Solana Stablecoin Guide: Best Projects, Treasury Solutions, and Yield Options

Solana Stablecoin has become a cornerstone of the ecosystem in 2025, driving liquidity, payments, and treasury solutions across one of the fastest blockchains in the world. Solana’s speed, with capacity for over 65,000 transactions per second and negligible fees, has made it the ideal home for stablecoin adoption. Whether for everyday payments, trading in DeFi, or serving as a corporate treasury tool, stablecoins on Solana are now indispensable.

Today, the total stablecoin market cap on Solana stands at nearly $15 billion, with USDC commanding around 70% dominance and USDT close behind. Alongside these giants, decentralized stablecoins like USDH and UXD, yield-bearing models such as USDY and YBX, and non-USD assets like EUROe and EURC are carving out their own niches.

This guide explores why stablecoins matter on Solana, which projects lead the pack, how enterprises can use them for treasury management, and what the future may hold. And if you’re looking for a way to store, swap, and earn yield on stablecoins, Bitget Wallet offers an all-in-one platform built for Solana DeFi.

Manage all your tokens in one beginner-friendly app – download Bitget Wallet today.

Key Takeaways

- USDC and USDT dominate Solana’s stablecoin market, but decentralized and yield-bearing stablecoins are growing in traction.

- Non-USD stablecoins like EUROe and EURC provide forex diversification for enterprises managing global treasuries.

- Bitget Wallet simplifies stablecoin use on Solana with secure storage, cross-chain swaps, and Stablecoin Earn Plus.

Stablecoins on Solana: What They Are and Why They Matter

Stablecoins on Solana are digital assets designed to maintain a stable value, usually pegged to fiat currencies like the US dollar or the euro. Unlike volatile cryptocurrencies, they act as anchors for trading, payments, lending, and treasury diversification. Solana stablecoins differ from “pegged assets” such as synthetic dollars or algorithmic designs, which rely on mechanisms other than direct fiat backing.

What makes Solana stand out? It’s the combination of speed, scalability, and negligible fees. With throughput exceeding 65,000 transactions per second and average costs measured in fractions of a cent, Solana makes stablecoin transfers seamless compared to chains like Ethereum.

How Do Solana Stablecoins Work Compared to Ethereum or Other Chains?

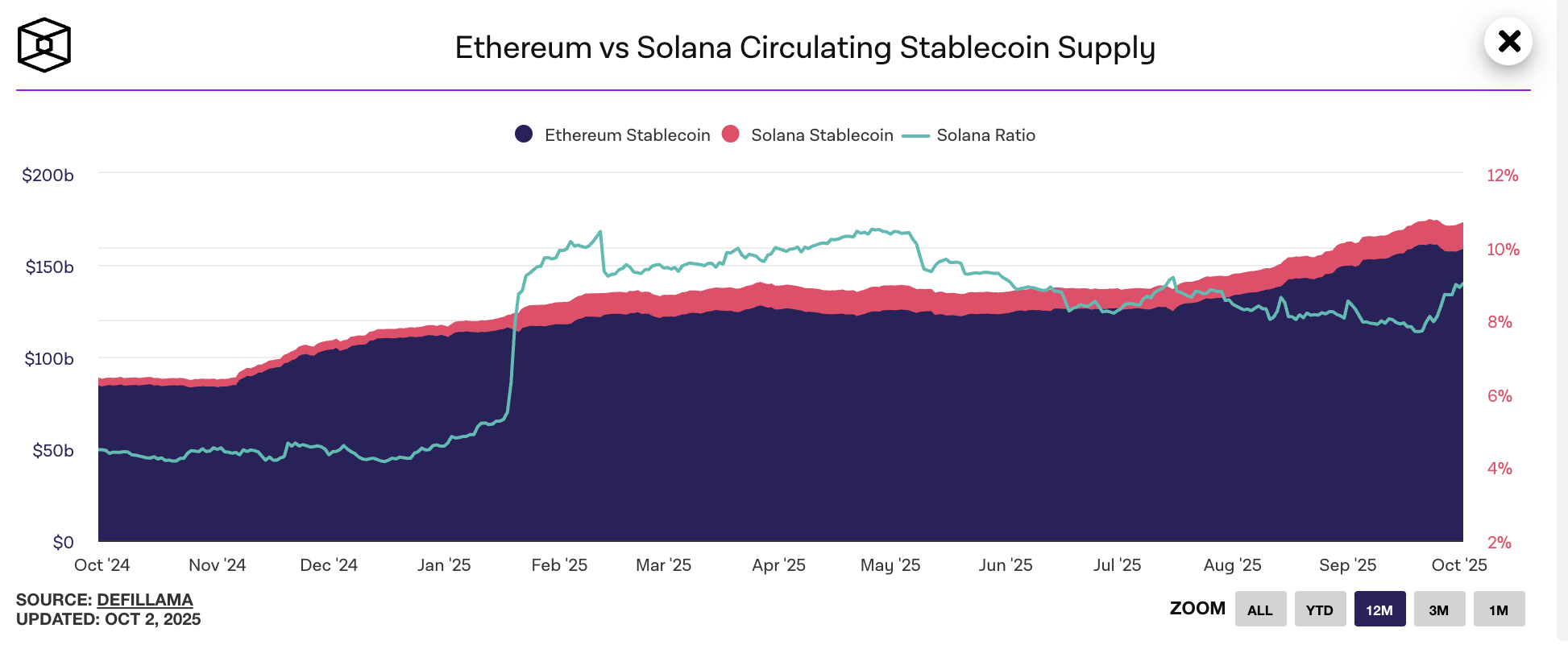

On Ethereum, stablecoins like USDC and USDT remain dominant, but transaction fees during network congestion can exceed $10 per transfer. In contrast, Solana’s architecture allows near-instant settlement for pennies, creating an efficient network for micro-transactions, trading, and business payments. This cost advantage, combined with deep liquidity, positions Solana stablecoins as a real alternative to Ethereum-based stable assets.

Source: DeFiLlama

Which Are the Leading Solana Stablecoin Projects in 2025?

According to DeFiLlama, the total Solana stablecoin supply is approximately $14.9 billion, with USDC holding the lion’s share. Beyond centralized leaders, Solana hosts a diverse landscape of decentralized, yield-bearing, and non-USD stablecoins.

Each project listed below links to its Bitget Wallet wiki page, where you can learn how to buy and store them.

- USDC on Solana – Circle’s fully regulated stablecoin, USDC, is the backbone of Solana DeFi. With ~70% market share, it offers unmatched liquidity, trust, and seamless on/off ramps for businesses and traders.

Source: Coinmarketcap

- USDT on Solana – Tether’s USDT remains a global liquidity giant on Solana, offering deep markets and fast settlement. While transparency debates persist, it remains essential for cross-border DeFi activity.

Source: Bitget

- USDH – Hubble Protocol’s USDH is a decentralized stablecoin collateralized by crypto assets on Solana. It offers censorship resistance and aligns with DeFi’s ethos of transparency.

Source: Bitget

- UXD – UXD is a delta-neutral stablecoin designed to maintain peg stability without centralized backing. Built for censorship resistance, it represents Solana’s push into decentralized finance innovation.

Source: ICOdrops

- Sky Dollar (USDS) – USDS, or Sky Dollar, is an emerging decentralized Solana stablecoin. Though smaller in liquidity, it aims to provide a secure, algorithmic alternative to centralized tokens.

Source: Coinbase

- USDY – Ondo Finance’s USDY brings real-world yield to Solana stablecoins by tokenizing U.S. Treasuries. It allows investors and treasuries to hold stable value while earning passive returns.

Source: Ondo Finance’s

- sUSD – sUSD from Solayer is a yield-bearing stablecoin that accrues staking rewards automatically. It’s designed to make stablecoins productive assets rather than idle value holders.

Source: Synthetix

- USDe – Ethena’s USDe is a synthetic stablecoin that generates yield through derivatives strategies. It blends DeFi innovation with institutional-grade mechanics, appealing to yield seekers.

Source: Ethena labs

- EUROe – EUROe, issued by Membrane Finance, is a fully regulated euro-pegged stablecoin on Solana. It enables forex diversification and European enterprise adoption.

Source: Euroe

- EURC – Circle’s EURC is a euro-denominated counterpart to USDC. With institutional trust and Solana’s speed, it offers businesses a stable, euro-based digital asset.

Source: Circle

Why Are USDC and USDT Still the Market Leaders on Solana?

- USDC remains the most trusted and widely integrated stablecoin, issued by Circle and backed by fully attested reserves. Its liquidity makes it the go-to choice for DeFi trading and enterprise on/off ramps.

- USDT, issued by Tether, continues to play a massive role, with deep liquidity and global reach despite long-standing debates over transparency.

Both dominate Solana thanks to their fiat off-ramp advantages and ubiquity across exchanges, wallets, and payment networks.

What Are the Most Promising Decentralized Solana Stablecoins?

- USDH by Hubble Protocol: collateralized decentralized stablecoin backed by crypto assets.

- UXD: delta-neutral mechanism, designed for censorship resistance and minimizing volatility.

- Sky Dollar (USDS): a smaller but innovative decentralized option aiming for transparency and decentralization.

These Solana stablecoins offer censorship resistance and align with DeFi’s ethos. However, liquidity is thinner than centralized alternatives.

Which Yield-Bearing Solana Stablecoins Offer the Best Returns?

Yield-bearing stablecoins on Solana provide interest accrual directly within the token design. Examples include:

- sUSD by Solayer — accrues staking rewards.

- Ethena’s USDe — uses derivatives to generate yield.

- USDY by Ondo Finance — tokenized Treasuries generating stable yield.

These assets turn stablecoins from passive instruments into income-producing treasury tools.

What Are the Emerging Non-USD Stablecoins on Solana?

- EUROe (issued by Membrane Finance).

- EURC (Circle’s euro stablecoin).

- GYEN, VEUR, VCHF — regional currencies tokenized on Solana.

These non-USD Solana stablecoins are critical for enterprises operating across multiple currencies, offering forex stability and hedging tools.

How Can Enterprises Use Solana Stablecoins for Treasury Management?

Stablecoins on Solana aren’t just for retail users; enterprises are adopting them for treasury management. Squads highlights how companies diversify reserves, manage payments, and even earn yield.

Why Do Enterprises Prefer USDC for On/Off Ramps?

Circle’s USDC integrates seamlessly with business accounts, fiat banking, and payment rails. Enterprises rely on it for reliable liquidity and easy conversion to dollars.

How Can Companies Diversify Treasury Beyond USD?

By holding EUROe, EURC, or GYEN, companies hedge against USD fluctuations and gain flexibility in cross-border transactions. Solana’s efficiency makes multi-currency treasury operations practical.

What Role Do Yield-Bearing Stablecoins Play in Treasury Diversification?

Treasuries are adopting USDY, YBX, and Credix lending products to generate returns. While attractive, these instruments carry counterparty and liquidity risks, requiring robust risk frameworks.

What Is the Future of Stablecoins on Solana?

The future is bright but contested. Community discussions, such as this Reddit thread, highlight the balance between centralized stability and decentralized innovation.

Why Is Institutional Adoption the Next Big Step?

Regulated issuers like Brale, Paxos, GMO-Z, and PayPal’s PYUSD are exploring Solana. Institutional adoption could bring deeper liquidity and credibility.

Are Algorithmic and Synthetic Stablecoins Making a Comeback?

Projects like UXD and synthetic forex tokens are reviving algorithmic approaches. While innovative, they carry the memory of high-profile failures, making risk management critical.

How Could Solana Enable True On-Chain Forex?

With Solana’s high throughput and Phoenix’s orderbook DEX, multi-currency stablecoin pairs could create a real-time on-chain forex market. This would be a game-changer for both DeFi and TradFi.

How Can Bitget Wallet Help You Manage Stablecoins on Solana?

Bitget Wallet is an all-in-one platform for trading, storing, and earning yield on Solana stablecoins. With support for over 90 blockchains and 250,000+ tokens, it’s built for both beginners and enterprises.

Why Is Bitget Wallet the Best Tool for Solana Stablecoin Storage?

Bitget Wallet offers non-custodial, multi-chain security with institutional-grade protections. Whether you hold USDC, USDH, or EUROe, your assets remain under your control.

How Does Bitget Wallet Support Stablecoin Yield on Solana?

Through Stablecoin Earn Plus, Bitget Wallet users can earn up to 10% APY on Solana stablecoins. This makes it easy to compare centralized yields with yield-bearing options like USDY or YBX.

What Cross-Chain Features Make Bitget Wallet Stand Out?

- Seamless swaps across Solana, Ethereum, BNB, Polygon, Base.

- Zero-fee memecoin trading and exposure to tokenized real-world assets.

- Global crypto card (Visa/Mastercard) for spending stablecoins directly.

Conclusion

Solana Stablecoin remains the backbone of the ecosystem in 2025, powering trading, payments, and treasury solutions across a thriving DeFi landscape. With nearly $15 billion in circulating stablecoins, USDC and USDT dominate, but decentralized and yield-bearing assets like USDH, USDY, and EUROe show that innovation is alive and well.

From cross-border forex solutions to institutional adoption, the future of Solana stablecoins lies in balancing stability with decentralization. But success isn’t just about the tokens — it’s about how you manage them.

With Bitget Wallet, users can:

- Securely store Solana stablecoins.

- Earn up to 10% APY with Stablecoin Earn Plus.

- Swap across blockchains instantly.

- Spend stablecoins globally with a crypto card.

The Solana stablecoin revolution is underway — and with the right wallet, you can be part of it.

FAQs About Solana Stablecoins

1. What is the safest Solana stablecoin in 2025?

USDC is the most widely trusted thanks to Circle’s regulated reserves, though USDT remains more liquid in some markets.

2. How do I earn yield with Solana stablecoins?

You can use yield-bearing assets like USDY or platforms like Bitget Wallet Stablecoin Earn Plus (up to 10% APY).

3. Which non-USD stablecoins are available on Solana?

EUROe, EURC, GYEN, VEUR, and VCHF provide exposure to euros, yen, and Swiss francs.

4. Can Solana stablecoins be frozen like USDC/USDT?

Yes — centralized stablecoins can be frozen by issuers, while decentralized options like USDH and UXD cannot.

5. How can I store Solana stablecoins securely?

Use a non-custodial solution like Bitget Wallet to maintain full control of your assets.

Risk Disclosure

Please be aware that cryptocurrency trading involves high market risk. Bitget Wallet is not responsible for any trading losses incurred. Always perform your own research and trade responsibly.