Crypto Crash: How Trump Tariffs on China Sparked a $20 Billion Meltdown and What’s Next?

The crypto crash 2025 wasn’t just another market dip — it was a financial shockwave that erased more than $20 billion in market value within a single day and liquidated 1.6 million leveraged positions. The trigger? Trump’s 100% tariffs on Chinese imports, a policy announcement that rippled through global risk markets faster than algorithms could react.

What started as a headline quickly became a cascade of panic. The Bitcoin crash and Ethereum crash followed within hours, as traders rushed to de-risk in a liquidity vacuum. But amid the chaos, one truth became clear: this wasn’t the death of crypto — it was its stress test.

Tools like Bitget Wallet proved crucial during the selloff, helping traders monitor real-time volatility, manage cross-chain assets, and execute stablecoin swaps instantly while exchanges lagged under volume strain.

In this analysis, we uncover what caused the crash, how political policy spilled into digital markets, how traders can recover, and why the crypto market crash may be the catalyst for a stronger, smarter industry.

Key Takeaways

- Over $20 billion in crypto value vanished in a day, as over-leveraged traders faced mass liquidations across major exchanges.

- Trump’s China tariffs reignited global risk aversion, triggering a fast, synchronized sell-off across Bitcoin, Ethereum, and altcoins.

- Despite the chaos, crypto’s core systems held, proving the market is volatile—but no longer fragile.

What Caused the Crypto Crash 2025?

The crypto market crash didn’t happen in isolation. It was the outcome of overlapping global pressures — political tension, excessive leverage, and structural fragility. Each element fed the other, creating a feedback loop that magnified volatility far beyond normal bounds.

Did Trump’s 100% China Tariffs Start the Domino Effect?

When Trump’s 100% tariffs on Chinese imports were announced, global investors immediately fled from risk. The announcement rekindled fears of a prolonged US–China trade war, driving a surge in the U.S. dollar and a rapid pullback from speculative assets.

For crypto, the impact was immediate. Liquidity drained, leverage unwound, and asset correlations tightened. This was not a blockchain failure; it was a reaction to global economic uncertainty — a stark reminder that crypto doesn’t move in a vacuum.

Source: Financial Times

Why Did Leverage Make the Crash So Severe?

Leverage turned a correction into a digital asset crash.

Data revealed a staggering imbalance — $16.7 billion in long positions against just $2.5 billion in shorts. That lopsided optimism created the perfect setup for forced liquidations once the market turned.

Within hours, billions in leveraged positions were wiped out. Bitcoin plunged from near $125,000 to $106,000, while Ethereum tumbled below $3,800. Automated liquidations triggered wave after wave of selling, magnifying every small move until the system reset itself.

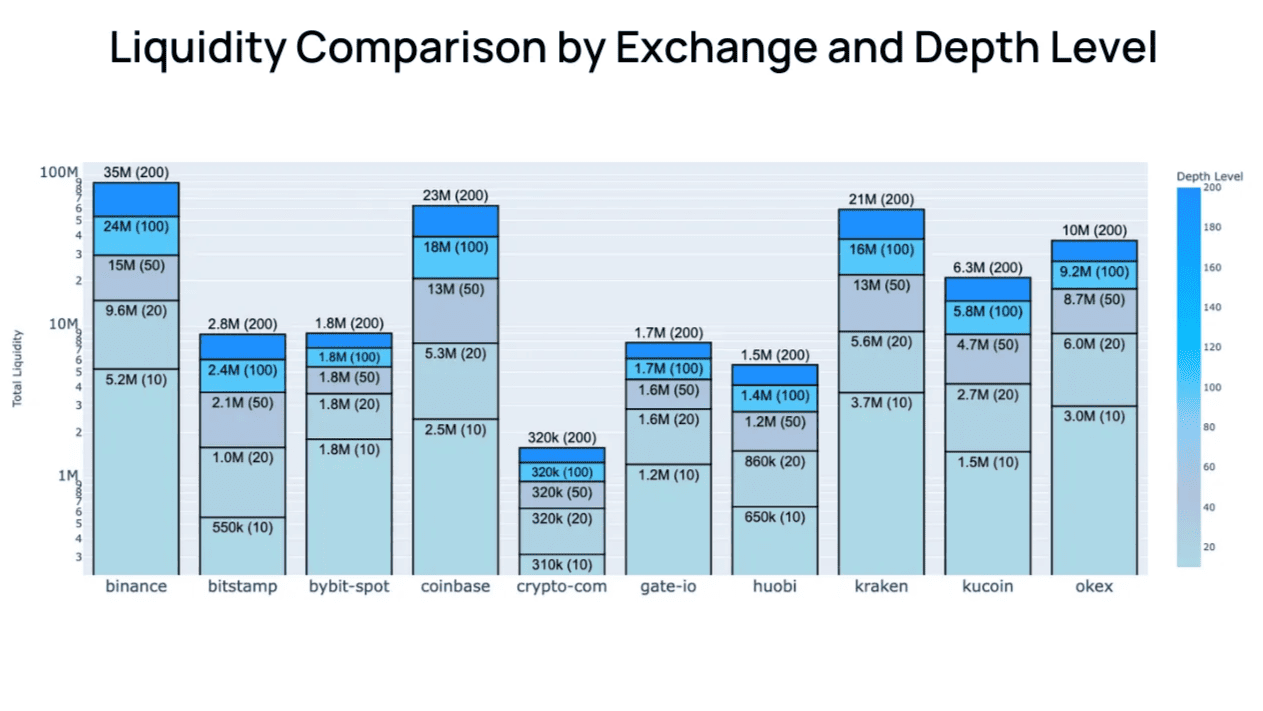

How Did Liquidity Gaps Turn Panic Into Meltdown?

The crypto crash 2025 struck late Friday, when global liquidity was thin and Asian markets were closed.

Market makers widened spreads, order books thinned, and even small sales hit prices disproportionately.

Once the first liquidation cycle started, algorithmic bots accelerated the decline, executing massive sell orders with no emotional hesitation.

Crypto’s weakness wasn’t just volatility — it was liquidity. A handful of automated trades cascaded into a full-blown market event.

What Are the Deeper Causes Behind the Market Meltdown?

The cryptocurrency crash revealed that while the technology behind blockchain has matured, the market behavior surrounding it has not. Beneath the surface, a reliance on leverage, fragile liquidity, and psychological exuberance set the stage for collapse.

Source: Trading View

Which Macro Forces Converged to Hit Crypto?

Three global currents converged to create the storm:

- Rising interest rates that restricted liquidity.

- A strengthening U.S. dollar that diverted capital away from crypto.

- Renewed trade tensions that undermined investor confidence.

Crypto, as the most sensitive asset class to global liquidity shifts, absorbed the shock directly. Investors who had assumed immunity from macro trends were forced to confront how integrated crypto now is within the global financial system.

What Systemic Weaknesses Did the Selloff Expose?

The crash made one fact undeniable: much of crypto’s liquidity is synthetic.

What appears deep in normal conditions can vanish instantly in panic. The crypto price drop revealed the fragility of liquidity networks that depend heavily on leverage rather than real demand.

Even large players found themselves trapped in feedback loops of forced selling and slippage.

The market didn’t fail — it froze, exposing the limits of unregulated high-speed trading.

Source: Keyrock

Were There Insider or Front-Running Concerns?

Wallet data showed several large liquidations moments before the tariff announcement, sparking suspicion of insider behavior.

No solid evidence emerged, but the event reignited old concerns about transparency in crypto markets.

Until exchanges fully disclose order data and regulatory frameworks mature, every coincidence will look like manipulation — and that perception alone damages trust.

How Does the 2025 Crypto Crash Compare to 2022?

Analysts were quick to draw parallels between the 2025 crypto crash and the devastating events of 2022, but beneath the surface, the two crises were entirely different beasts. The 2022 collapse was a contagion driven by insolvency and mismanagement, as centralized lenders and exchanges imploded under their own corruption. The 2025 crash, in contrast, was a liquidity and leverage correction — brutal, fast, but fundamentally clean. One was caused by deception; the other by excess confidence in an overheated market.

Was 2025 Another Luna-Style Collapse?

On the surface, it looked that way. Charts showed altcoins plunging 80–90% in hours, mirroring the chaos of the Luna disaster. But this time, the foundations held. No stablecoins depegged, no major platforms filed for bankruptcy, and DeFi protocols kept operating under pressure. Smart contracts executed liquidations transparently and efficiently, proving that the infrastructure had matured since 2022. Crypto didn’t implode — it recalibrated. The industry demonstrated it could now endure what would once have been fatal.

Why Was This a Liquidity Event, Not a Credit Crisis?

The distinction lies in the mechanics. In 2022, projects like FTX and Celsius collapsed because of hidden leverage, fraud, and insolvency. In 2025, it was pure market physics — over-leveraged positions meeting thin liquidity. When the forced liquidations cleared, exchanges and DeFi platforms resumed normal operations within hours. There were no bankruptcies, no bailouts, and no contagion. This was a mechanical flush, not a moral failure — a sharp but necessary reset in a system that finally functioned as intended.

How Long Will the Crypto Crash Last?

Every crypto market crash tends to follow a familiar rhythm — an abrupt collapse, a phase of consolidation, and then gradual recalibration. The 2025 crypto crash is unfolding along the same lines, but U.S.–China trade tensions and tighter global liquidity could stretch the recovery timeline. A true rebound won’t emerge from optimism alone; it will depend on fresh liquidity, macro stability, and traders regaining the confidence to take calculated risks.

Do Crashes Usually Rebound in 4–6 Weeks?

Historically, yes.

Most crypto crash recovery phases take four to six weeks once derivatives markets reset, open interest declines, and funding rates return to neutral. However, the emotional fallout lasts longer. Traders become more defensive, volumes dip, and risk appetite takes time to rebuild. This cooling period — when fear fades but greed hasn’t yet returned — is often where the next wave of accumulation begins. Those who stay alert during this calm tend to spot the next breakout first.

Could the US–China Trade Rift Delay Recovery?

Yes — prolonged trade tension between the U.S. and China could significantly delay the crypto crash recovery. Political uncertainty keeps global investors cautious, diverting capital toward safer assets like bonds or the U.S. dollar. If Trump’s tariffs remain in place, they could suppress liquidity across all risk markets, creating a drag effect that limits crypto’s ability to rebound. Tighter trade conditions also strengthen the dollar, making it harder for speculative assets like Bitcoin and Ethereum to attract inflows.

However, if trade negotiations ease or central banks introduce liquidity support, the tide could shift rapidly. Historically, when macro pressure lifts, crypto markets rebound faster and harder than traditional equities — as risk capital rushes back into high-volatility assets. The path to recovery, then, hinges less on blockchain fundamentals and more on geopolitical mood — a reminder that crypto’s heartbeat still syncs with the global economy.

Source: Trading view

What Does the Crash Reveal About Crypto’s Maturity?

The 2025 crypto crash was painful, but it proved something vital: this market can absorb a global shock without collapsing.

What broke in 2022 stayed intact in 2025. Infrastructure, protocols, and exchanges worked under pressure — a sign of real progress.

How Did the System Hold Up Under Pressure?

Despite the scale of the crypto crash 2025, the system demonstrated remarkable resilience under pressure. Stablecoins held their pegs, maintaining trust in the backbone of crypto liquidity. DeFi platforms continued operating flawlessly, executing smart contracts and liquidations transparently without halts or human intervention. Major exchanges processed billions in forced liquidations without freezing withdrawals — a stark contrast to the exchange collapses of 2022. Even during the most violent volatility, blockchain settlement speeds remained steady, confirming that the underlying infrastructure can handle extreme market stress. The takeaway is simple: crypto didn’t just survive — it worked exactly as designed.

Why This Crash Proves Crypto’s Resilience

The true story of the 2025 crypto market crash isn’t the plunge, but the rebound. This event showcased that decentralized architecture can absorb losses automatically and openly, with no hidden bailouts or systemic contagion. While traditional markets often rely on intervention, crypto self-corrects through code and transparency. The digital asset crash revealed that volatility isn’t a symptom of weakness — it’s part of the system’s adaptive evolution. Every liquidation, every reset, refines the market’s strength. In short, 2025 proved that crypto isn’t fragile anymore — it’s anti-fragile, learning and hardening with every shock.

Read More: How to Protect Your Crypto Assets During a Bear Market?

What Lessons Should Traders Take From the Crypto Crash 2025?

The crypto crash 2025 was more than a financial event — it was a humbling reset for an overconfident market. It turned greed into humility and speculation into strategy, forcing traders to confront the reality that no rally lasts forever. The sudden collapse reminded everyone that in crypto, success isn’t about perfect timing but about surviving the cycles. Those who managed risk, preserved capital, and stayed disciplined are now positioned to thrive in the recovery, while those chasing quick gains learned that resilience — not luck — is the real alpha.

Why Is Leverage Discipline Essential?

Leverage multiplies both profit and pain.

The traders who endured the crash were those who managed exposure, not those who predicted the market.

To survive a crypto crash, one must treat leverage as a tool for precision, not acceleration.

How Can Traders De-Risk Without Exiting the Market?

Avoiding risk doesn’t mean abandoning opportunity.

Diversification across networks, smaller position sizing, and stablecoin buffers are smart moves.

Bitget Wallet offers these capabilities in one place, letting traders swap assets across chains and manage portfolios without leaving the market.

De-risking is not withdrawal; it’s evolution.

How Can Data and Automation Improve Survival Odds?

Data reveals what emotion hides.

Monitoring funding rates, open interest, and liquidation clusters helps traders anticipate volatility before it strikes.

Automation — through alerts and smart bots — turns chaos into informed action.

How Can You Recover and Prepare for the Next Cycle?

Every bear phase plants the seed of the next bull run — the market always resets itself, but those who adapt early recover faster. In crypto, survival is strategy; preparation during the downturn determines who profits when momentum returns.

What Signals Indicate Market Stabilization?

The earliest signs of recovery often emerge quietly before prices surge. These indicators help traders spot when fear is subsiding and confidence is returning:

- Rising Bitcoin dominance — capital flows back to BTC as investors seek stability before rotating into altcoins.

- Increased stablecoin inflows — liquidity returning to exchanges signals traders are preparing to re-enter positions.

- Normalized funding rates — leveraged bets cool down, showing a healthier, more balanced market structure.

When these signals align, they suggest the crypto market crash is easing and accumulation has begun — the calm before the next bull run.

Where Could the Next Rally Come From?

The next rally will likely emerge from a combination of macro and market catalysts working in sync. ETF inflows can reignite institutional demand by channeling new capital into Bitcoin and Ethereum. Monetary easing — such as potential rate cuts or renewed liquidity programs — could make risk assets attractive again. And if U.S.–China tariff tensions ease, global markets may recover their appetite for speculation.

As these forces converge, sidelined liquidity will begin to flow back in, marking the shift from crypto crash recovery to the next expansion cycle — where conviction replaces caution and accumulation turns into momentum.

Why Bitget Wallet Helps Traders Stay Ready in Any Market

Market volatility is unavoidable, but how traders respond to it determines survival. During every crypto crashor sudden rally, speed and security define the winners. That’s where Bitget Wallet gives traders an edge — empowering them to act instantly, across every chain, without losing control of their assets.

How Does Bitget Wallet Support Multi-Chain Resilience?

Bitget Wallet gives traders unified control over assets across major blockchains, including Ethereum, Solana, Polygon, and BNB.

Its features include real-time liquidation data, stablecoin yield options, and both MPC and seed phrase security.

When markets swing, having one hub for swaps, tracking, and safety is invaluable.

Why Smart Traders Choose Bitget Wallet Post-Crash

Every crypto crash clears the field for a new generation of strategic traders.

Those who use Bitget Wallet stay ahead by managing risk and reacting instantly when opportunity returns.

Download Bitget Wallet today to safeguard your crypto, monitor markets, and trade smarter across every blockchain before the next cycle begins.

Conclusion

What caused the crypto crash 2025 wasn’t the failure of technology, but an overextension of human confidence.

The crypto market crash stripped out leverage, tested infrastructure, and proved that crypto can withstand systemic shocks.

This was not the end of digital finance — it was its evolution.

Trade confidently in every market condition with Bitget Wallet — your secure, cross-chain command center for digital assets and analytics.

Safely store and use stablecoins across chains with Bitget Wallet – ideal for beginners.

FAQs

1. What caused the crypto crash 2025?

The crypto crash 2025 began when Trump announced 100% tariffs on Chinese imports, sparking global risk aversion and triggering a flight to safety. As traders rushed to unwind positions, over-leveraged markets spiraled into forced liquidations. Within hours, billions in positions were wiped out across exchanges, proving how geopolitical shocks can ripple instantly through digital markets.

2. How long will the crypto crash last?

Historically, major corrections take 4–6 weeks to stabilize as funding rates normalize and derivatives rebalance. However, the duration of this downturn depends on how long U.S.–China trade tensions persist. If tariffs continue to pressure global liquidity, the recovery could take longer — though short-term relief rallies may emerge along the way.

3. Why did Bitcoin and Ethereum crash so fast?

The Bitcoin crash and Ethereum crash were amplified by excessive leverage. When prices dipped, billions in overextended long positions were automatically liquidated, triggering a chain reaction across exchanges. Algorithmic bots accelerated the process, converting a market correction into a full-blown liquidation spiral.

4. Is the crypto crash over or still unfolding?

While prices have begun to stabilize, volatility remains elevated. Traders are cautiously re-entering positions, and key indicators like stablecoin inflows and funding rates show early signs of recovery. However, until macro conditions — especially trade policy and dollar strength — settle, the market will remain vulnerable to sudden swings.

5. How can traders prepare for crypto crash recovery?

Survival comes down to discipline and diversification. Avoid excessive leverage, focus on liquidity management, and track macro signals before re-entering aggressively. Tools like Bitget Wallet allow traders to monitor multiple blockchains, manage stablecoins securely, and execute swaps instantly — helping them stay liquid, informed, and ready when the next recovery phase begins.

Risk Disclosure

Please be aware that cryptocurrency trading involves high market risk. Bitget Wallet is not responsible for any trading losses incurred. Always perform your own research and trade responsibly.