XRP Price Prediction Today: What To Expect From XRP in October 2025?

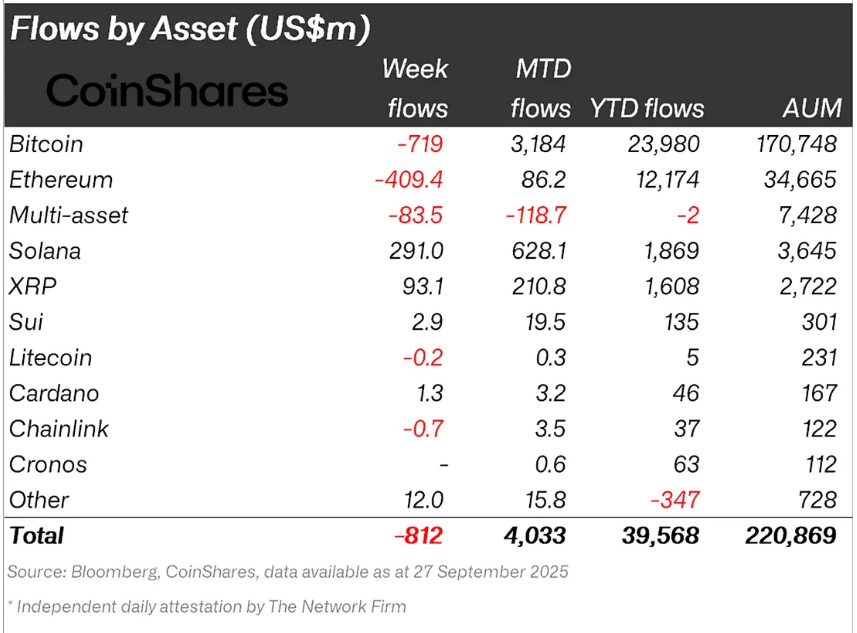

XRP price prediction today highlights how Ripple's token is shaping the market in October 2025, with prices hovering near $3 as institutional inflows reach $210 million and spot ETF approvals draw closer.

Historically, October has delivered average returns of -4.5% for XRP, making it the second-worst month for performance. This year may break that pattern as stronger fundamentals, including resolved regulatory battles and growing institutional infrastructure, support a more bullish XRP price forecast 2025.

This article examines the potential ETF catalyst, critical technical breakout patterns including the descending wedge formation, Ripple's RLUSD stablecoin integration, and long-term price targets extending through 2028. Traders can monitor these shifts using multi-chain tools like Bitget Wallet.

Key Takeaways

- XRP trades between $2.80 and $3.00 within a descending wedge pattern. Institutional inflows reached $210 million in September, while ETF decisions scheduled for October 18 to 25 could trigger significant price movement.

- Pending spot XRP ETF approvals and Ripple's RLUSD stablecoin integration drive bullish sentiment. ETFs could unlock $4 to $8 billion in institutional capital, while RLUSD transactions create sustained XRP utility demand through network fees.

- Long-term forecasts project $5.90 to $12.50 by 2028 based on institutional adoption. Standard Chartered targets $8.00 in 2026 and $12.50 by 2028, driven by cross-border payment expansion and regulatory clarity advantages.

What Is the Current Market Outlook for XRP in October 2025?

XRP is trading between $2.80 and $3.00 as the token consolidates within a descending wedge pattern. This technical formation typically signals potential bullish momentum ahead.

XRP technical analysis reveals two main factors driving strong confidence in the token's long-term outlook.

-

Institutional Commitment:

September 2025 recorded $210 million in institutional inflows despite market volatility. Exchange withdrawal data shows over 439 million XRP moved to cold storage, reducing immediate selling pressure.

-

ETF Approval Timeline:

The SEC is expected to decide on multiple spot XRP ETF applications between October 18-25. Analysts project successful approvals could generate $3-10 billion in institutional inflows during the first year.

Historically, October has averaged negative 4.5% returns for XRP over the past decade, making it the second-worst performing month. The 2025 XRP price forecast differs significantly due to regulatory battles and institutional infrastructure.

XRP forecast for 2025 shows traders expecting a possible breakout beyond $3.02, with derivatives markets reflecting increased positioning at $8.95 billion in open interest.

Source: CoinShares

What Factors Could Drive XRP Prices Higher This Month?

Strong institutional confidence and upcoming ETF decisions are two major catalysts positioning XRP for significant price appreciation in October 2025.

How Might ETF Approvals Affect XRP Price Prediction Today?

The SEC has adopted a more favorable stance toward digital assets under the Trump administration. Paul Atkins, a crypto advocate confirmed as SEC Chair in April 2025, has shifted the agency's approach from restrictive enforcement to supportive regulation.

Multiple spot XRP ETF applications face decision deadlines between October 18 and 25. Grayscale, 21Shares, Bitwise, Canary Capital, CoinShares, and WisdomTree have pending applications scheduled for this critical week. This concentrated timeline could trigger simultaneous institutional interest across multiple approved products.

Bitcoin's 165% rally following spot ETF approvals in early 2024 provides a compelling precedent. Analysts project similar momentum for XRP, with JPMorgan estimating $8 billion in first-year capital inflows. Current XRP price forecast for 2025 targets suggest $3.61 to $5.89 potential upside from present levels.

ETF listings could unlock both institutional and retail demand through regulated investment vehicles accessible via traditional brokerage accounts.

How Does Ripple's Stablecoin RLUSD Strengthen Its Ecosystem?

Ripple stablecoin RLUSD is a dollar-backed stablecoin tied 1:1 to USD. The asset functions on the XRP Ledger using complete reserves of cash deposits and treasury bonds. Each RLUSD transfer charges fees paid in XRP, generating consistent demand for the underlying token.

USDC and USDT dominate more than 80% of the stablecoin space, creating tough competition for Ripple stablecoin RLUSD. Yet, RLUSD stands out through regulatory oversight by the New York Department of Financial Services, which gives it institutional-grade compliance.

-

Cross-Border Settlements:

RLUSD enables real-time international transfers without pre-funding foreign currency accounts. Financial institutions use RLUSD for dollar-denominated transactions while XRP facilitates cross-currency settlements.

-

Banking Liquidity Bridge:

RLUSD serves as a liquidity tool within Ripple's On-Demand Liquidity service for banks. The stablecoin leverages the XRP Ledger's 3 to 5 second settlement times and minimal transaction fees.

What Do Technical Indicators Say About XRP’s Next Move?

XRP technical analysis reveals the token is consolidating near critical levels. Price action has compressed into a tight range, signaling that a significant breakout or breakdown appears imminent within October 2025.

Which Price Levels Should Traders Watch Closely?

XRP price prediction today centers on the $3.08 Fibonacci resistance level marking the symmetrical triangle's upper boundary. This threshold has capped rallies since August. Support sits at $2.65, aligning with the 200-day exponential moving average, while the triangle apex approaches its resolution point near $3.00.

-

Bullish Breakout Path:

A decisive close above $3.08 with volume confirmation could trigger rapid advancement toward $3.30 and $3.46. This scenario requires sustained buying pressure to maintain upward momentum.

-

Bearish Breakdown Risk:

Failure to hold support or a drop below $2.75 could precipitate a swift retreat to $2.65. More severe breakdown below this floor could target the $2.22 level.

Derivatives markets show $8.95 billion in open interest near yearly highs. Options activity has surged 45% with open interest doubling. Binance data reveals retail accounts favor long positions at 3:1 ratios, while institutional positioning remains more cautious at 2.7:1.

| Date | Price | Key Level | Signal |

| Oct 1-4 | $2.97-$3.01 | Support/Resistance Test | Consolidation |

| Oct 5 | $3.05 | Recent High | Overbought |

| Oct 6-8 | $2.95-$3.00 | Triangle Apex | Critical Zone |

Could XRP Reach $5 or More in 2025?

The XRP breakout target $5.89 is a realistic near-term projection based on ETF-driven institutional inflows. This XRP price prediction for October 2025 assumes successful navigation above $3.08 resistance and sustained momentum through intermediate targets.

Standard Chartered projects an XRP long-term prediction of $12.50 by 2028. Geoffrey Kendrick's research outlines progressive milestones: $5.50 by late 2025, $8.00 in 2026, $10.40 in 2027, and $12.50 by 2028. This forecast incorporates ETF approvals generating $4 to $8 billion in first-year inflows.

Short-term trading predictions focus on technical patterns and immediate catalysts spanning three to twelve months. Multi-year investment forecasts incorporate fundamental factors including regulatory evolution and institutional adoption.

XRP's liquidity advantage stems from its $184 billion market cap and $7.73 billion daily volume. This depth provides stability compared to smaller cryptocurrencies relying primarily on speculative demand.

Source: TradingView

How Does XRP Compare With Other Cryptocurrencies Right Now?

XRP price prediction today positions the token uniquely within the cryptocurrency market. The asset balances established institutional utility with moderate growth potential, while regulatory clarity sets it apart from most competitors.

Is XRP Still a Good Investment Compared to New Projects?

XRP offers moderate upside potential with institutional backing, while presale tokens like Layer Brett ($LBRETT) promise exponentially higher returns with substantially greater risk. Layer Brett claims 172x potential returns from its $0.0058 presale price, offering 600% to 700% staking rewards.

Investors might hold XRP for stability while exploring smaller, high-growth projects as part of a balanced portfolio strategy. This approach allocates 70% to 80% to established assets and 20% to 30% to speculative opportunities. XRP's reliability and real-world utility continue to attract institutions even if its ROI is smaller.

Will XRP's Regulatory Clarity Give It an Edge Over Competitors?

The Ripple vs SEC case update confirms XRP's non-security status following the August 2025 settlement. This resolution removed the legal uncertainty that suppressed institutional adoption for nearly five years. Ripple has since expanded global payment partnerships across Asia, Africa, and the Middle East.

Legal clarity helps banks and payment firms adopt XRP by removing the risks that stopped earlier use. These companies can now add XRP functions to their systems without facing potential securities law violations. Other altcoins still face regulatory scrutiny, limiting their banking partnerships and institutional custody options.

What Is the Long-Term Price Prediction for XRP 2026–2028?

XRP long-term prediction targets vary across institutional forecasts. Motley Fool sees $5.90 by 2028, pointing to consistent growth over time. Standard Chartered predicts a higher 2028 price of $12.50 for XRP, with intermediate targets of $8.00 in 2026 and $10.40 in 2027.

-

Institutional Adoption Growth:

Ripple's On-Demand Liquidity service processed $1.3 trillion in Q2 2025. The network now connects over 150 financial institutions globally, with projections targeting 14% of SWIFT's cross-border transaction volume.

-

RLUSD Ecosystem Effects:

RLUSD transactions require XRP for network fees, creating sustained utility demand. Enterprise partnerships like Ondo Finance's $1.2 billion OUSG fund demonstrate growing institutional confidence in the ecosystem.

-

ETF Capital Inflows:

Approved XRP ETFs could inject $4 to $8 billion in first-year institutional capital. This demand creates permanent price support as ETF structures require physical XRP holdings, reducing circulating supply.

XRP price prediction today connects short-term technical patterns to these multi-year forecasts. The XRP price prediction 2026 of $8.00 assumes continued institutional adoption and regulatory clarity. Investors should note that XRP dropped more than 20% twice in 2024, demonstrating ongoing volatility despite institutional backing.

Why Is Bitget Wallet the Best Tool to Track and Trade XRP in 2025?

Bitget Wallet provides a comprehensive solution for XRP trading and cross-chain stablecoin storage. The platform combines intuitive design with advanced features, serving both casual investors and professional traders through a unified interface.

-

Zero-Fee XRP Swaps:

Bitget Wallet enables fee-free conversions between XRP and other supported digital assets. This cost-effective mechanism helps traders capture market opportunities instantly while preserving capital and maximizing potential returns.

-

Stablecoin Earn Plus:

The Stablecoin Earn Plus program offers up to 10% APY on major USD-pegged assets including RLUSD, USDC, and USDT. Users can balance XRP exposure with high-yield stablecoin savings, creating diversified income strategies.

-

Global Crypto Card:

The integrated Bitget Crypto Card accepts Visa and Mastercard payments worldwide. Spend XRP anywhere traditional cards are accepted with real-time conversions at competitive rates and no hidden fees.

-

Cross-Chain Trading Access:

Bitget Wallet supports trading across Solana, Ethereum, BNB Chain, Base, and Polygon networks. Users can instantly swap XRP for assets on other chains and access DeFi opportunities from a single wallet interface.

Manage, trade, and earn with XRP securely. Download Bitget Wallet today to explore seamless cross-chain trading and stablecoin savings across multiple blockchain networks.

Read more:

- How to Buy Ripple (XRP) on Bitget Wallet?

- How to Buy XRP in 2025: Step-by-Step Guide, Legal Insights, and Best Practices

- How to Earn Passive Income with Ripple ($XRP): Best Crypto Investment in 2025?

Conclusion

XRP price prediction today reveals a compelling setup for October 2025, driven by pending ETF approvals between October 18 and 25, Ripple's RLUSD stablecoin integration creating sustained utility demand, bullish descending wedge patterns targeting $3.30 to $5.89, and long-term XRP price forecast 2025 projections reaching $12.50 by 2028.

Despite historical volatility including two 20% corrections in 2024, XRP remains a cornerstone asset for regulated cryptocurrency growth through institutional adoption and resolved legal clarity.

Track XRP price movements and trade seamlessly across multiple chains using Bitget Wallet for secure stablecoin storage, zero-fee swaps, and instant cross-chain access to DeFi opportunities.

Sign up Bitget Wallet now - grab your $2 bonus!

FAQs

1. What is the XRP price prediction for October 2025?

October 2025 price targets sit between $3.30 and $5.89 based on ETF results. Analysts see $12.50 possible by 2028 as more institutions join the network.

2. Will XRP break above $3.00 today?

XRP's triangle consolidation pattern near $3.00, rising RSI at 56, and open interest reaching $8.95 billion signal an imminent directional move from current levels.

3. Is XRP a good investment now?

Buying between $2.85 and $2.90 gives solid upside potential with limited downside risk. Wait for bounce signals or a clean break past $3.08 before buying.

Risk Disclosure

Please be aware that cryptocurrency trading involves high market risk. Bitget Wallet is not responsible for any trading losses incurred. Always perform your own research and trade responsibly.

- Crypto's Halloween Rally: 5 Best Cryptos to Haunt Before Christmas 20262025-10-24 | 5 mins