What is Crypto Credit Card and How Does It Work?

What is Crypto Credit Card? It’s a payment card that allows you to spend in fiat currency while earning cryptocurrency rewards such as Bitcoin, Ethereum, or stablecoins. Unlike traditional cards tied only to banks, a crypto credit card connects to your digital wallet and uses Visa or Mastercard networks to convert crypto into local currency at checkout. This makes everyday shopping seamless while giving you rewards in digital assets instead of standard cashback or points. For example, the Bitget Wallet Card lets you spend globally, draw from your crypto balance, and earn rewards in popular tokens—bridging traditional payments with the benefits of blockchain.

This makes everyday shopping seamless while giving you rewards in digital assets instead of standard cashback or points. For instance, the Bitget Wallet Card allows you to make purchases globally, spend directly from your crypto balance, and receive crypto rewards—combining convenience with asset-building potential.

In the sections ahead, we’ll break down how crypto credit cards work, the difference between credit and debit variants, how to apply, and the factors to weigh when choosing the best option for your needs.

Key Takeaways

- How Crypto Credit Cards Work

Crypto credit cards let you spend Bitcoin, Ethereum, and stablecoins like cash by instantly converting them into fiat at checkout. This makes them usable anywhere Visa or Mastercard is accepted. -

Crypto Credit Card Rewards vs Cashback

Crypto credit card rewards can include Bitcoin, Ethereum, or stablecoins—unlike traditional cards that only give cashback or points. Over time, these rewards may grow in value, turning everyday spending into a potential investment.

-

Crypto Credit vs Debit Cards

Choosing between a crypto credit card and a crypto debit card depends on your goals. Credit cards offer rewards and build credit history, while debit cards draw directly from your wallet balance for instant settlement. The Bitget Wallet Card combines low fees with wallet integration, making it easier to manage spending and rewards in one place.

What is a Crypto Credit Card and How Does It Work?

A crypto credit card is a payment card that works like a traditional credit card but gives you rewards in cryptocurrency such as Bitcoin, Ethereum, or stablecoins. You still pay in fiat (USD, EUR, GBP, etc.), while the issuer converts everything behind the scenes so the merchant receives fiat and you receive crypto rewards.

According to industry data from leading providers, most crypto rewards cards offer between 1.5% and 3% back in cryptocurrency. The exact percentage depends on the card and spending category. For example:

- Gemini Credit Card – Up to 3% back in crypto for dining, 2% on groceries, 1% on all other purchases, rewards paid per transaction.

- BlockFi Rewards Visa – Flat 1.5% back in Bitcoin on all purchases, rewards paid monthly.

One notable difference among cryptocurrency credit cards is reward payout timing. Some, like Gemini, deposit rewards immediately after each transaction, allowing you to benefit from market swings sooner. Others, like BlockFi, credit rewards monthly, which can delay your ability to trade or use the earned crypto.

Currently, most crypto credit cards don’t pull funds directly from your crypto wallet for payments. Instead, they operate like standard credit cards, using a fiat balance with crypto rewards layered on top. However, as wallet integration evolves, future cards may allow direct spending from assets held in platforms like Bitget Wallet Card, making them even more versatile.

Source: Gemini

What Types of Rewards Can You Earn with a Crypto Credit Card?

Crypto credit card rewards vary depending on the issuer, but typically include Bitcoin, Ethereum, stablecoins, or even altcoins. These rewards work like cashback, except instead of fiat, you accumulate digital assets that may grow in value.

- Bitcoin (BTC) – The most common crypto reward, often treated as a long-term investment.

- Ethereum (ETH) – A top choice for users involved in DeFi or NFT markets.

- Stablecoins (USDC, USDT) – Rewards pegged to fiat for those who want to avoid volatility.

- Altcoins – Some cards allow a choice of alternative cryptocurrencies, offering higher risk and potential reward.

Flexibility vs. Fixed Rewards

- Flexible rewards: Cards like the Gemini Credit Card let you choose from 60+ cryptocurrencies and switch anytime.

- Fixed rewards: Others, such as BlockFi Visa, limit rewards to Bitcoin only.

Limitations to Consider

- Not every coin is available across all issuers.

- Some providers only offer their in-house tokens as rewards.

| Card Provider | Reward Rate | Reward Options | Flexibility | Payout Timing |

| Gemini Credit Card | 3% dining, 2% groceries, 1% all else | BTC, ETH, 60+ others | Flexible | Per transaction |

| BlockFi Visa | 1.5% flat | Bitcoin only | Fixed | Monthly |

| Bitget Wallet Card* | Varies by region | BTC, ETH, USDT, USDC, others | Flexible | Per transaction |

- Availability and rates may vary based on jurisdiction

Are Crypto Credit Cards Safe and Regulated?

While cryptocurrency credit cards operate within established payment networks, their safety depends on both the issuer and your personal security practices.

Security & Network Protections

- Issued by banks or fintechs partnered with Visa or Mastercard, offering standard fraud protection.

- Encrypted transactions and multi-factor authentication on associated apps.

Regulation & Jurisdiction

- Must comply with financial regulations in the country of issuance.

- May not be available in all regions due to crypto-related restrictions.

Risks to Consider

- Volatility – Rewards paid in Bitcoin, Ethereum, or altcoins can fluctuate in value, sometimes sharply.

- Tax Implications – In many jurisdictions, crypto rewards count as taxable income and trigger capital gains when sold or spent.

- Custodial Risk – Rewards are often held by the issuer or an exchange partner; you may not have immediate self-custody.

By choosing reputable providers, monitoring market conditions, and staying compliant with local regulations, you can mitigate most of the risks while taking advantage of the unique benefits of a crypto credit card.

Crypto Credit Card vs Crypto Debit Card: Key Differences

Both crypto credit cards and crypto debit cards allow you to spend cryptocurrency in the real world, but they operate very differently under the hood. A crypto debit card is linked directly to your crypto wallet or exchange account, using your existing digital asset balance to fund transactions. In contrast, a crypto credit card functions like a traditional credit card, letting you borrow up to a set limit and repay later—while earning rewards in cryptocurrency.

Understanding these distinctions is essential before choosing the right option for your needs.

Key Differences Between Crypto Credit and Debit Cards

| Feature | Crypto Credit Card | Crypto Debit Card |

| Funding Source | Borrowed credit line (paid monthly) | Direct from wallet or exchange balance |

| Billing Method | Monthly statement, minimum payment required | Immediate deduction from available funds |

| Rewards Payout | Crypto rewards (BTC, ETH, stablecoins) after each transaction or monthly | Often none, or limited cashback in crypto |

| Fees | Interest on carried balances, annual fees possible | Conversion fees, loading fees |

| Credit Impact | ✅ Can improve score with responsible use ❌ Missed payments hurt score |

❌ No credit score effect |

| Pros | ✅ Builds credit ✅ Crypto rewards ✅ Higher spending power |

✅ No debt risk ✅ Instant settlement ✅ Simple approval |

| Cons | ❌ Interest risk ❌ Potential for debt ❌ Eligibility requirements |

❌ Limited rewards ❌ Dependent on wallet balance ❌ Conversion volatility |

How Does a Crypto Credit Card Work?

A crypto credit card works almost exactly like a conventional credit card in terms of payment flow. You use the card for purchases, the merchant receives fiat currency via the Visa or Mastercard network, and you receive a monthly statement showing your total balance due. Instead of traditional cashback or points, you earn cryptocurrency rewards—often between 1.5% and 3% of your spending, depending on the issuer and category.

Key aspects include:

- Fiat Settlement – All payments are processed in local currency, with crypto rewards credited to your account.

- Interest Fees – If you carry a balance, standard credit card interest rates apply.

- Credit Score Impact – Activity is reported to credit bureaus, meaning responsible use can improve your score, while missed payments can harm it.

- Eligibility Requirements – You typically need good credit, proof of income, and residency in supported jurisdictions.

How Does a Crypto Debit Card Work?

A crypto debit card is directly linked to a crypto wallet or exchange account, such as Bitget Wallet, and draws funds from your existing balance. You can either preload the card with cryptocurrency or allow the issuer to auto-convert your assets to fiat at the time of purchase.

Key aspects include:

- Direct Link to Wallet/Exchange – No borrowing; spending is limited to your available balance.

- Conversion Process – Crypto is sold instantly at current market rates to settle the transaction in fiat.

- Transaction Speed – Purchases clear as quickly as a traditional debit card.

- No Interest Fees – Since there’s no credit involved, you won’t pay interest, but conversion fees may apply.

- Spending Limits – Limits depend on your wallet balance, exchange withdrawal caps, and card provider rules.

Read more: What Is a Crypto Debit Card and How Does It Work?

How Can You Apply for a Crypto Credit Card?

Most crypto credit cards require a good credit score, KYC verification, and an online application. Applicants usually provide proof of identity, residency, and income.

Typical Application Steps:

- Choose a Provider – Look for trusted names with solid reputations, clear fee structures, and strong security records.

- Check Eligibility – Requirements often include proof of identity, residency in a supported country, and meeting minimum income levels.

- Review Supported Cryptocurrencies – Some cards only offer Bitcoin rewards, while others let you choose from dozens of coins.

- Apply Online – Fill out the issuer’s secure application form and consent to the credit check.

- Wait for Approval – Once approved, you’ll receive your card by mail and can start earning rewards on everyday purchases.

Provider Evaluation Factors:

- Trust & Reputation – Choose issuers backed by well-known financial institutions or regulated exchanges.

- Fees & Rates – Compare annual fees, foreign transaction fees, and interest rates.

- Reward Structure – Assess reward percentages, payout timing, and available cryptocurrencies.

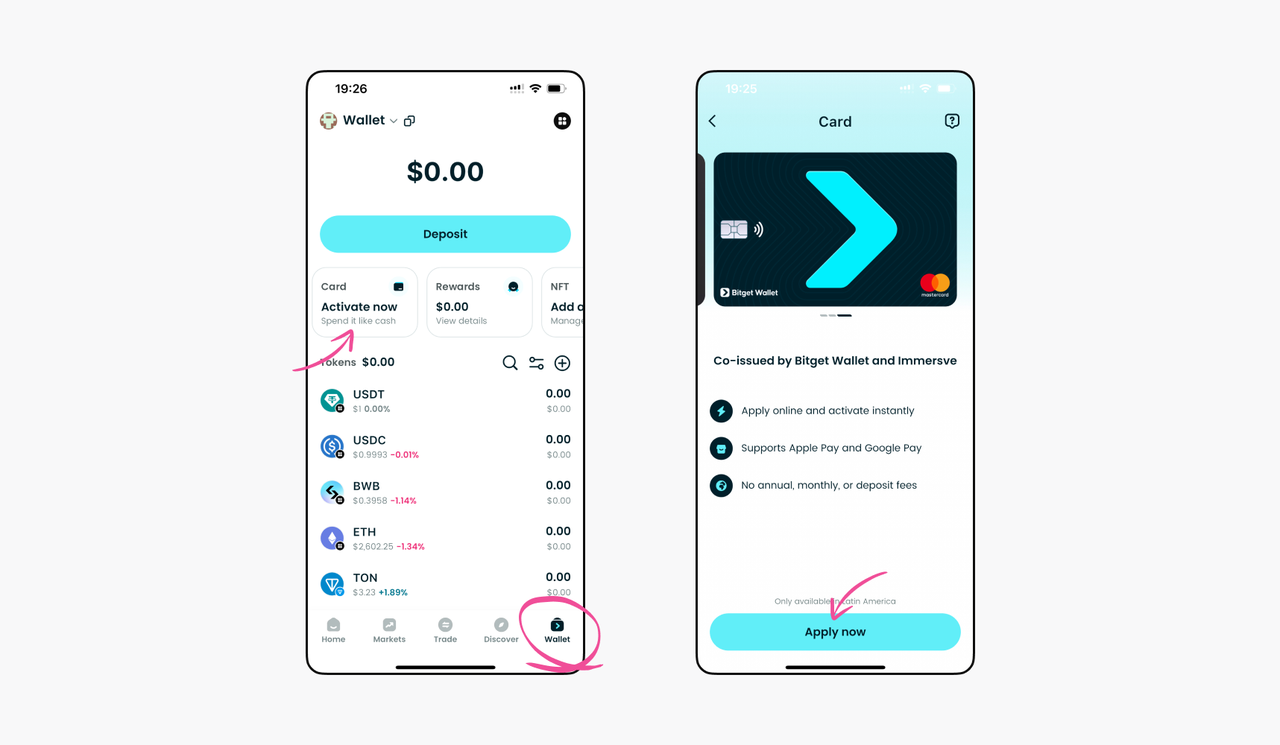

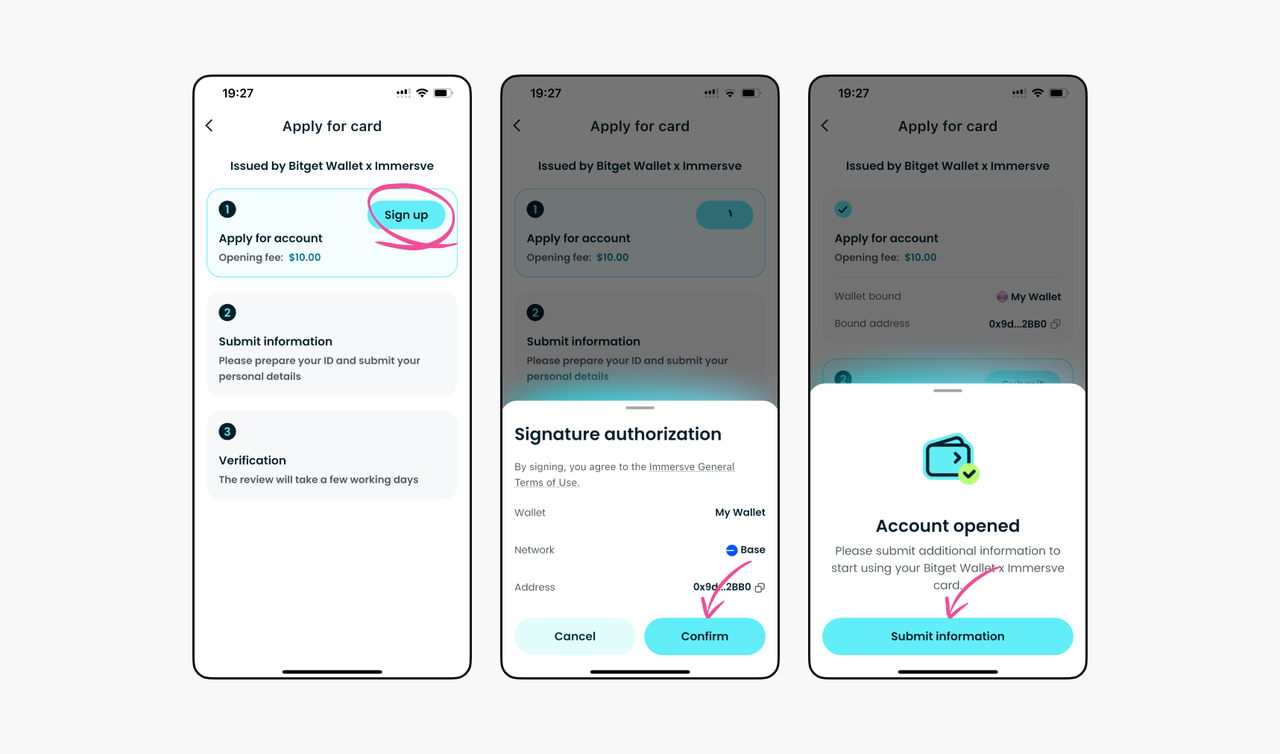

How to Apply for Bitget Wallet Card?

Getting started takes just a few simple steps:

Step 1 – Download Bitget Wallet & Apply

-

Install the Bitget Wallet app from the official site or app store.

Navigate to Wallet → Card → Apply Now.

Step 2 – Sign Up & Pay the Issuance Fee

-

Sign up within the app and sign the transaction.

Pay the one-time issuance fee of 10 USDC.

Step 3 – Provide Personal Details

Enter your country, address, contact info, and estimated monthly spend.

Step 4 – Complete Identity Verification

-

Upload a valid ID (passport, driver’s license, or national ID).

-

Complete face verification (usually takes under 3 minutes).

Step 5 – Activate Your Card & Add to Pay Services

- Activate your card once approved.

- Add it to Google Pay or Apple Pay for in-store and online use.

Why Bitget Wallet Card Stands Out?

Among the many options available in the crypto card space, the Bitget Wallet Card distinguishes itself through its legal infrastructure, seamless wallet integration, and highly competitive fee model. Unlike most crypto cards that act as third-party extensions, Bitget's solution is directly backed by its wallet ecosystem — allowing users to enjoy smoother KYC, native crypto-to-fiat conversion, and a host of financial perks.

Here’s why the Bitget Wallet Card is one of the most compelling choices :

✅ Sign Up, Verify, Earn: Complete KYC and get $5 cashback, no strings attached.

✅ Extra financial perks: Enjoy up to 8% APY on staked stablecoins (region-based), plus cashback bonuses during the first 30 days.

✅ Lowest fees on the market: Only 1.7% comprehensive fee, compared to 2–3% for most competitors, with zero top-up or monthly charges.

✅ Legally issued: Through official Mastercard in the EU and Visa in Asia, making it one of the few truly licensed cross-region crypto cards.

✅ Seamless payment experience: Integrated with Google Pay and Apple Pay, enabling NFC tap-to-pay at any Mastercard/Visa terminal.

✅ Native crypto-to-fiat conversion: Instantly converts crypto at the moment of transaction, removing manual steps or delays.

👉 Ready to experience the future of crypto payments?

Get started with the Bitget Wallet Card today and enjoy low fees, instant crypto-to-fiat spending, and exclusive rewards — all backed by a trusted Web3 wallet.

🔗 Download Bitget Wallet and apply in minutes.

How to Choose the Right Crypto Credit Card for You?

With so many options on the market, finding the ideal card comes down to understanding the benefits of crypto credit card use versus the potential fees for crypto credit card accounts. A well-chosen card can help you grow your crypto holdings while fitting seamlessly into your everyday spending habits.

Key Factors to Consider:

- Reward Rate & Eligible Coins – Look at the percentage back in cryptocurrency. Rates vary widely, typically between 1.5% and 3%, and the list of eligible coins can range from just Bitcoin to dozens of altcoins and stablecoins.

- Annual & Transaction Fees – Compare annual membership costs, foreign transaction charges, and crypto conversion fees. Even “no-fee” cards may have hidden costs like ATM withdrawal charges.

- Credit Limit & Perks – Higher credit limits offer more spending power but require stronger credit histories. Some cards include extras like airport lounge access, partner discounts, or priority customer support.

- Availability in Your Location – Not every card is available globally. For example, BitPay supports U.S. residents with a maximum balance of $25,000, while certain European-issued cards have different limits.

- Spending Limits – Consider daily or monthly caps. High-limit cards suit frequent travelers or business expenses, while lower limits may suit casual users.

If you’re exploring ways to integrate crypto into your spending, platforms like Bitget Wallet not only store and swap your coins but also connect to payment solutions, making it easier to bridge the gap between blockchain assets and real-world purchases.

What Are the Pros and Cons of Using a Crypto Credit Card?

| Pros ✅ | Cons ❌ |

| Earn Crypto Rewards Receive Bitcoin, Ethereum, or other coins instead of traditional points. |

Volatility Risk The value of rewards can drop quickly with market swings. |

| Global Acceptance Spend anywhere Visa/Mastercard is accepted. |

Tax Implications Rewards are often taxable as income; using them may trigger capital gains. |

| Flexible Redemption Convert to fiat, hold for potential appreciation, or trade for other coins. |

Potentially High Fees Annual, transaction, and conversion fees can erode rewards. |

| Integration with Wallets Some cards link to crypto wallets for easy management. |

Limited Availability Not all cards are accessible in every country. |

FAQs about Crypto Credit Cards

1. Do crypto credit cards affect your credit score?

Yes. Like traditional credit cards, crypto credit cards report activity to credit bureaus. Responsible use can improve your score, while late payments may hurt it.

2. Which cryptocurrencies can I earn as rewards?

It depends on the issuer. Options often include Bitcoin, Ethereum, stablecoins, and sometimes altcoins. Check each provider’s eligible rewards list before applying.

3. Can I spend crypto directly with these cards?

Most do not spend crypto directly. They process purchases in fiat, with rewards credited in cryptocurrency. Future cards may allow direct wallet spending.

4. Are crypto credit card rewards taxable?

In many jurisdictions, yes. Rewards are taxable as income, and converting or spending them may trigger capital gains tax.

5. What’s the difference between crypto credit cards and prepaid crypto cards?

Credit cards use a borrowed credit line and repay monthly, earning rewards. Prepaid crypto cards are loaded with your own crypto or fiat balance for spending.

Sign up Bitget Wallet now - grab your $2 bonus!

Conclusion

What is Crypto Credit Card is more than a payment tool — it’s a gateway to earning and using digital assets in daily life. By converting fiat purchases into cryptocurrency rewards, these cards combine familiar credit features with the benefits of blockchain technology. From understanding how they work to weighing reward rates, fees, and availability, choosing the right card means balancing convenience with long-term value. Whether you prefer Bitcoin, Ethereum, stablecoins, or a mix, the right choice can turn everyday spending into an investment strategy. To start securely, download Bitget Wallet to manage your assets, explore rewards, and connect with supported cards for seamless crypto-powered payments.

If you want to explore a practical option, the Bitget Wallet Card offers one of the lowest-fee structures available and integrates seamlessly with your wallet. To start securely, download Bitget Wallet to manage your assets, explore rewards, and connect with supported cards for seamless crypto-powered payments.

Risk Disclosure

Please be aware that cryptocurrency trading involves high market risk. Bitget Wallet is not responsible for any trading losses incurred. Always perform your own research and trade responsibly.

- How to Apply for a Crypto Mastercard2026-01-05 | 5 mins

- How to Apply for a Crypto Visa Card and Start Spending Crypto Worldwide2026-01-02 | 5 mins

- How to Top Up Your Crypto Debit Card with USDT2025-12-29 | 5mins