USDC Earn Returns: How to Evaluate APY, Liquidity, and Smart Contract Exposure

USDC Earn returns vary across DeFi lending, CeFi lending, and real-world asset strategies. While many platforms advertise attractive USDC APY figures, the headline rate alone does not reflect true risk-adjusted return.

Investors comparing USDC Earn vs savings account alternatives must assess liquidity flexibility, capital preservation, and smart contract exposure before allocating funds. Unlike a fixed bank deposit, the USDC interest rate fluctuates based on utilization and lending demand. In this article, we’ll examine where USDC Earn returns come from, how to evaluate USDC Earn APY sustainability, and how to stress-test liquidity risk properly.

Key Takeaways

- USDC Earn returns depend on yield source and structural risk, not just headline USDC APY. Higher USDC APY often reflects greater exposure to liquidity constraints or protocol risk.

- Liquidity risk and smart contract exposure determine real safety when evaluating USDC Earn returns. Investors should assess withdrawal flexibility and underlying infrastructure before committing capital.

- Sustainable USDC APY matters more than short-term promotional yield. Comparing long-term stability helps ensure USDC Earn returns remain consistent over time.

What Is USDC Earn and How Do USDC Earn Returns Work?

USDC Earn allows users to generate stablecoin yield through DeFi lending, CeFi lending, or real-world asset backing strategies. USDC Earn returns are generated from borrower interest, liquidity allocation, or structured yield programs depending on platform design. Understanding how USDC Earn works is essential before comparing USDC APY across different platforms.

Where Do USDC Earn Returns Come From?

The answer to where do USDC Earn returns come from depends on infrastructure and lending demand. Different models allocate USDC into separate yield-generating mechanisms, which directly influence USDC Earn returns and USDC APY stability.

- DeFi lending — Users supply USDC into liquidity pools where borrowers pay variable interest.

- CeFi lending — Platforms lend USDC to institutional counterparties and share revenue.

- Real-world asset backing — Yield linked to treasury-like instruments.

- Liquidity incentives — Short-term campaigns that temporarily increase USDC APY.

Why Do USDC Earn Returns Differ Across Platforms?

USDC Earn returns differ due to platform structure and capital allocation models. Variations in borrower demand, risk pricing, and liquidity depth directly impact sustainable USDC APY levels.

- Utilization levels

- Borrower demand

- Incentive subsidies

- Platform liquidity depth

Higher yield usually signals higher risk pricing.

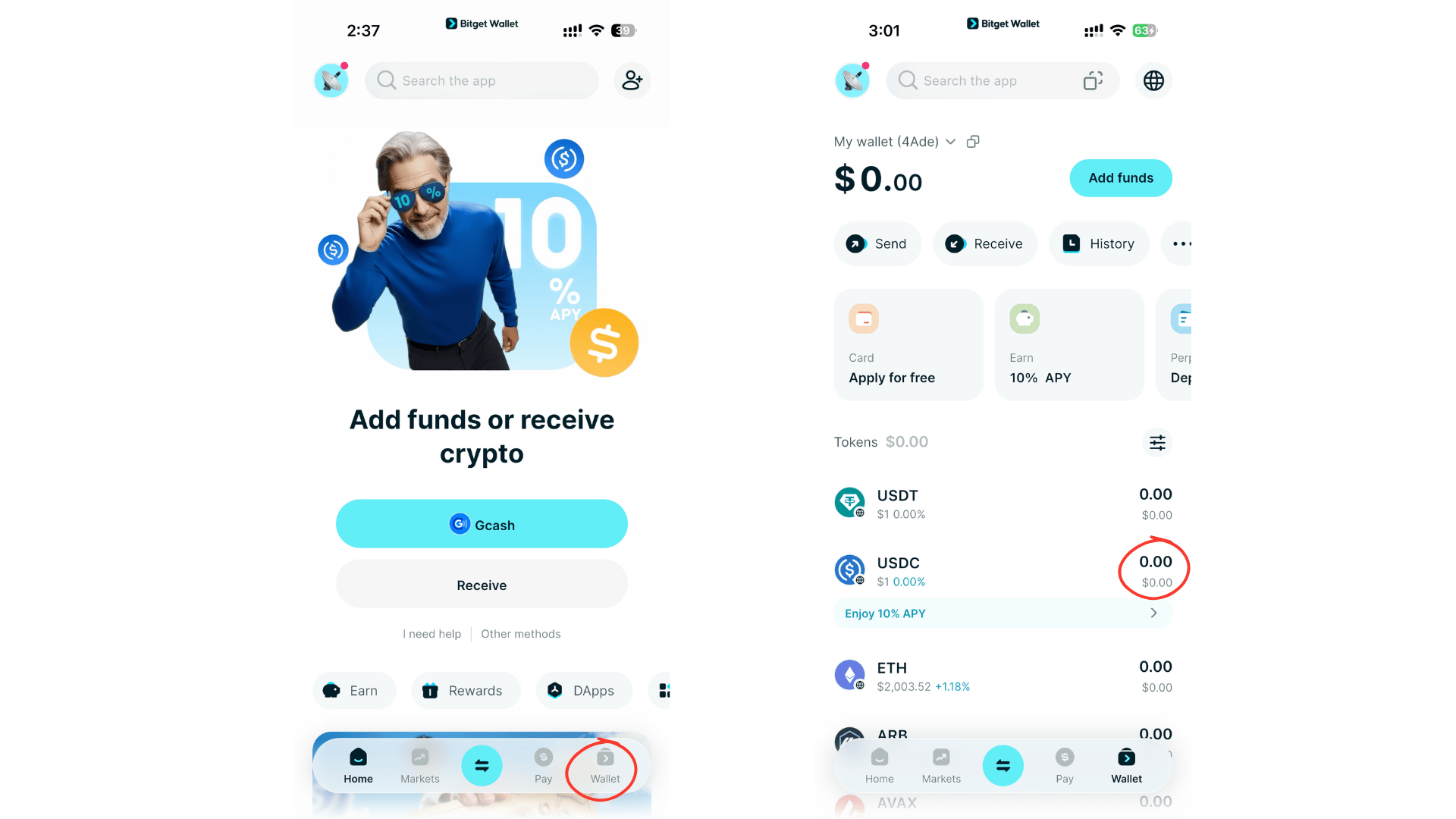

Stablecoin Earn Plus: A Simplified Way to Access USDC Earn

Once you understand how USDC Earn returns are generated, selecting the right infrastructure becomes critical for managing risk and liquidity. A secure, non-custodial environment allows users to access stablecoin yield while maintaining full control over capital.

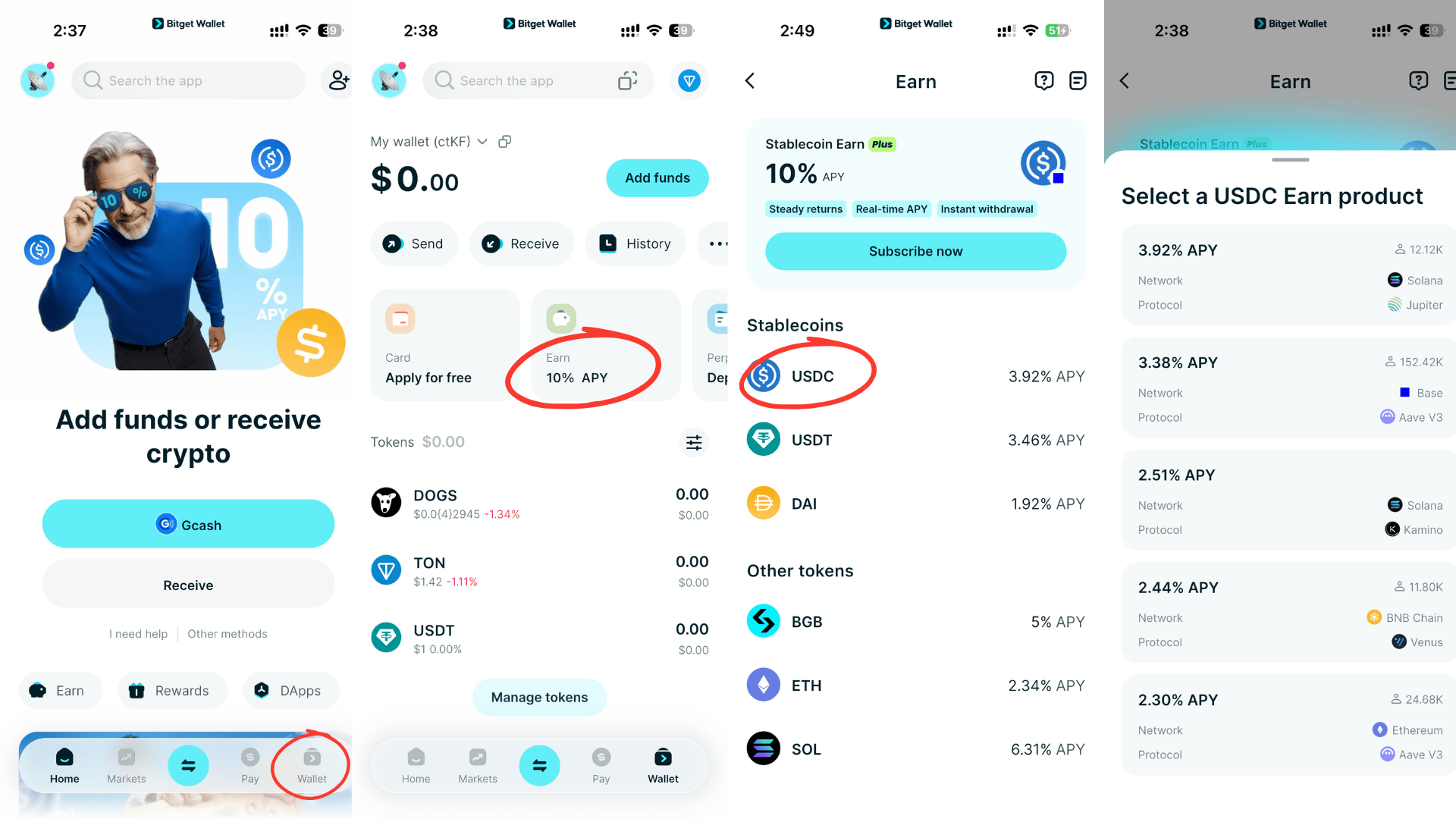

Stablecoin Earn Plus inside Bitget Wallet provides:

- Earn up to 10% APY on stablecoins

- Flexible participation without forced long-term lock

- Cross-chain USDC management

- Non-custodial asset control

- Integrated Stablecoin Earn access for streamlined USDC Earn participation

👉 Download Bitget Wallet to securely store stablecoins and access cross-chain USDC Earn opportunities with greater flexibility and transparency.

What Is the Current USDC Earn APY and How Should You Interpret It?

The current USDC APY changes based on lending demand, liquidity conditions, and platform structure. The USDC interest rate moves with utilization levels and broader market cycles, which means headline yield does not always reflect sustainable USDC Earn returns. Understanding how USDC APY is generated helps investors avoid relying solely on promotional rates. Confusion around USDC staking vs earn can also cause misinterpretation, since most USDC yield is lending-based rather than true staking.

How Does DeFi Lending Influence USDC APY?

In DeFi lending markets, USDC APY fluctuates dynamically based on borrower demand and pool utilization. When liquidity is tight and borrowing demand increases, the USDC interest rate rises to incentivize additional supply.

- Rates fluctuate dynamically

- High utilization increases USDC APY

- Smart contract exposure exists

How Does CeFi Lending Set a Fixed USDC Interest Rate?

CeFi lending platforms often advertise a fixed or predictable USDC interest rate to attract deposits. However, the sustainability of USDC APY in CeFi models depends on counterparty credit quality and risk management practices.

- Offer predictable USDC interest rate

- Introduce counterparty risk

- Sometimes rely on promotional yield

How Do Real-World Asset Strategies Stabilize USDC Earn Returns?

Real-world asset backing strategies aim to provide more stable USDC Earn returns by linking yield to traditional fixed-income instruments. Because these models are tied to macro-rate environments, USDC APY may be less volatile compared to pure DeFi lending markets.

- Lower volatility USDC Earn returns

- Macro-rate linkage

- Improved capital preservation

APY Comparison Modeling Table

| Model | Typical USDC APY | Risk | Liquidity |

| DeFi Lending | 5–12% | Smart contract exposure | Variable |

| CeFi Lending | 4–8% | Counterparty risk | Medium |

| RWA Yield | 3–6% | Lower volatility | Higher |

How to Evaluate USDC Earn APY Sustainability?

Understanding how to evaluate USDC Earn APY helps investors distinguish sustainable yield from short-term promotional incentives. A disciplined approach to USDC APY analysis improves long-term stability and reduces exposure to unsustainable rate spikes.

Is the USDC APY Subsidized?

Not all USDC APY is generated from organic lending demand. In some cases, platforms temporarily boost the USDC interest rate through token emissions or liquidity campaigns to attract deposits.

Promotional USDC APY may include:

- Emission-backed yield

- Temporary liquidity campaigns

- Short-term boosts

Is Yield Organic and Borrower-Driven?

Sustainable USDC Earn returns are typically borrower-driven rather than incentive-subsidized. When yield is generated through real lending revenue and stable utilization, the USDC interest rate is more likely to remain consistent over time.

Organic yield reflects:

- Lending revenue

- Stable utilization

- Sustainable USDC interest rate

What Is the Real Net USDC Earn Return?

Headline USDC APY does not always represent the true net return received by users. Evaluating the real net USDC Earn return requires understanding compounding mechanics and platform fee structures.

Consider:

- APR vs APY

- Compounding frequency

- Platform fees

What Is USDC Earn Liquidity Risk Explained?

USDC Earn liquidity risk explained refers to the possibility of delayed or restricted withdrawals during periods of high utilization or market stress. Even when USDC Earn returns appear stable, liquidity flexibility determines whether capital can be accessed when needed, making liquidity risk a critical evaluation factor. This form of USDC liquidity risk becomes visible when withdrawal demand exceeds available pool liquidity.

What Are Lock-Up Periods in USDC Earn?

Some USDC Earn programs require fixed-term commitments in exchange for higher USDC APY. While these lock-up structures may enhance yield predictability, they limit withdrawal flexibility and reduce short-term capital access.

In certain cases, early redemption penalties may apply. Investors seeking capital preservation should carefully evaluate whether the additional USDC APY compensates for reduced liquidity.

How Does Pool Utilization Affect Liquidity?

Pool utilization plays a central role in determining liquidity availability. When utilization is low, USDC withdrawals are typically processed quickly; however, as utilization increases, available liquidity declines. Elevated utilization increases USDC liquidity risk, especially during volatile market conditions.

If utilization remains elevated for extended periods, redemption queues may form. High utilization levels can therefore increase USDC Earn liquidity risk even if USDC Earn returns remain attractive.

How Does Market Stress Impact Stablecoin Yield?

During market stress events, liquidity pressure can rise quickly across DeFi lending and CeFi lending platforms. Even if the USDC interest rate appears stable, a surge in withdrawals may cause delays. In extreme conditions, USDC liquidity risk increases as available pool liquidity declines and redemption demand spikes. Such liquidity crunch scenarios may challenge capital preservation objectives. Understanding USDC Earn liquidity risk explained in the context of stress testing helps investors prepare for volatility rather than focusing solely on yield.

What Is USDC Smart Contract Risk and Smart Contract Exposure?

USDC smart contract risk arises when funds are deployed into automated DeFi protocols that rely on coded logic rather than centralized intermediaries. Because these systems execute transactions programmatically, smart contract exposure must be carefully evaluated before allocating capital into USDC Earn strategies.

Smart contract exposure represents the technical risk embedded in decentralized infrastructure. Even when USDC Earn returns appear attractive, underlying code vulnerabilities can introduce non-market risks.

What Are Common Smart Contract Vulnerabilities?

Smart contracts are software programs, and like any software, they may contain flaws or exploitable logic errors. If vulnerabilities are discovered, attackers may exploit them to drain liquidity pools or manipulate yield mechanisms.

Common smart contract vulnerabilities include:

- Reentrancy exploits

- Flash loan attacks

- Oracle manipulation

Robust auditing and security design reduce USDC smart contract risk but do not eliminate it entirely.

How Does Governance Risk Affect USDC Earn?

Governance mechanisms allow protocol stakeholders to modify parameters such as collateral ratios, utilization curves, or interest rate models. While governance improves adaptability, it also introduces decision risk that may impact USDC Earn returns.

Sudden upgrades or parameter changes can alter the USDC interest rate structure or liquidity conditions. Investors should assess governance transparency when evaluating smart contract exposure.

Smart Contract Exposure vs Counterparty Risk

In DeFi lending environments, risk primarily stems from smart contract exposure and protocol design. In CeFi lending models, risk shifts toward counterparty insolvency or credit failure.

Understanding this distinction helps investors compare decentralized and centralized USDC Earn models. Both carry risk, but the source of risk differs structurally.

Is USDC Earn Safe Compared to a Savings Account?

Whether USDC Earn is safe depends on risk tolerance, liquidity structure, and underlying yield source. Unlike insured bank deposits, USDC Earn returns are generated through lending or asset allocation strategies, which introduce structural risk alongside higher yield potential. The question many investors ask is: is USDC Earn safe during market stress or liquidity shocks?

Investors comparing USDC Earn vs savings account options must evaluate risk-adjusted return rather than nominal yield alone. Capital preservation and withdrawal flexibility are critical decision factors.

Can You Lose Money with USDC Earn?

Yes, it is possible to lose money with USDC Earn under certain conditions. Although USDC is designed to maintain price stability, risks exist within the yield-generating infrastructure.

Potential loss scenarios include:

- Smart contract exploits

- Counterparty default in CeFi lending

- Severe liquidity stress during market volatility

Understanding these risks helps investors evaluate whether USDC Earn returns compensate adequately for exposure.

USDC Earn vs Savings Account Risk Comparison

The structural differences between USDC Earn and traditional savings accounts are significant. While savings accounts prioritize capital preservation and regulatory insurance, USDC Earn prioritizes higher yield through market-based mechanisms.

| Factor | USDC Earn | Savings Account |

| Yield | Higher | Lower |

| Insurance | Platform dependent | FDIC insured |

| Liquidity | Variable | High |

| Risk | Smart contract exposure or counterparty risk | Minimal |

Ultimately, deciding whether is USDC Earn safe depends on how an investor weighs yield opportunity against structural risk.

USDC Earn vs Yield-Bearing Stablecoins: Which Is Structurally Better?

USDC Earn vs yield-bearing stablecoins compares two different approaches to generating stablecoin yield. While both aim to increase returns on stablecoin holdings, the structural design, liquidity flexibility, and risk exposure differ significantly.

Understanding USDC staking vs earn comparisons helps clarify whether yield is generated externally through allocation or embedded within a token structure.

-

External USDC Earn Lending Model

In the USDC Earn model, users deposit standard USDC into lending or structured yield platforms. Yield is generated externally through DeFi lending, CeFi lending, or real-world asset backing, allowing users to withdraw back into regular USDC without holding a modified token.

-

Embedded Yield Stablecoins

Yield-bearing stablecoins integrate yield directly into the token structure. Instead of depositing USDC separately, users hold a token that automatically accrues yield, either through balance increases or redemption value adjustments.

-

Transparency and Liquidity Comparison

The key difference in USDC Earn vs yield-bearing stablecoins lies in flexibility versus automation. USDC Earn models prioritize withdrawal control and clearer tracking of USDC Earn returns, while embedded yield tokens prioritize convenience but may require token conversion for liquidity access.

How to Evaluate Any USDC Earn Platform in 5 Steps?

A structured evaluation framework improves decision quality when comparing USDC Earn returns. Investors who understand how to evaluate USDC Earn APY, liquidity risk, and smart contract exposure can better distinguish sustainable yield from temporary promotional rates.

1. Identify the Yield Source

Determine where USDC Earn returns come from, whether through DeFi lending, CeFi lending, or real-world asset backing. Confirm whether yield is borrower-generated or incentive-subsidized and assess transparency of revenue flow.

2. Model USDC APY Sustainability

Analyze whether the USDC APY is fixed or variable and whether it is supported by organic lending revenue. Apply a structured method for how to evaluate USDC Earn APY beyond headline promotional rates.

3. Stress-Test Liquidity Risk

Review lock-up periods, early withdrawal penalties, and pool utilization levels. Model withdrawal scenarios during market stress to evaluate true liquidity flexibility.

4. Quantify Smart Contract Exposure

Examine audit reports, exploit history, governance design, and oracle mechanisms. Compare smart contract exposure in DeFi models with counterparty risk in CeFi lending structures.

5. Compare Risk-Adjusted Return

Evaluate net USDC Earn returns after fees, volatility, and structural risk. Compare against savings account alternatives while prioritizing capital preservation and long-term sustainability.

Where Can You Access Cross-Chain USDC Earn Safely?

Accessing USDC Earn across chains requires secure custody and integrated yield infrastructure. Bitget Wallet, as a non-custodial wallet with cross-chain support and Stablecoin Earn access, simplifies participation while preserving private key ownership and liquidity flexibility.

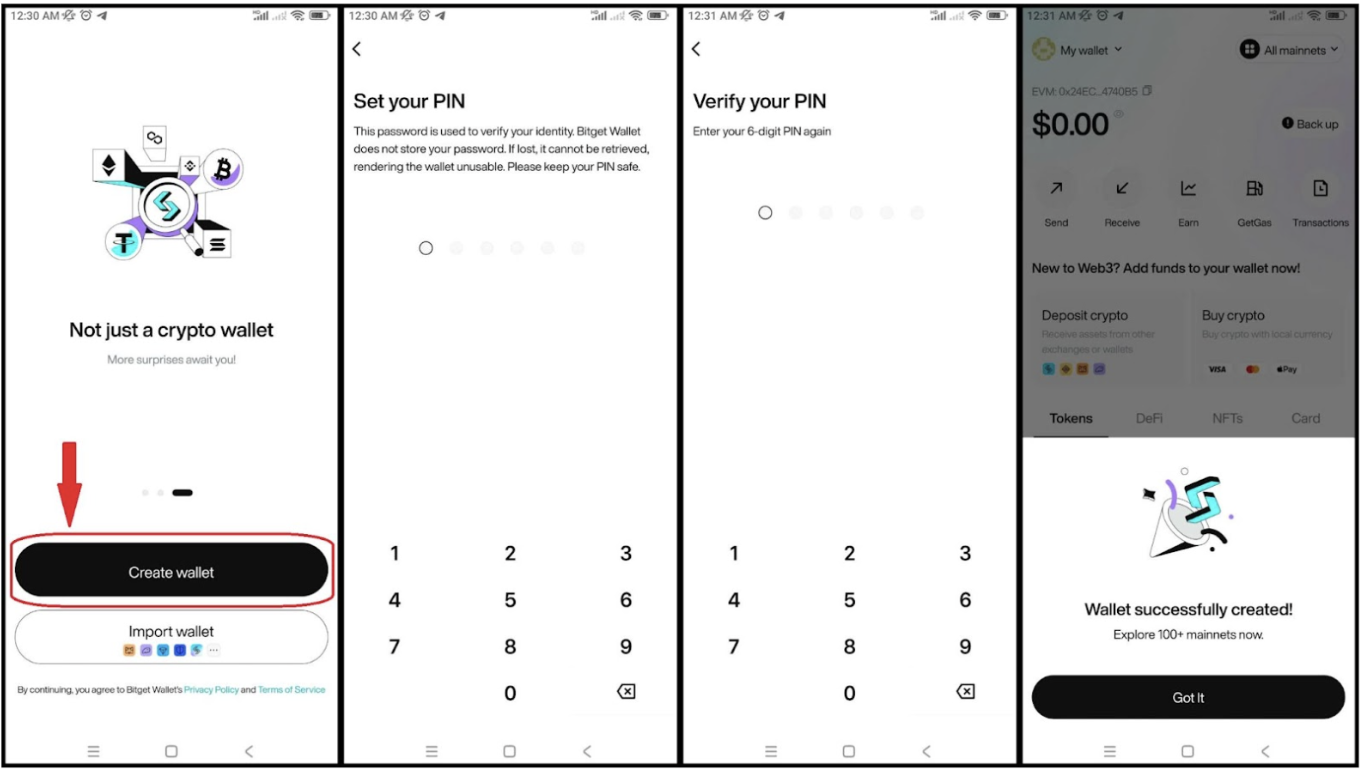

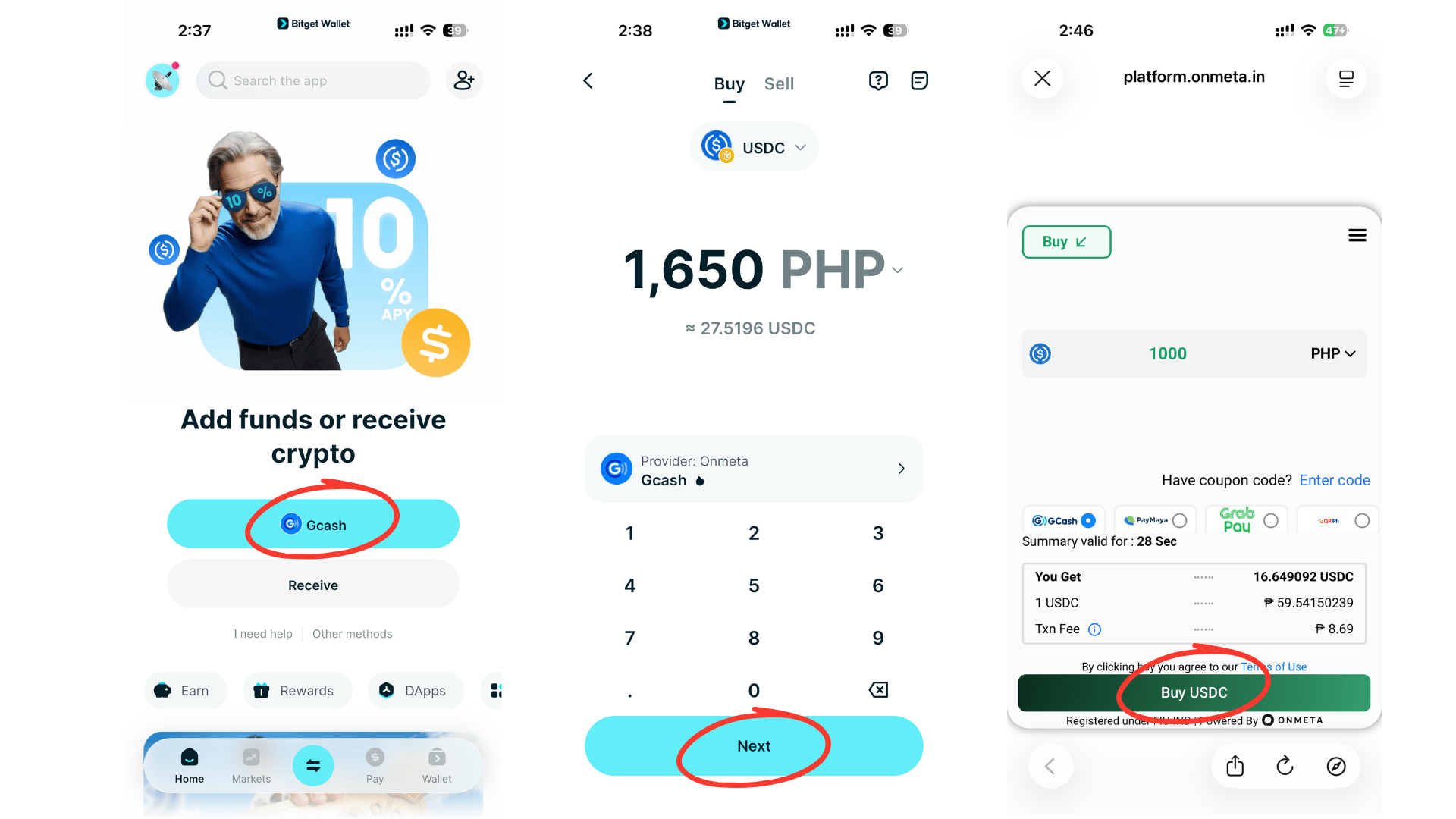

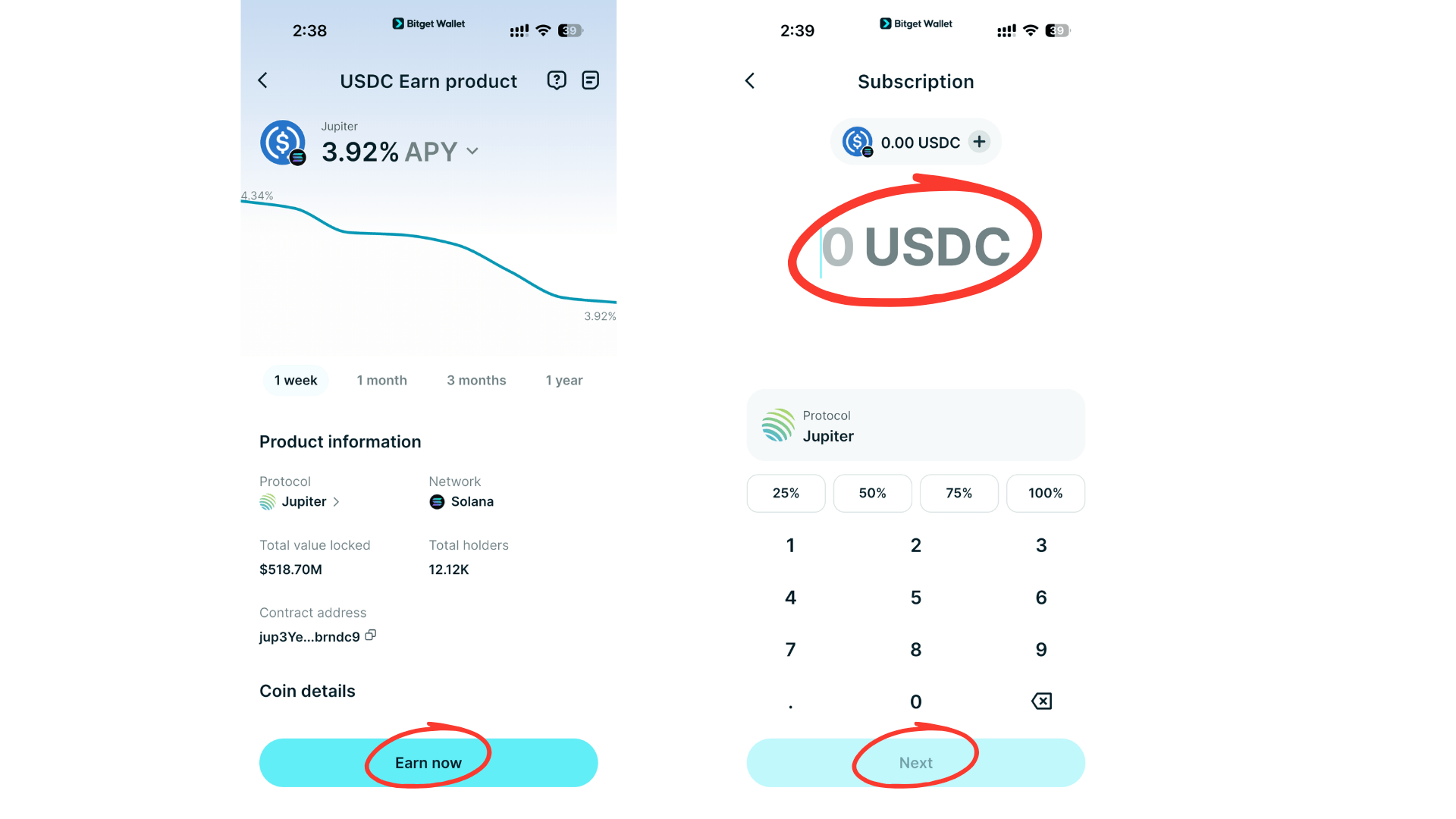

How to Start USDC Earn with Bitget Wallet?

- Download Bitget Wallet from the official website or app store.

- Create or import your wallet and securely back up your recovery phrase.

- Deposit, swap, or purchase USDC within Bitget Wallet.

- Navigate to the Stablecoin Earn section.

- Select a USDC Earn option based on APY and liquidity terms.

- Confirm participation and monitor your USDC Earn returns inside the wallet dashboard.

Related Reading on USDT & USDC Yield

If you're exploring USDT earn or USDC earn opportunities — from fixed APY savings to on-chain yield strategies — these guides will help you understand how stablecoin yield works, how to evaluate risk, and how to optimize returns safely.

🔹 Understanding Stablecoin Yield Basics

- Yield Farming: What Is It and How Does It Work?

- How to Earn Passive Income With Cryptocurrency? A Beginner’s Guide

🔹 USDT Earn & Yield

- USDT Earn Explained: How to Generate Yield on Tether Safely

- How to Earn Yield on USDT: Fixed vs Flexible APY Compared

🔹 USDC Earn & Yield

- USDC Earn Explained: A Complete Guide to Yield, APY, and Risk

- USDC Earn Returns: How to Evaluate APY, Liquidity, and Smart Contract Exposure

- Stablecoin Earn Plus: What USDC Earn Is and How to Start Generating Yield

🔹 Evaluating APY & Risk

- What Is APY in Crypto and How Yield Is Calculated

- Stablecoin Yield Risks: Smart Contracts, Counterparty & Liquidity

Conclusion

USDC Earn returns should be evaluated based on APY sustainability, liquidity flexibility, and smart contract exposure rather than headline USDC interest rate alone. Investors comparing USDC Earn vs savings account alternatives must prioritize capital preservation and risk-adjusted return over short-term promotional yield.

For secure storage and structured cross-chain stablecoin yield access, Bitget Wallet offers a non-custodial solution designed for disciplined asset management. Through Stablecoin Earn Plus: Earn up to 10% APY on your holdings while maintaining full custody and liquidity flexibility.

Download Bitget Wallet to access cross-chain USDC Earn opportunities today.

Sign up Bitget Wallet now - grab your $2 bonus!

FAQs

1. What is the return rate for USDC?

The return rate for USDC depends on the platform and yield model used in USDC Earn programs. Typical USDC APY ranges from 3%–12%, depending on liquidity demand, risk profile, and smart contract exposure.

2. Can you earn on USDC?

Yes, users can generate yield through USDC Earn programs offered via DeFi lending, CeFi lending, or real-world asset strategies. USDC Earn returns vary based on platform structure and the sustainability of the underlying USDC interest rate.

3. Is USDC yield bearing?

USDC itself is not automatically yield-bearing when held in a wallet. It becomes yield-generating only when allocated into USDC Earn platforms or structured stablecoin yield programs.

4. What is the APY for USDC staking?

When comparing USDC staking vs earn, most yield programs labeled as staking are actually lending-based USDC Earn structures. Although often referred to as staking, USDC staking typically involves lending-based USDC Earn mechanisms rather than proof-of-stake validation.

5. Is holding USDC worth it?

Holding USDC provides price stability and capital preservation compared to volatile crypto assets. However, participating in USDC Earn allows users to generate additional yield while maintaining stablecoin exposure.

6. Can you lose money with USDC Earn?

Yes, you can lose money with USDC Earn under certain conditions. Whether USDC Earn is safe depends on platform structure, liquidity risk, and smart contract exposure. Evaluating how to evaluate USDC Earn APY and platform risk reduces the likelihood of unexpected losses.

7. How much is $100 in USDC?

USDC is designed to maintain a 1:1 peg with the U.S. dollar. Therefore, $100 typically equals approximately 100 USDC, subject to minor market deviations.

8. How much is 1000 USDC worth?

1000 USDC is generally worth approximately $1000 due to its dollar peg mechanism. Small fluctuations may occur during extreme market conditions but are usually minimal.

9. How to get USDC fast?

Users can acquire USDC through exchanges, on-ramp providers, or supported wallet integrations. After purchasing USDC, funds can be allocated into USDC Earn programs to generate stablecoin yield.

Risk Disclosure

Please be aware that cryptocurrency trading involves high market risk. Bitget Wallet is not responsible for any trading losses incurred. Always perform your own research and trade responsibly.