Japan Crypto Tax Cut: Will 20% Separate Taxation Transform Web3 Investments?

The Japan crypto tax cut is set to change the way investors look at digital assets starting in 2025. The government plans to lower the current high tax rates—sometimes over 55%—to a simpler flat 20% tax under the Financial Instruments and Exchange Act (FIEA). This big shift comes after months of discussion led by the Japan Blockchain Association (JBA), which submitted its proposal in July 2024.

The goal is to bring Japan’s tax rules closer to international standards and give the local Web3 space a boost. As these changes approach, tools like Bitget Wallet will help investors manage their crypto assets securely while handling the new tax reporting requirements.

Key Takeaways

- Japan will tax crypto gains at a flat 20%, replacing the complex progressive system that sometimes reached 55%.

- Surveys show that 84% of Japanese investors are planning to increase their crypto investments if the tax cut happens.

- This reform puts Japan in line with other crypto-friendly countries like Singapore and South Korea, improving its chances to become Asia’s Web3 hub.

What Is Japan’s Crypto Tax Cut Proposal?

Japan’s tax system for cryptocurrencies is about to undergo a major change. Instead of treating crypto profits as miscellaneous income taxed up to 55%, the government wants to classify cryptocurrencies as financial products under the Financial Instruments and Exchange Act. This means crypto gains would be taxed at a flat 20%, similar to stocks and bonds.

- The Japan Blockchain Association (JBA) proposed this reform in July 2024 after working closely with government agencies.

- The new system aims to make taxes simpler and fairer, reducing paperwork for both individual and institutional investors.

- By aligning with global standards, the change is expected to encourage more innovation and attract bigger investors.

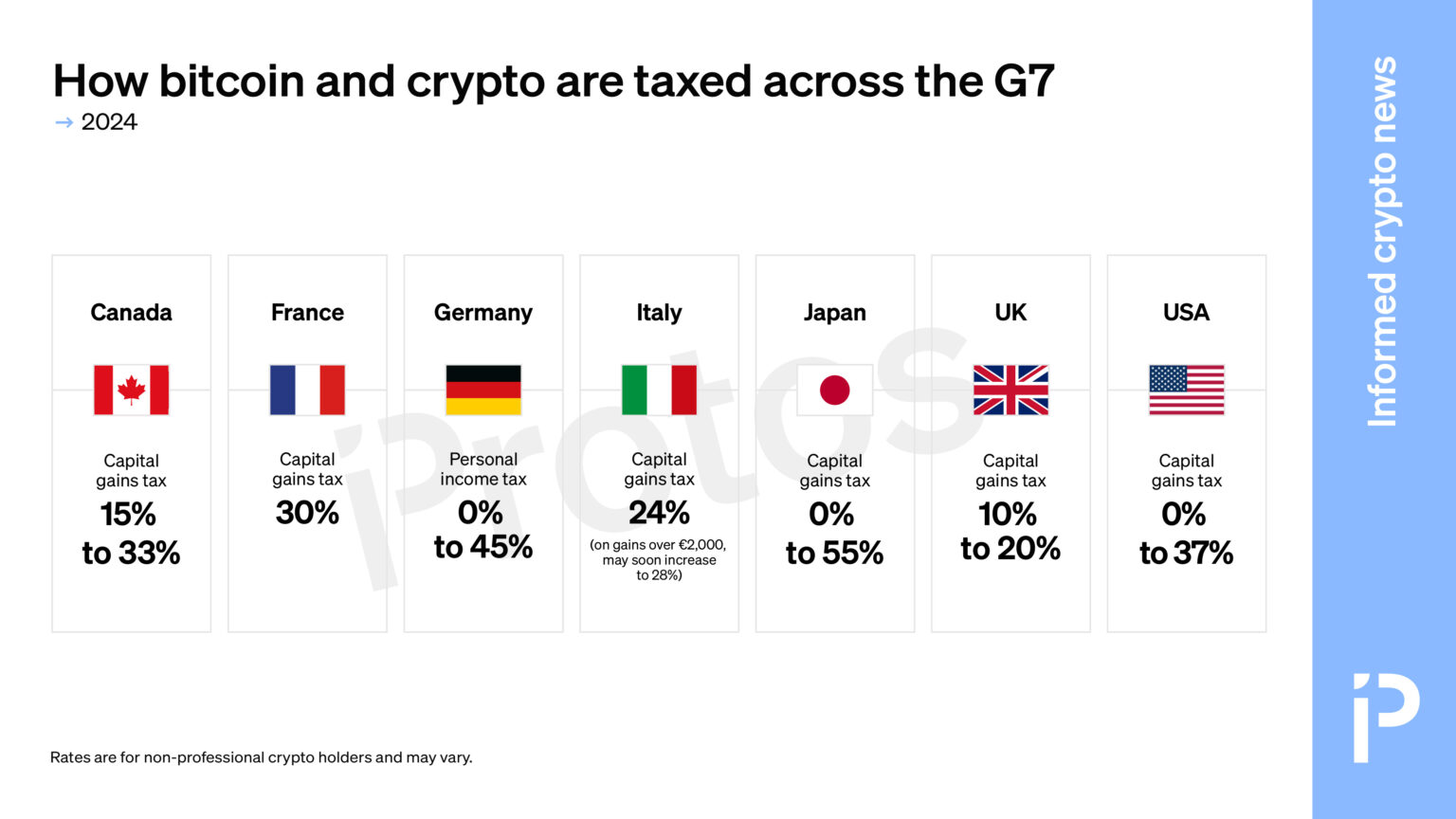

Source: Protos

Why Is This Shift Historic for Web3 in Japan?

Since cryptocurrencies were officially recognized in Japan in 2017, the country’s approach has been strict and cautious.

- High taxes and complex rules have discouraged many investors.

- A ban on crypto ETFs limited options for large financial institutions.

- As a result, many institutional investors moved to other countries, while retail adoption slowed.

Changing to a Japan crypto separate taxation system with a flat 20% rate is a big step forward. It signals that the government is ready to support a growing Web3 ecosystem and make crypto investments more accessible.

How Could a 20% Separate Taxation Impact Investors?

Lower and clearer taxes are expected to encourage more people to invest in cryptocurrencies, potentially transforming Japan’s digital asset market.

- Increased investment intentions: A recent survey shows that 84% of Japanese investors say they would increase their crypto holdings if the proposed 20% tax cut is implemented. This strong positive response reflects how much current high taxes discourage investment and how relief could unlock greater market participation.

- Significant growth potential: Despite Japan’s advanced tech scene, only around 13% of the population currently owns cryptocurrencies. This is relatively low compared to other developed countries. With a more attractive tax environment, many new investors—especially younger, tech-savvy individuals—may be motivated to enter the market.

- Boost to investor confidence: The simpler tax structure and reduced rates lower the barriers to entry by making it easier and cheaper to hold and trade crypto. Investors won’t have to worry about facing extremely high tax bills or complex filing procedures. This clarity can encourage both new and existing investors to diversify into emerging sectors like decentralized finance (DeFi) and non-fungible tokens (NFTs), fueling innovation and trading volumes.

- Market liquidity and ecosystem growth: As more investors participate, liquidity in crypto markets is expected to increase. This can help reduce volatility and create more opportunities for price discovery. Additionally, higher adoption rates can attract more projects, startups, and institutional players, further strengthening Japan’s Web3 ecosystem.

- Potential institutional return: Institutional investors who previously avoided Japan due to the steep tax burden may reconsider their position. The 20% flat tax aligns more closely with global standards, providing a more predictable and competitive investment landscape that could see increased fund flows into Japanese crypto markets.

Source: Vietnamplus

Will It Boost Retail and Institutional Participation?

Japan’s crypto adoption is still low compared to other countries:

| Country | Crypto Holding Rate (%) |

| United States | 16 |

| Singapore | 11 |

| South Korea | 9 |

| Japan | 4.5 |

Source: Benzinga

The proposed tax cut could lower entry barriers for retail investors, especially among younger demographics.

For institutional investors, clearer regulations and a more predictable tax environment might encourage re-entry into the Japanese crypto market, potentially leading to the development of new crypto investment products.

What About Loss Carryforward and Derivatives?

The proposed reforms include provisions for a three-year loss carryforward, allowing investors to offset gains with previous losses, which is particularly beneficial in volatile markets. Additionally, the inclusion of crypto derivatives like futures and options under the tax framework will enable more sophisticated trading strategies and risk management.

- Loss carryforward: Investors will be able to offset gains with losses from previous years for up to three years. This helps smooth out tax liabilities during volatile market periods and encourages long-term holding.

- Inclusion of derivatives: Crypto derivatives such as futures and options will now fall under the tax rules. This opens the door for more advanced trading strategies, risk management, and hedging opportunities.

- Alignment with traditional finance: By treating crypto more like stocks and bonds, these changes provide a clearer, more mature tax framework that encourages investors to integrate digital assets into diversified portfolios.

Together, these measures aim to create a more investor-friendly environment that supports both cautious and sophisticated crypto market participants

How Does Japan’s Tax Reform Compare Globally?

Japan's proposed 20% flat tax on cryptocurrency gains aligns it with other nations aiming to attract crypto investors.

| Country | Crypto Tax Rate | Notes |

| Japan | 20% (proposed) | Loss carryforward, under FIEA |

| United States | 15–20% | Some regulatory uncertainty |

| South Korea | 20% (planned) | Reconsidering ETF bans |

| Singapore | 0% | No capital gains tax on crypto |

Source: CryptonewsAustralia

Japan's shift from a progressive tax system, where crypto gains were taxed up to 55%, to a flat 20% rate aligns with traditional capital gains taxes, potentially enhancing its appeal to both retail and institutional investors.

Could Japan Become a Crypto-Friendly Hub in Asia?

The Japan crypto tax cut, combined with regulatory updates, marks a strategic push to make the country a top destination for digital asset innovation in Asia.

- Strengths:

- Regulatory Clarity: A 20% flat tax and alignment with the Financial Instruments and Exchange Act (FIEA) provide a clearer, more predictable framework for investors and businesses.

- Institutional Backing: Government initiatives—such as potential Bitcoin ETF approvals—signal long-term support for the crypto economy.

- Advanced Infrastructure: Japan’s mature financial sector and tech ecosystem enable seamless integration of blockchain and Web3 services.

- Challenges and Competition:

- Singapore remains attractive due to its 0% capital gains tax and streamlined licensing regime.

- South Korea is re-evaluating its crypto policies, including ETF access and taxation, aiming to retain regional competitiveness.

- Japan must balance compliance and innovation to stand out in this fast-moving landscape.

What Are the Challenges and Remaining Questions?

While the proposed tax reform is a major step forward, several uncertainties remain. Investors will need to choose between separate taxation, which requires self-reporting, and withholding tax, where taxes are automatically deducted. Many prefer the simplicity of withholding, but implementation details are still pending.

- Taxpayers must choose between separate taxation (self-reporting) or withholding tax (tax deducted automatically).

- Many investors prefer withholding tax to keep things simple.

- The government plans to finalize rules by the 2026 fiscal year, but some parts remain unclear.

- Exchanges and wallets will have to help users with tax compliance.

How Will Investors Handle Reporting and Compliance?

Japan's crypto tax reform introduces separate taxation and possible withholding tax, each with different effects on how investors report their earnings and stay compliant. Separate taxation requires manual reporting, while withholding tax simplifies the process by deducting taxes automatically.

- Under separate taxation, investors calculate and report gains themselves, which requires careful record-keeping.

- Under withholding tax, taxes are deducted automatically during transactions, reducing paperwork.

- Wallets like Bitget Wallet are building tools to track gains and losses automatically, making tax reporting easier and more accurate.

Conclusion

The Japan crypto tax cut could mark a turning point for the country’s Web3 adoption, signaling a shift toward a more investor-friendly environment. With a proposed 20% flat tax, potential loss carryforward, and clearer treatment of derivatives, Japan is aligning with global standards and opening doors for institutional inflows.

As these reforms approach, investors can stay ahead by using tools like **Bitget Wallet,** a secure option for managing crypto across multiple chains and tax jurisdictions.

▶️ **Explore and download Bitget Wallet** to manage your digital assets ahead of the upcoming reforms.

Download Bitget Wallet

FAQs on Japan Crypto Tax Cut

1. What is Japan’s current crypto tax rate?

Currently, crypto gains are taxed as miscellaneous income, with rates between 5% and 55%, depending on income.

2. When will the 20% separate taxation start?

The government aims to implement the new tax system in the 2026 fiscal year.

3. Does the tax cut include NFTs?

Yes, the reform covers all crypto assets, including NFTs, by classifying them under the Financial Instruments and Exchange Act.

4. How does this affect foreign investors?

The clearer tax rules should make Japan a more attractive market for foreign crypto investors by reducing uncertainty.

Risk Disclosure

Please be aware that cryptocurrency trading involves high market risk. Bitget Wallet is not responsible for any trading losses incurred. Always perform your own research and trade responsibly.

- Crypto's Halloween Rally: 5 Best Cryptos to Haunt Before Christmas 20262025-10-24 | 5 mins