USDC Earn Explained: A Complete Guide to Yield, APY, and Risk

USDC Earn is one of the most searched stablecoin yield strategies in 2026, offering investors a structured way to earn interest on USDC while maintaining exposure to a dollar-pegged asset. Unlike volatile cryptocurrencies, USDC Earn products focus on generating predictable USDC yield through lending, liquidity deployment, or real-world asset strategies.

As more investors look to earn interest on USDC instead of leaving capital idle, understanding how USDC APY works becomes critical. Not all platforms offer the same USDC interest rate, and differences in liquidity terms, smart contract exposure, and counterparty risk can significantly impact returns. Before committing funds, investors should evaluate APY vs APR mechanics, withdrawal flexibility, and the sustainability of the underlying yield source.

This guide breaks down how USDC Earn works, where USDC yield comes from, how to compare USDC APY offers, and how to assess liquidity and smart contract risks with an investor-focused framework.

Take control of your USDC Earn strategy — download Bitget Wallet now and access integrated stablecoin yield tools in one secure app.

Key Takeaways

- USDC Earn generates stablecoin yield primarily through lending markets or real-world asset strategies.

- USDC APY differs from APR due to compounding and payout frequency.

- Evaluating liquidity risk and smart contract exposure is essential before earning interest on USDC.

What Is USDC Earn and How Does It Work?

USDC Earn refers to structured products that allow investors to earn interest on USDC by deploying capital into DeFi lending pools, CeFi lending desks, or yield-bearing stablecoin mechanisms. Returns vary depending on USDC interest rate dynamics, borrower demand, and platform structure.

How Does USDC Earn Work in Practice?

When asking how does USDC earn work, the answer typically centers on lending mechanics. Users deposit USDC into a protocol. That capital is lent to borrowers who pay interest. The collected interest becomes USDC yield distributed back to depositors.

The yield source may include:

- DeFi lending pools

- Institutional CeFi lending

- Treasury-backed real-world asset exposure

In short, you earn interest on USDC because someone else is borrowing it and paying a USDC interest rate.

DeFi Lending vs CeFi Lending Models

DeFi lending uses smart contracts to match lenders and borrowers algorithmically. USDC interest rate levels fluctuate based on supply and demand.

CeFi lending involves centralized intermediaries lending USDC to institutions. Returns may appear more stable, but counterparty exposure increases.

Both models generate stablecoin yield, but risk profiles differ significantly.

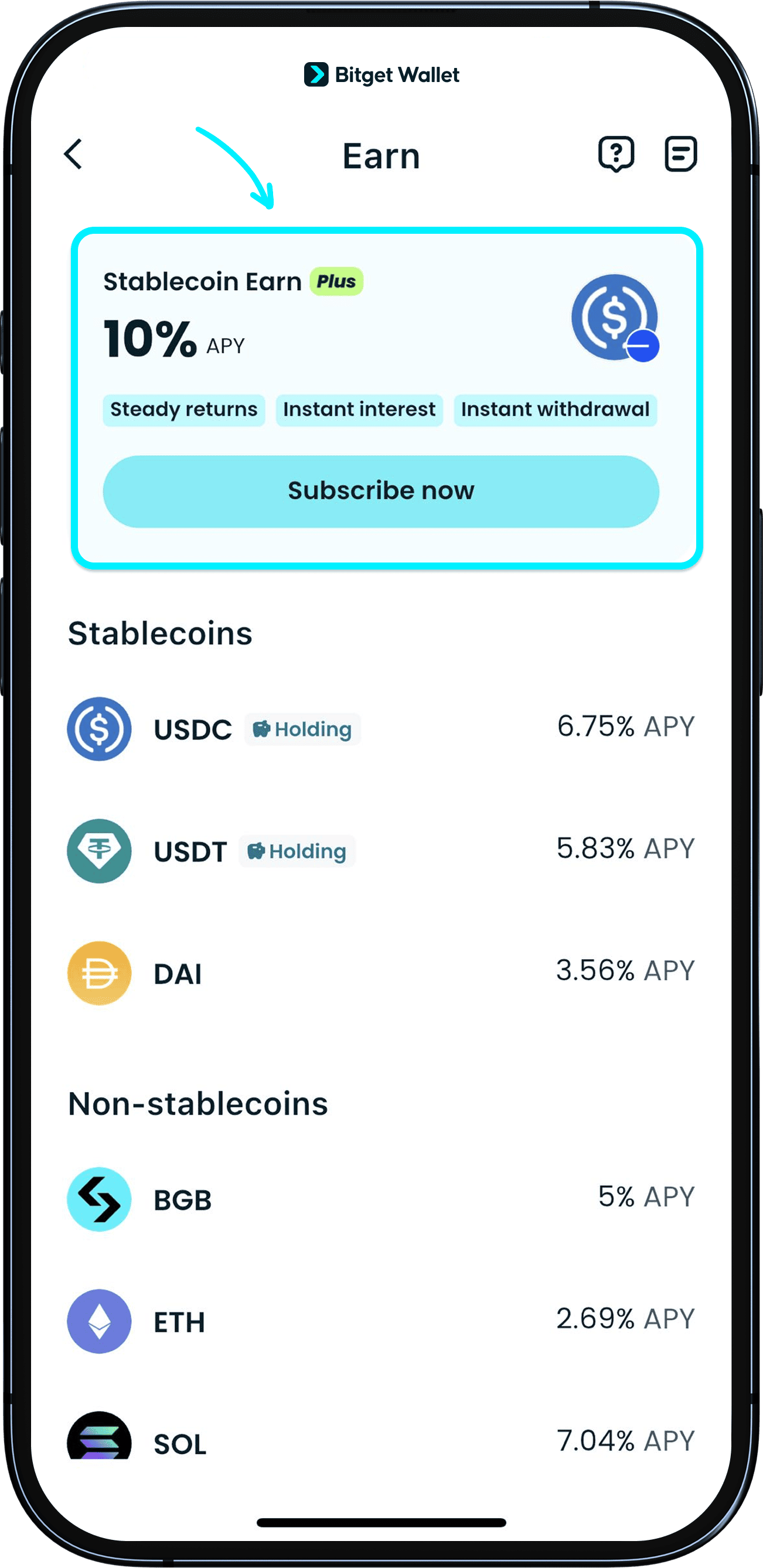

Bitget Wallet offers different yield rates for different stablecoins based on the underlying protocols. To receive the 10% APY, you need to choose USDC on the Base network under the Stablecoin Earn Plus product.

When you subscribe to Stablecoin Earn Plus, you deposit USDC on the Base network into the Aave protocol.

This is then lent out to borrowers who pay you interest, while Bitget Wallet adds a percentage bonus on top of it.

Sign up Bitget Wallet now - grab your $2 bonus!

Where Does USDC Yield Come From?

USDC yield originates from borrower demand, structured lending programs, or real-world asset backing such as short-term government debt exposure.

Borrower Demand and Lending Pools

Most USDC yield is generated through lending pools. When traders or institutions need stablecoin liquidity, they borrow USDC and pay a variable USDC interest rate.

Higher borrowing demand → Higher USDC APY

Lower demand → Reduced yield

Real-World Asset Backing and Fixed-Income Exposure

Some yield-bearing stablecoin models rely on real-world asset backing, such as short-term Treasury bills. In these cases, USDC Earn behaves similarly to a short-duration fixed-income instrument focused on capital preservation.

This structure aligns USDC Earn more closely with traditional yield-bearing stablecoin frameworks rather than speculative DeFi yield farming.

USDC APY vs APR — How to Compare Real Returns

USDC APY includes compounding, while APR reflects simple annual interest. For investors evaluating USDC Earn opportunities, the difference between APY and APR directly impacts expected return and portfolio modeling.

APR shows the base annual interest rate without accounting for reinvestment. APY reflects the effective annual return assuming earned interest is continuously reinvested.

A 7% APR does not equal a 7% APY if rewards compound daily.

USDC Earn APY vs APR Explained

-

APR (Annual Percentage Rate):

The simple interest rate paid over one year, excluding compounding.

-

APY (Annual Percentage Yield):

The effective annual return including compounding frequency.

For example:

- 8% APR compounded daily results in ~8.33% APY

- 8% APR compounded monthly results in ~8.30% APY

The more frequent the compounding, the higher the effective USDC APY.

Understanding USDC earn APY vs APR prevents misinterpreting headline returns. Some platforms advertise APR while others display APY, making side-by-side comparisons misleading if not standardized.

Investors should always confirm:

- Compounding frequency

- Whether rewards auto-compound

- Whether bonus rates are temporary

USDC Earn Rewards Frequency and Compounding

USDC earn rewards frequency typically follows one of these models:

- Daily accrual + daily compounding

- Daily accrual + weekly payout

- Monthly distribution

- Manual claim required for reinvestment

Even if interest accrues daily, payout timing affects effective yield. If rewards are not automatically reinvested, APY may be lower than advertised unless manually compounded.

Frequent compounding increases effective USDC yield over time, especially for long-term holders. However, investors should weigh this against liquidity restrictions and platform risk.

USDC Earn vs USDC Staking — Are They the Same?

USDC staking is commonly used as marketing terminology, but most USDC Earn products operate through lending mechanisms rather than true blockchain staking.

Unlike proof-of-stake tokens, USDC does not secure a blockchain network through staking rewards. Instead, USDC Earn typically involves:

- Lending USDC to borrowers

- Deploying USDC into liquidity pools

- Allocating USDC into structured yield strategies

Understanding this distinction clarifies risk exposure.

USDC Earn vs Staking Comparison Table

| Feature | USDC Earn | USDC Staking |

| Yield Source | Lending / Borrower demand | Rarely applicable to USDC |

| Primary Risk | Counterparty + Smart contract | Protocol-level staking risk |

| Yield Stability | Variable | Reward schedule-based |

| Capital Exposure | Market + platform risk | Validator / slashing risk |

Most so-called “USDC staking” products are lending pools under a different label.

When “Staking” Actually Means Lending

In many DeFi and CeFi platforms, “staking USDC” means supplying liquidity to a lending market. The platform then lends that capital to margin traders, arbitrage desks, or institutional borrowers.

Yield depends on:

- Utilization rate (how much of the pool is borrowed)

- Market demand for stablecoin liquidity

- Risk premium during volatile conditions

Clarifying USDC earn vs staking helps investors properly evaluate where returns come from and what risks they are assuming.

USDC Earn Risks Explained — Liquidity, Smart Contract, and Counterparty Exposure

USDC Earn returns are not guaranteed. While stablecoins reduce price volatility compared to other cryptocurrencies, yield generation introduces layered risks.

Investors should assess risk-adjusted return, not just headline USDC APY.

1. USDC Earn Liquidity Risk

USDC earn liquidity risk refers to limitations on capital withdrawal.

Key liquidity considerations:

- Lock-up periods (e.g., 7–30 days)

- Redemption notice requirements

- Withdrawal limits during high market stress

- Variable liquidity during utilization spikes

In extreme conditions, platforms may restrict redemptions temporarily to prevent liquidity collapse.

Liquidity flexibility should always be evaluated alongside APY. Higher USDC yield often correlates with stricter withdrawal conditions.

2. USDC Smart Contract Risk

DeFi-based USDC Earn programs rely on smart contracts to automate lending and reward distribution.

Risks include:

- Code vulnerabilities

- Oracle manipulation

- Flash loan exploits

- Governance attacks

Even audited protocols can experience exploits. Smart contract risk cannot be fully eliminated — only mitigated.

Investors should review:

- Audit history

- Total value locked (TVL) stability

- Protocol longevity

Understanding USDC smart contract risk is critical when participating in on-chain yield strategies.

3. Is USDC Earn Safe? Risk-Adjusted Perspective

Is USDC Earn safe? The answer depends on platform structure.

Risk layers include:

- Counterparty risk: Centralized platforms may become insolvent.

- Regulatory risk: Yield programs may face compliance changes.

- Protocol risk: DeFi exploits or liquidity cascades.

- Stablecoin risk: Temporary depeg events.

USDC Earn is generally less volatile than token farming strategies but should not be viewed as risk-free income.

How to Evaluate a USDC Earn Platform in 5 Steps

Evaluating a USDC Earn platform requires more than comparing headline APY. Investors building a sustainable USDC passive income strategy should assess yield source, rate stability, liquidity structure, and technical risk before deciding how to earn yield on USDC safely.

Step 1: Identify Yield Source

The first question is simple: where does the USDC yield come from? Yield may be generated through DeFi lending, CeFi institutional borrowing, or real-world asset exposure. If a platform advertises unusually high USDC APY, determine whether the return is driven by real borrower demand or temporary incentives.

Key yield structures include:

- DeFi lending pools

- CeFi lending desks

- Real-world asset backing

- Incentive-based bonus programs

Transparent yield sourcing is the foundation of any stable USDC Earn strategy.

Step 2: Compare USDC APY Sustainability

Not all USDC APY figures are long-term sustainable. Some include temporary promotional boosts layered on top of a base rate.

Investors should verify:

- Base rate vs bonus component

- Historical APY fluctuations

- Compounding frequency

- Duration of promotional rates

A stable 6–8% yield sustained over time is often more reliable than a short-lived 12% headline rate.

Step 3: Assess Liquidity Flexibility

Liquidity terms directly affect capital preservation. Higher USDC yield frequently comes with tighter withdrawal conditions.

Evaluate:

- Lock-up periods

- Redemption notice requirements

- Early withdrawal penalties

Flexibility can be more valuable than marginal yield differences, especially in volatile markets.

Step 4: Compare Risk-Adjusted Return

Raw APY does not equal attractive return. A proper USDC passive income strategy weighs yield against platform risk.

Consider counterparty exposure, regulatory clarity, and transparency. A slightly lower USDC interest rate with stronger safeguards may offer superior risk-adjusted performance over time.

Step 5: Measure Smart Contract Exposure

For on-chain USDC Earn programs, smart contract risk cannot be ignored. Review protocol audits, maturity, and total value locked stability.

Higher yield should justify higher technical exposure. If the risk premium does not compensate for potential vulnerabilities, the opportunity may not be efficient.

USDC Earn vs Savings Accounts and Yield-Bearing Stablecoins

USDC Earn typically offers higher yield than traditional savings accounts, but with added risk exposure.

Savings accounts prioritize capital preservation. Deposits are usually insured, liquidity is immediate, and returns are modest.

USDC Earn programs provide higher USDC APY by deploying funds into lending markets or structured yield strategies. However, they are not FDIC insured and involve counterparty or smart contract risk.

Yield-bearing stablecoin models fall in between. Some allocate capital into short-term real-world assets, offering stablecoin yield with a risk profile closer to money market instruments.

In short:

- Savings accounts: Lower yield, insured

- USDC Earn: Higher APY, market-driven risk

- Yield-bearing stablecoins: Hybrid approach

The tradeoff is simple — stronger capital protection versus higher return potential.

How to Earn Interest on USDC Using Bitget Wallet

Bitget Wallet integrates non-custodial stablecoin yield access directly into its Web3 interface, allowing users to participate in USDC Earn strategies while retaining control of their assets.

Bitget Wallet provides a streamlined way to earn interest on USDC through its Stablecoin Earn Plus product. Instead of transferring funds to a centralized platform, users interact with on-chain protocols while maintaining self-custody.

Key features include:

- Transparent USDC APY display — clearly separates base yield and bonus components

- On-chain Base network support — optimized for lower fees and faster transactions

- Integrated Stablecoin Earn Plus access — subscribe directly within the wallet interface

When using Bitget Wallet, USDC on the Base network is deployed into underlying lending protocols, generating USDC yield from borrower demand. Interest accrues automatically, and users can monitor performance directly within the app.

This structure allows users to earn interest on USDC while maintaining visibility, control, and on-chain transparency — a core advantage for investors prioritizing both yield and asset custody.

How can I subscribe to Stablecoin Earn Plus

Step 1: Update Bitget Wallet app

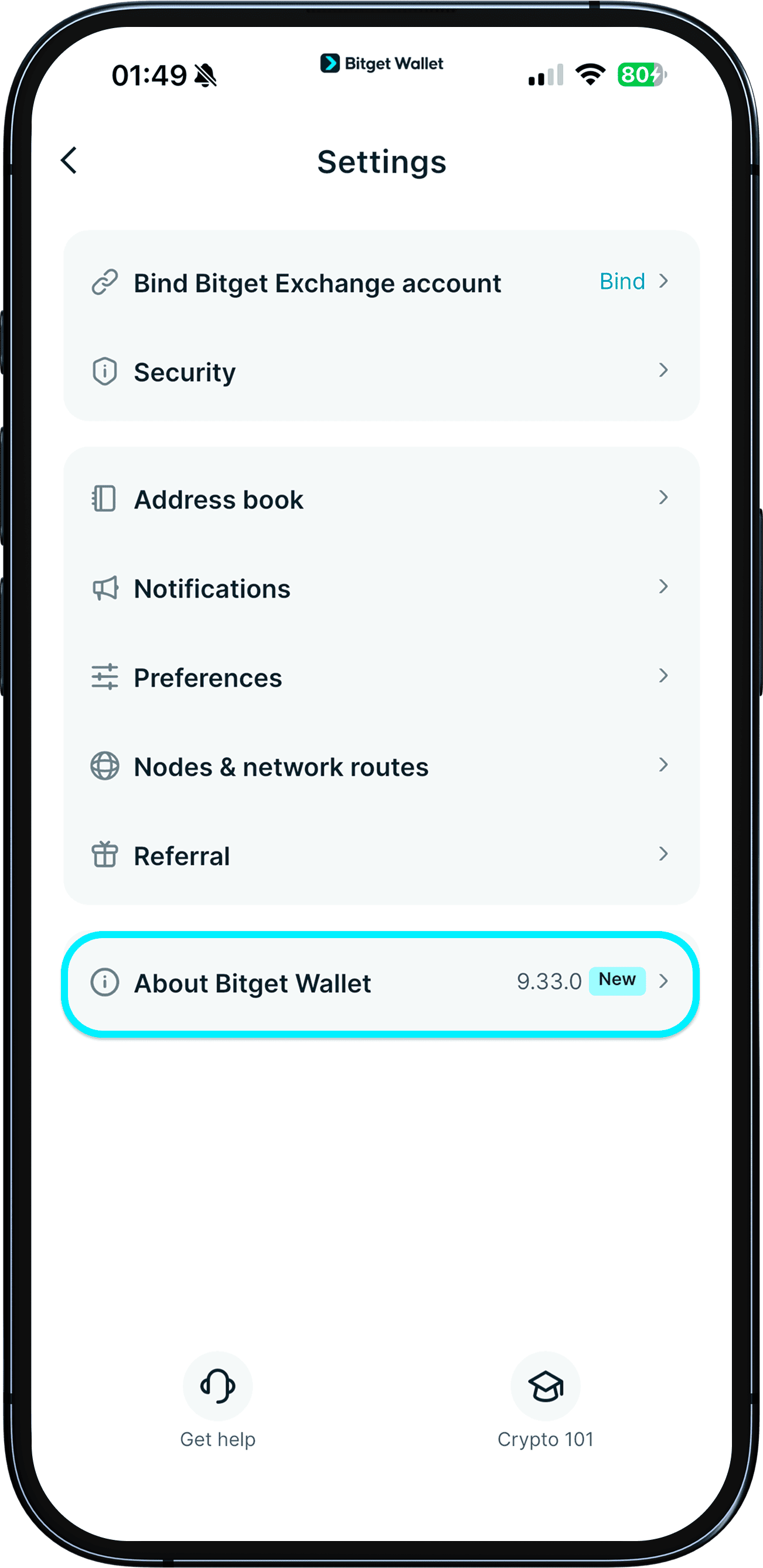

Visit "Home" > "Settings" > "About Bitget Wallet" > "App version".

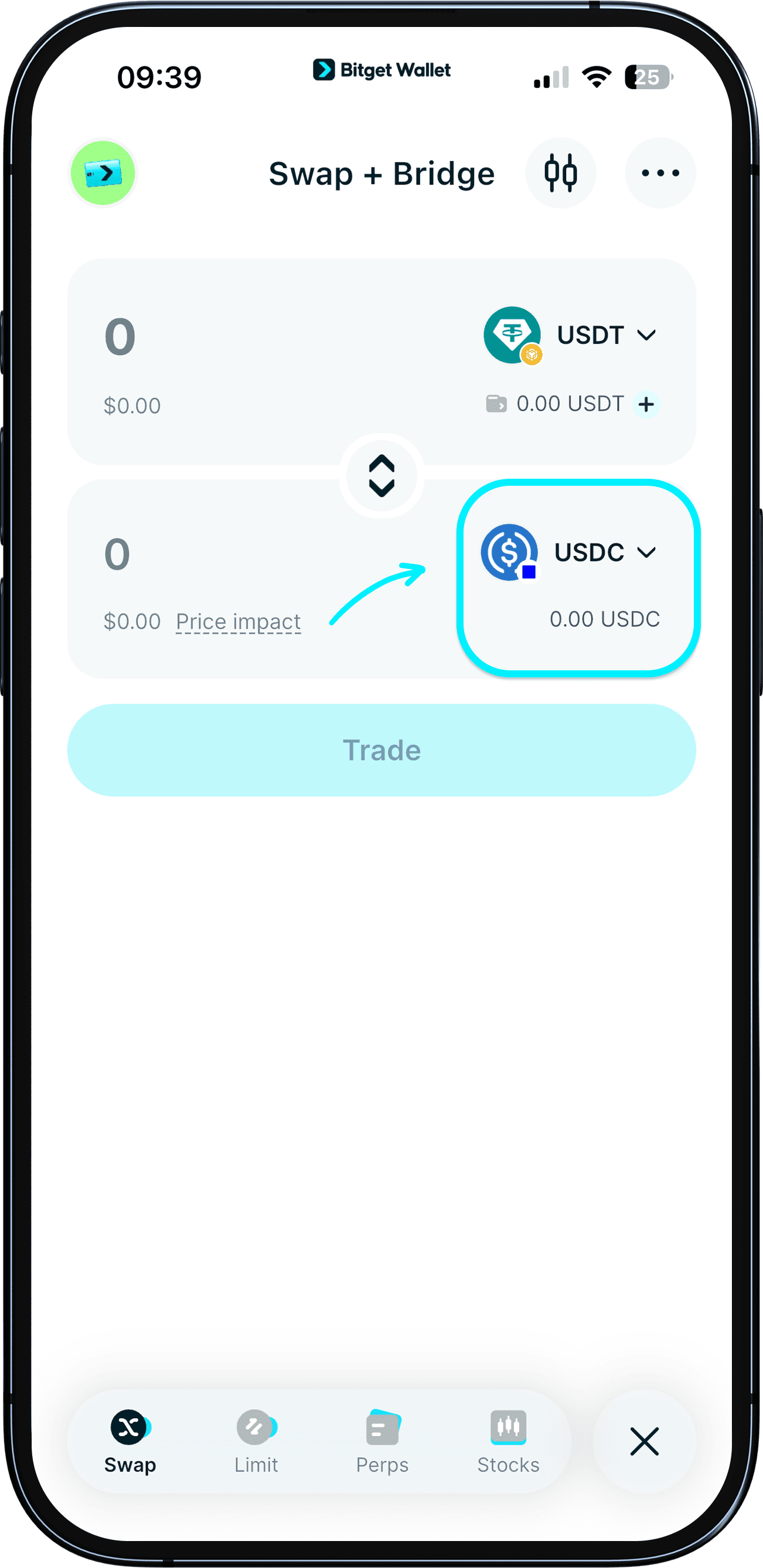

Step 2: Swap for USDC on the Base network

Stablecoin Earn Plus currently only supports USDC on the Base network.

You can visit "Trade" to swap any token you have in your wallet to USDC on the Base network.

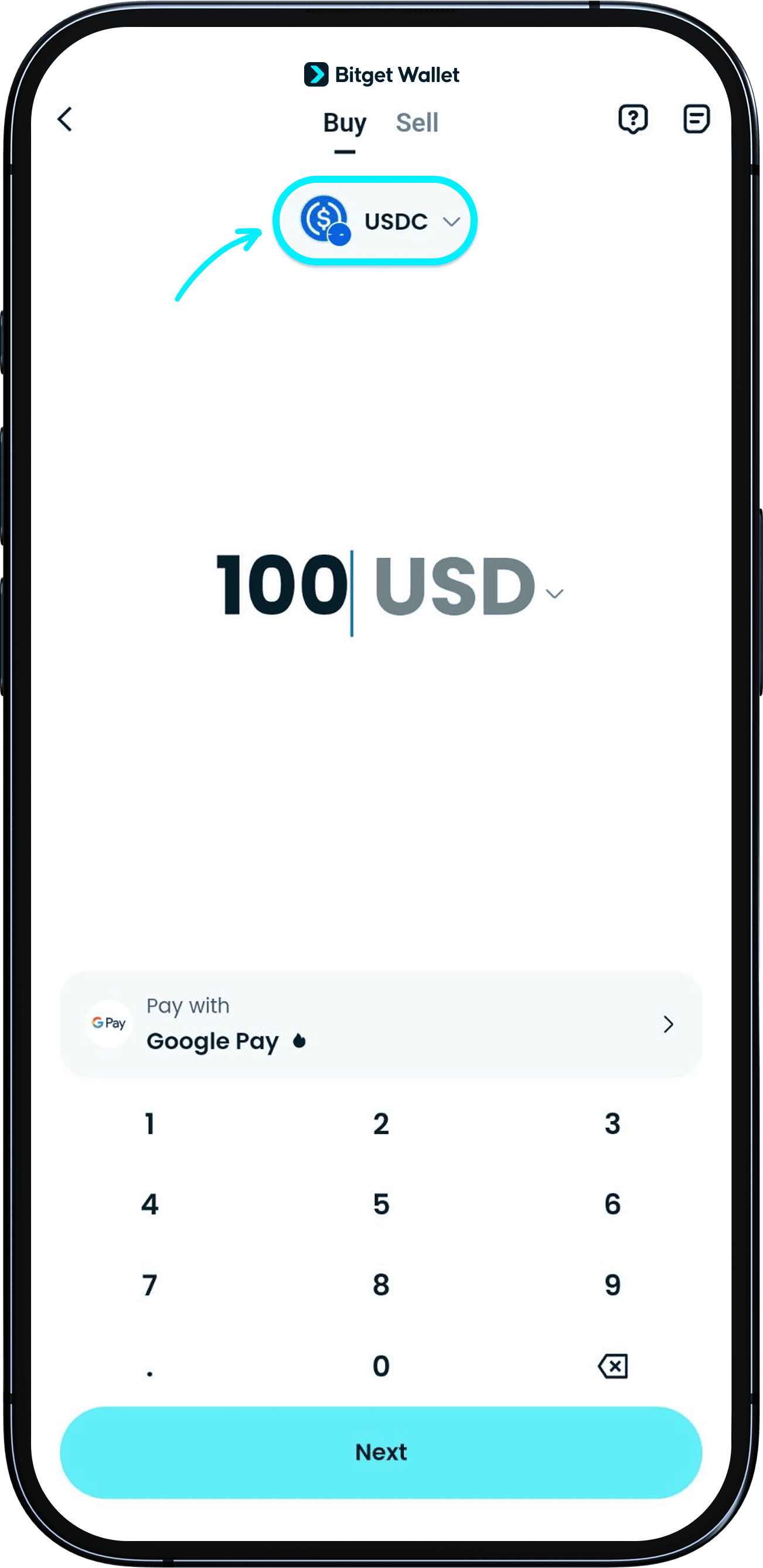

Step 3: Depositing USDC on the Base network

You can also top up USDC on the Base network directly. On the Home screen, tap "Add funds" then choose to transfer from an exchange, buy using your local currency, or buy via P2P.

Note: Be sure to select USDC on the Base network when topping up or buying.

Step 4: Invest now

Next, in "Wallet", tap "Earn" > "Stablecoin Earn Plus" > "Subscribe now".

Note: Only one wallet per device can subscribe to this product.

Step 5: Check product details

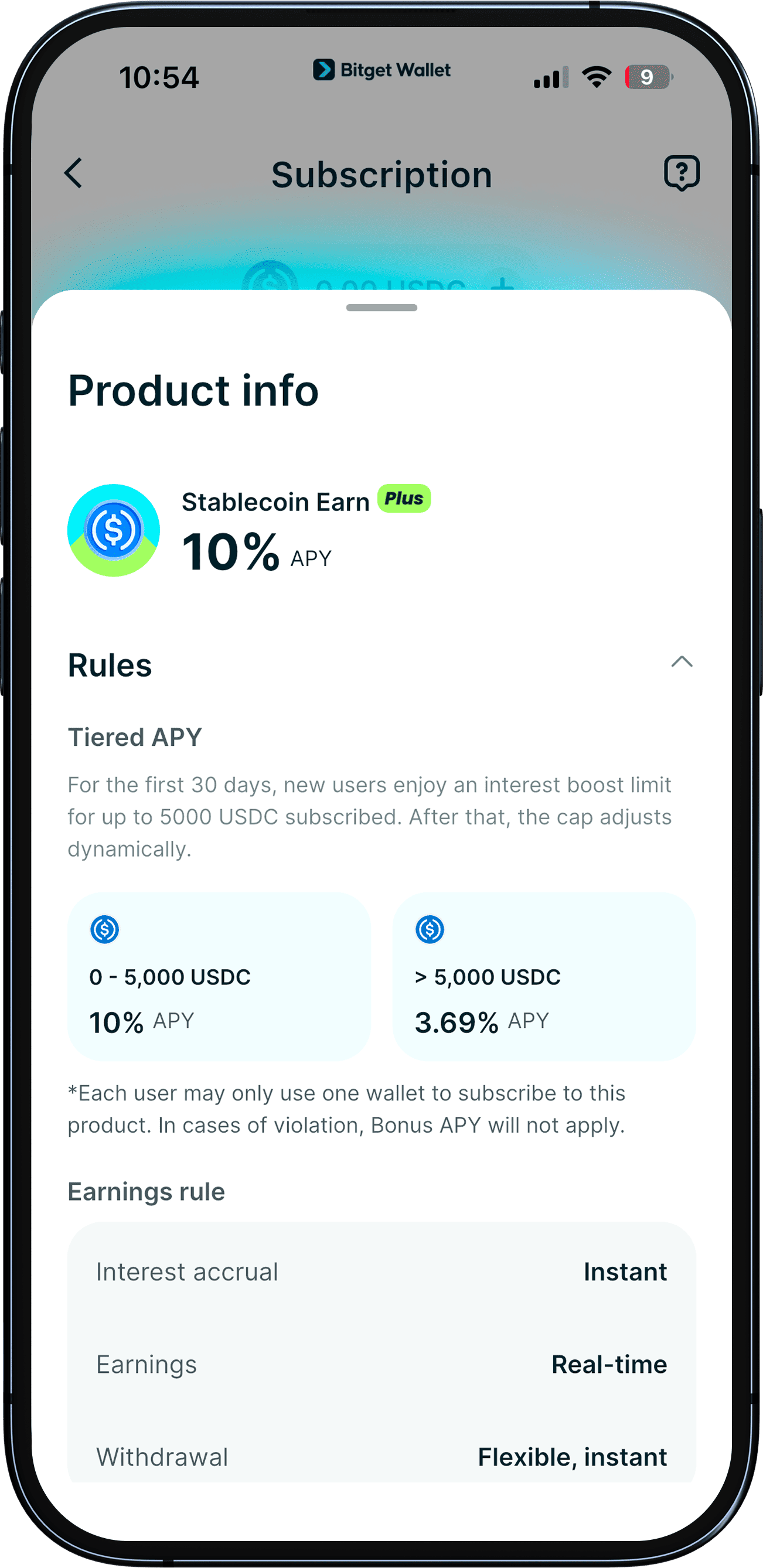

Tap on the product name to check the product details, understand the tiered APY, learn more about where your interest comes from, and other market information.

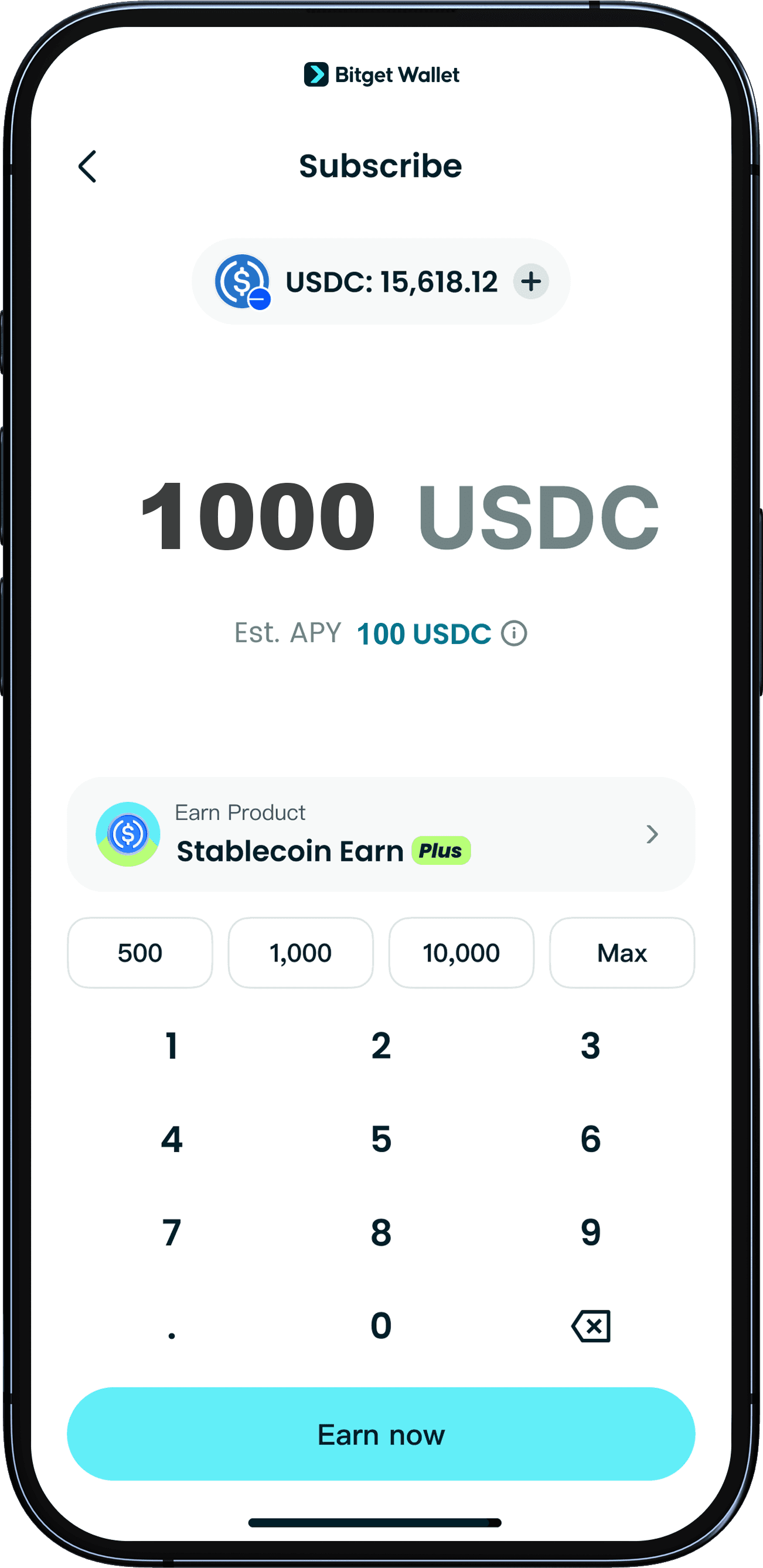

Step 6: Enter amount to invest

Here, you will enter the amount of USDC on the Base network you want to invest. Once you have entered an amount, you will also see an estimate of the interest you will be receiving in a year.

Next, tap "Subscribe".

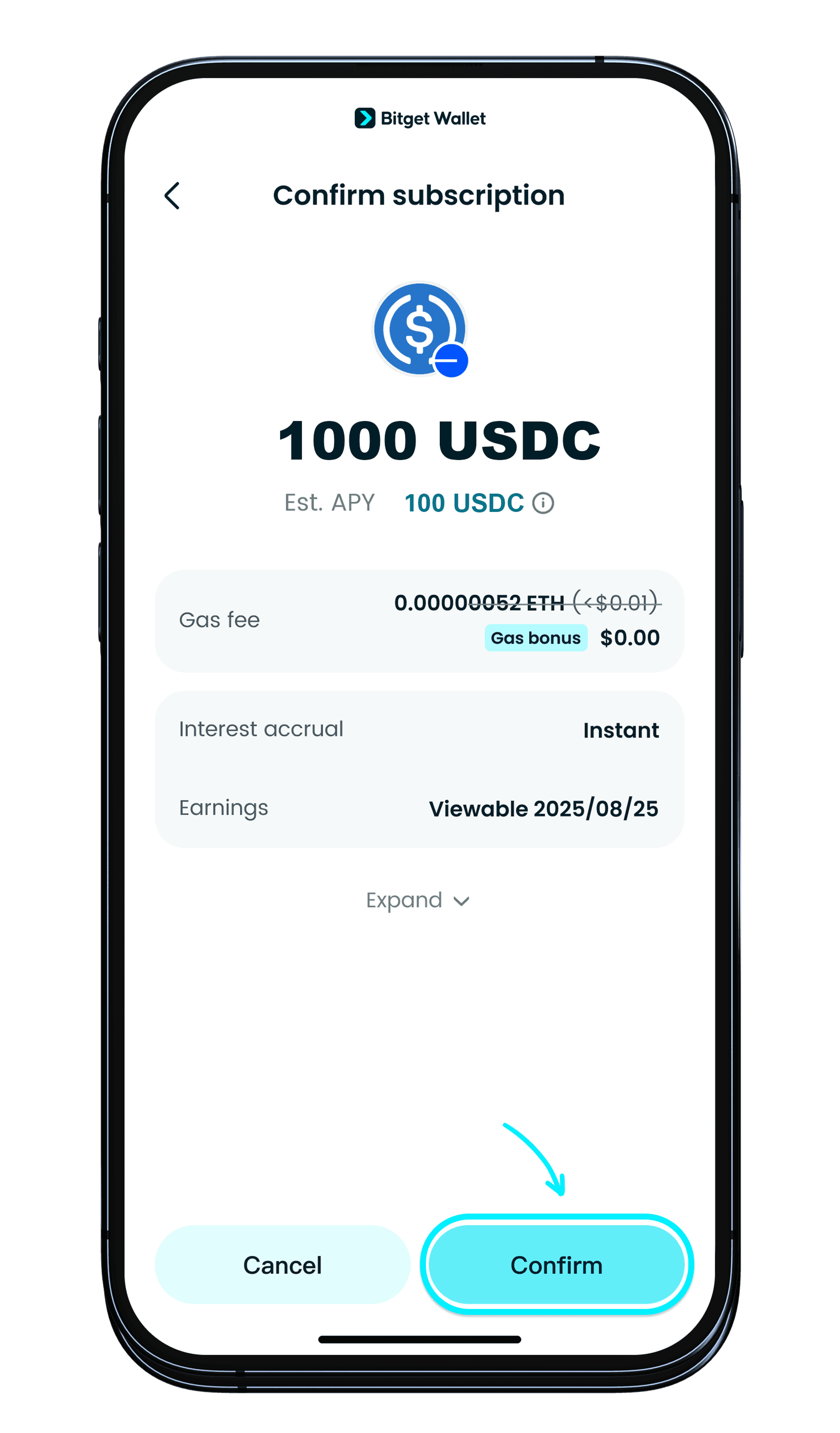

Step 7: Confirm subscription

Review the details of your subscription again, and when you are sure, tap "Confirm". You will then be asked for your signature on the transaction via biometric identification or PIN code.

Once subscription is successful, interest will start accruing immediately.

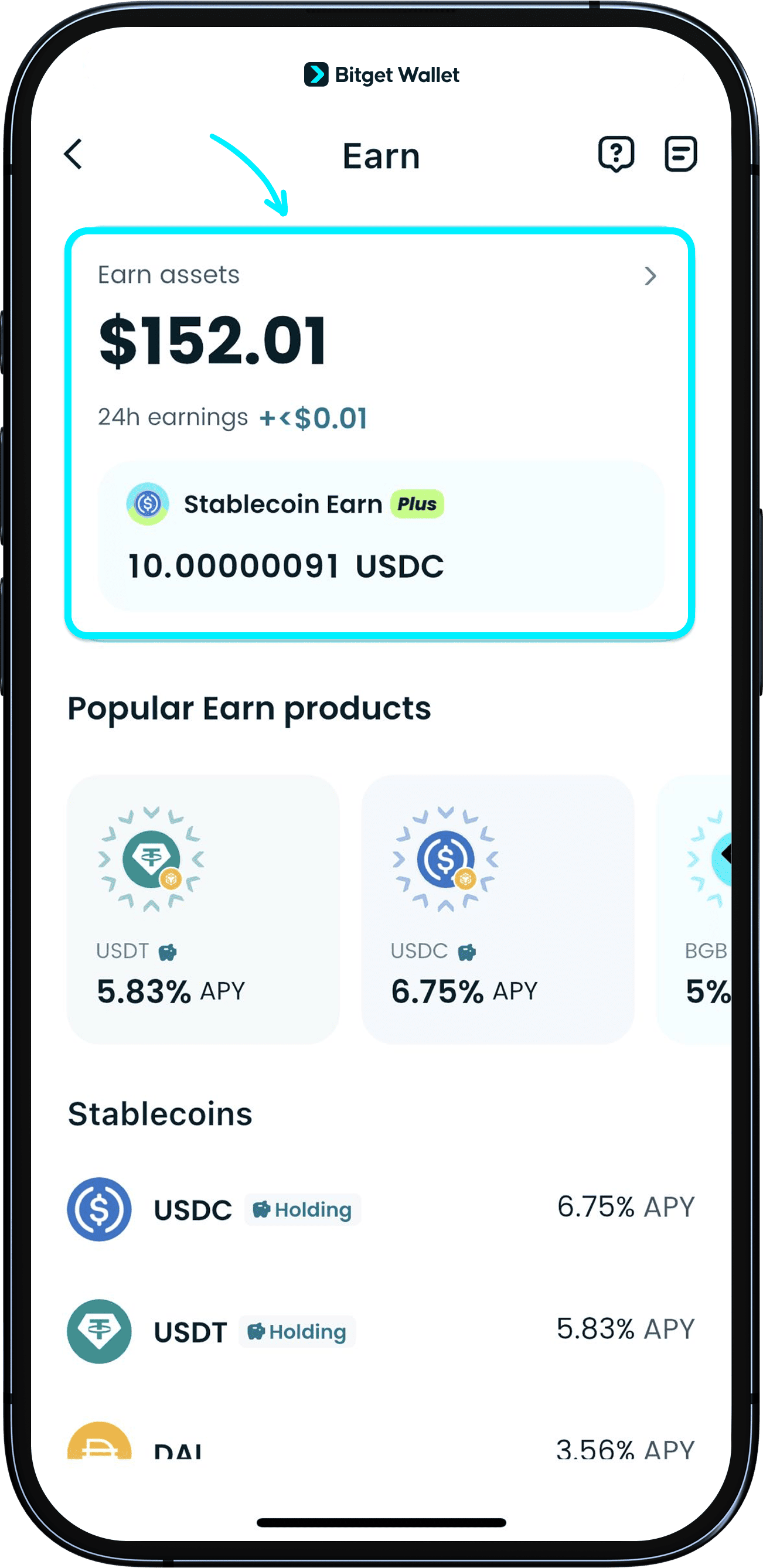

Step 8: View your postions

On the "Earn" home, tap "Earn Assets" to view your holdings. Your "Stablecoin Earn Plus" holdings are shown separately.

Related Reading on USDT & USDC Yield

If you're exploring USDT earn or USDC earn opportunities — from fixed APY savings to on-chain yield strategies — these guides will help you understand how stablecoin yield works, how to evaluate risk, and how to optimize returns safely.

🔹 Understanding Stablecoin Yield Basics

- Yield Farming: What Is It and How Does It Work?

- How to Earn Passive Income With Cryptocurrency? A Beginner’s Guide

🔹 USDT Earn & Yield

- USDT Earn Explained: How to Generate Yield on Tether Safely

- How to Earn Yield on USDT: Fixed vs Flexible APY Compared

🔹 USDC Earn & Yield

- USDC Earn Explained: A Complete Guide to Yield, APY, and Risk

- USDC Earn Returns: How to Evaluate APY, Liquidity, and Smart Contract Exposure

- Stablecoin Earn Plus: What USDC Earn Is and How to Start Generating Yield

🔹 Evaluating APY & Risk

- What Is APY in Crypto and How Yield Is Calculated

- Stablecoin Yield Risks: Smart Contracts, Counterparty & Liquidity

Conclusion

USDC Earn offers investors a structured way to generate stablecoin yield while maintaining exposure to a dollar-pegged asset. However, evaluating USDC APY sustainability, liquidity flexibility, and smart contract exposure is essential before allocating capital.

A disciplined approach — comparing USDC interest rate sources, understanding compounding mechanics, and assessing risk-adjusted return — allows investors to make informed decisions.

For integrated, on-chain access to Stablecoin Earn Plus and Base-network USDC yield opportunities, explore Bitget Wallet and review current APY tiers before subscribing.

Unlock your USDC Earn potential — download Bitget Wallet and access Stablecoin Earn Plus in minutes.

Sign up Bitget Wallet now - grab your $2 bonus!

FAQs

1. Is USDC Earn Safe?

USDC Earn is not risk-free. While USDC itself is designed to maintain a dollar peg, earning yield introduces additional layers of risk. These include liquidity restrictions, smart contract vulnerabilities (for DeFi platforms), and counterparty exposure (for centralized providers). Safety ultimately depends on platform structure, transparency, and yield sustainability.

2. How Often Does USDC Earn Pay Interest?

USDC Earn payout frequency varies by platform. Most programs offer daily interest accrual, with rewards distributed daily, weekly, or monthly. Some platforms automatically compound earnings, while others require manual reinvestment to maximize effective USDC APY.

3. Can You Lose Money With USDC Earn?

Yes. Although stablecoins reduce price volatility, losses can still occur due to smart contract exploits, counterparty insolvency, regulatory disruptions, or temporary depegging events. Higher USDC yield generally corresponds to higher underlying risk.

4. What Determines the USDC Interest Rate?

The USDC interest rate is primarily driven by borrower demand and lending pool utilization. When demand for stablecoin liquidity rises, rates typically increase. Broader macroeconomic conditions, such as prevailing short-term interest rates, also influence sustainable USDC yield levels.

5. Is USDC Staking Different From USDC Earn?

Yes. Most USDC Earn products rely on lending mechanisms rather than true blockchain staking. Since USDC is not a proof-of-stake token, “staking USDC” typically refers to supplying liquidity into lending pools rather than securing a network.

Risk Disclosure

Please be aware that cryptocurrency trading involves high market risk. Bitget Wallet is not responsible for any trading losses incurred. Always perform your own research and trade responsibly.