What Is the Real WLFI Token: How to Avoid Scams and Trade Safely

The real WLFI token is the official cryptocurrency of World Liberty Financial, a high-profile DeFi project linked to former U.S. President Donald Trump. Launched in 2025 with a total supply of 24.66 billion tokens, WLFI aims to position itself as a bridge between traditional finance and decentralized ecosystems. Yet its debut has been clouded by controversy and confusion, as a wave of copycat contracts and bundled clones quickly appeared across decentralized exchanges, making it difficult for traders to distinguish the authentic WLFI from scams.

Beyond imitation tokens, volatility is another challenge. With a small initial float, presale unlocks, and speculative demand, WLFI’s price swings sharply in both directions. Leverage trading and political headlines amplify these moves, creating uncertainty for beginners and seasoned traders alike.

This article provides a clear roadmap on how to identify the real WLFI token, avoid common scam pitfalls, and trade with risk awareness. From verifying contract addresses to choosing the right exchanges and managing volatility, the goal is to help readers participate safely. For added protection, Bitget Wallet is highlighted as a secure, multi-chain solution to verify, trade, and store WLFI with built-in safeguards against scams.

Key Takeaways

- The real WLFI token is officially deployed on Ethereum, BNB Smart Chain, and Solana — always verify contract addresses.

- World Liberty Financial (WLFI) is listed on trusted exchanges like Bitget, Binance, Bybit, KuCoin.

- Volatility drivers include thin liquidity, presale selling, leveraged derivatives, and political/media hype.

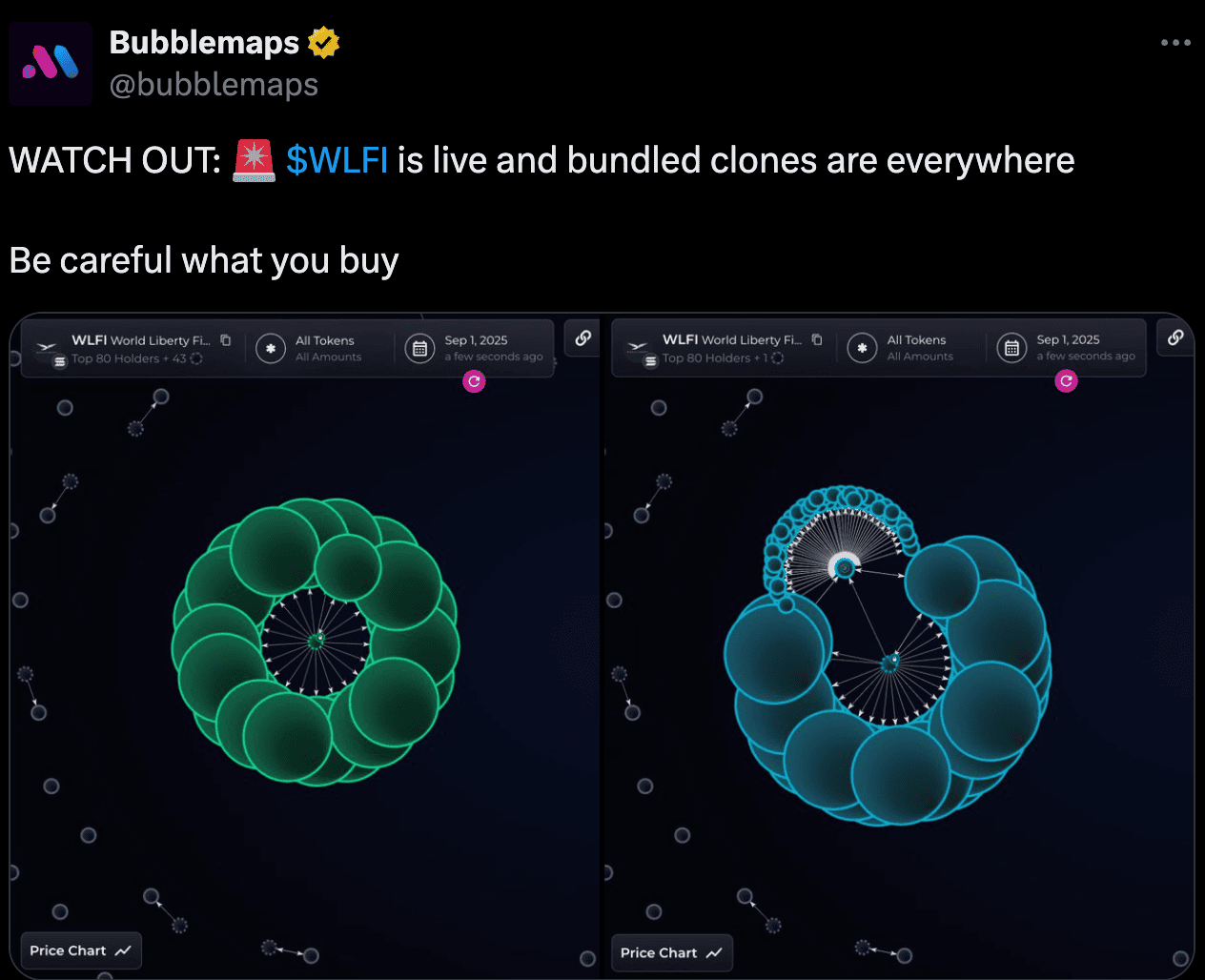

- Scam risks: Bubblemaps flagged WLFI clones on DEXs — avoid copycats by checking only official sources.

- Beginners often make mistakes such as buying fake tokens or trading on FOMO; Bitget Wallet helps reduce risks with built-in contract security checks.

- WLFI Token is a high-risk, high-reward token, so use limit orders, stop-losses, and small position sizing to trade safely.

What Is the Real WLFI Token World Liberty Financial?

The real WLFI token refers to the official cryptocurrency of World Liberty Financial, launched as a high-profile entry into the DeFi landscape. Backed by political ties and designed as a governance asset, WLFI’s release has attracted global attention but also confusion, with scams and clone tokens circulating alongside the genuine version.

Why Was WLFI Created and What Does It Represent?

The real WLFI token was officially launched in September 2025 as the native asset of World Liberty Financial, a decentralized finance platform promoted as a bridge between traditional banking and blockchain innovation. Its political backing from former U.S. President Donald Trump elevated attention, making WLFI both a financial experiment and a political statement. The token represents governance power within the ecosystem, giving holders a say in protocol decisions and future unlock schedules.

How Was WLFI Allocated and Distributed?

WLFI launched with a fixed supply of 24.66 billion tokens, distributed across several entities and purposes.

- 10 billion were allocated to World Liberty Financial Inc.

- 7.78 billion went to enterprise blockchain firm Alt5 Sigma Corporation.

- 2.88 billion were reserved for liquidity and marketing efforts.

- Just over 4 billion tokens were released to the public, primarily through presale allocations.

This structure shows strong institutional backing but leaves only a fraction circulating at launch, intensifying volatility.

What Are WLFI’s Governance and Unlocking Rules?

WLFI uses a Lockbox system to manage token unlocks. On launch day, 20% of presale allocations became claimable, while the remaining 80% is subject to a governance-based schedule decided by token holders. This participatory model reflects WLFI’s emphasis on community-driven decision-making, but it also means future supply unlocks could heavily impact price dynamics depending on market sentiment.

Which Exchanges Support the Real WLFI Token?

Knowing where to buy and trade the real WLFI token is crucial for avoiding scams and securing the best trading experience. This section highlights trusted exchanges, explains how to verify the contract address, and introduces safe storage options.

Where Can You Trade WLFI Safely?

The real WLFI token is now available on several major exchanges. Confirmed listings include Bitget, Binance, Bybit, KuCoin, and conditionally Coinbase depending on regulatory clearance. Beginners should always start with trusted, centralized platforms since they offer higher liquidity and verified trading pairs. Using a secure exchange reduces exposure to scams that may appear on smaller or unverified marketplaces.

Read more: World Liberty Financial (WLFI) Listing Exchanges: Full Guide 2025

How to Verify the Official WLFI Contract Address?

To ensure you are trading the authentic WLFI token, always verify its official contract address. WLFI exists on Ethereum, BNB Smart Chain, and Solana, and each chain has a unique contract. Using any unverified address from DEXs can expose you to fake or cloned tokens created by scammers.

| Blockchain | Official WLFI Contract Address | Notes for Verification |

| Ethereum (ERC-20) | 0xdA5e1988097297dCdc1f90D4dFE7909e847CBeF6 | Check on Etherscan and compare with the project’s official site. |

| BNB Smart Chain (BEP-20) | 0x47474747477b199288bF72a1D702f7Fe0Fb1DEeA | Verify on BscScan; be wary of similarly named tokens. |

| Solana (SPL) |

WLFinEv6ypjkczcS83FZqFpgFZYwQXutRbxGe7oC16g

|

Confirm on Solscan; only interact with the official WLFI mint address. |

⚠️ Tip: Always cross-check WLFI contract addresses on trusted, official channels before making a trade.

- Project Website: worldlibertyfinancial.com – the primary source for verified WLFI information.

- Official X (Twitter) Account: @worldlibertyfi – follow updates and announcements directly from the project team.

- CoinGecko: WLFI on CoinGecko – check listed contracts and token data from a reliable aggregator.

- CoinMarketCap: WLFI on CoinMarketCap – cross-verify addresses and market details.

🚫 Never trust contract addresses shared by random Telegram groups or DEX pop-ups, as scammers frequently exploit these channels to spread fake tokens.

Why Is Bitget Wallet Recommended for WLFI Storage?

Buying WLFI is only the first step—keeping it safe is equally important. Bitget Wallet provides multi-chain storage, built-in risk alerts, and non-custodial control, making it one of the most reliable ways to manage WLFI tokens. Its beginner-friendly features help users store, swap, and secure WLFI without worrying about scam contracts.

What Are the Main Risks and Volatility Factors in WLFI Trading?

Like many new tokens, the real WLFI token carries significant risks that traders must understand before entering the market. Price swings can be sharp and unpredictable, driven by liquidity issues, leverage, and even political headlines. This section explains the biggest volatility triggers every WLFI trader should watch.

Why Is WLFI So Volatile After Launch?

WLFI’s early trading environment is defined by channelled liquidity and limited trading volume, leading to several volatility-inducing issues:

-

Thin Order Books & High Slippage

With most traded on only a few major exchanges, WLFI often faces shallow order depth. This thin liquidity amplifies price shifts even from modest buy or sell orders. The image above highlights this starkly by showing sparse bid/ask depth, often referred to as low liquidity zones.

-

Limited Token Float

Only a small percentage of the total WLFI supply is unlocked at launch, leading to scarcity that compounds volatility as demand spikes sharply around each listing or unlock event.

-

Presale Selling Pressure

Early backers—like presale investors—often liquidate part of their holdings soon after launch, adding sudden selling pressure and downward movement in price.

Source: Beincrypto

How Do Derivatives Amplify WLFI Price Swings?

On futures and perpetual trading platforms, WLFI can be traded with high leverage. This leverage effect cuts both ways: it boosts potential gains but also accelerates losses. When prices move quickly, liquidation cascades can occur, where forced sell-offs by over-leveraged traders trigger further drops. As more exchanges add derivatives for WLFI, traders should expect heightened volatility compared to spot markets.

What Role Do Hype and Politics Play in WLFI’s Price Action?

Unlike most altcoins, WLFI’s narrative is closely tied to political figures and media cycles. A single endorsement, headline, or piece of regulatory commentary can flip market sentiment within hours. Traders often chase these headlines, leading to sudden rallies or sharp corrections. In short, WLFI’s price action is influenced as much by hype and politics as by technical or fundamental factors.

Read more: How to Buy OFFICIAL TRUMP (TRUMP) Guide │ Memecoin │ Crypto │ Token WLFI Price Prediction 2025–2030: What to Expect From Trump-Backed Crypto

How to Avoid WLFI Scams and Fake Tokens?

Because WLFI has strong political and media attention, scammers are quick to create fake versions across decentralized exchanges (DEXs). Traders who don’t double-check details risk losing funds to copycat contracts. This section highlights warnings from analytics firms, key security practices, and common mistakes beginners should avoid.

What Did Bubblemaps Warn About WLFI Clones?

Blockchain analytics platform Bubblemaps flagged suspicious WLFI look-alikes appearing across multiple DEXs. These bundled clones fragment liquidity and trick traders into swapping into counterfeit contracts. Some of these fake pools even use near-identical tickers or logos, making it difficult to distinguish from the real WLFI. Always confirm liquidity depth and contract addresses through trusted sources before trading.

Source: Bubblemaps on X

What Security Practices Should Traders Follow?

To trade WLFI safely, follow strict security protocols:

- Use only official sources such as the World Liberty Financial website, @worldlibertyfi on X, CoinGecko, or CoinMarketCap.

- Trade on centralized exchanges that require KYC verification to reduce fraud exposure.

- Enable 2FA (two-factor authentication) on both exchanges and wallets.

- Set up anti-phishing codes in your exchange account to prevent fake email or website attacks.

- Bookmark official exchange URLs and avoid clicking random links from Telegram or Discord groups.

Which Mistakes Do Beginners Commonly Make?

Most WLFI scams succeed because beginners rush in without checking details. Common errors include:

- Buying copycat tokens listed on DEXs without verifying the contract address.

- Falling for FOMO hype, chasing pumps from influencers or unverified groups.

- Ignoring contract verification, failing to cross-check against official explorers like Etherscan, BscScan, or Solscan.

To reduce these risks, beginners should not only verify every WLFI contract but also use trusted tools like Bitget Wallet. As a multi-chain, non-custodial wallet, Bitget Wallet includes built-in security checks that flag suspicious contracts and help users avoid interacting with fake tokens. By storing WLFI in Bitget Wallet, traders can add an extra layer of protection while focusing on legitimate trading opportunities.

What Are the Best Strategies to Trade WLFI Safely?

Trading the real WLFI token requires more than just picking an exchange. Because the token is volatile and politically sensitive, traders should apply disciplined strategies that balance opportunity with safety. This section explores practical methods to reduce risk and improve decision-making when trading WLFI.

Read more: How to Buy World Liberty Financial WLFI Token Safely: A Beginner Purchase Guide

Should You Use Market Orders or Limit Orders?

When liquidity is thin, market orders can cause large slippage and unexpected fills. For WLFI, using limit orders is safer, as it allows you to define the exact entry or exit price. This approach prevents overpaying during sharp upward spikes and reduces losses when sell pressure accelerates. Beginners should practice with limit orders first before attempting advanced trading setups.

How Can Risk Management Protect You?

The key to long-term success is managing downside risk. Traders should:

- Use stop-loss orders to exit losing trades automatically.

- Keep position sizes small relative to account balance to avoid overexposure.

- Avoid high leverage, especially in futures, since WLFI can move quickly and liquidations happen fast.

These basic rules help limit losses and protect capital, which is more important than chasing short-term gains.

How to Monitor On-Chain Metrics and Official Updates?

Fundamentals also matter. Tracking on-chain metrics such as active wallets, transaction volumes, and liquidity pools can signal whether WLFI adoption is growing or fading. At the same time, official communication channels provide real-time alerts.

To confirm contract addresses, unlock schedules, and governance votes:

👉Follow the verified X account: @worldlibertyfi 👉Follow World Liberty Financial official website: https://worldlibertyfinancial.com/ Combining data with trusted announcements helps you stay ahead of market sentiment and avoid misinformation.

Conclusion

The real WLFI token requires careful verification and safe trading practices. Traders should rely on confirmed exchange listings such as Bitget, while always cross-checking the official contract addresses on Ethereum, BNB Smart Chain, and Solana. WLFI’s volatility comes from thin liquidity, leveraged derivatives, and political headlines, which means risk management is essential. At the same time, scams and fake tokens remain a constant threat, so beginners must avoid copycat contracts and verify details only through official channels.

WLFI is a high-risk, high-variance asset, making it unsuitable for impulsive speculation. Successful trading depends on discipline, patience, and proper tools that enhance security.

Download Bitget Wallet to trade the real WLFI token securely, verify official contracts, and explore cross-chain DeFi in one beginner-friendly app.

Sign up Bitget Wallet now - grab your $2 bonus!

FAQs

Is WLFI a legitimate token or a scam?

WLFI is the official governance token of World Liberty Financial, launched with verified contracts on Ethereum, BNB Smart Chain, and Solana. However, many clones exist on DEXs, so traders must double-check contract addresses before buying.

What is the official WLFI contract address?

The authentic WLFI contracts are:

-

Ethereum (ERC-20):

0xdA5e1988097297dCdc1f90D4dFE7909e847CBeF6 -

BNB Smart Chain (BEP-20):

0x47474747477b199288bF72a1D702f7Fe0Fb1DEeA -

Solana (SPL):

WLFinEv6ypjkczcS83FZqFpgFZYwQXutRbxGe7oC16gAlways confirm on worldlibertyfinancial.com or trusted platforms like CoinGecko and CoinMarketCap.

Which exchange is best for beginners to buy WLFI?

Top centralized exchanges such as Bitget already support WLFI trading. Beginners may find Bitget more beginner-friendly due to its simple UI and integrated wallet security.

Why is WLFI so volatile compared to other tokens?

WLFI trades with a limited float, thin order books, and high leverage exposure on derivatives. Media hype and political headlines also cause sharp swings, making the token more volatile than most altcoins.

Is Bitget Wallet safe for storing WLFI tokens?

Yes. **Bitget Wallet** is a non-custodial, multi-chain wallet with built-in security checks and phishing protection. It allows users to securely store WLFI while maintaining full control of their private keys.

Risk Disclosure

Please be aware that cryptocurrency trading involves high market risk. Bitget Wallet is not responsible for any trading losses incurred. Always perform your own research and trade responsibly.

- What Is a Multi-Chain Wallet?2026-02-13 | 5 mins