What is Tether USDT: A Complete Guide to the World’s Leading Stablecoin

What is Tether USDT the stablecoin? This question has become increasingly important as USDT has grown into the world's largest stablecoin with over $157 billion in circulation. Tether USDT is a dollar-pegged cryptocurrency designed to maintain stable value by holding equivalent reserves in U.S. Treasury securities and other high-quality assets.

Unlike volatile cryptocurrencies such as Bitcoin or Ethereum, USDT provides price stability that makes it ideal for trading, payments, and storing value during market turbulence. With $75+ billion in daily trading volume and acceptance by over 27,000 merchants globally, USDT has become the backbone of cryptocurrency infrastructure.

This complete guide explores how Tether works, its backing mechanisms, investment benefits, and buying strategies. Beginners can securely store and trade USDT through Bitget Wallet, which offers seamless multi-chain support and beginner-friendly features for stablecoin management.

What is Tether USDT The Stablecoin?

Tether USDT represents a pegged cryptocurrency that maintains its value by holding equivalent reserves in traditional assets. This USDT stablecoin operates as a blockchain dollar designed to eliminate price volatility commonly found in other digital currencies.

Understanding how does Tether work requires examining its core operational features below:

-

Company Origins:

Tether Limited created USDT in 2014, establishing the framework for issuing new tokens when users deposit equivalent USD amounts. They can redeem USDT for fiat in a reverse process, where the tokens are burned and fiat is returned.

-

Multi-Chain Presence:

USDT operates across various blockchains, including Ethereum (ERC-20), Tron (TRC-20), Solana, and more. This trait enables fast transfers and broad compatibility for global users.

-

Stability Mechanism:

Each Tether stablecoin maintains its one-dollar value via reserve backing, with Tether Limited possessing comparable assets (primarily USD, cash equivalents, short-term securities, etc.) to uphold the 1-to-1 peg ratio.

USDT prevents the huge price swings that hit most digital assets. This creates a dependable method for buying and storing value in a stable token that stays at 1 USD. These traits render USDT as a medium for low-volatility transactions across crypto markets and DeFi platforms worldwide.

Read more: What is Stablecoin? A Beginner’s Guide to Price-Stable Cryptocurrencies

Who Created Tether USDT and What is Its History?

Tether USDT emerged from the collaborative vision of three cryptocurrency pioneers. Brock Pierce, Reeve Collins, and Craig Sellars launched the project as "RealCoin" in July 2014, rebranding to "Tether" by November to better capture its function as a digital tether to traditional currency.

Source: Forbes India

What are USDT's Key Milestones and Partnerships?

Understanding Tether history requires examining its most significant developmental achievements throughout the years.

-

Bitfinex Launch:

First trading began on Bitfinex exchange in 2015, establishing USDT as a legitimate trading pair and liquidity provider.

-

Network Expansion:

USDT evolved from Bitcoin's Omni Layer to support Ethereum, Tron, Solana, and multiple blockchains for enhanced accessibility.

-

Market Dominance:

Surpassing $160 billion market cap in 2025 solidified USDT's position as the world's largest and most trusted stablecoin.

Strategic partnerships have significantly accelerated USDT's global adoption across different sectors and use cases.

| Category | Partnership Details |

| Payment Networks | Integration with Telegram's TON network enables instant messaging payments. Collaboration with Checkout.com and BitPay expands merchant acceptance globally. |

| Financial Institutions | Visa's stablecoin API pilots incorporate USDT into traditional payment systems. Over 27,000 merchants in Latin America and Southeast Asia accept USDT payments. |

| DeFi Platforms | Major protocols like Aave, Compound, and FraxLend accept USDT as collateral, strengthening its utility in decentralized finance ecosystems. |

What are the Controversies and Legal Actions around Tether USDT?

Tether controversy has shaped public perception and regulatory approaches toward stablecoins since its early operational years.

-

Banking Crisis:

Between 2017-2019, Tether token faced banking relationship losses and withdrawal suspensions that raised questions about operational transparency.

-

NY Investigation:

New York Attorney General investigation in 2019 resulted in an $18.5 million settlement requiring regular reserve reporting and operational transparency.

-

CFTC Penalties:

The Commodity Futures Trading Commission imposed $41 million in fines during 2021 for misleading statements about reserve backing practices.

-

Ongoing Scrutiny:

Active court battles feature class-action lawsuits claiming market manipulation plus demands from government agencies for more reserve disclosure .

How Did Tether USDT Evolve Over the Years?

Tether cryptocurrency transformation reflects broader changes in blockchain technology and regulatory expectations for digital asset operators.

-

Blockchain Diversification:

USDT stablecoin expanded from single Bitcoin integration to supporting Ethereum, Tron, Solana, and other major blockchain networks worldwide.

-

Usage Evolution:

Market adoption grew from simple exchange trading utility to encompass global payments, cross-border remittances, and institutional treasury management.

-

Reserve Modernization:

Backing assets evolved from basic USD deposits to include U.S. Treasury bonds and securities, making Tether a significant Treasury holder.

-

Compliance Enhancement:

Transparency initiatives introduced real-time attestation dashboards and increased compliance spending following regulatory settlements and public pressure.

How is Tether USDT Backed and Secured?

Tether USDT maintains its stability through a meticulously structured reserve system that has undergone dramatic transformation since regulatory settlements. As of Q2 2025, Tether holds $127 billion in U.S. Treasury securities, making it the seventh-largest foreign holder of U.S. government debt globally.

Detailed Reserve Composition (Q2 2025 Official Attestation)

| Asset Category | Amount | Percentage of Total Reserves |

| U.S. Treasury Bills | $105.5 billion | 67.2% |

| Reverse Repos & Money Market Funds | $21.3 billion | 13.6% |

| Cash & Bank Deposits | $6.2 billion | 4.0% |

| Corporate Bonds | $3.8 billion | 2.4% |

| Secured Loans | $6.1 billion | 3.9% |

| Bitcoin Holdings | $8.9 billion | 5.7% |

| Gold & Precious Metals | $4.8 billion | 3.1% |

| Other Investments | $0.2 billion | 0.1% |

This reserve structure represents a complete transformation from the problematic composition that triggered regulatory action in 2021. Tether eliminated all commercial paper holdings by late 2022 and now maintains 80-85% of reserves in U.S. Treasury securities and cash equivalents, providing transparency and liquidity.

Independent Verification and Transparency

BDO Global conducts quarterly attestations confirming reserve adequacy, though Tether has never completed a full independent audit since promising one in 2017. The company publishes daily reserve updates and maintains real-time transparency dashboards showing:

- Current circulation across all blockchain networks.

- Reserve composition by asset class.

- Excess reserve buffer calculations.

- Quarterly profit and loss statements.

Blockchain-Level Security Architecture

Multi-chain deployment across 13 blockchain networks provides redundancy and accessibility:

-

Ethereum (ERC-20):

$55.2 billion circulation - highest security through Proof-of-Stake consensus

-

Tron (TRC-20):

$51.6 billion circulation - lowest transaction fees under $0.01

-

BNB Chain:

$1.8 billion circulation - fast settlement for trading applications

-

Solana, Polygon, Avalanche:

Combined $1.4 billion circulation for DeFi integration

Does Tether USDT Always Maintain a 1-to-1 Peg?

While USDT generally maintains its dollar peg through reserve backing and redemption mechanisms, significant market stress can cause temporary deviations. The most notable test occurred during May 2022's crypto market collapse when USDT briefly traded at $0.9584, representing a 4.16% deviation from its target.

This depeg resulted from massive selling pressure as investors fled risky assets, not from reserve inadequacy. Tether processed $7 billion in redemptions during the crisis while honoring every request at full $1.00 value, demonstrating that underlying backing remained intact. The price recovered to $0.995+ within 48 hours as arbitrageurs bought discounted USDT and redeemed it for full dollars.

Why Do Investors Use Tether USDT?

Investors use Tether USDT for many purposes, with three primary applications driving its widespread adoption across global financial markets.

-

Volatility Protection:

USDT stablecoin serves as a digital dollar refuge during market turbulence, allowing traders to preserve capital value without converting back to traditional banking systems.

-

Efficient Transfers:

This digital currency eliminates costly off-ramp fees and banking delays, enabling rapid movement between cryptocurrency investments and stable value storage within minutes.

-

DeFi Integration:

Tether USDT powers decentralized finance applications through lending pools, yield farming, and smart contract operations that generate passive income for holders.

How Does Tether USDT Compare to Other Stablecoins?

USDT dominates by market capitalization, liquidity, and global acceptance, yet faces ongoing transparency questions that distinguish it from competitors in this stablecoin comparison.

| Feature | USDT (Tether) | USDC (USD Coin) | DAI (MakerDAO) |

| Market Cap | $159 billion (largest) | $63 billion (second) | $5.4 billion (smaller) |

| Backing Method | Fiat reserves, Treasuries, gold, Bitcoin | Fully regulated fiat reserves | Crypto-collateralized (ETH, others) |

| Transparency Level | Quarterly attestations with limited detail | Monthly audits, high regulatory compliance | Fully on-chain, always visible |

| Redemption Access | Direct redemption ($100,000 minimum) | Direct redemption ($100 minimum) | Algorithmic redemption through protocol |

| Blockchain Support | Multi-chain (Ethereum, Tron, Solana) | Multi-chain with regulatory focus | Primarily Ethereum-based |

| Primary Use Cases | Global trading, payments, cross-border | Institutional adoption, compliance-focused | DeFi protocols, decentralized applications |

Read more:

- USDC vs USDT: What’s the Difference? Investor’s Guide for 2025

- What is Dai the Stablecoin (DAI)? Complete Guide to MakerDAO’s Decentralized Dollar-Pegged Asset

How to Buy Tether USDT Safely: Step-by-Step Guide for Beginners

Multiple channels enable users to purchase Tether USDT, each offering distinct advantages for different trading preferences and regional requirements.

| Channel | Pros | Cons | Regional Availability |

| Exchanges | High liquidity, advanced trading features, competitive spreads | Custodial control, potential withdrawal restrictions | Global access, varies by local regulations |

| OTC Desks | Large volume trades, negotiated rates, institutional service | High minimums, complex verification process | Limited to major financial centers |

| P2P Platforms | Local payment methods, competitive rates, direct trading | Counterparty risk, longer settlement times | Wide availability, especially in restricted regions |

| Brokerages | Simple interface, instant purchases, card payments | Higher fees, limited trading options | Varies by jurisdiction and payment providers |

What's the Difference between Buying Tether USDT on Bitget Wallet and Bitget Exchange?

Users can purchase Tether USDT directly through the Bitget Wallet application, which offers unique advantages over traditional exchange platforms like Bitget. These superiorities include:

-

Early Access:

Bitget Wallet provides access to trending tokens before they reach major exchanges, enabling users to capture price movements ahead of broader market adoption.

-

Cross-Chain Freedom:

Seamless USDT stablecoin management across multiple blockchains eliminates technical barriers and reduces dependency on centralized exchange infrastructure for cross-chain operations.

-

Enhanced Security:

Non-custodial architecture ensures users maintain complete control over private keys, eliminating risks associated with centralized exchange custody and potential withdrawal restrictions.

-

Long-Term Ownership:

Direct wallet storage provides genuine asset ownership without counterparty risk, offering peace of mind for users planning extended holding periods.

Read more: Differences Between Bitget Wallet and Bitget Exchange: A Guide to Choosing the Right Tool

How to Buy Tether USDT on Bitget Wallet: Step-by-Step Guide

The following guide demonstrates how to use Tether USDT through Bitget Wallet's integrated purchasing system for beginners. Choose Bitget Wallet to access seamless stablecoin trading with multi-chain support and beginner-friendly features.

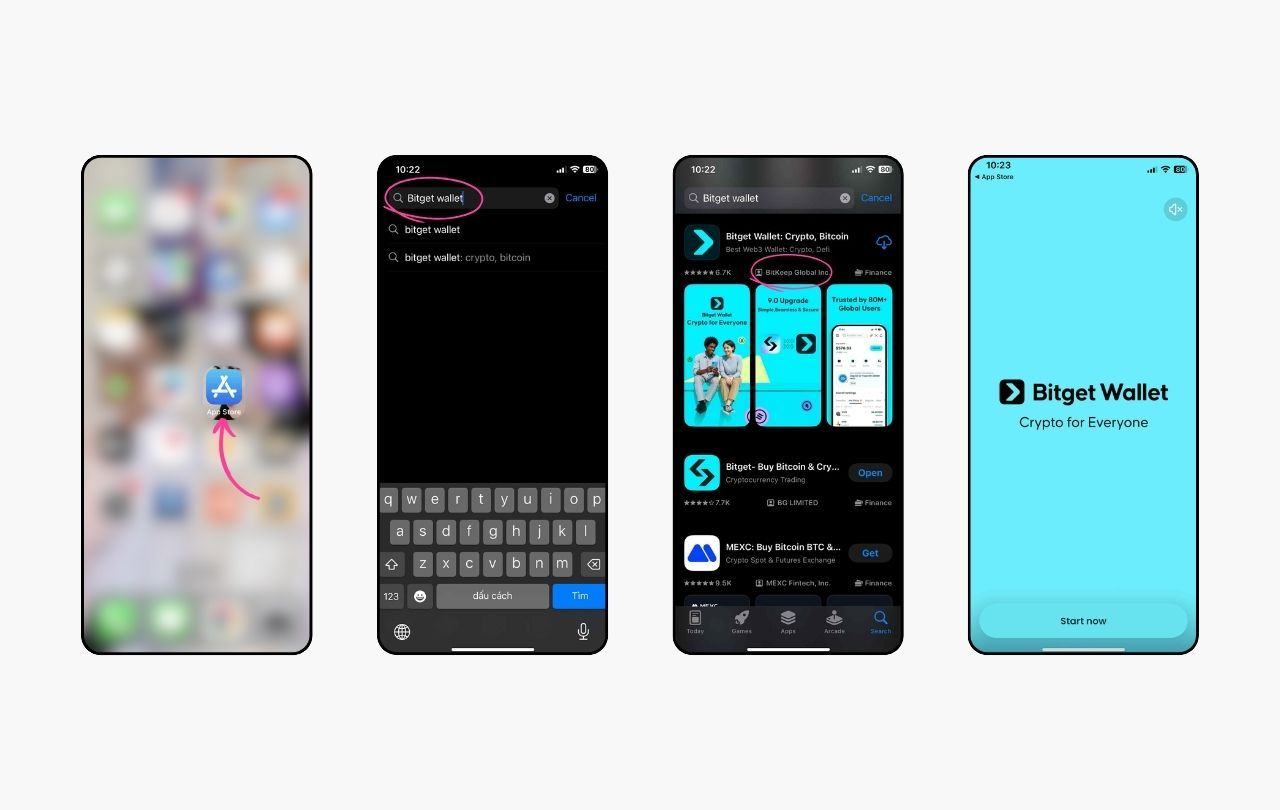

Step 1: Download Bitget Wallet

Download Bitget Wallet app from your device's app store or download the browser extension for desktop access and account creation.

Read more:

- How to Download Bitget Wallet in 2025: Mobile & Desktop Guide

- Bitget Wallet Extension: Complete Guide to Download, Setup & Use in 2025

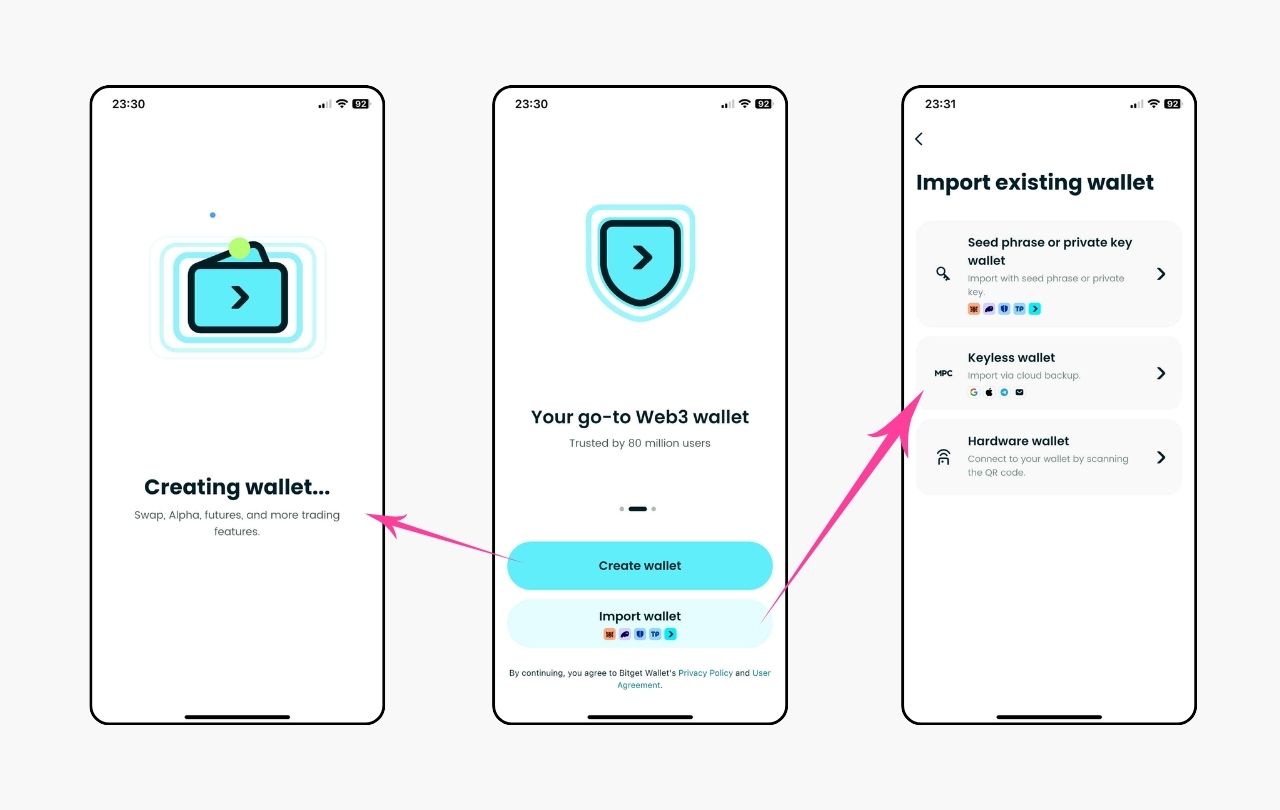

Step 2: Wallet Setup

Create a new wallet by generating a secure seed phrase or import an existing wallet using your recovery phrase to restore previous holdings.

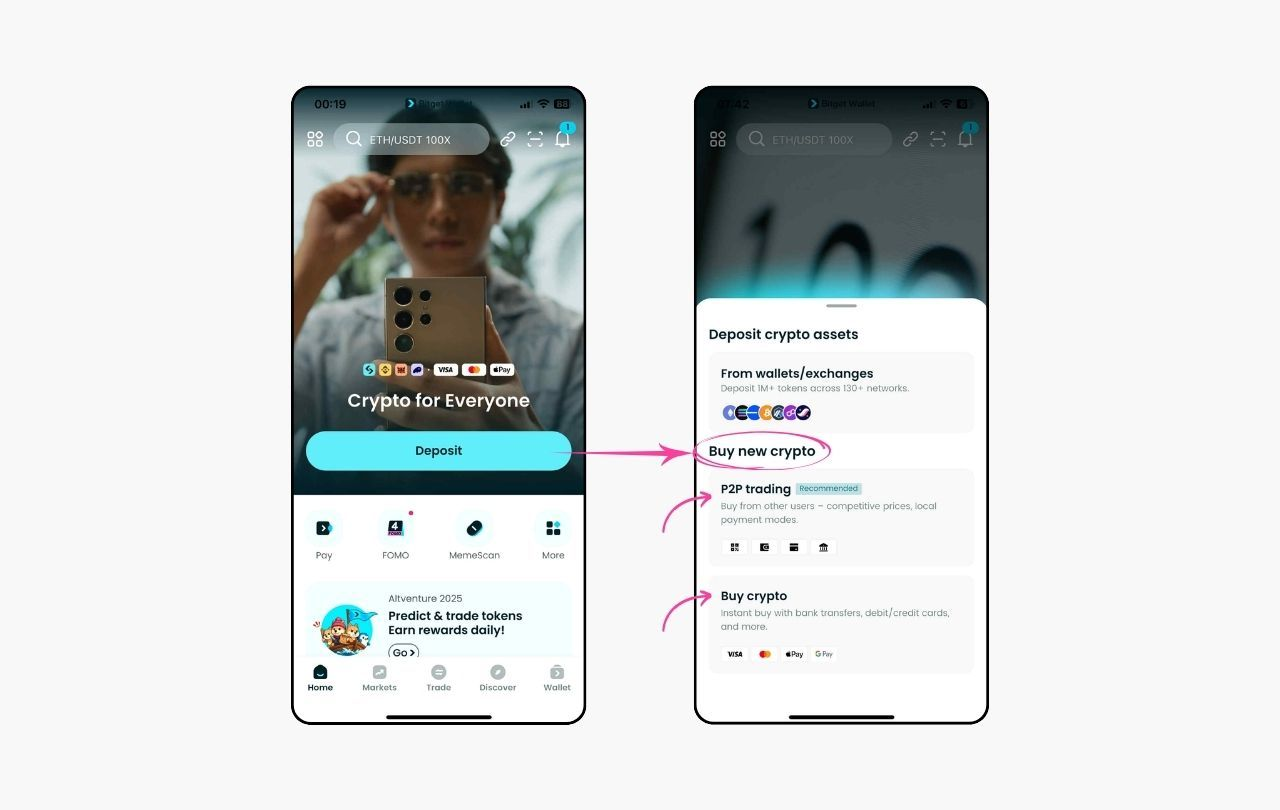

Step 3: Navigate Purchase Interface

Access the main dashboard and select the "Deposit" option, then choose "Buy new crypto" to explore available purchasing methods and payment options.

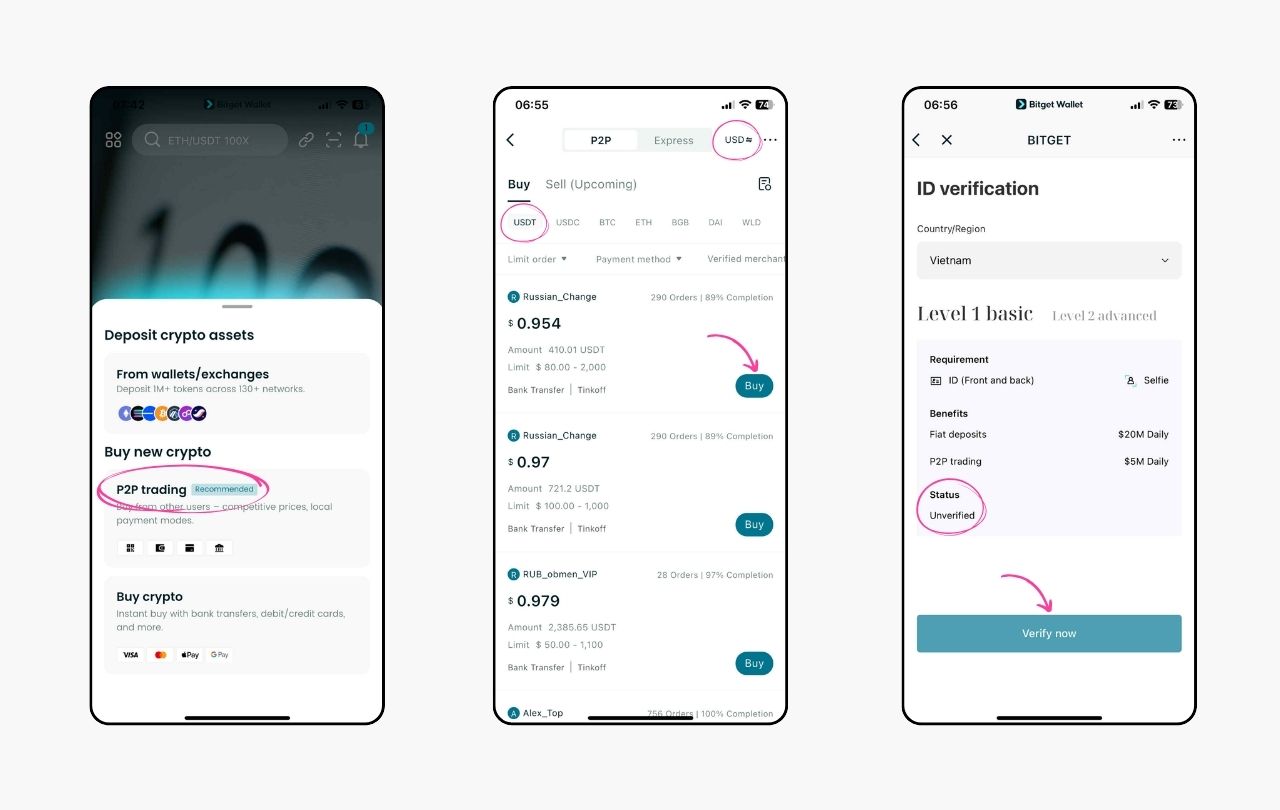

Step 4: Choose Payment Method

Select between P2P trading for competitive rates with local payment methods or credit card purchases for instant transactions with higher convenience fees.

Only verified users are permitted to conduct cryptocurrency transactions on Bitget Wallet. Consequently, ensure the completion of both phone and identification verifications prior to proceeding to subsequent steps.

Step 5: Network Selection

Choose your preferred blockchain network such as Ethereum (ERC-20), Tron (TRC-20), or Solana for USDT delivery based on transaction speed and fee preferences.

Step 6: Complete Transaction

Verify payment details, complete any required identity verification steps, and confirm the purchase to receive Tether USDT directly in your non-custodial wallet.

Read more: How to Buy USDT with a Credit Card: A Step-by-Step Beginner’s Guide

Is Tether USDT Safe to Hold? Understanding the Real Risks and Safety Concerns

Although Tether USDT is widely used, its possession entails distinct dangers that diverge from those associated with conventional financial instruments.

-

Counterparty Dependency:

Tether USDT relies entirely on Tether Limited's management of reserves and redemption obligations. This results in concentrated risk exposure to the operational integrity of a single corporate entity.

-

Regulatory Uncertainty:

Government inspections and the Tether dispute about transparency have led to considerable penalties and persistent legal examination that may severely affect future operations.

-

Market Manipulation:

Accusations persist that unbacked USDT token creation pushes crypto values higher unfairly, possibly causing major market chaos if these claims prove correct or perceived as true.

Is Tether USDT FDIC-Insured or Government-Backed?

No, this dollar-tied digital money gets zero government insurance or support, while conventional bank deposits possess FDIC protection that covers up to $250,000 each.

Tether owners must entirely trust the company's reserve management without any governmental safety net, making it riskier than normal bank products for keeping money safe.

How Does Tether USDT Fit Into the Future of Crypto?

Tether USDT appears positioned to play an increasingly central role as the global financial system continues embracing digital currency infrastructure.

-

Payment Infrastructure:

USDT serves as the primary digital dollar for cross-border commerce, processing over 70% of global stablecoin transactions with settlement speeds under one minute.

-

Emerging Market Bridge:

Growing adoption in Asia, Africa, and Latin America positions Tether USDT as a financial lifeline where traditional banking infrastructure remains underdeveloped.

-

CBDC Integration:

Multi-chain architecture enables potential interoperability between future Central Bank Digital Currencies and existing cryptocurrency ecosystems, facilitating seamless value transfer across different monetary systems.

Will Tether USDT Remain the Top Stablecoin?

Tether USDT will likely maintain its position as the dominant digital dollar in the near term, though its long-term leadership depends on several evolving factors. The following table examines key strengths supporting USDT's market position alongside emerging challenges that could reshape the competitive landscape.

| Strengths Supporting USDT’s Dominance | Challenges to USDT’s Leadership |

| Network Effects: Largest circulation and deepest market integration across exchanges |

Regulatory Pressure: Ongoing transparency demands and compliance requirements |

| Global Reach: Dominant adoption in high-growth emerging markets with weak banking |

Institutional Competition: USDC gaining ground through compliance-first approach |

| Multi-Chain Support: Operates seamlessly across 13+ blockchain networks |

CBDC Development: Government-backed digital currencies entering the market |

| Cost Efficiency: Extremely low transaction fees, especially on Tron network |

Read more: Top Stablecoins by Marketcap in 2025: Which Digital Dollars Are Leading the Market?

Conclusion

What is Tether USDT the stablecoin? This token is the world's largest stablecoin, maintaining dollar stability while enabling seamless cryptocurrency transactions across global markets with unmatched liquidity and adoption.

This Tether stablecoin functions as a critical bridge between traditional finance and cryptocurrency ecosystems, offering significant utility for traders while requiring careful consideration of associated counterparty and regulatory risks.

Understanding how USDT coin operates empowers informed financial decisions in the digital economy. Download Bitget Wallet today to securely manage USDT across multiple blockchains and access comprehensive DeFi opportunities.

Sign up Bitget Wallet now - grab your $2 bonus!

FAQs

1. What is Tether USDT the stablecoin ?

Tether USDT is the world's largest stablecoin, a digital currency pegged to the U.S. dollar at a 1:1 ratio, operating across multiple blockchains for global transactions.

2. How does Tether work to maintain its dollar peg?

Tether maintains its peg through diversified reserves including U.S. Treasuries, cash, and gold, with quarterly attestations and direct redemption mechanisms ensuring dollar value stability.

3. Is Tether safe for long-term holding?

Tether offers price stability but carries counterparty risk, lacks government insurance, and faces regulatory scrutiny, making it riskier than traditional bank deposits for investors.

4. How to use Tether USDT for secure buying and storage?

Purchase USDT through exchanges or P2P platforms, then store in non-custodial wallets like Bitget Wallet for enhanced security, cross-chain support, and direct asset control.

5. What are the main benefits of Tether USDT?

USDT provides price stability during market volatility, enables fast cross-border payments, supports DeFi applications, and offers global accessibility across multiple blockchain networks seamlessly.

Risk Disclosure

Please be aware that cryptocurrency trading involves high market risk. Bitget Wallet is not responsible for any trading losses incurred. Always perform your own research and trade responsibly.