What is Dai the Stablecoin (DAI)? Complete Guide to MakerDAO’s Decentralized Dollar-Pegged Asset

What is Dai Stablecoin (DAI)? DAI is essentially a decentralized cryptocurrency pegged to the US Dollar (USD), created by MakerDAO. What makes DAI special is that it always tries to keep its value stable at ~1 USD. This is achieved through the mechanism of "overcollateralization" and automated smart contracts running on the Ethereum blockchain.

Unlike centralized stablecoins like USDC or USDT, DAI operates without the control of any intermediary. As a result, it is more transparent and less susceptible to censorship.

DAI can be understood as a "trustless" stablecoin that operates by algorithms, playing an extremely important role in the Decentralized Finance (DeFi) ecosystem. DAI helps users around the world transact, save, or pay with a currency that retains its value - regardless of local inflation or banking restrictions. The entire system is governed by the MakerDAO community and is backed by a variety of cryptoassets locked in Maker Vaults.

As the leading tool for storing and using DAI, Bitget Wallet helps you manage assets securely across chains, combining the stability of DAI with the flexibility to participate in the DeFi ecosystem.

What is Dai the Stablecoin (DAI) and How Does It Work?

DAI is a decentralized stablecoin that maintains a stable price equal to the USD. It does not rely on conventional cash reserves, its stability mechanism works thanks to an automated system: users lock collateral assets (such as ETH, USDC or WBTC) into Maker Vault to borrow DAI. The system requires over-collateralization to hedge against price fluctuations. If the asset's price falls below a certain threshold, it will be liquidated to protect stability.

Unlike USDC or USDT (issued and held by a centralized company), DAI's mechanism is transparent, verifiable on the blockchain and governed by MakerDAO token holders.

Source: Makerdao.com

How Does MakerDAO Keep DAI at $1?

MakerDAO uses a combination of on-chain mechanisms and community governance to preserve DAI’s $1 peg:

-

Oracles:

Price feeds supply real-time market data to ensure accurate collateral valuations.

-

Collateralization Ratio:

Typically above 100%, often around 150% or more to prevent under-collateralization.

-

Liquidation Process:

If collateral value falls below the ratio, it is auctioned to repay DAI, keeping the peg stable.

-

Maker Governance:

MakerDAO members vote to adjust parameters like stability fees and collateral types to maintain long-term sustainability.

Who Created Dai and Why Was It Launched?

DAI was developed by Rune Christensen and the Maker Foundation as part of MakerDAO. Launched in December 2017 as Single-Collateral DAI, it maintained its USD peg even during ETH’s 2018 crash, proving its reliability. The goal was a decentralized stablecoin, free from centralized control, with governance later fully transferred to the MakerDAO community.

The Meaning Behind the Name Dai?

The name DAI comes from the Chinese character 貸 (read as "long"), which means "to lend" or "to provide capital". More than just a name, it carries a special mission: to help crypto assets "generate" liquidity, so that users can take advantage of their value without having to sell them. A groundbreaking idea - turning assets into a profitable resource, not just a storage tool!

What Are the Key Features of Dai Stablecoin?

DAI is a decentralized stablecoin running on the Ethereum blockchain, with its price pegged to $1 through overcollateralization and managed by the MakerDAO community. With the ability to accept multiple types of collateral, integrate direct savings interest, and fast transactions, DAI has become a trusted choice for global payments and value storage.

-

Stability & transparency

Pegged to 1 USD and governed through a decentralized governance mechanism.

-

Overcollateralized security

Requires locking crypto assets worth more than the DAI issued to ensure system safety.

-

Diverse collateral support

Accepts various cryptocurrencies such as ETH, wBTC, USDC, COMP, and more.

-

DAI Savings Rate (DSR)

Earn interest by depositing DAI directly into a smart contract, with withdrawals at any time.

-

24/7 operation

Fast, low-cost, and borderless transactions.

-

Deep DeFi integration

Widely used in lending, borrowing, blockchain games, cross-border payments, and remittances.

What Cryptocurrencies Can Be Used as Collateral?

Currently, DAI can be generated by locking multiple Ethereum-based assets, including:

-

ETH (Ethereum)

The original collateral for DAI.

-

BAT (Basic Attention Token)

Widely used in the Brave ecosystem.

-

USDC (USD Coin)

A stablecoin that adds fiat-backed stability.

-

wBTC (Wrapped Bitcoin)

Bitcoin represented on Ethereum.

-

COMP (Compound)

Governance token of the Compound protocol.

What Are the Benefits of DAI Crypto for Users?

DAI crypto offers a powerful blend of stability, transparency, and accessibility, making it a versatile asset for everyday users and traders alike.

-

Stable Value:

DAI provides a reliable hedge against the wild price swings common in cryptocurrencies like Bitcoin or Ethereum. Its value stays remarkably steady.

-

Safe Digital Storage:

It's an excellent option for preserving wealth digitally, especially valuable in regions struggling with high inflation or unstable national currencies.

-

Financial Inclusion:

Access is permissionless through the Maker Protocol – no banks, credit checks, or minimum deposits stand in your way.

-

Transparent Governance:

The system is governed openly by MKR token holders, who vote on critical decisions like interest rates, accepted collateral types, and protocol upgrades.

How DAI Stacks Up Against Traditional Bank Transfers?

When compared to traditional bank wires, DAI offers several clear advantages:

-

Speed:

Transactions settle in minutes, not days. Forget waiting for several business days.

-

Cost:

Network fees are typically far lower than standard bank charges or remittance service costs.

-

Availability:

It works 24 hours a day, 7 days a week – no closures for weekends, holidays, or banking hours.

-

Borderless Use:

Send and receive value seamlessly across countries without the delays and hassle of currency conversions.

What Are the Risks of Using Dai Stablecoin?

Dai stablecoin (DAI) offers multiple benefits, but it also carries certain risks that users should carefully consider before using it:

-

Algorithmic Risk vs. Fiat-Backed Stablecoins

Unlike USDC or USDT, which are fully backed by fiat currency reserves, DAI maintains its $1 peg through algorithmic mechanisms and overcollateralized crypto assets. In extreme market conditions, this system may come under stress.

-

USDC Dependence Risk

A significant portion of DAI’s collateral consists of USDC. If USDC faces liquidity issues or regulatory action, DAI’s stability could also be affected.

-

Smart Contract Vulnerabilities

DAI operates entirely on Maker Protocol smart contracts. Any security flaw, bug, or exploit in these contracts could lead to asset loss or peg deviation.

How Can Users Mitigate These Risks?

To reduce exposure to these risks when using Dai stablecoin:

-

DYOR (Do Your Own Research)

Always study the project, its mechanisms, and market conditions before committing funds.

-

Diversify Holdings

Avoid putting all your assets into a single stablecoin; spread them across different assets to reduce risk.

-

Use Trusted Wallets

Store your DAI in reputable, secure wallets to minimize the risk of hacks, phishing, or unauthorized access.

What Are the History and Milestones of the DAI Coin?

Since its inception, DAI has gone through an impressive development journey, marking many important milestones that have helped it become one of the most trusted decentralized stablecoins.

- 2015 – MakerDAO is born: Rune Christensen founded MakerDAO, laying the foundation for a decentralized stablecoin system where all decisions, big and small, are decided by the community

Source: decrypt.co

- 2017 – DAI goes public: The first version of DAI, collateralized only by ETH (Single-Collateral DAI - SCD), goes live.

Source: mybroadband.co.za

-

2019 – A big leap:

Collateral diversity: Maker protocol expands, accepting many different types of collateral such as BAT, USDC, wBTC, COMP. This move makes DAI much more stable and flexible.

Source: makerdao.com

-

2020 – COVID Challenge:

The global financial earthquake tested DAI's "dollar peg", pushing the price temporarily above $1. However, thanks to a solid governance mechanism, the system quickly recovered to stability.

Source: blockchain.news

In addition to technical progress, DAI also attracted support from venture capital giants such as Andreessen Horowitz. At the same time, MakerDAO's governance process also evolved into a fully decentralized system, where MKR holders directly vote on key changes to the protocol.

Source: transfi.com

How is DAI's appeal growing?

From being a dedicated stablecoin in DeFi, DAI has now expanded much further:

-

DeFi core:

Now essential on DEXs, lending platforms, yield aggregators, and even blockchain games.

-

Broader reach:

Supported by major wallets, payment gateways, and e-commerce, enabling both on-chain and offline payments.

-

Steady growth:

Rising on-chain transactions and wallet numbers reinforce DAI’s position as a trusted decentralized alternative to centralized stablecoins.

How to Use Dai Stablecoin in Everyday Transactions?

The Dai stablecoin (DAI) can be used flexibly in various everyday financial activities thanks to its stability and multi-chain compatibility. You can purchase DAI on Bitget Wallet

-

Payments:

Purchase goods/services from merchants accepting cryptocurrency.

-

Lending/Borrowing in DeFi:

Lend to earn profits or borrow to access capital in the Decentralized Finance system.

-

Gaming:

Spend DAI in blockchain-based games or metaverse platforms.

-

Saving:

Save with the Dai Savings Rate (Dai Savings Rate - DSR) to receive secure interest.

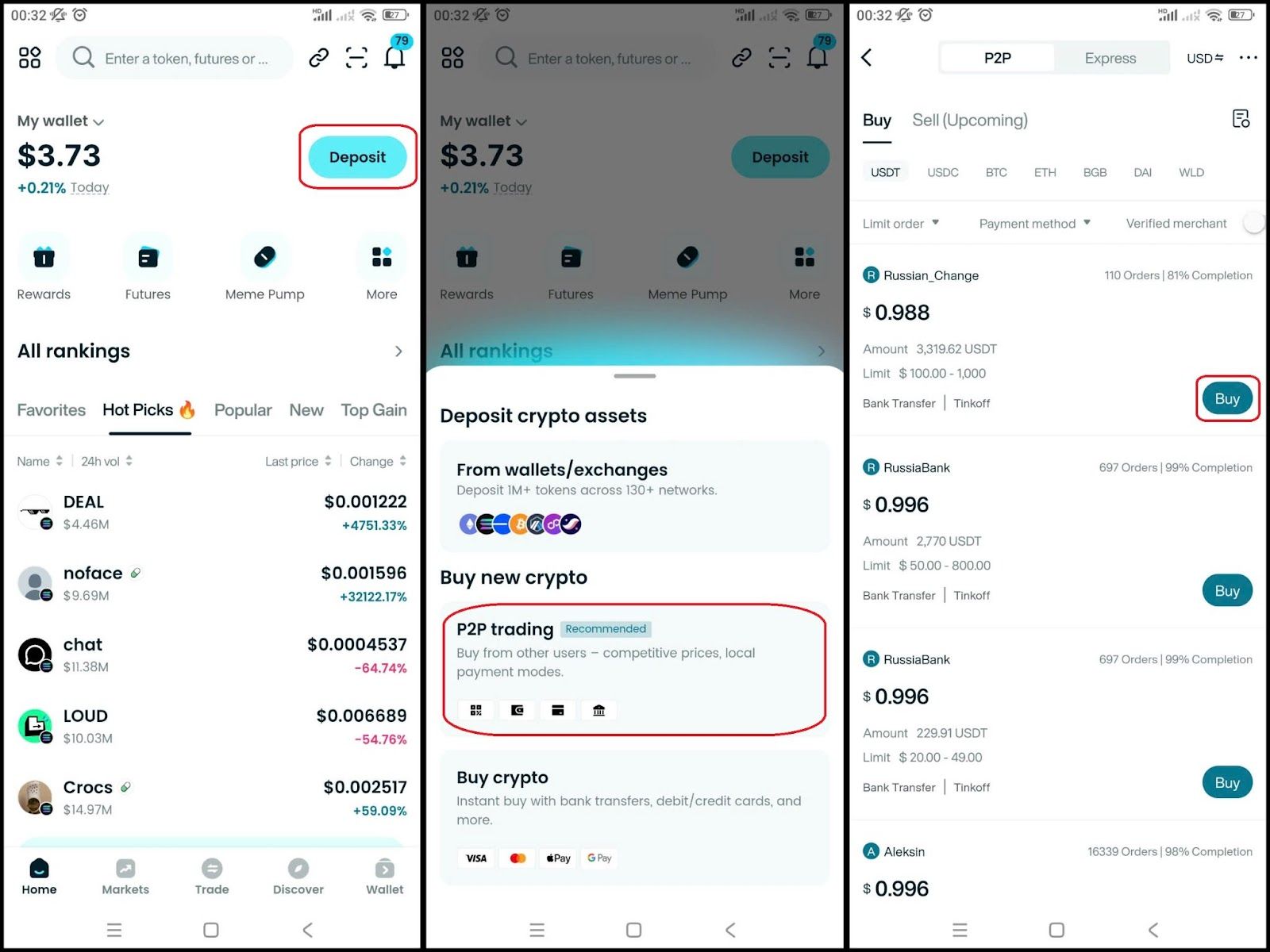

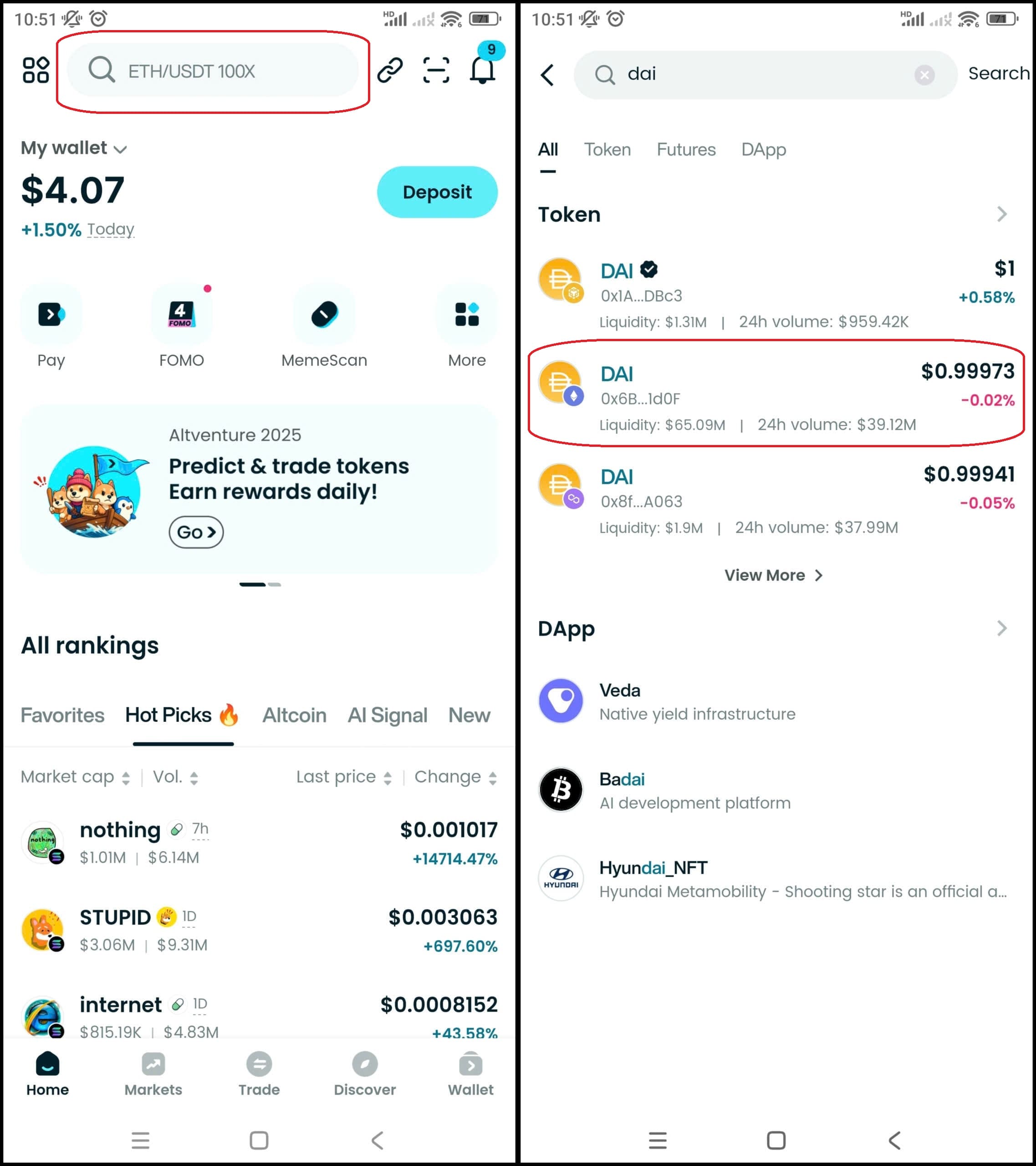

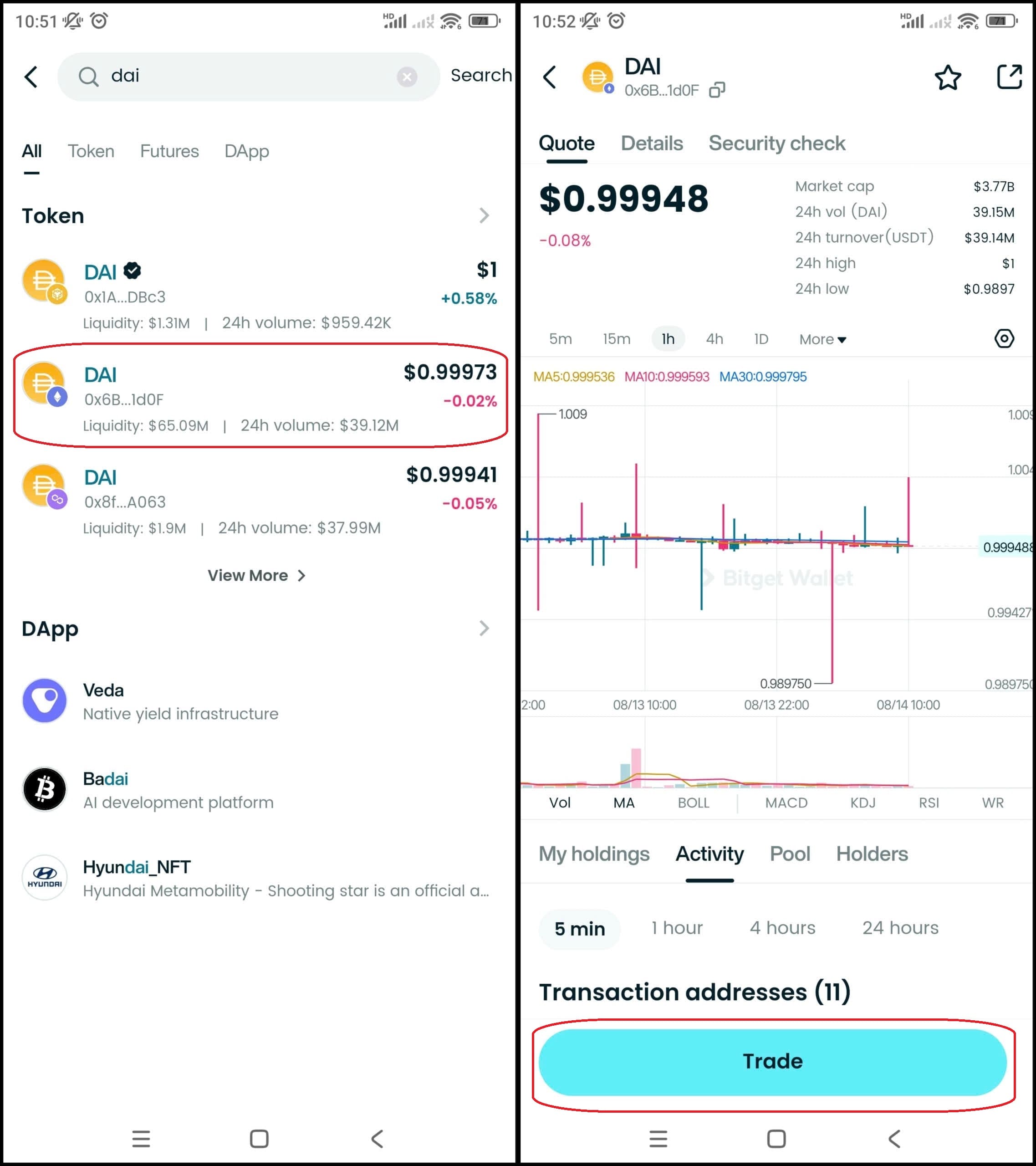

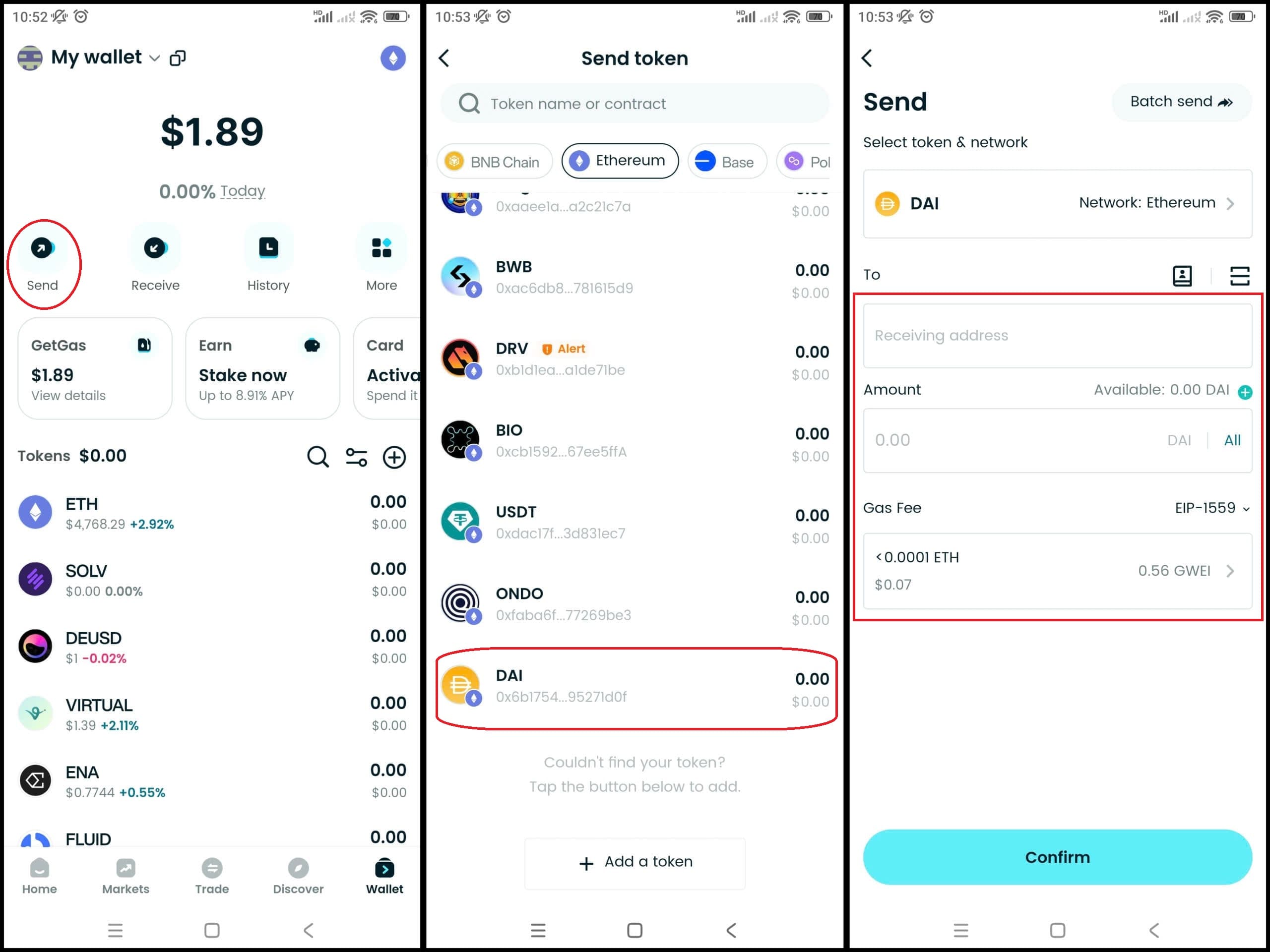

How to Buy Dai Stablecoin on Bitget Wallet?

Trading Dai stablecoin (DAI) is simple on Bitget Wallet. Follow these steps:

Step 1: Create an Account

Download the Bitget Wallet app. Sign up with the required details and verify your identity.

Step 2: Deposit Funds

Deposit funds by:

- Transferring Crypto: Send from another wallet.

- Buying Crypto: Use a credit or debit card directly on Bitget Wallet to ensure you have enough for trading DAI.

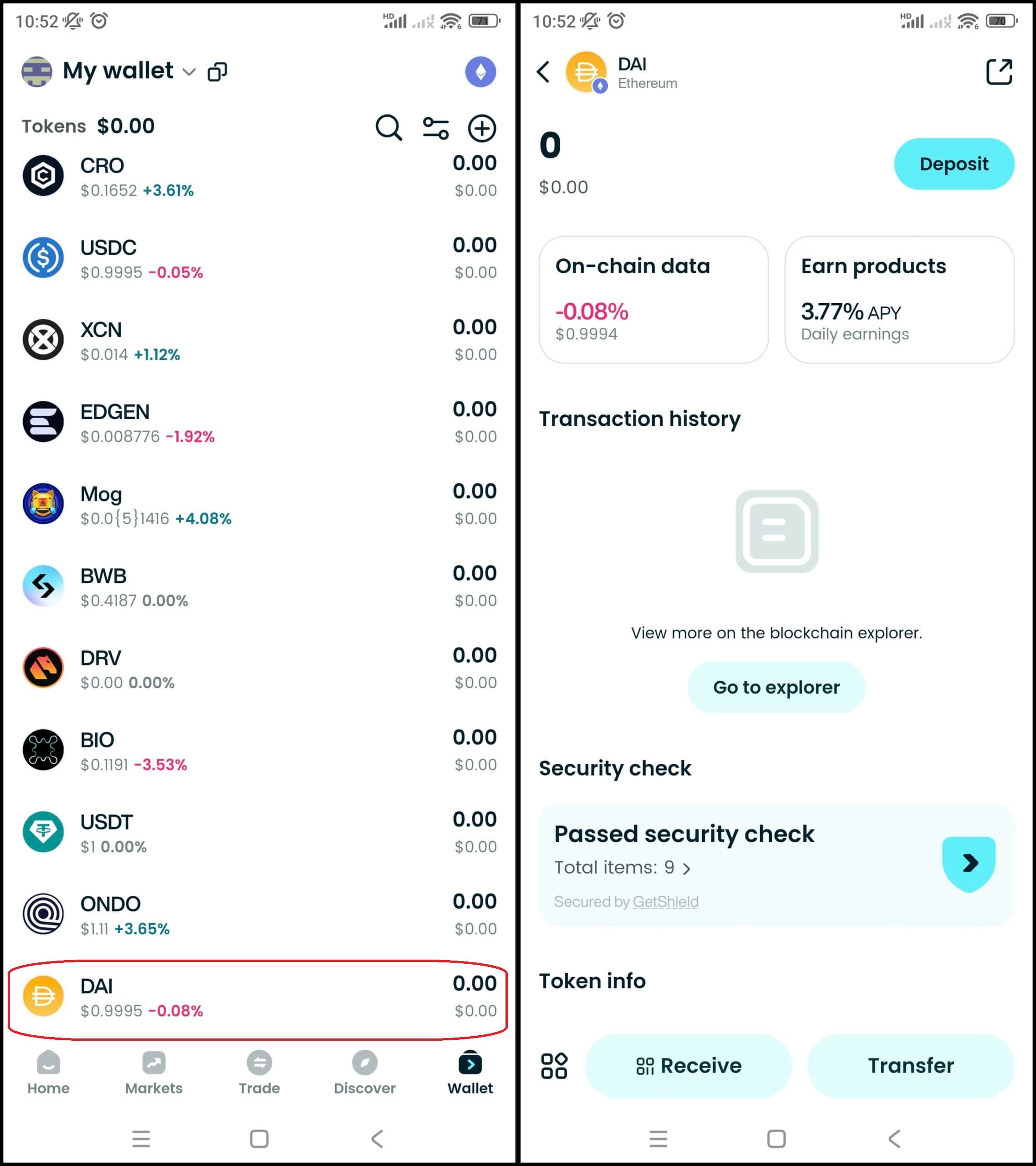

Step 3: Find Dai Stablecoin (DAI)

Go to the market section, search “DAI,” and open its trading page.

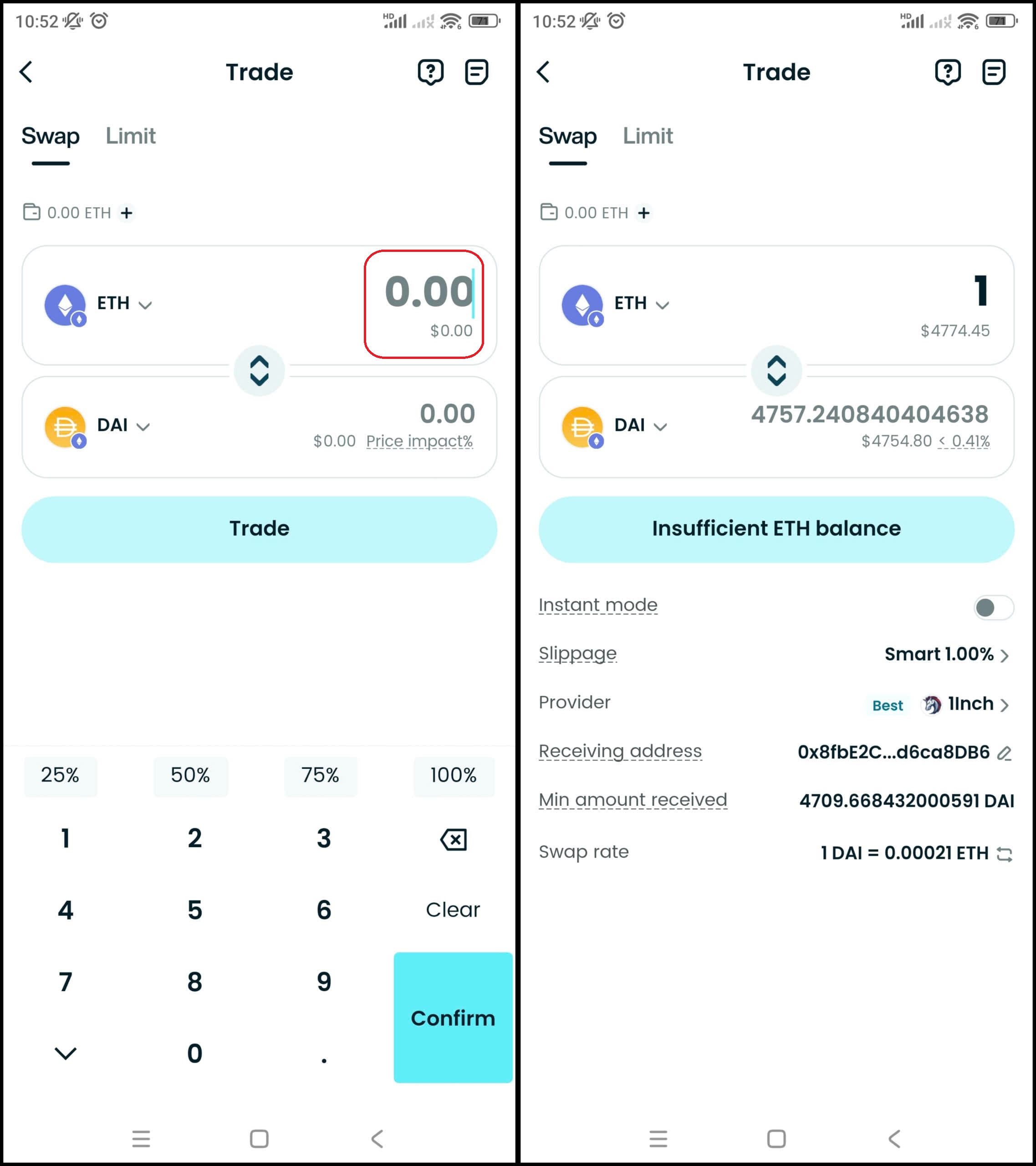

Step 4: Choose Your Trading Pair

Select a pair like DAI/USDT to trade against USDT or another token.

Step 5: Place Your Order

Choose a market order (buy/sell at current price) or limit order (set your price). Enter the amount of DAI and confirm.

Step 6: Monitor Your Trade

Track your order in “Open Orders.” Once executed, check your balance for your DAI.

Step 7: Withdraw Funds (Optional)

To send DAI to another wallet, go to withdrawal, enter the address, and confirm.

▶ Learn more about Dai stablecoin (DAI):

- What is Dai stablecoin (DAI)?

- Dai stablecoin (DAI) Airdrop Guide

- Dai stablecoin (DAI) Listing Date and How to Buy It

- MetaMask vs Bitget Wallet: Which Is Better in 2025?

- Trust Wallet vs Bitget Wallet: Which One Is Better in 2025?

- Phantom vs Bitget Wallet: Which One Is Better?

- What is Stablecoin? A Beginner’s Guide to Price-Stable Cryptocurrencies

- What Are Types of Stablecoins and Which One Should You Use?

- Top Stablecoins to Watch in 2025: Which Digital Dollars Are Leading the Market?

Conclusion

What is Dai Stablecoin (DAI)? In the simplest terms, DAI is a decentralized, collateral-backed stablecoin that maintains a value of close to $1 thanks to the smart operation of the MakerDAO protocol. DAI brings you stability, security, and financial freedom, while opening up countless practical applications - from everyday payments and savings tools to DeFi transactions and gaming entertainment.

Not only that, with the ability to operate across chains (multi-chain) and completely independent of any centralized control organization, DAI becomes a powerful tool to help you preserve value and seize investment opportunities. Download Bitget Wallet now to securely store, trade, and use DAI easily on multiple chains - whether you use it for DeFi, payments, or long-term savings! Experience an extremely beginner-friendly interface, top-notch security, and full stablecoin support!

Sign up Bitget Wallet now - grab your $2 bonus!

FAQs

What is Dai stablecoin backed by?

DAI is backed by overcollateralized crypto assets (such as ETH, USDC, wBTC) locked in MakerDAO smart contracts.

How to earn interest on DAI?

You can deposit DAI into DAI Savings Rate (DSR) or DeFi lending platforms to earn passive interest.

Is DAI better than USDC or USDT?

DAI provides decentralized algorithmic stability without relying solely on fiat reserves like USDC or USDT.

Can DAI de-peg?

Yes, market volatility or collateral issues can sometimes cause DAI to deviate in the short term, but there is always an automatic mechanism in place to bring the value back to $1.

Where to safely store DAI?

Use non-custodial wallets like Bitget Wallet to store, trade, and swap DAI cross-chain, with full control over your private keys.

Risk Disclosure

Please be aware that cryptocurrency trading involves high market risk. Bitget Wallet is not responsible for any trading losses incurred. Always perform your own research and trade responsibly.