Yes-No Market vs Polls: What Investors Should Know About Signal Quality and Bias

Yes-No Market vs Polls is not a question of which forecasting method is “right,” but rather which one answers the decision you are trying to make. For investors, analysts, and probability-driven thinkers, understanding the difference between Yes-No Market vs Polls is essential to interpreting signals responsibly—especially in crypto and macro markets where incentives matter.

In the first 100 words, it is important to clarify this core distinction: prices and opinions are designed to measure different things. Polls capture stated beliefs without consequence, while yes-no markets express beliefs through prices formed under financial risk. The Yes-No Market vs Polls comparison therefore functions as a framework for evaluating incentives, signal quality, and bias—rather than a contest of accuracy.

This article approaches Yes-No Market vs Polls as a tool for better decision-making, helping investors understand how probabilities emerge, how bias is corrected, and why incentives fundamentally change how forecasts are formed. For users navigating prediction markets and on-chain signals, tools like Bitget Wallet play a key role by enabling secure access to market-based data, assets, and decentralized platforms where these probability-driven signals are expressed in real capital.

Key Takeaways

- Yes-No Market vs Polls compares incentives, not just outcomes

- Markets aggregate priced beliefs, polls collect cost-free opinions

- Financial consequences change forecasting behavior

- Bias exists in both systems, but correction mechanisms differ

- Investors must interpret probabilities within liquidity, regulation, and resolution context.

Yes-No Market vs Polls: What Are the Key Differences?

At a conceptual level, Yes-No Market vs Polls distills into one simple distinction: what question is being asked? Polls ask “What do you think?” without penalty for error. A yes-no market asks “What do you think the outcome will be?” with capital at stake. This transforms forecasting from a free opinion into a priced belief with consequences for being wrong.

Polls gather responses with no direct financial risk, leading to what we might call opinion without cost. In contrast, a yes-no market aggregates belief under consequence — participants risk capital, so the price becomes a real-time expression of collective judgment under incentives.

What does a yes-no market measure that a poll cannot?

A yes-no market (a form of prediction market) assigns a probability to an event’s occurrence through trading prices that settle to a known value (e.g., $1 if yes, $0 if no). These prices fluctuate as traders reassess their views based on incoming information and risk preferences. Polls, by contrast, provide a snapshot of static responses collected over a period, prone to sampling and framing biases.

- Binary outcomes and resolved events: Markets deal in definitive outcomes with explicit resolution criteria.

- Probabilities expressed through prices: The price you see on a yes-no contract is the market’s current expectation of an event.

- Consequences for being wrong: Traders risk capital for their predictions — unlike poll respondents.

Source jdsupra.com

Why Are Prediction Markets Not the Same as Polls?

Yes-No Market vs Polls becomes stark when you contrast opinions with priced beliefs. Polls often measure sentiment — what people say they think — while prediction markets embed financial incentives that encourage participants to consider expected value and to update their positions as new information becomes available.

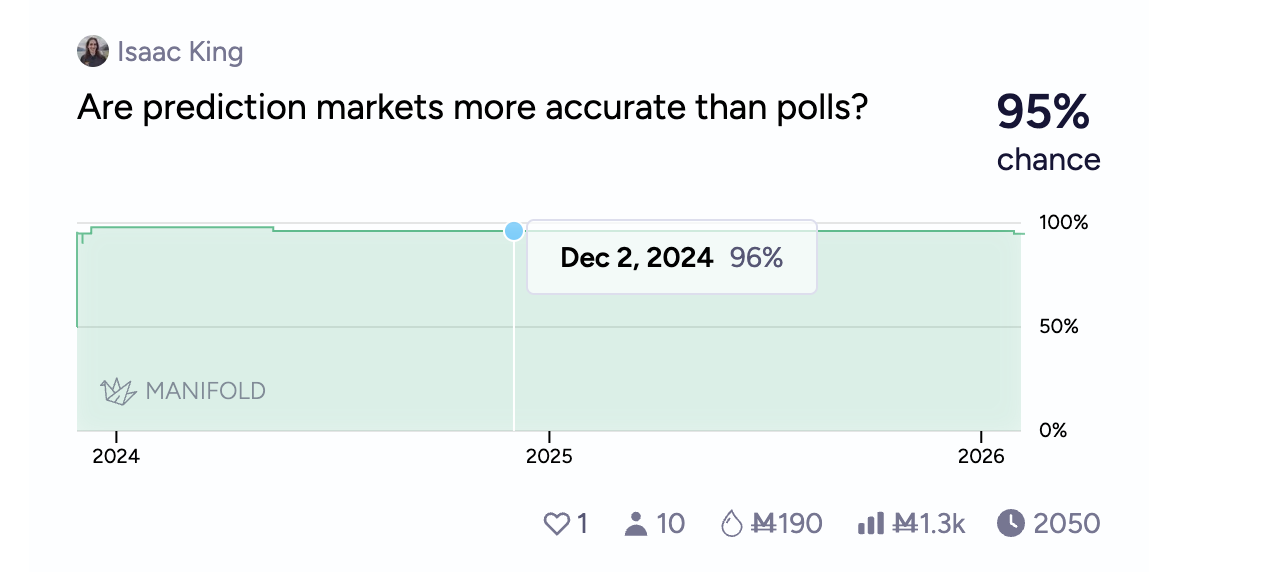

A key insight, when money is on the line, participants shift from telling you what they feel to betting on what they believe with consequence. Studies and expert analyses suggest that markets can sometimes generate forecasts that outperform polls, precisely because traders have skin in the game and update continuously based on information flow

Read more Yes-No Market vs Polls: What Investors Should Know About Signal Quality and Bias

Why does financial incentive change how people form predictions?

Financial incentives in prediction markets introduce a discipline absent in opinion polls:

- Expected value logic: When traders risk capital, they evaluate the likelihood of outcomes and potential payoff, leading to a pricing of probability rather than a mere tally of sentiment.

- Costless voting vs capital at risk: Poll responses don’t constrain respondents with downside risk — markets do.

- Incentive-driven forecasting: Traders with accurate information can profit, while incorrect views incur losses. This dynamic enhances signal quality by rewarding accurate prediction and penalizing guesswork.

How Do Yes-No Markets Aggregate Information Differently?

Under Yes-No Market vs Polls, a core promise of prediction markets is how they weight information. Unlike a simple average of responses, market prices reflect not just who thinks what but how strongly and confidently participants believe it — often seen in their willingness to allocate capital.

Source X

Read more How Do Sports Prediction Markets Work?

How does capital weighting improve information discovery?

- Confidence expressed: Via position size larger positions signal stronger conviction.

- Self-selection of informed participants: Traders who invest capital tend to research and refine their views.

- Dynamic repricing: Markets adjust in real time as new information arrives, continuously integrating it into prices.

What does a market probability actually represent?

A market probability isn’t consensus opinion or “truth.” It’s the best tradable estimate available — shaped by incentives, liquidity, and available information. This makes yes-no market pricing a distinct kind of signal compared to periodic polling averages.

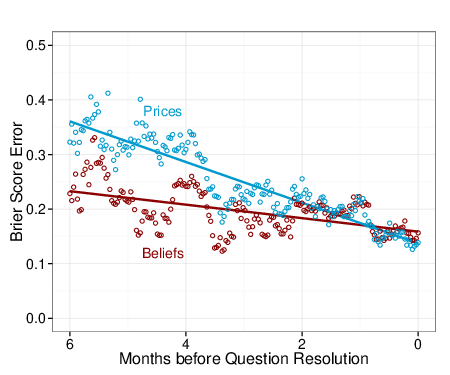

How Does Yes-No Market vs Polls Differ on Bias and Error Correction?

Both prediction markets and polls can be biased, but the mechanisms and corrections differ.

Source Cambridge University

Why can markets self-correct faster than polls?

Markets adjust instantly as new information becomes known. Prices shift as participants update beliefs and capitalize on mispricings, which often leads to quicker error correction than periodic polls. Continuous trading and arbitrage help prune outdated forecasts.

- Continuous updating: Market prices adjust in real time as new information becomes available.

- Financial incentives: Participants are rewarded for correcting mispricings, not just expressing opinions.

- Arbitrage pressure: Inconsistent or outdated beliefs are quickly challenged by traders seeking profit.

When can prediction markets still produce distorted signals?

Markets aren’t perfect: low liquidity can produce noise, poor resolution rules can skew outcomes, and regulatory uncertainty can undermine confidence or access. Misinterpreting prices as definitive truth, rather than probabilistic estimates, is another common pitfall.

- Low liquidity: Thin markets can amplify noise and allow small trades to move prices disproportionately.

- Poorly designed resolution rules: Ambiguous or flawed settlement criteria can bias participant behavior.

- Regulatory or access constraints: Restrictions can reduce participant diversity and capital flow.

- Information asymmetry: A small group of insiders can temporarily dominate price signals.

- Misinterpretation of prices: Treating market prices as certainties rather than probabilistic forecasts leads to overconfidence.

How Does Regulation Influence Signal Quality in Prediction Markets?

Regulatory clarity — especially oversight by bodies like the U.S. Commodity Futures Trading Commission (CFTC) — plays a central role in investor trust and market integrity for yes-no markets.

Why does CFTC oversight matter for event-based markets?

CFTC regulation brings

- Market integrity and surveillance

- Clear settlement and resolution rules

- Protections against manipulation

These elements help ensure that yes-no market signals reflect genuine trading activity and aren’t undermined by misinformation or operational flaws.

How do Kalshi and Polymarket differ structurally?

Kalshi operates under formal CFTC approval, subject to federal derivatives rules. Other platforms like Polymarket — especially outside the U.S. — operate with lighter oversight, which can mean higher agility but also higher regulatory risk.

- Kalshi Operates under formal CFTC approval and complies with U.S. federal derivatives regulations.

- Polymarket: Functions with lighter or offshore oversight, particularly outside the U.S., and is not CFTC-regulated.

Source X

When Are Prediction Markets More Useful Than Polls for Investors?

The question are prediction markets better than polls doesn’t have a universal answer. Instead, investors must consider when and why one signal might be preferable.

What types of decisions benefit most from market-based probabilities?

In these contexts, markets can provide real-time, incentive-aligned insights that move faster than periodic polls.

- High-stakes outcomes with clear resolution criteria

- Time-bounded forecasts with active trading

- Events where continuous price updates reflect evolving information

How should investors interpret probabilities responsibly?

Interpret probabilities with context: examine liquidity, regulatory status, and resolution rules. Understanding what a given implied probability means — and what it doesn’t — is key to responsible interpretation.

- Treat probabilities as estimates, not facts: Market-implied probabilities reflect current beliefs, not guaranteed outcomes.

- Check liquidity levels: Thin liquidity can exaggerate price movements and distort implied probabilities.

- Review regulatory status: The legal framework affects market integrity, participation, and enforcement.

- Understand resolution rules: Know exactly how outcomes are defined and settled before trusting a signal.

How Do Yes-No Markets Aggregate Information More Effectively?

Beyond simple averages, prediction markets use incentives to weight participants by confidence and track record. The more accurate a trader’s forecasts have been, the more capital they can allocate, reinforcing strong signals over time.

Why are better predictors naturally weighted more heavily over time?

Successful traders accumulate more capital or positions, letting their views exert greater influence on prices. This doesn’t guarantee perfect forecasts, but it aligns incentives with information quality rather than sheer numbers of opinions.

- Capital accumulation: Successful forecasts generate profits that increase future position size.

- Endogenous reputation effects: Accuracy translates into greater influence without explicit ranking systems.

- Risk tolerance sorting: Poor predictors lose capital or exit, reducing their price impact.

- Merit-based weighting: Influence comes from demonstrated performance, not popularity or volume of opinions.

- Incentive alignment: Rewards are tied directly to information quality rather than participation alone.

What does a market probability actually represent to investors?

A yes-no market probability is not a universal truth. It’s a dynamic, tradable estimate — influenced by confidence, liquidity, and the prevailing risk environment.

- A tradable estimate: Prices reflect where participants are willing to commit capital at a given moment.

- Conditional information: Probabilities depend on current knowledge, assumptions, and available data.

- Liquidity-sensitive signals: Thin markets can overstate confidence or volatility.

- Risk-adjusted beliefs: Prices embed uncertainty, hedging behavior, and risk preferences.

- Dynamic, not final: Market probabilities evolve as conditions and information change.

How Does Yes-No Market vs Polls Compare on Bias and Selection Effects?

While both polls and prediction markets aim to forecast outcomes, they differ in bias sources and corrective mechanisms. Polls capture opinions from selected samples, which may misrepresent the general population.

Markets aggregate financial stakes and real-time information, weighting participants by confidence and performance. Understanding these differences helps investors interpret signals responsibly.

How does selection bias affect polls differently than prediction markets?

Polls rely on survey respondents who may not represent the broader population, and respondents have no financial incentive to be accurate. Prediction markets may attract participants with stakes and expertise, but they may also reflect the biases of those with capital to deploy.

| Polls | Prediction markets |

| Respondents may not represent the full population (age, geography, ideology, etc.). | Participants self-select based on interest, expertise, or available capital. |

| No financial incentive means responses may reflect preference or social desirability rather than accuracy. | Traders have financial incentives to forecast correctly, aligning their actions with accuracy. |

| Sampling methodology and timing can create systematic errors. | Markets may still overrepresent wealthy or highly engaged participants, creating skewed signals. |

Can prediction markets still be biased, and why does regulation matter?

Yes. Market concentration, low participation, and uneven access can skew probabilities. Strong governance and clear compliance frameworks help mitigate these biases, making prices more reliable signals.

- Potential sources of bias:

- Low liquidity can make prices volatile and unrepresentative.

- Market concentration allows a few participants to disproportionately influence prices.

- Unequal access across geographies or regulatory jurisdictions limits diversity of opinions.

- Role of regulation and governance:

- Strong oversight ensures transparent rules, fair settlement, and dispute resolution.

- Clear compliance frameworks increase participant trust and broaden engagement.

- Well-regulated markets reduce manipulation risk, making probabilities more reliable as signals.

Are Prediction Markets Better Than Polls for Investors Making Decisions?

In synthesizing Yes-No Market vs Polls, the question isn’t which is universally superior, but when investors should lean on one signal over another. Markets excel when incentives align with information flow and outcomes have clear, tradable stakes. Polls remain useful for gauging sentiment and demographic preferences.

When should investors trust markets over surveys?

Markets are valuable when real-time probabilities matter and when incentives ensure that participants update views based on information rather than social desirability or static opinion snapshots.

- Real-time updates: Markets reflect new information instantly, whereas surveys are periodic and can be outdated.

- Incentive alignment: Traders risk capital, motivating them to forecast accurately rather than provide socially desirable answers.

- Aggregation of expertise: Markets weight opinions by confidence and past performance, highlighting informed participants.

- Error correction: Mispricings are quickly exploited by participants, reducing persistent biases.

- Complex or uncertain events: Markets can integrate diverse information that surveys might miss, especially when outcomes are probabilistic.

What framework can investors use to interpret market probabilities responsibly?

To interpret implied probabilities from yes-no markets and other prediction markets in a responsible, decision-ready way, investors should evaluate several key dimensions of the market environment and the contracts themselves:

- Liquidity depth: Ensure the market has sufficient activity and capital backing trades so that prices reflect diverse participant views rather than thin liquidity or manipulation. Higher liquidity generally supports more stable probability signals and reduces price distortion from isolated orders.

- Regulatory clarity: Understand the regulatory framework governing the market you’re using. Markets with clear compliance and oversight (such as regulated derivatives exchanges) help protect participants and can reduce legal or counterparty risk that might otherwise cloud interpretation of prices

Together, these criteria form a practical framework that helps translate Yes-No Market vs Polls into actionable insight by gauging whether a given market probability reflects a credible, information-weighted estimate of an event’s likelihood rather than noise or bias.

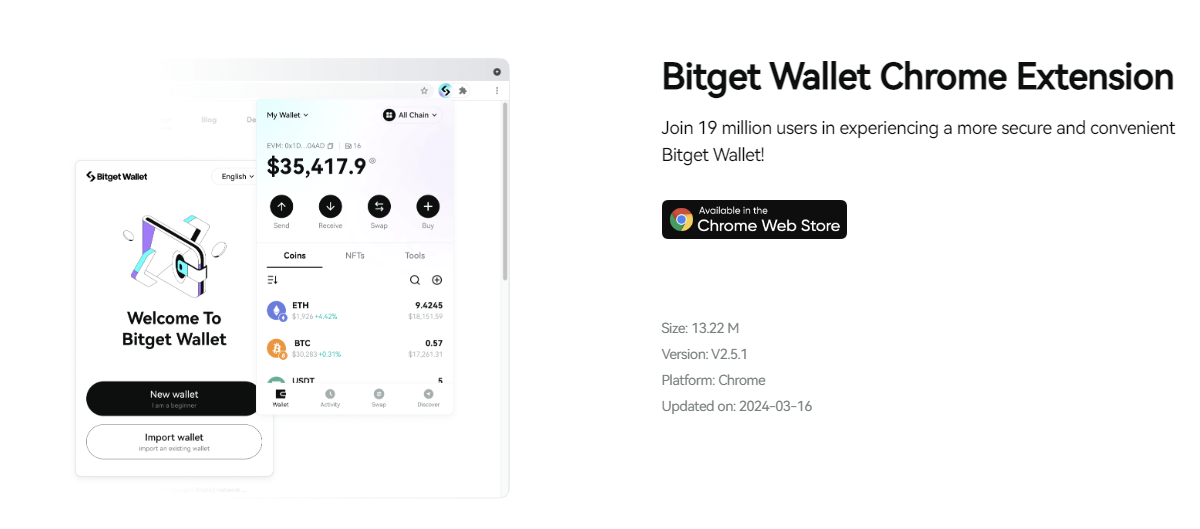

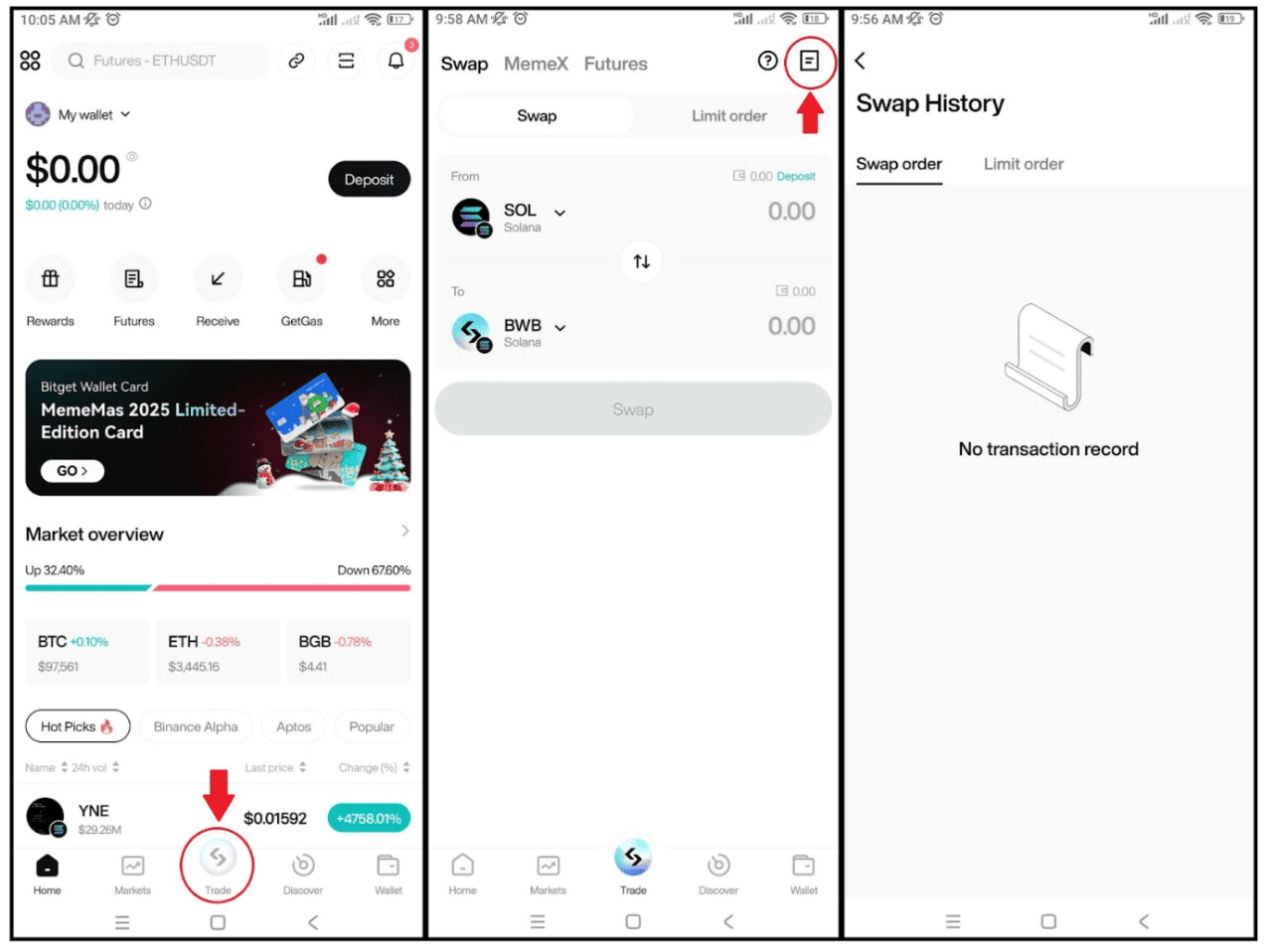

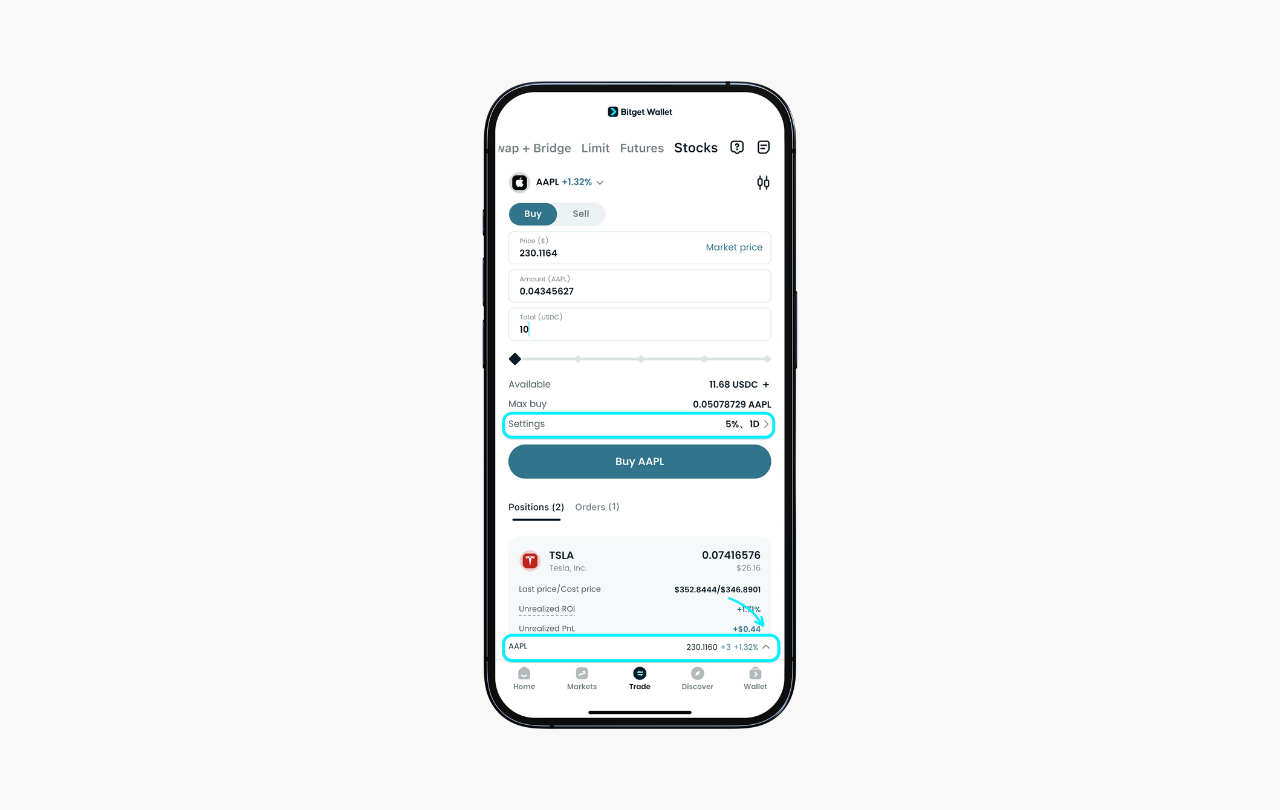

How Can Investors Use Bitget Wallet to Participate in On-Chain Prediction and Bitcoin Markets Safely?

For investors exploring on-chain prediction markets — where binary outcomes and probabilistic pricing intersect with blockchain transparency — Bitget Wallet offers practical, non-custodial control over assets and engagement in decentralized markets.

How does Bitget Wallet support secure participation in on-chain markets

- Non-custodial asset control: You retain keys and manage risk.

- On-chain transparency: Transaction history and contract rules are visible on chain.

- Risk management: Monitor positions and exposure without intermediaries.

The Steps Investors Should Follow to Engage Responsibly Using Bitget Wallet

To navigate on-chain prediction markets and other decentralized financial environments with confidence, investors can follow a clear, structured process that prioritizes secure asset control and disciplined decision-making:

Step 1: Prepare and fund your wallet with stable assets.

Start by funding your Bitget Wallet with stablecoins or other appropriate tokens before engaging in any prediction or yes-no market contracts.

Step 2: Connect only with verified, compliant on-chain protocols.

Use Bitget Wallet’s built-in Web3 browser to access decentralized prediction platforms that have clear rules and a reputable track record. Avoid unverified dApps to reduce counterparty and smart contract risk.

Step 3: Review event contracts and resolution terms thoroughly.

Before placing any prediction market bet or yes-no contract, understand the specific outcome language, resolution timeline, and settlement criteria. Clear terms help you interpret the market probability appropriately and align expectations with payouts.

Step 4: Track outcomes and adjust exposure based on pricing signals.

Once positions are open, monitor markets on-chain to see how probabilities evolve. Liquidity and price movement can indicate shifting sentiment, helping you decide whether to maintain, hedge, or exit positions

Related Reading on Prediction Market:

If you want to explore prediction market further, you may find the following articles helpful:

- What Is a Yes No Market: How Investors Trade Probabilities Using Yes-or-No Contracts

- How to Trade on Yes-No Market: A Practical Guide to Binary Prediction Trading

- Yes-No Market vs Polls: What Investors Should Know About Signal Quality and Bias

- What Is a Prediction Market?

- How Do Sports Prediction Markets Work?

- What You Need to Know About Prediction Markets Before You Bet

Conclusion

Yes-No Market vs Polls surfaces a crucial point for investors: incentives — not just data collection method — shape the quality of forecasting signals. Markets that price probabilities via capital-at-risk decisions tend to adjust continuously and weight strong convictions more heavily than opinion surveys.

Regulation — such as federal oversight of event contracts — further anchors signal reliability and investor protection.

Markets reveal probabilities, not consensus sentiment. When interpreted through a framework that values liquidity, governance, and resolution clarity, yes-no markets complement traditional polls rather than simply replace them.

Tools like Bitget Wallet help investors engage with on-chain market mechanisms safely, letting them apply probability-based insights while maintaining control of their assets.

Ready to explore on-chain prediction markets and manage your assets responsibly? Learn how Bitget Wallet empowers you to participate with transparency and secure control while applying insights from Yes-No Market vs Polls to your strategy.

Sign up Bitget Wallet now - grab your $2 bonus!

FAQs

Question 1: Are prediction markets better than polls for forecasting outcomes?

Prediction markets and polls each have strengths and limitations when forecasting outcomes. Prediction markets often update probabilities in real time and incorporate financial incentives that encourage participants to commit capital only when they believe an outcome is likely, which can reduce some forecast biases compared with traditional polling.

Question 2: What risks should investors consider in yes-no markets?

Investors engaging in yes-no markets should consider several risks that differ from conventional opinion polling:

- Liquidity and manipulation risk: Low liquidity markets can be dominated by a few large participants, potentially distorting prices and reducing signal quality.

- Market distortion from misinformation: Public platforms can amplify misleading information if traders react to bad data or false signals, affecting probability pricing.

Question 3: How does regulation affect prediction market reliability?

Regulation plays a significant role in shaping the reliability, compliance, and accessibility of prediction markets:

- Legal classification: In some jurisdictions, prediction markets are treated as financial derivatives requiring licensing and oversight, while in others they may fall under gambling laws or operate in regulatory grey zones.

- Investor protection and fairness: Clear regulatory frameworks — including anti-money-laundering and consumer protection rules, can reduce fraud risk, improve market integrity, and encourage broader participation.

Risk Disclosure

Please be aware that cryptocurrency trading involves high market risk. Bitget Wallet is not responsible for any trading losses incurred. Always perform your own research and trade responsibly.