What Is Golden Dome Reserve (DOME) and How the Golden Dome Narrative Shapes On-Chain Price Discovery

What is Golden Dome Reserve (DOME)? Rooted in the “Golden Dome” protection narrative, often framed in crypto as a metaphor for robust security, transparency, and guarded asset movement, Golden Dome Reserve (DOME) bridges story led branding and on chain trading within the Solana token ecosystem. It leverages blockchain rails to keep that narrative portable in the digital economy, where attention and liquidity can form a token’s “heritage” and relevance in modern markets.

Thanks to the support of on chain liquidity venues and swap routing tools such as Bitget Wallet Swap’s Solana markets for DOME, GOLDEN DOME RESERVE (DOME) is accessible as a tradable asset rather than just a static ticker. It functions as more than just a token in the sense that its primary “job” is liquidity and speculation flow, a unit traders use to express the Golden Dome narrative through swaps, price discovery, and short horizon positioning on Solana. Bitget Wallet supports this flow as Secure Stablecoin Storage + Hot Memecoin Trading + Seamless Cross chain Experience.

Through this article, we explore Golden Dome Reserve (DOME), outlining its vision, unique characteristics, and market prospects. Whether you’re assessing its real world functionality, investment potential, or broader impact, this guide helps you navigate its significance in the crypto space.

Key Takeaways

- Golden Dome Reserve (DOME) is a Solana ecosystem token framed around the “Golden Dome” protection narrative, blending story-led branding with on-chain trading.

- DOME’s practical utility today is primarily liquidity and speculation flow, driven by swaps and short-horizon price discovery rather than a proven real-world product.

- If you engage with DOME, prioritize verification and execution discipline: confirm you’re using the correct Solana token, assess liquidity conditions, and treat narrative claims as unverified until independently proven.

What Is Golden Dome Reserve (DOME): What You Should Know?

Golden Dome Reserve (DOME) is a narrative driven token on the Solana blockchain that positions itself around the “Golden Dome” protection concept and trades as an on chain asset via Solana swap markets. The broader “Golden Dome” framing commonly emphasizes security minded ideas such as transparent smart contract rules and multi party approval concepts.

The project embodies the following values:

- Security first design

- Transparency and verifiability

- Community led participation

Golden Dome Reserve (DOME) not only inherits the spirit of this protection narrative but also applies it to on chain trading as a liquidity and price discovery asset within Solana markets.

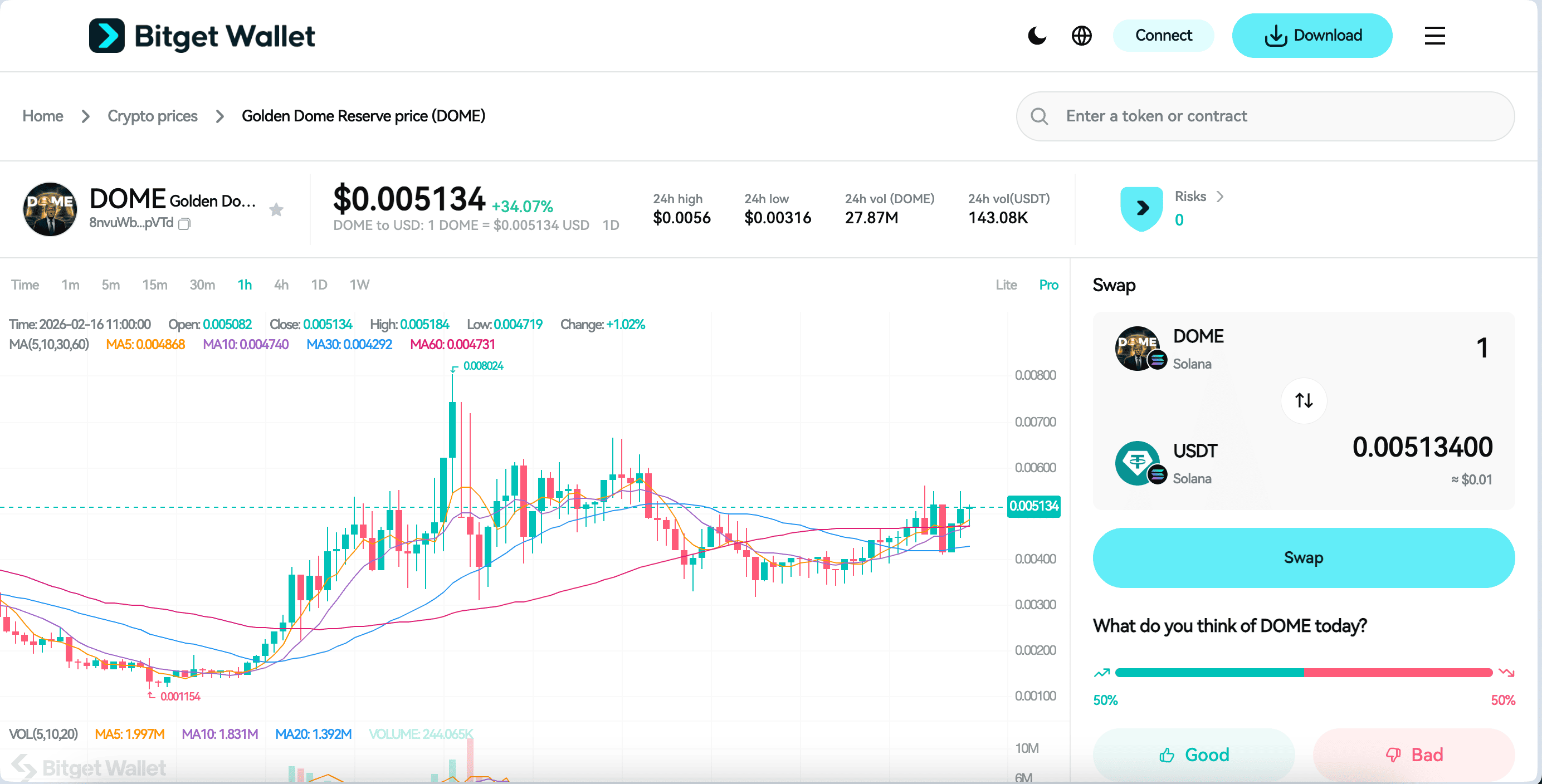

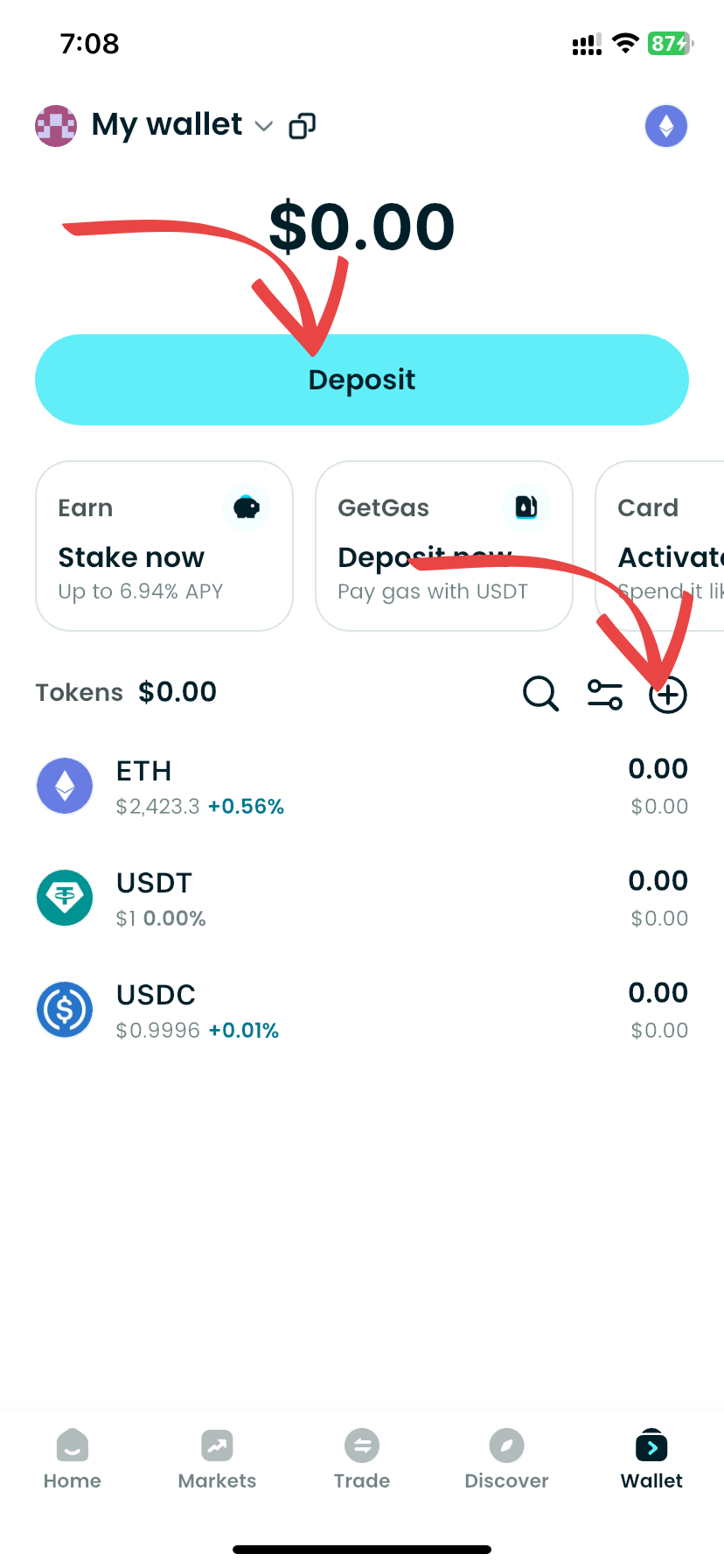

Source: Bitget Wallet

Golden Dome Reserve (DOME) is live on Solana with the mint 8nvuWbvxrabbkEThNoiDMM44nVfP1JuEuVNNCwqQpVTd, and it is actively tradable via on chain swap venues such as Bitget Wallet Swap, where real time pricing and recent trading activity are displayed for the Solana pair.

Golden Dome Reserve (DOME) Listing Details and Launch Date

1. Key Listing Information

Here are the important details about the Golden Dome Reserve (DOME) listing:

- Exchange: To be announced

- Trading Pair: DOME/USDT

- Deposit Available: To be announced

- Trading Start: To be announced

- Withdrawal Available: To be announced

Don’t miss your chance to start trading GOLDEN DOME RESERVE (DOME) once an official exchange listing schedule is announced.

- Please refer to the official announcement for the most accurate schedule.

Golden Dome Reserve (DOME) Market Trends & Price Predictions 2026

Golden Dome Reserve (DOME)’s price is currently driven more by on-chain liquidity conditions and short-term narrative momentum than by verified fundamentals. Recent public trackers show DOME trading around the $0.002–$0.004 zone, with live quotes near $0.0038 on Bitget Wallet Swap and similar ranges on Solana DEX trackers. Because there are no widely verified analyst forecasts for DOME, any “price prediction” for 2026 should be treated as speculative scenario planning, not a reliable target.

Factors Influencing the Price of Golden Dome Reserve (DOME)

Several crucial aspects contribute to the growth potential of GOLDEN DOME RESERVE (DOME):

- Market Trends: DOME tends to follow risk-on/risk-off flows in Solana microcaps, where shifts in SOL sentiment and meme/narrative rotations can move price rapidly, especially with thinner liquidity.

- Adoption & Real-World Utility: Current “adoption” is mostly trading activity (swaps, liquidity, holders) rather than confirmed real-world usage; traction is reflected through on-chain pools and routing demand.

- Project Advancements: The biggest catalysts are typically verifiable updates (official docs, audited contracts, product releases, listings) that reduce uncertainty; absent those, price is usually dominated by attention and liquidity.

Long-Term Growth Potential

Should Golden Dome Reserve (DOME) expand beyond narrative trading into clearer, verifiable utility, demand could rise and support higher valuations. In practice, DOME’s long-term trajectory in 2026 will likely hinge on whether liquidity deepens and whether the project produces confirmable deliverables; otherwise, it may remain a high-volatility Solana token where large swings are driven by market cycles and rotation flows.

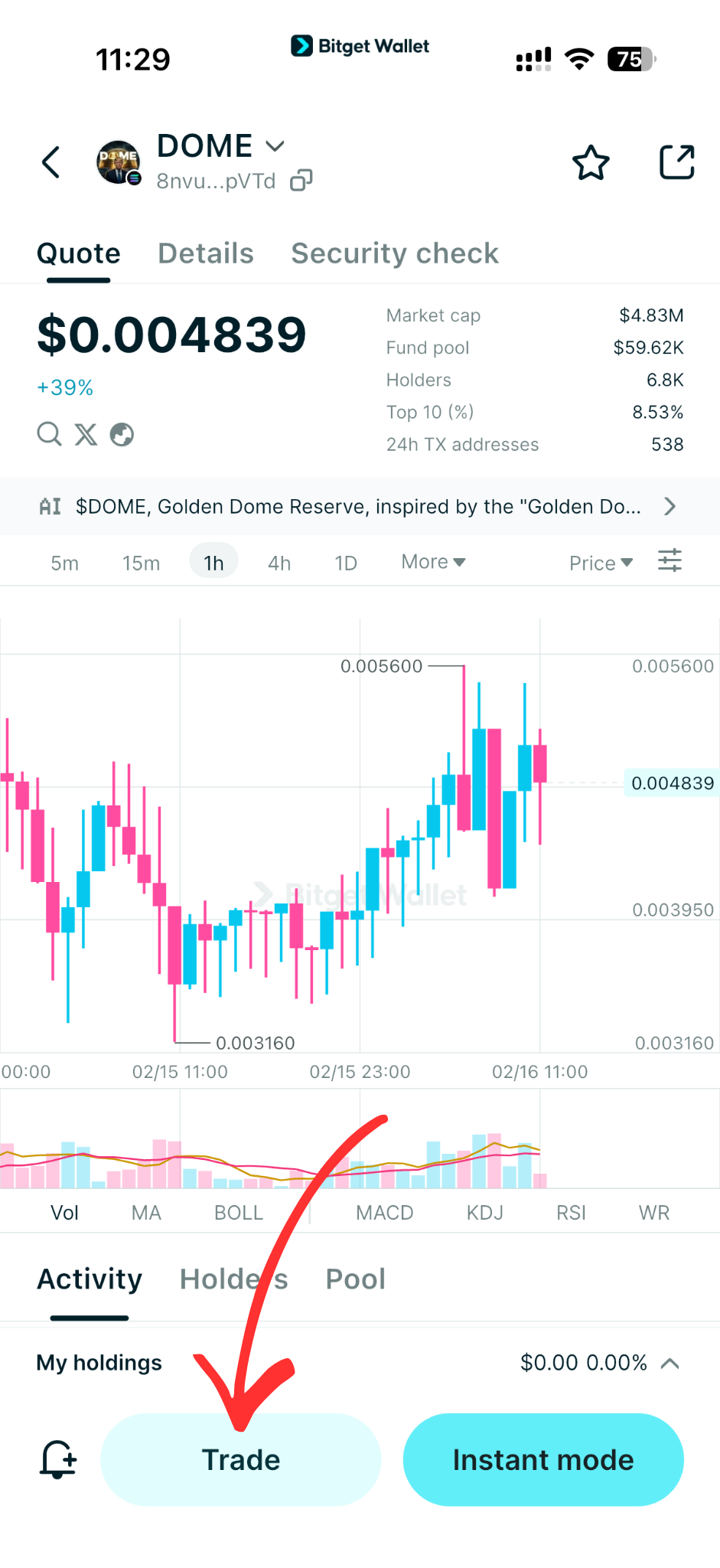

Source: Bitget Wallet

Why Golden Dome Reserve (DOME) Stands Out: Essential Features

The standout features of Golden Dome Reserve (DOME) include:

-

Solana-native trading access via swap routing

DOME is directly swappable on Solana through routing interfaces like Bitget Wallet Swap, which aggregates execution paths and displays live market data for the token.

-

On-chain verifiability through a clear mint and pool footprint

DOME is identifiable by its Solana mint 8nvuWbvxrabbkEThNoiDMM44nVfP1JuEuVNNCwqQpVTd, and its liquidity activity can be monitored via public DEX analytics (pool balances, transactions, holders, and pair details).

-

Real-time market transparency on swap and DEX trackers

Traders can observe DOME’s 24h high/low, volume, and live price movement directly on swap pages and DEX dashboards, which is critical for managing slippage and short-horizon volatility.

The Golden Dome Reserve Ecosystem: How It Functions?

Golden Dome Reserve (DOME) is a decentralized Solana token that functions primarily through on-chain liquidity pools and swap routing, enabling users to trade it directly on Solana without relying on a confirmed CEX listing. Live market pages show DOME paired against SOL on Solana DEX liquidity (e.g., Meteora) and routed through swap interfaces such as Bitget Wallet Swap.

Below is a step-by-step overview of how the Golden Dome Reserve (DOME) ecosystem works:

| Step | Process | Benefit |

| 1. Blockchain Integration | DOME runs on Solana, using Solana transactions for on-chain transfers and swaps. | Fast settlement and low-fee on-chain execution (relative to many L1s). |

| 2. Token Transactions | Users can buy/sell/swap DOME via on-chain markets (typically DOME/SOL) and routing tools that aggregate liquidity. | Direct access to price discovery and liquidity without a custodial account. |

| 3. Smart Contracts | Trading is executed through DEX pool contracts (AMM-style liquidity pools), where swaps occur against pooled liquidity (e.g., the DOME/SOL pool shown on DEX analytics). | Automated swaps and transparent pool-level data (liquidity, txns, holders). |

| 4. Governance Participation | No public, verifiable governance mechanism is confirmed for DOME from the trading pages and DEX profile alone. | Avoids assuming “DAO voting” features that may not exist. |

| 5. Staking & Yield Farming | No verified staking/yield program is confirmed for DOME from the same public market sources; treat any staking claims as unverified unless an official document is provided. | Reduces feature misstatements; keeps the ecosystem description accurate to what’s observable today. |

Golden Dome Reserve Team: Leadership and Strategic Vision

Leadership

Golden Dome Reserve (DOME) does not publicly present a clearly doxxed leadership team in its primary public-facing channels. The most visible “leadership” signal is the project’s official social handle communicating launches and the Solana mint, rather than named executives or a documented foundation structure.

Strategy

The observable strategy for Golden Dome Reserve (DOME) is Solana-first distribution + liquidity-led growth: the token is positioned for on-chain trading and price discovery through Solana swap markets and routing interfaces (e.g., Bitget Wallet Swap), with momentum driven by liquidity, volume, and narrative attention rather than a clearly published product roadmap.

Why Utility Matters for Golden Dome Reserve?

For Golden Dome Reserve (DOME), “utility” is what separates a token that only moves with attention from one that can sustain demand over time. Right now, the most observable utility is on-chain tradability and liquidity access on Solana, meaning the token’s day-to-day “use” is largely tied to swaps, price discovery, and market participation. If DOME later adds verified functions (staking, governance, protocol fees, or product access), that would materially change how investors evaluate it.

Key Use Cases of Golden Dome Reserve

-

On-chain swapping and liquidity-based price discovery

DOME can be used as a tradable unit on Solana via DEX liquidity pools and swap routing interfaces.

-

Portfolio positioning and short-horizon speculation

Traders use DOME to express a view on its narrative momentum, typically in smaller-cap Solana rotation flows.

-

Transfers between wallets

Like other Solana tokens, DOME can be transferred peer-to-peer on-chain, which supports basic distribution and exchange outside centralized venues.

What’s Next for Golden Dome Reserve?

The next meaningful step for DOME is verifiable delivery: a clear official roadmap, transparent documentation, and any confirmed product mechanics that go beyond trading (for example, defined governance, staking, or a protocol role that creates recurring demand). Until those are publicly confirmed, the most realistic “next” phase is continued liquidity building and market-led discovery on Solana, with volatility driven by attention and depth of pools rather than fundamentals.

How to Buy Golden Dome Reserve (DOME) on Bitget Wallet?

Trading Golden Dome Reserve (DOME) is easy on Bitget Wallet. Follow these simple steps to get started:

Step 1: Create an Account

If you don't currently have an account, install the Bitget Wallet app. Register by inputting the required details and confirming your identity.

Step 2: Deposit Funds

After setting up an account, you must deposit money. You can do this by:

- Transferring Cryptocurrency: Transfer crypto from a different wallet.

- Purchasing Crypto: Utilize a credit or debit card to buy crypto directly from Bitget Wallet, making sure you have sufficient capital for trading Golden Dome Reserve (DOME).

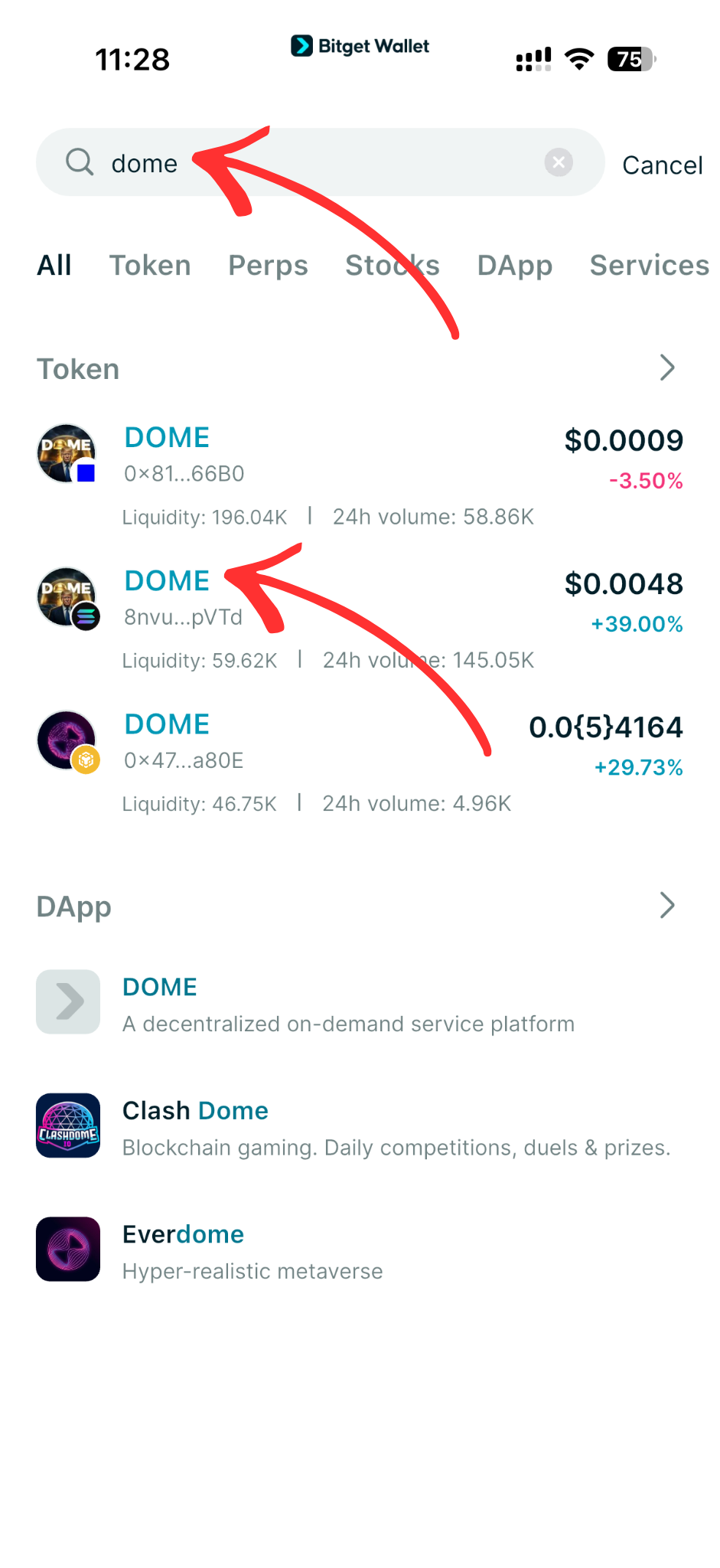

Step 3: Find Golden Dome Reserve (DOME)

On the Bitget Wallet platform, go to the market area. Search for Golden Dome Reserve (DOME) using the search function. Click on the token to access its trading page.

As this token has not been listed yet, please look at the last contract address sent by the project team upon listing of the token.

Step 4: Choose Your Trading Pair

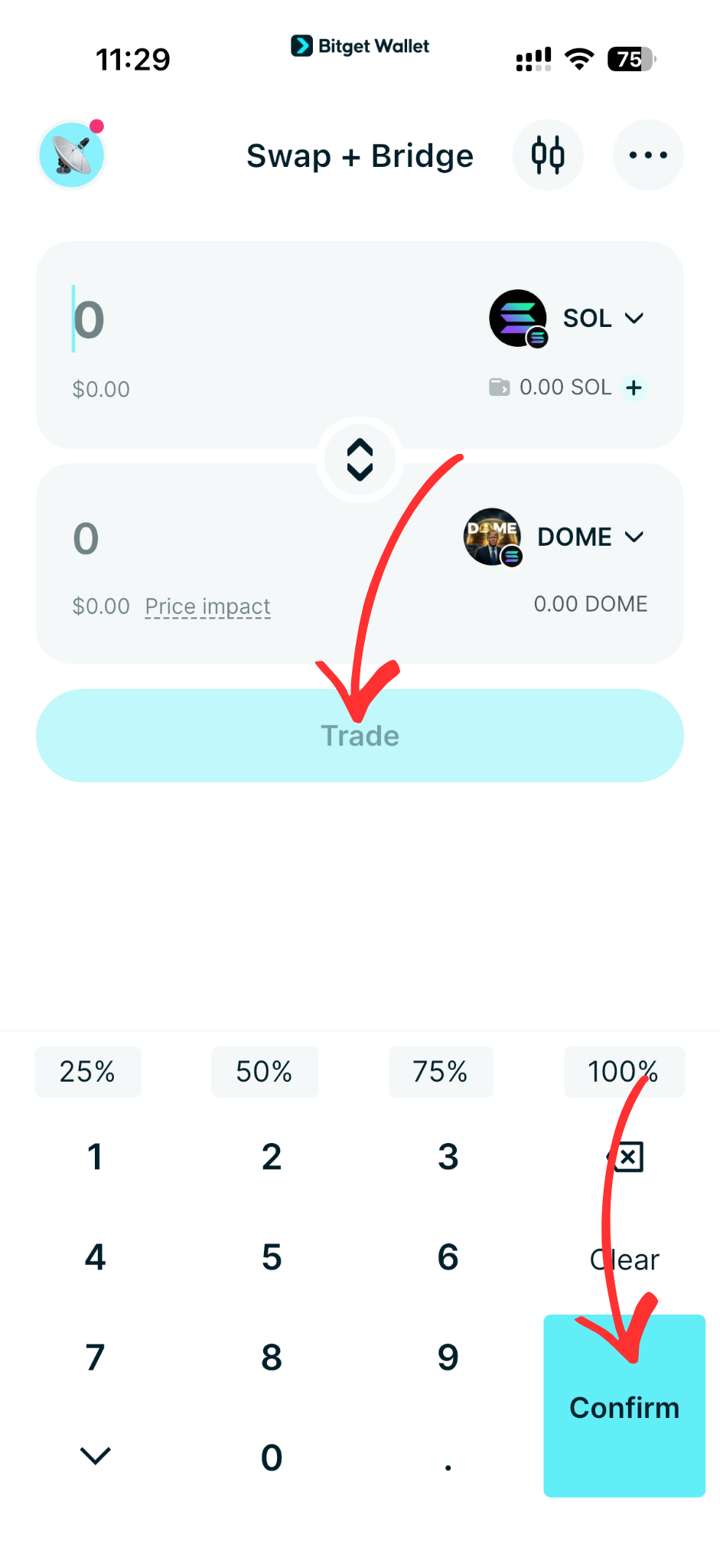

Select your trading pair you would like to deal with, for instance, DOME/USDT.

By doing this, you will be able to exchange Golden Dome Reserve (DOME) for USDT or any other cryptocurrency.

Step 5: Place Your Order

Choose whether to carry out a market order—either buy or sell at the prevailing rate—or place a limit order at your desired price. Fill in the amount of Golden Dome Reserve (DOME) you want to exchange, then proceed to confirm in order to complete the trade.

Step 6: Monitor Your Trade

Once you have ordered, you can track the status of your order under "Open Orders." Upon completion of the order, you can view your balance to see the newly purchased Golden Dome Reserve (DOME).

Step 7: Withdraw Your Funds (Optional)

If you want to transfer your Golden Dome Reserve (DOME) or any other cryptocurrency to another wallet, go to the withdrawal section, provide your wallet address, and confirm the transaction.

Conclusion

What is Golden Dome Reserve (DOME)? GOLDEN DOME RESERVE (DOME) is best viewed as a Solana narrative token where the real activity today comes from on chain liquidity and swaps. If you trade it, focus on verification, liquidity depth, and execution discipline instead of assuming long term fundamentals.

Using DOME via Bitget Wallet helps you manage execution in one place, with direct swap access plus extra utility beyond a single token. You can also improve capital efficiency with Stablecoin Earn Plus (up to 10% APY) and benefit from zero fee trading on memecoins and RWA U.S. stock tokens.

Manage all your tokens in one beginner-friendly app – download Bitget Wallet today.

Sign up Bitget Wallet now - grab your $2 bonus!

FAQs

1. What is Golden Dome Reserve (DOME)?

Golden Dome Reserve (DOME) is a Solana based token that trades on chain via liquidity pools and swap routes, and is commonly framed around the “Golden Dome” protection narrative rather than a clearly verified product with published fundamentals.

2. Is Golden Dome Reserve (DOME) an official “Golden Dome” government project?

There is no reliable public proof that DOME is officially connected to any government program. Treat narrative claims as unverified unless you can confirm them through authoritative, primary sources.

3. What blockchain is Golden Dome Reserve (DOME) on?

The commonly referenced version is on Solana. Because tickers can be reused across chains, always verify the exact network and mint or contract address before you trade.

4. Where can I buy Golden Dome Reserve (DOME)?

At the moment, buying is primarily done on chain through Solana swap markets and routing tools. If a CEX listing appears later, confirm it matches the correct Solana token identity before depositing funds.

5. What should I verify before buying Golden Dome Reserve (DOME)?

Verify the correct Solana mint address, check the token’s liquidity depth and recent trading activity, and watch for copycat tokens using the same name or ticker. Use conservative slippage and only risk what you can afford to lose in high volatility microcap markets.

Risk Disclosure

Please be aware that cryptocurrency trading involves high market risk. Bitget Wallet is not responsible for any trading losses incurred. Always perform your own research and trade responsibly.

- How to Buy 404 Coin in 2026: A Beginner’s Step-by-Step Guide to 404 Coin2026-02-20 | 5mins