What Are Crypto On-Ramps and Off-Ramps: How to Convert Fiat Into Digital Assets?

What Are Crypto On-Ramps and Off-Ramps? A crypto on-ramp is the process of converting fiat money into crypto, while a crypto off-ramp converts crypto back into fiat. This matters because it gives users a clear way to enter and exit the market using familiar payment rails like cards and bank transfers. For beginners, a USDT on-ramp is often the simplest first step because stablecoins reduce price volatility during onboarding.

Ramps are not just “buy and sell buttons.” They include payment methods, a payment provider layer, and compliance steps such as KYC verification—plus practical risks like choosing the wrong token network.

In this article, we’ll explain the core definitions, why ramps drive adoption, how the end-to-end process works, where mistakes happen, and how to buy crypto safely in-app using an on-ramp workflow.

Key Takeaways

- An on ramp converts fiat into crypto while an off ramp converts crypto into fiat and confusing access through ramps with trading is the main source of user error.

- USDT on ramps are common because stablecoins reduce volatility and make onboarding and budgeting easier for beginners.

- Crypto ramps depend on payment providers KYC verification and correct network selection and even fast systems can fail without careful execution.

What Are Crypto On-Ramps and Off-Ramps?

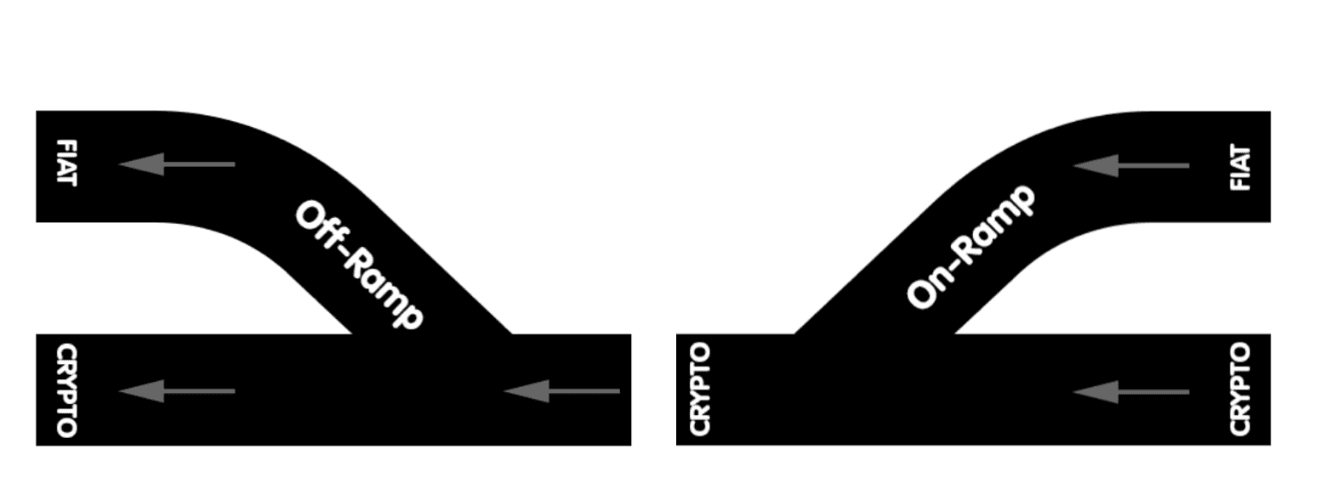

Crypto on-ramps and crypto off-ramps are the “bridge layer” between traditional finance and digital assets. They allow users to move value between bank accounts, payment cards, and wallets on one side—and cryptocurrencies and stablecoins on the other.

Source: fiahub.com

What Is a Crypto On-Ramp?

A crypto on-ramp is the process or service that converts fiat to crypto.

- In other words: On-ramp = fiat → crypto.

- Crypto on-ramps typically use payment methods such as credit cards, bank transfers, or local online payments to purchase digital assets. Because fiat currencies remain the dominant form of money globally, a fiat on-ramp is the most common way new users access crypto for the first time.

- Many users start with a stablecoin on-ramp, such as buying USDT or USDC, because stablecoins reduce price volatility during onboarding and are widely usable across exchanges and on-chain applications.

What Is a Crypto Off-Ramp?

A crypto off-ramp is the process or service that converts crypto to fiat. This includes selling cryptocurrency and receiving funds back to a bank account, card, or other fiat payout method.

Off-ramps are critical because they provide exit assurance. Users are more willing to hold and use crypto when they know they can convert digital assets back into fiat at any time. Without reliable off-ramps, crypto would function as a closed system rather than a practical financial tool.

What’s the Difference Between Fiat On-Ramps and Crypto On-Ramps?

The terms are closely related but serve different levels of meaning.

- A crypto on-ramp describes the overall concept of entering crypto from traditional finance.

- A fiat on-ramp refers specifically to using government-issued money—via cards or banks—to do so.

- Likewise, a fiat off-ramp means receiving fiat after converting crypto.

| Term | What it refers to | Conversion direction |

| Crypto on-ramp | General entry into crypto | Fiat → Crypto |

| Fiat on-ramp | Buying crypto using fiat payment methods | Fiat → Crypto |

| Crypto off-ramp | General exit from crypto | Crypto → Fiat |

| Fiat off-ramp | Receiving fiat after selling crypto | Crypto → Fiat |

Why Do Crypto On-Ramps and Off-Ramps Matter for Adoption?

Crypto on-ramps and off-ramps are not just technical tools—they are the usability layer that determines whether digital assets can reach mainstream users. Without simple and trusted conversion paths, crypto remains inaccessible to anyone outside niche communities.

By integrating familiar payment rails, ramps reduce complexity and make participation possible without deep technical knowledge.

Source: epicofinance.com

How Do On-Ramps Reduce Friction for First-Time Users?

On-ramps lower the entry barrier by allowing users to pay with methods they already understand, such as debit cards or bank transfers. Instead of learning wallets, gas fees, and networks upfront, users can focus on a single action: buying crypto.

When on-ramping feels as simple as paying online, new users are more likely to take the first step into digital assets without fear or confusion.

How Do Off-Ramps Build Trust and Real-World Utility?

Off-ramps create confidence by ensuring users are not locked into crypto indefinitely. This ability to convert crypto to fiat enables practical use cases, including:

- Cross-border remittances

- Everyday payments and merchant settlement

- Business payouts and treasury management

Without off-ramps, crypto would struggle to function beyond speculation.

How Are Payment Networks and Partners Improving Ramps?

Payment networks and infrastructure providers are actively improving ramp experiences by supporting stablecoins, faster settlement, and broader regional coverage. Traditional finance and crypto-native systems increasingly work together to reduce friction at the conversion layer.

For example, Mastercard has explored stablecoin-compatible payment flows, while infrastructure providers such as Paxos support regulated stablecoin frameworks. These efforts point toward ramps that are faster, safer, and more intuitive for everyday users.

How Does the Crypto On-Ramp and Off-Ramp Process Work End-to-End?

At a core level, crypto on-ramps and off-ramps function as an infrastructure layer that connects traditional payment systems with blockchain settlement. While products and interfaces differ, the underlying logic is consistent: fiat and crypto are exchanged through regulated intermediaries that manage payment routing, compliance, and settlement.

Core Process Flow

- Payment initiation: A fiat or crypto conversion request is created using a supported payment rail.

- Provider routing: A payment provider determines pricing, liquidity sourcing, and regional availability.

- Compliance checks: KYC and risk controls are applied based on jurisdiction, payment method, and transaction size.

- Settlement: Value is settled either on-chain (for crypto delivery) or through traditional rails (for fiat payout).

This sequence defines how value moves between fiat and crypto, regardless of platform design.

On-Ramp vs Off-Ramp at the System Level

| Process Type | Input | Output | Primary Role |

| Crypto on-ramp | Fiat currency | Crypto asset | Enable entry into crypto |

| Crypto off-ramp | Crypto asset | Fiat currency | Enable exit back to fiat |

Most friction occurs at system boundaries, such as network mismatches, execution cost opacity, gas requirements, or compliance delays, which is why ramps should be understood as infrastructure rather than simple buy or sell actions.

What Is a USDT On-Ramp and Why Do Beginners Use It So Often?

A USDT on-ramp is one of the most widely used entry points into crypto, particularly for first-time users. Stablecoins like USDT reduce exposure to short-term price volatility, making them a practical starting asset when converting fiat into digital value.

Source: dev.to

What Does “USDT On-Ramp” Mean in Practice?

A USDT on-ramp refers to buying USDT with fiat through a crypto on-ramp using payment methods such as cards or bank transfers. Instead of purchasing a volatile asset directly, users receive a stablecoin that is pegged to the U.S. dollar.

In practice, USDT functions as a stable-value bridge that allows users to enter the crypto ecosystem before deciding how or when to allocate funds into other assets.

Why Is USDT Often the Default Stablecoin On-Ramp?

USDT is commonly used as a stablecoin on-ramp for several practical reasons:

- Price stability compared to assets like BTC or ETH

- Broad acceptance across exchanges, DeFi protocols, and on-chain applications

- Simpler budgeting for users unfamiliar with crypto market volatility

These characteristics make USDT easier to understand and manage during the onboarding phase.

When Should Users Prefer a Stablecoin On-Ramp Over Buying BTC or ETH Directly?

A stablecoin on-ramp may be more suitable when:

- Users plan to swap into other tokens after onboarding

- Users want to avoid immediate price fluctuations

- Users need stable settlement for payments, transfers, or short-term holding

In these cases, starting with a USDT on-ramp provides flexibility without forcing an immediate exposure to market volatility.

Which Types of Crypto On-Ramps and Off-Ramps Exist Today?

Crypto on-ramps and off-ramps come in several structural forms, each designed to balance speed, cost, compliance, and custody in different ways. While the conversion goal is the same—moving value between fiat and crypto—the execution model varies depending on user needs and regulatory context.

Understanding these categories helps users choose the right ramp based on convenience, control, and risk tolerance.

What Are the Main Ramp Types Users Will See?

Most users encounter one of the following ramp types:

-

Centralized exchanges:

These platforms combine fiat payment rails with custodial crypto accounts. They often offer high liquidity and broad asset support, but users rely on the platform to hold funds during conversion.

-

P2P marketplaces:

Peer-to-peer ramps match buyers and sellers directly. While flexible, they may involve longer settlement times and higher counterparty risk.

-

Payment processors / embedded ramp providers:

These services integrate fiat-to-crypto and crypto-to-fiat conversion directly into apps or wallets, abstracting banking, compliance, and settlement through a payment provider layer.

-

Broker-style checkout experiences:

Simplified “buy now” interfaces that prioritize ease of use, often at the cost of higher spreads or fees.

Each type reflects a trade-off between simplicity, custody control, and compliance overhead.

How Do Embedded Ramp Providers Bundle On-Ramp and Off-Ramp?

Embedded ramp providers combine on-ramp and off-ramp functionality into a single integration. Instead of redirecting users to multiple services, these providers handle fiat payments, crypto delivery, compliance checks, and payouts within one consistent flow.

Typical features include global payment coverage, built-in KYC verification, fraud monitoring, and regional payout support. For example, MoonPay offers a unified ramp infrastructure that allows users to buy crypto and cash out to fiat without leaving the host application.

This model reduces friction for end users while simplifying compliance and settlement for product builders.

What Should a Comparison Table Include for Choosing a Ramp?

When comparing crypto on-ramps and off-ramps, a clear framework helps avoid surface-level decisions based on price alone. A practical comparison table should include:

| Method | Typical speed | Fees / spread | KYC intensity | Best for | Key risk |

| Centralized exchange | Medium | Lower fees, variable spread | High | Active traders | Custody exposure |

| P2P marketplace | Slow–Medium | Negotiated | Low–Medium | Regional access | Counterparty risk |

| Embedded payment provider | Fast | Moderate spread | Medium | Beginners, apps | Limited provider choice |

| Broker-style checkout | Fast | Higher spread | Low–Medium | Simplicity | Cost opacity |

Placing payment provider details alongside speed, fees, and KYC requirements helps users understand where costs and delays originate.

Why Do KYC Verification and Compliance Matter in On-Ramping and Off-Ramping?

Crypto on-ramps and off-ramps interact directly with regulated fiat systems, which makes compliance unavoidable. Identity verification, transaction monitoring, and fraud controls exist to protect both users and payment networks from abuse.

Rather than being optional friction, these checks are a structural requirement of fiat-to-crypto conversion.

What Is KYC Verification?

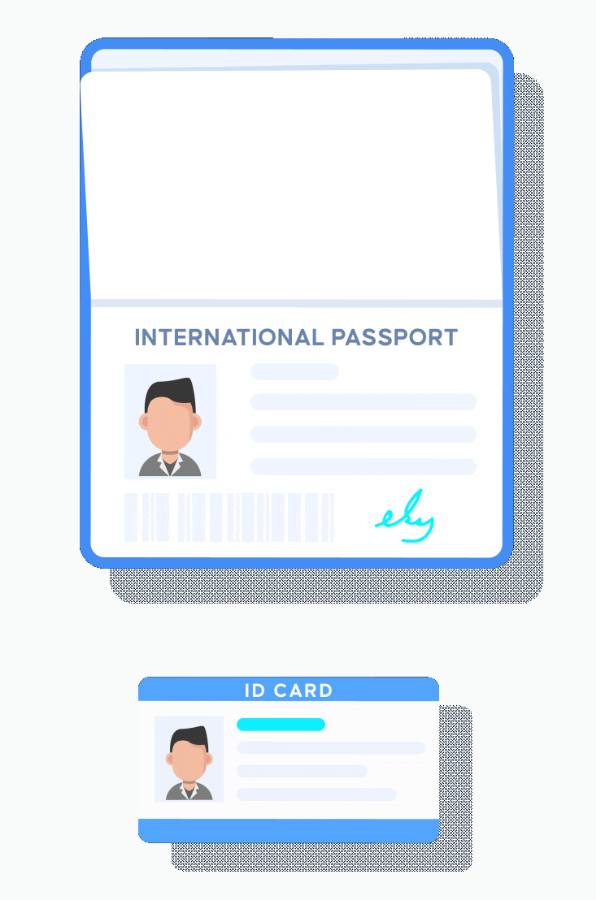

KYC verification (Know Your Customer) is the process of confirming a user’s identity for regulatory compliance and fraud prevention. It typically involves submitting identification documents and basic personal information.

Users most often encounter KYC when increasing transaction limits, using card-based payment rails, or operating in jurisdictions with stricter financial regulations.

How Do Fraud Checks and Chargebacks Affect Card-Based On-Ramps?

Card-based on-ramps carry higher fraud and chargeback risk than bank transfers. To manage this, providers apply additional verification steps, transaction limits, or pricing adjustments.

These controls explain why some on-ramps appear faster but more expensive, while others are slower with lower fees. The trade-off is usually between speed, cost, and security rather than arbitrary pricing.

Practical Risk-Reduction Guidelines

- Use trusted and well-established payment providers

- Verify the correct token network before confirming any transaction

- Start with small test amounts when using a new ramp

- Keep records of transaction IDs and payment confirmations

These steps help reduce delays and errors when moving between fiat and crypto.

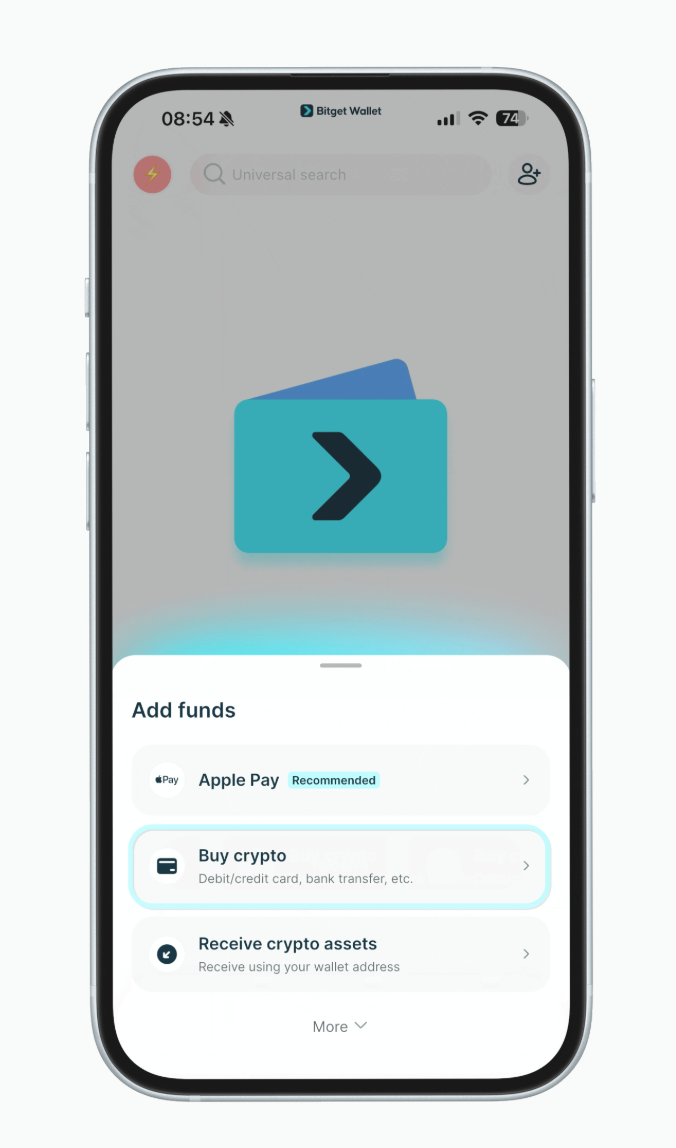

How Can You Buy Crypto Safely Using an On-Ramp Inside Bitget Wallet?

Buying crypto through an on-ramp inside a self-custodial wallet requires careful execution rather than speed alone. The goal is to convert fiat into crypto accurately, confirm delivery on the correct network, and retain full control of assets after settlement. Bitget Wallet integrates on-ramp functionality directly into the wallet interface, allowing users to buy crypto with fiat while keeping custody of funds.

How Do You Buy Crypto in Bitget Wallet?

To buy crypto with fiat inside Bitget Wallet, users follow a structured on-ramp workflow:

Step 1: Open the app and tap Add funds → Buy crypto.

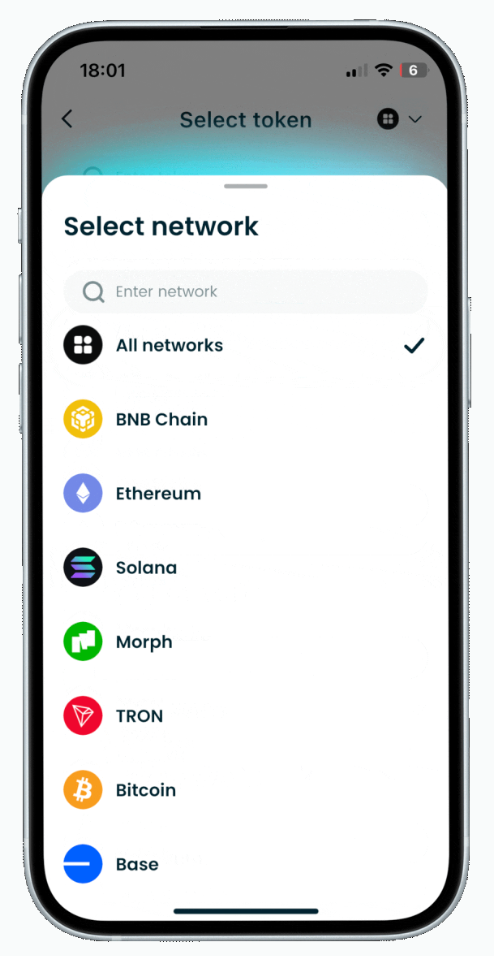

Step 2: Choose a fiat currency and Select the network carefully

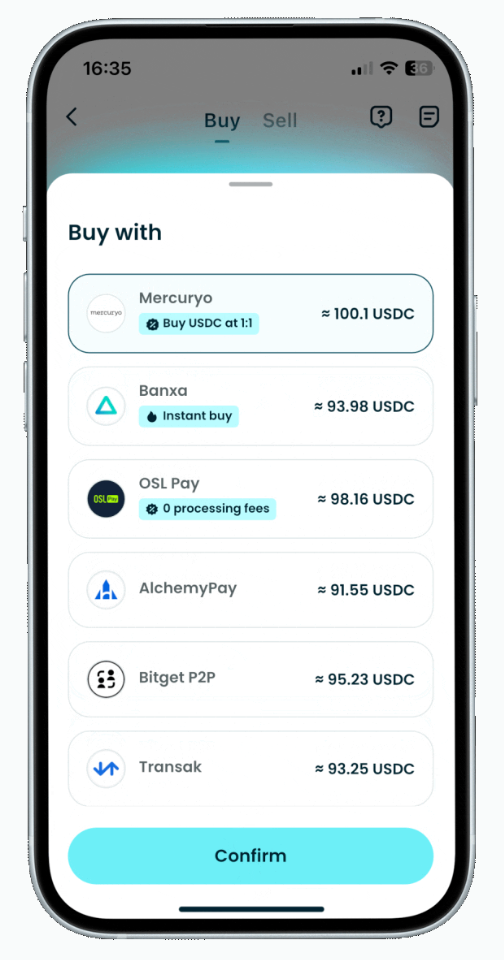

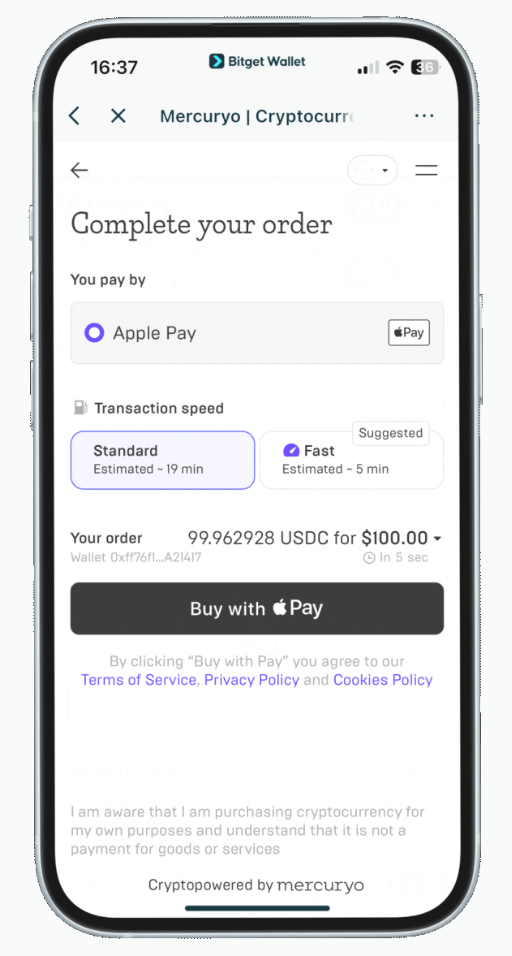

Step 3: Pick a payment provider by comparing price, fees, and settlement speed.

Step 4: Complete KYC verification if prompted by the provider.

Step 5: Confirm payment, return to the app, and check the balance and deposit order.

Before confirming, users should double-check the network and consider buying native gas coins first (such as ETH for Ethereum or SOL for Solana) to avoid transaction issues after purchase. This workflow reflects a standard way to buy crypto with fiat while minimizing common on-ramp errors.

Bitget Wallet Benefits

Bitget Wallet extends on-ramp functionality beyond the initial purchase by supporting post-settlement asset management:

- Stablecoin management: Users can store and manage stablecoins in one place, with optional access to Stablecoin Earn Plus, offering up to 10% APY on eligible holdings.

- Spending utility: The Bitget Wallet crypto card (Mastercard/Visa) enables global spending with zero fees, allowing users to use stablecoins for everyday payments without converting assets elsewhere.

Together, these features support a full on-ramp lifecycle—from fiat conversion to on-chain use—without requiring users to relinquish custody.

Related Reading on Buying Crypto

If you’re looking to better understand how to buy crypto safely and efficiently, the following guides can help:

- What is Stablecoin? A Beginner’s Guide to Price-Stable Cryptocurrencies

- What is Tether USDT: A Complete Guide to the World’s Leading Stablecoin

- What Are Crypto On-Ramps and Off-Ramps

- USDT On-Ramp Complete Guide: How to Buy Tether (USDT) with Fiat?

- USDC vs USDT: What’s the Difference? Investor’s Guide for 2026

Conclusion

What Are Crypto On-Ramps and Off-Ramps ultimately comes down to how users enter and exit the digital asset economy. An on-ramp converts fiat → crypto, while an off-ramp converts crypto → fiat, creating a usable bridge between traditional finance and blockchain networks. Without simple, compliant ramps, crypto adoption would remain limited to technical users.

For beginners, a safer crypto workflow starts with using stable assets, selecting the correct network, understanding fees clearly, and having realistic expectations around KYC verification, rather than focusing solely on speed. By integrating on-ramp access directly into a self-custodial environment, Bitget Wallet supports this approach by combining fiat on-ramping, stablecoin management, and optional spending and earning features in a single interface, allowing users to follow a step-by-step process that reduces execution risk while maintaining full on-chain control.

Download Bitget Wallet now to start buying crypto with fiat securely and keep full control of your assets from day one.

Sign up Bitget Wallet now - grab your $2 bonus!

FAQs

1. What Are Crypto On-Ramps and Off-Ramps?

Crypto on-ramps convert fiat into crypto, while crypto off-ramps convert crypto back into fiat, enabling entry and exit from the digital asset ecosystem.

2. How do you convert fiat into crypto safely as a beginner?

Use a regulated on-ramp, verify the token network, start with small amounts, and ensure sufficient gas for on-chain transactions.

3. When is KYC verification required for crypto on-ramps and off-ramps?

KYC is typically required when using card payments, increasing transaction limits, or operating in regulated jurisdictions.

Risk Disclosure

Please be aware that cryptocurrency trading involves high market risk. Bitget Wallet is not responsible for any trading losses incurred. Always perform your own research and trade responsibly.