How to Buy HASH in 2026: A Beginner’s Step-by-Step Guide to HASH Token

How to buy HASH is a growing question among investors exploring multichain DeFi utility tokens in 2026. HASH Token operates across multiple blockchains, which means buying it requires understanding network selection, liquidity venues, and contract verification.

Because HASH exists on more than one chain, users must choose the correct version before executing a swap or exchange trade. In this article, you’ll learn how to buy HASH step by step, where to buy HASH safely, how to verify the HASH contract address, and how to approach HASH price volatility with discipline using Bitget Wallet for Secure Stablecoin Storage, Hot Memecoin Trading, and a Seamless Cross-chain Experience.

Key Takeaways

- HASH is a multichain utility token available on Ethereum (ERC-20), BNB Chain (BEP-20), Polygon, and XDC Network. Because it exists across multiple blockchains, liquidity and trading conditions can differ depending on the selected network.

- Where to buy HASH depends on current exchange listings and on-chain liquidity availability. Some chains may offer deeper trading pools or better execution, while others may have thinner liquidity.

- Learning how to buy HASH safely requires verifying the correct official contract address for the chosen blockchain. Since HASH is multichain, impersonation tokens can appear on alternative networks, making verification essential.

What Is HASH Token (HASH)?

HASH Token (HASH) is a multichain utility token used within the Hashbon ecosystem, which focuses on cross-chain infrastructure and hybrid CeFi–DeFi functionality. Rather than being a meme or purely narrative-driven asset, HASH is positioned as a utility token supporting payments, execution services, and ecosystem rewards.

It exists across multiple networks including Ethereum (ERC-20), BNB Chain (BEP-20), Polygon, and XDC Network.

What makes HASH different from pure utility or meme tokens?

- Narrative vs utility: HASH is primarily a utility token, not a meme coin. Its value proposition centers on ecosystem integration rather than social momentum.

- Price driver: Liquidity conditions, exchange listings, and adoption inside its ecosystem.

- Where it trades: Available on selected centralized exchanges and decentralized liquidity pools depending on the chain version.

Source: Coinbase

Is HASH Token (HASH) a scam or just high-risk?

HASH Token (HASH) is not automatically a scam—it’s presented as a utility token within the Hashbon FiRe ecosystem, with documented use cases around payments and cross-chain swap infrastructure.

That said, HASH can still be high-risk in practice—especially if trading activity is thin or fragmented across chains, which increases slippage and makes price execution more fragile.

Not automatically a scam, but high-risk if:

- Limited transparency around active development, current liquidity venues, or ecosystem adoption (common across small-cap/mid-cap tokens).

- Low or uneven liquidity across chains, leading to larger spreads and higher slippage risk.

- Copycats / impersonation tokens show up on the wrong chain or via fake “airdrop” links (a well-documented pattern in crypto markets).

- Sudden pumps driven by attention or listings rather than sustained utility usage.

What users must do before buying HASH:

- Verify the official HASH contract address for the exact chain you’re using (ERC-20 vs BEP-20 vs Polygon vs XDC).

- Avoid unofficial links from random social posts, DMs, or “support” accounts—token impersonation and address-poisoning scams are real.

- Watch liquidity depth + holder concentration on the specific chain you plan to trade, because multichain tokens can look “liquid” on one network and illiquid on another.

HASH Token (HASH) is not flagged as a scam by major data platforms, but it remains high-risk due to liquidity differences across chains and general crypto market volatility. Because regulators like the FBI have warned about token impersonation and fake contracts, users should always verify the official HASH contract address, avoid unofficial links, and check on-chain liquidity and holder concentration before buying.

Where to Buy HASH?

When users ask “where to buy HASH,” they usually want the safest and most efficient method. The decision depends on whether they prefer custodial trading on exchanges or non-custodial on-chain swaps.

Availability depends on exchange listings and decentralized liquidity on each network. Because HASH is multichain, liquidity conditions differ between Ethereum, BNB Chain, Polygon, and XDC.

Comparison of HASH Buying Methods

| Buying Method | Custody Model | Execution | Control | Recommended For | Main Risks |

| On-chain Swap (DEX via Wallet) | Non-custodial | User-controlled | High | DeFi users | Contract impersonation, slippage |

| On-chain UEX (via Exchange) | Custodial | Platform-managed | Medium | Semi-advanced users | Custodial exposure |

| Centralized Exchange (CEX) | Custodial | Platform-managed | Low | Beginners | Withdrawal limits, regulatory risk |

Why Many Users Buy HASH With Bitget Wallet?

If HASH Token (HASH) liquidity is mainly on-chain, a non-custodial wallet helps you swap while keeping control of assets. Bitget Wallet also supports cross-chain access and helps reduce common beginner mistakes like interacting with impersonation tokens.

What Bitget Wallet Helps With?

✅ Self-custody and asset control Users retain full ownership of private keys and funds, reducing exposure to custodial and platform-related risks.

✅ On-chain swaps with transparent execution Explore over 1M tokens with real-time in-app rankings—discover trending assets early and stay ahead of the market.

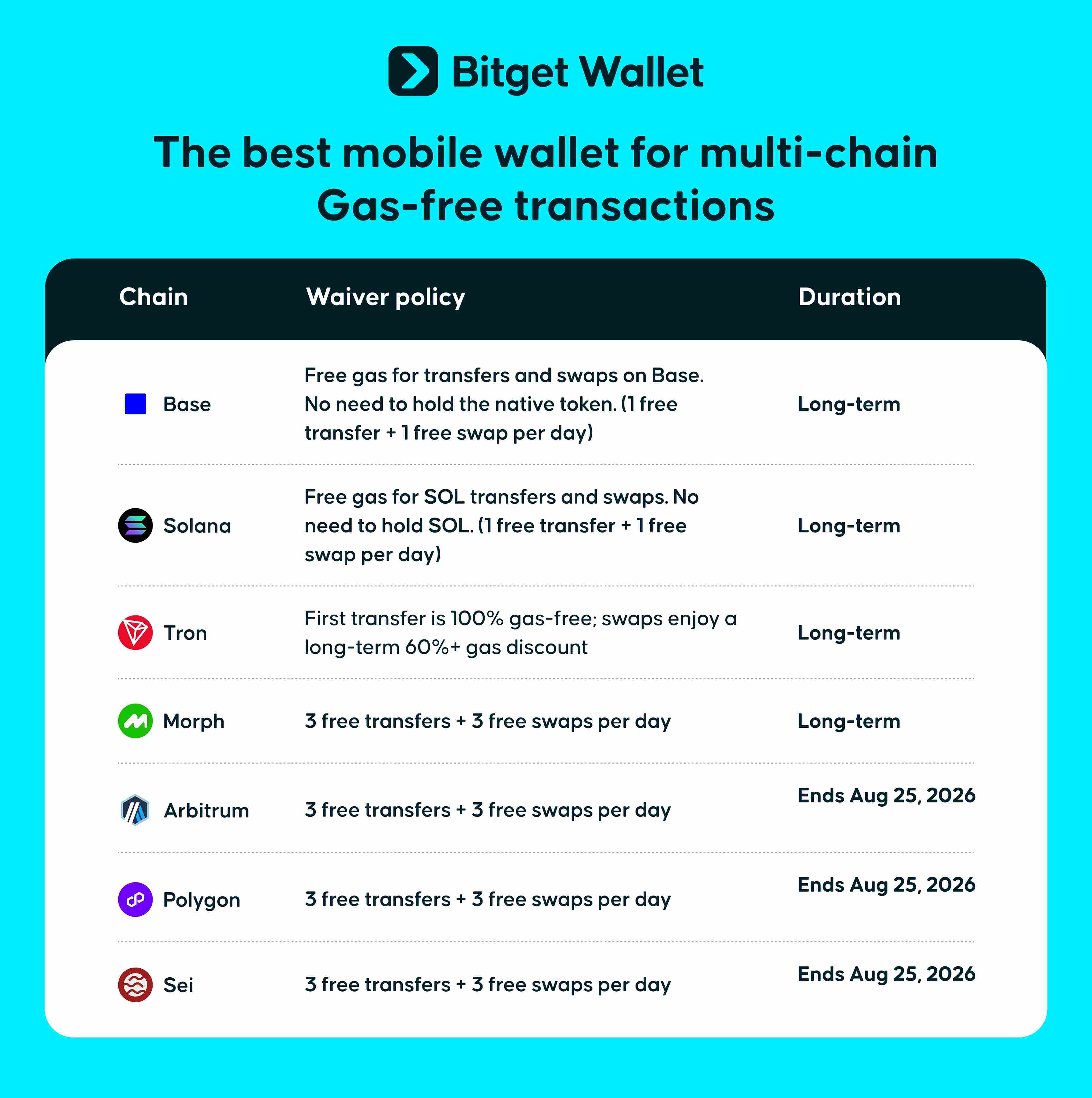

✅ Multi-chain access with cost-efficient execution Bitget Wallet supports 130+ blockchains, including 7 major networks such as Solana, Base, Arbitrum, Polygon, Tron, and more. This allows users to buy, hold, and manage HASH across different ecosystems without being locked into a single chain environment.

On supported networks, users can also benefit from gas-free transactions or long-term gas discounts, helping reduce execution costs when swapping, transferring, or managing assets across chains—an advantage for users who trade frequently or operate across multiple ecosystems.

✅ Flexible post-purchase asset management After buying HASH, users can hold, transfer, or manage assets freely across supported chains without withdrawal limits or third-party restrictions, making it easier to adapt to changing liquidity or market conditions.

Sign up Bitget Wallet now - grab your $2 bonus!

How to Buy HASH on Bitget Wallet?

Trading HASH Token (HASH) is easy on Bitget Wallet. Follow these simple steps to get started:

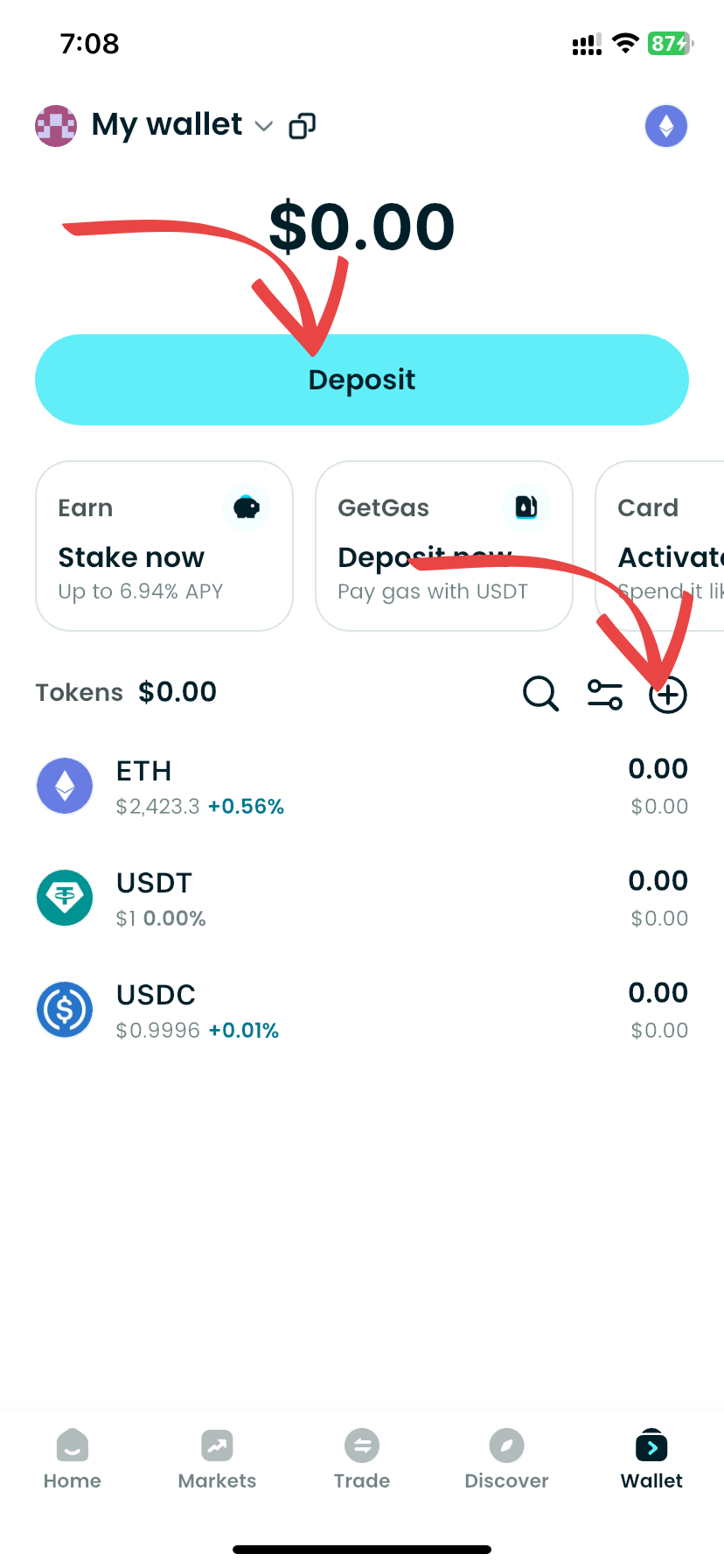

Step 1: Create an Account

If you don't currently have an account, install the Bitget Wallet app. Register by inputting the required details and confirming your identity.

Step 2: Deposit Funds

After setting up an account, you must deposit money. You can do this by:

- Transferring Cryptocurrency: Transfer crypto from a different wallet.

- Purchasing Crypto: Utilize a credit or debit card to buy crypto directly from Bitget Wallet, making sure you have sufficient capital for trading HASH Token (HASH).

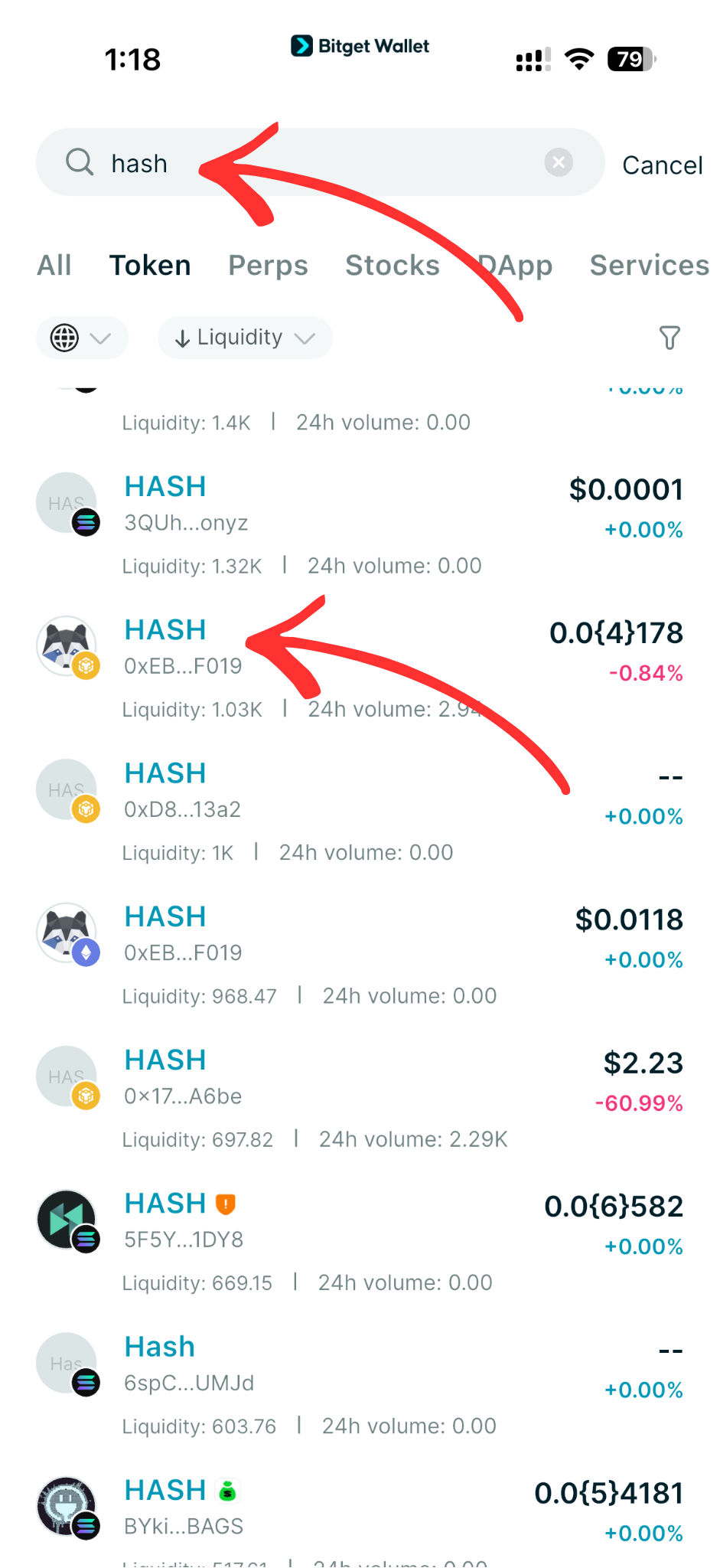

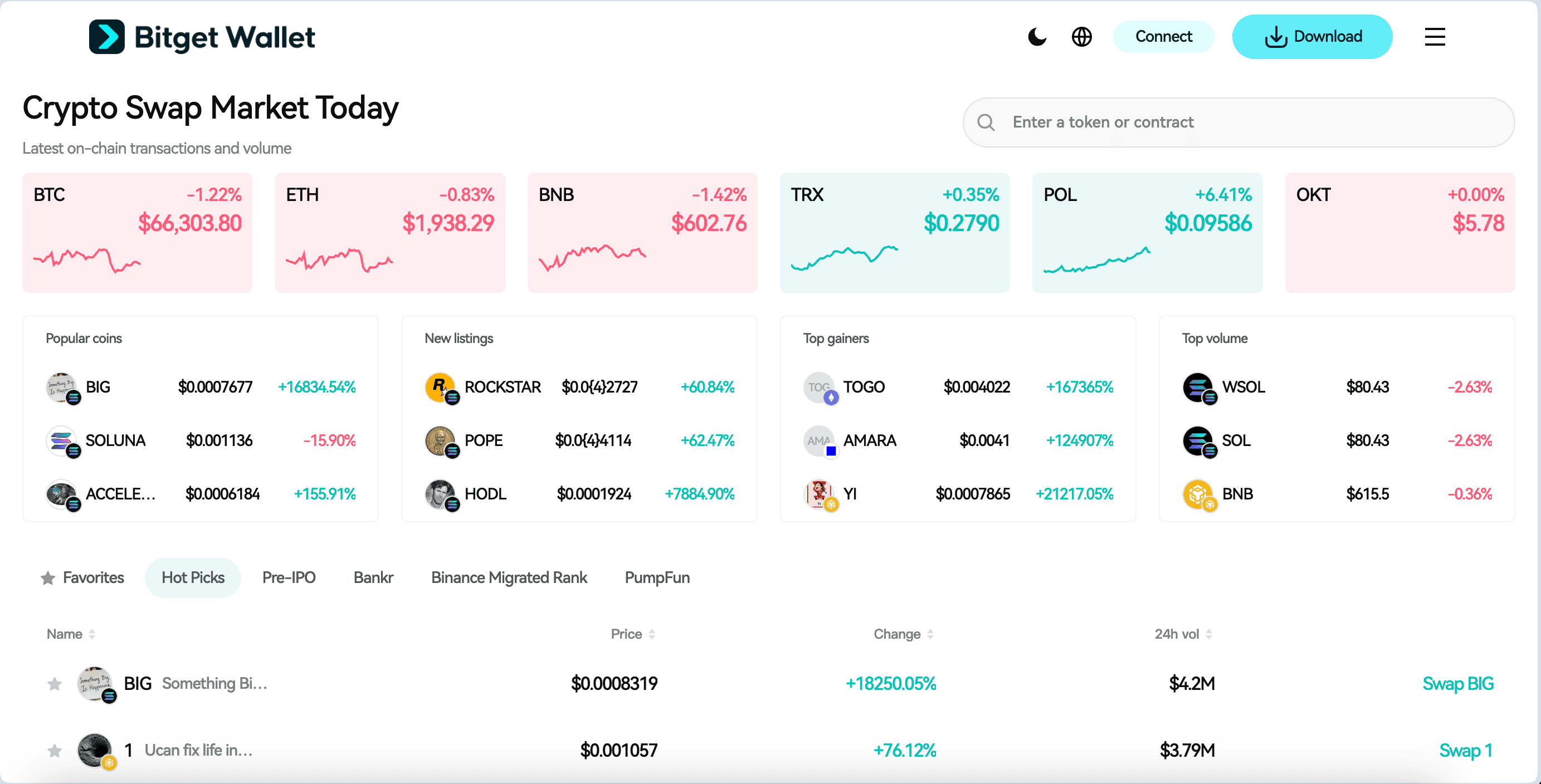

Step 3: Find HASH Token (HASH)

On the Bitget Wallet platform, go to the market area. Search for HASH Token (HASH) using the search function. Click on the token to access its trading page.

As this token has not been listed yet, please look at the last contract address sent by the project team upon listing of the token.

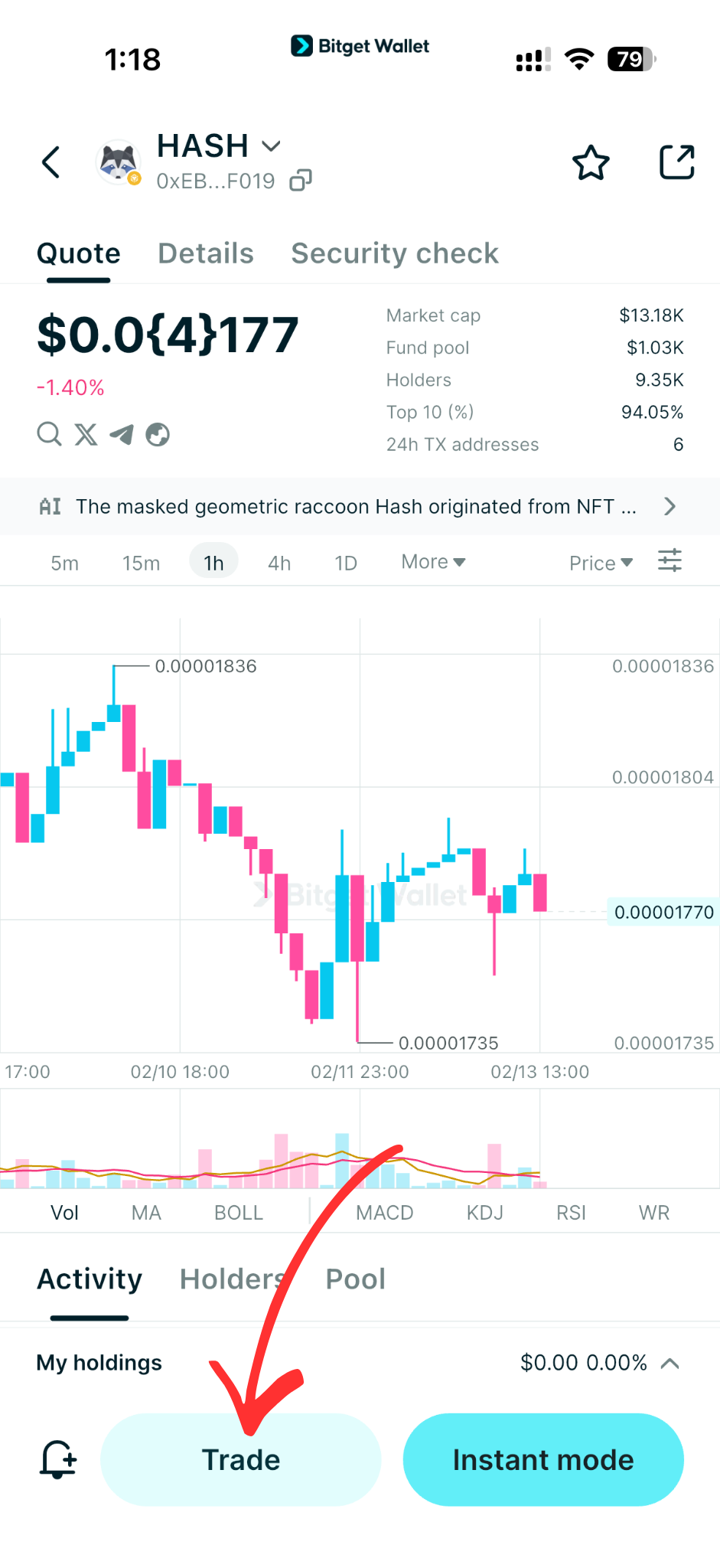

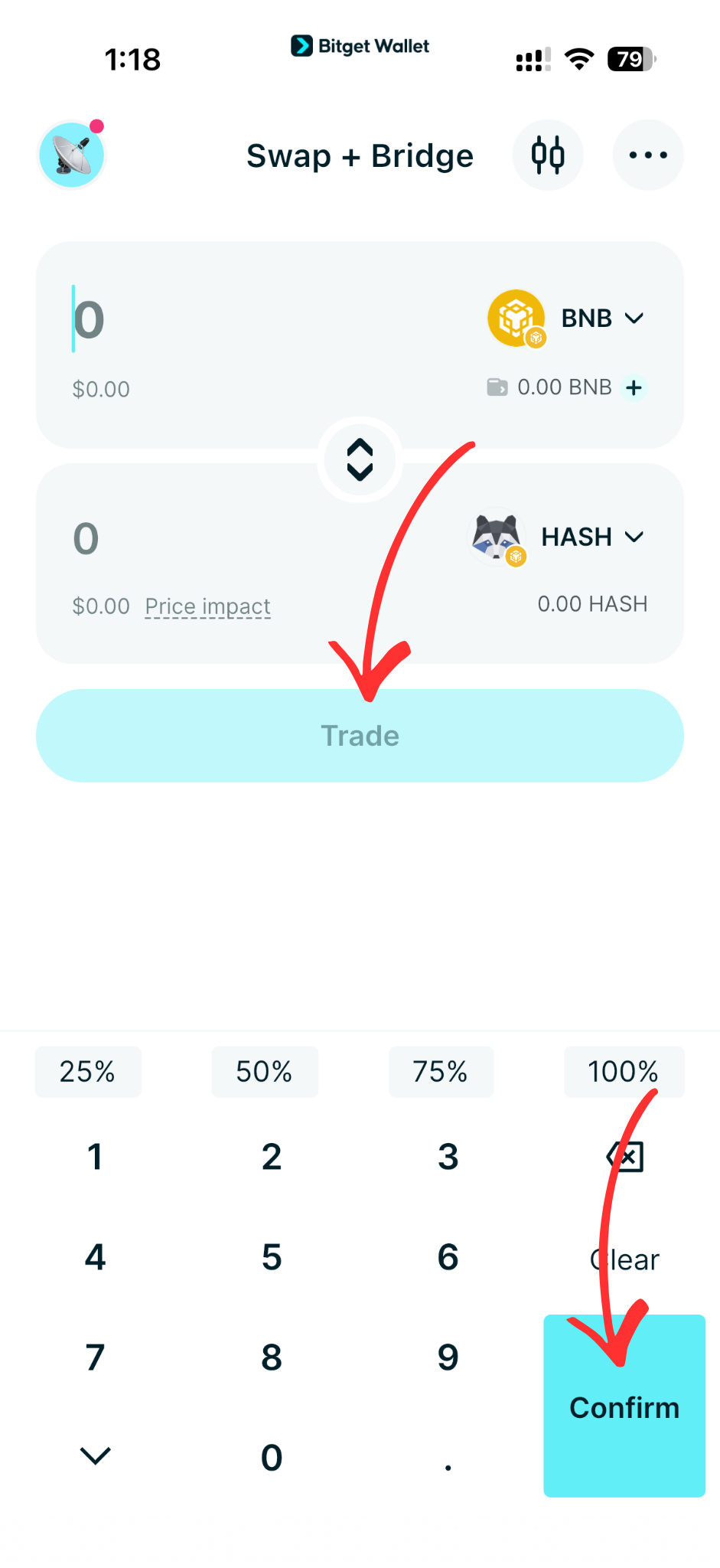

Step 4: Choose Your Trading Pair

Select your trading pair you would like to deal with, for instance, HASH/USDT.

By doing this, you will be able to exchange HASH Token (HASH) for USDT or any other cryptocurrency.

Step 5: Place Your Order

Choose whether to carry out a market order—either buy or sell at the prevailing rate—or place a limit order at your desired price. Fill in the amount of HASH Token (HASH) you want to exchange, then proceed to confirm in order to complete the trade.

Step 6: Monitor Your Trade

Once you have ordered, you can track the status of your order under "Open Orders." Upon completion of the order, you can view your balance to see the newly purchased HASH Token (HASH).

Step 7: Withdraw Your Funds (Optional)

If you want to transfer your HASH Token (HASH) or any other cryptocurrency to another wallet, go to the withdrawal section, provide your wallet address, and confirm the transaction.

What Should You Know About HASH Price Volatility?

HASH is a multichain utility token, and its price volatility is primarily driven by liquidity fragmentation across different blockchains and overall crypto market sentiment. Because trading activity varies between Ethereum, BNB Chain, Polygon, and other supported networks, price movements can be amplified by uneven liquidity and short-term attention cycles.

On-chain liquidity and market sentiment play a larger role than traditional fundamentals in short-term price behavior. Volatility should therefore be treated as a risk characteristic of multichain tokens, not as an opportunity signal, since price spikes driven by attention or temporary liquidity changes can reverse quickly.

HASH Price Prediction: How High Can HASH Token Go?

Predicting the price of any cryptocurrency depends on broader market conditions, liquidity depth, and real ecosystem usage rather than short-term speculation. As a multichain utility token, HASH’s price behavior is closely tied to trading volume across supported networks and the level of adoption within its underlying infrastructure ecosystem, meaning stabilization depends more on sustained usage than hype cycles.

If HASH continues expanding integrations and maintains consistent liquidity across Ethereum, BNB Chain, Polygon, and other supported chains, its valuation will likely reflect actual network activity rather than temporary sentiment spikes. However, price movements remain sensitive to market-wide crypto volatility and execution conditions.

Source: Bitget Wallet

Is HASH Crypto Safe to Invest In?

Whether HASH is “safe” depends less on the token itself and more on how users manage execution, position sizing, and contract verification. As a multichain utility token, the primary risks stem from liquidity fragmentation, market volatility, and user errors rather than a guaranteed structural failure.

Safety in crypto is largely behavioral — disciplined trade execution and proper verification matter more than the asset label.

Key Risks to Consider

-

Fake or impersonation tokens

Because HASH exists across multiple blockchains, counterfeit versions can appear on the wrong network. Failing to verify the official contract address increases the risk of buying a fake token.

-

Low or uneven liquidity across chains

Liquidity depth may differ between Ethereum, BNB Chain, Polygon, and other networks. Thin liquidity increases slippage risk and can amplify price swings.

-

Overexposure to a single asset

Concentrating too much capital in one multichain token increases portfolio volatility and downside exposure.

-

Execution errors (wrong network selection)

Sending funds on the wrong chain or interacting with the incorrect token version can result in permanent loss.

How to Approach HASH Volatility With a Smarter Strategy?

Managing HASH volatility requires discipline rather than perfect timing. Because HASH is a multichain utility token with liquidity spread across networks, users reduce avoidable losses by controlling exposure, verifying execution conditions, and focusing on process over short-term price movements. This approach builds practical on-chain skills that remain useful beyond a single token.

Volatility should be treated as a structural feature of crypto markets, not a signal to chase rapid gains. Education and controlled execution matter more than reacting to sudden price swings.

Practical Risk-Management Principles

-

Observe on-chain liquidity behavior

Review liquidity depth, trading pairs, and recent volume on the specific chain you plan to use. Multichain tokens like HASH can show different execution quality depending on network conditions.

-

Use small position sizes

Start with limited capital allocation to reduce exposure to sharp price movements and slippage.

-

Set clear capital limits

Define maximum portfolio allocation and acceptable drawdown levels before entering a trade.

-

Prioritize secure execution

Verify the official HASH contract address, confirm the correct blockchain, and double-check transaction details before approving swaps.

Conclusion

How to buy HASH depends on selecting the correct blockchain, verifying the official contract address, and choosing the right custody method based on your experience level. Because HASH is a multichain utility token, execution quality, liquidity awareness, and disciplined risk management matter more than short-term price movement.

If you prefer secure self-custody with multichain flexibility, Bitget Wallet provides a streamlined way to swap, hold, and manage HASH across supported networks. Be the first to access emerging on-chain tokens with beginner-friendly tools — and explore additional features like Stablecoin Earn Plus (up to 10% APY) and zero-fee trading on selected assets directly inside the wallet.

Trade, store, and explore Web3 seamlessly – beginner-ready with Bitget Wallet.

Sign up Bitget Wallet now - grab your $2 bonus!

FAQs

1. How to buy HASH safely as a beginner?

To buy HASH safely, first confirm the official contract address on the correct blockchain (Ethereum, BNB Chain, Polygon, or XDC). Then use a reputable exchange or a non-custodial wallet, start with a small position size, and double-check the network before approving any transaction.

2. Where can I buy HASH?

You can buy HASH on selected centralized exchanges or through on-chain swaps depending on the chain version you choose. Availability and liquidity may vary between Ethereum, BNB Chain, Polygon, and other supported networks.

3. Do I need KYC to buy HASH?

Whether KYC is required depends on the purchase method. Centralized exchanges (CEXs) typically require KYC, as users trade through custodial accounts managed by the platform.

In contrast, buying HASH through on-chain swaps using a non-custodial wallet like Bitget Wallet does not require KYC. Users interact directly with decentralized liquidity from their own wallet, without submitting identity information. However, this also means users are fully responsible for security, contract verification, and transaction execution.

4. Is HASH crypto high risk?

Yes, HASH carries typical crypto market risks, including price volatility, liquidity fragmentation across chains, and potential execution errors. Risk depends largely on how users manage exposure, verify contracts, and select trading venues.

5. How to avoid fake HASH tokens?

Always verify the official HASH contract address from trusted sources before buying. Avoid unsolicited links, double-check the blockchain network you are using, and review liquidity and token details before executing a swap.

Risk Disclosure

Please be aware that cryptocurrency trading involves high market risk. Bitget Wallet is not responsible for any trading losses incurred. Always perform your own research and trade responsibly.

- What Is a Multi-Chain Wallet?2026-02-13 | 5 mins