USDT On-Ramp Complete Guide: How to Buy Tether (USDT) with Fiat?

What is USDT on-ramp? Entering the world of cryptocurrency, most of us start with a seemingly simple question: "How do I exchange my cash for USDT?" That conversion moment – from familiar fiat currencies like USD, EUR, or VND to Tether (USDT) – is a crucial turning point. It's done through a special gateway: USDT on-ramp.

The real challenge for newcomers isn't buying USDT, but choosing the right gateway amidst a sea of options, along with concerns about hidden fees, cumbersome KYC verification procedures, and transaction risks. USDT, with its near-absolute stability thanks to its USD peg, deep liquidity, and widespread support, has become the default asset for anyone wanting to enter the crypto world.

In this guide, we'll unravel the workings of on-ramps, highlight key considerations when choosing one, and show you how to use them intelligently and effectively.

Key Takeaways

- USDT on-ramps are the standard entry point into crypto, enabling users to convert fiat into USDT with predictable value, deep liquidity, and broad on-chain compatibility.

- Choosing the right USDT on-ramp matters, as fees, KYC requirements, speed, and custody models vary significantly across centralized, wallet-based, and local payment platforms.

- Safe and cost-efficient USDT onboarding requires discipline, including verifying platforms, avoiding intermediaries, selecting the correct network, and managing fees after a Tether deposit.

What Is an On-Ramp?

An on-ramp acts as a digital bridge. On one side is the traditional payment system with banks and credit/debit cards. On the other side is the decentralized blockchain world, where you actually own your assets.

Its core role is to handle everything from transactions and legal compliance (KYC/AML) to settlement, transforming value from your bank account into "digital fuel" that can circulate on the chain. More specifically, an on-ramp:

- Performs conversion: Allows you to directly purchase USDT using fiat currency.

- Acts as a bridge: Connects traditional payment pipelines with blockchain wallets or exchanges.

- As a starting point: A successful Tether deposit transaction via on-ramp is when your physical currency becomes digital liquidity, ready for any further journey in the crypto universe.

Ream more: What Are Crypto On-Ramps and Off-Ramps: How to Convert Fiat Into Digital Assets?

Why Use USDT as Your Entry Asset When On-Ramping with Fiat?

USDT is the most common asset used to convert USD to USDT because it allows users to move fiat value on-chain without immediately taking on market volatility. Instead of timing the price of BTC or ETH at the entry point, users can complete a USDT on-ramp first, preserve value, and decide later how to allocate funds across trading, transfers, or DeFi. This makes USDT a functional entry asset rather than a speculative bet.

Key advantages of using Tether (USDT) to start participating in the crypto market:

- Stability: While BTC and ETH can fluctuate wildly, USDT is like cash in your pocket – 1 USDT is almost always equal to 1 USD. For beginners, using USDT helps you avoid the situation where your deposited funds disappear immediately due to volatility.

- Widely accepted: USDT is now considered the common currency of crypto. From large and small exchanges, personal wallets, to hundreds of DeFi applications – almost everywhere accepts USDT. You can use it immediately after purchase, without the hassle of exchanging it back and forth.

- Deep liquidity: USDT is present on many blockchains (Ethereum, Tron, BSC, Solana…), with huge trading volume, so when you need to transfer money or swap to other coins, it's extremely fast, with low fees, and without fear of slippage.

Therefore, depositing with USDT is like having a safe haven before setting sail. You have control over when to buy and sell, avoiding being overwhelmed by market fluctuations before you even understand the game. Start with a solid foundation, and you'll be more confident in taking the next steps.

What Types of USDT On-Ramp Platforms Are Available?

Different USDT on-ramp platforms serve different user needs depending on experience level, region, and compliance preferences. The table below summarizes the main models and their trade-offs.

| On-Ramp Type | Overview | Strengths | Limitations |

| Centralized exchange on-ramps | Platforms that allow users to buy USDT with fiat via cards or bank transfers | Beginner-friendly, high liquidity, fast execution | Custodial, KYC required, withdrawal controls |

| Decentralized & wallet-based on-ramps | Wallet-integrated services enabling non-custodial crypto onboarding | User retains asset control, flexible on-chain usage | Higher fees in some regions, limited payment methods |

| Local payment on-ramp services | Region-specific providers tailored to local banks and payment rails | Solves how to buy USDT in [region], localized access | Variable reliability, fragmented coverage, compliance varies |

Each model differs in fees, speed, and regulatory friction. Choosing the right on-ramp depends on whether the priority is ease of use, self-custody, or regional payment compatibility.

How Do You Buy USDT with Fiat Currency?

Buying USDT with fiat typically follows a structured crypto onboarding flow that combines account setup, payment selection, compliance checks, and final settlement. While interfaces vary by platform, the underlying process is largely consistent across most USDT on-ramp services.

At a high level, users go through account creation and verification, choose a fiat funding method, execute the purchase, and then manage their USDT after the Tether deposit.

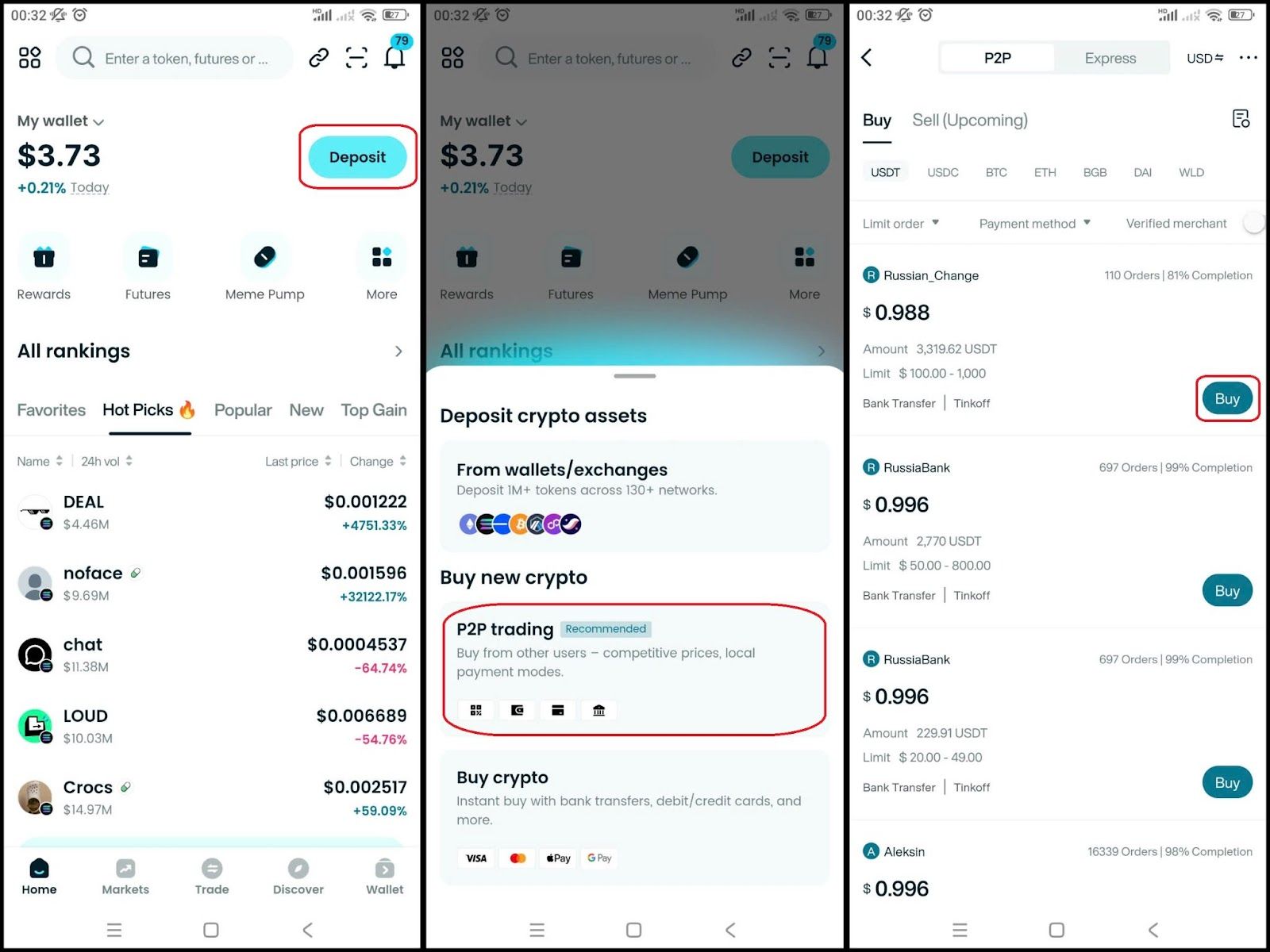

Step 1: Buy using bank transfers, credit cards, and more

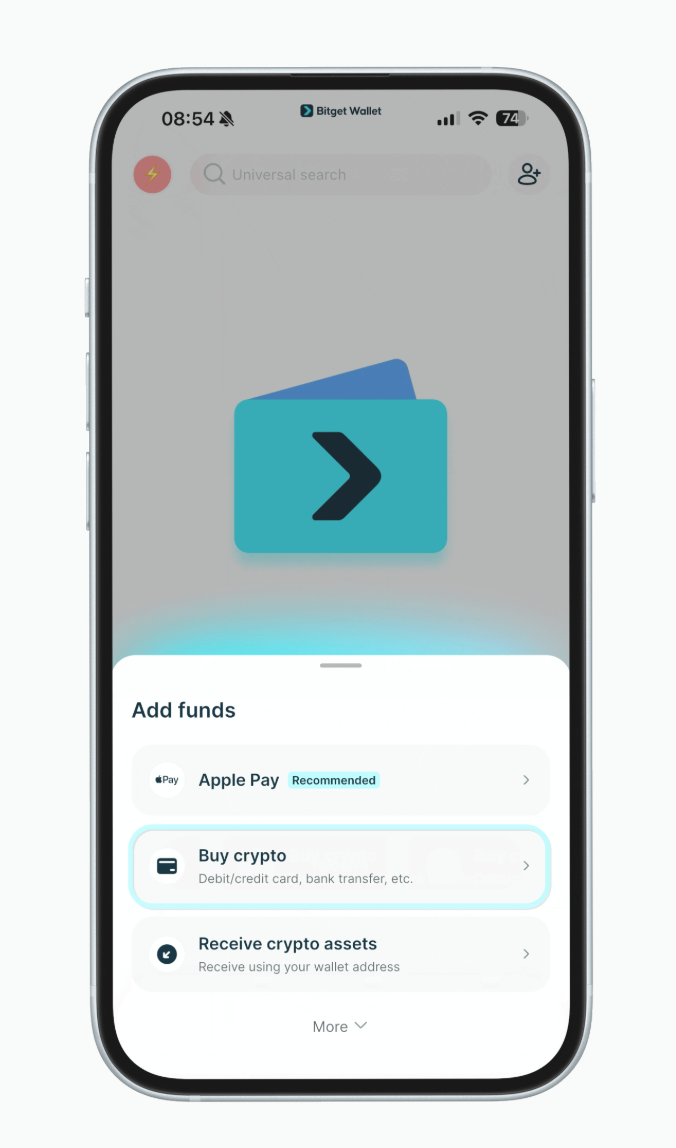

Tap "Add funds" > "Buy crypto" to buy crypto instantly using bank transfers, credit cards, and other online payment methods.

Step 2: Choose payment currency and token to buy

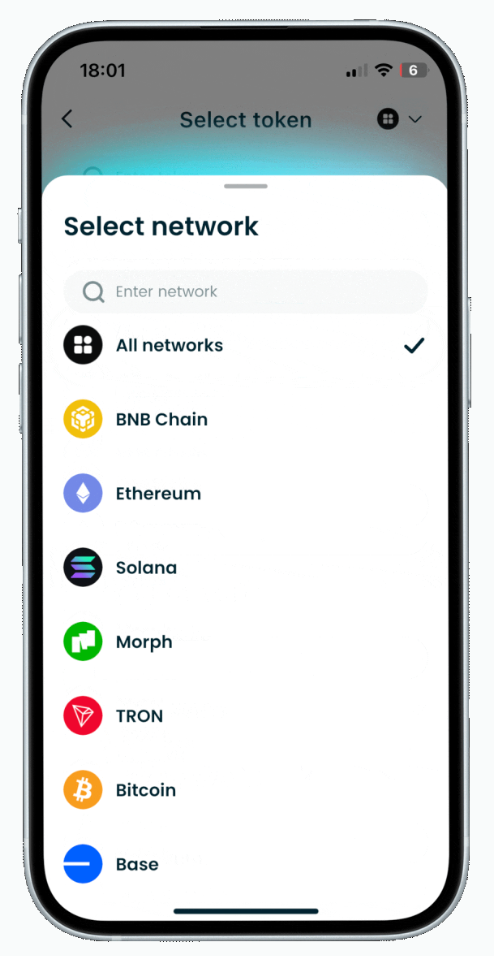

Make sure to double-check the network (mainnet) of the token you want to buy. Many tokens exist on multiple networks.

We recommend buying some native coins (e.g., ETH for Ethereum, SOL for Solana) to start with.

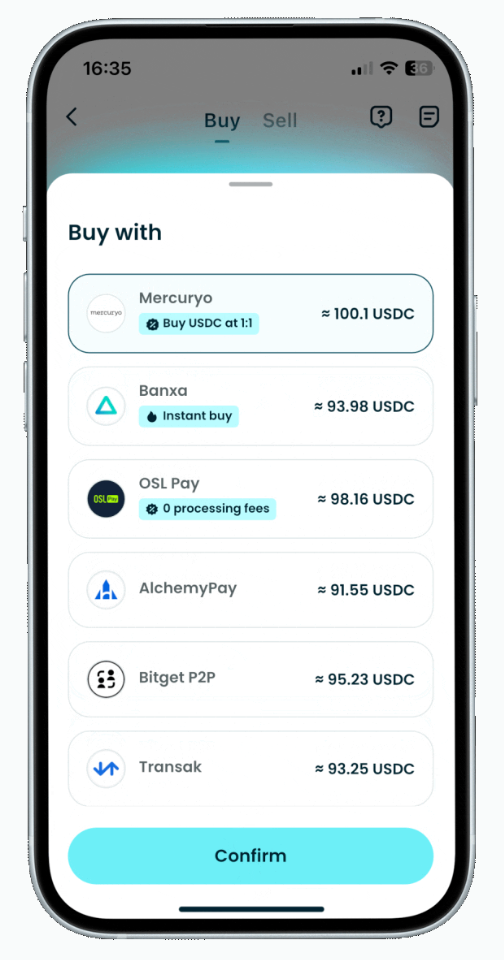

Step 3: Choose a payment provider

We'll automatically choose the best payment provider, but you can switch to another one if you prefer.

Step 4: Completing identity verification

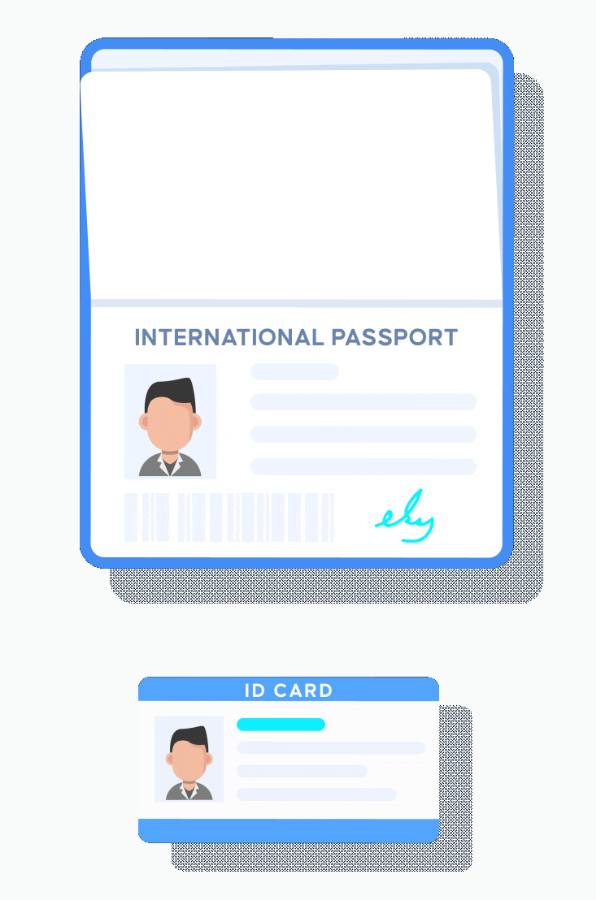

You will be asked to verify your identity (known as KYC, or Know Your Customer) with a passport or ID card. This is important for safety and compliance reasons, preventing fraud and money laundering.

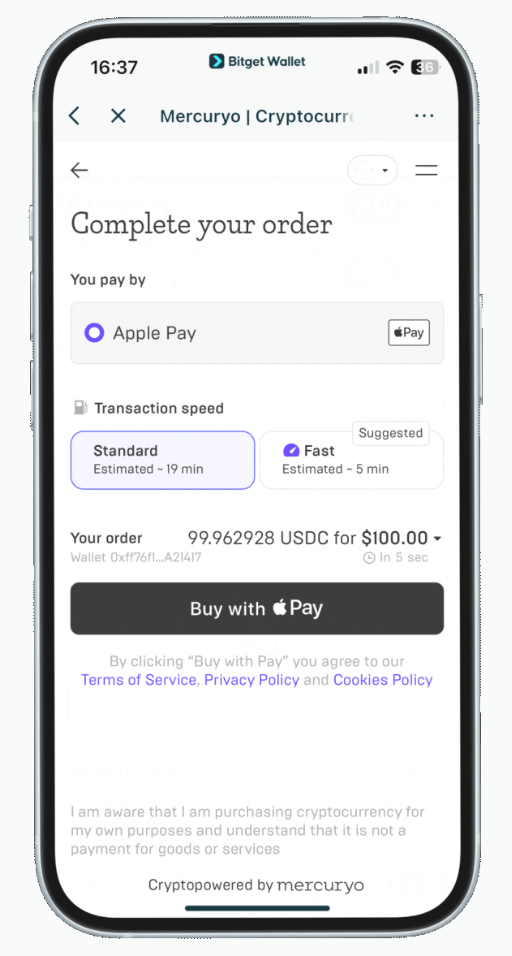

Step 5: Completing your payment

Follow the instructions to complete your payment.

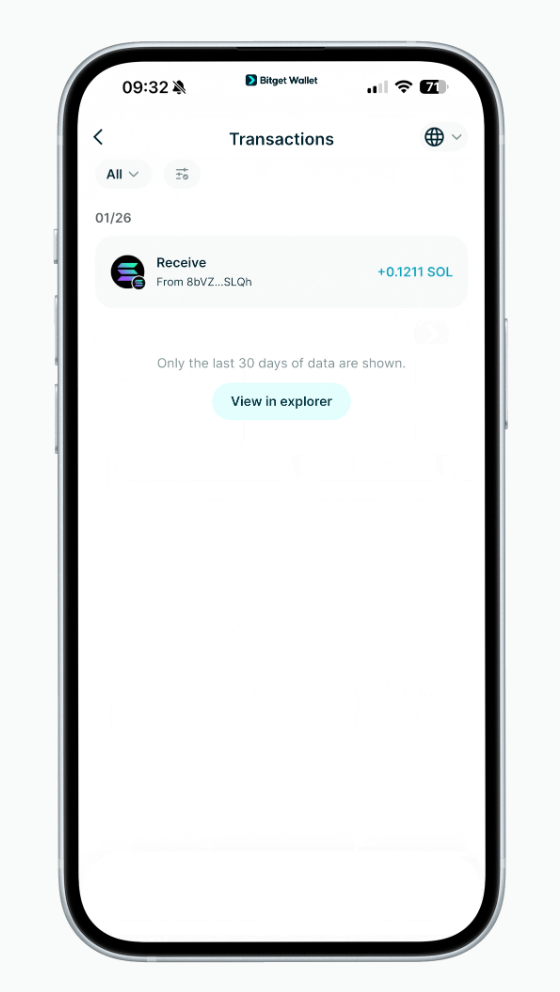

Step 6: Checking your balance

Once payment is successful, you will be redirected back to the app. Here, you can check your balance and view the deposit order.

After purchase, users may keep USDT on the platform, transfer it to a self-custodial wallet, bridge it across chains, or deploy it for trading, payments, or DeFi—depending on their goals.

How Can You Minimize the Fees for a USDT On-Ramp?

Depositing and buying USDT might seem simple, but if you're not careful, you can easily be ripped off by hidden fees. Understanding the cost structure will help you find the cheapest way to buy USDT, suitable for your region and payment method.

Typically, you will encounter the following fees:

- Payment processing fee: Charged by payment gateways (cards, banks, local e-wallets).

- Spread: The difference between the market price and the actual price you pay – this is often overlooked but unexpectedly costly.

- Withdrawal/Deposit/Transfer fee: Network fee when you withdraw USDT to your personal wallet or transfer it to another network.

Generally, bank transfers (ACH, SEPA, or local channels) are usually cheaper but slower, while debit/credit cards are more expensive for near-instantaneous speed. Local payment methods are sometimes very advantageous, but their reliability and limits vary widely.

To reduce fees, remember:

- Compare different exchanges/platforms carefully before deciding to buy.

- Check if the listed price includes the spread.

- Consider combining transactions to avoid repeated network fees.

The optimal choice usually depends on three factors: where you are located, whether you need it urgently, and how much you are buying.

How Can You Use USDT On-Ramps Safely and Avoid Common Risks?

USDT deposit services are generally reliable, but this "entry-level" step is where most users make mistakes and fall into scams – especially when converting from fiat currency to USDT for the first time.

Common pitfalls to watch out for:

- Fake websites impersonating legitimate exchanges or deposit services.

- Unauthorized "middlemen" offer to "assist" you in buying USDT.

- Social media tactics pressure you into taking unsafe actions before the transaction is complete.

To protect yourself, follow these basic safety principles:

- Check the platform carefully: Only access the official website or use the in-app deposit feature. Stay away from strange links from private messages or social media.

- Say no to middlemen: Absolutely do not transfer cash or cryptocurrency to any individual who claims to "buy on your behalf."

- Use a secure wallet: After purchasing, withdraw USDT to your own wallet (the wallet where you hold the private key). Don't keep it on an exchange for too long.

- Be careful with the network: USDT exists on multiple blockchains. Choosing the wrong network when withdrawing funds can cause your assets to disappear permanently.

- Be cautious about urgent requests: Legitimate platforms will never request private keys, seed phrases, or urgent payments outside the platform.

Adhering to these guidelines ensures that USDT deposits are truly a safe gateway to the crypto world, not a weakness that leaves you penniless.

How Can You Buy and Manage USDT Using Bitget Wallet?

Bitget Wallet is not just a storage place; it can become a comprehensive "transfer station" for your journey with USDT – from purchasing with cash, to storage, swapping, and cross-chain movement, all in a single interface.

Key benefits of using Bitget Wallet for USDT:

- Multi-chain support: You can hold and use USDT on major networks such as Ethereum, BNB Chain, Tron, Polygon, Solana, etc., making capital movement between ecosystems smooth.

- In-wallet swaps: You can easily convert USDT to other tokens directly on the chain without leaving your wallet, ready to participate in trading, DeFi, or payments with just a few taps.

- Centralized asset management: All operations, from depositing fiat currency and swapping tokens to transfers, are performed in a secure and unified non-custodial environment.

Buying USDT on Bitget Wallet is easy! Just follow these simple steps:

Step 1: Create a wallet

- If you don't have a wallet, download Bitget Wallet app now.

- Register with your phone number or email, verify quickly and you can use it right away.

Step 2: Deposit money into your wallet

Once you have finished your wallet, you just need to deposit money into it. You can:

- Transfer coins from other wallets: Send BTC, ETH or any coin you have from an external wallet.

- Buy directly with a card: Use a bank card or credit card to buy USDT or ETH right in the app.

What Are the Alternatives to Using a USDT On-Ramp?

While USDT on-ramps are the most common entry path, they are not the only option for crypto onboarding.

- Using other stablecoins: Some users choose USDC or regional stablecoins depending on availability, regulation, or on-chain use cases.

- Buying volatile assets directly: Users may buy BTC, ETH, or other cryptocurrencies with fiat, accepting price exposure at the entry point.

- Cost-based alternatives: In certain regions, direct purchases of major assets or local stablecoins may be cheaper than a USDT on-ramp.

Each alternative involves trade-offs between price stability, liquidity, and execution risk. For most users, however, a USDT on-ramp remains the most flexible and predictable starting point.

Related Reading on Buying Crypto

If you’re looking to better understand how to buy crypto safely and efficiently, the following guides can help:

- What is Stablecoin? A Beginner’s Guide to Price-Stable Cryptocurrencies

- What is Tether USDT: A Complete Guide to the World’s Leading Stablecoin

- What Are Crypto On-Ramps and Off-Ramps

- USDT On-Ramp Complete Guide: How to Buy Tether (USDT) with Fiat?

- How to Buy USDT: A Step-by-Step Guide for Beginners and Advanced Users

- USDC vs USDT: What’s the Difference? Investor’s Guide for 2026

Conclusion

Choosing a platform to buy USDT with fiat currency ultimately involves a trade-off between three factors: platform type, hidden costs, and payment method. There's no perfect solution. You always have to compromise between fast transaction speeds, the lowest fees, and wide reach – especially when your goal is to find the cheapest and least cumbersome way to buy USDT.

Once you have USDT in hand, the real journey begins. You can keep it safe in your self-managed wallet, move it across chains to explore new opportunities, or flexibly swap it to other assets as the market fluctuates. At this point, a comprehensive tool like Bitget Wallet becomes invaluable, integrating swap capabilities, multi-chain support, and giving you complete control on a single interface.

Sign up Bitget Wallet now - grab your $2 bonus!

FAQs

1. Is KYC required to buy USDT?

Most exchanges/gateways require KYC to comply with regulations, especially when using bank cards or bank transfers. A few platforms may allow limited transactions with simpler procedures.

2. What is the minimum amount to buy USDT?

This varies depending on the platform and payment method. Card transactions usually require a higher minimum amount, while bank transfers or local channels may be more flexible, allowing you to buy smaller amounts.

3. How long does a USDT deposit transaction usually take?

If using a card, you will usually receive USDT immediately. With bank transfers, the time can range from a few hours to several business days, depending on the method and provider you choose.

4. Are there any country/region restrictions when buying USDT?

Yes. Due to differences in local regulations, supported payment methods, transaction limits, and service availability will vary by country or region.

Risk Disclosure

Please be aware that cryptocurrency trading involves high market risk. Bitget Wallet is not responsible for any trading losses incurred. Always perform your own research and trade responsibly.