?

Users can mint USDH by depositing USDC into the Hyperliquid ecosystem. Redemption works in reverse, allowing holders to convert USDH back to USDC at par value.

Is USDH safer than USDC?

Not necessarily. While USDH reduces reliance on Circle, it still depends on centralized custodians for reserves. Safety depends on adoption, governance, and regulatory clarity.

Where can I trade USDH?

USDH can be traded natively on Hyperliquid. Support from other DeFi protocols and exchanges is expected to grow as adoption increases.

What risks should I watch for when using USDH?

Key risks include centralization (custodial reliance), liquidity migration challenges from USDC, and potential regulatory changes around stablecoins.

Risk Disclosure

Please be aware that cryptocurrency trading involves high market risk. Bitget Wallet is not responsible for any trading losses incurred. Always perform your own research and trade responsibly.