What Are Sports Prediction Markets: How They Differ From Sports Betting?

What Are Sports Prediction Markets, and why are they increasingly compared to sports betting? In recent years, sports prediction markets have moved from niche forecasting tools into mainstream discussion, drawing attention from financial media, crypto communities, and sports fans alike. As platforms experiment with trading contracts tied to game outcomes, many users struggle to understand whether these markets are simply another form of sports betting—or something fundamentally different.

At the core of this confusion is a structural difference: sports prediction markets trade probabilities, while sports betting relies on fixed odds set by bookmakers. Media coverage of platforms like Kalshi and Polymarket has intensified this debate, especially as regulators examine how these markets should be classified. As participation grows, many users also monitor exposure and on-chain activity using self-custody tools like Bitget Wallet.

Key Takeaways

- Sports prediction markets trade probabilities, not odds. Prices move based on collective expectations and new information, rather than being fixed in advance by a bookmaker.

- Sports betting relies on bookmaker-set prices and locked wagers. Once a bet is placed, odds typically cannot change, limiting flexibility compared with contract-based trading.

- Event contracts offer flexible entry, exit, and regulation varies by platform. Users can buy or sell positions before events settle, but legal treatment depends on jurisdiction and market structure.

What Are Sports Prediction Markets?

Sports prediction markets are probability-based marketplaces where participants trade contracts tied to the outcome of sporting events. Their core purpose is not entertainment-driven wagering, but information aggregation—using prices to reflect collective expectations about future outcomes.

How Sports Prediction Markets Turn Sports Outcomes Into Probabilities?

In sports prediction markets, users trade contracts linked to specific outcomes such as a team winning a match, a player scoring a goal, or a total score exceeding a threshold. Each contract represents a clear yes-or-no outcome.

Contracts are typically priced between $0 and $1, with the price reflecting the market’s implied probability. For example, if a contract trades at $0.70, the market is signaling a 70% chance that the outcome will occur. As new information emerges—injuries, lineups, weather conditions, or shifts in public sentiment—prices adjust in real time.

This dynamic pricing mechanism is the key distinction between sports prediction markets and traditional sports betting, where odds are fixed once a wager is placed.

Read more: Is Prediction Market Gambling: Sports Betting or Financial Forecasting?

How Do Sports Prediction Markets Work?

To understand how do sports prediction markets work, it helps to view them as simplified financial markets rather than betting platforms. Instead of placing a one-time wager, participants buy and sell event contracts whose prices continuously reflect the market’s collective assessment of a sports outcome. These prices move as new information becomes available, turning forecasts into tradable probabilities rather than fixed bets.

How Probability Pricing Works in Sports Prediction Markets?

Prices in sports prediction markets are determined by supply and demand. When more traders believe an outcome is likely, they buy contracts, pushing the price higher. When confidence falls, selling pressure pushes prices lower.

For example, a “Team A wins” contract trading at $0.65 implies a 65% probability based on current market consensus. This price can move continuously before the event ends, reflecting how new information reshapes expectations.

Buying, Selling, and Settling Event Contracts

In sports prediction markets, participants are not limited to a single, locked-in wager. Instead, they interact with event contracts much like tradable positions, choosing when to enter, adjust, or exit based on changing probabilities.

Participants can:

- Buy contracts early if they believe the market is underestimating an outcome

- Sell contracts before settlement to lock in gains or cut losses

- Hold contracts to settlement, where winning contracts settle at $1 and losing ones at $0

This flexibility to exit positions is a major difference from sports betting, where most bets are locked until the event concludes.

Prediction Markets vs Sports Betting — What’s the Difference?

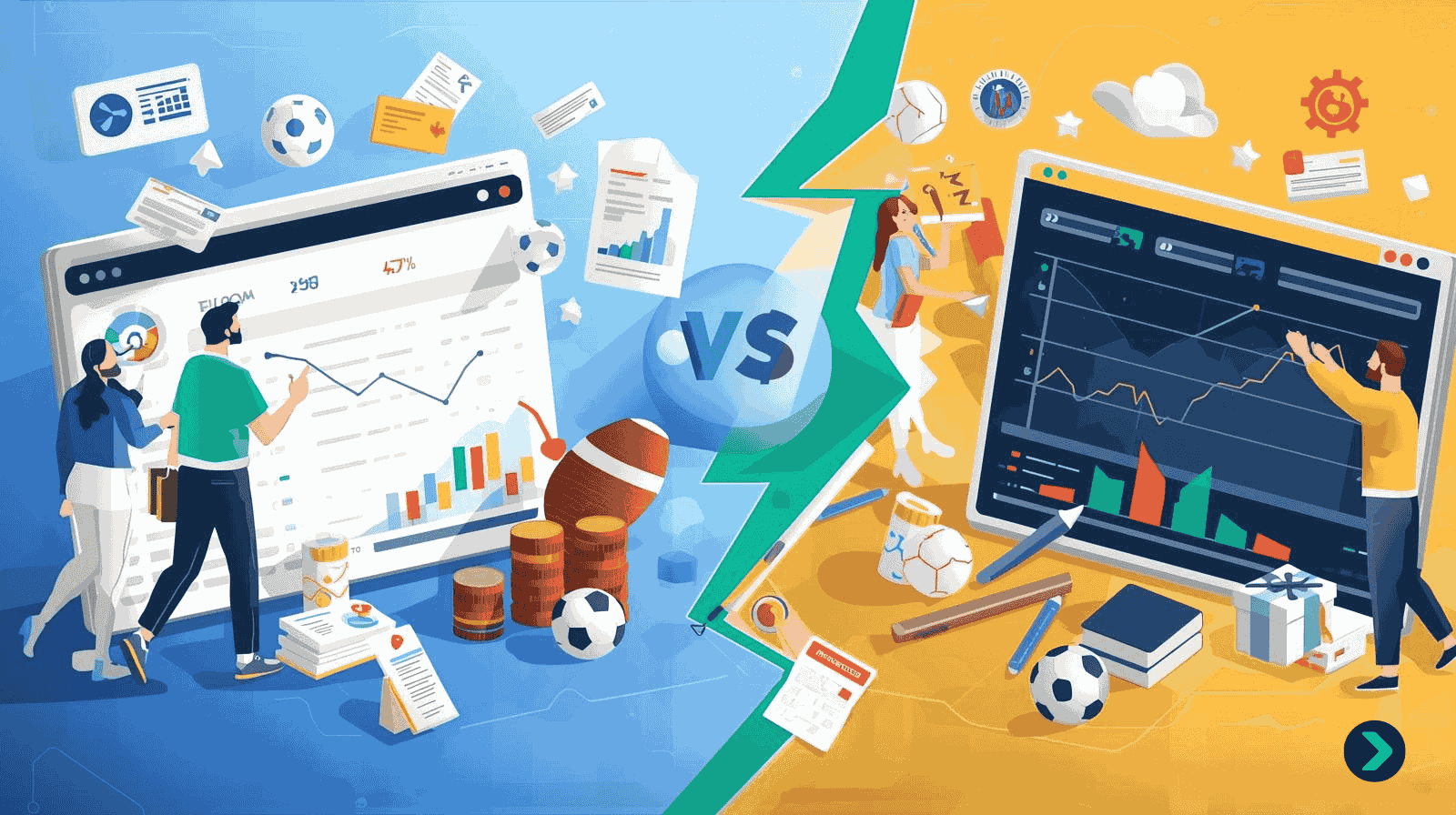

The comparison between prediction markets vs sports betting often causes confusion because both involve forecasting game outcomes. However, their underlying mechanics, pricing models, and risk structures differ in ways that fundamentally change how participants interact with each system.

Prediction Markets vs Sports Betting — Structural Differences

Although sports prediction markets and sports betting both involve forecasting outcomes, they are built on very different structures and incentives. Understanding these differences helps explain why they are often regulated and used in distinct ways.

| Aspect | Sports Prediction Markets | Sports Betting |

| Pricing | Market-driven | Bookmaker-set |

| Role | Trader | Bettor |

| Exit | Flexible | Usually locked |

| Purpose | Forecasting | Entertainment |

Sports prediction markets focus on information discovery, while sports betting emphasizes entertainment and risk-taking against a house edge.

Sports Prediction Markets vs Sportsbooks

Sportsbooks act as direct counterparties, profiting from built-in odds margins regardless of who wins. Sports prediction markets, by contrast, are peer-to-peer, with participants trading against one another rather than against a house.

Key differences include:

- Pricing control: sportsbooks set odds, while markets discover prices

- Risk exposure: sportsbooks manage risk centrally, markets distribute it among users

- Incentives: sportsbooks optimize for margin, prediction markets for information flow

Event Contracts vs Sports Betting

In sports prediction markets, users own contracts, not bets. Each contract represents a tradable position tied to a specific outcome, rather than a one-time wager.

This structure enables:

- Early exits before an event concludes

- Position adjustments as probabilities change

- Hedging strategies that are rarely possible in traditional sports betting

These mechanics make event contracts fundamentally different from fixed, locked sports bets.

Read more: What Is a Prediction Market in Crypto and How Blockchain-Based Prediction Markets Work

Are Sports Prediction Markets Legal?

Whether sports prediction markets are legal depends heavily on jurisdiction and platform structure, as regulators assess whether these platforms function more like financial markets or traditional gambling products. Legal treatment varies not only by country, but also by how each platform designs its contracts, manages risk, and interacts with existing sports betting laws.

Are Sports Prediction Markets Legal in the United States?

In the U.S., some platforms operate under the oversight of the Commodity Futures Trading Commission (CFTC). These markets are typically framed as event contracts, not gambling products. However, regulatory approval does not mean unrestricted use, and product offerings remain tightly controlled.

CFTC Regulated Prediction Markets Explained

CFTC regulated prediction markets are designed to operate under financial market standards rather than gambling frameworks. Instead of prioritizing entertainment or wagering volume, these platforms emphasize market integrity, transparency, and formal risk controls. This regulatory approach helps explain why sports prediction markets are often evaluated differently from sportsbooks, particularly in jurisdictions where event contracts fall under commodities or derivatives oversight rather than gaming law.

Risks and Limitations of Sports Prediction Markets

Despite their analytical appeal, sports prediction markets carry meaningful risks that differ from both traditional investing and sports betting. Understanding these limitations is essential before participating, especially in fast-moving or low-liquidity markets.

Market Liquidity and Volatility Risks

Some sports prediction markets suffer from thin liquidity, meaning there are fewer buyers and sellers at any given time. This can lead to unstable pricing and execution challenges, especially around major news or live events.

Common liquidity-related risks include:

- Sharp price swings caused by small trades moving the market

- Wide bid–ask spreads that increase entry and exit costs

- Slippage when orders are filled at worse prices than expected

In low-participation markets, prices may temporarily reflect crowd sentiment rather than accurate probability estimates.

User Responsibility and Capital Risk

There are no guaranteed returns in sports prediction markets. Users may overestimate their informational edge or confuse probability signals with certainty, particularly during live events where emotions run high. Poor risk management and impulsive trading can amplify losses over time.

Users interacting with crypto-based sports prediction markets often rely on Bitget Wallet to manage assets securely and track exposure across chains, helping keep speculative positions separate from core holdings.

Read more: Top Crypto Predictions for 2026: Bitcoin, Ethereum, and the Altcoins to Watch

Sports Prediction Markets Explained for Beginners

Sports prediction markets are not suitable for everyone, especially for users who expect simple, entertainment-focused wagering. These markets require a basic understanding of probabilities, price movement, and disciplined decision-making rather than intuition alone.

Who Are Sports Prediction Markets Best Suited For?

Sports prediction markets tend to appeal to users who are comfortable treating outcomes as probabilities rather than bets.

- Data-driven users who analyze information such as injuries, lineups, and trends

- Those comfortable interpreting probabilities instead of fixed odds

- Participants with a disciplined risk-management approach who can manage position sizing and exits

Who Might Prefer Sports Betting Instead?

Traditional sports betting may be a better fit for users who value simplicity and entertainment over analytical trading.

- Users seeking simple entertainment rather than active decision-making

- Fans who prefer fixed odds and clear outcomes without monitoring price changes

- Casual participants who want straightforward wagers with minimal complexity

Conclusion

What Are Sports Prediction Markets ultimately comes down to understanding how probabilities are traded rather than how bets are placed.

While sports prediction markets and sports betting may look similar on the surface, their mechanics, objectives, and regulatory treatment differ in fundamental ways. These markets reward information processing and timing rather than pure speculation—but they remain high-risk instruments.

For users exploring sports prediction markets—especially crypto-native platforms—using a secure self-custody solution like Bitget Wallet helps manage assets, monitor exposure, and maintain discipline rather than impulse. Download Bitget Wallet today to securely manage your assets, track prediction market exposure, and participate in Web3 markets with confidence.

Sign up Bitget Wallet now - grab your $2 bonus!

FAQs

1. What Are Sports Prediction Markets?

Sports prediction markets are platforms where users trade contracts that reflect the probability of sports outcomes rather than placing fixed wagers. Prices act as signals of collective expectations instead of bookmaker odds.

2. How do sports prediction markets work?

Contracts are typically priced between $0 and $1, with prices moving based on supply and demand. These movements reflect how the market updates probabilities as new information becomes available.

3. Are sports prediction markets legal?

Legality depends on jurisdiction and platform structure, and rules vary widely across countries. In the United States, some platforms operate under oversight from regulators such as the CFTC.

4. How are sports prediction markets different from sports betting?

Prediction markets allow users to trade probabilities and exit positions before events conclude. Sports betting relies on bookmaker-set odds, with wagers usually locked until the outcome is decided.

5. Can Bitget Wallet be used to manage assets related to sports prediction markets?

Yes, many users rely on Bitget Wallet to securely manage and monitor assets linked to on-chain prediction market activity. Using a self-custody wallet can help users track exposure while maintaining control of their funds.

Risk Disclosure

Please be aware that cryptocurrency trading involves high market risk. Bitget Wallet is not responsible for any trading losses incurred. Always perform your own research and trade responsibly.