Best Prediction Market Platforms in 2026: Top Sites for Crypto, Sports, & Events

Best Prediction Market Platforms have evolved significantly by 2026, becoming a distinct category of event-based trading platforms that sit between financial markets and traditional sports betting. Instead of placing fixed wagers against a bookmaker, users trade contracts whose prices reflect the collective probability of real-world outcomes such as elections, sports results, economic indicators, or major news events.

The relevance of prediction markets has increased sharply in 2026 as regulatory clarity improves in some regions, crypto-native platforms mature, and sports event trading expands beyond politics into mainstream markets. As participation grows, many users also rely on self-custody tools like Bitget Wallet to manage assets securely when interacting with decentralized prediction markets.

In this article, we’ll explore how prediction markets work, the different types of platforms available today, and review the most notable prediction market platforms shaping the landscape in 2026.

Key Takeaways

- Prediction markets operate as probability-based exchanges where users trade event outcome contracts driven by collective market sentiment, not fixed betting odds.

- Prediction market platforms in 2026 span regulated U.S. markets, crypto-native platforms, reputation-based forecasting systems, and academic research-driven models.

- Web3 prediction markets require careful attention to liquidity, regulation, and self-custody, as users remain responsible for asset control and security.

What Is a Prediction Market?

Prediction markets are platforms where users trade contracts tied to the outcomes of future events rather than placing fixed bets. Contract prices are set by market demand and represent the collective probability of an outcome occurring, allowing participants to enter or exit positions before an event is resolved.

Unlike traditional sportsbooks, prediction markets operate as peer-to-peer exchanges. Prices fluctuate as new information emerges, reflecting changing sentiment rather than house-set odds. If an outcome resolves as true, winning contracts typically settle at a fixed value; losing contracts expire worthless.

From a regulatory perspective, prediction markets fall into different categories. Some platforms operate under U.S. federal oversight, others function as crypto-based decentralized markets, and some use reputation or academic frameworks without real-money trading. Access and legality vary by region, making jurisdiction an important consideration for users.

Source: rejolut.com

Which Types of Prediction Market Platforms Exist Today?

Prediction market platforms in 2026 can be grouped into four main categories based on how they handle regulation, custody, and participation incentives.

Types of Prediction Market Platforms

| Platform Type | Core Characteristics | Typical Use Cases |

| Centralized regulated platforms | Federally regulated, fiat rails, identity verification | Politics, economics, select sports |

| Web3 / crypto prediction markets | Decentralized, wallet-based access, on-chain settlement | Global events, sports, breaking news |

| Reputation-based forecasting platforms | No real-money trading, scoring systems | Research, long-term forecasting |

| Academic & research markets | Limited capital, institutional oversight | Election studies, behavioral research |

Centralized platforms prioritize regulatory compliance and accessibility, while Web3 prediction markets emphasize decentralization and global participation. Reputation-based and academic markets focus less on profit and more on forecasting accuracy and research value.

What Are the Best Prediction Market Platforms in 2026?

The best prediction market platforms in 2026 span a mix of defunct pioneers, active regulated markets, Web3 crypto-native platforms, and reputation-based forecasting sites. This section provides a factual overview of notable platforms—past and present—based strictly on publicly documented sources, highlighting their models, status, and ideal use cases without speculation.

1. Augur

Augur was one of the earliest fully decentralized prediction market platforms, built on Ethereum and designed to allow users to create and trade markets on real-world events without centralized intermediaries. During the early DeFi era, Augur helped define the architecture of on-chain event markets, though governance complexity, oracle disputes, and declining liquidity eventually contributed to its shutdown.

Key characteristics

- Early fully decentralized prediction protocol

- Permissionless on-chain market creation

- Historically influential in Web3 forecasting design

| Attribute | Details |

| Status | Defunct |

| Chain | Ethereum |

| Model | Decentralized |

| Regulation | None |

| Notes | Early Web3 pioneer |

| Pros | Fully decentralized; censorship-resistant |

| Cons | No longer active; low historical liquidity |

Source: Augur on X

2. Good Judgment Open

Good Judgment Open is a reputation-based forecasting platform that emphasizes probabilistic accuracy rather than financial returns. It gained recognition through large-scale forecasting tournaments and is widely used by researchers, policy analysts, and institutions seeking high-quality collective intelligence rather than speculative trading outcomes.

Key characteristics

- No real-money trading or payouts

- Emphasis on long-term forecasting accuracy

- Commonly used for research and strategic analysis

| Attribute | Details |

| Status | Active |

| Chain | N/A |

| Model | Reputation-based |

| Regulation | None |

| Notes | Forecast accuracy focus |

| Pros | No financial risk; high-quality forecasts |

| Cons | No monetary incentives |

Source: Good Judgment Open on X

3. Iowa Electronic Markets

The Iowa Electronic Markets operate as an academic research project examining political and economic behavior through limited-stakes prediction markets. Strict investment caps are enforced to ensure the platform remains a research tool, and its long-running election data has been frequently cited in academic and media analysis.

Key characteristics

- Operated by an academic institution

- Investment caps typically limited to $500

- Long-standing election forecasting dataset

| Attribute | Details |

| Status | Active |

| Chain | N/A |

| Model | Academic |

| Regulation | University oversight |

| Notes | Election research market |

| Pros | High academic credibility |

| Cons | Limited scale; low capital limits |

Source: iem.uiowa.edu

4. iPredict

iPredict was a regional prediction market platform based in New Zealand, focusing primarily on political and economic outcomes. Active for several years, the platform demonstrated the value of localized forecasting markets but faced regulatory and scale limitations that restricted broader international adoption.

Key characteristics

- Region-specific political and economic markets

- Strong focus on public policy outcomes

- Limited international accessibility

| Attribute | Details |

| Status | Inactive |

| Chain | N/A |

| Model | Centralized |

| Regulation | Regional |

| Notes | New Zealand focus |

| Pros | Local policy insight |

| Cons | No longer broadly accessible |

Source: iPredict on

5. Kalshi

Kalshi is a U.S.-based prediction market operating under Commodity Futures Trading Commission (CFTC) oversight, offering regulated event contracts across politics, economics, weather, and selected sports. The platform has also partnered with Robinhood, expanding retail access to prediction markets through a familiar brokerage interface.

Key characteristics

- Federally regulated prediction market in the U.S.

- Market-driven pricing model

- Integrated access via Robinhood partnership

| Attribute | Details |

| Status | Active |

| Chain | N/A |

| Model | Centralized exchange |

| Regulation | CFTC |

| Notes | U.S. legal clarity; Robinhood integration |

| Pros | Regulatory compliance; transparency |

| Cons | Geographic restrictions |

Source: Kalshi on X

6. Manifold

Manifold is a community-driven prediction platform that uses play money and reputation points instead of real capital. Its open-ended market creation tools allow users to explore forecasting across a wide range of topics, making it popular for experimentation, discussion, and informal forecasting.

Key characteristics

- User-generated markets on nearly any topic

- No real-money exposure for participants

- Community moderation and reputation scoring

| Attribute | Details |

| Status | Active |

| Chain | N/A |

| Model | Reputation-based |

| Regulation | None |

| Notes | Community-driven |

| Pros | Flexible; low barrier to entry |

| Cons | No financial incentives |

Source: manifold.markets

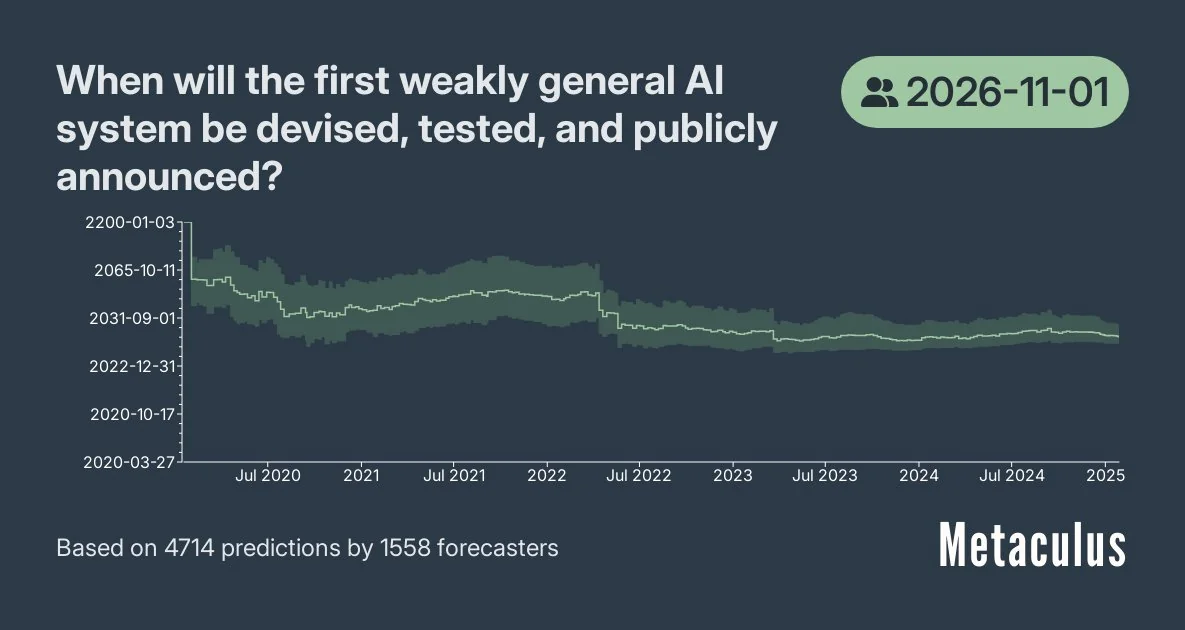

7. Metaculus

Metaculus is a forecasting platform specializing in long-term, numeric-range, and date-based predictions, inspired by earlier research projects such as SciCast. It is widely used for scientific, technological, and geopolitical forecasting, with a strong emphasis on analytical rigor and historical accuracy.

Key characteristics

- Numeric-range and date-based predictions

- Long-horizon analytical focus

- Strong research and expert forecasting community

| Attribute | Details |

| Status | Active |

| Chain | N/A |

| Model | Reputation-based |

| Regulation | None |

| Notes | Inspired by SciCast |

| Pros | High-quality analysis |

| Cons | No trading or payouts |

Source: metaculus.com

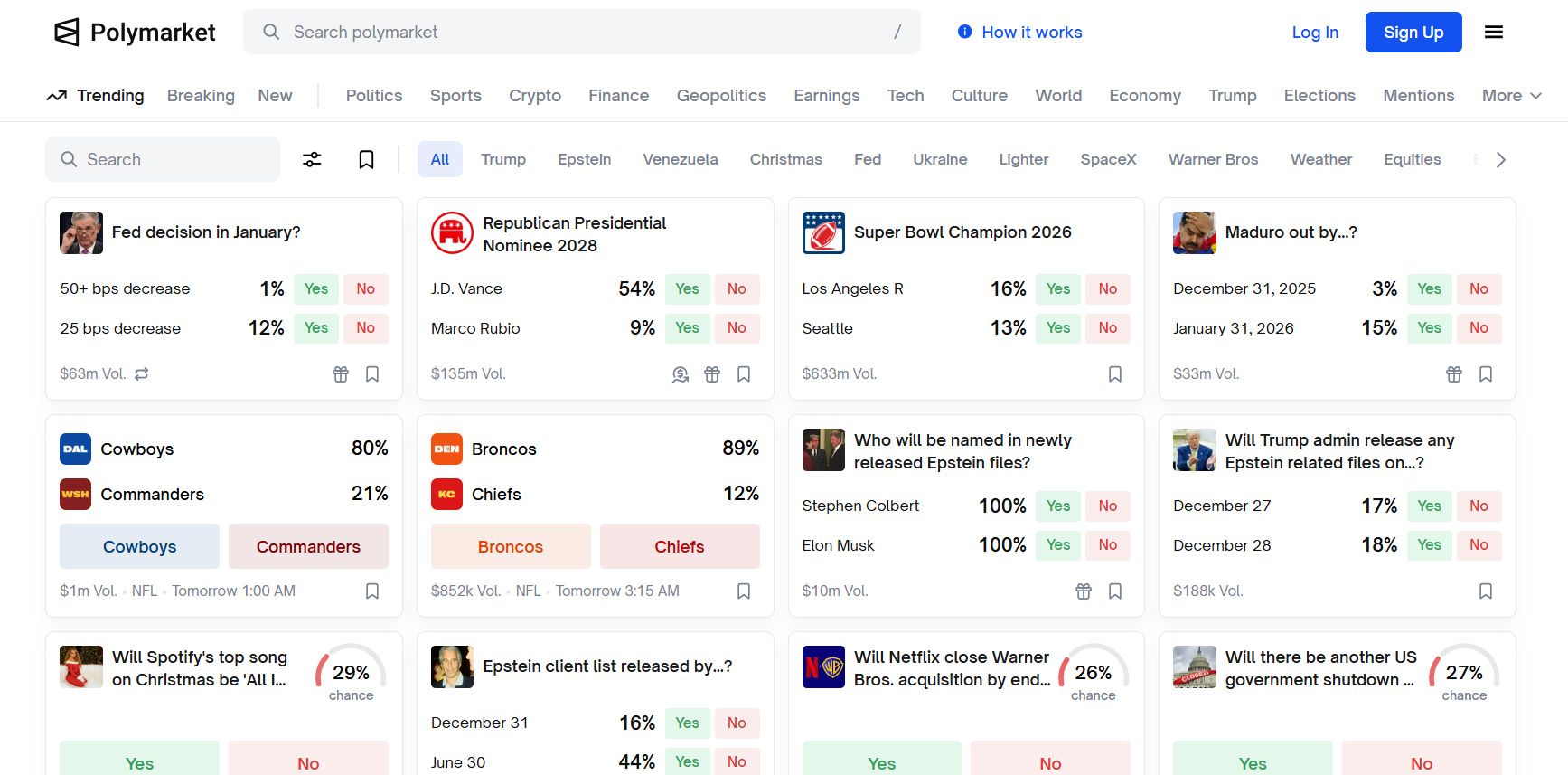

8. Polymarket

Polymarket is one of the largest crypto-native prediction markets, built on Polygon and using USDC for settlement. It has become a dominant Web3 platform for trading political, sports, and global news event contracts, though access remains restricted for U.S. users due to regulatory constraints.

Key characteristics

- On-chain settlement using USDC

- Deep liquidity on major global events

- Requires Web3 wallet connectivity

| Attribute | Details |

| Status | Active (Non-US) |

| Chain | Polygon |

| Model | Decentralized |

| Regulation | Offshore |

| Notes | USDC-based trading |

| Pros | High liquidity; fast markets |

| Cons | U.S. access restrictions |

Source: Polymarket.com

9. PredictIt

PredictIt focuses on U.S. political and financial prediction markets, operating under regulatory agreements that impose strict limits on position sizes and participation. The platform is widely referenced in political analysis despite its constrained trading environment.

Key characteristics

- Specialization in U.S. political events

- Enforced position and participation limits

- Retail-friendly interface

| Attribute | Details |

| Status | Limited |

| Chain | N/A |

| Model | Centralized |

| Regulation | Restricted |

| Notes | Position limits enforced |

| Pros | Clear political markets |

| Cons | Capital and participation caps |

Source: washingtonmonthly.com

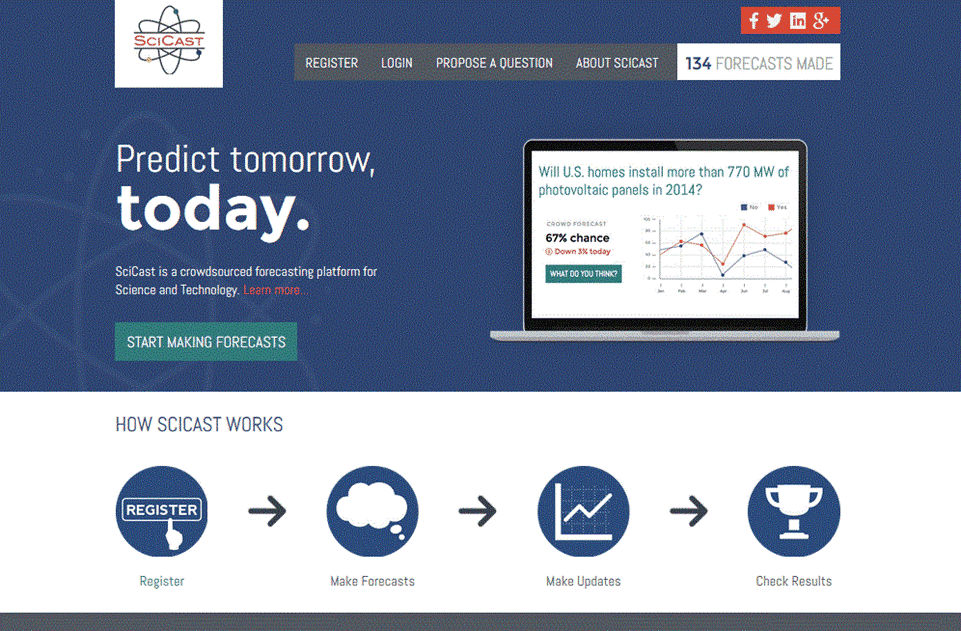

10. SciCast

SciCast was an experimental combinatorial prediction market focused on science and technology forecasting. While no longer operational, it remains notable for its innovative approach to modeling complex outcome dependencies and its influence on later forecasting platforms.

Key characteristics

- Combinatorial forecasting design

- Science and technology focus

- Research-driven objectives

| Attribute | Details |

| Status | Defunct |

| Chain | N/A |

| Model | Combinatorial |

| Regulation | None |

| Notes | Research experiment |

| Pros | Advanced forecasting concepts |

| Cons | Platform discontinued |

Source: adigaskell.org

How Does Bitget Wallet Help Users Access Prediction Market Platforms Safely?

Bitget Wallet functions as a self-custody on-chain gateway for users participating in Web3 prediction markets. With 80+ million users globally and support for 130+ blockchains, it enables access to prediction market platforms across multiple ecosystems without relying on centralized custodians.

-

Store USDC securely for prediction markets

Users can hold stablecoins such as USDC and USDT in a non-custodial wallet, retaining full control of private keys—well suited for on-chain settlement of event contracts.

-

Connect to Web3 prediction dApps

The built-in Discover / DApp browser allows direct wallet connections to prediction market dApps, enabling on-chain interaction without intermediaries.

-

Cross-chain support across major ecosystems

Native cross-chain capability supports Ethereum, Polygon, Solana, and BNB Chain, allowing users to participate wherever prediction markets are most active.

-

Zero-fee swaps for trending tokens (campaign-based)

Periodic campaign-based zero-fee swaps help users adjust exposure efficiently when promotions are available.

-

Optional: Earn on idle stablecoins

Idle stablecoins can be deployed through Earn options, with potential returns reaching up to ~10% APY, depending on product terms.

How to Participate in Prediction Markets with Bitget Wallet?

Here’s a step-by-step flow to get started:

Step 1: Set up a non-custodial wallet

Begin by creating a Bitget Wallet and completing the initial security setup. This ensures you, not a third party, control your private keys and approvals.

- Create a new Bitget Wallet

- Securely back up your recovery phrases offline

- Enable basic security settings such as passcodes or biometric access

Step 2: Fund the wallet

Before interacting with any prediction market, add a small amount of supported assets.

- Use stablecoins or other supported tokens

- Start with small test amounts to minimize risk during early interactions

Step 3: Access prediction market dApps

Bitget Wallet includes an integrated Web3 browser, allowing users to reach on-chain prediction markets without relying on external tools.

- Open the Web3 browser in the Discover section

- Search for a prediction market platform by name or enter its direct URL

- Once on the platform, connect your wallet directly to access available markets

Step 4: Interact with prediction contracts

After connecting, users can begin interacting with prediction contracts on-chain.

- Select a market based on the event or outcome you want to forecast

- Review contract terms, settlement conditions, and timelines carefully

- Approve and sign transactions directly through the wallet interface

Step 5: Monitor outcomes on-chain

Once a position is open, transparency becomes critical.

- Track your positions and settlement status directly on-chain

- Verify outcomes using smart contract data

- Avoid relying solely on centralized dashboards or third-party summaries

With just a few simple steps, you can securely manage your assets and explore decentralized forecasting tools. Don’t hesitate — start your beginner-friendly, non-custodial Web3 journey with Bitget Wallet.

Conclusion

Best Prediction Market Platforms in 2026 represent a rapidly maturing ecosystem that spans regulated U.S. exchanges, decentralized crypto-native markets, reputation-based forecasting platforms, and academic research initiatives. Each model serves a different purpose—from compliant event trading under federal oversight to global, on-chain prediction markets driven by real-time sentiment. As this landscape continues to evolve, understanding platform structure, liquidity, and regulatory context is essential for anyone looking to participate responsibly.

For users engaging with Web3 prediction market platforms, self-custody is no longer optional—it is a core requirement. Managing stablecoins securely, connecting directly to decentralized dApps, and verifying outcomes on-chain all depend on using a reliable non-custodial wallet. Bitget Wallet provides a practical gateway to prediction markets across major blockchains, allowing users to store USDC safely, interact with on-chain event contracts, and maintain full control of their assets at every step.

Download Bitget Wallet now to explore prediction markets securely and participate in the next generation of event-based trading with confidence!

Sign up Bitget Wallet now - grab your $2 bonus!

FAQs

1. What are the Best Prediction Market Platforms in 2026?

The best platforms include regulated markets like Kalshi, decentralized platforms like Polymarket, and reputation-based forecasting sites such as Metaculus and Manifold—each serving different user needs.

2. Are prediction market platforms legal in the U.S.?

Legality depends on the platform. Some operate under federal oversight, while others are restricted or unavailable to U.S. users.

3. Can I use a Web3 wallet for prediction markets?

Bitget Wallet lets you safely use Web3 prediction markets by storing stablecoins, connecting directly to decentralized platforms, and signing event contracts on-chain—giving you full asset control without relying on centralized intermediaries.

Risk Disclosure

Please be aware that cryptocurrency trading involves high market risk. Bitget Wallet is not responsible for any trading losses incurred. Always perform your own research and trade responsibly.