Yield Basis Listing: $YB Launch Date! How YB Rebalances Liquidity for Sustainable DeFi BTC-ETH Yields?

Yield Basis (YB) listing is creating a buzz in the crypto market, and investors are wondering: Could this be the next breakout opportunity? With Yield Basis (YB) set to launch on exchanges, traders have a unique opportunity to secure their position before broader market interest intensifies.

As a next-generation DeFi protocol, Yield Basis distinguishes itself with its innovative vaults, leverage via crvUSD, and impermanent loss mitigation, solidifying its place as a key player in the rapidly advancing blockchain sector. This milestone event paves the way for fresh investment prospects, granting global traders access to a promising new asset. In this article, we’ll break down all the essential details—from trading mechanics to core project fundamentals—helping you stay informed and ahead in the ever-evolving crypto sphere.

Yield Basis (YB) Listing Details and Launch Date

Here are the important details about the [Projector Name](Token Name) listing:

- Exchange: To be announced

- Trading Pair: YB/USDT

- Deposit Available: October 2025

- Trading Start: October 2025

- Withdrawal Available: October 2025

Don’t miss your chance to start trading Yield Basis (YB) on exchanges and be part of this groundbreaking journey.

- Please refer to the official announcement for the most accurate schedule.

Yield Basis (YB) Price Prediction 2025: How It Compares to Similar Projects

Comparing Yield Basis (YB) to Similar Tokens: Post-Listing Performance Projections

Historical trends offer valuable insights into how Yield Basis (YB) may perform after its exchange listing. By analyzing three comparable tokens from the DeFi liquidity sector (THORChain, Curve DAO, and Convex Finance), we can estimate an average listing premium and potential retracement risk.

Comparative Token Performance (First 30 Days Post-Listing)

| Token | Initial Price | Peak Price (T+30 Days) | % Increase | Retracement (%) |

| THORChain (RUNE) | $0.015 | $0.02345 | +56% | ~-30% |

| Curve DAO (CRV) | $3.02 | $4.70 | +55% | ~-40% |

| Convex Finance (CVX) | $2.47 | $19.88 | +704% | ~-55% |

| Yield Basis (YB) | $0.20 (public sale) | $0.30–$0.60 (Est.) | +50% → +200% | ~-35% to -55% |

Key Insights from Historical Analysis

-

Average Listing Premium:

Tokens in the same DeFi liquidity sector have historically delivered +50% to +200% price surges within 30 days of listing, with rare outliers (like CVX) exceeding +700%.

-

Retracement Risk:

Based on previous patterns, a 35%–55% correction is typical within 30–60 days post-peak, especially after initial hype fades or token unlocks begin.

-

Market Sentiment Factor:

If Yield Basis (YB) follows similar trajectories, its short-term upside potential could reach $0.30–$0.60 from the $0.20 sale price, with a retracement support zone likely around $0.18–$0.25.

Price Projection Based on Market History

| Time Frame | Predicted Price Range | Historical Benchmark |

| Short-term (1-3 months) | $0.30–$0.60 | Comparable token performance (RUNE +56%, CRV +55%, CVX +704% in first 30 days) |

| Medium-term (3-6 months) | NA | Industry growth patterns |

| Long-term (1 year or more) | NA | Market trends, adoption trajectory |

Note: The price prediction is sourced from third-party media at the time of writing and is for reference only. It does not represent the official stance of Yield Basis and Bitget Wallet. Please conduct your own research and refer to official market data before making any investment decisions.

What Is Yield Basis (YB) and Its Key Features?

Yield Basis (YB) is a DeFi protocol, designed to provide sustainable yield for BTC and ETH liquidity providers while minimizing impermanent loss. The project combines leverage, rebalancing vaults, and crvUSD integration to boost returns and bring a new model of liquidity provision to Web3. Its mission is to unlock safer, more efficient yield strategies for tokenized Bitcoin and Ethereum holders.

Key features

- Impermanent Loss Mitigation: Uses rebalancing vaults and leverage to protect LPs while maximizing yield.

- crvUSD Integration: Incorporates Curve’s stablecoin for collateralized borrowing and ~2x leveraged positions.

- veYB Tokenomics: Holders can lock tokens into veYB for governance, boosted rewards, and protocol fee sharing.

Source: Yield Basis on X

🚀 Yield Basis Officially Emerges! Legion Ventures Unveils $YB Token Sale Details

Yield Basis has officially stepped into the spotlight! Legion Ventures has revealed full details of the upcoming $YB token sale.

Everything kicks off with the FCFS (First Come, First Served) round at 2:00 PM UTC on October 1, 2025, aiming to raise $5 million at a $200 million FDV. The biggest highlight? 100% of tokens will unlock at TGE — a huge advantage for early backers.

Right after, applications for the exclusive pre-sale round targeting strategic, value-add investors will open, leading up to the official Token Generation Event (TGE) expected in October 2025. This marks not only Yield Basis’s public debut but also a rare chance for the community to help shape a next-generation DeFi infrastructure, set to redefine capital efficiency and yield strategies in Web3.

How Yield Basis (YB) Operates and What Benefits It Delivers?

Yield Basis (YB) operates as a liquidity vault protocol, automatically rebalancing positions while integrating leverage via crvUSD. This system delivers higher yield, minimized risk, and governance participation for token holders and LPs.

Key Technological Components

- Blockchain Network: Built on Ethereum, ensuring transparent, verifiable, and secure on-chain execution.

- Consensus Mechanism: Secured by Ethereum’s Proof-of-Stake (PoS), providing decentralization and strong security guarantees.

- Smart Contracts: Power vaults, yield distribution, veYB governance, and rebalancing mechanisms, all open-source and auditable.

- Scalability Solutions: Designed for composability with Curve and other DeFi protocols, enabling efficient liquidity flows across Web3.

The Companies and Organizations Supporting Yield Basis (YB)

The Companies

| Section | Details |

| The Team | Led by Michael Egorov (founder of Curve Finance) through Swiss Stake AG, with extensive experience in DeFi, AMMs, and ve-tokenomics. Their goal is to make Yield Basis (YB) a symbol of fairness, sustainability, and innovation in Bitcoin-native yield. |

| The Vision | Focused on building a BTC-native yield protocol, the project aims to develop a sustainable ecosystem that represents transparency and efficiency in decentralized finance, while linking liquidity providers, governance, and emissions in a balanced way. |

| Partnerships | Yield Basis (YB) collaborates with Kraken (compliance and token launch), Legion (fair allocation via Legion Score), and the Curve DAO ecosystem (support via crvUSD credit lines and governance integration) to strengthen its ecosystem and expand into Bitcoin yield and broader DeFi sectors. |

The Organization’s Partnerships

- Kraken ensures regulatory compliance, global distribution, and liquidity through Kraken Launch.

- Legion provides a reputation-based allocation system (Legion Score) to reward builders and active users in the presale.

- Curve DAO supports with crvUSD credit lines, governance, and licensing allocation, linking Yield Basis to the established Curve ecosystem.

- Community & LPs (liquidity providers) contribute by choosing between BTC fees or YB emissions, shaping the protocol’s incentives and governance.

How They Work Together?

By combining centralized launchpad expertise (Kraken, Legion) with decentralized liquidity ecosystems (Curve, veYB governance), Yield Basis bridges retail investors and institutional backers. Together, they enhance YB adoption, provide secure trading access, and fuel ecosystem incentives for long-term sustainability.

How Yield Basis (YB) is Used: Practical Benefits

Yield Basis (YB) serves a variety of purposes, including:

- Liquidity Provision with Reduced Impermanent Loss – LPs can use YB vaults to earn sustainable yields while minimizing risk through automated rebalancing.

- Leverage with crvUSD – Users can borrow crvUSD against assets to double exposure, boosting returns without manually managing complex positions.

- Governance Participation – By locking tokens into veYB, holders gain voting rights, helping steer protocol decisions and future upgrades.

- Ecosystem Incentives – Liquidity mining rewards and staking incentives drive adoption while rewarding long-term holders.

- Cross-Market Utility – Tokenized BTC/ETH holders can deploy assets in Yield Basis vaults for yield, improving capital efficiency in DeFi.

These applications highlight the practical value of $YB in decentralized finance (DeFi) by enabling safer yield generation, governance influence, and leverage opportunities.

Projector (YB Token)’s Benefits

- High Liquidity Incentives: 30% of supply allocated to LP rewards.

- Fair Governance: veYB tokenomics ensure active holders influence protocol direction.

- No Vesting at TGE: 100% unlock offers immediate usability and market activity.

- Strong Backing: Partnerships with Kraken, Legion, and Curve add credibility.

- Capital Efficiency: Integration with crvUSD enhances yield strategies without excessive risk.

Yield Basis (YB) Roadmap 2025: Key Milestones and Expansion Plans

The roadmap for Yield Basis (YB) outlines a clear path for growth and innovation:

| Quarter | Roadmap |

| Q3 2025 | Finalize private sale, strategic partnerships, and audit release before launch. |

| Q4 2025 | Token Generation Event (TGE) and official listing; FCFS public sale on Oct 1; distribution of 25M YB (2.5% supply); launch of liquidity incentives (30% allocation). |

| Q1 2026 | Expansion of ecosystem integrations, veYB governance activation, and Curve licensing fee distribution. |

These milestones highlight the practical value of $YB in the DeFi and liquidity management industry.

How to Buy Yield Basis (YB) on Bitget Wallet?

Buying Yield Basis (YB) on Bitget Wallet is easy! Just follow these simple steps:

Step 1: Create a wallet

- If you don't have a wallet, download Bitget Wallet app now.

- Register with your phone number or email, verify quickly and you can use it right away.

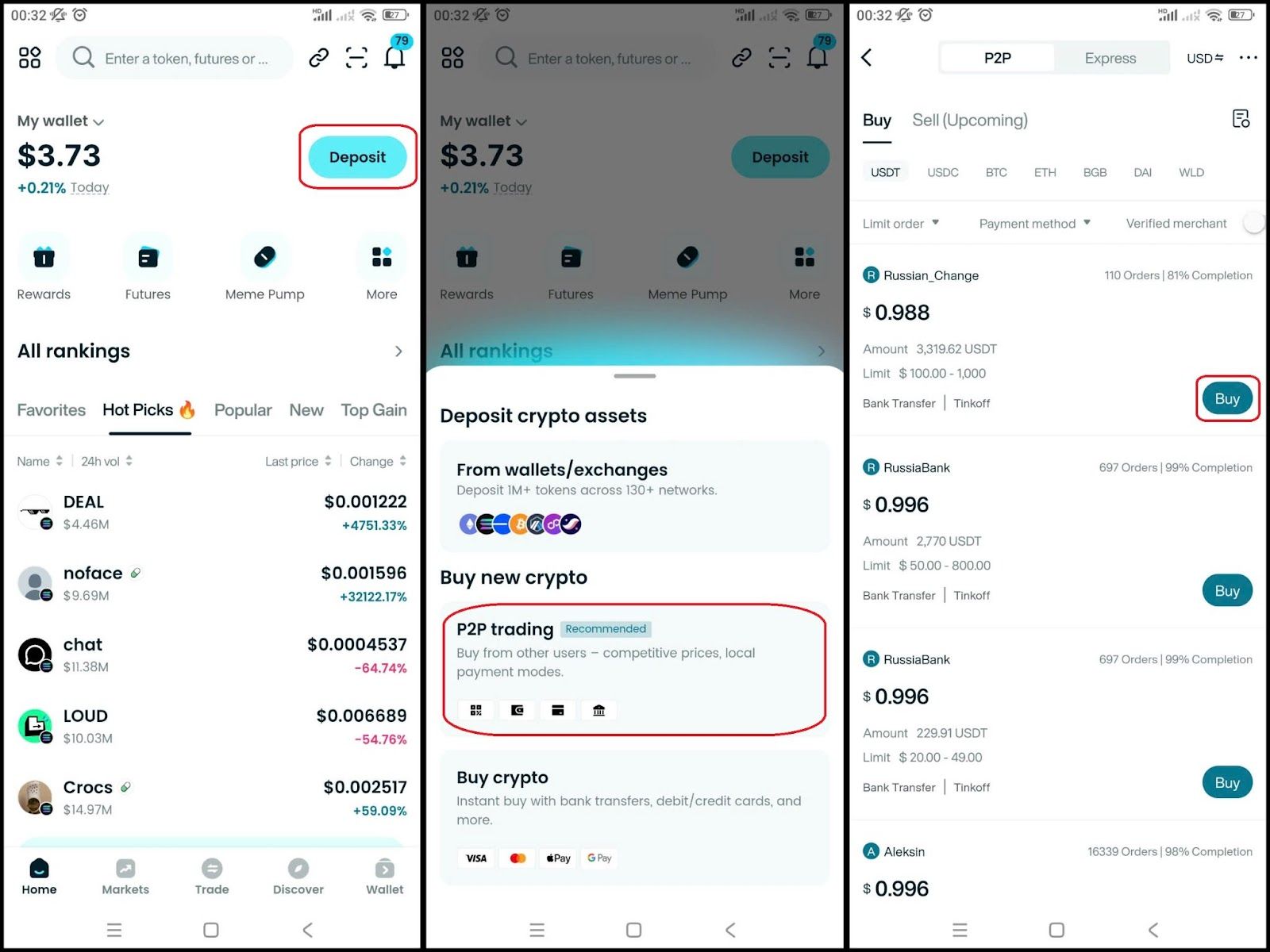

Step 2: Deposit money into your wallet

Once you have finished your wallet, you just need to deposit money into it. You can:

- Transfer coins from other wallets: Send BTC, ETH or any coin you have from an external wallet.

- Buy directly with a card: Use a bank card or credit card to buy USDT or ETH right in the app and then exchange it for USDC.

Step 3: Find Yield Basis (YB)

- In the main interface of the wallet, go to Market, type "YB" in the search bar.

- Select Yield Basis (YB) to see the trading page.

Since this token has not been listed yet, please refer to the final contract address provided by the project team after the token is officially listed.

Step 4: Select the trading pair

Select the pair you want to trade, for example YB/USDT. So you can use USDT to buy Yield Basis (YB), or vice versa.

Step 5: Place an order

Enter the amount of Yield Basis (YB) you want to buy, check carefully and confirm the order.

Step 6: Check the order

After buying, you can check your YB in the Wallet section.

Step 7: Withdraw (if needed)

Once you have Yield Basis (YB), if you want to withdraw to another wallet, go to Withdraw, fill in the receiving wallet address, check the blockchain network and the amount carefully, then confirm.

▶Learn more about Yield Basis (YB):

- What is Yield Basis (YB)?

- Yield Basis (YB) Airdrop Guide

- Yield Basis (YB) Listing Date and How to Buy It

- MetaMask vs Bitget Wallet: Which Is Better in 2025?

- Trust Wallet vs Bitget Wallet: Which One Is Better in 2025?

- Phantom vs Bitget Wallet: Which One Is Better?

Conclusion

The listing of Yield Basis (YB) on exchanges marks a significant milestone, opening new doors of opportunity for both traders and Web3 users. With standout features and strong growth potential, this is certainly a project worth following in its upcoming expansion journey.

If you’re considering joining, getting in early—whether through trading, staking, or community incentive programs—could deliver valuable long-term rewards.

And to be ready for every opportunity, you’ll need a trusted companion. Managing your assets becomes simpler and smoother than ever with Bitget Wallet. From secure self-custody and multi-chain support to a beginner-friendly design, it’s the easiest way to stay ahead in the Web3 world.

👉 Don’t miss out—download Bitget Wallet today and take full control of your crypto journey.

Sign up Bitget Wallet now - grab your $2 bonus!

FAQs

1. What is Yield Basis (YB) Token?

Yield Basis (YB) is a DeFi protocol designed to optimize liquidity provision for BTC and ETH by reducing impermanent loss through leverage and rebalancing mechanisms. The YB token powers governance, liquidity incentives, and ecosystem growth.

2. When is the Yield Basis (YB) Token Sale?

The Yield Basis (YB) token sale will go live on October 1, 2025, at 14:00 UTC under an FCFS format. A total of 25 million YB tokens (2.5% of supply) will be sold at a price of $0.20, with 100% unlocking at TGE.

3. What is the Best YB Wallet?

Bitget Wallet is the best option for storing and managing YB tokens thanks to its Web3 integration, multi-chain support, and built-in DeFi features. It allows users to swap, stake, and participate in Yield Basis ecosystem activities seamlessly and securely.

Risk Disclosure

Please be aware that cryptocurrency trading involves high market risk. Bitget Wallet is not responsible for any trading losses incurred. Always perform your own research and trade responsibly.

- What Is a Multi-Chain Wallet?2026-02-13 | 5 mins