Cash Out USDT: How to Withdraw USDT to Bank Account?

Cash Out USDT is the process of converting your stablecoin holdings into fiat currency that can be deposited into a traditional bank account. To withdraw USDT to bank account, you must first complete a crypto-to-fiat conversion through a regulated USDT off-ramp or exchange platform.

Because banks do not accept blockchain tokens directly, users must convert USDT to USD or another local currency before initiating a USDT to USD bank transfer. This process may involve network fees, USDT withdrawal fees, and KYC verification requirements. In this guide, you’ll learn the complete step-by-step process using Bitget Wallet, along with alternative methods such as exchange withdrawals, P2P USDT withdrawal, and debit card payouts.

Cash out USDT securely today—download Bitget Wallet and convert USDT to USD with a trusted off-ramp in minutes.

Key Takeaways

- Cash Out USDT requires converting your stablecoins into fiat through a regulated USDT off-ramp, exchange, or integrated wallet solution that connects blockchain assets to banking rails.

- Before initiating a USDT to USD bank transfer, you must first convert USDT to USD (or your selected local fiat currency) at the current market rate.

- Network selection matters: sending TRC20 USDT typically costs less in gas fees than ERC20 USDT, which can significantly impact total withdrawal costs.

- Most crypto to fiat conversion services require KYC verification due to AML compliance rules, especially for larger withdrawals.

- Bitget Wallet simplifies the process with a structured Sell Crypto flow—select USDT, choose fiat, complete verification, and confirm your withdrawal in one guided interface.

How to Cash Out USDT to Bank Account (Complete Step-by-Step Guide)

How to cash out USDT to bank account involves selecting a regulated USDT off-ramp, transferring ERC20 USDT or TRC20 USDT, converting USDT to USD, completing KYC verification, and initiating a USDT to USD bank transfer through a supported withdrawal method such as bank card or Visa payout.

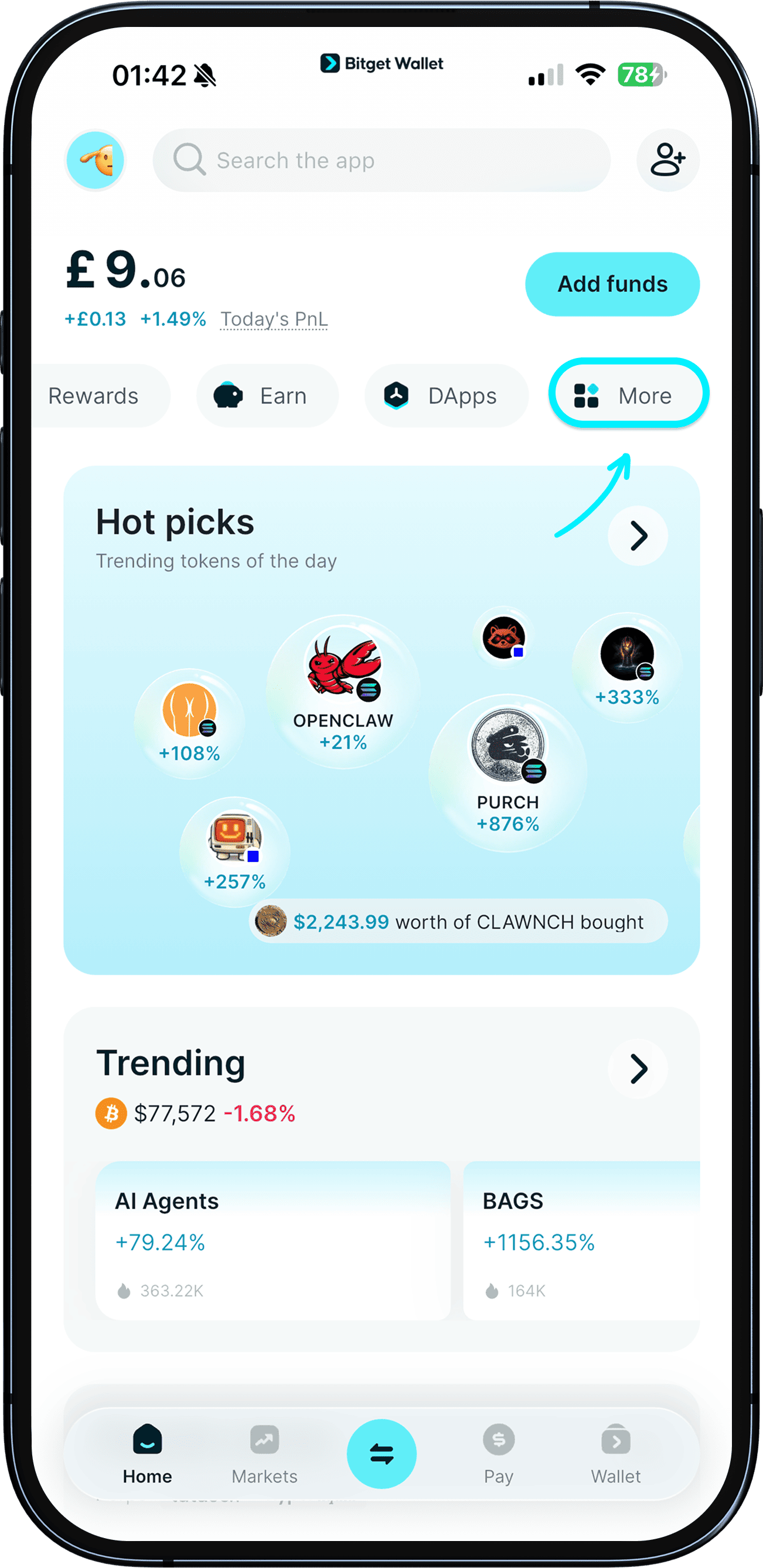

Step 1 – Open Sell Crypto in Bitget Wallet

To begin the process:

- Open Bitget Wallet

- Navigate to Home → More → Sell Crypto

- Select USDT from your wallet balance

- Choose the correct network (TRC20 USDT or ERC20 USDT)

- Confirm available balance before you sell USDT

Selecting the correct network helps minimize gas fees and ensures successful crypto to fiat conversion.

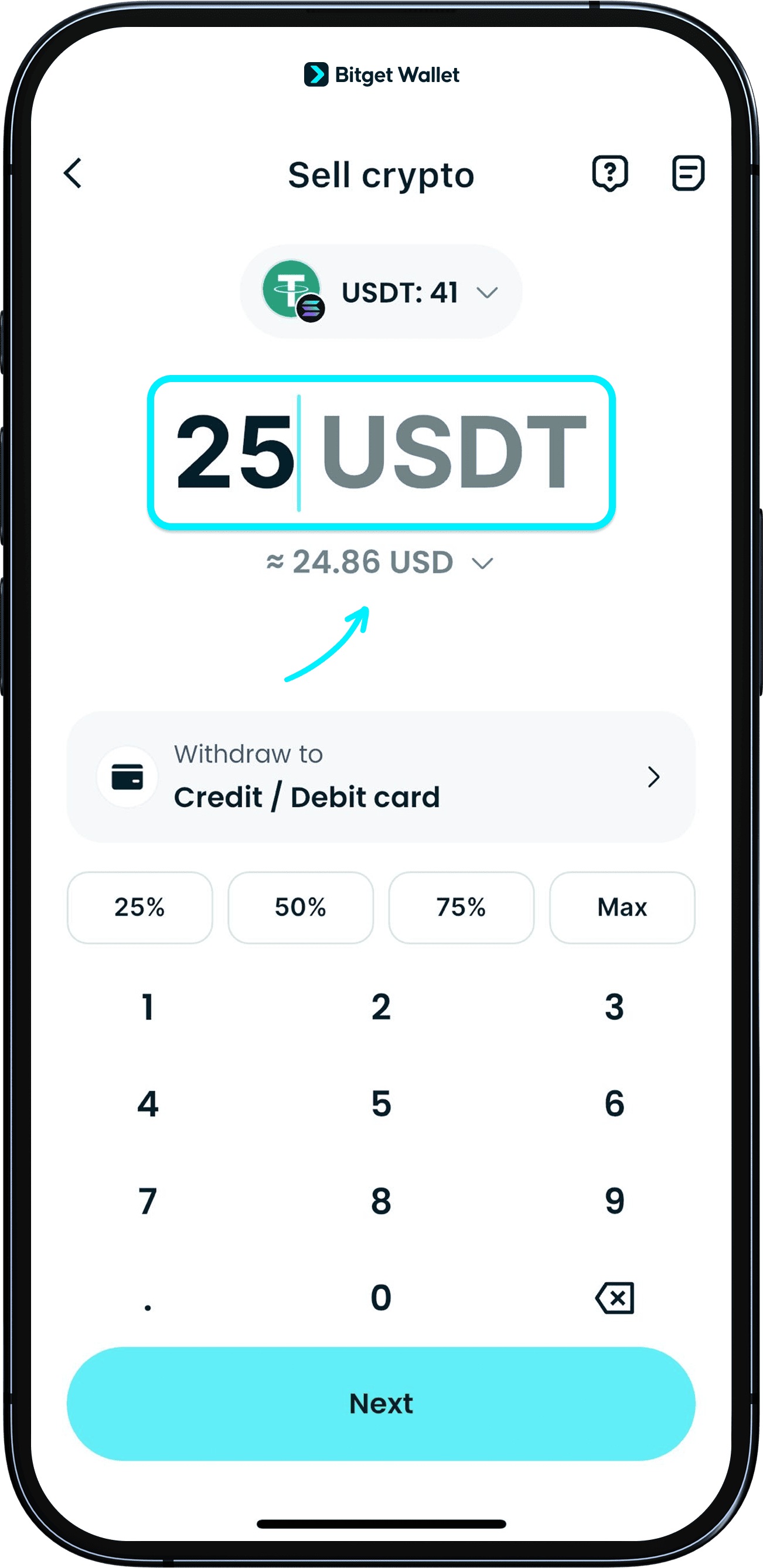

Step 2 – Enter Amount and Convert USDT to USD

Next:

- Enter the amount of USDT you want to sell

- Preview the real-time exchange rate

- Convert USDT to USD or supported fiat

- Review the estimated payout amount before confirming

This step ensures transparency in conversion rates and allows you to evaluate potential USDT withdrawal fees before proceeding.

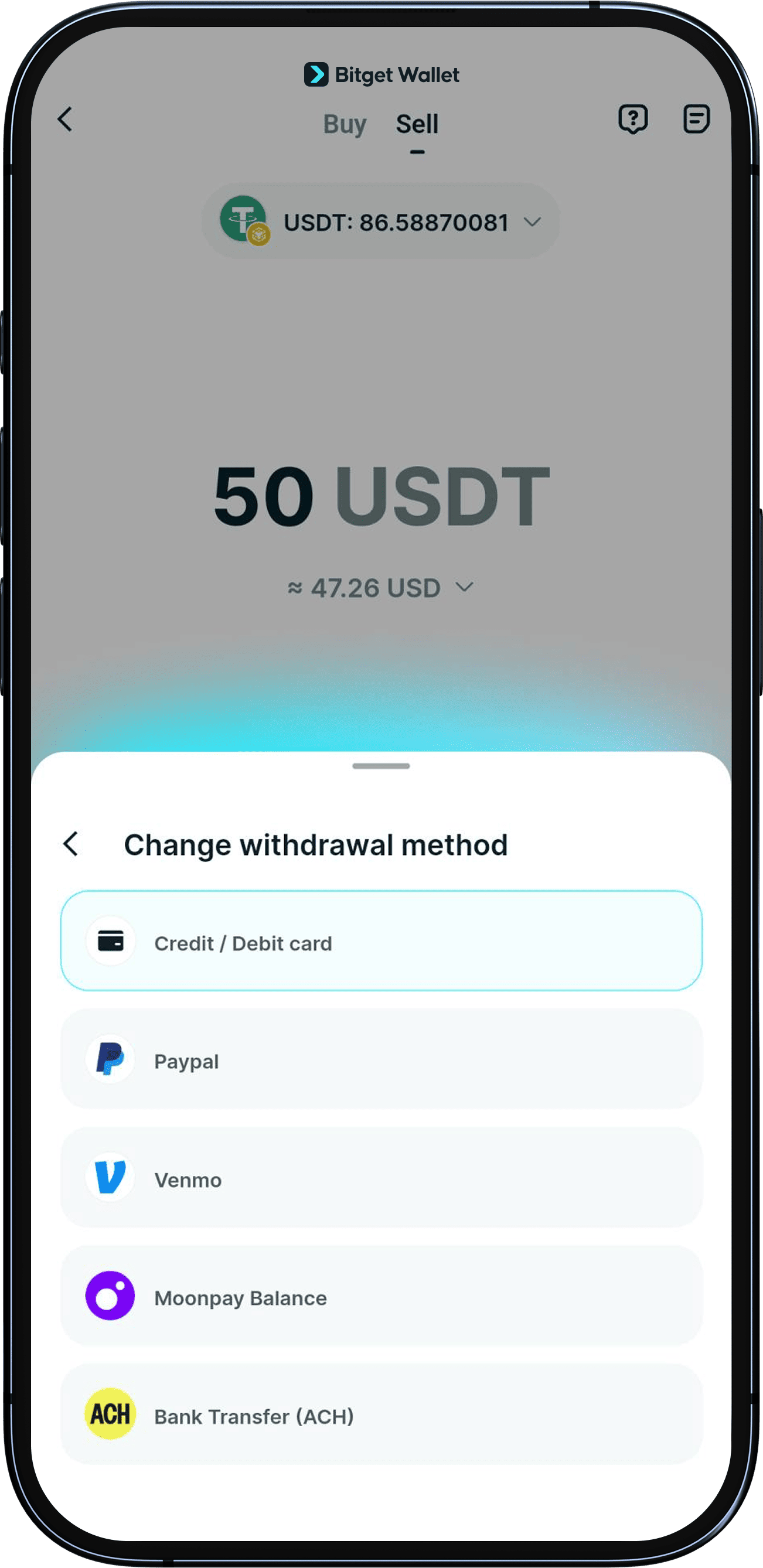

Step 3 – Choose Withdrawal Method

After conversion, choose how you want to receive fiat:

- Bank card transfer

- Visa / Mastercard payout

- Supported digital payment rails

The selected method determines processing speed and possible settlement fees.

Step 4 – Complete KYC Verification

Before finalizing the withdrawal:

- Submit required identity documents

- Complete selfie or verification steps

- Wait for approval confirmation

KYC verification is mandatory for most USDT off-ramp providers due to AML compliance requirements.

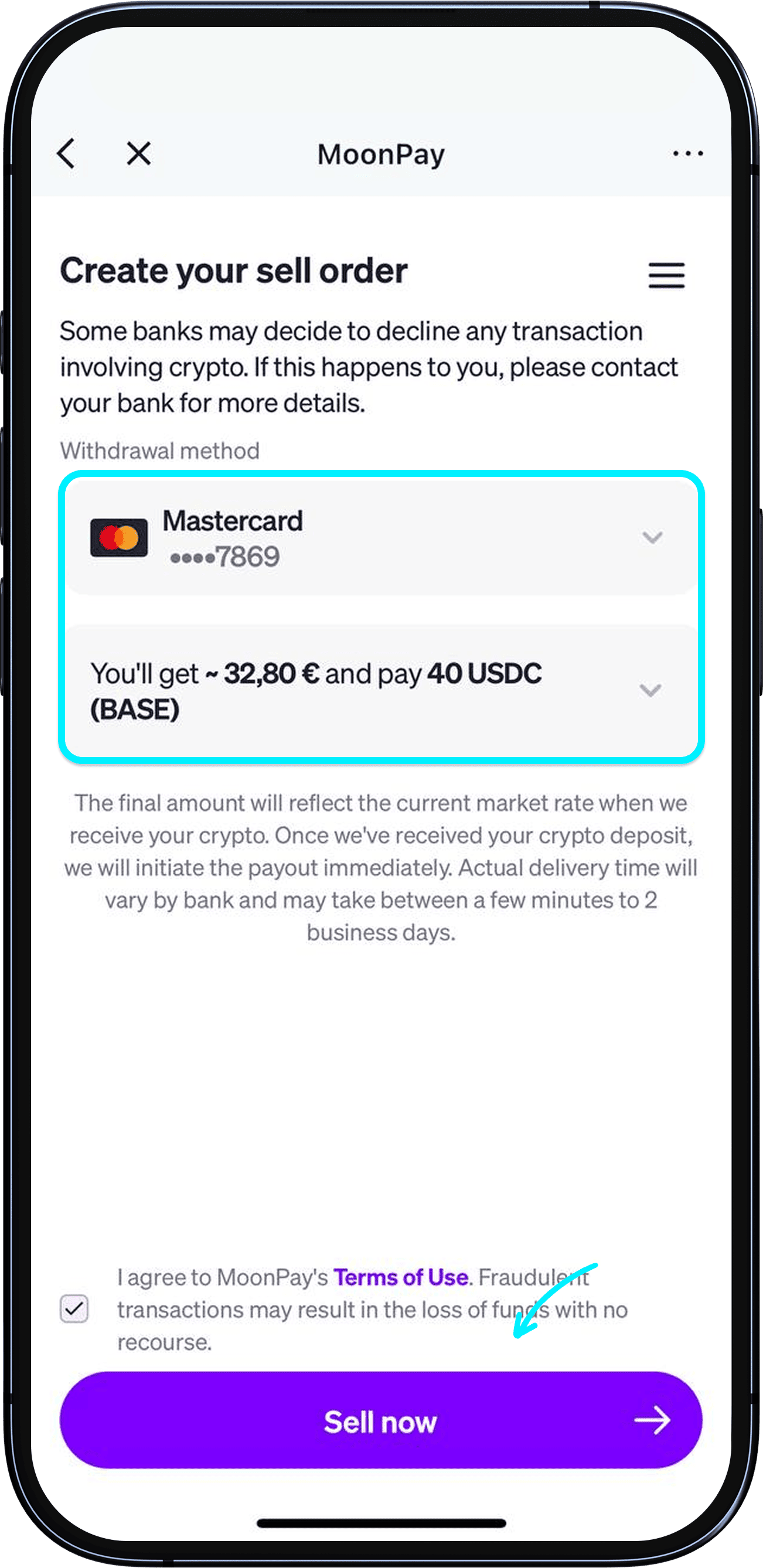

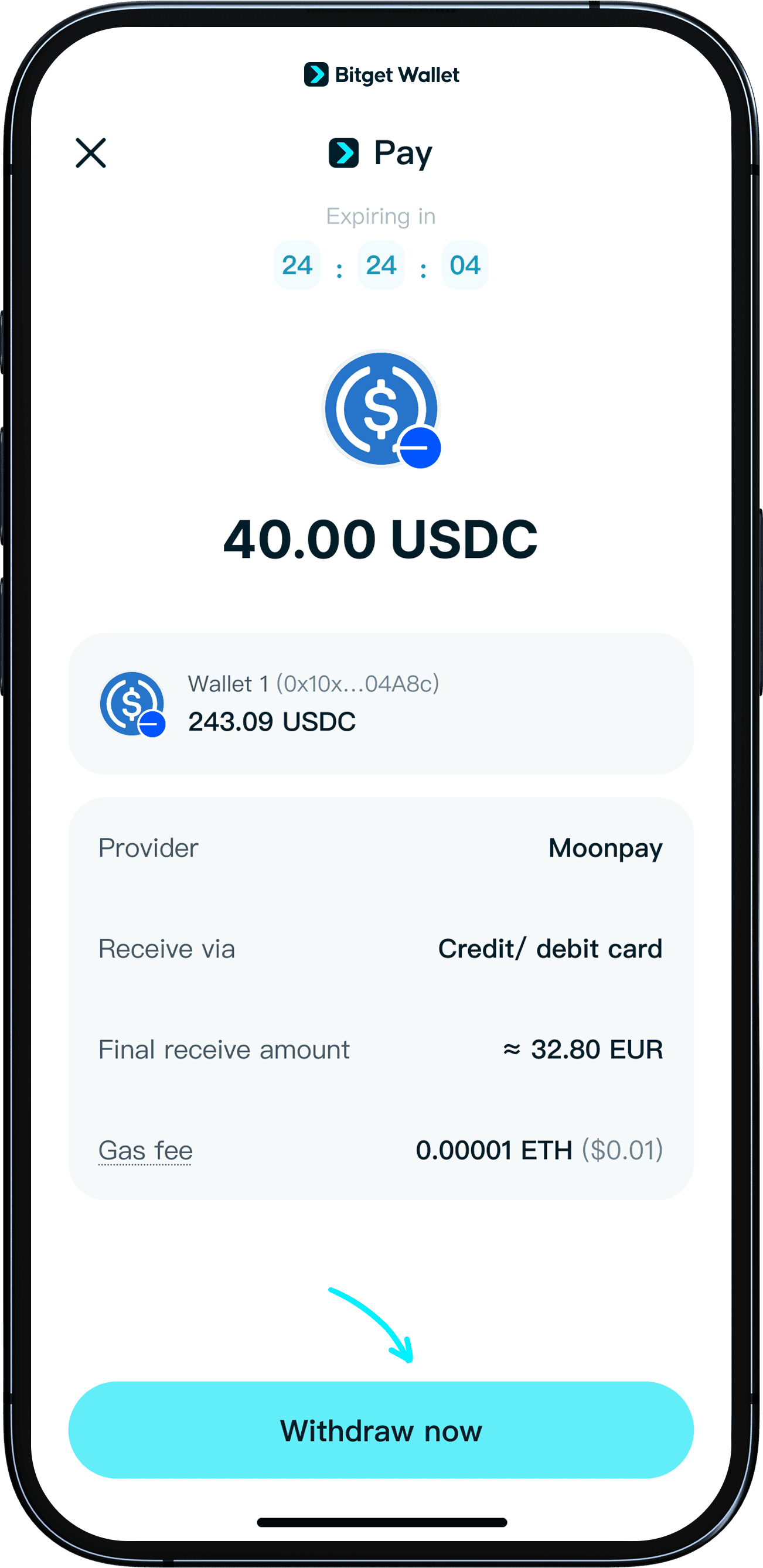

Step 5 – Confirm USDT to USD Bank Transfer

Once verified:

- Confirm transaction details

- Approve the conversion

- Track the USDT to USD bank transfer status

Settlement typically takes minutes to several hours, though some bank transfers may require 1–3 business days depending on region and compliance checks.

What Is a USDT Off-Ramp and Why Is It Required to Cash Out USDT?

A USDT off-ramp is a regulated financial service that allows users to convert blockchain-based assets like USDT into traditional fiat currencies. Since banks do not accept stablecoins directly, an off-ramp acts as the bridge between crypto networks and the traditional banking system. Without a USDT off-ramp, you cannot complete a USDT to USD bank transfer or withdraw USDT to a bank account.

When you cash out USDT, the off-ramp handles the conversion, settlement, and compliance checks required to move funds from blockchain to banking rails.

How USDT Off-Ramp Providers Work

USDT off-ramp providers operate through a structured crypto-to-fiat conversion process:

- Liquidity aggregation: They source market liquidity to convert USDT to USD (or local fiat) at competitive rates.

- Conversion execution: Once you sell USDT, the provider executes the trade behind the scenes.

- Compliance screening: Transactions are reviewed for AML compliance and risk monitoring.

- Bank settlement routing: The converted fiat is transferred to your linked bank card or bank account.

This entire process transforms your on-chain USDT into usable fiat currency.

Regulatory and Compliance Considerations

When you cash out USDT through an off-ramp, regulatory requirements apply:

- AML monitoring: Large transactions may trigger automated review systems.

- Mandatory KYC verification: Identity verification is required before enabling withdrawals.

- Jurisdiction-based reporting thresholds: Rules vary by country and region.

- Withdrawal limits: Higher limits often require higher verification tiers.

Understanding these compliance steps in advance helps prevent delays, rejected withdrawals, or temporary account holds during crypto to fiat conversion.

What Is the Best Way to Cash Out USDT Using Bitget Wallet?

The best way to cash out USDT depends on your priorities—speed, fees, security, and compliance. Inside Bitget Wallet, users can access an integrated USDT off-ramp through the Sell Crypto feature. Alternatively, users may transfer USDT to an exchange or use P2P USDT withdrawal methods, each with different cost structures and risk levels.

1. Sell crypto via Bitget Wallet

Selling USDT directly inside Bitget Wallet is the most streamlined option for most users.

- Integrated USDT off-ramp: Access fiat conversion without manually transferring funds to another platform.

- Simple crypto to fiat conversion: Select USDT, choose fiat currency, and confirm the transaction in a guided interface.

- Transparent rate preview: View the real-time rate when you convert USDT to USD before final confirmation.

- Direct USDT to USD bank transfer: Withdraw fiat to supported bank cards or payout rails after completing KYC verification.

This method reduces operational complexity and minimizes transfer risk since the entire flow happens within the wallet interface.

2. Sell USDT via Exchange Withdrawal

Another way to cash out USDT is to transfer funds to a centralized exchange.

- Deposit USDT (TRC20 USDT or ERC20 USDT) into the exchange.

- Convert USDT to USD using spot trading or instant sell options.

- Initiate a fiat withdrawal to your linked bank account.

While exchanges may offer deep liquidity, this method requires transferring assets externally and may involve additional USDT withdrawal fees and verification steps.

3. P2P USDT Withdrawal

P2P USDT withdrawal allows users to sell USDT directly to another party.

- Direct bank settlement between buyer and seller.

- Escrow system holds USDT until fiat payment is confirmed.

- Lower fees in some cases, but higher fraud or reversal risk.

Although P2P methods can sometimes reduce conversion costs, they require careful counterparty verification and strong attention to transaction safety.

What USDT Withdrawal Fees Should You Expect?

When you cash out USDT, total costs go beyond a simple conversion fee. USDT withdrawal fees typically include trading spreads when you sell USDT, blockchain network gas costs, and bank settlement or FX charges during a USDT to USD bank transfer. Understanding each layer helps you minimize overall crypto to fiat conversion costs.

- Fees When You Sell USDT

When converting USDT to USD, platforms usually charge one of two cost models:

- Spread-based pricing: Instant sell features often include a markup embedded in the exchange rate.

- Order book trading fees: Spot markets may charge a fixed percentage (e.g., 0.1%–0.3%) per trade.

- Instant conversion costs: While convenient, instant sell USDT options may cost slightly more than limit orders.

Always compare the effective rate before confirming your crypto to fiat conversion.

- Network Fees (TRC20 USDT vs ERC20 USDT)

Blockchain network selection directly impacts how much it costs to move USDT before withdrawal.

- TRC20 USDT: Typically lower gas fees and more cost-efficient for transfers.

- ERC20 USDT: Higher gas fees during Ethereum congestion.

- Impact on total cost: Even before you convert USDT to USD, network fees can reduce net proceeds.

Choosing the correct network can significantly reduce overall USDT withdrawal fees.

- USDT to USD Bank Transfer Costs

After conversion, fiat settlement may involve additional costs:

- Bank processing fees: Flat withdrawal charges depending on payment rail.

- Card payout fees: Visa or Mastercard withdrawals may carry service fees.

- FX markup: If withdrawing in a non-USD currency, currency conversion margins may apply.

These charges apply after you convert USDT to USD and initiate the USDT to USD bank transfer. Reviewing all fee layers ensures you select the best way to cash out USDT efficiently.

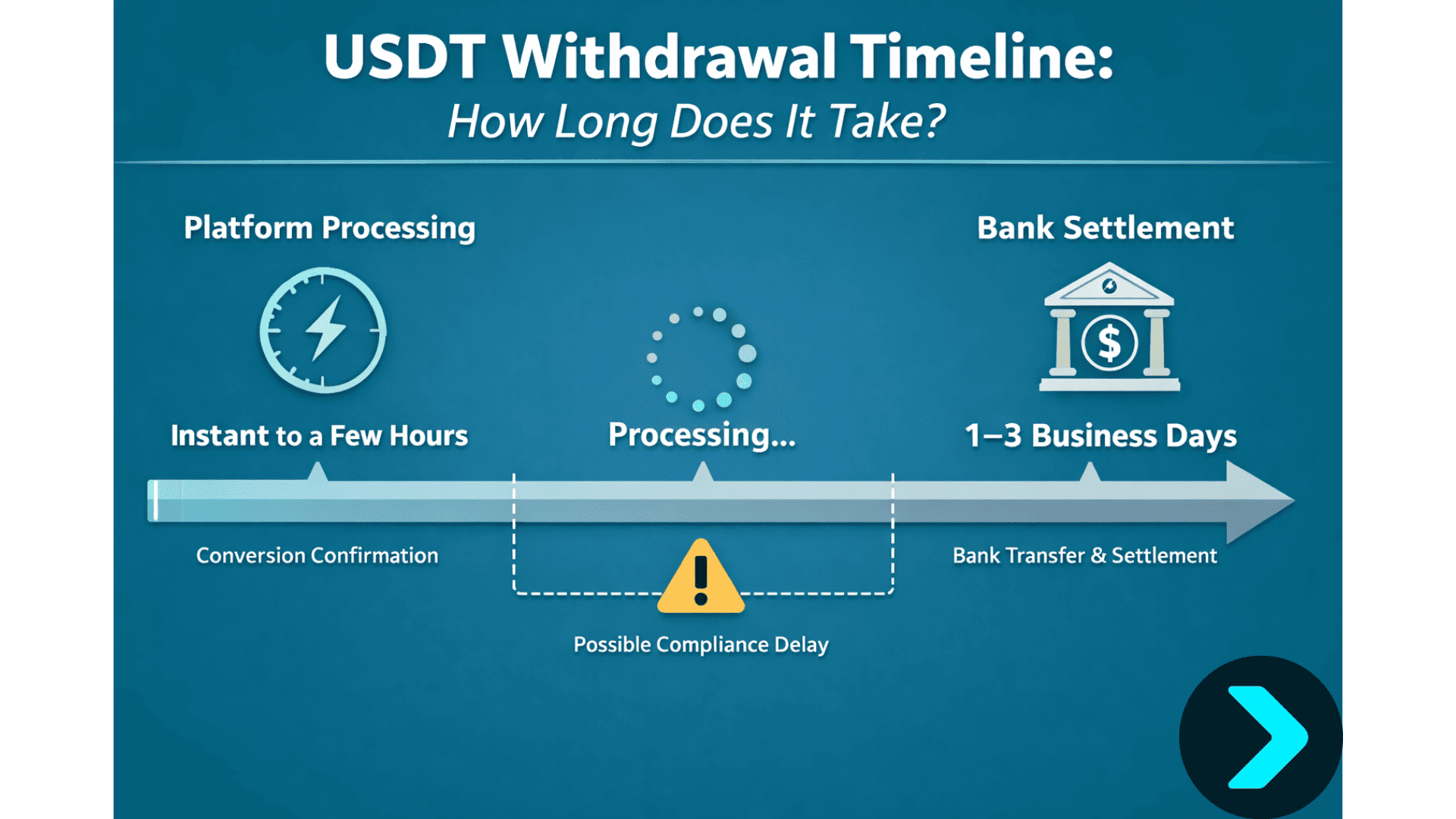

How Long Does It Take to Withdraw USDT to Bank Account?

The time required to withdraw USDT to bank account depends on two layers: the USDT off-ramp processing time (crypto to fiat conversion) and the final banking settlement window.

Platform Processing Time

This stage covers the crypto to fiat conversion and internal compliance checks.

Typical timeline:

- 0–10 minutes: Blockchain confirmation (TRC20 USDT is usually faster than ERC20 USDT)

- 5–30 minutes: Convert USDT to USD through the USDT off-ramp

- Additional review (if triggered): Manual compliance screening

Factors affecting speed:

- Network congestion (especially ERC20 gas conditions)

- Transaction size

- KYC verification status

- Risk monitoring flags

If KYC verification is already completed and the network is stable, most users can complete the USDT to USD conversion within minutes.

Bank Settlement Time

Once the USDT to USD bank transfer is initiated, the funds move through traditional banking rails.

Typical settlement window:

- Instant to same day: Supported debit rails or fast payout networks

- 1–3 business days: Standard bank transfers

- Longer delays possible: Weekends, public holidays, compliance reviews

Additional delay factors:

- Cross-border transfers

- FX conversion checks

- Large transaction thresholds

Risks to Consider Before You Cash Out USDT

Before you cash out USDT, understanding operational, banking, and compliance risks helps reduce delays, frozen transfers, unexpected USDT withdrawal fees, or failed crypto to fiat conversion attempts.

1. Banking Restrictions

Traditional banks do not operate on blockchain infrastructure. When you initiate a USDT to USD bank transfer, funds pass through regulated financial institutions that may apply internal risk controls.

Potential issues include:

- Crypto-linked transfer blocks triggered by transaction monitoring systems

- Bank policies restricting inbound transfers from digital asset platforms

- Temporary account freezes pending source-of-funds clarification

- Rejection of large or cross-border crypto to fiat conversion payouts

Mitigation strategies:

- Ensure KYC verification is fully completed before initiating withdrawal

- Avoid unusually large first-time withdrawals

- Confirm your bank supports crypto-related deposits

2. Compliance & Reporting

When you cash out USDT through a regulated USDT off-ramp, compliance frameworks apply automatically.

Key considerations:

- AML monitoring for suspicious transaction patterns

- Enhanced KYC verification triggers for high-value transfers

- Reporting thresholds depending on jurisdiction

- Transaction limits based on account verification tier

If documentation is incomplete, your convert USDT to USD request may be paused for manual review.

3. P2P USDT Withdrawal Risks

P2P USDT withdrawal can sometimes appear to be the best way to cash out USDT due to flexible pricing, but it introduces counterparty exposure.

Common risks:

- Reversal scams where fiat payments are clawed back after USDT release

- Disputes involving false payment confirmations

- Off-platform communication vulnerabilities

- Escrow misuse or delayed release

Risk reduction practices:

- Use only verified escrow systems

- Avoid releasing USDT before confirmed settlement

- Maintain transaction records for dispute resolution

Understanding these risks ensures you can sell USDT and complete crypto to fiat conversion securely, with fewer compliance disruptions and minimized financial exposure.

Related Reading on Fiat On-Ramps & Off-Ramps

If you want to better understand how fiat on-ramps and off-ramps work — from buying crypto with bank cards to converting USDT back into fiat — these guides will help you navigate the full process safely and efficiently:

🔹 Understanding Crypto On-Ramps & Off-Ramps

- What Are Crypto On-Ramps and Off-Ramps: How to Convert Fiat Into Digital Assets?

- What Is a Crypto On-Ramp and How to Buy Crypto with Fiat

- What Is a Crypto Off-Ramp and How to Convert Crypto to Fiat

🔹 Stablecoins & Fiat Conversion

- What Is Stablecoin? A Beginner’s Guide to Price-Stable Cryptocurrencies

- What Is Tether (USDT)? Complete Guide to the Leading Stablecoin

- USDC vs USDT: What’s the Difference? Investor’s Guide

🔹 Practical Guides: Buying and Selling Crypto with Fiat

- USDT On-Ramp Complete Guide: How to Buy Tether (USDT) with Fiat

- Cash Out USDT: How to Withdraw USDT to Bank Account?

- How to Withdraw USDT and Tether via Exchanges, P2P, and Crypto Cards

Conclusion

Cash Out USDT is not simply about clicking withdraw — it requires a structured process: selecting a regulated USDT off-ramp, choosing the correct network (TRC20 USDT or ERC20 USDT), converting USDT to USD at transparent rates, completing KYC verification, and confirming a compliant USDT to USD bank transfer.

By following a step-by-step framework, you reduce USDT withdrawal fees, avoid banking disruptions, and ensure smooth crypto to fiat conversion. Using an integrated solution like Bitget Wallet simplifies the process by combining wallet control, Sell Crypto access, rate preview, and secure off-ramp routing within a single interface.

Ready to cash out USDT fast? Download Bitget Wallet now and start your secure USDT to USD bank transfer today.

Sign up Bitget Wallet now - grab your $2 bonus!

FAQ

1. How do I cash out USDT to bank account using Bitget Wallet?

Open Bitget Wallet, go to Sell Crypto, select USDT, convert USDT to USD, complete KYC verification, and confirm your USDT to USD bank transfer through the integrated USDT off-ramp.

2. What is the best way to cash out USDT?

The best way to cash out USDT depends on speed, fees, and security. Using a regulated USDT off-ramp inside Bitget Wallet simplifies crypto to fiat conversion while reducing transfer risks.

3. How do I convert USDT to USD before withdrawal?

You must sell USDT through an exchange or USDT off-ramp. Select the amount, review the exchange rate, confirm the conversion, and then initiate the fiat withdrawal.

4. Are USDT withdrawal fees high?

USDT withdrawal fees vary depending on network choice (TRC20 USDT vs ERC20 USDT), trading spreads, and bank settlement charges. Choosing lower-fee networks can reduce total costs.

5. What is a USDT off-ramp?

A USDT off-ramp is a regulated service that enables crypto to fiat conversion by converting USDT into traditional currency and transferring funds to your bank account.

6. How long does a USDT to USD bank transfer take?

After conversion, most USDT to USD bank transfers settle within minutes to 3 business days, depending on payment method and compliance checks.

Risk Disclosure

Please be aware that cryptocurrency trading involves high market risk. Bitget Wallet is not responsible for any trading losses incurred. Always perform your own research and trade responsibly.