Cash Out USDT: How to Withdraw USDT and Tether via Exchanges, P2P, Crypto Wallets, and Crypto Cards

Cash Out USDT safely is one of the most searched questions among stablecoin holders in 2026. While USDT is designed to track the U.S. dollar, withdrawing USDT to a bank account is not always frictionless. Users frequently encounter frozen transfers, unexpected USDT withdrawal fees, KYC verification delays, or settlement lags when attempting to convert USDT to fiat.

To withdraw USDT and complete a proper USDT to fiat conversion, you must select a compliant off-ramp pathway. Whether you choose a centralized exchange, a P2P marketplace, or a crypto card will determine your speed, total cost, and risk exposure. Users who prefer self-custody can also withdraw USDT directly through crypto wallets such as Bitget Wallet, which integrates compliant off-ramp services.

In this article, we’ll compare Exchanges vs P2P vs Crypto Cards, break down USDT withdrawal fees, assess risks, and help you determine the best way to cash out USDT.

Key Takeaways

- Cash Out USDT requires selecting the right withdrawal method based on transaction size, urgency, and compliance needs. Exchanges offer structured liquidity and regulatory clarity for USDT to fiat conversion, while P2P and crypto cards provide alternative pathways.

- To withdraw USDT efficiently, exchanges are safest for large withdrawals, P2P can reduce visible spread but increases counterparty risk, and crypto cards enable instant USDT to fiat spending without waiting for bank settlement.

- Understanding total USDT withdrawal fees — including network costs (TRC20 USDT vs ERC20 USDT), trading spreads, and FX or banking charges — helps minimize losses when you convert USDT to fiat.

How Does Cash Out USDT Work?

Before choosing a method, it’s important to understand how the process to cash out USDT wrks. Understanding this workflow is the first step in learning how to cash out USDT efficiently, securely, and with minimal USDT withdrawal fees.

At its core, withdrawing USDT involves converting Tether to USD or local currency through a regulated intermediary. You are not withdrawing USDT directly to a bank account. You must first convert USDT to fiat and then initiate settlement through an exchange, P2P platform, crypto wallet off-ramp, or crypto card provider.

Step-by-Step Cash Out USDT Process

- Hold or deposit USDT (TRC20 USDT or ERC20 USDT).

- Sell USDT for USD or local fiat currency.

- Select a payout method (bank transfer via exchange, P2P settlement, crypto wallet off-ramp, or crypto card).

- Complete KYC verification if required.

- Receive fiat settlement.

The pathway you choose affects total USDT withdrawal fees, settlement time, and compliance friction.

How to Withdraw USDT via Exchanges?

Centralized exchanges (CEX) remain the most common method to withdraw USDT to a bank account, and they are also the primary channel used by investors who want to withdraw Tether through regulated infrastructure. By allowing users to sell USDT and complete compliance procedures within a secure environment, exchanges offer the safest pathway for larger withdrawals while maintaining compatibility with traditional banking systems.

USDT Withdrawal Process via Centralized Exchanges (CEX)

To withdraw USDT through a centralized exchange (CEX), users must complete a structured USDT to fiat conversion process that includes selling USDT, verifying identity, and initiating a regulated bank payout.

- Deposit USDT to the exchange.

- Sell USDT for USD or local currency. This step is where you convert Tether to USD before initiating a bank withdrawal.

- Initiate bank withdrawal.

- Complete KYC verification and compliance checks.

- Receive fiat settlement (typically 1–3 business days).

Advantages and Limitations

Before deciding to cash out USDT via exchanges, it’s important to weigh the operational strengths against potential USDT withdrawal fees and banking delays.

Advantages

- High liquidity

- Lower slippage for large transactions

- Strong compliance framework

Limitations

- Banking delays

- USDT withdrawal fees

- Trading spreads

If your priority is compliance and larger withdrawals, exchanges are usually the best way to cash out USDT securely.

How to Withdraw USDT via P2P?

Users who prefer flexibility may choose to withdraw Tether through peer-to-peer marketplaces instead of centralized exchanges. This approach enables direct USDT to fiat conversion between participants and may reduce visible spreads, but it introduces additional operational and counterparty risk.

USDT Withdrawal Process via P2P Marketplaces

To withdraw USDT via P2P, users must complete a peer-matched transaction secured by an escrow mechanism.

- List USDT for sale on a P2P marketplace.

- Match with a verified buyer.

- Receive fiat payment.

- Confirm receipt of funds.

- Release USDT from escrow.

Advantages and Limitations

Before choosing this method to cash out USDT, it is important to understand both the flexibility and the associated risks of P2P USDT withdrawal.

Advantages

- Flexible pricing

- Faster settlement in some cases

- Reduced exchange trading spread

Limitations

- Counterparty risk

- Possible bank freezes

- Fraud disputes

P2P can be the fastest way to cash out USDT in certain scenarios, but it requires careful verification to avoid reversal scams and payment disputes.

How to Withdraw USDT via Crypto Wallets?

Crypto wallets with integrated off-ramp infrastructure provide a self-custody method to convert USDT to fiat without first transferring assets to a centralized exchange. Instead of depositing funds into a CEX, users can initiate a direct USDT to fiat conversion inside their wallet through licensed off-ramp partners.

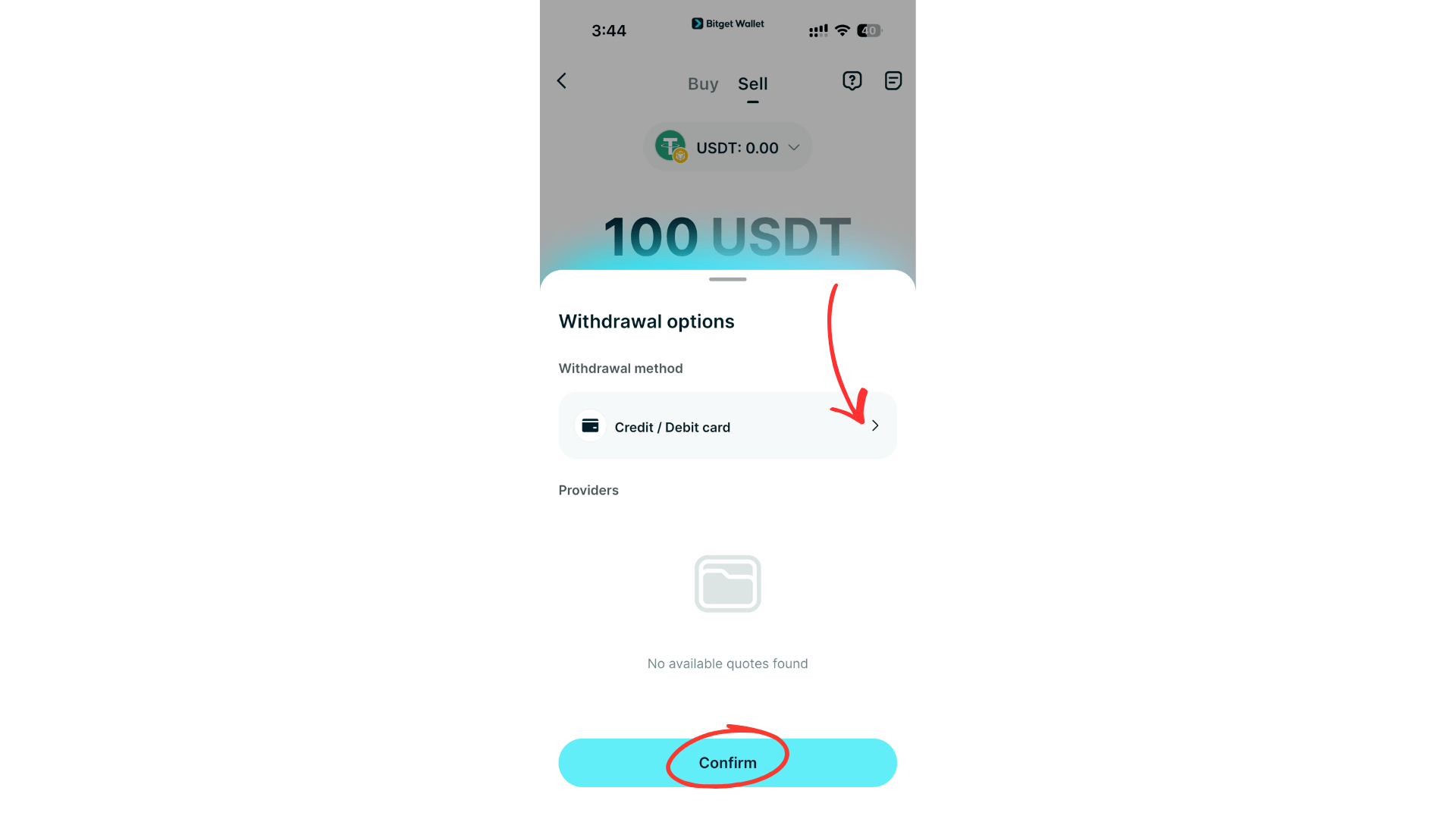

For example, Bitget Wallet (BGW) enables users to withdraw USDT directly from a non-custodial environment using integrated fiat off-ramp providers. This allows you to maintain wallet control while completing a compliant USDT to fiat conversion.

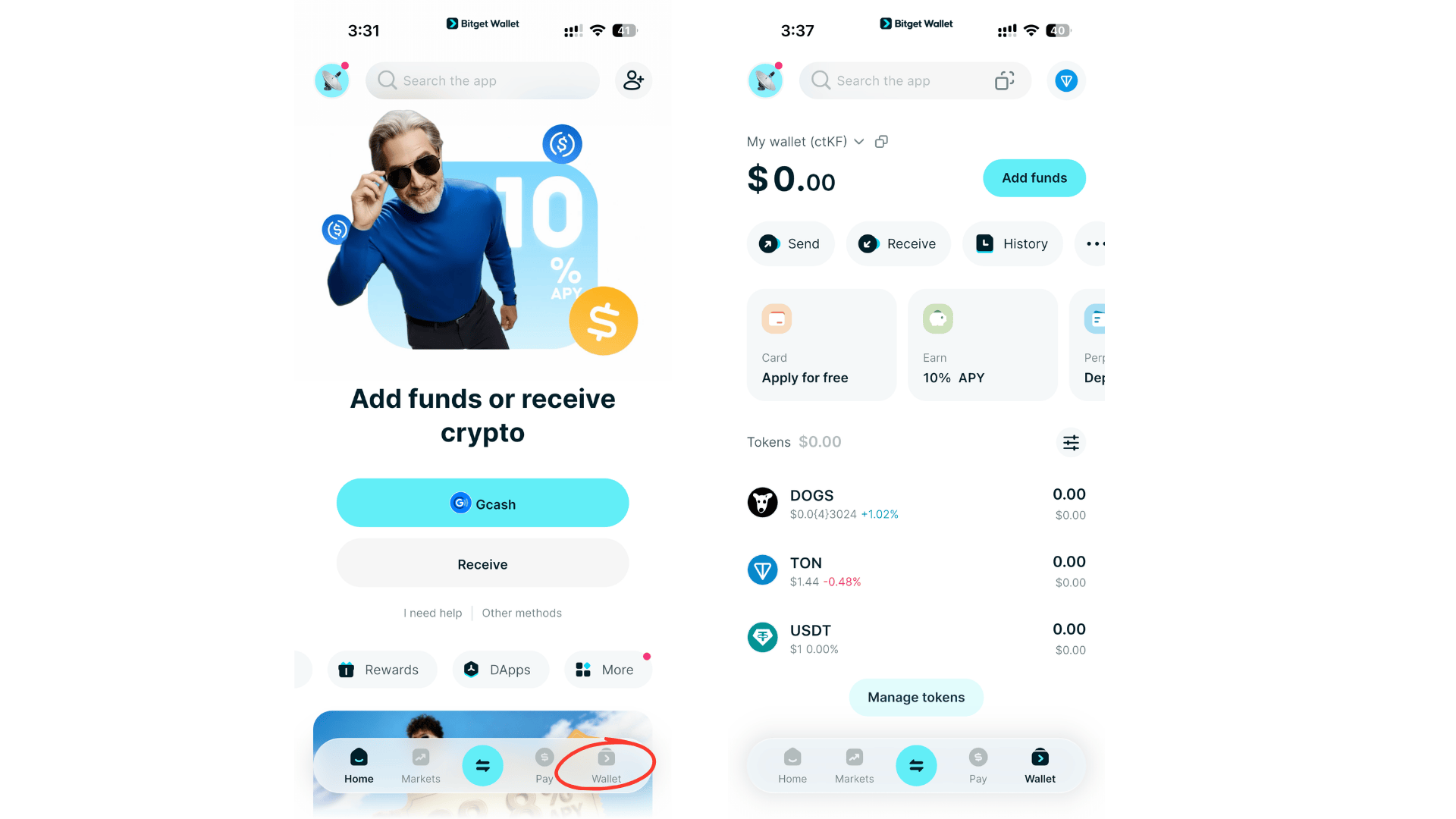

USDT Withdrawal Process via Bitget Wallet

- Open Bitget Wallet and confirm your USDT balance (TRC20 USDT or ERC20 USDT).

- Navigate to the Sell / Off-Ramp section.

- Select USDT as the asset to convert.

- Choose a supported off-ramp provider inside BGW.

- Preview the real-time USDT to fiat rate and associated fees.

- Complete KYC verification required by the provider.

- Confirm payout details and initiate withdrawal to your bank account.

This approach eliminates the need to move funds across multiple platforms and reduces operational friction when you withdraw USDT.

How to Withdraw USDT via Crypto Cards?

Crypto cards offer one of the fastest ways to withdraw USDT by converting USDT to fiat at the point of payment instead of initiating a traditional bank transfer. Rather than sending USDT to an exchange and withdrawing to a bank account, users complete an automatic USDT to fiat conversion during checkout.

With solutions such as the Bitget Wallet Card, users can link their USDT balance and spend globally wherever supported payment networks are accepted.

USDT Withdrawal Process via Crypto Cards

When you withdraw USDT using a crypto card, the conversion occurs automatically at transaction time.

- Link your USDT balance inside Bitget Wallet to the crypto card.

- Initiate a purchase at a supported merchant (online or in-store).

- Automatic USDT to fiat conversion occurs at the current FX rate.

- The merchant receives settlement in local currency.

- The payment network processes the transaction instantly.

There is no separate bank withdrawal step — your USDT is converted and spent in real time.

Advantages and Limitations of Using Crypto Cards to Cash Out USDT

Before choosing crypto cards as your method to convert USDT to fiat, it’s important to evaluate how instant liquidity compares to total USDT withdrawal fees, FX spreads, and long-term cost efficiency. While crypto cards offer the fastest way to cash out USDT for spending, they may not be the most cost-effective solution for larger withdrawals or bank-based settlements.

Advantages

- Instant liquidity (fastest way to cash out USDT for spending)

- Global merchant acceptance

- No bank transfer waiting period

- Seamless integration inside Bitget Wallet

Limitations

- FX spread applies

- Card transaction fees may apply

- Not ideal for large USDT liquidation to a bank account

- Requires KYC for card issuance

Is a Crypto Card the Best Way to Withdraw USDT?

Crypto cards are ideal for daily spending and small-to-medium USDT conversions where speed matters. However, for large withdrawals to a bank account, exchanges may offer more structured settlement rails.

If your priority is instant access and real-time USDT to fiat conversion, using a crypto card integrated with Bitget Wallet provides one of the fastest and most convenient withdrawal methods available.

Exchange vs P2P vs Crypto Wallets vs Crypto Cards — Best Way to Cash Out USDT in 2026

Looking for the best way to cash out USDT? This comparison breaks down Exchange vs P2P vs Crypto Wallets vs Crypto Cards based on speed, USDT withdrawal fees, compliance, and fraud exposure so you can choose the safest and fastest method to convert USDT to fiat.

Choosing how to withdraw USDT depends on settlement time, total fees, and regulatory compatibility. While all three methods support USDT to fiat conversion, each pathway offers a different balance between liquidity access, operational risk, and compliance protection.

Comparison: Exchange vs P2P vs Crypto Wallet vs Crypto Card for USDT Withdrawal

The table below summarizes how each method performs when you withdraw USDT.

| Factor | Exchange | P2P | Crypto Wallet (Off-Ramp) | Crypto Card |

| Speed | 1–3 business days | Minutes–hours | Minutes–1 business day | Instant at payment |

| USDT Withdrawal Fees | Medium (spread + network + withdrawal) | Low–Medium (negotiated spread) | Medium (provider fee + network) | FX spread + card fees |

| KYC Required | Yes | Partial / Platform dependent | Yes (off-ramp provider) | Yes |

| Fraud Risk | Low | Medium–High (counterparty risk) | Low | Low |

| Best Use Case | Large bank withdrawals | Flexible local liquidity | Self-custody cash-out to bank | Daily spending & instant access |

1. Exchange — Most Structured Way to Withdraw USDT

Using a centralized exchange remains the most bank-compatible way to withdraw USDT to a bank account. You deposit USDT, convert to fiat, and request a withdrawal through regulated banking rails.

Best for:

- Large withdrawals

- High compliance regions

- Clear transaction history

Trade-off: Slower settlement and layered fees.

2. P2P — Flexible Way to Cash Out USDT

P2P platforms allow users to sell USDT directly to buyers using local payment methods. This can provide faster access and sometimes tighter spreads.

Best for:

- Regions with limited exchange access

- Users seeking flexible payout methods

Risk factor: Higher fraud exposure without proper escrow and verification.

3. Crypto Card — Fastest Way to Cash Out USDT

Crypto cards enable real-time USDT to fiat conversion at the point of payment. Instead of transferring to a bank first, your USDT converts automatically when you spend.

Best for:

- Instant liquidity

- Everyday purchases

- Travel and online transactions

Trade-off: FX spreads and card program fees may apply.

Which Is the Best Way to Cash Out USDT?

Your choice should reflect withdrawal size, urgency, and risk tolerance.

- Safest for large withdrawals → Exchange

- Fastest way to cash out USDT instantly → Crypto Card

- Lower visible spread when selling USDT → P2P

- Most bank-compliant method to withdraw USDT → Exchange

There is no universal answer when deciding how to withdraw USDT. The best way to convert USDT to fiat depends on your transaction profile, speed requirements, and security priorities.

What USDT Withdrawal Fees Should You Expect?

When you withdraw USDT to fiat, total USDT withdrawal fees are layered and vary depending on the method used to cash out USDT. Whether you use exchanges, P2P platforms, or crypto cards, the final cost includes network, trading, and banking components.

-

Network Fees

TRC20 USDT generally has lower network fees than ERC20 USDT due to reduced gas costs, which can significantly impact total USDT withdrawal fees during large transactions.

-

Trading Spread

When you sell USDT for USD or local currency, instant USDT to fiat conversion often includes a higher spread compared to limit-order execution on exchanges.

-

FX and Banking Costs

When you withdraw USDT to a bank account, banks may apply currency conversion markups, processing fees, or settlement charges depending on the payout rail.

Understanding these components helps reduce total USDT withdrawal fees and improves cost efficiency when you cash out USDT.

What Risks Should You Consider Before You Cash Out USDT?

Before you cash out USDT, it’s important to assess operational, compliance, and market risks that may affect your ability to withdraw USDT smoothly and complete a successful USDT to fiat conversion.

-

Banking Risks

Some banks flag crypto-related transfers when you withdraw USDT to a bank account, which may result in delayed settlement or temporary account restrictions.

-

Compliance Risks

KYC verification delays, enhanced due diligence checks, or withdrawal limits can slow down your attempt to withdraw USDT through regulated platforms.

-

P2P Fraud Risks

When using peer-to-peer marketplaces to cash out USDT, reversal scams, payment disputes, or identity mismatches may occur.

-

Market Risk

Price volatility during high-traffic periods can lead to slippage when converting USDT to fiat, especially for larger transactions.

Mitigating these risks helps ensure a smoother USDT to fiat conversion and reduces unexpected disruptions when you cash out USDT.

Best Way to Withdraw USDT: How to Cash Out USDT Using Bitget Wallet?

The fastest way to withdraw USDT is through a direct crypto-to-fiat off-ramp inside a self-custody wallet. Bitget Wallet enables users to cash out USDT directly from a non-custodial environment via integrated off-ramp providers like MoonPay, allowing compliant USDT-to-fiat conversion without transferring funds to a centralized exchange first.

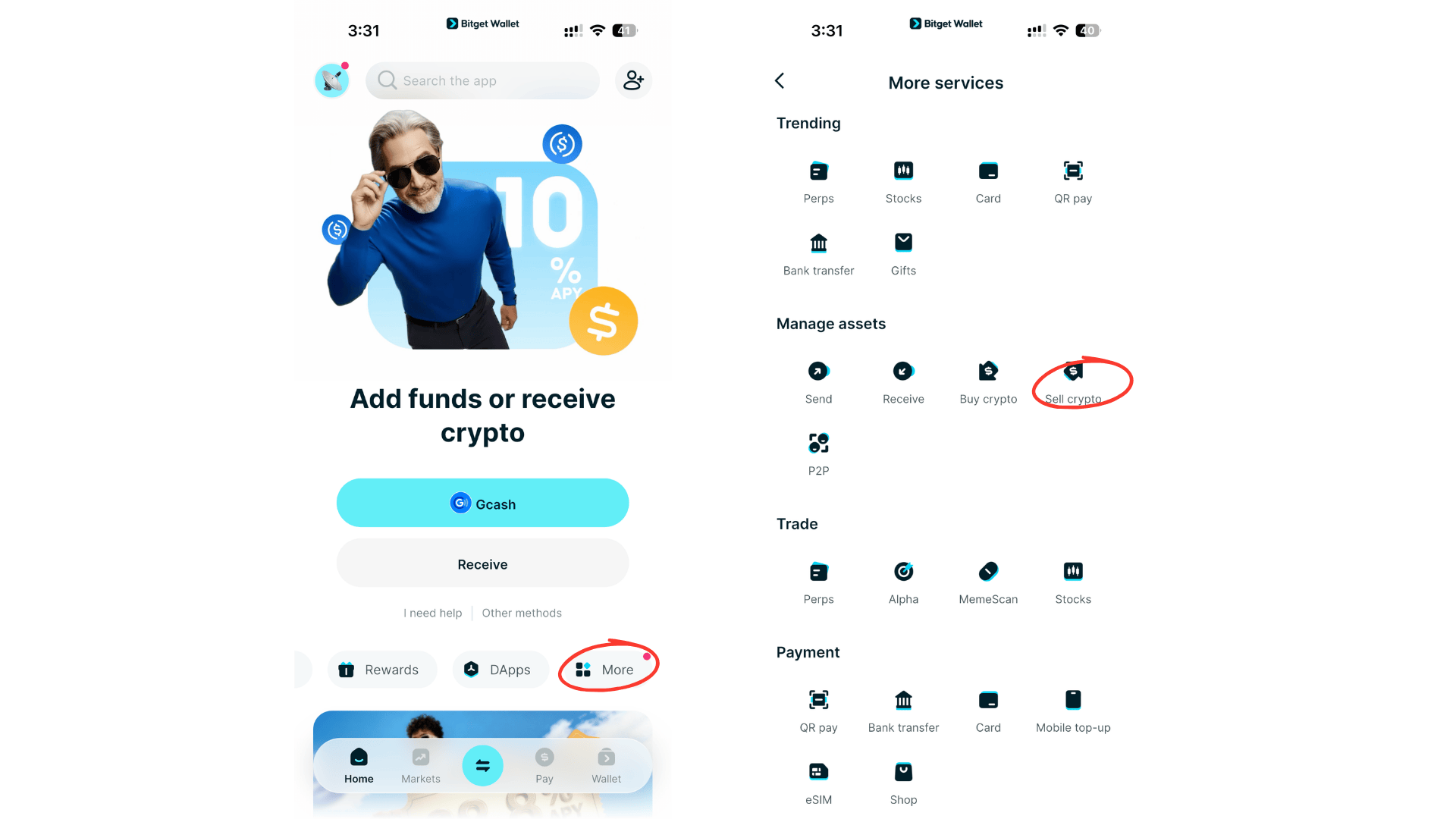

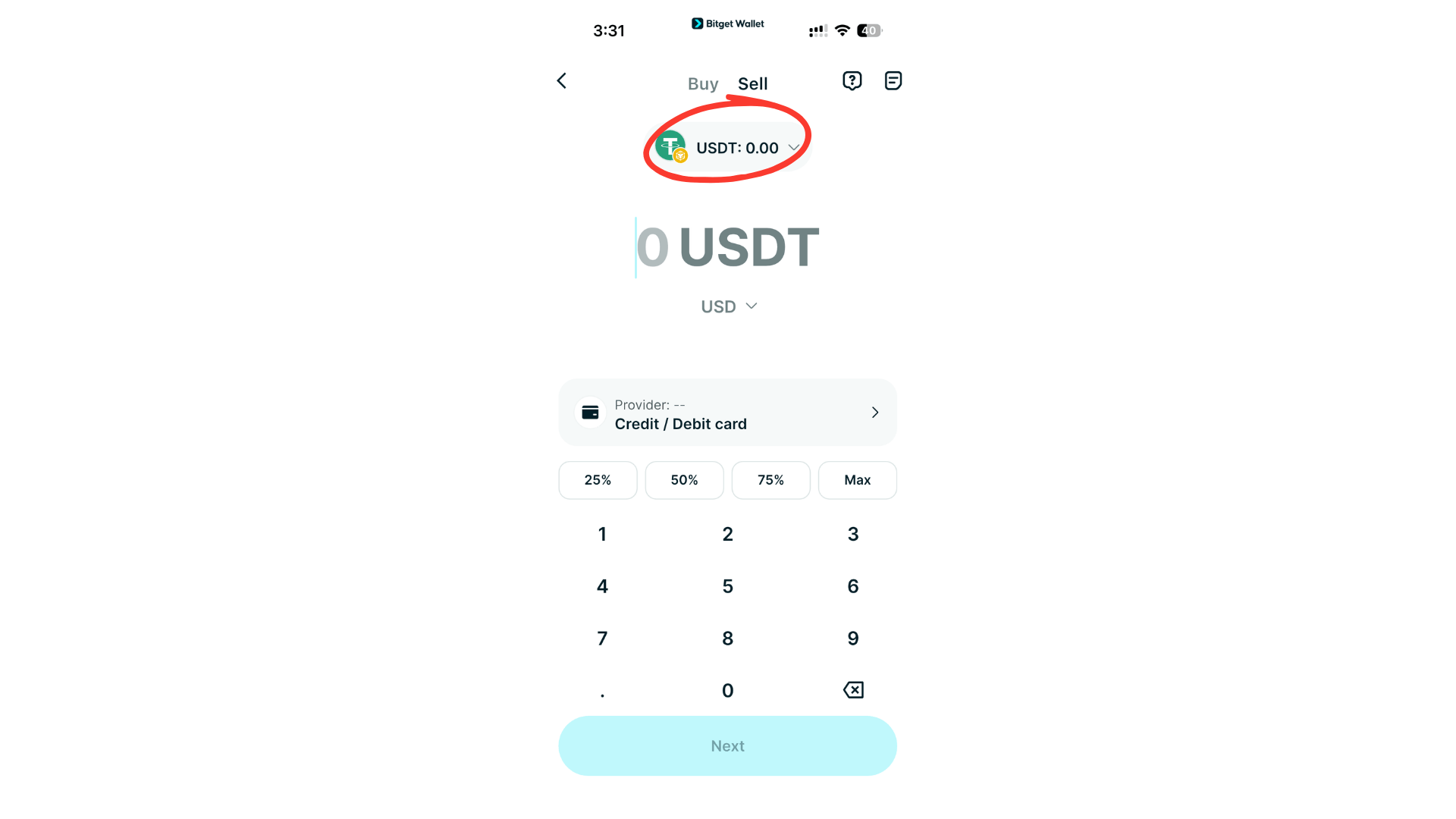

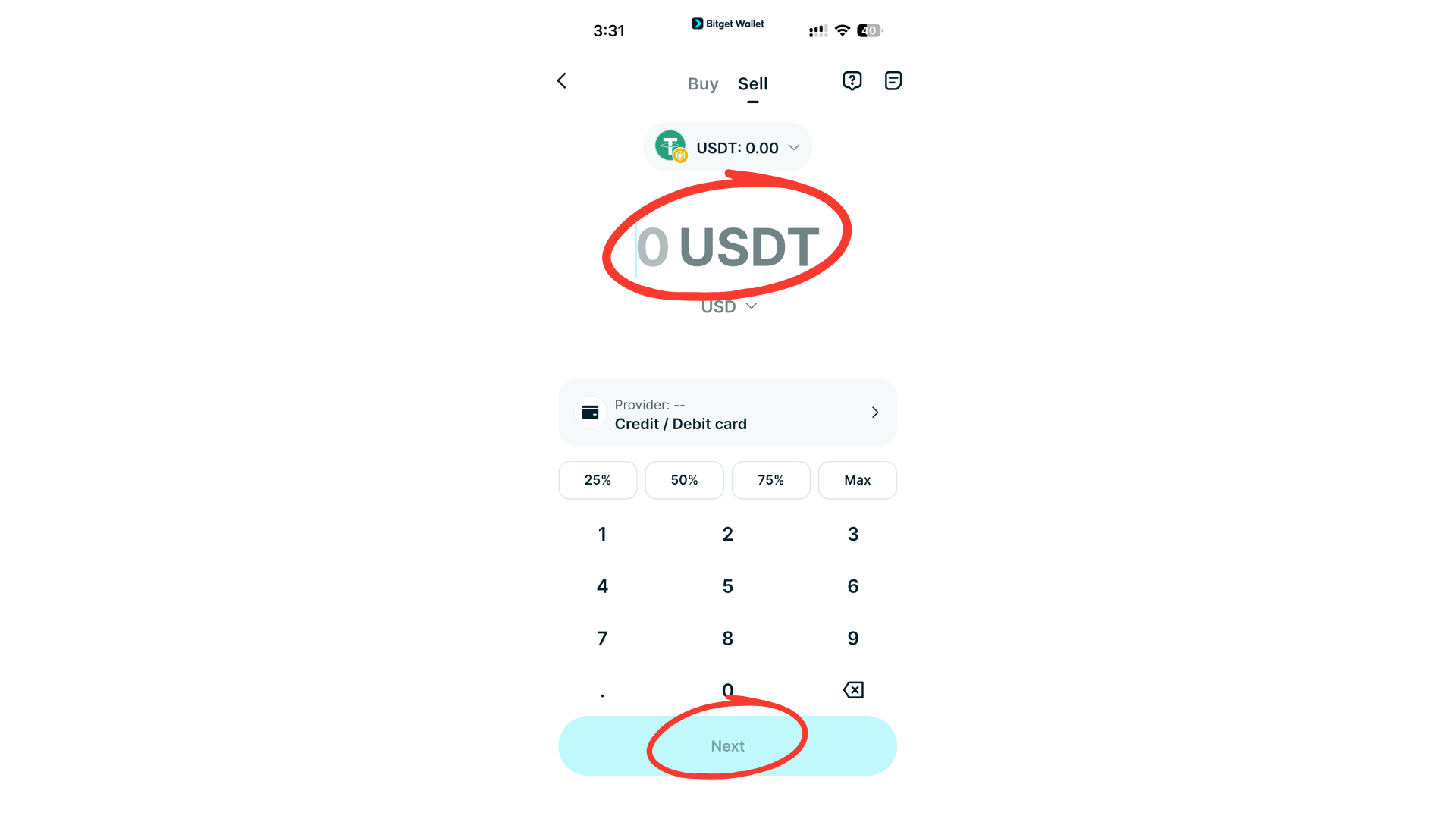

Follow these steps to Cash Out USDT within Bitget Wallet:

- Download Bitget Wallet and set up your wallet securely.

- Open Bitget Wallet and confirm your USDT balance (TRC20 USDT or ERC20 USDT).

- Navigate to Sell Crypto / Off-Ramp.

- Select USDT as the asset to convert.

- Enter the withdrawal amount and preview the real-time USDT to fiat rate.

- Choose a supported payout method to withdraw USDT.

- Complete KYC verification required by the off-ramp provider.

- Confirm the transaction and wait for fiat settlement.

This approach combines self-custody security with compliant off-ramp infrastructure, making it an efficient way to cash out USDT while minimizing operational friction and unnecessary USDT withdrawal fees.

Related Reading on Fiat On-Ramps & Off-Ramps

If you want to better understand how fiat on-ramps and off-ramps work — from buying crypto with bank cards to converting USDT back into fiat — these guides will help you navigate the full process safely and efficiently:

Understanding Crypto On-Ramps & Off-Ramps

- What Are Crypto On-Ramps and Off-Ramps: How to Convert Fiat Into Digital Assets?

- What Is a Crypto On-Ramp and How to Buy Crypto with Fiat

- What Is a Crypto Off-Ramp and How to Convert Crypto to Fiat

Stablecoins & Fiat Conversion

- What Is Stablecoin? A Beginner’s Guide to Price-Stable Cryptocurrencies

- What Is Tether (USDT)? Complete Guide to the Leading Stablecoin

- USDC vs USDT: What’s the Difference? Investor’s Guide

Practical Guides: Buying and Selling Crypto with Fiat

- USDT On-Ramp Complete Guide: How to Buy Tether (USDT) with Fiat

- Cash Out USDT: How to Withdraw USDT to Bank Account?

- How to Withdraw USDT and Tether via Exchanges, P2P, and Crypto Cards

Conclusion

Cash Out USDT decisions should be based on safety, settlement speed, and total USDT withdrawal fees. Exchanges offer compliance and liquidity for larger withdrawals. P2P provides flexibility with higher counterparty exposure. Crypto cards allow instant liquidity for spending.

For users who prefer secure self-custody combined with integrated off-ramp access, crypto wallets such as Bitget Wallet offer a streamlined solution for USDT to fiat conversion.

Download Bitget Wallet today to cash out USDT safely, convert Tether to USD efficiently, and manage your crypto with confidence.

Sign up Bitget Wallet now - grab your $2 bonus!

FAQs

1. How to cash out USDT safely?

To cash out USDT safely, use regulated exchanges, verified P2P platforms with escrow protection, or compliant crypto cards that support secure USDT to fiat conversion. Always complete KYC verification and confirm payout details before you withdraw USDT to a bank account.

2. What is the best way to cash out USDT?

The best way to cash out USDT depends on transaction size, urgency, and risk tolerance. Exchanges are typically safest for large withdrawals, while crypto cards allow instant liquidity and P2P may reduce visible spreads.

3. How do I withdraw USDT to a bank account?

To withdraw USDT to a bank account, sell USDT on a centralized exchange and convert Tether to USD or local fiat currency. After completing KYC verification, initiate a USDT to fiat bank transfer through the exchange’s withdrawal system.

4. Are USDT withdrawal fees high?

USDT withdrawal fees vary depending on network selection (TRC20 USDT vs ERC20 USDT), trading spreads, and banking or FX charges. Understanding these components helps reduce total costs when you cash out USDT.

5. Can I cash out USDT instantly?

You can cash out USDT instantly using crypto cards that convert USDT to fiat at checkout. Some P2P transactions may also settle quickly, but speed depends on buyer response and banking compatibility.

6. Is withdrawing USDT the same as withdrawing Tether?

Yes, withdrawing USDT is the same as withdrawing Tether because USDT is the ticker symbol for Tether. Both terms refer to converting the same stablecoin asset into fiat currency.

Risk Disclosure

Please be aware that cryptocurrency trading involves high market risk. Bitget Wallet is not responsible for any trading losses incurred. Always perform your own research and trade responsibly.