How to Buy USRX in 2026: A Beginner’s Step-by-Step Guide to United States RX

How to buy USRX is a growing question in 2026 as United States RX (USRX) gains attention across on-chain markets. Before deciding how to buy USRX, investors should understand liquidity depth, custody models, and execution risks.

If you are researching how to buy USRX safely, this guide explains where to buy USRX, how to verify the USRX contract address, how to buy USRX step by step, and how to approach USRX price volatility with discipline. You’ll also see how to buy USRX on-chain using Bitget Wallet — Secure Stablecoin Storage + Hot Memecoin Trading + Seamless Cross-chain Experience — while maintaining full custody control. In this article, you’ll learn both the execution mechanics and the risk framework required to buy USRX responsibly.

Key Takeaways

- How to buy USRX depends on where liquidity is concentrated and whether you choose custodial or non-custodial execution. Before deciding how to buy USRX, evaluate trading depth, gas requirements, and custody control.

- Verifying the USRX contract address is mandatory before executing any swap. Using the wrong contract address can expose you to impersonation tokens and irreversible losses.

- Understanding USRX price volatility reduces avoidable losses and emotional trading decisions. Since volatility is driven by liquidity and sentiment, risk management must come before position sizing.

What Is United States RX (USRX)?

United States RX (USRX) is a narrative-driven crypto asset primarily traded on decentralized markets. Unlike utility tokens tied to protocol revenue, USRX price action is influenced by sentiment cycles and liquidity participation.

Because liquidity is typically concentrated on DEX venues, many users researching where to buy USRX ultimately choose to buy USRX on-chain rather than waiting for centralized exchange listings.

What makes United States RX (USRX) different from utility tokens?

- Narrative vs utility: USRX is narrative-driven, not revenue-backed.

- Price driver: Liquidity, attention, listings, and trading momentum.

- Where it trades: Primarily on-chain liquidity pools on its native blockchain.

Source: Bitget Wallet

Is United States RX (USRX) a scam or just high-risk?

United States RX (USRX) is not automatically a scam, but it should be considered high-risk under certain conditions. Tokens with limited transparency, low liquidity, a high concentration of holders, or frequent sudden pumps can amplify execution and market risks.

To assess whether and how to buy USRX safely, users must take a disciplined verification approach:

- Verify the official USRX contract address before any transaction to avoid impersonation tokens.

- Avoid unofficial links and copycat websites or social posts that purport to represent the project.

- Watch liquidity depth and holders concentration on-chain using block explorers and DEX analytics.

Evaluate USRX using verified on-chain data, trusted blockchain explorers, and reputable crypto analytics platforms rather than social media claims. Confirm the official USRX contract address, review liquidity and holder distribution, and cross-check announcements through verified project channels to base decisions on measurable evidence instead of speculation.

Where to Buy USRX?

When users ask where to buy USRX, they usually want the safest and most efficient execution path. The real choice depends on custody: custodial exchanges hold funds for you, while on-chain swaps allow you to buy USRX on-chain directly from your wallet.

Where to buy USRX also depends on listings and liquidity. If USRX liquidity is primarily decentralized, the practical answer to where to buy USRX is through a wallet-connected DEX.

Comparison of USRX Buying Methods

| Buying Method | Custody Model | Execution | Control | Recommended For | Main Risks |

| On-chain Swap (DEX via Wallet) | Non-custodial | User-controlled | High | DeFi users | Fake contracts, slippage |

| On-chain UEX | Custodial | Platform-managed | Medium | Simplified access | Withdrawal limits |

| Centralized Exchange | Custodial | Platform-managed | Low | Beginners | Custodial exposure |

If liquidity remains decentralized, users evaluating where to buy USRX often prefer non-custodial swaps.

Why Many Users Buy USRX With Bitget Wallet?

If United States RX (USRX) liquidity is mainly on-chain, a non-custodial wallet helps you swap while keeping control of assets. Bitget Wallet also supports cross-chain access and helps reduce common beginner mistakes like interacting with impersonation tokens.

What Bitget Wallet Helps With?

✅ Self-custody and asset control Users retain full ownership of private keys and funds, reducing exposure to custodial and platform-related risks.

✅ On-chain swaps with transparent execution Explore over 1M tokens with real-time in-app rankings—discover trending assets early and stay ahead of the market.

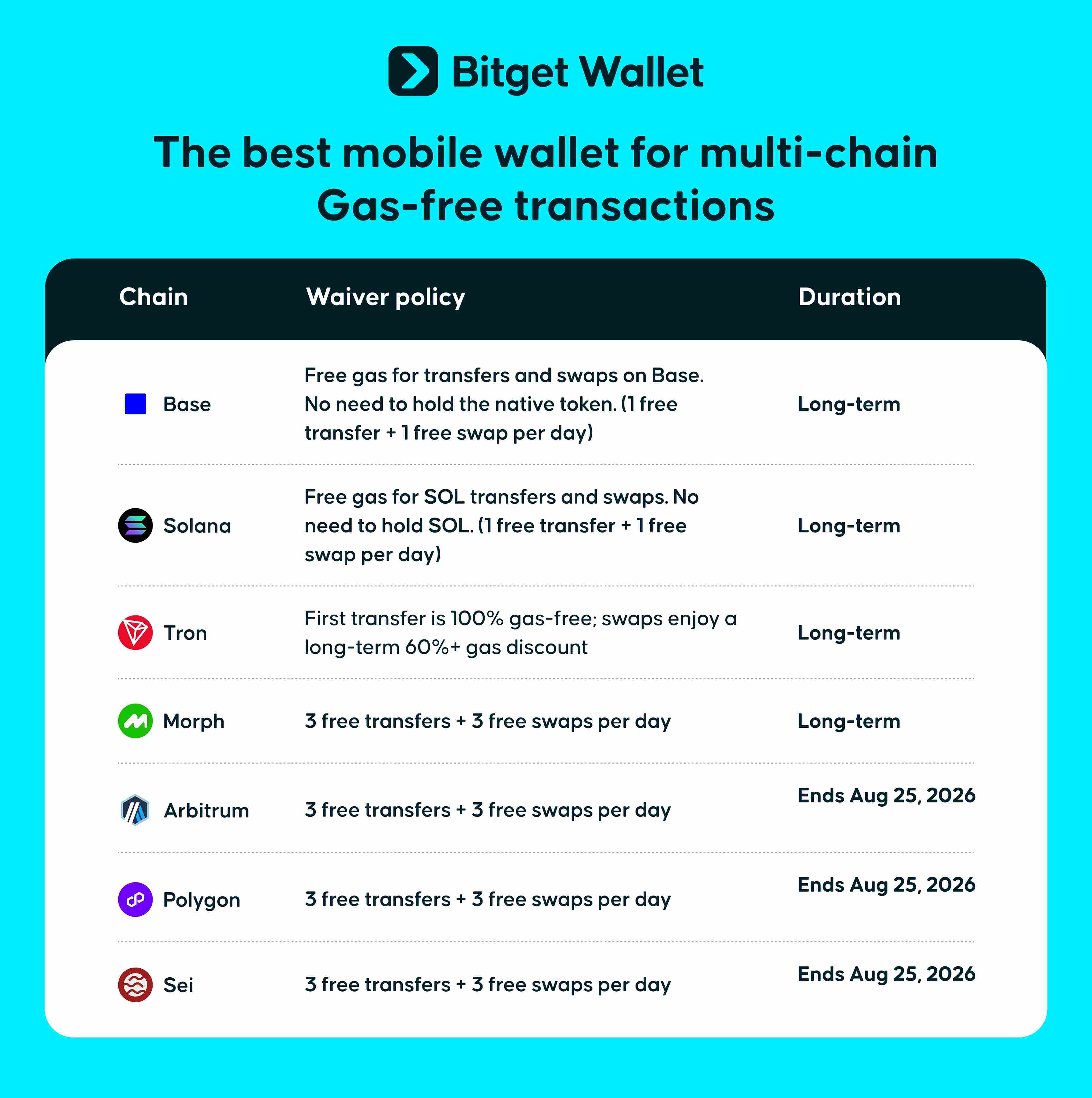

✅ Multi-chain access with cost-efficient execution Bitget Wallet supports 130+ blockchains, including 7 major networks such as Solana, Base, Arbitrum, Polygon, Tron, and more. This allows users to buy, hold, and manage USRX across different ecosystems without being locked into a single chain environment.

On supported networks, users can also benefit from gas-free transactions or long-term gas discounts, helping reduce execution costs when swapping, transferring, or managing assets across chains—an advantage for users who trade frequently or operate across multiple ecosystems.

✅ Flexible post-purchase asset management After buying USRX, users can hold, transfer, or manage assets freely across supported chains without withdrawal limits or third-party restrictions, making it easier to adapt to changing liquidity or market conditions.

Sign up Bitget Wallet now - grab your $2 bonus!

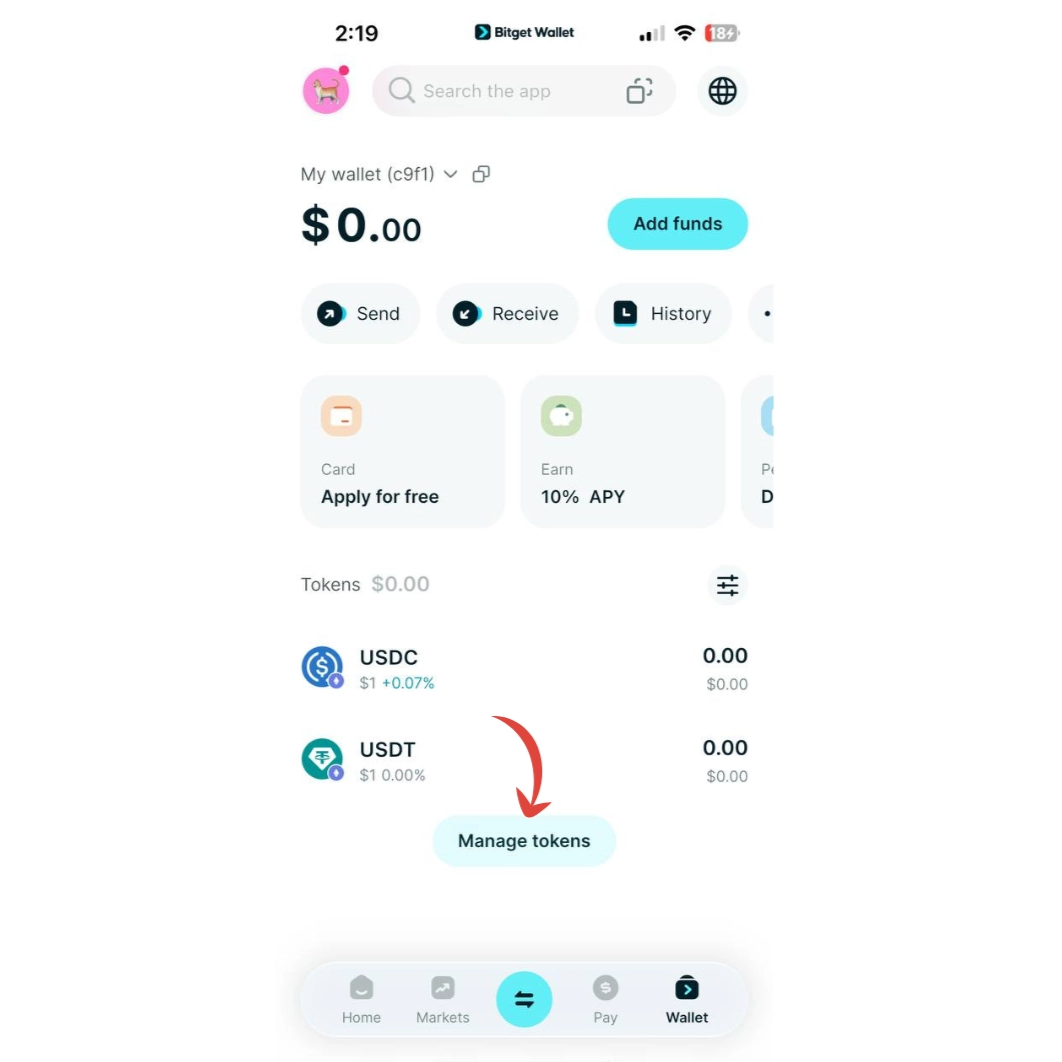

How to Buy USRX on Bitget Wallet?

Trading United States RX (USRX) is easy on Bitget Wallet. Follow these simple steps to get started:

Step 1: Create an Account

If you don't have an account, download the Bitget Wallet app. Sign up by providing the necessary information and verifying your identity.

Step 2: Deposit Funds

Once your account is set up, you need to deposit funds. You can do this by:

- Transferring Cryptocurrency: Send crypto from another wallet.

- Buying Crypto: Use a credit or debit card to purchase crypto directly on Bitget Wallet, ensuring you have enough funds for trading United States RX (USRX).

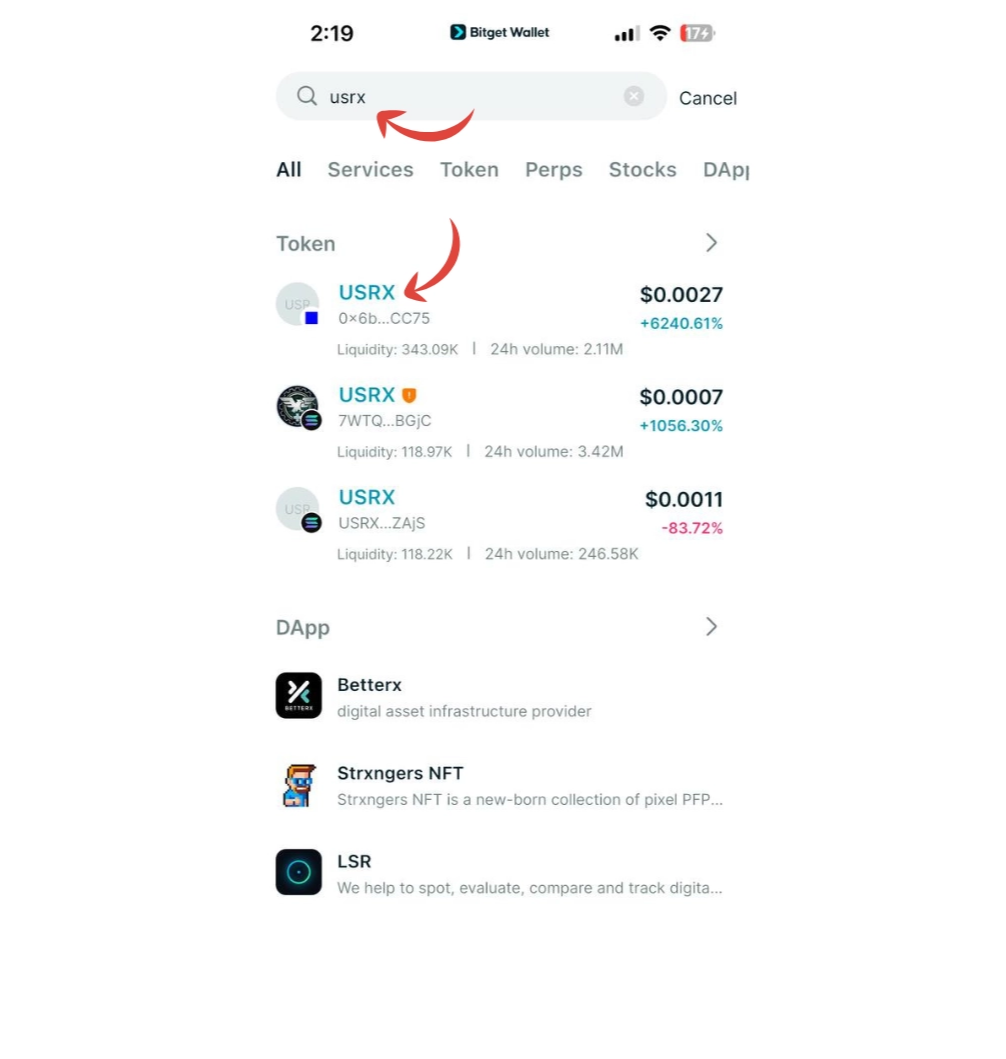

Step 3: Find United States RX (USRX)

In the Bitget Wallet interface, navigate to the market section. Use the search bar to find United States RX (USRX). Click on the token to view its trading page.

Since this token has not been listed yet, please refer to the final contract address provided by the project team after the token is officially listed.

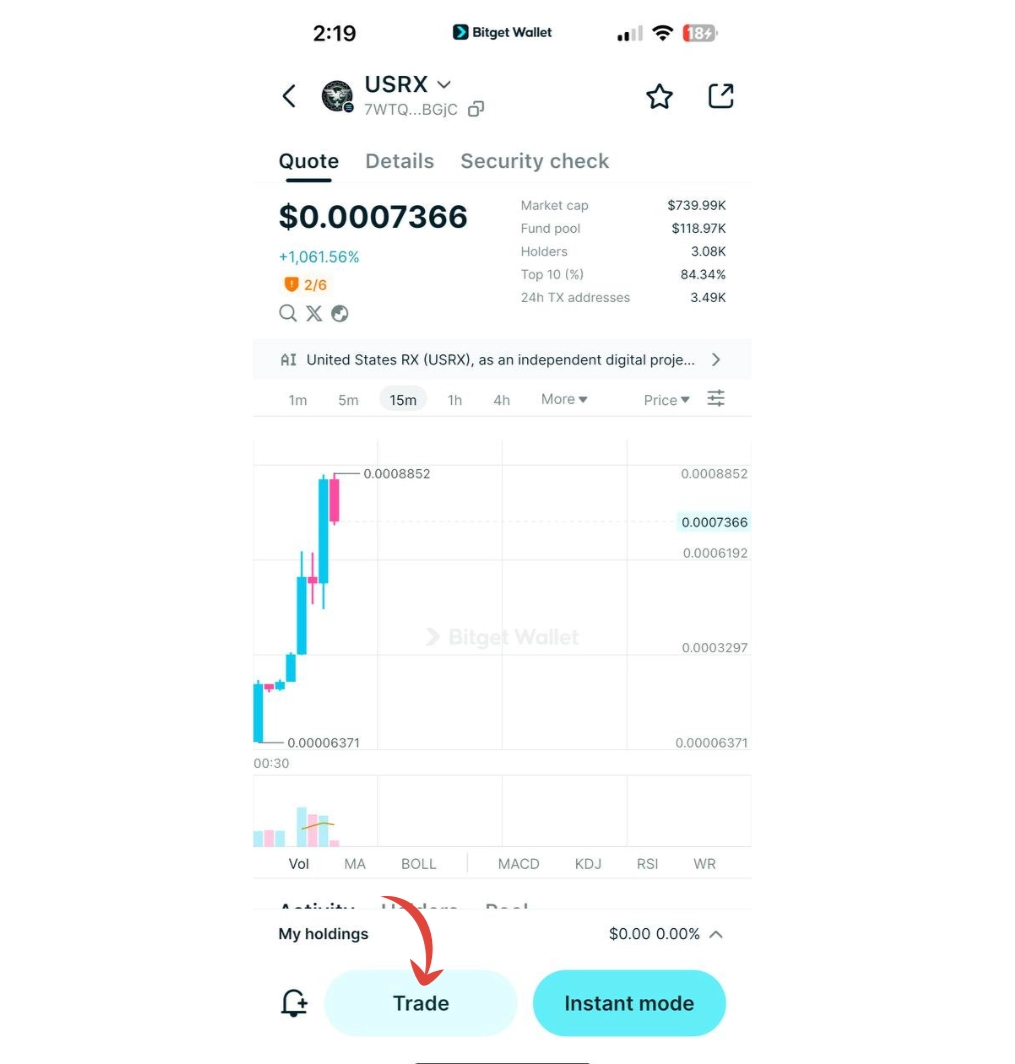

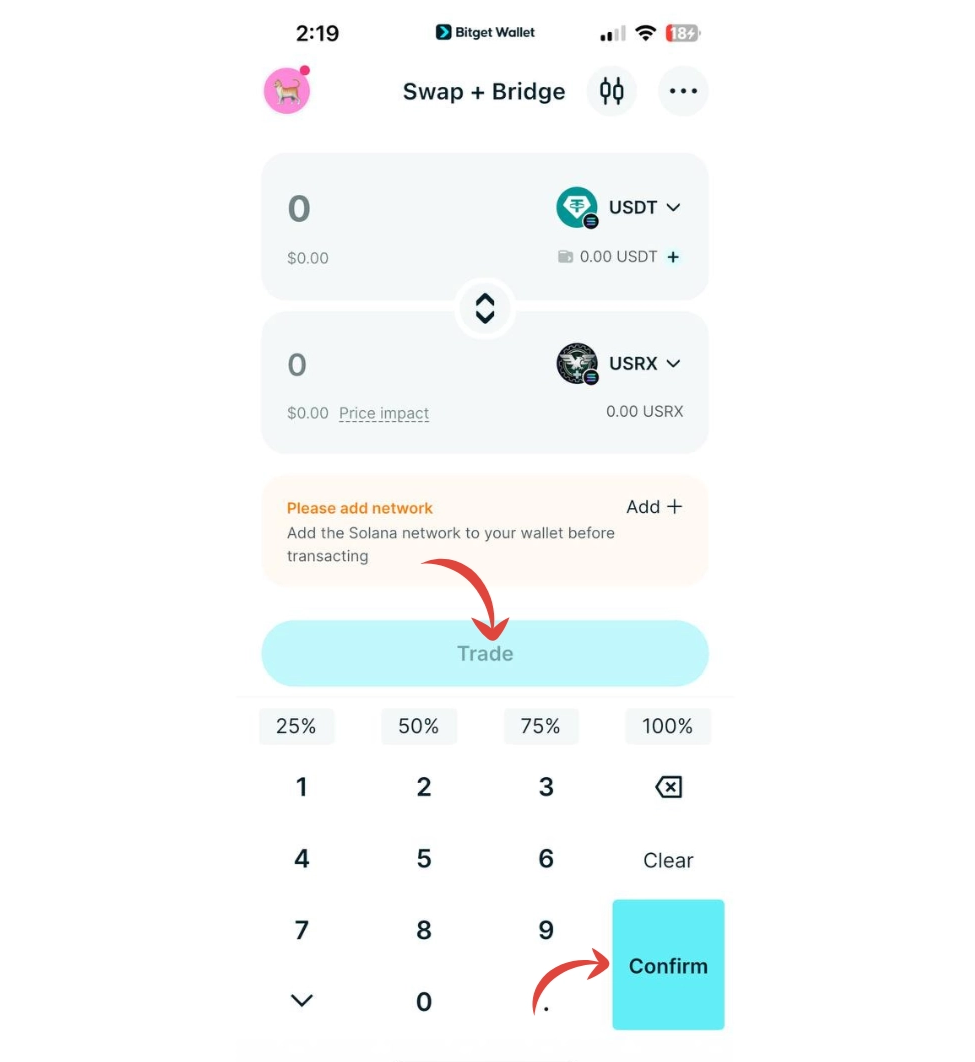

Step 4: Choose Your Trading Pair

Select the trading pair you wish to use, such as USRX/USDT. This will allow you to trade United States RX (USRX) against USDT or another cryptocurrency.

Step 5: Place Your Order

Decide whether you want to place a market order (buy/sell at the current market price) or a limit order (set your own price). Enter the amount of United States RX (USRX) you wish to buy or sell, then confirm your order.

Step 6: Monitor Your Trade

After placing your order, you can monitor its status in the “Open Orders” section. Once the order is executed, you can check your balance to see your newly acquired United States RX (USRX).

Step 7: Withdraw Your Funds (Optional)

If you wish to transfer your United States RX (USRX) or any other cryptocurrency to another wallet, navigate to the withdrawal section, enter your wallet address, and confirm the transaction.

▶Learn more about United States RX (USRX):

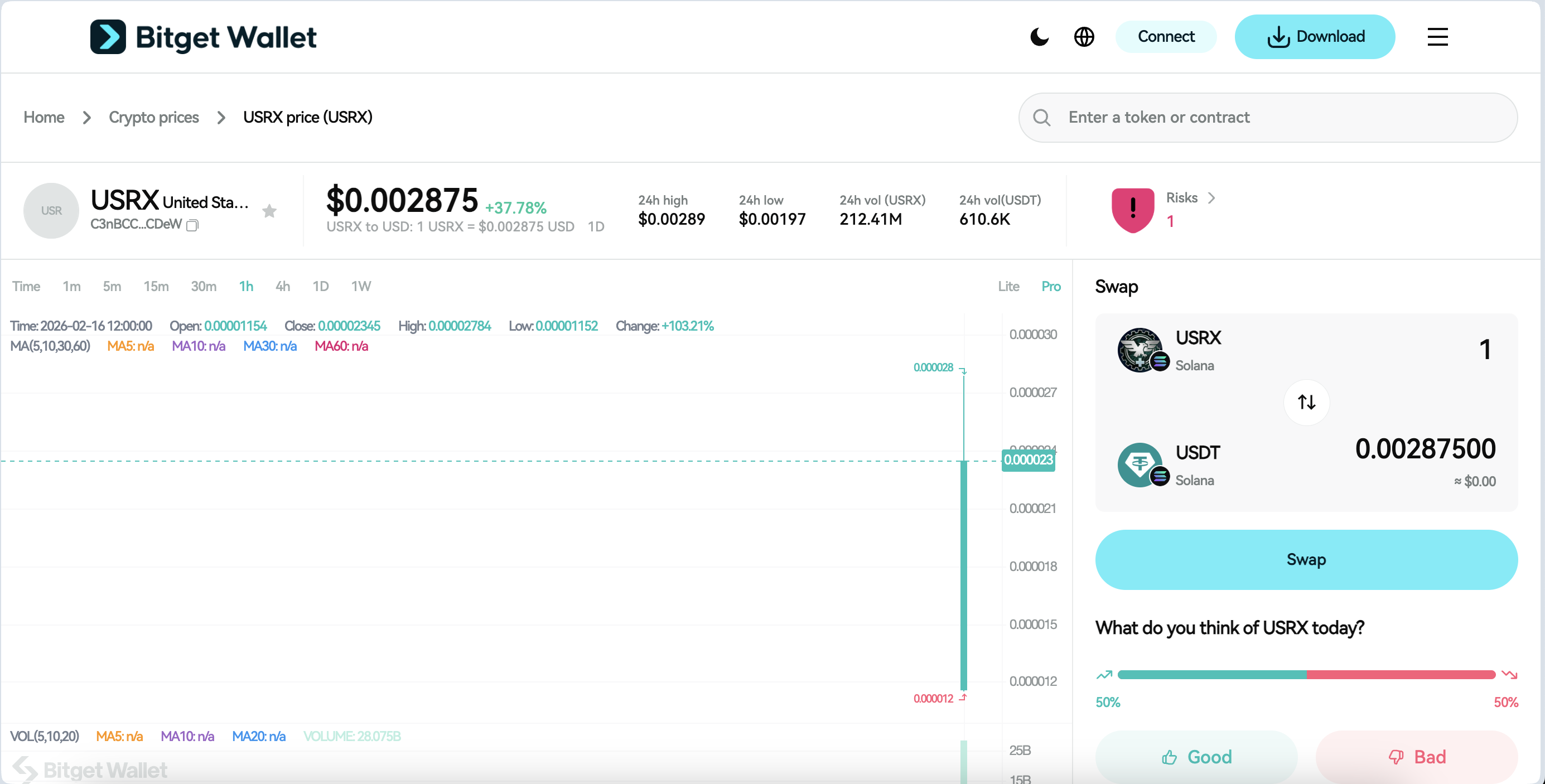

What Should You Know About USRX Price Volatility?

United States RX (USRX) is a narrative-driven token whose price is primarily influenced by market sentiment and on-chain liquidity conditions rather than revenue generation or protocol fundamentals. USRX price volatility is typically driven by trading momentum, liquidity depth, and shifts in community attention across exchanges and social channels.

USRX experiences sharp price fluctuations because speculative inflows and outflows can move relatively thin liquidity pools quickly. Since volatility is shaped more by sentiment and liquidity dynamics than intrinsic value metrics, it should be treated as a structural risk characteristic rather than an opportunity, requiring disciplined execution and controlled exposure.

USRX Price Prediction: How High Can United States RX Go?

The value of United States RX (USRX) is primarily shaped by market sentiment, on-chain liquidity conditions, and community participation rather than traditional revenue metrics. As a narrative-driven token, its trading range is influenced more by attention cycles and liquidity depth than by intrinsic cash flow models. If development transparency improves and participation within its related on-chain ecosystem expands, USRX may experience price fluctuations within liquidity-defined ranges rather than predictable valuation bands.

Key Factors Impacting United States RX (USRX) Price

Several aspects influence the potential price movement of United States RX (USRX):

- Market Conditions: Broader crypto sentiment, Bitcoin volatility, and risk-on or risk-off cycles directly affect speculative tokens like USRX. Sharp macro shifts can amplify price swings.

- Adoption & Utility: Because USRX is primarily narrative-based, adoption is measured through trading activity, wallet participation, and liquidity pool growth rather than protocol revenue.

- Project Expansion: Exchange listings, ecosystem partnerships, and sustained community engagement can influence demand, but these factors must be evaluated through verifiable announcements and on-chain data.

As United States RX (USRX) evolves within its on-chain trading ecosystem, price behavior will likely remain closely tied to liquidity depth and sentiment cycles. While increased visibility and broader participation could support higher demand, volatility should be expected given its narrative-driven structure. Before deciding how to buy USRX or increase exposure, investors should carefully assess liquidity stability, regulatory developments, and overall market conditions.

Source: Bitget Wallet

Is USRX Crypto Safe to Invest In?

Whether USRX is “safe” depends less on the token itself and more on how users trade, verify information, and manage risk exposure. For narrative-driven tokens like United States RX (USRX), safety is determined by execution quality, liquidity awareness, and disciplined position sizing rather than by the project label alone.

Key Risks to Consider:

- Fake or impersonation tokens: Copycat contracts using similar names can mislead buyers who fail to verify the official USRX contract address.

- Low liquidity awareness: Thin liquidity pools can cause high slippage and exaggerated price swings during entry or exit.

- Holder concentration risk: If a small number of wallets control a large share of supply, sudden sell-offs can trigger sharp declines.

- Overexposure to speculative assets: Allocating too much capital to a volatile narrative token increases portfolio instability.

No speculative crypto asset is risk-free, and USRX is no exception. Investors should approach exposure with measured sizing, verified contract checks, and realistic expectations about volatility and execution risk.

How to Approach USRX Volatility With a Smarter Strategy

Managing USRX volatility requires discipline rather than perfect timing. Because United States RX (USRX) is influenced by sentiment and liquidity shifts, controlled exposure and structured decision-making reduce avoidable losses more effectively than chasing short-term price swings. Developing a disciplined approach not only improves risk management but also builds transferable on-chain skills applicable across other crypto assets.

Practical Risk-Control Framework:

- Observe on-chain liquidity behavior: Review pool depth, trading volume, and holder distribution before entering or exiting positions.

- Use small position sizes: Limit exposure relative to total portfolio value to reduce the impact of sudden volatility.

- Set clear capital limits: Define maximum allocation and acceptable loss thresholds before executing any trade.

- Prioritize secure execution: Verify the official USRX contract address and confirm transaction details carefully to avoid preventable errors.

A structured, education-first strategy helps investors build long-term competence in liquidity analysis, contract verification, and risk control—skills that remain valuable regardless of short-term market conditions.

Conclusion

How to buy USRX successfully depends on understanding liquidity structure, verifying the official USRX contract address, and choosing the right custody model before executing any trade. Rather than focusing on short-term price movements, investors should prioritize disciplined execution, liquidity awareness, and risk control when deciding where to buy USRX and how to buy USRX safely.

If you want a beginner-friendly way to access on-chain tokens like USRX, Bitget Wallet provides secure self-custody, transparent swap execution, and seamless cross-chain support. Start trading responsibly with full control of your assets, and explore additional tools like Stablecoin Earn Plus (up to 10% APY) and zero-fee trading on selected memecoins and RWA U.S. stock tokens—all within one integrated wallet experience.

Manage all your tokens in one beginner-friendly app – download Bitget Wallet today.

Sign up Bitget Wallet now - grab your $2 bonus!

FAQs

1. How to buy USRX safely as a beginner?

To understand how to buy USRX safely, beginners should first verify the official USRX contract address, check on-chain liquidity depth, and confirm holder distribution before executing any swap. Using a non-custodial wallet with transparent swap routing helps reduce exposure to fake tokens and execution errors.

2. Where can I buy USRX?

Where to buy USRX depends on listing availability and liquidity concentration. If USRX liquidity is primarily on-chain, users typically buy USRX through a decentralized exchange (DEX) using a wallet-connected swap interface rather than a centralized exchange.

3. Do I need KYC to buy USRX?

Whether KYC is required depends on the purchase method. Centralized exchanges (CEXs) typically require KYC, as users trade through custodial accounts managed by the platform.

In contrast, buying USRX through on-chain swaps using a non-custodial wallet like Bitget Wallet does not require KYC. Users interact directly with decentralized liquidity from their own wallet, without submitting identity information. However, this also means users are fully responsible for security, contract verification, and transaction execution.

4. Is USRX crypto high risk?

Yes. USRX is considered high-risk because its price is primarily driven by market sentiment and liquidity conditions rather than measurable revenue or protocol fundamentals. Sharp volatility, thin liquidity, and holder concentration can amplify both upward and downward price movements.

5. How can I avoid fake USRX tokens?

To avoid fake USRX tokens, always confirm the official USRX contract address through verified project channels and trusted blockchain explorers. Double-check token symbols, liquidity pools, and transaction details before approving any swap.

Risk Disclosure

Please be aware that cryptocurrency trading involves high market risk. Bitget Wallet is not responsible for any trading losses incurred. Always perform your own research and trade responsibly.

- How to Buy 404 Coin in 2026: A Beginner’s Step-by-Step Guide to 404 Coin2026-02-20 | 5mins