How to Buy COIN in 2026: A Beginner’s Step-by-Step Guide to NEW ELON MUSK xCOIN

How to buy COIN is a question many on-chain traders are asking in 2026 as narrative-driven Solana tokens like NEW ELON MUSK xCOIN (COIN) appear across decentralized swap interfaces. Before executing any COIN swap, it’s critical to understand custody models, liquidity depth, and how to verify the correct COIN contract address.

Because COIN trades primarily on-chain, users need to know where to buy COIN, how to buy COIN safely, and how COIN price volatility behaves in low-liquidity environments. In this article, you’ll learn how to buy COIN step by step, how to avoid fake COIN tokens, and how to approach COIN trading with discipline.

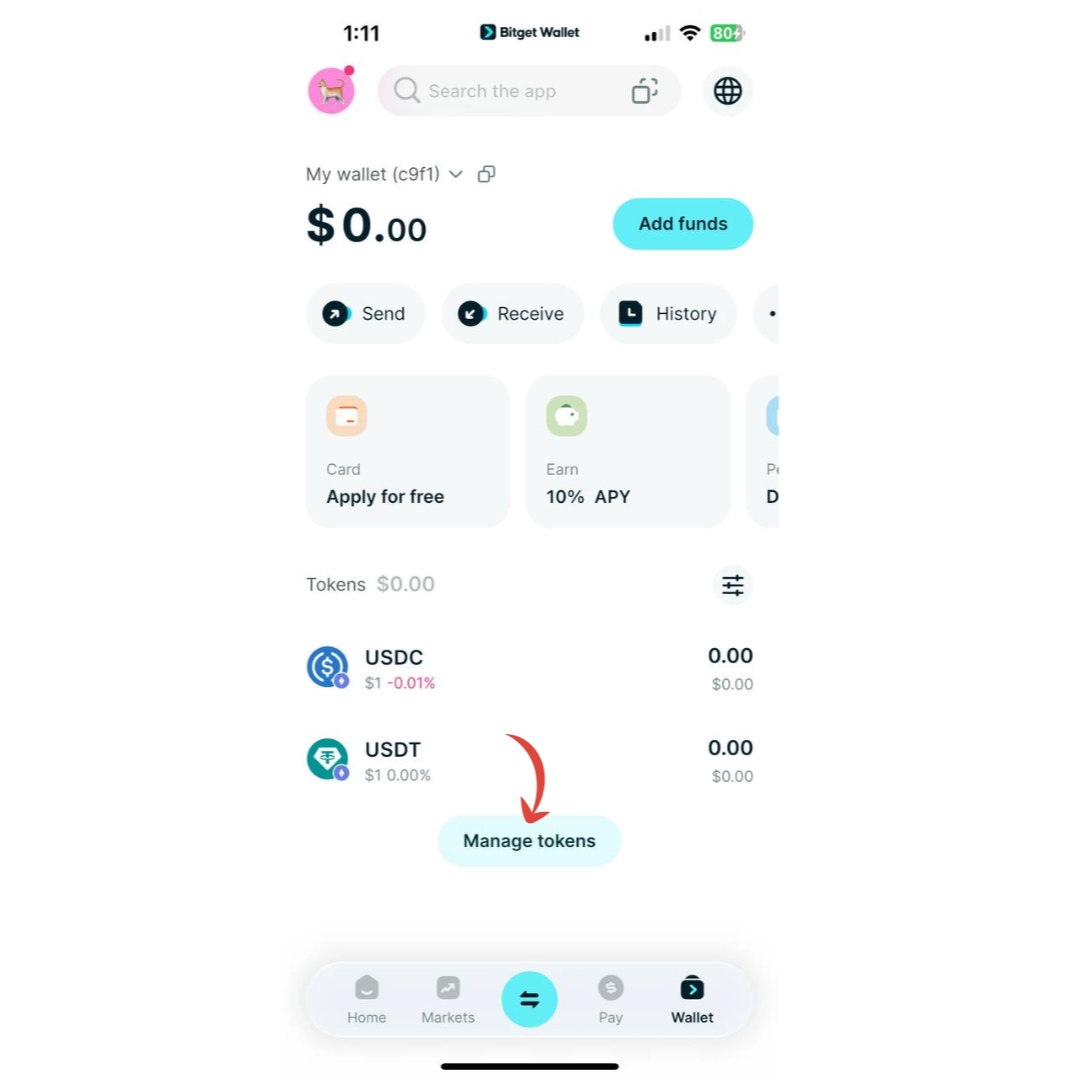

Manage all your tokens in one beginner-friendly app – download Bitget Wallet today.

Key Takeaways

- NEW ELON MUSK xCOIN (COIN) is a Solana-based narrative token with on-chain liquidity and high volatility characteristics.

- Understanding where to buy COIN depends on liquidity availability and whether you choose custodial or non-custodial execution.

- Learning how to buy COIN safely requires verifying the COIN contract address, checking liquidity conditions, and managing exposure carefully.

What Is NEW ELON MUSK xCOIN (COIN)?

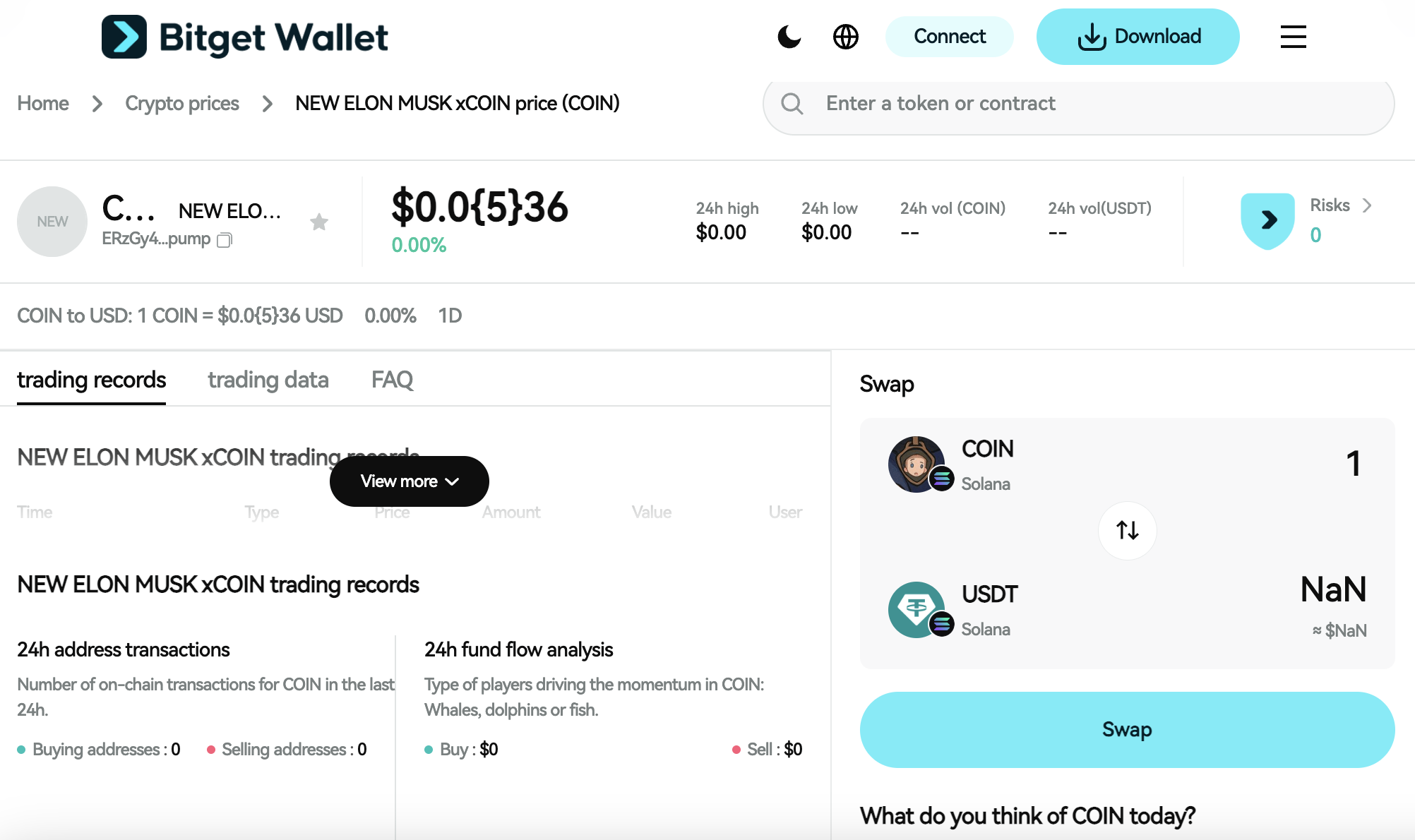

NEW ELON MUSK xCOIN (COIN) is a Solana-based SPL token that appears to follow a meme or narrative-driven structure rather than a utility-backed framework. It trades primarily through on-chain swap interfaces and does not present formal documentation, audited utility layers, or ecosystem governance structures commonly seen in infrastructure projects.

COIN’s activity is concentrated in decentralized liquidity pools on Solana, and its price behavior reflects sentiment, attention cycles, and liquidity shifts rather than underlying revenue or protocol usage.

What makes NEW ELON MUSK xCOIN (COIN) different from utility tokens?

- Narrative vs utility: COIN functions as a narrative-driven token rather than a utility or governance asset. It does not publicly present staking mechanics, revenue models, or protocol ownership structures.

- Price driver: COIN price volatility is influenced primarily by on-chain liquidity, short-term attention, and speculative positioning rather than adoption metrics.

- Where it trades: COIN trades on Solana through decentralized swap interfaces. Liquidity is typically accessible through wallet-based DEX routing rather than centralized listings.

Source: Bitget Wallet

Is NEW ELON MUSK xCOIN (COIN) a scam or just high-risk?

COIN is not automatically a scam simply because it is narrative-driven. However, it qualifies as high-risk due to:

- Limited public transparency

- Low liquidity conditions

- High concentration risk

- Potential for copycat tokens using similar names

Users must:

-

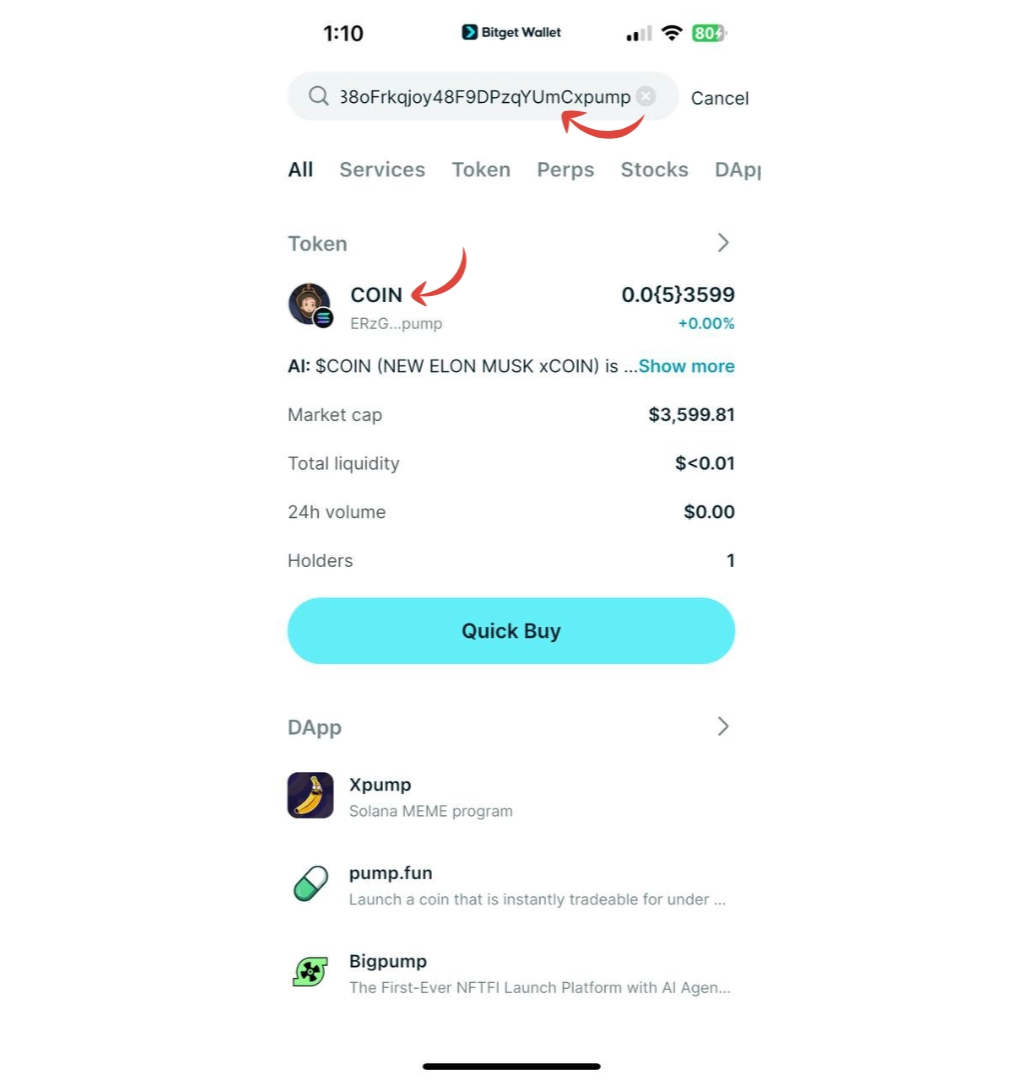

Verify the official COIN contract address:

ERzGy4jxGxTf5TTjs38oFrkqjoy48F9DPzqYUmCxpump -

Avoid unofficial social links or impersonation websites

-

Learn how to check COIN liquidity before executing a swap

-

Monitor holder concentration and transaction activity

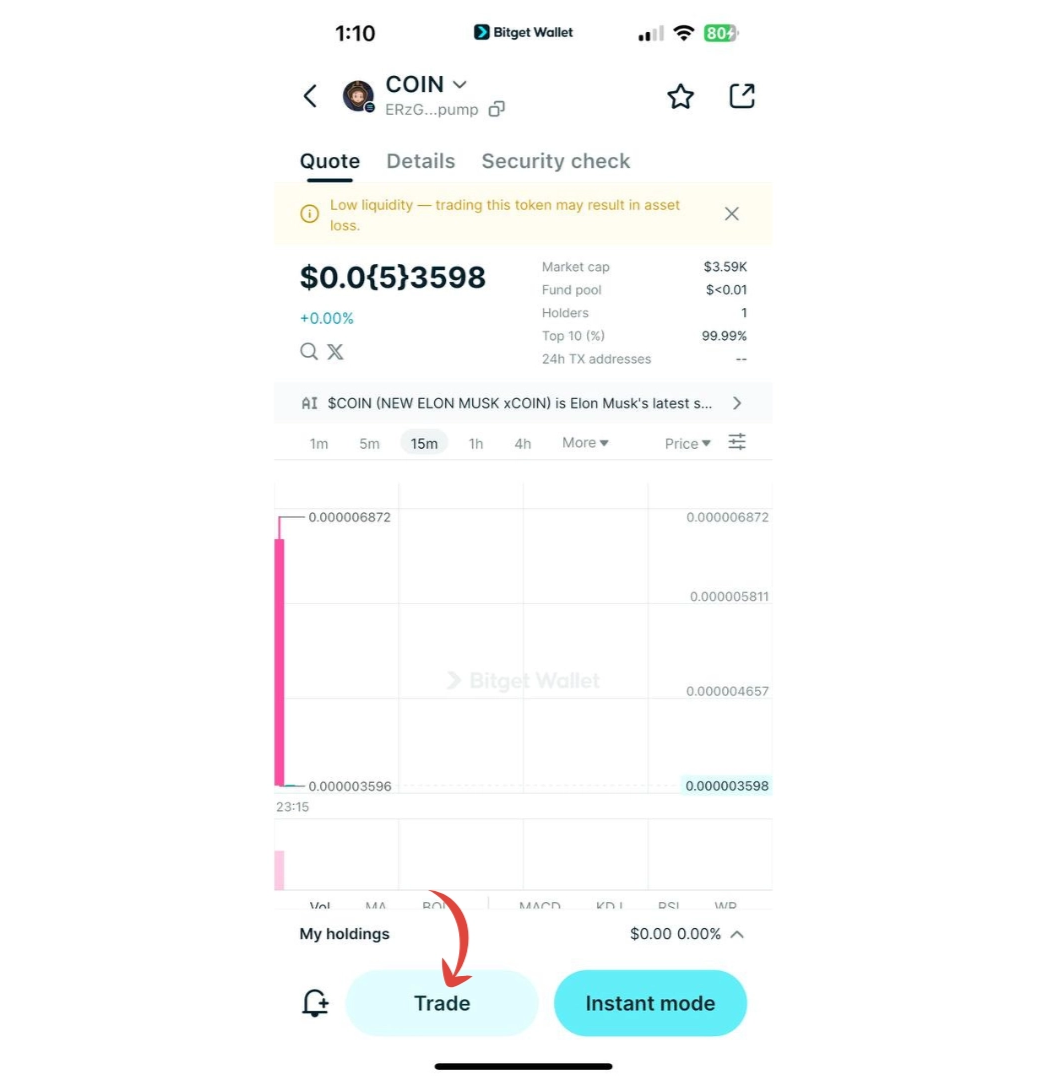

On-chain data shows limited holder distribution and minimal trading depth, reinforcing the classification of COIN as a speculative, high-volatility asset rather than a structured investment product.

Where to Buy COIN?

When users ask “where to buy COIN,” they usually mean the best mix of convenience, safety, and execution quality. The real decision is custody model: custodial platforms hold assets for you, while on-chain swaps let you trade directly from your own wallet.

COIN is primarily available through on-chain Solana swap routing, meaning availability depends on liquidity pools rather than centralized exchange listings. Where to buy COIN therefore depends on whether you prefer full self-custody or platform-managed access.

Liquidity availability may change quickly. Before deciding where to buy COIN, users should verify active pools and slippage conditions.

Comparison of COIN Buying Methods

| Buying Method | Custody Model | Execution | Control | Recommended For | Main Risks |

| On-chain Swap (DEX via Wallet) | Non-custodial | User-controlled, on-chain | High | Self-custody, DeFi users | • Contract impersonation• Price slippage• Gas fee volatility |

| On-chain UEX (via Exchange) | Custodial | Platform-managed, on-chain | Medium | Users who want exposure without wallet management | • Custodial exposure• Withdrawal limits• Platform dependency |

| Centralized exchange (CEX) | Custodial | Platform-managed | Low | Beginners, fiat users | • Custodial risk• Withdrawal delays• Regulatory restrictions |

Why Many Users Buy COIN With Bitget Wallet?

If NEW ELON MUSK xCOIN (COIN) liquidity is mainly on-chain, a non-custodial wallet allows users to buy COIN on-chain while maintaining full control of their assets. Since COIN trades through Solana-based liquidity pools rather than established centralized listings, using Bitget Wallet helps reduce common beginner mistakes such as interacting with fake COIN tokens or using the wrong COIN contract address.

What Bitget Wallet Helps With?

✅ Self-custody and asset control

When users buy COIN with Bitget Wallet, they retain full ownership of their private keys and funds. This reduces exposure to custodial risks, withdrawal freezes, or platform dependency.

✅ On-chain swaps with transparent execution

Bitget Wallet enables direct COIN swap routing on Solana with visible slippage estimates and real-time liquidity conditions. This is critical when dealing with high COIN price volatility and low liquidity environments.

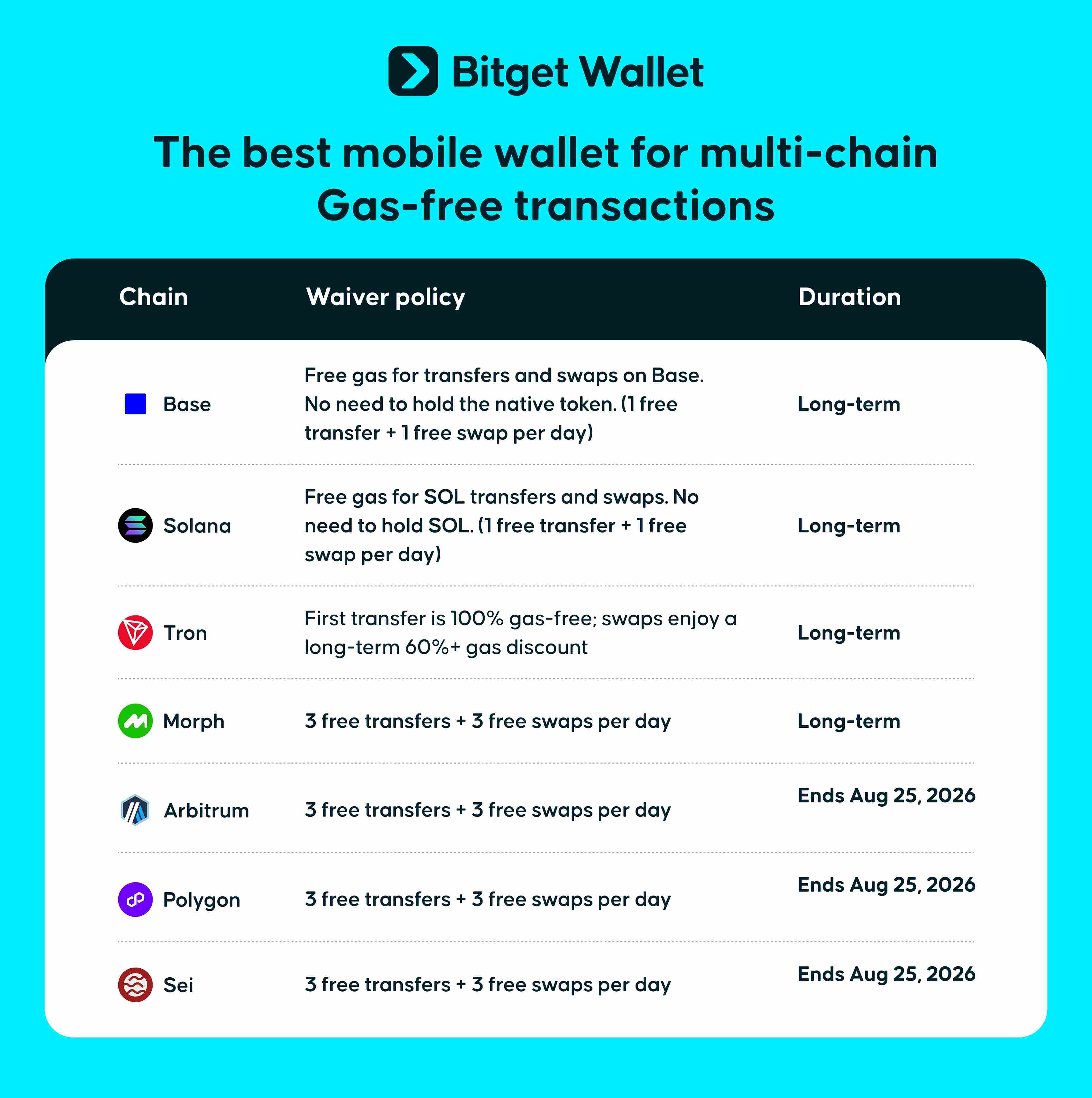

✅ Multi-chain access with cost-efficient execution

Bitget Wallet supports 130+ blockchains, including Solana, Base, Arbitrum, Polygon, and Tron. While COIN is a Solana-based token, users can manage diversified portfolios across ecosystems without being locked into a single chain environment.

On supported networks, users may benefit from gas optimization mechanisms or long-term gas discounts, helping reduce execution costs when swapping, transferring, or managing assets across chains.

✅ Flexible post-purchase asset management

After you buy COIN on-chain, you can hold, transfer, or manage it without withdrawal limits or third-party restrictions. This flexibility is particularly important for tokens like COIN, where liquidity conditions may change rapidly.

Sign up Bitget Wallet now - grab your $2 bonus!

How to Buy NEW ELON MUSK xCOIN (COIN) on Bitget Wallet?

Trading NEW ELON MUSK xCOIN (COIN) is easy on Bitget Wallet. Follow these simple steps to get started:

Step 1: Create an Account

If you don't have an account, download the Bitget Wallet app. Sign up by providing the necessary information and verifying your identity.

Step 2: Deposit Funds

Once your account is set up, you need to deposit funds. You can do this by:

- Transferring Cryptocurrency: Send crypto from another wallet.

- Buying Crypto: Use a credit or debit card to purchase crypto directly on Bitget Wallet, ensuring you have enough funds for trading NEW ELON MUSK xCOIN (COIN).

Step 3: Find NEW ELON MUSK xCOIN (COIN)

In the Bitget Wallet interface, navigate to the market section. Use the search bar to find NEW ELON MUSK xCOIN (COIN). Click on the token to view its trading page.

Since this token has not been listed yet, please refer to the final contract address provided by the project team after the token is officially listed.

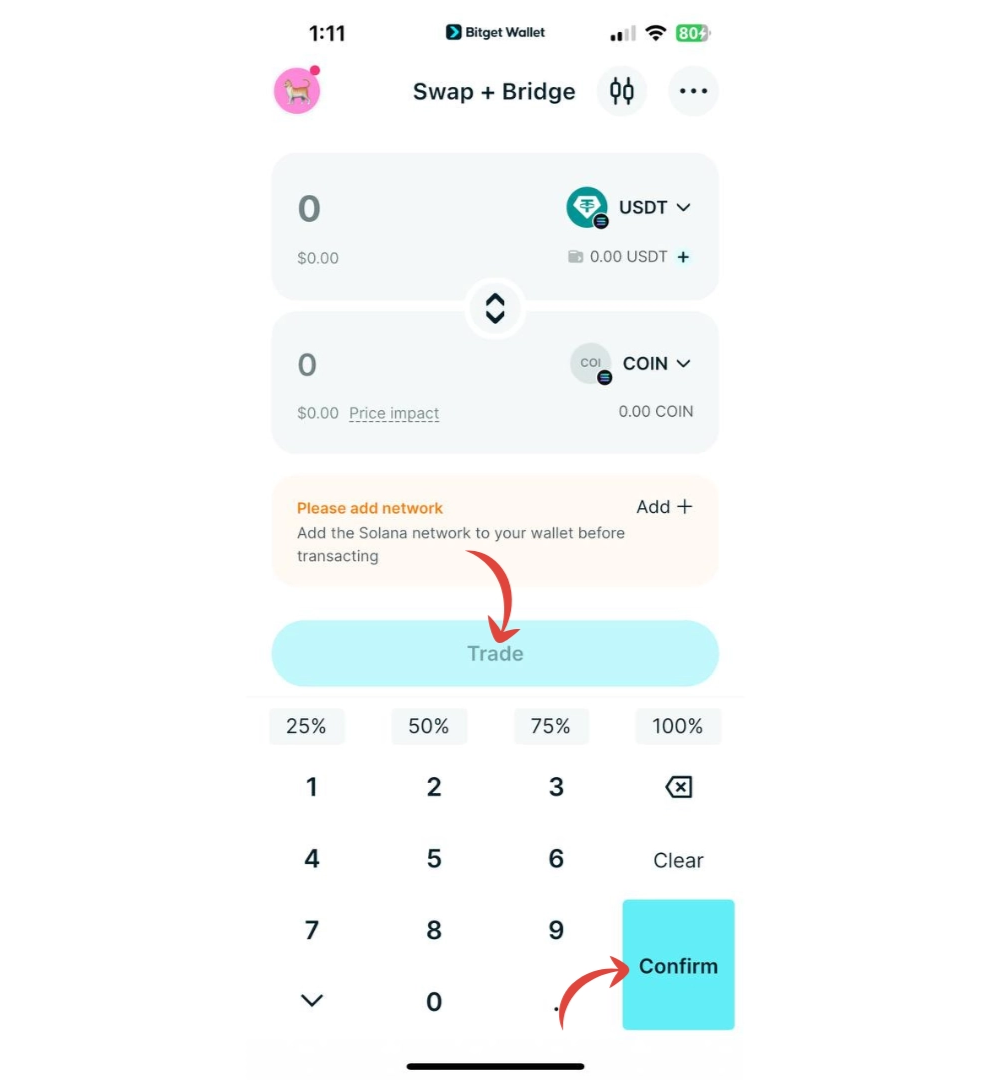

Step 4: Choose Your Trading Pair

Select the trading pair you wish to use, such as COIN/USDT. This will allow you to trade NEW ELON MUSK xCOIN (COIN) against USDT or another cryptocurrency.

Step 5: Place Your Order

Decide whether you want to place a market order (buy/sell at the current market price) or a limit order (set your own price). Enter the amount of NEW ELON MUSK xCOIN (COIN) you wish to buy or sell, then confirm your order.

Step 6: Monitor Your Trade

After placing your order, you can monitor its status in the “Open Orders” section. Once the order is executed, you can check your balance to see your newly acquired NEW ELON MUSK xCOIN (COIN).

Step 7: Withdraw Your Funds (Optional)

If you wish to transfer your NEW ELON MUSK xCOIN (COIN) or any other cryptocurrency to another wallet, navigate to the withdrawal section, enter your wallet address, and confirm the transaction.

What Should You Know About COIN Price Volatility?

COIN is a narrative-driven Solana token whose price volatility is largely tied to liquidity depth and attention cycles. Because it lacks fundamental revenue drivers, price movement is influenced primarily by sentiment and trading activity.

Low liquidity environments amplify sharp swings. Even moderate trade sizes can cause disproportionate price shifts. This is why COIN price volatility should be treated as a structural risk factor.

Short bursts of attention can temporarily increase volume, but without sustained liquidity, price retracements can be equally rapid. Understanding how to check COIN liquidity before buying is essential.

COIN Price Prediction: How High Can NEW ELON MUSK xCOIN Go?

The value of NEW ELON MUSK xCOIN (COIN) is shaped by market sentiment, liquidity depth, and speculative attention cycles. Because COIN does not present formal utility or revenue-backed fundamentals, its potential price expansion can only be modeled using comparative historical data from similar early-stage Solana meme tokens.

A relevant benchmark is BONK, which during its early decentralized exchange phase expanded approximately 10× from microcap levels before broader listings amplified its visibility. Using that early-stage expansion pattern as a comparative model allows us to calculate realistic numeric scenarios for COIN.

Key Factors Impacting NEW ELON MUSK xCOIN (COIN) Price

Several aspects influence the potential price movement of NEW ELON MUSK xCOIN (COIN):

- Market Conditions: In strong Solana meme cycles, early-stage tokens have historically expanded between 5× and 10× due to liquidity inflows.

- Adoption & Utility: COIN currently lacks ecosystem integration or utility drivers that would support sustained demand.

- Project Expansion: No verified roadmap or centralized exchange listings currently support structural long-term growth.

Future Price Outlook

At a current market capitalization of approximately $3,600 and a total supply of 1,000,000,000 COIN, the implied spot price is roughly $0.0000036.

If COIN mirrors BONK’s early 5× microcap expansion, price would reach approximately $0.000018.

If COIN mirrors BONK’s early 10× expansion, price would reach approximately $0.000036.

These figures are based on historical microcap expansion behavior observed in early Solana meme tokens before large-scale listings occurred. Without sustained liquidity growth or structural development, similar tokens have historically retraced significantly after short-term spikes.

Source: Solana, CoinMarketCap

Source: Bitget Wallet

Is COIN Crypto Safe to Invest In?

Safety depends less on the token itself and more on how users execute and manage risk. Learning how to buy COIN safely requires disciplined verification and exposure control.

Key risks include:

- Fake tokens using similar names (learn how to avoid fake COIN tokens)

- Low liquidity awareness and slippage losses

- Overexposure to high-volatility assets

- Holder concentration risk

- Rapid price collapses after attention spikes

No speculative crypto asset is risk-free. COIN should be treated as a high-volatility on-chain token rather than a stable investment vehicle.

How to Approach COIN Volatility With a Smarter Strategy?

Managing COIN price volatility requires discipline, not timing predictions. Users reduce avoidable losses by focusing on execution quality rather than short-term hype.

Best practices:

- Observe on-chain liquidity behavior before swapping

- Use small position sizes

- Set clear capital limits

- Prioritize secure execution and verify the COIN contract address

- Avoid emotional trading during spikes

Developing these habits builds transferable on-chain risk management skills beyond a single token.

Conclusion

How to buy COIN safely in 2026 requires more than simply executing a swap. It involves verifying the COIN contract address, understanding where to buy COIN based on liquidity, and managing COIN price volatility responsibly.

If you want to buy COIN on-chain with full control and reduced custodial exposure, consider using Bitget Wallet. Be the first to trade trending memecoins — beginner-friendly on Bitget Wallet.

Bitget Wallet also supports Stablecoin Earn Plus (up to 10% APY) and zero-fee trading on selected assets.

Trade, store, and explore Web3 seamlessly – beginner-ready with Bitget Wallet.

Sign up Bitget Wallet now - grab your $2 bonus!

FAQs

Q1. How to buy COIN safely as a beginner?

To learn how to buy COIN safely, first verify the official COIN contract address on Solana. Use a trusted non-custodial wallet, check liquidity conditions, and start with a small position size to manage COIN price volatility.

Q2. Where can I buy COIN?

Where to buy COIN depends on liquidity availability. COIN is primarily accessible through on-chain Solana swaps rather than major centralized exchange listings.

Q3. Do I need KYC to buy COIN?

Whether KYC is required depends on the purchase method. Centralized exchanges (CEXs) typically require KYC.

In contrast, buying COIN through on-chain swaps using a non-custodial wallet like Bitget Wallet does not require KYC. Users interact directly with decentralized liquidity from their own wallet.

Q4. Is COIN crypto high risk?

Yes. COIN qualifies as a high-risk, narrative-driven token due to low liquidity, limited transparency, and volatility concentration.

Q5. How to check COIN liquidity before buying?

Use a Solana swap interface to review pool depth, recent transactions, and slippage estimates. Low liquidity can amplify COIN price volatility significantly.

Risk Disclosure

Please be aware that cryptocurrency trading involves high market risk. Bitget Wallet is not responsible for any trading losses incurred. Always perform your own research and trade responsibly.

- How to Buy 404 Coin in 2026: A Beginner’s Step-by-Step Guide to 404 Coin2026-02-20 | 5mins