How to Buy UXM in 2026: A Beginner’s Step-by-Step Guide to Universal X Money

How to buy UXM is a question more traders are asking as Universal X Money (UXM) gains visibility across on-chain markets. If you are researching how to buy UXM, you must understand its blockchain environment, liquidity structure, and execution risks before entering a position.

Buying early-stage tokens requires more than just clicking “swap.” In this article, you’ll learn where to buy UXM, how to buy UXM step by step, how to verify the UXM contract address, and how to approach UXM price volatility with structured risk management, while using Bitget Wallet for Secure Stablecoin Storage + Hot Memecoin Trading + Seamless Cross-chain Experience.

Key Takeaways

- How to buy UXM safely requires more than just executing a swap. It involves verifying the official UXM contract address, checking on-chain liquidity depth, and applying disciplined position sizing before confirming any transaction.

- Where to buy UXM depends on current listing availability and active liquidity pools. If liquidity is primarily on-chain, users must choose between custodial platforms and non-custodial wallet swaps based on their preferred custody model.

- UXM price volatility is influenced more by sentiment cycles and liquidity fluctuations than by audited fundamentals. Because of this structure, price movements can be sharp and attention-driven rather than valuation-based.

What Is Universal X Money (UXM)?

Universal X Money (UXM) is a crypto asset associated with the Universal X Money ecosystem. Based on available public information, UXM functions as a tradable digital token rather than a revenue-generating equity instrument. Its market behavior currently reflects narrative positioning and liquidity participation rather than audited fundamental backing.

UXM trades in on-chain environments depending on network deployment and liquidity provisioning.

What makes Universal X Money (UXM) different from utility tokens?

- Narrative vs utility: UXM appears to function primarily as a narrative-driven token rather than a protocol-governance or revenue-sharing utility asset.

- Price driver: Market sentiment, liquidity inflow, trading volume spikes, and listing exposure.

- Where it trades: Availability depends on current liquidity pools and supported networks.

Source: X

Is Universal X Money (UXM) a scam or just high-risk?

UXM is not automatically a scam, but it should be treated as high-risk if transparency is limited, liquidity is shallow, copycat tokens exist, or price action shows sudden pump-and-dump behavior. Like many narrative-driven tokens, its risk profile depends heavily on execution quality, liquidity depth, and market structure rather than audited fundamentals.

What users must do before they buy UXM on-chain:

- Verify the official contract address directly from the project’s primary communication channels and confirm it on a reputable blockchain explorer before executing a swap.

- Avoid unofficial links, especially those shared in replies, comments, or private messages promoting “airdrops,” “support,” or urgent migrations.

- Watch liquidity and holder concentration, as thin liquidity can increase slippage risk and high wallet concentration can amplify sudden sell pressure.

Rely on verifiable on-chain data such as contract creation records, transaction history, liquidity pool size, and token distribution metrics rather than promotional narratives or social media hype.

Where to Buy UXM?

When users ask “where to buy UXM,” they usually mean the safest and most efficient execution method. The key difference is custody model: custodial platforms hold assets for you, while on-chain swaps allow you to buy UXM directly from your own wallet.

Availability depends on listings and liquidity. If UXM liquidity is primarily decentralized, traders often choose on-chain swaps rather than waiting for centralized exchange support.

Comparison of UXM Buying Methods

| Buying Method | Custody Model | Execution | Control | Recommended For | Main Risks |

| On-chain Swap (DEX via Wallet) | Non-custodial | User-controlled | High | DeFi users | Contract impersonation, slippage |

| On-chain UEX | Custodial | Platform-managed | Medium | Simplified on-chain exposure | Platform risk |

| Centralized Exchange | Custodial | Platform-managed | Low | Beginners | Withdrawal limits, custodial risk |

Why Many Users Buy UXM With Bitget Wallet?

If Universal X Money (UXM) liquidity is mainly on-chain, a non-custodial wallet helps you swap while keeping control of assets. Bitget Wallet also supports cross-chain access and helps reduce common beginner mistakes like interacting with impersonation tokens.

What Bitget Wallet Helps With?

✅ Self-custody and asset control Users retain full ownership of private keys and funds, reducing exposure to custodial and platform-related risks.

✅ On-chain swaps with transparent execution Explore over 1M tokens with real-time in-app rankings—discover trending assets early and stay ahead of the market.

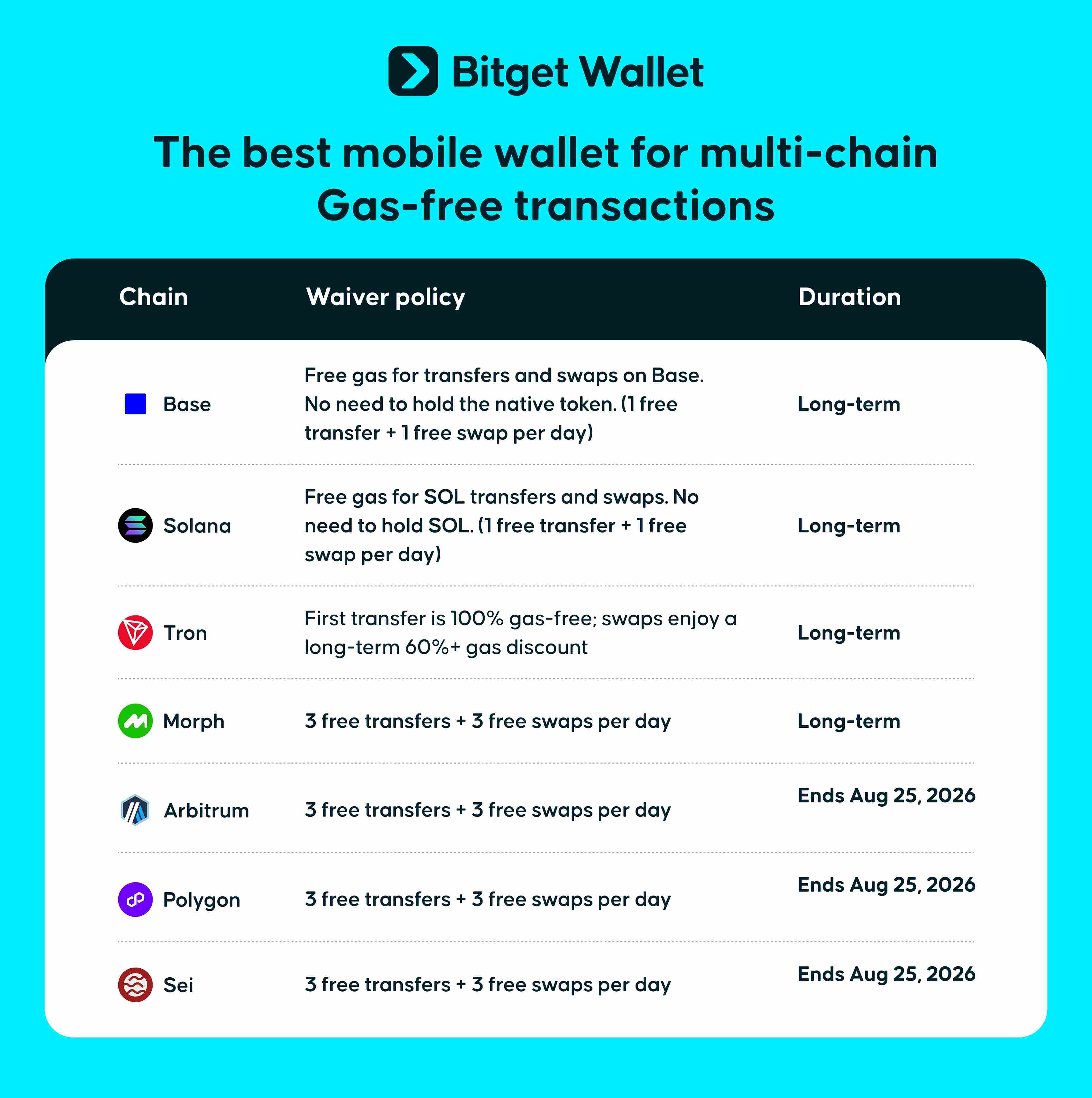

✅ Multi-chain access with cost-efficient execution Bitget Wallet supports 130+ blockchains, including 7 major networks such as Solana, Base, Arbitrum, Polygon, Tron, and more. This allows users to buy, hold, and manage UXM across different ecosystems without being locked into a single chain environment.

On supported networks, users can also benefit from gas-free transactions or long-term gas discounts, helping reduce execution costs when swapping, transferring, or managing assets across chains—an advantage for users who trade frequently or operate across multiple ecosystems.

✅ Flexible post-purchase asset management After buying UXM, users can hold, transfer, or manage assets freely across supported chains without withdrawal limits or third-party restrictions, making it easier to adapt to changing liquidity or market conditions.

Sign up Bitget Wallet now - grab your $2 bonus!

How to Buy UXM on Bitget Wallet?

Trading Universal X Money (UXM) is easy on Bitget Wallet. Follow these simple steps to get started:

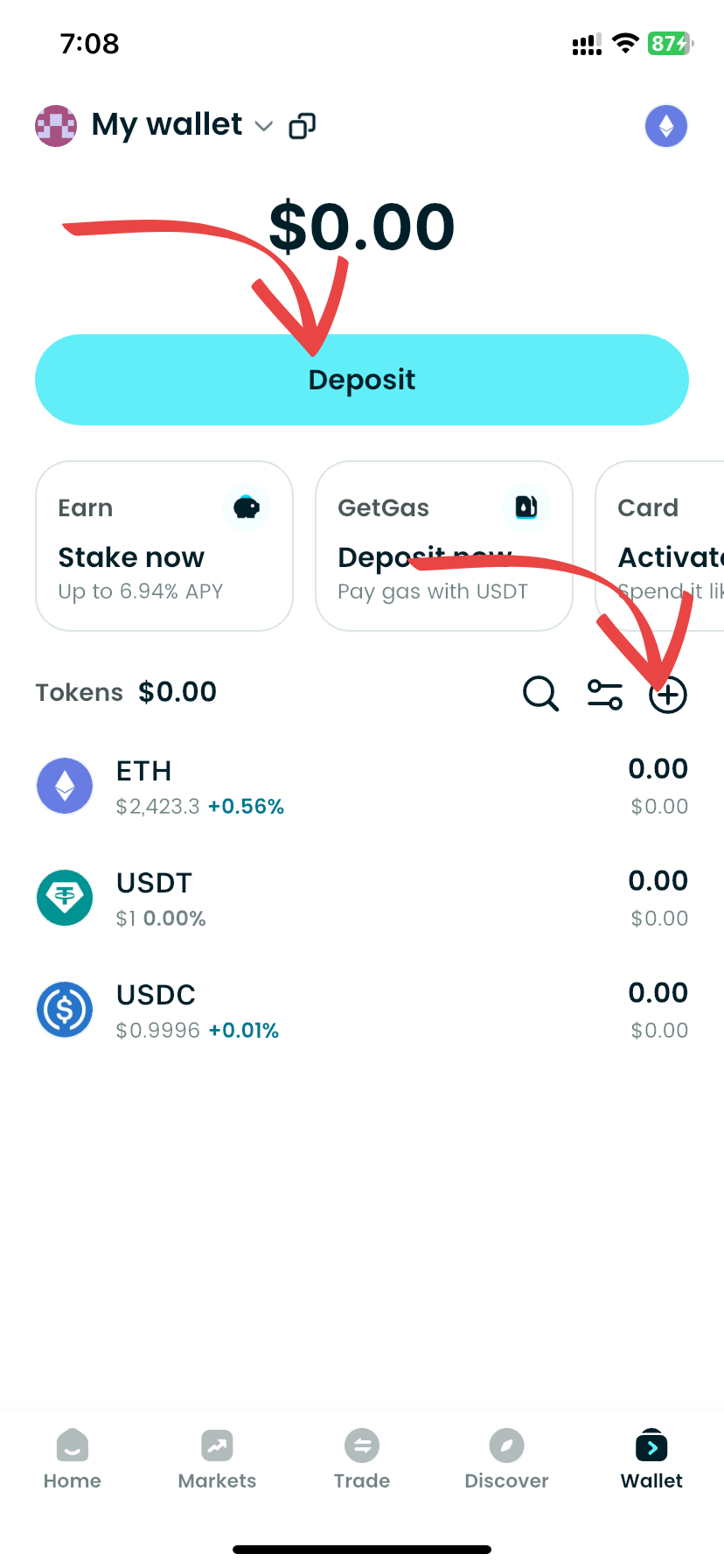

Step 1: Create an Account

If you don't currently have an account, install the Bitget Wallet app. Register by inputting the required details and confirming your identity.

Step 2: Deposit Funds

After setting up an account, you must deposit money. You can do this by:

- Transferring Cryptocurrency: Transfer crypto from a different wallet.

- Purchasing Crypto: Utilize a credit or debit card to buy crypto directly from Bitget Wallet, making sure you have sufficient capital for trading Universal X Money (UXM).

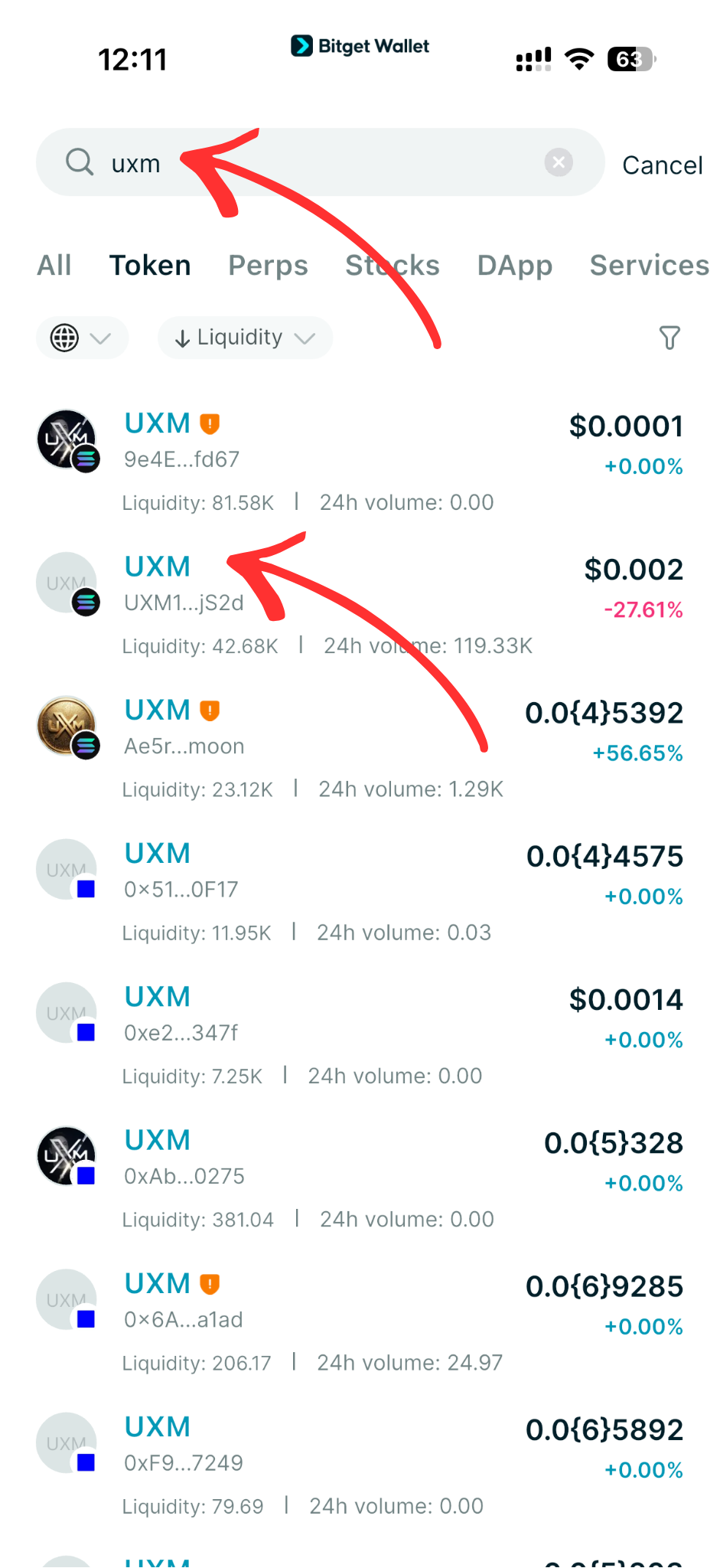

Step 3: Find Universal X Money (UXM)

On the Bitget Wallet platform, go to the market area. Search for Universal X Money (UXM) using the search function. Click on the token to access its trading page.

As this token has not been listed yet, please look at the last contract address sent by the project team upon listing of the token.

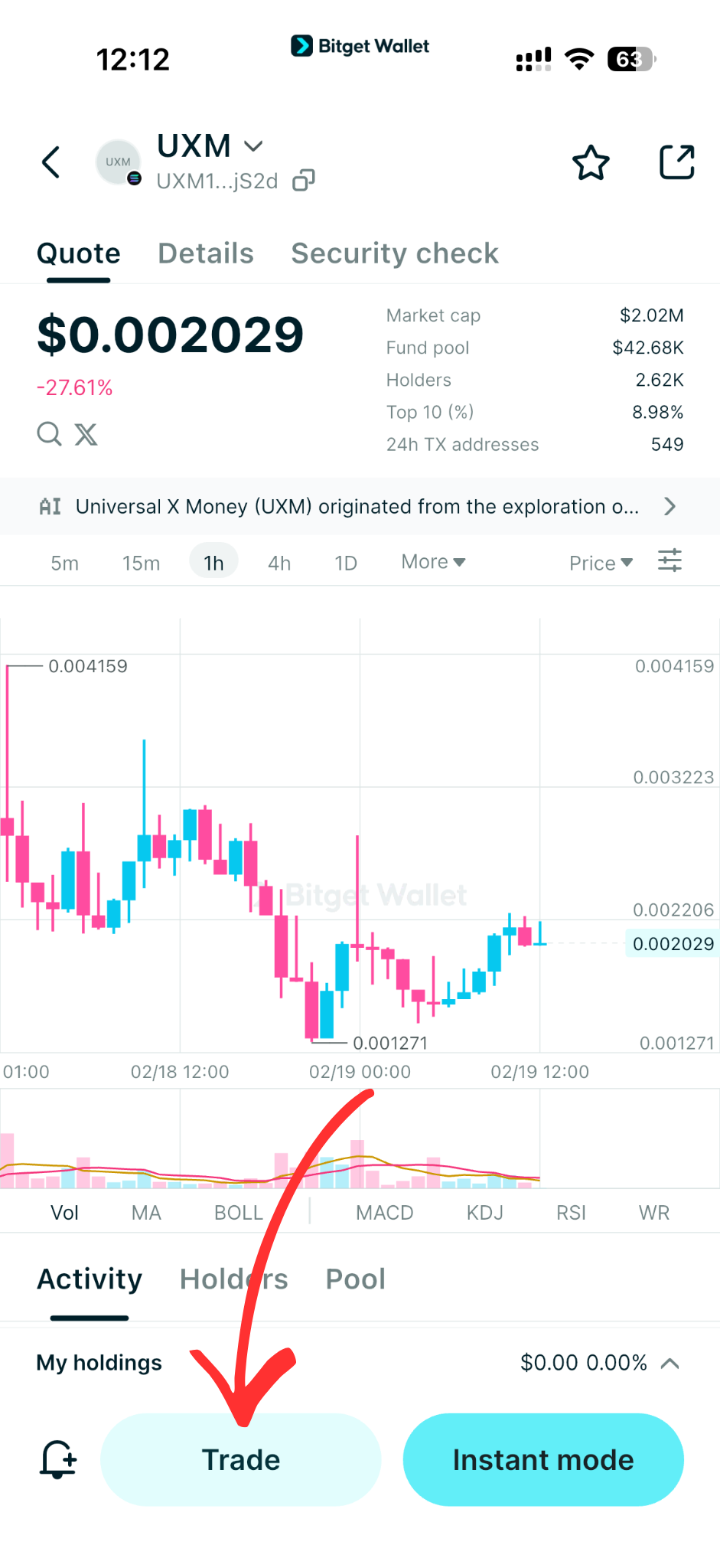

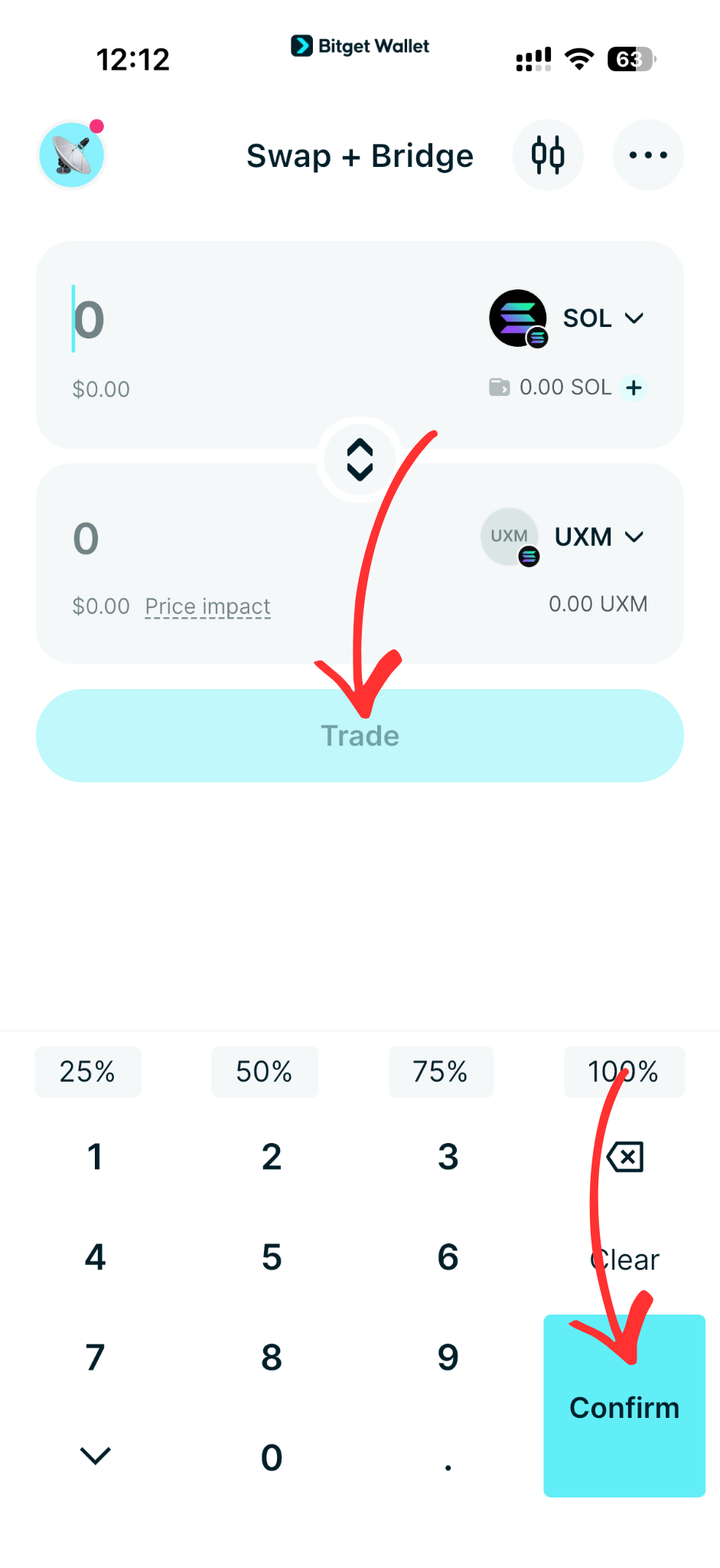

Step 4: Choose Your Trading Pair

Select your trading pair you would like to deal with, for instance, UXM/USDT.

By doing this, you will be able to exchange Universal X Money (UXM) for USDT or any other cryptocurrency.

Step 5: Place Your Order

Choose whether to carry out a market order—either buy or sell at the prevailing rate—or place a limit order at your desired price. Fill in the amount of Universal X Money (UXM) you want to exchange, then proceed to confirm in order to complete the trade.

Step 6: Monitor Your Trade

Once you have ordered, you can track the status of your order under "Open Orders." Upon completion of the order, you can view your balance to see the newly purchased Universal X Money (UXM).

Step 7: Withdraw Your Funds (Optional)

If you want to transfer your Universal X Money (UXM) or any other cryptocurrency to another wallet, go to the withdrawal section, provide your wallet address, and confirm the transaction.

▶Learn more about Universal X Money (UXM):

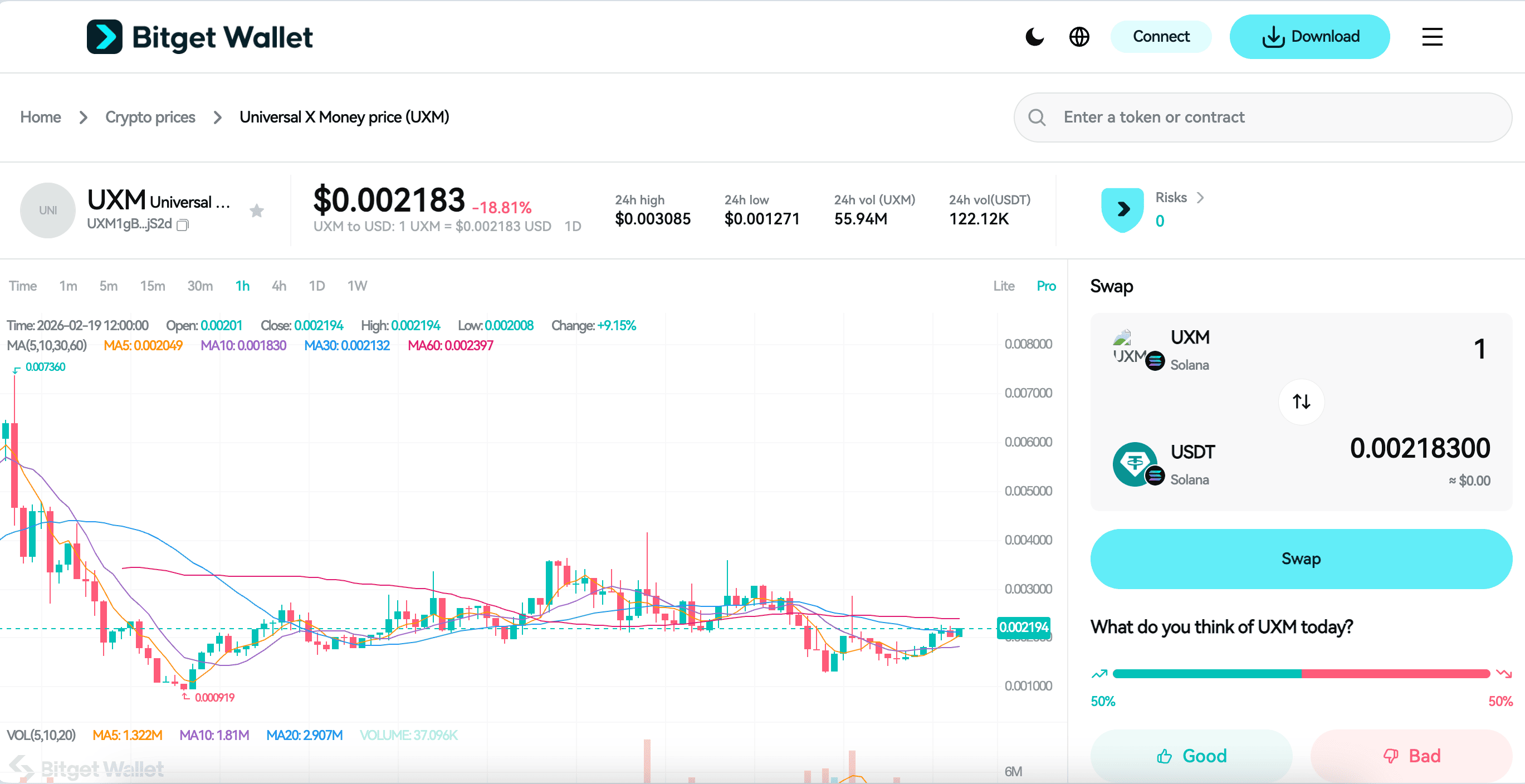

What Should You Know About UXM Price Volatility?

Universal X Money (UXM) operates primarily as a narrative-driven crypto asset rather than a revenue-backed utility token, which means its price behavior is heavily influenced by market sentiment and liquidity depth. Because UXM trading activity may concentrate in relatively shallow on-chain pools, even moderate buy or sell pressure can trigger sharp and rapid price fluctuations.

UXM price volatility is therefore driven more by attention cycles, social media momentum, and short-term speculative flows than by audited fundamentals or protocol revenue. For this reason, volatility should be treated as a structural risk characteristic of the token’s market environment—not as an inherent opportunity—and exposure should be managed with disciplined position sizing and liquidity awareness.

UXM Price Prediction: How High Can Universal X Money Go?

UXM (Universal X Money)’s price is determined primarily by liquidity conditions, trading volume concentration, and broader crypto market cycles rather than measurable revenue or cash flow metrics. As a narrative-driven digital asset, UXM may trade within a range defined by active liquidity pools and short-term participation levels, with valuation shifts closely tied to ecosystem visibility and sustained trading interest rather than fixed intrinsic benchmarks.

Factors Influencing the Price of UXM (Universal X Money)

Several key variables influence UXM price behavior:

- Market Trends: Broader crypto sentiment, especially movements in major assets and Solana ecosystem activity, can amplify or suppress UXM trading demand.

- Adoption & On-Chain Activity: Growth in wallet participation, transaction frequency, and liquidity depth may support price stability, while declining activity can increase volatility.

- Liquidity Structure & Listings: Expansion to additional trading venues or deeper liquidity pools can improve execution quality, whereas shallow pools may intensify price swings.

Long-Term Growth Potential

If Universal X Money (UXM) continues to expand its on-chain presence and maintains consistent liquidity support, demand stability could improve over time. However, long-term valuation remains dependent on sustained ecosystem participation, broader market conditions, and regulatory developments, and should be evaluated with disciplined risk management rather than assumption-based projections.

Source: Bitget Wallet

Is UXM Crypto Safe to Invest In?

Whether UXM is “safe” depends less on the token itself and more on how users execute trades and manage exposure. For narrative-driven, liquidity-sensitive assets like UXM, safety is primarily determined by contract verification, position sizing discipline, and awareness of market structure risks.

Key Risks to Consider:

- Fake or impersonation tokens: Copycat contracts using similar names can mislead traders who fail to verify the official UXM contract address.

- Low liquidity exposure: Thin liquidity pools can result in extreme slippage and rapid price drops during sell pressure.

- High holder concentration: If a small number of wallets control a large percentage of supply, sudden sell-offs can trigger sharp declines.

- Overexposure to volatile assets: Allocating excessive capital to a single narrative token increases portfolio instability.

- Sentiment-driven volatility: Price movements driven by attention cycles rather than fundamentals can reverse quickly.

No speculative crypto asset is risk-free, especially those driven by liquidity and market sentiment. Investors should approach UXM with disciplined capital allocation, verified contract interaction, and a clear understanding that volatility is a structural characteristic of this market segment.

How to Approach UXM Volatility With a Smarter Strategy?

When dealing with UXM price volatility, discipline matters far more than trying to time short-term price swings. Traders reduce avoidable losses by focusing on controlled exposure, liquidity awareness, and structured execution rather than reacting to hype cycles. Over time, this disciplined approach helps build transferable on-chain skills that apply across multiple tokens and ecosystems.

Practical Risk-Control Checklist:

- Observe on-chain liquidity behavior: Review liquidity pool depth, recent transaction flow, and slippage estimates before entering a UXM position.

- Use small position sizes: Allocate only a controlled percentage of total capital to limit downside exposure.

- Set clear capital limits: Define maximum acceptable loss thresholds before executing any trade.

- Prioritize secure execution: Verify the official UXM contract address and confirm all wallet transaction details before signing.

By approaching UXM volatility with structured discipline instead of short-term speculation, users develop stronger liquidity analysis habits, better capital allocation practices, and more secure on-chain execution skills that remain valuable beyond a single token.

Conclusion

How to buy UXM requires verification, liquidity awareness, and controlled execution. Understanding where to buy UXM, how to verify the UXMcontract address, and how to manage UXM price volatility are more important than chasing short-term momentum.

Be the first to trade trending on-chain tokens in a beginner-friendly environment with Bitget Wallet, combining secure stablecoin storage, hot memecoin trading, and a seamless cross-chain experience across 130+ blockchains; users can access Stablecoin Earn Plus to earn up to 10% APY on supported stablecoins while benefiting from zero-fee trading on memecoins and selected RWA U.S. stock tokens.

Trade, store, and explore Web3 seamlessly – beginner-ready with Bitget Wallet.

Sign up Bitget Wallet now - grab your $2 bonus!

FAQs

1. How to buy UXM safely as a beginner?

Verify the official UXM contract address, check liquidity depth, use small position sizes, and execute through a secure non-custodial wallet.

2. Where can I buy UXM?

Where to buy UXM depends on liquidity listings. If primarily decentralized, you can buy UXM on-chain via supported wallets.

3. Do I need KYC to buy UXM?

Whether KYC is required depends on the purchase method. Centralized exchanges (CEXs) typically require KYC, as users trade through custodial accounts managed by the platform.

In contrast, buying UXM through on-chain swaps using a non-custodial wallet like Bitget Wallet does not require KYC. Users interact directly with decentralized liquidity from their own wallet, without submitting identity information. However, this also means users are fully responsible for security, contract verification, and transaction execution.

4. Is UXM crypto high risk?

Yes. UXM price volatility, liquidity concentration, and sentiment-driven trading activity classify it as a high-risk digital asset that requires disciplined risk management.

5. How to avoid fake UXM tokens?

Always verify the official UXM contract address from trusted sources before executing any transaction. Cross-check the address on a reputable blockchain explorer to ensure it matches exactly and avoid impersonation tokens.

Risk Disclosure

Please be aware that cryptocurrency trading involves high market risk. Bitget Wallet is not responsible for any trading losses incurred. Always perform your own research and trade responsibly.

- How to Buy 404 Coin in 2026: A Beginner’s Step-by-Step Guide to 404 Coin2026-02-20 | 5mins