Best Crypto Debit Card with No Fees: Full Comparison of Features, Rewards, and Limits

Best Crypto Debit Card with No Fees is quickly becoming one of the most searched terms as global interest in crypto payment solutions surges. In this year, crypto debit cards are no longer niche tools—they’re practical, everyday financial instruments. Whether you’re spending USDT at a café in London or topping up your mobile bill in Singapore, these cards enable fast, flexible, and borderless transactions that blend seamlessly into your lifestyle.

The rising demand for low-fee, Web3-compatible debit cards is transforming the fintech landscape. Users now expect mobile-first functionality, compatibility with Apple Pay and Google Pay, instant crypto-to-fiat conversion, and even passive income via staking APY.

In this article, we’ll summarize the best crypto debit cards with no fees, compare their features and regional access, and explain why the Bitget Wallet Card stands out as a top choice for navigating today’s decentralized Web3 world.

What Is a Crypto Debit Card and How Does It Work?

A crypto debit card allows you to spend Bitcoin, Ethereum, or stablecoins just like a traditional bank card. Linked to Visa or Mastercard networks, it automatically converts your crypto into fiat currency at the point of sale—bridging the Web3 and Web2 worlds seamlessly.

Unlike traditional cards tied to bank accounts, crypto cards often connect to self-custody Web3 wallets or custodial crypto accounts. This means you retain full control of your assets while gaining real-world usability.

| Feature | Traditional Debit Card | Crypto Debit Card |

| Currency | Fiat only | Crypto (converted to fiat at payment) |

| Issuer | Banks | Crypto/Fintech platforms |

| KYC Requirements | Mandatory | Optional (some offer no-KYC options) |

| Compatible Networks | Visa/Mastercard | Visa/Mastercard |

| Global Usage | Yes | Yes (region-dependent) |

| Linked Wallet | Bank account | Crypto wallet (custodial or non-custodial) |

| On-chain Spending | ❌ | ✅ Auto-swap enabled |

How Crypto Integrates Into Daily Spending?

Crypto debit cards have evolved from experimental tools to practical payment solutions. With Web3 wallets, Layer 2 networks, and real-time swap technology, you can now spend crypto as smoothly as fiat—while all conversions happen automatically in the background.

- Spend crypto directly: Buy coffee in EUR while holding only USDT—auto-conversion happens at checkout.

- Instant swaps, no manual steps: The process runs seamlessly in the background; just tap and pay.

- Full asset control: You retain ownership of your Web3 wallet or custodial assets—unlike with banks.

- Smart routing for lower fees: Some Visa/Mastercard cards optimize networks for cost and speed.

Why Choose a No-Fee Crypto Debit Card?

A no-fee crypto card provides a frictionless way to spend your crypto—without being punished by hidden or recurring charges. In this year, the push toward transparency and accessibility has made fee-free models not just desirable, but expected by crypto-savvy users.

Traditional cards—and even some early crypto cards—were notorious for nickel-and-diming users through a maze of fees:

- Top-up fees when transferring crypto

- FX (foreign exchange) fees for cross-border spending

- Monthly maintenance fees

- Inactivity penalties after a few months of dormancy

These costs can add up, eating into your crypto gains. That’s why many are switching to best crypto prepaid cards with zero-fee policies, especially those issued by innovative platforms like Bitget Wallet, Crypto.com, and Wirex. They allow you to retain more value from your crypto while enjoying full payment flexibility.

Choosing a no-fee crypto debit card also reflects a shift toward user-first design in the Web3 space—where financial tools are expected to be transparent, accessible, and aligned with decentralized principles.

Which Are the Best Crypto Debit Cards with No Fees?

Best Crypto Debit Cards with No Fees are not just about spending crypto—they offer rewards, passive income, and global usability.

Below are the top-performing no-fee crypto cards this year, with a breakdown of their features, limits, and regional support. Whether you're based in the UK, EU, or Asia, there's an option tailored for your lifestyle.

1. Bitget Wallet Card

Bitget Wallet Card is hands down the best crypto card you can own in 2025. It’s more than just a payment tool—it's your ultimate Web3 companion, built for those who want to spend smarter, earn passively, and stay fully in control of their digital assets. Legally issued under Mastercard and deeply integrated with the Bitget Wallet app, this card lets you live the Web3 lifestyle effortlessly and securely.

- No top-up fees, no withdrawal fees, no monthly fees – total transparency, zero hassle.

- Instant $5 reward after KYC, with no need to stake any tokens.

- Earn up to 8% APY on stablecoins—make your idle crypto work for you.

- Use globally with Apple Pay & Google Pay, online and in-store.

- Self-custody by default – your keys, your coins, your freedom.

This isn’t just a card—it’s your gateway to a smarter, borderless financial future. While other cards tie you down with staking, hidden fees, or regional limitations, Bitget Wallet Card keeps it simple, powerful, and user-first. Spend instantly, earn passively, and control your assets—all in one app, with no compromises. It’s made for pioneers who don’t just spend crypto—they grow it.

2. Crypto.com Visa Card

Crypto.com’s Visa card remains popular, especially for users invested in the CRO ecosystem. It offers up to 8% cashback (in CRO), but only for users who stake large amounts of CRO tokens. Lower-tier cards come with fewer perks and include FX fees for international use.

Perks such as Netflix and Spotify reimbursements are still appealing, but the need to stake CRO and the fluctuating reward structure make it less accessible than Bitget Wallet’s straightforward model.

Source: Crypto.com

3. Coinbase Card

The Coinbase Card is designed for existing Coinbase users and offers 1–4% cashback in GRT or XLM. While it charges no annual fee, it does include foreign exchange and crypto conversion fees, which can cut into reward value during international travel or high-frequency use.

It works well for U.S.-based users who already store their assets in Coinbase and want easy access to spendable crypto.

Source: Coinbase.com

4. Wirex Card

Wirex Card supports over 25 types of crypto and offers up to 8% cashback in its native WXT token. It stands out with ATM withdrawal support and the ability to earn passive yield on select crypto balances. It’s ideal for users seeking flexibility and reward diversity, although fee structures for international usage can vary depending on the region and tier.

Source: Wirexapp.com

5. Nexo Card

The Nexo Card is a hybrid between a credit and debit card, offering 0.5–2% cashback depending on loyalty tier. It doesn’t charge monthly fees, but regional availability is limited, and users may need to maintain assets on the Nexo platform to unlock full functionality.

Its strength lies in allowing users to spend without selling—crypto is used as collateral, making it more attractive for long-term holders.

Source: Nexo.com

6. Bybit Card

A relatively new entrant, the Bybit Card offers up to 10% cashback depending on usage and balance. It supports 8 major cryptocurrencies and is known for its intuitive UX and rapid issuance process. However, features like staking or advanced yield are still in development.

It’s a solid entry-level option for users who already trade on Bybit and want integrated spending capabilities.

Source: Announcements.bybit.com

Card Comparison Table

| Card | Fees | Cashback | APY | Supported Regions | Google/Apple Pay |

| Bitget Wallet | 1.7% (total) | $5 bonus + BGB | Up to 8% | UK, EU, Asia | ✅ |

| Coinbase | FX + conversion | 1–4% (GRT/XLM) | ❌ | US | ✅ |

| Crypto.com | FX (lower tiers) | Up to 8% (CRO) | Varies | Global (CRO limits) | ✅ |

| Wirex | Region-based | Up to 8% (WXT) | Passive yield | EU, UK, SEA | ✅ |

| Nexo | ❌ | 0.5–2% | ❌ (but uses crypto as collateral) | EU, UK, parts of Asia | ❌ |

| Bybit | Low (launch promo) | Up to 10% | ❌ | EU + expanding | ✅ |

Clearly, Bitget Wallet Card stands out as the center of Web3 spending—low fees, strong rewards, and full DeFi integration make it the top no-fee crypto debit card of this year.

What Features Should You Compare Before Choosing a Crypto Debit Card?

The best no-fee crypto debit cards are those that deliver real, practical value — from flexible daily spending and generous cashback to passive income via staking. Before choosing a card, carefully evaluate the key factors that directly impact your experience and long-term financial gains.

| Criteria | Why It Matters | Recommended Benchmark |

| Usage Fees | Avoid hidden or recurring charges that reduce your asset value | 0–1.7% total fees |

| Cashback | Maximize rewards on everyday spending | 5–10% |

| Staking Yield / APY | Earn passive income on stablecoins | 5–8% |

| Payment Compatibility | Seamless spending online or in-store via mobile | Google Pay, Apple Pay |

| KYC & Legal Compliance | Ensures the card is legally issued with full feature support | Licensed in EU, Asia, UK |

| Fiat Support | Instant crypto-to-fiat conversion at checkout | Integrated swap within wallet |

Comparing these criteria helps you choose a no-fee crypto card that’s not only cost-efficient but also aligned with your lifestyle and financial goals.

How to Apply for a Crypto Debit Card?

Crypto debit cards offer a seamless way to spend digital assets in real life—but not all cards are easy to apply for. Fortunately, Bitget Wallet Card stands out as one of the most user-friendly and cost-effective options, especially for those seeking a crypto debit card with no hidden fees.

Whether you're new to Web3 or a seasoned crypto user, here's a step-by-step guide on how to apply for a crypto debit card, using Bitget Wallet Card as a prime example.

Bitget Wallet Card is one of the most accessible and feature-rich crypto debit cards of year.

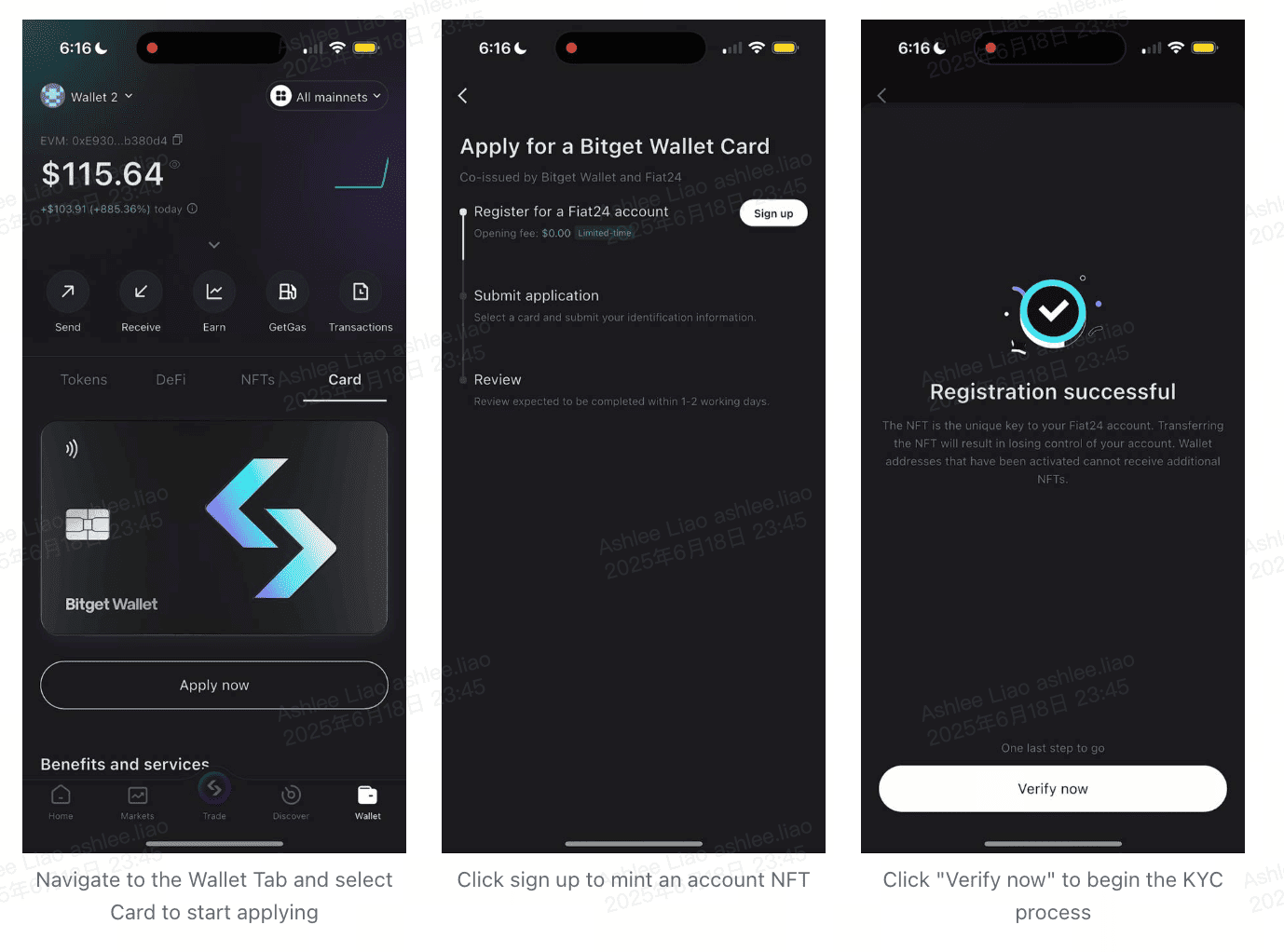

To apply for the crypto debit card, follow these steps:

Step 1: Download Bitget Wallet

Go to the App Store or Google Play and install Bitget Wallet app. It’s a non-custodial Web3 wallet that supports multi-chain assets, on-chain swaps, and staking.

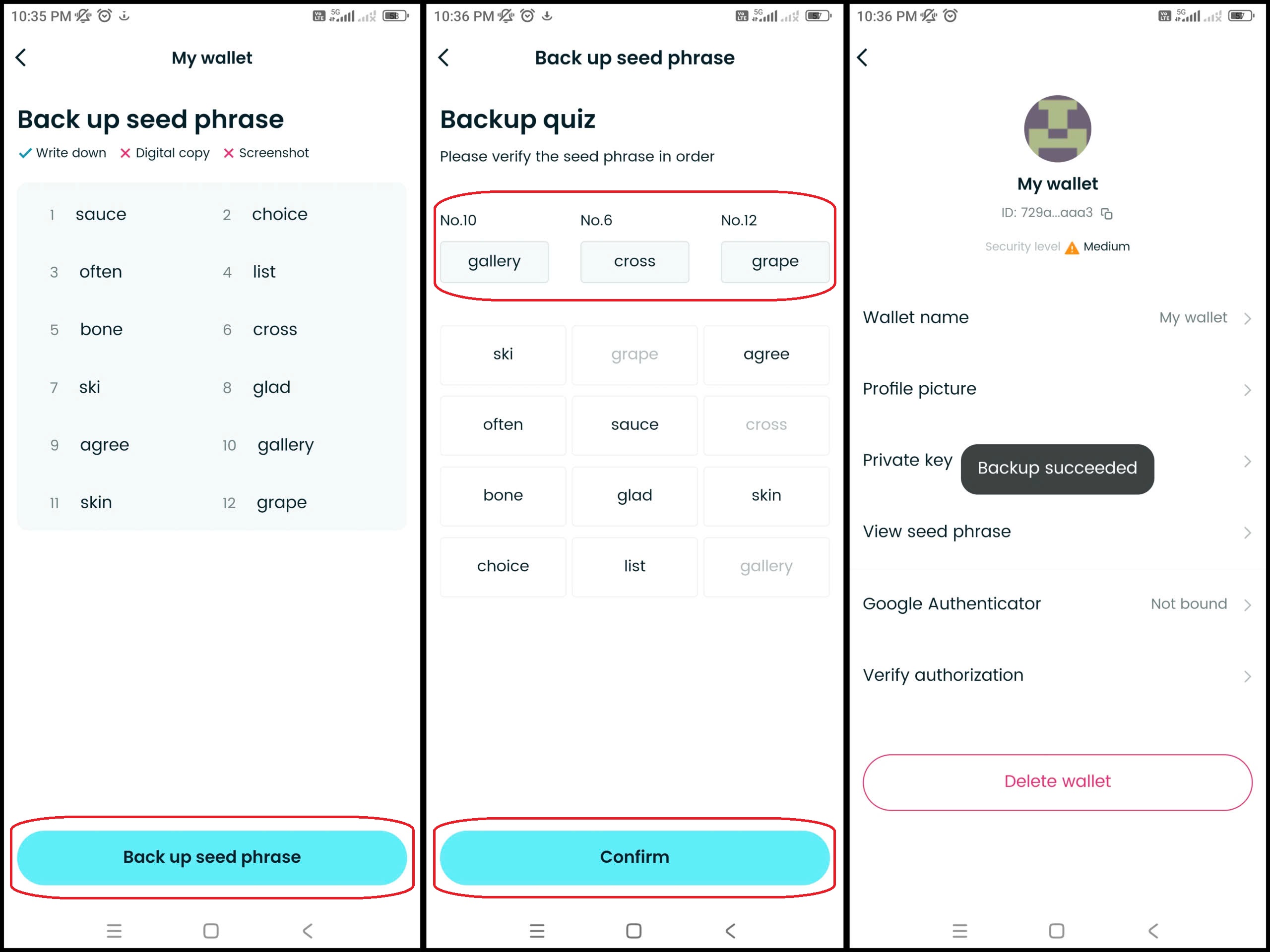

Step 2: Create an Account & Secure Your Wallet

Open the app and create a new wallet. You'll be prompted to save a 12-word recovery phrase. Store it securely—you’ll need it to access your wallet in case of device loss.

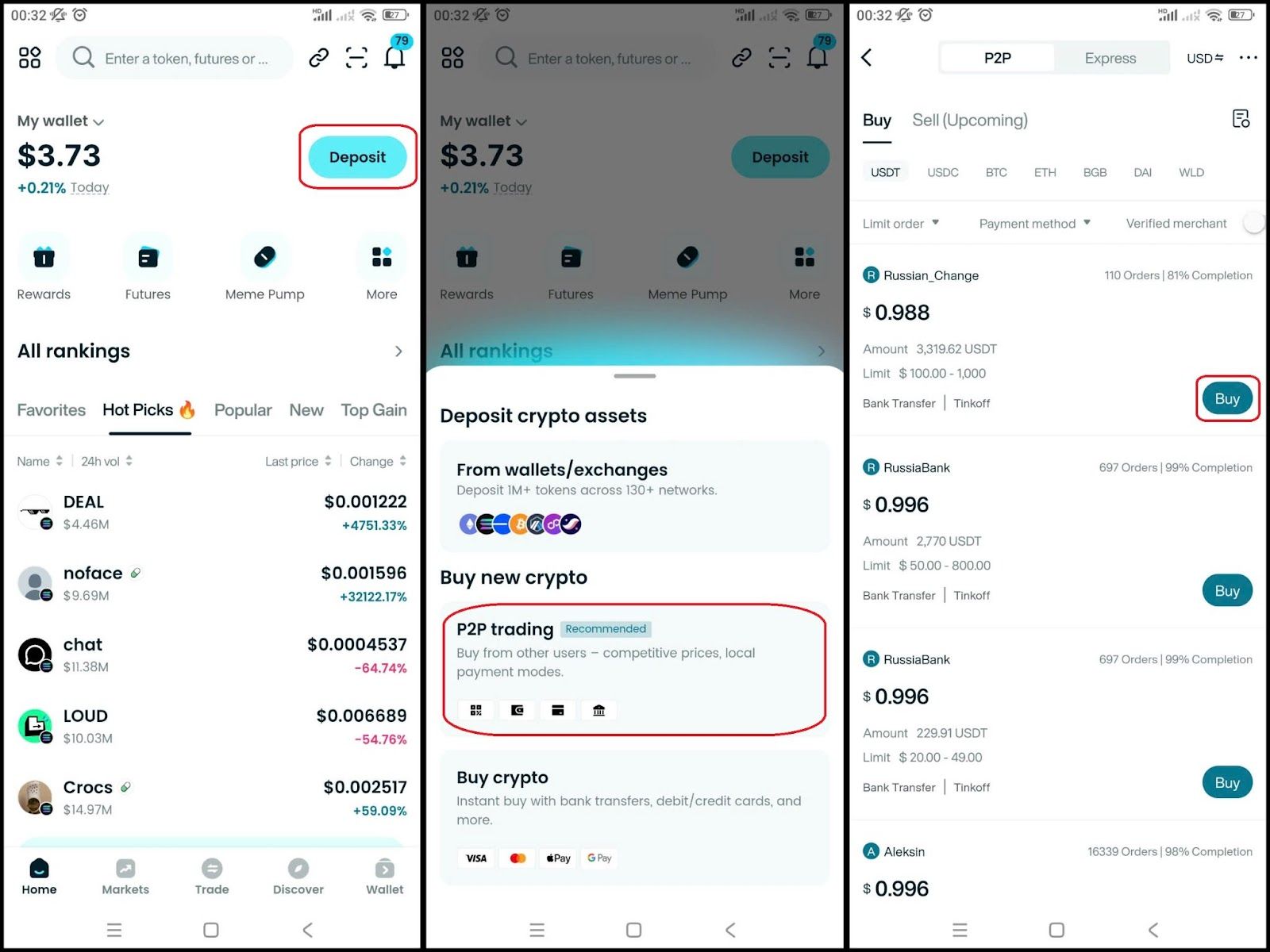

Step 3: Fund Your Wallet

Deposit supported cryptocurrencies such as USDC (on Base or Ethereum), ETH, or BTC. This balance will be used to:

- Pay the card issuance fee (10 USDC)

- Load the card for spending

Step 4: Apply for the Card

In the Bitget Wallet app:

- Navigate to Wallet → Card → Apply Now

- Fill in your details and pay the 10 USDC issuance fee

- A virtual card will be issued instantly. For physical cards, shipping is available in eligible regions (EU, UK, LatAm, Australia, New Zealand).

With just a few simple steps, you can unlock the full potential of your crypto assets and start spending as easily as cash. The Bitget Wallet Card offers a user-friendly experience and powerful features, making it your ultimate companion for seamless crypto spending.

Where Can You Use the Best No-Fee Crypto Debit Cards?

Not all crypto debit cards work the same everywhere. Depending on your region, regulations, issuer networks (Visa/Mastercard), and local laws can impact where and how you use them.

- UK & EU:

- Bitget Wallet Card – legally issued, low fees, wide availability.

- Crypto.com Visa Card – strong brand, requires staking.

- Gnosis Pay – native EU launch, limited support.

- Asia-Pacific:

- Bitget Wallet Card – widely available across Southeast Asia and supports local currencies.

- Wirex – strong in Asia, supports over 25 tokens.

- Nexo Card – supported in select APAC countries only.

Legal Note: Always check your local KYC requirements and cross-border FX fees. Some cards (like Crypto.com) charge foreign exchange or inactivity fees depending on your jurisdiction.

Why Bitget Wallet Card Stands Out?

Among the many options available in the crypto card space, the Bitget Wallet Card distinguishes itself through its legal infrastructure, seamless wallet integration, and highly competitive fee model. Unlike most crypto cards that act as third-party extensions, Bitget's solution is directly backed by its wallet ecosystem — allowing users to enjoy smoother KYC, native crypto-to-fiat conversion, and a host of financial perks.

Here’s why the Bitget Wallet Card is one of the most compelling choices :

✅ Sign Up, Verify, Earn: Complete KYC and get $5 cashback, no strings attached.

✅ Extra financial perks: Enjoy up to 8% APY on staked stablecoins (region-based), plus cashback bonuses during the first 30 days.

✅ Lowest fees on the market: Only 1.7% comprehensive fee, compared to 2–3% for most competitors, with zero top-up or monthly charges.

✅ Legally issued: Through official Mastercard in the EU and Visa in Asia, making it one of the few truly licensed cross-region crypto cards.

✅ Seamless payment experience: Integrated with Google Pay and Apple Pay, enabling NFC tap-to-pay at any Mastercard/Visa terminal.

✅ Native crypto-to-fiat conversion: Instantly converts crypto at the moment of transaction, removing manual steps or delays.

👉 Ready to experience the future of crypto payments?

Get started with the Bitget Wallet Card today and enjoy low fees, instant crypto-to-fiat spending, and exclusive rewards — all backed by a trusted Web3 wallet.

🔗 Download Bitget Wallet and apply in minutes.

Apply for Bitget Wallet Card Right Now!

If you're looking for a legally issued crypto debit card with industry-low fees, instant crypto-to-fiat conversion, and seamless integration with your wallet and mobile payments — the Bitget Wallet Card is your best bet in 2025.

✅ Get $5 free just for verifying your account — no strings attached.

✅ Enjoy just 1.7% total fees — lower than 90% of the market

✅ Stake stablecoins and earn up to 8% APY

✅ Get extra cashback in your first 30 days

✅ No top-up or monthly fees, and quick KYC approval

👉 Ready to simplify your crypto spending?

Download Bitget Wallet and apply for your first crypto debit card in minutes!

Conclusion

Best crypto debit card with no fees isn’t just about skipping monthly charges—it’s about minimizing total costs while maximizing usability. From conversion and FX fees to cashback, staking, and supported regions, the cards we've covered—Bitget Wallet, Coinbase, Crypto.com, Wirex, Nexo, and Bybit—each serve different user needs. Yet only a few truly deliver across all fronts, especially for those who want global access and real utility without compromise.

If you want a legally issued, fee-minimal card that works seamlessly with Apple Pay, earns passive rewards, and lets you spend directly from your crypto wallet, the Bitget Wallet Card checks every box. With no top-ups, up to 8% APY, and a $5 welcome bonus, it’s the best crypto debit card with no fees of the year — and one you definitely shouldn’t miss.

Download Bitget Wallet and apply for your Bitget Wallet Card today.

Sign up Bitget Wallet now - grab your $2 bonus!

FAQs

1. Which crypto card has the lowest fees?

Bitget Wallet Card currently offers the lowest total fees in the market at just 1.7%, with no monthly, top-up, or withdrawal charges.

2. Do crypto cards with cashback perks require staking?

Some cards like Crypto.com or Nexo require staking to unlock higher cashback tiers. However, the Bitget Wallet Card offers cashback perks and APY without mandatory staking — making it a flexible option for passive earners.

3. Can I use crypto debit cards for online shopping?

Absolutely. Most leading cards, including Bitget Wallet card and Coinbase, are integrated with Google Pay or Apple Pay, allowing seamless online and offline purchases at millions of merchants.

4. Which no-fee crypto debit card is best for UK and EU users?

Bitget Wallet Card is a top choice for UK and EU users. It’s legally issued in these regions, supports Apple/Google Pay, and offers stablecoin staking rewards — making it the best no-fee crypto debit card for residents in these areas.

Risk Disclosure

Please be aware that cryptocurrency trading involves high market risk. Bitget Wallet is not responsible for any trading losses incurred. Always perform your own research and trade responsibly.

- How to Apply for a Crypto Mastercard2026-01-05 | 5 mins

- How to Apply for a Crypto Visa Card and Start Spending Crypto Worldwide2026-01-02 | 5 mins

- How to Top Up Your Crypto Debit Card with USDT2025-12-29 | 5mins