How to Buy Crypto with Visa Card: A Complete 2026 Guide for Beginners

How to Buy Crypto with Visa Card has never been easier — and in 2026, it’s one of the fastest, most beginner-friendly ways to enter the crypto market.

If you’re new to digital assets, here’s the quick takeaway: Visa cards let you buy crypto instantly without complex bank transfers, and platforms like Bitget Wallet make the process secure and seamless.

Using a Visa card for crypto purchases delivers speed, flexibility, and familiarity. Whether buying Bitcoin or chasing the latest memecoin, you get instant ownership without bank delays. With Bitget Wallet—offering secure stablecoin storage, hot memecoin trading, and seamless cross-chain swaps—you can pay with Visa, including prepaid or virtual cards, and start confidently.

Key Takeaways:

- Fast & Easy Entry – Accessing crypto with a Visa card means no dealing with slow bank transfers; with buying limits set at much lower levels, most transactions take only minutes before you can start trading.

- Multiple Card Options – You can purchase using a Visa credit, debit, prepaid, or virtual card — and even Visa gift cards — giving you flexibility to choose the payment method that best suits your budget and privacy needs.

- Secure & Reliable – Using trusted platforms like Bitget Wallet ensures advanced security measures, smooth payment processing, and a hassle-free experience from purchase to crypto delivery.

What Is the Easiest Way to Buy Crypto with Visa Card?

The easiest way to buy crypto with Visa Card is to use a reputable crypto wallet or exchange with instant Visa support like Bitget Wallet or to redeem a prepaid Visa gift card via a trusted marketplace such as Baxity Store.

Direct exchange purchases let you pay with your Visa credit or debit card, complete KYC, and receive your crypto in minutes. Baxity Store offers a simplified KYC process, instant voucher codes, and the ability to buy crypto vouchers with your Visa card — ideal if you want extra privacy or a quick gift option.

How Do Visa Crypto-Linked Cards Work?

Visa crypto-linked cards let you spend your digital assets just like regular money by automatically converting crypto to fiat at the moment you make a purchase. This means you can shop anywhere Visa is accepted without manually selling your crypto first.

How Do You Link a Visa Card to Your Crypto Wallet?

Through the Visa Crypto Fast Track program, partner exchanges and wallets — including Bitget Wallet — allow you to apply for and activate a Visa crypto-linked card directly from within the app. Once approved, the card is linked to your wallet balance, so you can use your stored crypto as a payment source.

How Do You Load Funds onto a Visa Crypto-Linked Card?

To top up your Visa crypto-linked card, you transfer crypto from your wallet into the card balance via the platform’s interface. The funds are instantly converted into your chosen fiat currency, making them ready for use in real-world purchases.

How Can You Use Visa Crypto-Linked Cards for Purchases?

From the merchant’s perspective, your transaction is processed like any other Visa payment — they receive local currency, while your card provider automatically handles the crypto-to-fiat conversion behind the scenes. This ensures smooth, instant payments without extra steps for the seller.

Can I Buy Crypto with a Credit Card or Debit Card?

Yes — you can buy crypto using a Visa credit card, Visa debit card, prepaid Visa, or virtual Visa card, and each option has its own advantages, drawbacks, fees, and limits.

| Card Type | Advantages | Drawbacks | Typical Fees | Limits | Region Restrictions |

| Visa Credit Card | Instant purchase, widely accepted | Cash advance fees, higher interest rates, stricter issuer controls | 2–5% transaction + possible cash advance fee | $1,000–$5,000/day depending on issuer | US: Some banks (e.g., Capital One) block; UK: Major banks restrict; India: RBI guidance limits direct buys |

| Visa Debit Card | Lower fees, fast settlement, funds from bank | Subject to bank crypto policies | 1.5–3% transaction fee | $1,000–$3,000/day | UK & EU: Generally allowed but some blocks; Middle East: Mixed acceptance |

| Prepaid Visa Card | Spending control, privacy, no link to bank account | Reload fees, limited balance | 2–4% purchase + reload fee | Balance capped by issuer (often <$2,500) | China: Often via offshore platforms; India: Acceptance varies |

| Virtual Visa Card | Extra privacy, quick issuance, secure online use | Short validity, not universally accepted | 2–4% transaction fee | $500–$2,000/day | Global: Varies by platform; some US & EU exchanges don’t support |

Tip: Choose your Visa payment type based on your region, transaction size, and privacy needs. Bitget Wallet Card supports multiple Visa payment types, handles transactions of various sizes, and offers strong security with seamless integration into your Bitget Wallet — making every purchase faster and more reliable.

What Are the Benefits of Buying Crypto with Visa Card?

Buying crypto with a Visa card offers a combination of speed, security, and worldwide accessibility that few other payment methods can match. Whether you’re a first-time buyer or a seasoned trader, Visa’s infrastructure makes entering the crypto market faster and more convenient.

- Global Acceptance – Tap into Visa’s vast merchant network of 80M+ locations worldwide, giving you unmatched reach for both purchases and withdrawals.

- Speed – Transactions typically clear in minutes, so you receive your crypto almost instantly instead of waiting days for bank transfers.

- Security – Visa’s advanced fraud protection and zero-liability policies add a strong layer of buyer safety when purchasing digital assets.

- Convenience – Use your existing Visa card without opening new bank accounts or setting up lengthy transfer arrangements.

- Flexibility – Choose from credit, debit, prepaid, or gift cards to match your budget and privacy preferences.

- Regulatory Compliance – Many Visa-partnered crypto platforms meet local and international compliance standards, reducing transaction failures and legal risk.

What Are the Risks and Fees When Using Visa to Buy Crypto?

While buying crypto with a Visa card is fast and convenient, it’s not without potential drawbacks. Fees, spending limits, and regional restrictions can affect your purchase, and extra security steps may be needed to avoid fraud or failed transactions. Understanding these factors will help you make safer, more cost-effective choices.

Are There Additional Costs When Paying with a Visa Card for Crypto?

Yes — depending on your card type and issuer, you may face cash advance fees on credit cards, payment gateway charges from the exchange, and currency conversion costs if the transaction is processed in a foreign currency. These fees can add 1–5% to your total purchase.

What Spending Limits and Processing Delays Should You Expect?

Most Visa card issuers set limits on crypto-related transactions to manage risk and comply with regulations. These limits and processing times can vary based on your card type, issuer, and location.

- Daily Limits – Often set between $1,000 and $5,000 for crypto purchases.

- Monthly Caps – Some issuers also enforce cumulative monthly spending limits.

- Risk-Based Holds – Transactions may be flagged for review if they appear unusual or exceed normal spending patterns.

- Settlement Delays – Processing can be delayed by compliance checks, especially for large transactions or high-risk regions.

What Are the Best Practices to Reduce Risks When Using Visa for Crypto Purchases?

To keep your transactions safe and cost-efficient, follow these proven strategies:

- Use Trusted Platforms – Stick with regulated services like Bitget Wallet or Baxity Store.

- Enable Two-Factor Authentication (2FA) – Adds an extra security layer against unauthorized access.

- Avoid Unverified Sellers – Reduces the risk of fraud and chargebacks.

- Monitor Card Statements – Quickly detect and report suspicious activity.

- Understand Your Card’s Terms – Check your issuer’s fees, limits, and crypto transaction policies before buying.

Which Platforms Accept Visa for Buying Crypto?

Many leading crypto exchanges and wallet services support Visa card purchases, but acceptance varies depending on your location, local banking rules, and the platform’s payment processor agreements. Some issuers and regions have restrictions on crypto transactions, so it’s important to confirm Visa support in your country before attempting a buy.

A notable option is the Bitget Wallet Card, which accepts Visa payments in multiple Asian countries, offering fast settlement, competitive fees, and broad multi-chain asset support. Its geo-friendly coverage makes it a reliable choice in areas where other platforms may have limited or no Visa card functionality, helping users avoid failed transactions and unnecessary delays.

How to Buy Crypto with Visa Card: Step-by-Step Guide

Buying crypto with a Visa card is fast and simple with Bitget Wallet. Whether paying directly or using a Visa gift card, here’s the full process — including how to apply for a Bitget Wallet Card for seamless purchases.

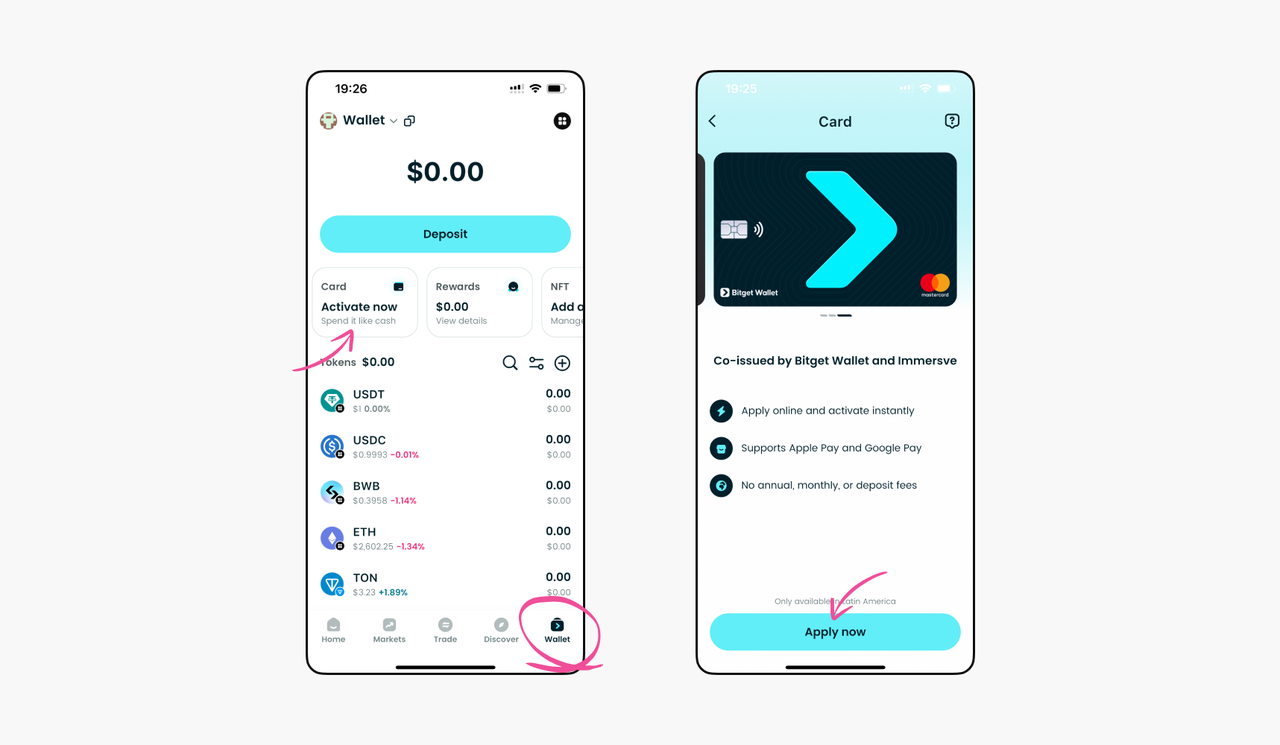

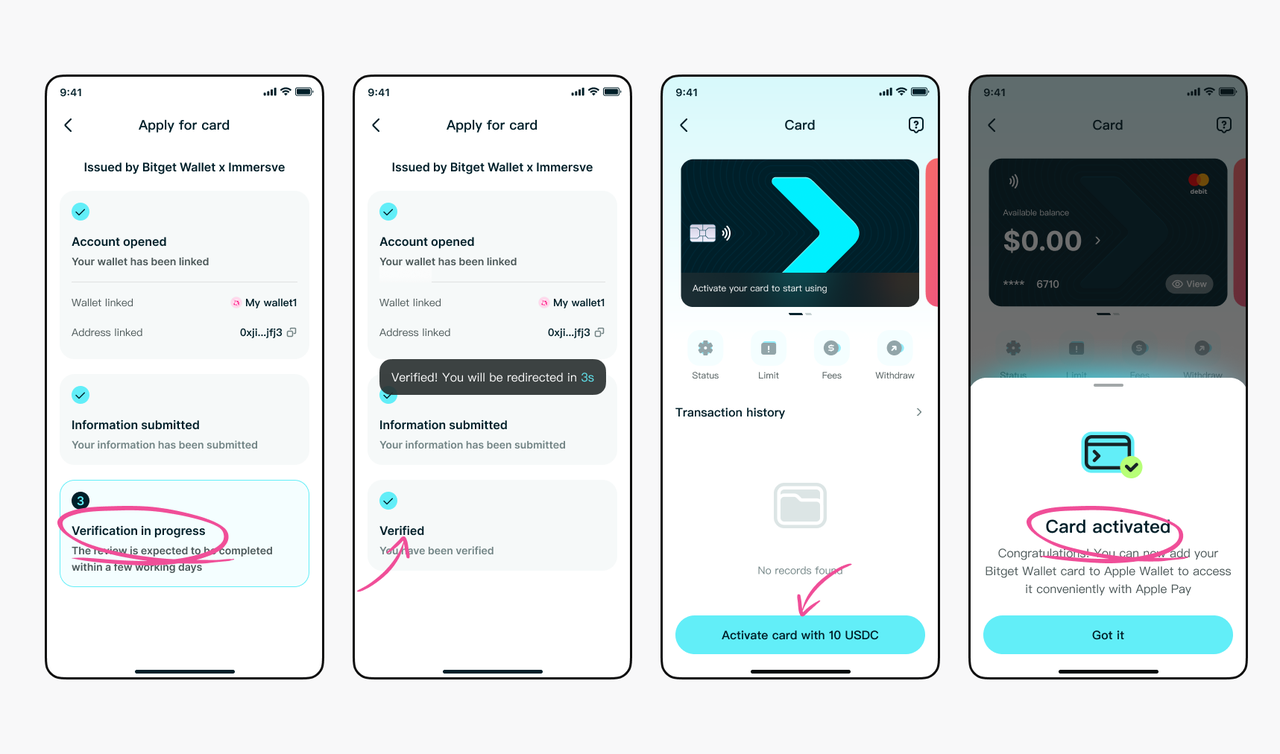

Step: 1 Download Bitget Wallet and Apply for the Card

Install the Bitget Wallet app, go to Wallet > Card > Apply Now, and start your application.

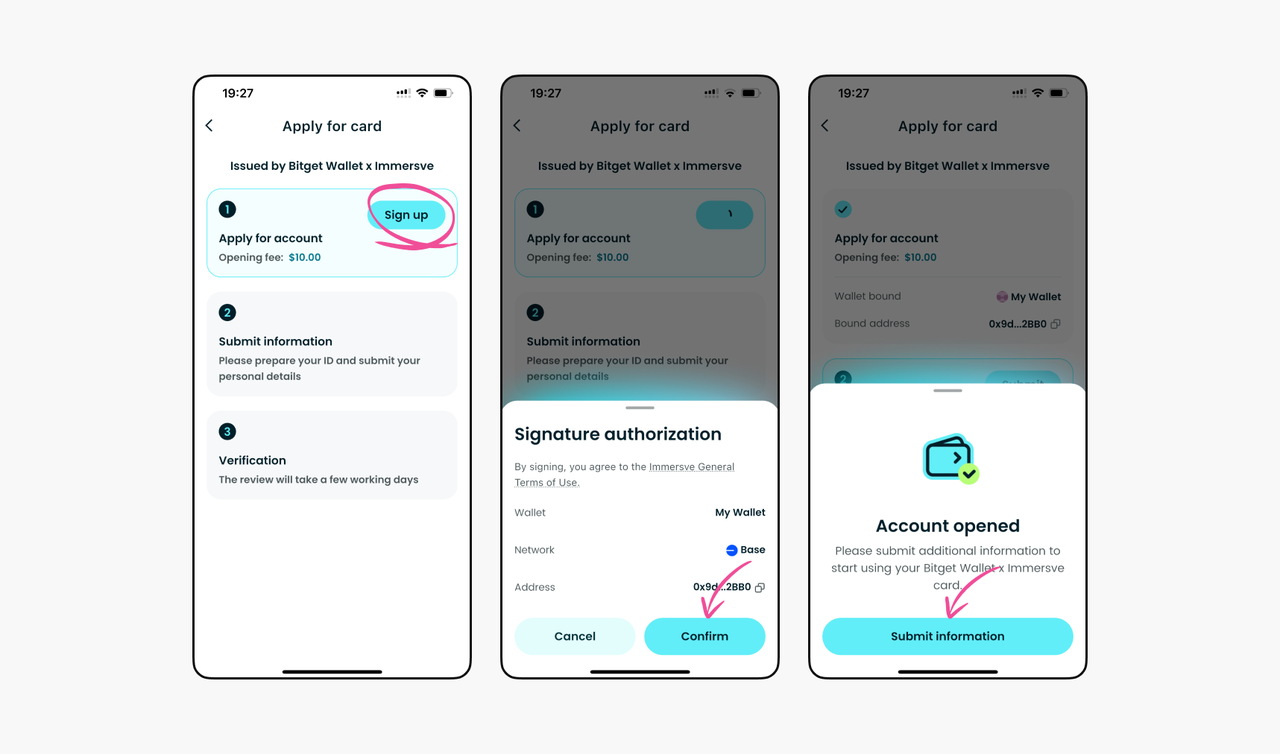

Step 2: Sign Up for an Account

Tap Sign Up and sign the on-screen transaction to create your card account. A one-time opening fee of 10 USDC applies.

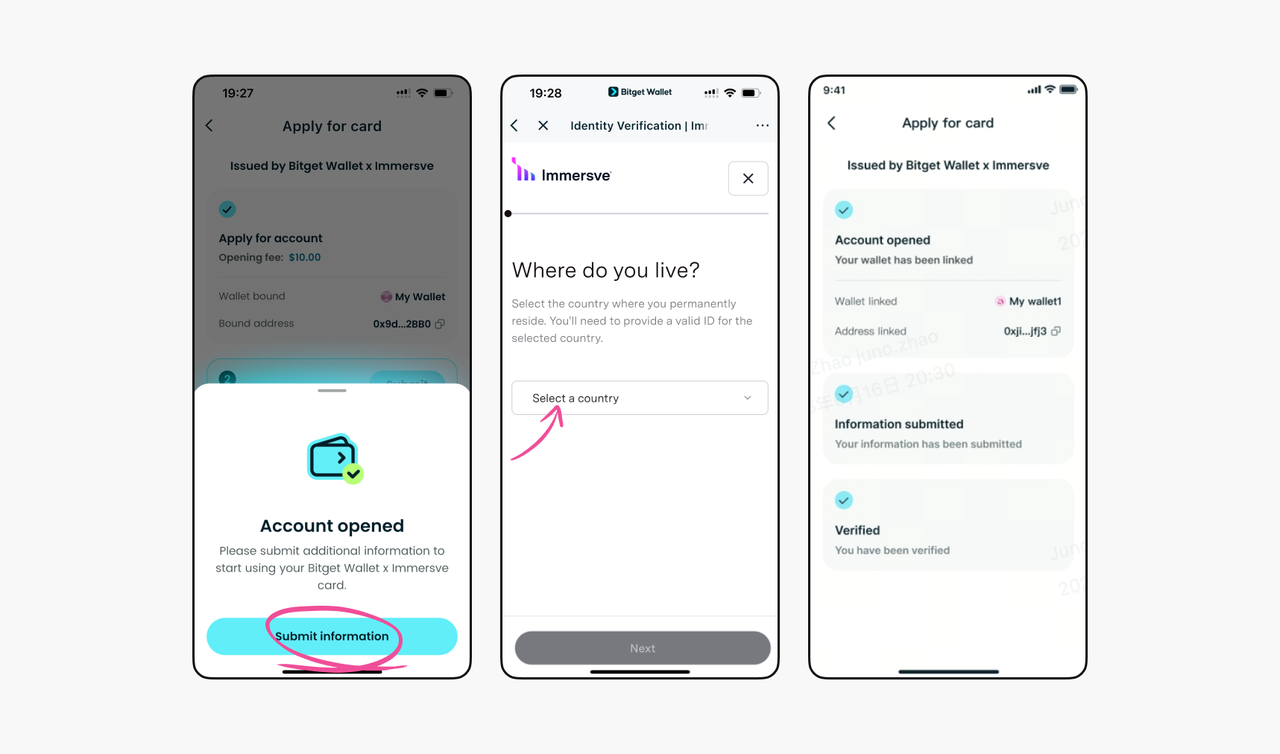

Step 3: Submit Personal Information

Provide your country, address, contact details, and estimated monthly spend. (Image alt: Visa crypto purchase account details form)

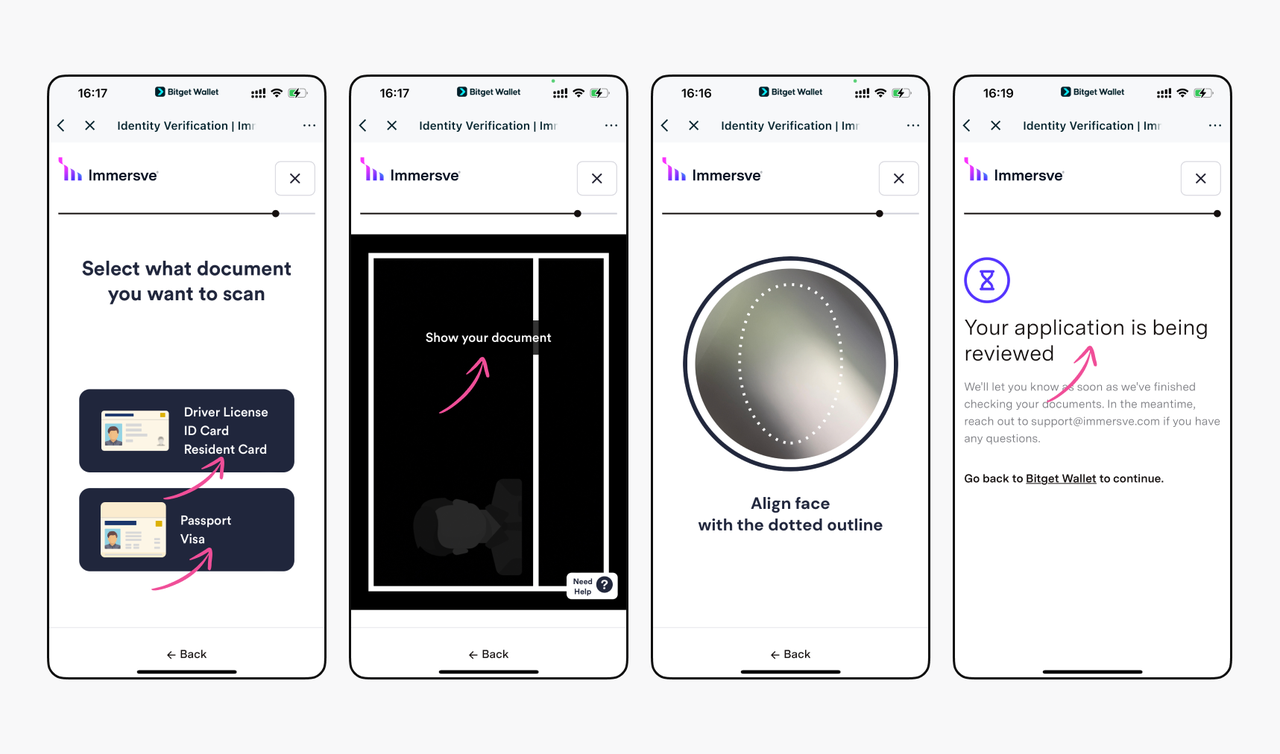

Step 4: Verify Your Identity

Upload a valid ID (passport, driver’s license, or national ID) and complete a quick face verification. Most applications are approved in under 3 minutes.

Step 5: Activate Your Card

Pay the 10 USDC issuance fee to activate your Bitget Wallet Card. Once activated, you can view your digital card details and add it to Apple Pay or Google Pay for instant use.

Why Use Bitget Wallet for Your Visa Crypto Purchases?

Bitget Wallet offers a secure, beginner-friendly platform with cross-chain support, advanced memecoin trading, and stablecoin integration. Compared to MetaMask, Phantom, or Trust Wallet, Bitget Wallet’s Visa card support in Asia, direct gift card redemption, and built-in DEX aggregator make it stand out.

Why Bitget Wallet Card Stands Out?

Among the many options available in the crypto card space, the Bitget Wallet Card distinguishes itself through its legal infrastructure, seamless wallet integration, and highly competitive fee model. Unlike most crypto cards that act as third-party extensions, Bitget's solution is directly backed by its wallet ecosystem — allowing users to enjoy smoother KYC, native crypto-to-fiat conversion, and a host of financial perks.

Here’s why the Bitget Wallet Card is one of the most compelling choices :

✅ Sign Up, Verify, Earn: Complete KYC and get $5 cashback, no strings attached.

✅ Extra financial perks: Enjoy up to 8% APY on staked stablecoins (region-based), plus cashback bonuses during the first 30 days.

✅ Lowest fees on the market: Only 1.7% comprehensive fee, compared to 2–3% for most competitors, with zero top-up or monthly charges.

✅ Legally issued: Through official Mastercard in the EU and Visa in Asia, making it one of the few truly licensed cross-region crypto cards.

✅ Seamless payment experience: Integrated with Google Pay and Apple Pay, enabling NFC tap-to-pay at any Mastercard/Visa terminal.

✅ Native crypto-to-fiat conversion: Instantly converts crypto at the moment of transaction, removing manual steps or delays.

👉 Ready to experience the future of crypto payments?

Get started with the Bitget Wallet Card today and enjoy low fees, instant crypto-to-fiat spending, and exclusive rewards — all backed by a trusted Web3 wallet.

🔗 Download Bitget Wallet and apply in minutes.

Apply for Bitget Wallet Card Right Now!

If you're looking for a legally issued crypto debit card with industry-low fees, instant crypto-to-fiat conversion, and seamless integration with your wallet and mobile payments — the Bitget Wallet Card is your best bet in 2025.

✅ Get $5 free just for verifying your account — no strings attached.

✅ Enjoy just 1.7% total fees — lower than 90% of the market

✅ Stake stablecoins and earn up to 8% APY

✅ Get extra cashback in your first 30 days

✅ No top-up or monthly fees, and quick KYC approval

👉 Ready to simplify your crypto spending?

Download Bitget Wallet and apply for your first crypto debit card in minutes!

Conclusion

How to Buy Crypto with Visa Card is one of the most convenient ways to enter the crypto market in 2025. With global acceptance, fast settlement, and compatibility with tools like Bitget Wallet, Visa lets you skip banking delays and own crypto instantly. Whether you’re buying Bitcoin, exploring DeFi, or collecting NFTs, Visa’s flexibility works for every strategy.

For secure storage, cross-chain swaps, and seamless Visa integration, Bitget Wallet is your all-in-one solution. Spend stablecoins anywhere with the beginner-friendly Bitget Wallet Card — making everyday crypto use effortless.

Sign up Bitget Wallet now - grab your $2 bonus!

FAQS

1: Can I buy crypto with any type of Visa card?

Yes — you can use Visa credit, debit, prepaid, and virtual cards to purchase crypto. Even Visa gift cards can be redeemed through supported platforms like Baxity Store and added to wallets such as Bitget Wallet.

2: How long does it take to receive crypto when paying with a Visa card?

Most Visa crypto purchases are processed instantly or within a few minutes, depending on the platform and your bank’s payment verification process.

3: Is it safe to buy crypto with a Visa card?

Yes — provided you use trusted, regulated platforms like Bitget Wallet. Visa’s fraud protection, combined with wallet-level security features like 2FA, makes it a secure payment method for crypto.

Risk Disclosure

Please be aware that cryptocurrency trading involves high market risk. Bitget Wallet is not responsible for any trading losses incurred. Always perform your own research and trade responsibly.

- How to Apply for a Crypto Mastercard2026-01-05 | 5 mins

- How to Apply for a Crypto Visa Card and Start Spending Crypto Worldwide2026-01-02 | 5 mins

- How to Top Up Your Crypto Debit Card with USDT2025-12-29 | 5mins