What is Volt (XVM): Solana RWA Token Surging With $20M Market Cap and $6M Daily Volume

What is Volt (XVM)? Rooted in the drive to bring real-world assets (RWA) onto the blockchain, Volt (XVM) bridges traditional finance and decentralized innovation within the digital asset space. It leverages the speed and scalability of Solana, while aiming for interoperability with networks like the XRP Ledger, to make tokenized ownership of tangible assets accessible in the modern economy.

Thanks to the surge of investor interest, centralized exchange listings (BitMart, MEXC), and retail community support, Volt (XVM) is redefining digital assets. It aspires to be more than a speculative coin—positioning itself as a foundation for fractional ownership, instant settlement, and liquidity access in the emerging RWA market.

Through this article, we explored Volt (XVM)—its vision, 1B capped supply, RWA narrative, and volatile market path. With Bitget Wallet’s secure stablecoin storage, hot memecoin trading, and seamless cross-chain experience, investors can access and manage XVM with confidence.

Key Takeaways

- Volt (XVM) is a Solana-based token positioned within the Real-World Asset (RWA) narrative, aiming to tokenize assets like real estate, commodities, and equity.

- Immutable supply of 1 billion XVM, but with a 34% team allocation, raising centralization and governance concerns.

- Recently listed on BitMart and MEXC, fueling speculation and a rapid 120% price surge, with 24-hour trading volumes exceeding $6M.

What Is Volt (XVM): What You Should Know?

Volt (XVM) is a real-world asset (RWA) token built on the Solana blockchain, designed to bring traditional finance into the decentralized era. The project embodies the following values:

- Accessibility – fractional ownership of real-world assets

- Liquidity – instant settlement and tradability of tokenized assets

- Innovation – bridging DeFi with tokenized finance on scalable infrastructure

Volt (XVM) applies these principles within the digital asset and RWA tokenization industry, aiming to create a sustainable, trustworthy, and collaborative community of investors and innovators.

Source: X

Volt (XVM), a Solana-based token riding the real-world asset narrative, has gained traction after listings on BitMart and MEXC, fueling a 120% surge in value and pushing daily trading volumes past $6M. With a fixed supply of 1 billion tokens and growing retail support, Volt positions itself as a speculative yet ambitious player in the tokenization of real-world assets.

Volt (XVM) Listing: Key Details and Trading Schedule

1. Key Listing Information

Here are the important details about the Volt (XVM) listing:

- Exchange: BitMart

- Trading Pair: XVM/USDT

- Deposit Available: February 28, 2025, 08:00 UTC

- Trading Start: February 28, 2025, 11:00 UTC

- Withdrawal Available: February 28, 2025, 14:00 UTC

Don’t miss your chance to start trading Volt (XVM) on BitMart and be part of this rapidly growing RWA tokenization movement.

- Please refer to the official BitMart announcement for the most accurate schedule.

Which Is Better: CEX or DEX Trading?

If you want full control of your assets and faster profit opportunities, choose Bitget Wallet. Unlike CEXs like Binance, where funds stay in platform custody, Bitget Wallet is self-custodial, giving you security, privacy, and early access to trending tokens and memecoins.

With cross-chain stablecoin management and instant swaps across Solana, Ethereum, and BNB, Bitget Wallet makes DeFi simple. Many users combine both — trade early with Bitget Wallet, then use CEX for large-volume orders.

👉 For autonomy and speed, Bitget Wallet gives you the edge.

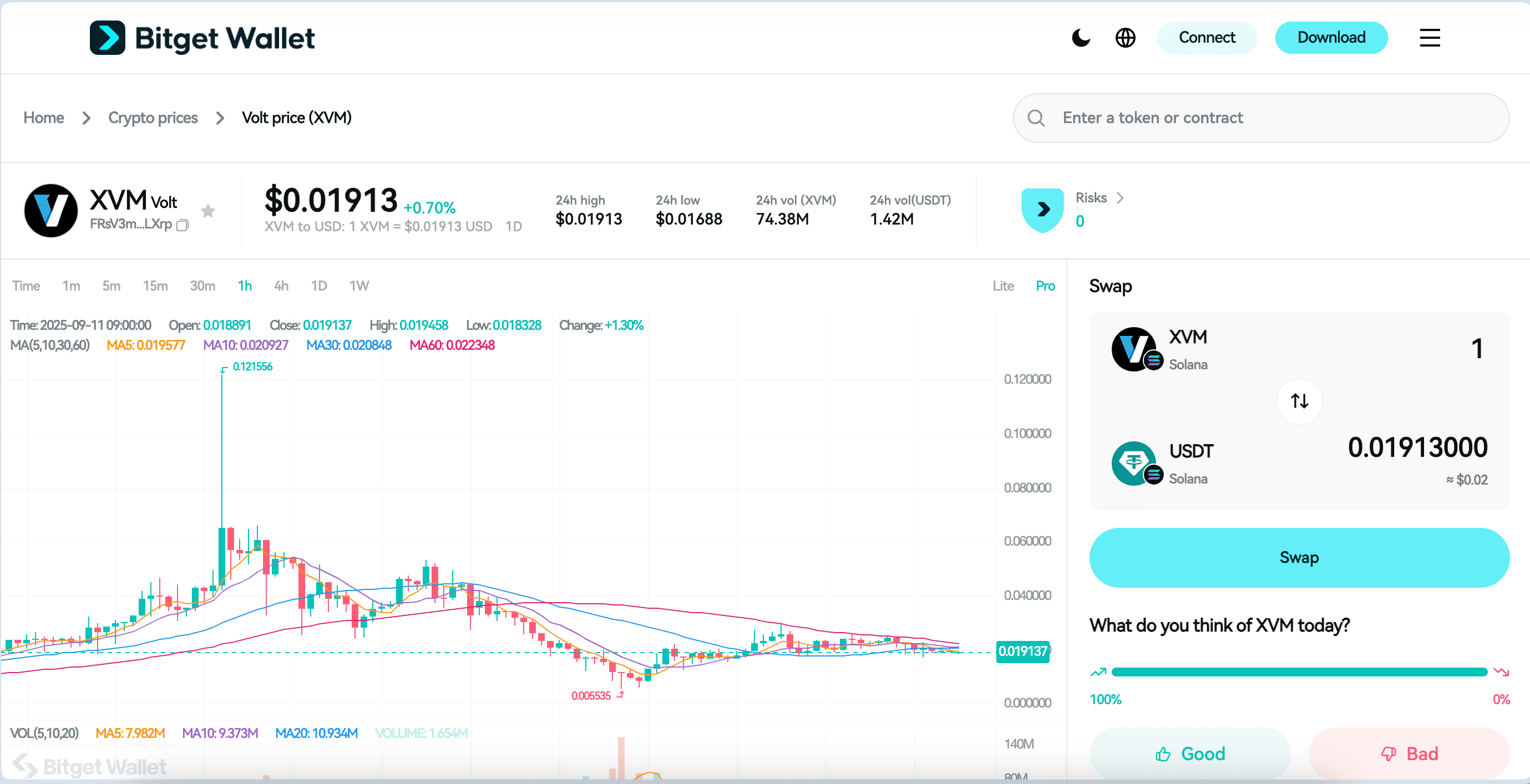

Volt (XVM) Market Trends & Price Predictions 2025

Volt (XVM)’s price is driven by crypto market cycles, the strength of its RWA (real-world asset) narrative, and early adoption by speculative communities. With a current market cap of around $20M and 24-hour volume above $6M, Volt could maintain a trading range between $0.015 – $0.030 in the near term. Future growth in the RWA sector and wider ecosystem integration may push its valuation toward the $0.05 – $0.08 range over the long term, provided momentum holds.

Factors Influencing the Price of Volt (XVM)

- Market Trends: XVM’s value has surged alongside the broader RWA tokenization narrative. If Bitcoin and Solana ecosystems remain strong through 2025, Volt benefits from liquidity flow into smaller caps. Conversely, any downturn could cut its speculative premium sharply.

- Adoption & Real-World Utility: At present, XVM has no functioning RWA platform, only positioning. Any credible partnerships or live applications for fractionalized real-world assets would be key triggers for sustained demand.

- Project Advancements: The immutable supply of 1 billion tokens and exchange listings (BitMart, MEXC) have created buzz. Further listings on top-tier CEXs (Binance, OKX, Coinbase) could significantly expand access and liquidity.

Long-Term Growth Potential

If Volt (XVM) successfully builds out its real-world asset strategy on Solana and the XRP Ledger, demand could rise and strengthen its long-term case. Analysts suggest that sustained momentum, innovation, and major exchange listings could drive its price toward $0.05 – $0.08 by late 2025. However, investors should remain cautious: high centralization of supply (34% team allocation) and general crypto market volatility make XVM a high-risk, high-reward token.

Source: CoinGecko, CoinMarketCap

Source: Bitget Wallet

Explore Volt (XVM) easily with Bitget Wallet — offering Secure Stablecoin Storage, Hot Memecoin Trading, and a Seamless Multi‑chain Experience, all in one beginner‑friendly app.

Why Volt (XVM) Stands Out: Essential Features

The standout features of Volt (XVM) include:

-

Real-World Asset (RWA) Narrative

Volt positions itself within the growing trend of tokenizing real-world assets like real estate, commodities, and equity. By aligning with this narrative, Volt taps into one of the most hyped themes in 2025, attracting both speculative traders and long-term believers in RWA adoption.

-

Immutable Tokenomics & Scarcity

XVM has a fixed supply of 1 billion tokens, deployed on the Solana blockchain. The contract is immutable—meaning no further changes can be made—which creates a sense of scarcity and transparency. However, a 34% team allocation is notable, raising both credibility (skin in the game) and centralization concerns.

-

Strong Market Momentum & Exchange Listings

Despite being early-stage, Volt has already secured listings on BitMart and MEXC, achieving daily volumes above $6M and a market cap around $20M. Rapid surges—like a recent 120% spike in 24 hours—showcase strong speculative momentum, with over 8,700 holders participating.

The Volt (XVM) Ecosystem: How It Functions

Volt (XVM) is a decentralized RWA-themed cryptocurrency project based on the Solana blockchain that aims to empower users with safe transactions, speculative token buying/selling, and upcoming real-world asset tokenization.

With the use of blockchain technology, Volt makes it easy for users to engage in activities like trading on centralized platforms, staking (if implemented), and likely governance once the ecosystem is established. Here is a step-by-step explanation of how the Volt (XVM) ecosystem operates:

| Step | Process | Benefit |

| 1. Blockchain Integration | Volt (XVM) runs on Solana, ensuring fast, low-cost, and scalable transactions. | High throughput and low fees make it attractive for speculative trading and potential RWA use cases. |

| 2. Token Transactions | Users can buy, sell, and trade XVM/USDT pairs on exchanges like BitMart and MEXC. | Provides liquidity and access for global retail investors. |

| 3. Smart Contracts | Immutable supply contract capped at 1B XVM, with automated processes for distribution. | Transparency, fixed scarcity, and trust in tokenomics. |

| 4. Governance Participation | In the future, token holders may participate in ecosystem decisions if governance is activated. | Community input could guide development and RWA integration. |

| 5. Staking & Yield Farming | Potential staking or yield programs may be introduced to reward holders. | Incentivizes long-term holding and strengthens ecosystem loyalty. |

Volt (XVM) Team: Leadership and Strategic Vision

Leadership

The Volt (XVM) project has not publicly disclosed a named leadership team, which is common in speculative meme/RWA-style tokens. Instead, the project emphasizes community growth, decentralized ownership, and immutable tokenomics as substitutes for traditional founder visibility. While this lack of transparency raises questions about accountability, it also appeals to the meme-coin culture of anonymity and collective hype.

Strategy

Volt’s strategy centers on riding the Real-World Asset (RWA) tokenization narrative by leveraging Solana’s fast, low-cost blockchain and aiming for future interoperability with ecosystems like the XRP Ledger. In the short term, the focus is on liquidity growth and visibility through centralized exchange listings such as BitMart and MEXC, while the long-term vision aspires to expand into staking utilities, fractional ownership of real-world assets, and broader adoption—though execution is still unproven.

Volt (XVM): Practical Applications & Use Cases

Why Utility Matters for Volt (XVM)?

Utility is what separates short-lived meme coins from projects that achieve lasting relevance. For Volt (XVM), the promise lies in real-world asset (RWA) tokenization — giving users the ability to access, trade, and fractionalize tangible assets like real estate or commodities on the blockchain. Without live use cases today, Volt’s current traction is fueled mainly by speculation and exchange listings, but utility will be essential for sustaining long-term value.

Key Use Cases of Volt (XVM)

- Speculative Trading: XVM is already live on exchanges such as BitMart and MEXC, offering liquidity and accessibility to retail traders.

- RWA Tokenization (Future Goal): The project aims to enable fractional ownership of real-world assets, increasing accessibility for smaller investors.

- Potential Staking & Rewards: Staking programs could incentivize holders and encourage long-term participation in the ecosystem.

- Governance (Roadmap): Future plans may include community voting on upgrades and ecosystem decisions, though not yet live.

What’s Next for Volt (XVM)?

Volt’s roadmap points toward building actual RWA integrations on Solana and exploring interoperability with networks like the XRP Ledger. The immediate focus is on expanding exchange listings and strengthening community adoption to maintain momentum. Long-term growth depends on whether the team can deliver tangible RWA utilities beyond speculative hype, while addressing risks like centralized token allocation and regulatory uncertainty.

Volt (XVM) Roadmap: What to Expect in 2025 and Beyond?

The roadmap for Volt (XVM) outlines a speculative but targeted path for growth and innovation within the real-world asset (RWA) tokenization narrative:

| Quarter | Roadmap |

| Q1 2025 | Secure additional centralized exchange listings (beyond BitMart and MEXC) to improve liquidity and retail access. Expand community outreach and marketing campaigns to strengthen XVM’s visibility. |

| Q2 2025 | Launch initial staking or yield incentives to reward long-term holders. Begin groundwork for RWA pilot integrations, focusing on tokenizing small-scale assets (test phase). |

| Q3 2025 | Announce interoperability progress with Solana-based DeFi apps and potential XRP Ledger collaborations. Explore governance model introduction to involve holders in key decisions. |

| Q4 2025 & Beyond | Roll out early-stage real-world asset tokenization utilities if pilot tests succeed. Target broader adoption through institutional partnerships and deeper integration with RWA platforms. |

These applications highlight the practical value of $XVM in the digital asset and RWA tokenization sector, where success depends on converting hype into functional adoption.

How to Buy Volt (XVM) on Bitget Wallet?

Trading Volt (XVM) is easy on Bitget Wallet. Follow these simple steps to get started:

Step 1: Create an Account

If you don't currently have an account, install the Bitget Wallet app. Register by inputting the required details and confirming your identity.

Step 2: Deposit Funds

After setting up an account, you must deposit money. You can do this by:

- Transferring Cryptocurrency: Transfer crypto from a different wallet.

- Purchasing Crypto: Utilize a credit or debit card to buy crypto directly from Bitget Wallet, making sure you have sufficient capital for trading Volt (XVM).

Step 3: Find Volt (XVM)

On the Bitget Wallet platform, go to the market area. Search for Volt (XVM) using the search function. Click on the token to access its trading page.

As this token has not been listed yet, please look at the last contract address sent by the project team upon listing of the token.

Step 4: Choose Your Trading Pair

Select your trading pair you would like to deal with, for instance, VXM/USDT. By doing this, you will be able to exchange Volt (XVM) for USDT or any other cryptocurrency.

Step 5: Place Your Order

Choose whether to carry out a market order—either buy or sell at the prevailing rate—or place a limit order at your desired price. Fill in the amount of Volt (XVM) you want to exchange, then proceed to confirm in order to complete the trade.

Step 6: Monitor Your Trade

Once you have ordered, you can track the status of your order under "Open Orders." Upon completion of the order, you can view your balance to see the newly purchased Volt (XVM).

Step 7: Withdraw Your Funds (Optional)

If you want to transfer your Volt (XVM) or any other cryptocurrency to another wallet, go to the withdrawal section, provide your wallet address, and confirm the transaction.

Conclusion

What is Volt (XVM)? At its core, Volt is a Solana-based token built around the Real-World Asset (RWA) narrative, designed to bring accessibility, liquidity, and innovation to the digital economy. Throughout this article, we’ve explored how Volt stands out with its immutable 1B supply, recent exchange listings, and speculative momentum, while also acknowledging that its true test lies in delivering real-world asset functionality beyond hype.

For investors, Bitget Wallet offers the most efficient way to engage with Volt (XVM). Supporting 90+ blockchains with fiat on-ramps, cross-chain swaps, and top-tier security, Bitget Wallet makes buying and storing XVM both simple and safe. Choosing Bitget Wallet not only streamlines participation in Volt’s ecosystem but also ensures users benefit from a trusted platform while tapping into one of crypto’s fastest-emerging narratives.

Manage all your tokens in one beginner-friendly app – download Bitget Wallet today.

Sign up Bitget Wallet now - grab your $2 bonus!

FAQs

1. What is Volt (XVM)?

Volt (XVM) is a token built on the Solana blockchain, aligned with the real-world asset (RWA) tokenization narrative. It has a fixed supply of 1 billion tokens and has recently gained traction through listings on exchanges like BitMart and MEXC.

2. Is Volt (XVM) a meme coin or a utility token?

Volt positions itself as an RWA-focused project, aiming to tokenize real-world assets such as real estate and commodities. However, as of now, it functions primarily as a speculative trading token, with RWA utility still in the development phase.

3. Where can I buy Volt (XVM)?

You can buy Volt (XVM) on BitMart and MEXC, with trading pairs like XVM/USDT. For secure storage and easy cross-chain access, Bitget Wallet is recommended, offering fiat on-ramps, swaps, and support for 90+ blockchains.

Risk Disclosure

Please be aware that cryptocurrency trading involves high market risk. Bitget Wallet is not responsible for any trading losses incurred. Always perform your own research and trade responsibly.

- How to Buy 404 Coin in 2026: A Beginner’s Step-by-Step Guide to 404 Coin2026-02-20 | 5mins