What Is Zeta Network ($ZNB)? The Nasdaq-Listed Firm Adding Bitcoin and SolvBTC to Its Treasury

What Is Zeta Network ($ZNB)? It’s the rebranded identity of Color Star Technology Co., Ltd., a Nasdaq-listed fintech company that officially became Zeta Network Group Limited in August 2025, trading under the ticker ZNB after a 25-for-1 reverse share split. The firm is now transitioning toward blockchain infrastructure and digital-asset finance.

In October 2025, Zeta Network announced a $230.8 million private placement, allowing investors to contribute in Bitcoin (BTC) or SolvBTC, a wrapped Bitcoin token issued by Solv Protocol. The deal, which includes new Class A shares and warrants, is designed to strengthen Zeta’s balance sheet and represents one of the first instances of a Nasdaq-listed company accepting crypto-denominated funding. In this article, we’ll explore what Zeta Network is, how its Bitcoin and SolvBTC strategy works, why its Nasdaq listing matters, and what this move means for the future of institutional crypto adoption.

Key Takeaways

- Zeta Network (Nasdaq: ZNB) is repositioning itself as a crypto-native business with a strong treasury focus on Bitcoin and SolvBTC.

- The $230.8M investment helps strengthen its balance sheet but also increases exposure to crypto volatility.

- Zeta’s trajectory is a bellwether for how public companies might adopt tokenized assets and yield strategies in their treasuries.

What Is Zeta Network ($ZNB)?

Zeta Network Group (Nasdaq: ZNB) is a publicly traded company that has recently redefined its business model toward digital asset infrastructure and institutional Bitcoin finance. Formerly known (or associated) with legacy non-crypto operations (e.g. via Color Star), Zeta is now aggressively repositioning itself in the Web3 / fintech overlap.

Rather than just being a blockchain company, its stated mission is to be a bridge between TradFi and crypto / digital finance—offering infrastructure, tokenized assets, treasury management, and yield generation for institutions.

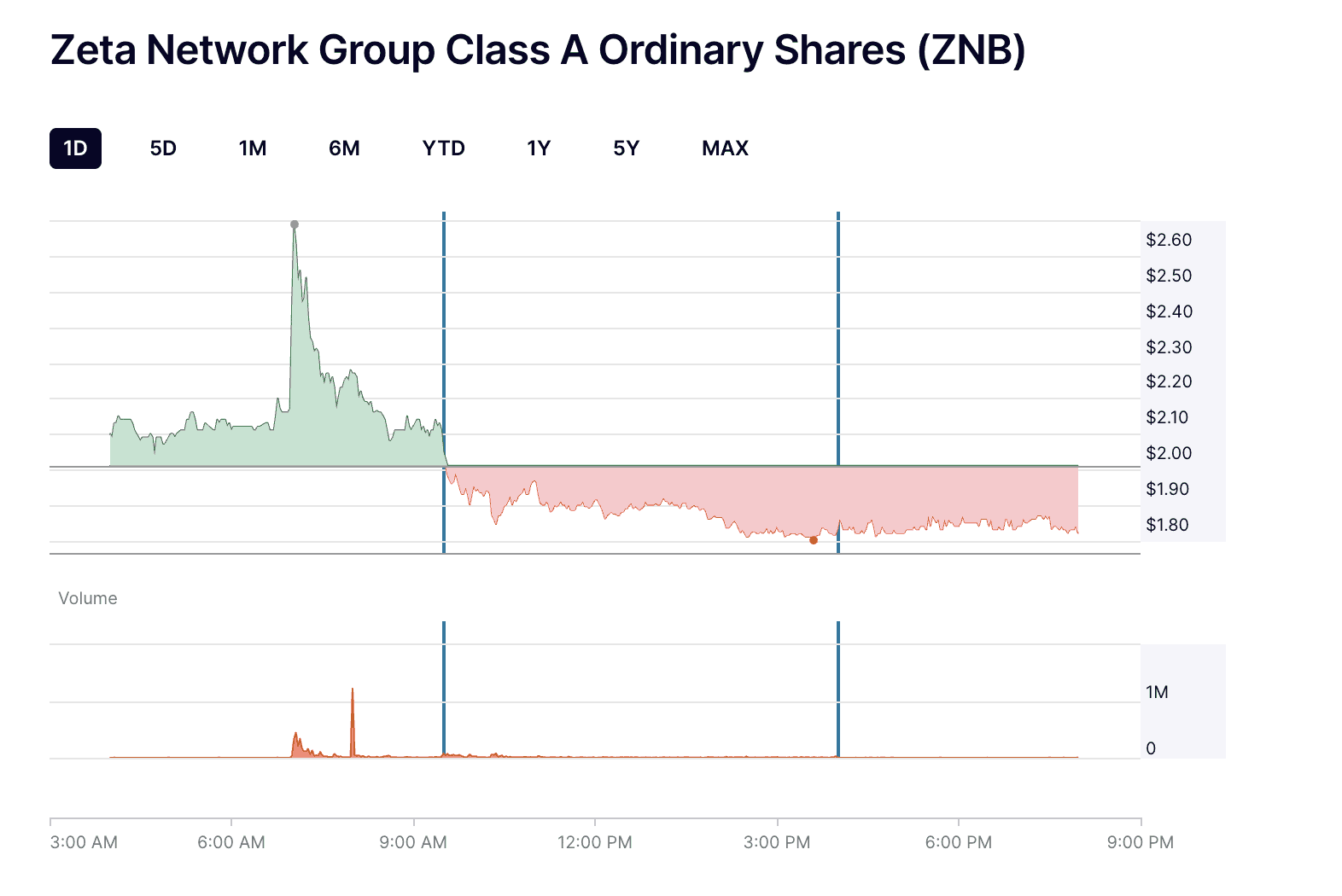

Source: Nasdaq

What Industry Does Zeta Network Operate In?

It sits at the intersection of fintech, digital assets, and blockchain infrastructure. It’s not purely a crypto exchange or protocol; rather, it’s a public company that aims to incorporate digital asset strategies (Bitcoin, wrapped tokens, yield protocols) into its core model.

How Is Zeta Network Positioned in the Web3 and Fintech Ecosystem?

Zeta Network sits at the intersection of traditional finance and blockchain innovation, positioning itself as a regulated gateway into the Web3 economy. Its strategy blends the compliance of a Nasdaq-listed company with the flexibility of decentralized finance.

- It’s one of the rare Nasdaq-listed firms that boldly embraces crypto in its balance sheet.

- It leverages tokenization (e.g. via SolvBTC) as a tool to access yield and liquidity amenities.

- It can appeal to institutional capital that wants regulated exposure to crypto without going through pure decentralized protocols.

- It faces the challenges of regulatory scrutiny, legacy skepticism, and the volatile nature of crypto markets.

Why Is Zeta Network Listed on Nasdaq?

Listing on Nasdaq gives Zeta Network credibility, transparency, and access to capital. It allows the company to raise funds under strict regulation while showing that Web3 businesses can operate within traditional finance. The move bridges crypto innovation with mainstream investor trust.

What Makes a Nasdaq Listing Important for a Web3 Company?

For a Web3 company, being listed on Nasdaq offers more than visibility—it provides a foundation of trust and legitimacy that most blockchain projects lack. It connects the innovation of crypto with the structure and scrutiny of traditional finance, helping bridge two very different worlds.

- Regulatory oversight & reporting – Listing requires full transparency through audits, disclosures, and compliance, reassuring regulators and investors alike.

- Access to capital markets – A Nasdaq listing allows the company to issue shares or warrants and raise funds under a trusted legal framework.

- Investor trust & credibility – Presence on a major exchange signals maturity and builds confidence among traditional, risk-averse investors.

- Symbolic alignment – It shows that Web3 firms are no longer on the fringe but are becoming part of the mainstream financial ecosystem.

How Does Listing Enhance Institutional Confidence in Zeta Network?

When you combine Nasdaq governance with crypto strategies, you get a hybrid product. Institutions can point to audited disclosures, SEC oversight, exchange rules, and combine that with exposure to Bitcoin or other token vehicles. Zeta’s listing is meant to reduce the “wild west” stigma of crypto treasuries and position itself as a credible digital finance firm.

How Does Zeta Network Use Bitcoin and SolvBTC in Its Treasury?

Zeta Network’s $230.8 million private placement, payable in Bitcoin (BTC) and SolvBTC, shows how public companies can now integrate crypto into traditional treasury models. The deal includes new Class A shares and warrants, giving Zeta access to digital capital while staying fully compliant with Nasdaq regulations.

SolvBTC plays a key role in this strategy—it’s a 1:1 Bitcoin-backed token created by Solv Protocol that combines the security of Bitcoin with the flexibility of tokenized finance.

Why it matters:

- Yield: SolvBTC can be used in institutional or DeFi markets to earn passive returns.

- Transparency: Each token is fully backed and verifiable on-chain through proof of reserves.

- Regulatory assurance: The token’s structure fits within compliance frameworks suitable for listed firms.

Zeta also applies a counter-cyclical approach, increasing Bitcoin exposure when markets are weak to build long-term value. This balance of regulation, transparency, and timing defines Zeta’s next-generation treasury model.

What Is SolvBTC and How Does It Work?

SolvBTC is a wrapped Bitcoin token developed by Solv Protocol, designed to represent 1 Bitcoin per token on a blockchain. Each unit is backed by Bitcoin held in institutional-grade custody and can move freely across DeFi and Web3 ecosystems. This allows holders—corporates or individuals—to unlock liquidity and yield opportunities while retaining exposure to Bitcoin’s price performance. In essence, SolvBTC transforms static Bitcoin into a programmable, verifiable financial instrument—combining the credibility of Bitcoin with the efficiency of tokenized finance.

Why Did Zeta Network Choose Bitcoin-Backed Assets?

Zeta’s preference for Bitcoin-backed instruments stems from a mix of liquidity, trust, and macro strategy.

- Institutional familiarity: Bitcoin remains the most recognized and liquid digital asset worldwide.

- Diversification: Crypto-denominated assets can reduce reliance on volatile fiat currencies and inflationary pressures.

- Transparency: Wrapped tokens like SolvBTC enable real-time auditability—essential for investor confidence.

- Long-term conviction: Zeta’s leadership views Bitcoin as a strategic reserve asset rather than a speculative trade.

By incorporating Bitcoin-backed holdings into its treasury, Zeta Network positions itself as a bridge between traditional finance and tokenized capital, showing how public companies can responsibly participate in the next phase of digital-asset integration.

What Does Zeta Network’s Bitcoin Investment Mean for the Market?

Zeta Network’s choice to accept Bitcoin (BTC) and SolvBTC marks a shift in how public companies use digital assets. It shows that crypto can work inside a regulated system rather than outside it. By raising funds through a Nasdaq-approved structure, Zeta blends blockchain transparency with traditional oversight.

This move also connects Zeta to a wider trend led by firms like MicroStrategy and Tesla, which are using Bitcoin as part of their corporate strategy. If Zeta’s approach succeeds, it could set a new example for other listed companies—showing that crypto treasuries can be both compliant and practical in everyday finance.

What Is a Crypto Treasury and Why Do Companies Adopt It?

A crypto treasury refers to a company allocating part of its balance sheet into digital assets (Bitcoin, Ethereum, or wrapped tokens) rather than just cash or traditional securities. Companies adopt this for:

- Diversification

- Hedge against inflation/devaluation

- Potential upside in crypto upside cycles

- Yield generation through DeFi or tokenized instruments

Examples: MicroStrategy, Tesla (briefly), and other forward-looking corporations. Zeta now adds itself to that list—but with a twist: it’s not just a passive holder; it aims to activate those assets.

How Does Zeta Network’s Strategy Compare to Other Bitcoin-Holding Companies?

Compared with other firms that hold Bitcoin, Zeta Network takes a more experimental approach. Its model blends traditional corporate structure with tokenized finance, making it one of the first Nasdaq-listed companies to integrate crypto funding directly into its operations.

- More aggressive – Accepting funding in BTC and SolvBTC rather than converting to fiat.

- Tokenized exposure – Using SolvBTC instead of holding only Bitcoin to generate potential yield.

- Hybrid public + crypto model – Operating under Nasdaq scrutiny while adopting digital-asset strategies usually seen in private firms.

- Higher risk – Exposure to crypto volatility could create greater balance sheet pressure than a conventional treasury.

Zeta’s strategy is a high-conviction move. If digital assets continue to gain legitimacy, it could become a model for others to follow. If markets turn against it, it might stand as a bold but risky experiment in corporate crypto finance.

How Does Zeta Network Bridge Traditional Finance and Crypto?

Zeta Network connects traditional finance with the crypto world by combining Nasdaq-level regulation with blockchain innovation. Working with Solv Protocol, the company uses tokenized Bitcoin assets like SolvBTC to manage liquidity and yield while maintaining transparency. Its goal is to prove that a public company can use digital assets responsibly, blending the trust of regulated finance with the speed and openness of blockchain.

What Role Does Solv Protocol Play in Zeta’s Institutional Strategy?

Solv provides the wrapped-token infrastructure (SolvBTC), yield structuring, and compliance layers. The idea: turn Bitcoin into a more fluid capital instrument, not just a dust-collector on a balance sheet. Zeta taps Solv so that its Bitcoin exposure can be productive.

Could Bitcoin Become a Yield Asset for Listed Companies?

Yes — if companies adopt strategies using wrapped tokens, staking derivatives, or DeFi protocols—while maintaining regulatory transparency and risk controls. Zeta is trying to pioneer that path. The success hinges on how regulators, token issuers, and market conditions evolve.

If this works, more public companies might treat Bitcoin not merely as a hedge, but as an income-generating asset class.

Manage Bitcoin and SolvBTC Securely with Bitget Wallet

To manage assets like Bitcoin (BTC) and SolvBTC, users need a secure and flexible wallet. Bitget Wallet offers a trusted cross-chain solution for both individuals and institutions looking to handle digital assets safely and efficiently.

Key features include:

- Multi-chain management – supports Bitcoin, SolvBTC, and hundreds of other tokens across major blockchains.

- Secure custody – advanced encryption and self-custody ensure users always control their assets.

- Yield tools – access staking, lending, and on-chain earning options within one platform.

Whether for corporate treasuries or personal portfolios, Bitget Wallet provides a simple way to hold, transfer, and grow crypto assets. Download Bitget Wallet to manage Bitcoin and SolvBTC confidently, all in one secure place.

Conclusion

Zeta Network ($ZNB) exemplifies how Nasdaq-listed firms are beginning to integrate Bitcoin and tokenized assets into modern finance. Its $230.8 million crypto-backed private placement shows a shift toward treating digital assets as productive, yield-oriented tools rather than speculative holdings. By combining blockchain transparency with Nasdaq-level governance, Zeta demonstrates what a regulated bridge between traditional markets and decentralized finance could look like.

This trend reflects a wider movement—digital assets are steadily finding a place on corporate balance sheets, reshaping how companies think about liquidity, reserves, and long-term value. As more publicly traded firms explore Bitcoin-backed funding and tokenized treasury models, the line between traditional finance and crypto will continue to blur, signaling a permanent change in how modern finance operates.

Disclaimer: This article is for informational purposes only and does not constitute financial advice.

Sign up Bitget Wallet now - grab your $2 bonus!

FAQs

1. What Is Zeta Network SolvBTC?

It’s a wrapped Bitcoin–backed token issued by Solv Protocol, intended to be fully collateralized by actual Bitcoin reserves, with added yield and utility features. It allows Zeta (and investors) to use Bitcoin in a capital-efficient way rather than holding inert tokens.

2. Is Zeta Network a Nasdaq Company Holding Bitcoin?

Yes, Zeta Network (ticker ZNB) is listed on Nasdaq and recently raised $230.8 million via a private placement in BTC and SolvBTC to strengthen its crypto treasury strategy.

3. What Is the Risk of ZNB Stock?

High. Zeta has limited historical revenue, reported a net loss of ~$26.9 million in 2024, and faces volatility from both equity markets and crypto markets. The use of tokenized instruments like SolvBTC introduces additional counterparty and regulatory risk.

Risk Disclosure

Please be aware that cryptocurrency trading involves high market risk. Bitget Wallet is not responsible for any trading losses incurred. Always perform your own research and trade responsibly.

- What Is a Multi-Chain Wallet?2026-02-13 | 5 mins