What is USD1 Stablecoin: Multi-Chain Stablecoin Backed by U.S. Treasuries for Web3 Payments

What Is USD1? Rooted in financial stability and transparency, USD1 bridges tradition and innovation within the stablecoin and payments industry. It leverages blockchain to provide a reserve-backed digital dollar, ensuring trusted value remains relevant in a modern financial landscape.

Thanks to the support of World Liberty Financial (WLFI) and trusted custodians like BitGo, USD1 is redefining digital assets, allowing investors and participants to engage in its rapidly growing network. It functions as more than just a token, serving as a foundation for secure cross-border transactions, DeFi liquidity, and everyday digital payments, ensuring its continued industry influence.

Through this article, we explore USD1, outlining its vision, unique characteristics, and market prospects. Whether you’re assessing its real-world functionality, stability as an investment tool, or broader impact in Web3, this guide helps you navigate its significance in the crypto space.

Key Takeaways

- What is USD1? It is a reserve-backed stablecoin launched by World Liberty Financial (WLFI), with reserves custodied by BitGo for transparency and trust.

- Backed by U.S. Treasuries and cash equivalents, USD1 ensures a reliable USD peg for secure payments, DeFi use cases, and everyday digital transactions.

- Deployed on Ethereum, BNB Chain, and TRON, USD1 is widely accessible across major blockchain ecosystems.

What Is USD1: What You Should Know?

USD1 is a reserve-backed stablecoin deployed on Ethereum, BNB Chain, and TRON that represents a modern version of a trusted digital dollar. The project embodies the following values:

- Financial stability

- Transparency in reserves

- Trust in cross-border transactions

USD1 not only inherits the spirit of sound money, but also applies it to the stablecoin and digital payments industry, building a sustainable, trustworthy, and compliant ecosystem for Web3 adoption.

Source: Reuters

Donald Trump’s World Liberty Financial (WLFI) is officially launching its USD1 stablecoin, fully backed by U.S. Treasuries, dollar deposits, and cash equivalents, with reserves held by custodian BitGo. The project raised over $550 million through the sale of its $WLFI governance token and aims to provide secure, sovereign institutional access to seamless cross-border transactions. Additionally, DWF Labs —an Abu Dhabi–based investor—has purchased $25 million in WLFI tokens and will serve as a liquidity provider for USD1, signaling strong institutional interest in the stablecoin’s market readiness.

Read more: World Liberty Financial Listing: $WLFI Launch Date! Airdrop Guide, and Price Prediction

USD1 Listing: Key Details and Trading Schedule

1. Key Listing Information

Here are the important details about the USD1 listing on Bitget:

- Exchange: Bitget

- Trading Pairs: USD1/USDT, USD1/USDC

- Deposits Available: May 26, 2025

- Trading Start: May 26, 2025 – 10:00 UTC

- Withdrawals Available: May 27, 2025 – 11:00 UTC

Don’t miss your chance to start trading USD1 on Bitget and be part of this groundbreaking stablecoin journey.

- Please refer to the official Bitget announcements for the most accurate schedule.

USD1 Market Trends & Price Predictions 2025

USD1 is a reserve-backed stablecoin pegged to $1, meaning its token price is designed to remain stable. Instead of speculative price swings, the real measure of USD1’s success lies in its market capitalization and adoption levels. According to Reuters, USD1 reached a market value of about $2.2 billion by mid-2025, quickly placing it among the top five global stablecoins.

Factors Influencing the Price of USD1

- Market Trends: Growing global demand for stablecoins in payments, remittances, and DeFi fuels USD1’s adoption as a trusted on-chain dollar.

- Adoption & Real-World Utility: Its availability on Ethereum, BNB Chain, TRON, and Solana expands real-world use cases across DeFi and digital payments.

- Project Advancements: Backing from World Liberty Financial (WLFI), BitGo’s custodianship of reserves, and U.S. stablecoin regulation (GENIUS Act) enhance trust and scalability.

Source: Reuters

Long-Term Growth Potential

Although USD1 will remain anchored at $1.00, its circulating issuance and overall valuation are projected to expand as user adoption increases. Market observers suggest that with rising institutional participation and adherence to new U.S. stablecoin regulations, USD1’s total capitalization could climb beyond $10 billion in the next few years. Nevertheless, this trajectory will depend on competitive pressure from other leading stablecoins, evolving regulatory frameworks, and the general stability of financial markets.

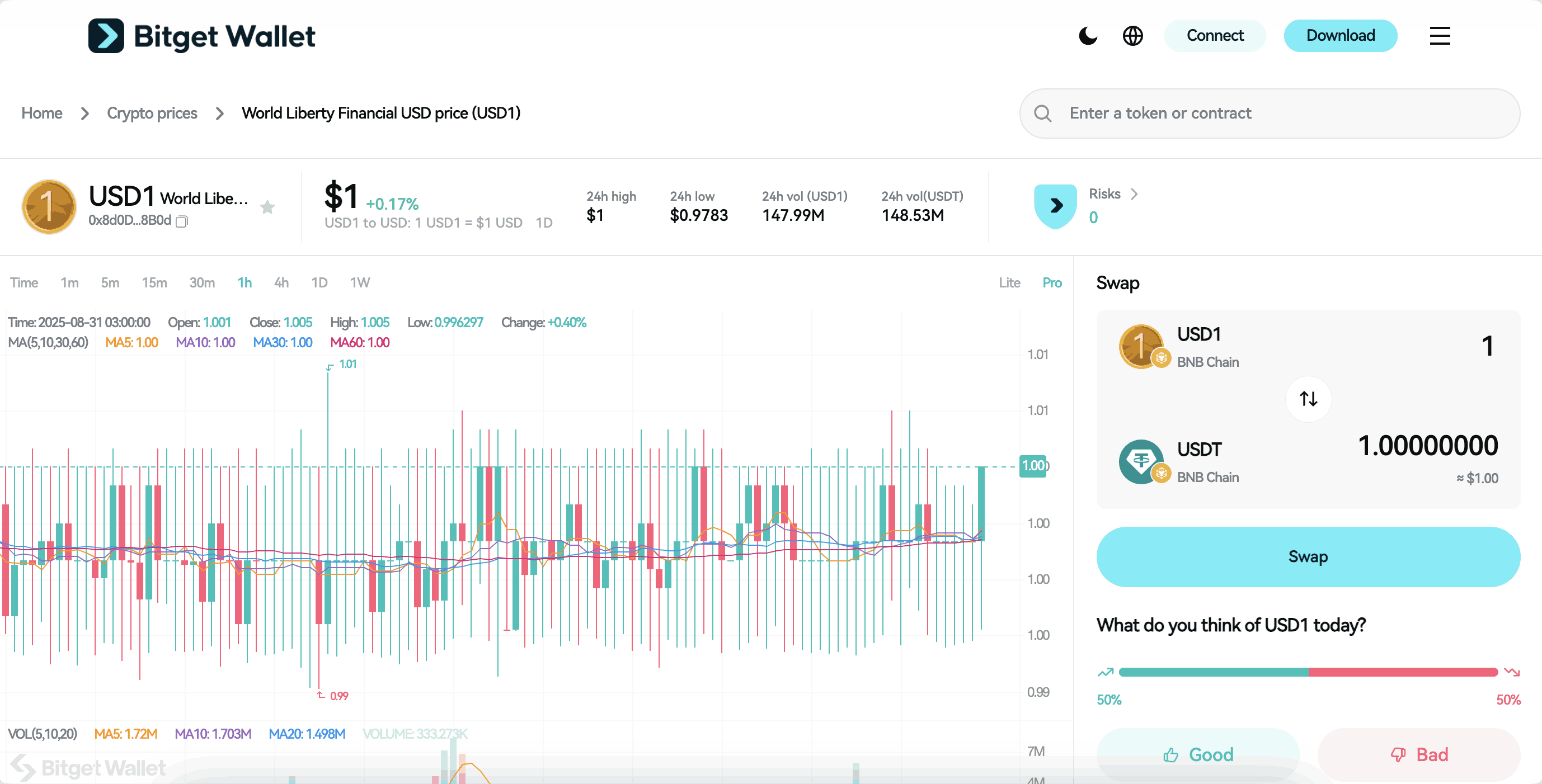

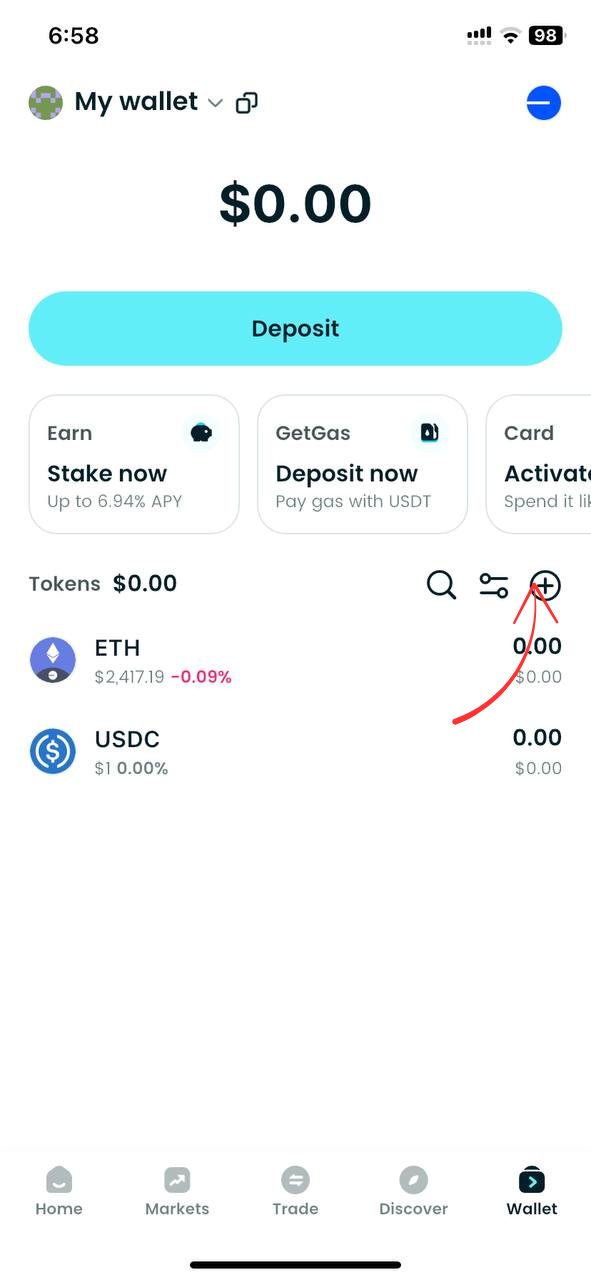

Source: Bitget Wallet

Read more: How to Buy World Liberty Financial Coin and What is the $WLFI Token?

Why USD1 Stands Out: Essential Features

The standout features of USD1 include:

-

Fully Reserve-Backed Stability

USD1 is pegged 1:1 to the U.S. dollar and backed by U.S. Treasuries, cash, and dollar deposits, with reserves held by the institutional custodian BitGo. This ensures transparency and significantly reduces the risks of de-pegging that have plagued other stablecoins.

-

Cross-Chain Accessibility

Unlike many stablecoins limited to a single chain, USD1 has launched across Ethereum, BNB Chain, TRON, and Solana. This multi-chain presence makes it widely usable for DeFi liquidity, payments, and cross-border transactions, offering flexibility for developers and institutions alike.

-

Regulatory Alignment Under U.S. Law

USD1 is one of the first stablecoins operating under the new GENIUS Act signed in July 2025, which requires full reserve backing, third-party audits, and compliance with U.S. regulations. This legal framework provides USD1 with a strong position in the stablecoin market, appealing to institutional investors seeking compliance and trust.

The USD1 Ecosystem: How It Functions?

USD1 is powered by a multi-chain stablecoin architecture rather than a single blockchain protocol. It leverages existing networks — including Ethereum, BNB Chain, TRON, and Solana — to ensure security, interoperability, and efficiency across diverse ecosystems. Backed 1:1 by U.S. Treasuries, cash, and deposits, and custodied by BitGo, USD1 is designed to deliver both transactional stability and institutional trust.

Key Technological Components

-

Blockchain Network:

USD1 is deployed as a token standard across multiple blockchains: ERC-20 on Ethereum, BEP-20 on BNB Chain, TRC-20 on TRON, and SPL on Solana. This cross-chain presence allows it to integrate into DeFi protocols, centralized exchanges, and payment systems seamlessly.

-

Consensus Mechanism:

Since USD1 is not its own Layer-1 chain, it relies on the underlying consensus mechanisms of its host networks (Ethereum’s Proof-of-Stake, BNB Chain’s Proof-of-Staked Authority, TRON’s Delegated Proof-of-Stake, and Solana’s Proof-of-History/Stake). This ensures security and decentralization without USD1 needing to operate its own consensus layer.

-

Smart Contracts:

USD1 operates via audited smart contracts that control minting, redemption, and reserve verification. These contracts enforce the peg by ensuring tokens are only minted when reserves are deposited and burned when redeemed, maintaining transparency and supply integrity.

-

Scalability Solutions:

By existing on multiple high-throughput blockchains, USD1 avoids bottlenecks tied to a single network. Solana provides ultra-fast settlement, Ethereum ensures deep liquidity and institutional adoption, and BNB Chain + TRON provide cost-efficient scaling for payments and retail adoption. This multi-chain distribution strategy ensures resilience and broad accessibility.

USD1: Practical Applications & Use Cases

Why Utility Matters for USD1?

Utility is the foundation of any stablecoin’s adoption. For USD1, its value lies not in speculative trading but in its role as a trusted digital dollar. By maintaining a reliable $1 peg, USD1 provides stability in volatile markets, supports seamless on-chain payments, and fosters confidence for institutions seeking compliant, transparent stablecoin infrastructure.

Key Use Cases of USD1

- Cross-Border Payments: USD1 enables fast, low-cost international transfers without relying on traditional banking intermediaries.

- DeFi Liquidity & Yield Farming: As a multi-chain stablecoin (Ethereum, BNB Chain, TRON, Solana), USD1 integrates into decentralized exchanges, lending protocols, and liquidity pools.

- Everyday Digital Payments: USD1 can be used for online commerce, remittances, and merchant transactions as a stable unit of account.

- Institutional Settlement: With reserves custodied by BitGo and aligned with U.S. regulation (GENIUS Act), USD1 offers institutions a compliant settlement asset for on-chain finance.

What’s Next for USD1?

Looking ahead, World Liberty Financial (WLFI) plans to expand USD1’s integration into more DeFi ecosystems, centralized exchanges, and payment networks. With the GENIUS Act providing regulatory clarity and ongoing institutional partnerships, USD1 is positioned to grow its market capitalization beyond $10B in the next phase of adoption. Strategic expansion into new blockchains and global partnerships will determine its competitive edge against USDT and USDC.

USD1 Roadmap: What to Expect in 2025 and Beyond?

The roadmap for USD1 outlines a clear path for growth and adoption:

| Quarter | Roadmap |

| Q1 2025 | Official USD1 launch by World Liberty Financial (WLFI); reserves established with BitGo custody; initial deployment on Ethereum, BNB Chain, and TRON |

| Q2 2025 | WLFI raises $550M via governance token sale; DWF Labs commits $25M as a liquidity provider; market cap crosses $2.2B |

| Q3 2025 | Expansion to Solana blockchain with 100M USD1 minted; preparation for governance token launch; positioning under new GENIUS Act regulatory framework |

These developments highlight the practical value of USD1 in the stablecoin and global payments industry, as it grows from launch to multi-chain adoption and institutional recognition.

How to Buy USD1 on Bitget Wallet?

Trading USD1 is easy on Bitget Wallet. Follow these simple steps to get started:

Step 1: Create an Account

If you don't currently have an account, install the Bitget Wallet app. Register by inputting the required details and confirming your identity.

Step 2: Deposit Funds

After setting up an account, you must deposit money. You can do this by:

- Transferring Cryptocurrency: Transfer crypto from a different wallet.

- Purchasing Crypto: Utilize a credit or debit card to buy crypto directly from Bitget Wallet, making sure you have sufficient capital for trading USD1.

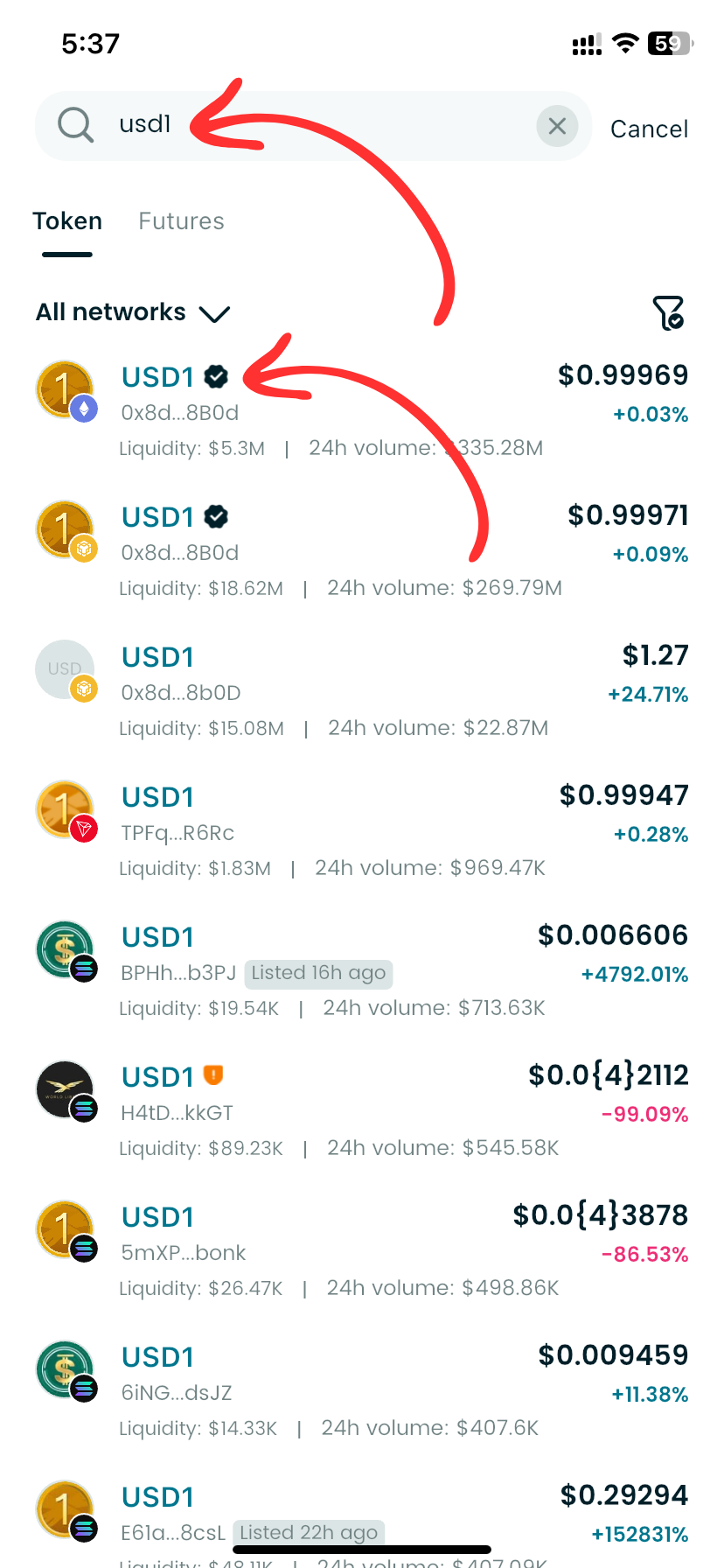

Step 3: Find USD1

On the Bitget Wallet platform, go to the market area. Search for USD1 using the search function. Click on the token to access its trading page.

As this token has not been listed yet, please look at the last contract address sent by the project team upon listing of the token.

Step 4: Choose Your Trading Pair

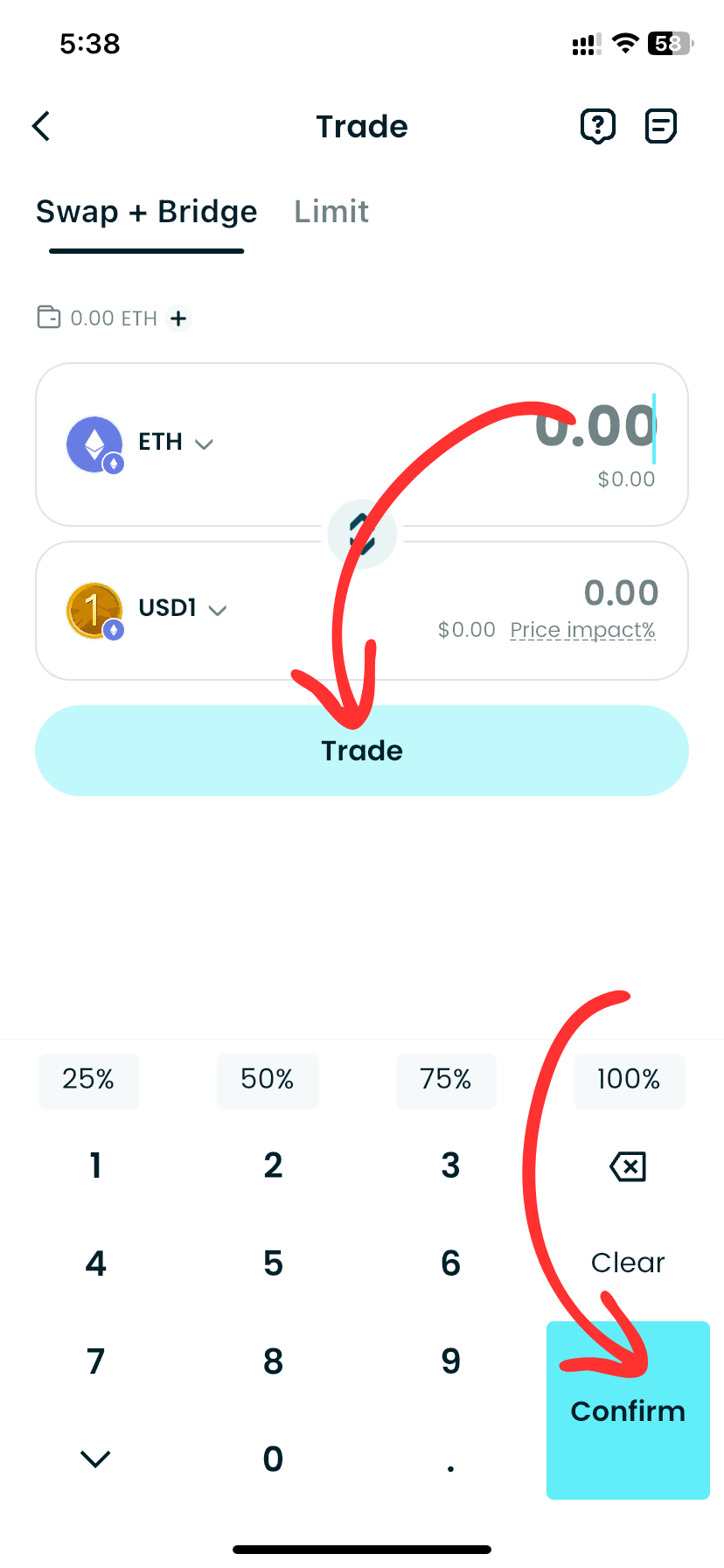

Select your trading pair you would like to deal with, for instance, USD1/USDT. By doing this, you will be able to exchange USD1 for USDT or any other cryptocurrency.

Step 5: Place Your Order

Choose whether to carry out a market order—either buy or sell at the prevailing rate—or place a limit order at your desired price. Fill in the amount of USD1 you want to exchange, then proceed to confirm in order to complete the trade.

Step 6: Monitor Your Trade

Once you have ordered, you can track the status of your order under "Open Orders." Upon completion of the order, you can view your balance to see the newly purchased USD1.

Step 7: Withdraw Your Funds (Optional)

If you want to transfer your USD1 or any other cryptocurrency to another wallet, go to the withdrawal section, provide your wallet address, and confirm the transaction.

Read more: How to Buy OFFICIAL TRUMP (TRUMP) Guide │ Memecoin │ Crypto │ Token

Conclusion

What is USD1? It is a reserve-backed stablecoin pegged to the U.S. dollar, designed for transparency, compliance, and global adoption. Backed by U.S. Treasuries and cash equivalents, with custody by BitGo, and supported by the regulatory clarity of the GENIUS Act, USD1 is positioned as a credible alternative to existing stablecoins like USDT and USDC. Its multi-chain deployment across Ethereum, BNB Chain, TRON, and Solana ensures it plays a central role in payments, DeFi, and institutional settlements.

Using USD1 through Bitget Wallet unlocks even more benefits. Traders and investors can safely store and use stablecoins across chains with Bitget Wallet – ideal for beginners, while also gaining access to cross-chain swaps, built-in DeFi tools, and secure asset management. Bitget Wallet not only simplifies buying and managing USD1 but also provides the flexibility to move assets seamlessly across networks. Download Bitget Wallet and start trading USD1 securely across Ethereum, BNB Chain, TRON, and Solana today.

Sign up Bitget Wallet now - grab your $2 bonus!

FAQs

1. What is USD1 and how does it work?

USD1 is a reserve-backed stablecoin pegged to $1, launched by World Liberty Financial (WLFI). It is backed by U.S. Treasuries, cash, and deposits, with reserves custodied by BitGo. USD1 maintains stability through a mint-and-burn mechanism, ensuring each token is fully backed and redeemable.

2. On which blockchains is USD1 available?

USD1 is deployed across Ethereum (ERC-20), BNB Chain (BEP-20), TRON (TRC-20), and Solana (SPL). This multi-chain presence makes it accessible for DeFi, payments, and cross-border transactions.

3. Why use USD1 with Bitget Wallet?

Using USD1 through Bitget Wallet allows users to safely store and use stablecoins across chains – ideal for beginners. Bitget Wallet also supports cross-chain swaps, DeFi integration, and secure management tools, making it one of the easiest ways to buy, hold, and use USD1.

Risk Disclosure

Please be aware that cryptocurrency trading involves high market risk. Bitget Wallet is not responsible for any trading losses incurred. Always perform your own research and trade responsibly.