What Is a Yes No Market: How Investors Trade Probabilities Using Yes-or-No Contracts

What Is a Yes No Market and why are investors increasingly turning to yes-or-no contracts to understand the likelihood of real-world events? As traditional opinion polls struggle with bias, lag, and framing issues, Yes No Markets offer an alternative way to express expectations—through prices rather than opinions.

A Yes No Market is a type of prediction market where participants trade contracts based on whether a specific event will happen or not. These yes-or-no contracts transform beliefs into market prices, allowing investors to trade probabilities directly. In this article, we’ll explain how Yes No Markets work, how prices reflect probabilities, and why investors increasingly compare Yes No Markets vs polls. For on-chain participation, Bitget Wallet offers secure self-custody and easy access to decentralized markets.

Key Takeaways

- A Yes No Market enables investors to trade probabilities rather than opinions by using yes-or-no contracts that settle based on objective outcomes, making it a distinct form of binary outcome market.

- In a Yes No Market, prices reflect incentives, conviction, and available information rather than popularity, allowing market signals to adjust continuously as traders update their expectations in real time.

- Compared to polls, a binary outcome market often delivers clearer and faster signals because incorrect beliefs are penalized financially, improving overall signal quality as new information appears.

What Is a Yes No Market?

A Yes No Market is a binary outcome market where contracts resolve to one of two outcomes: yes or no. Each contract settles at $1 if the event occurs and $0 if it does not. The price of the contract before settlement reflects the market’s implied probability of that outcome.

Unlike surveys or polls, a Yes No Market aggregates beliefs through trading behavior. Participants who are confident in their information can buy or sell more contracts, giving stronger signals greater influence. This structure makes Yes No Markets a specialized form of prediction market designed for probability discovery rather than opinion measurement.

Investors often search yes no market vs prediction market, and in practice a Yes No Market is a prediction market format built specifically around binary outcomes.

How Does a Yes No Market Work?

A Yes No Market follows a simple lifecycle of contract creation, trading, and settlement, with each market tied to a clearly defined event and objective resolution criteria. In a Yes No Market, participants trade yes-or-no contracts based on their assessment of probability, allowing prices to update continuously as new information appears. This structure explains how a yes no market works and why it functions as a binary outcome market for probability trading.

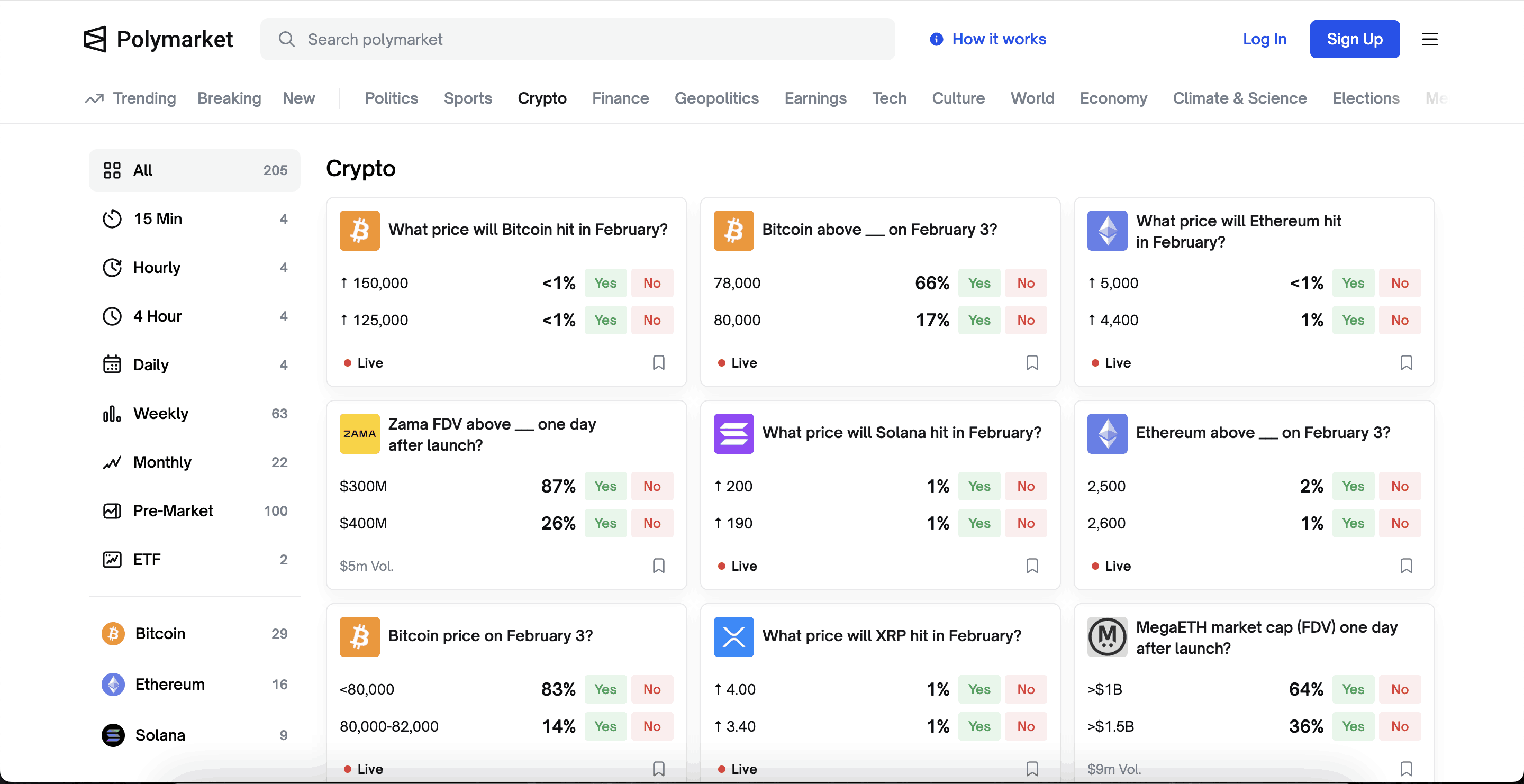

Source: Polymarket

How Do Yes-Or-No Contracts Settle?

In a Yes No Market, understanding settlement is essential because it determines the final value of every position. Yes-or-no contracts are designed to resolve in a clear, binary way based on whether a predefined event occurs, removing ambiguity from the outcome.

Yes-or-no contracts always resolve in a binary way:

- If the event happens, the contract settles at $1

- If the event does not happen, the contract settles at $0

This binary settlement keeps Yes No Markets simple to use while allowing investors to focus on evaluating likelihood rather than mechanics.

How Do Yes-Or-No Contracts Price Probabilities?

In a Yes No Market, price equals probability. A contract trading at $0.70 implies that the market collectively assigns a 70% chance that the event will occur. This relationship is what makes yes-or-no contract pricing intuitive for investors.

Why Price Is Probability, Not Certainty

A $0.70 contract does not guarantee an outcome. Instead, it reflects the weighted beliefs of all participants at that moment. As new information emerges, traders buy and sell accordingly, adjusting the price. This continuous adjustment is central to probability trading and explains how investors trade probabilities using Yes No Markets.

How Do Polls Measure Public Opinion?

Polls attempt to measure public sentiment by surveying a sample of respondents. The results reflect stated preferences at a specific point in time. While polls can be useful for understanding attitudes, they do not measure probability directly.

Most public opinion polls treat each response equally, regardless of how confident or informed the respondent is. Polling data is also typically updated on a fixed schedule, making it less responsive to rapid changes.

Where Does Bias Enter Polling Data?

Polling bias can arise from sampling methods, question framing, and timing. Because polls rely on voluntary responses, they are vulnerable to overrepresentation of certain groups and underrepresentation of others.

Another issue is signal quality. Respondents face no cost for being wrong, which means weakly held beliefs carry the same weight as strongly informed ones. This is a key limitation when comparing polls with a Yes No Market.

What Are the Key Differences in Yes-No Market vs Polls?

The difference between Yes-No Market vs Polls goes beyond surface-level format and reflects how each system processes information. While both aim to capture expectations about future events, a Yes No Market relies on financial incentives and real-time pricing, whereas polls rely on cost-free responses collected at fixed intervals. These structural differences affect accuracy, responsiveness, and how signals should be interpreted by investors.

Incentives vs Cost-Free Opinions

The first major difference between a Yes No Market and polls lies in incentives. In a Yes No Market, participants risk capital when trading yes-or-no contracts, which encourages careful evaluation of information. Poll respondents face no consequences for being wrong, allowing weakly held or biased opinions to carry the same weight as informed beliefs.

| Yes No Market | Polls |

| Participants trade yes-or-no contracts using real capital | Respondents provide opinions at no cost |

| Incorrect beliefs are punished financially | No penalty for inaccurate responses |

| Accurate predictions are rewarded | Accuracy is not incentivized |

| Signals reflect conviction and information | Signals reflect stated preference only |

Continuous Pricing vs Static Snapshots

Another key difference in Yes-No Market vs Polls is how information is updated. A Yes No Market adjusts prices continuously as traders react to new data, while polls capture opinions at a single point in time. This means polling results can become outdated quickly, especially during fast-moving events.

| Yes No Market | Polls |

| Prices update continuously in real time | Results are updated on a fixed schedule |

| New information is reflected immediately | Information lag is common |

| Market signals evolve with events | Poll snapshots can miss rapid changes |

| Investors can act on live probability signals | Users must wait for new surveys |

Why Do Yes-No Markets Often Produce Higher-Quality Signals?

Yes No Markets incentivize participants to research, verify information, and correct their own biases. Over time, traders who consistently make accurate predictions gain more influence, improving overall signal quality.

This mechanism explains why many investors view a prediction market as a superior tool for aggregating information compared to traditional surveys. Incentive-driven forecasting naturally filters out noise.

How Do Investors Trade Probabilities in Yes-No Markets?

This reflects how a yes no market works, how investors trade probabilities, and why binary yes no contracts differ from traditional forecasting tools. Investors approach Yes No Markets using expected value logic. If the market price differs from their own probability estimate, a trading opportunity exists.

For example, if an investor believes an event has an 80% chance of occurring but the contract trades at $0.60, buying the contract offers positive expected value. This framework underpins how investors trade probabilities in binary yes no contracts.

Over time, this is how a yes no market works in practice: prices move as capital updates probabilities. For investors, how investors trade probabilities often comes down to sizing exposure in binary yes no contracts when the implied probability diverges from their own estimate.

How Do Yes-No Markets React Faster Than Polls to New Information?

Because trading is continuous, Yes No Markets can respond immediately to debates, economic releases, policy announcements, and breaking news. As participants buy and sell yes-or-no contracts based on new information, prices adjust in real time to reflect changing expectations.

Polls, by contrast, require time to design surveys, collect responses, and publish results. This built-in delay means polling data often lags behind fast-moving developments. As a result, Yes No Markets are particularly useful in event-driven contexts where timing and rapid probability updates are critical for decision-making.

Are Yes-No Markets Gambling or Information Markets?

Although Yes No Markets may resemble betting at a surface level, they function fundamentally differently from traditional gambling. The primary goal of a Yes No Market is information aggregation, not entertainment. Participants trade yes-or-no contracts based on expected value and probability estimates rather than odds set by a house.

Unlike sportsbooks, Yes No Markets do not profit from users losing. Instead, prices emerge from the interaction of buyers and sellers, allowing the market to reflect collective beliefs about uncertain outcomes. This structure separates Yes No Markets from gambling products and positions them as analytical tools within binary outcome markets designed to surface probability signals.

In that sense, Yes No Markets are part of binary prediction markets that aggregate information rather than provide entertainment.

Read more: Is Prediction Market Gambling: Sports Betting or Financial Forecasting?

How Are Yes-No Markets Regulated in the United States?

In the United States, some Yes No Markets operate as regulated event-based markets under federal oversight. Certain platforms have brought event contracts into a compliant framework, treating them as regulated prediction markets rather than unregulated wagering.

Regulation focuses on market integrity, participant protections, surveillance, and clear resolution standards. These requirements are designed to reduce manipulation, ensure transparent outcomes, and reinforce trust in compliant prediction markets. As regulatory clarity improves, event-based markets are increasingly viewed as legitimate tools for probability discovery rather than speculative gambling.

How Can Investors Interpret Yes-No Market Prices Correctly?

When reading prices in a Yes No Market, investors should treat them as probability estimates, not predictions of certainty. A contract trading at $0.65 reflects a 65% implied probability, not a guaranteed outcome.

Liquidity plays a critical role in interpretation. Low-liquidity markets may show sharper price movements that do not fully represent consensus, while higher trading volume often indicates stronger information aggregation. Understanding yes-or-no contract pricing, market depth, and trading activity is essential for making informed probability trading decisions in Yes No Markets.

How Can Bitget Wallet Support Participation in Event-Based Markets?

While Yes No Markets operate on specialized platforms, managing capital securely remains essential. Bitget Wallet allows users to store and manage stablecoins in a non-custodial environment, supporting flexibility when engaging with event-based markets.

Bitget Wallet can support this workflow by helping users:

- Hold stablecoins securely for funding positions in a Yes No Market without relying on custodial accounts

- Maintain non-custodial control of assets and private keys, reducing third-party risk during probability trading

- Move assets across chains when interacting with Web3 tools connected to event-based markets

- Track balances and transfers clearly, which helps investors manage exposure while trading yes-or-no contracts

By retaining control of private keys and enabling cross-chain access, Bitget Wallet fits naturally into a workflow that involves probability trading across Web3 platforms.

What Should Investors Know Before Using Yes-No Markets?

Yes No Markets involve uncertainty, volatility, and information risk. Prices can move sharply as new data emerges, especially around key events, and not all markets offer the same level of liquidity. Thinly traded markets may show larger price swings that do not always reflect stable consensus.

Before participating in a Yes No Market, investors should size positions carefully, review how yes-or-no contracts resolve, and understand the specific resolution criteria for each event. It is important to treat Yes No Markets as probabilistic tools rather than guarantees, using them to assess likelihood rather than to seek certainty.

Related Reading on Prediction Market:

If you want to explore prediction market further, you may find the following articles helpful:

- What Is a Yes No Market: How Investors Trade Probabilities Using Yes-or-No Contracts

- How to Trade on Yes-No Market: A Practical Guide to Binary Prediction Trading

- Yes-No Market vs Polls: What Investors Should Know About Signal Quality and Bias

- What Is a Prediction Market?

- How Do Sports Prediction Markets Work?

- What You Need to Know About Prediction Markets Before You Bet

Conclusion

What Is a Yes No Market becomes clear when comparing it to traditional polls: instead of collecting opinions, Yes-No Markets translate beliefs into prices through real capital, incentives, and continuous trading. This mechanism often delivers faster, more precise signals for investors assessing uncertain outcomes.

For investors seeking probability-based insights, understanding how Yes No Markets work is increasingly valuable. Managing capital securely with tools like Bitget Wallet helps investors stay prepared as event-based markets continue to expand. Download Bitget Wallet now to manage stablecoins, stay in control of your assets, and explore Web3 market opportunities with non-custodial security.

Sign up Bitget Wallet now - grab your $2 bonus!

FAQS

1. What Is a Yes No Market?

A Yes No Market is a type of prediction market where participants trade yes-or-no contracts that settle at $1 or $0 based on whether a clearly defined event occurs. The contract price reflects the market’s implied probability of that outcome.

2. How Is a Yes No Market Different From a Poll?

A Yes No Market prices probabilities using financial incentives, while polls measure opinions without consequences. In a Yes No Market, incorrect beliefs are penalized through trading losses, whereas poll responses carry no cost for being wrong.

3. Are Yes-No Markets Legal?

Some Yes No Markets operate legally under regulated frameworks, depending on jurisdiction and platform. In certain regions, event-based prediction markets are subject to oversight and compliance requirements that distinguish them from gambling products.

4. Can Beginners Use Yes-No Markets Safely?

Beginners can use Yes No Markets safely by understanding probability-based trading, managing position size, and focusing on clearly defined events. Learning how yes-or-no contracts work and avoiding overexposure are key to responsible participation.

Risk Disclosure

Please be aware that cryptocurrency trading involves high market risk. Bitget Wallet is not responsible for any trading losses incurred. Always perform your own research and trade responsibly.