What Is STBL Crypto (STBL): Stablecoin Project With $260M Market Cap and Its Future Forecast

What is STBL (STBL)? STBL (STBL) carries the ambition of “Stablecoin 2.0,” blending tradition with innovation in the stablecoin and DeFi sector. STBL (STBL) uses blockchain technology to bring new financial significance into the digital asset space. Blending financial heritage with blockchain technology unlocks fresh possibilities in the digital asset space. It both upholds stability values and modernizes digital asset applications.

With strong backing from Tether co-founder Reeve Collins, STBL (STBL) is shaping the future of digital assets while enabling investors and participants to engage with its expanding network. More than just a token, it serves as a key component in stable value storage and yield separation, securing its lasting impact in the industry.

This article breaks down STBL (STBL), covering its mission, key features, and potential expansion. If you're looking to understand its role in blockchain, evaluate its investment value, or stay informed about its market influence, this guide has you covered.

Download Bitget Wallet for faster cross-chain trending trades, perfect for beginners.

Key Takeaways

- STBL (STBL) is branded as “Stablecoin 2.0,” built on BNB Chain with a unique USST mechanism that separates yield from principal.

- The project has backing from Tether co-founder Reeve Collins, giving it credibility and industry attention.

- STBL aims to modernize stablecoins by balancing stability and yield, positioning itself as a potential disruptor in the DeFi sector.

What Is STBL (STBL): What You Should Know?

STBL (STBL) is a stablecoin project based on the BNB Chain that represents a modern version of stable digital assets. The project embodies the following values:

- Stability

- Innovation

- Financial inclusivity

STBL (STBL) not only inherits the spirit of financial trust but also applies it to the DeFi sector to build a sustainable, trustworthy, and collaborative community.

Source: X

STBL, backed by Tether’s co-founder Reeve Collins, is positioning itself as “Stablecoin 2.0” with its innovative USST mechanism that separates yield from principal. Having launched at under $0.03 and reaching a market cap of over $260M at its peak, the token is being closely watched as a potential disruptor in the stablecoin market.

Which Is Better: Crypto Exchange or Crypto Wallet Trading?

If you want full control of your assets and maximum earning power, choose Bitget Wallet. Unlike crypto exchanges where funds remain in custody, Bitget Wallet is self-custodial, giving you security, privacy, and direct access to DeFi.

Bitget Wallet Key Advantages:

✅ Stablecoin Earn Plus: Earn up to 18% APY on your holdings

✅ Zero-fee trading on memecoins and RWA U.S. stock tokens

✅ Crypto card with Mastercard & Visa: Spend globally with zero fees

Add to that instant cross-chain swaps across Solana, Ethereum, and BNB, and you’ll see why many users combine both worlds — trading early and fee-free with Bitget Wallet, then using CEXs for bulk orders.

👉 For autonomy, yield, and zero fees, Bitget Wallet gives you the edge.

STBL (STBL) Future Price Outlook: 2025 and Beyond

Market movements, project sustainability, and community participation influence a cryptocurrency’s price. With its established support and cultural appeal, STBL (STBL) may trade within the $0.40 – $0.70 range in late 2025. If it sustains growth and further integrates into the DeFi and stablecoin sector, it has the potential to rise to the $1.00 – $1.50 range long-term.

What Affects STBL (STBL) Price?

Several factors influence the potential price trajectory of STBL (STBL):

-

Investor Sentiment:

Backing from Tether’s co-founder has strengthened confidence. Community enthusiasm and branding as “Stablecoin 2.0” continue to drive momentum.

-

Adoption & Demand:

The KuCoin listing (Sept 25, 2025) with the STBL/USDT pair marks a major milestone. Its USST yield-splitting mechanism and staking model encourage holding and reduce circulating supply.

-

Regulatory Influence:

As a stablecoin-related project, evolving policies in global markets will directly affect growth potential and valuation.

Future Price Prospects

If STBL (STBL) continues its expansion within DeFi, increased adoption may lead to a surge in demand. As STBL cements its role in the industry, projections indicate its value could escalate to the $1.00 – $1.50 range in the coming years. However, a thoughtful investment approach must take into account financial market swings, legislative policies, and wider economic influences.

Source: KuCoin

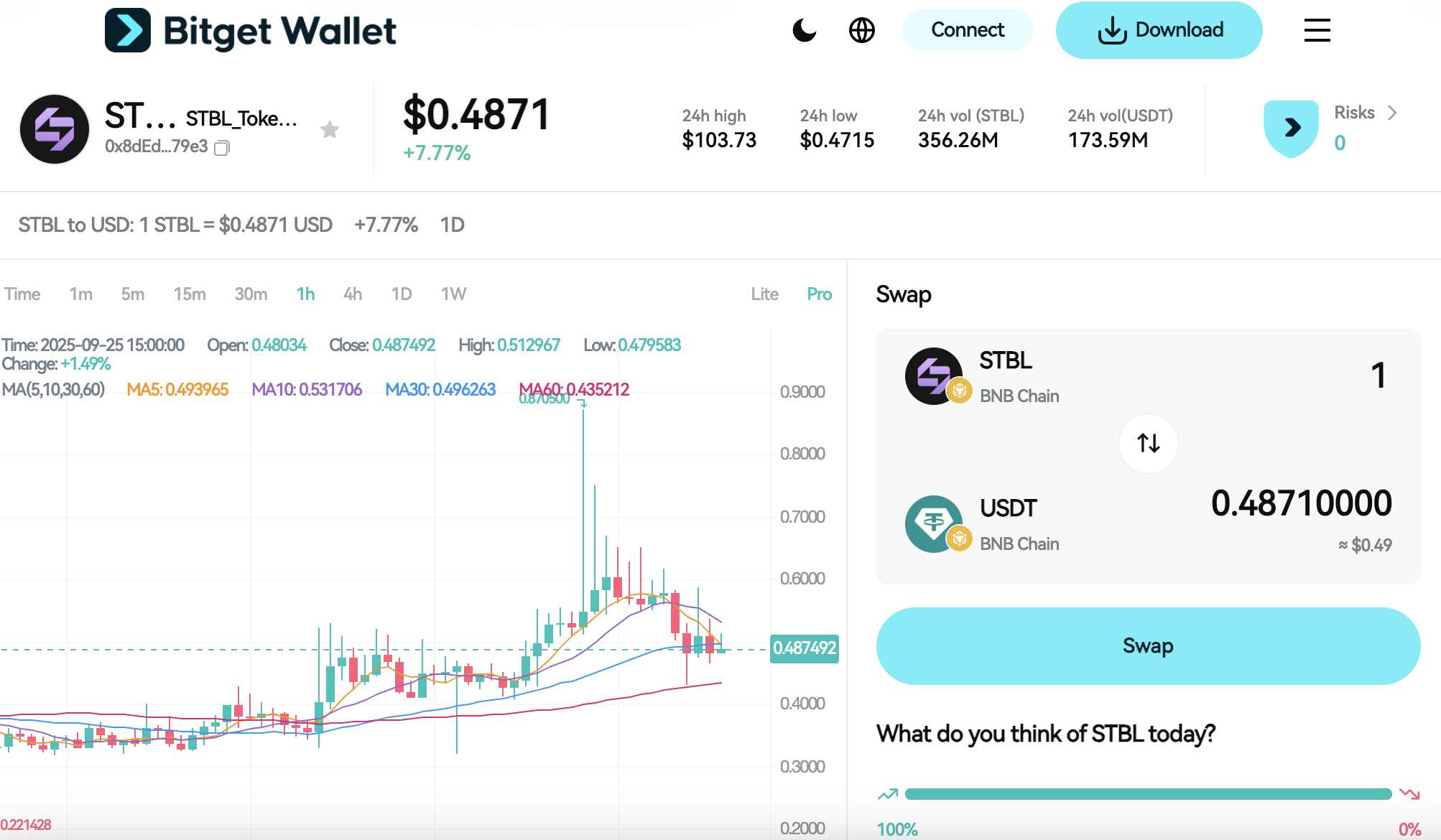

Source: Bitget Wallet

Why STBL (STBL) Stands Out: Essential Features

The standout features of STBL (STBL) include:

-

USST Yield-Separation Mechanism

STBL introduces an innovative model where yield is separated from principal. This allows users to hold a stable asset while accessing yield opportunities through the USST mechanism — something that differentiates it from traditional stablecoins.

-

Backed by Tether Co-Founder

With direct support from Reeve Collins, one of Tether’s co-founders, STBL benefits from credibility, visibility, and strong industry networks. This backing reassures investors and boosts confidence in its long-term sustainability.

-

Multi Factor Staking (MFS)

STBL’s staking system encourages holders to lock tokens, boost rewards, and reduce circulating supply. By aligning incentives with stability, the protocol strengthens its ecosystem and fosters committed community participation.

The STBL (STBL) Ecosystem: How It Functions

How STBL Works?

- Built on the BNB Chain, enabling fast, low-cost, and secure transactions.

- Utilizes a yield-separation mechanism (USST) that isolates principal from yield, providing both stability and earning potential.

- Supports integration across DeFi protocols, stable value storage, and staking models.

Key Benefits

- Stable Value with Yield Opportunities – Unlike traditional stablecoins, STBL lets users store stable value while also accessing yields through its USST mechanism.

- Strong Credibility & Backing – With Tether’s co-founder Reeve Collins involved, STBL gains trust, visibility, and serious industry weight.

- Community-Centric Growth – Multi Factor Staking (MFS) and governance models encourage long-term holding and active participation in the ecosystem.

STBL (STBL)'s Team, Vision, and Partnerships

| Section | Details |

| The Team | Led by a team backed by Tether co-founder Reeve Collins, with extensive experience in digital assets and financial innovation. Their goal is to make STBL (STBL) a symbol of trust, stability, and innovation in the DeFi space. |

| The Vision | Focused on building a Stablecoin 2.0 ecosystem, the project aims to develop a sustainable financial framework that represents secure value storage and yield opportunities in blockchain finance. |

| Partnerships | STBL (STBL) collaborates with ecosystem partners in the BNB Chain and broader DeFi space to strengthen adoption, liquidity, and integration across financial applications. |

STBL (STBL): Practical Applications & Use Cases

STBL (STBL) serves a variety of purposes, including:

-

Stable Value Storage

Provides users with a reliable way to preserve purchasing power while still engaging with blockchain-based finance.

-

Yield-Enhanced Staking

Through its USST yield-separation mechanism and Multi Factor Staking (MFS), STBL allows holders to earn rewards without compromising stability.

-

DeFi Integration

Functions as a utility within the DeFi ecosystem, supporting lending, liquidity pools, and cross-chain interoperability on the BNB Chain.

These applications highlight the practical value of $STBL in the stablecoin and DeFi sector.

STBL (STBL) Roadmap: Key Milestones and Future Developments

The roadmap for STBL (STBL) outlines a clear path for growth and innovation:

| Quarter | Roadmap |

| Q1 2025 | Launch of STBL ecosystem with the USST yield-separation mechanism and initial governance framework. |

| Q2 2025 | Expansion of Multi Factor Staking (MFS) model and integration into BNB Chain-based DeFi protocols. |

| Q3 2025 | Major exchange listings (including KuCoin) and ecosystem partnerships to drive adoption and liquidity. |

These milestones highlight the practical value of $STBL in the stablecoin and DeFi sector.

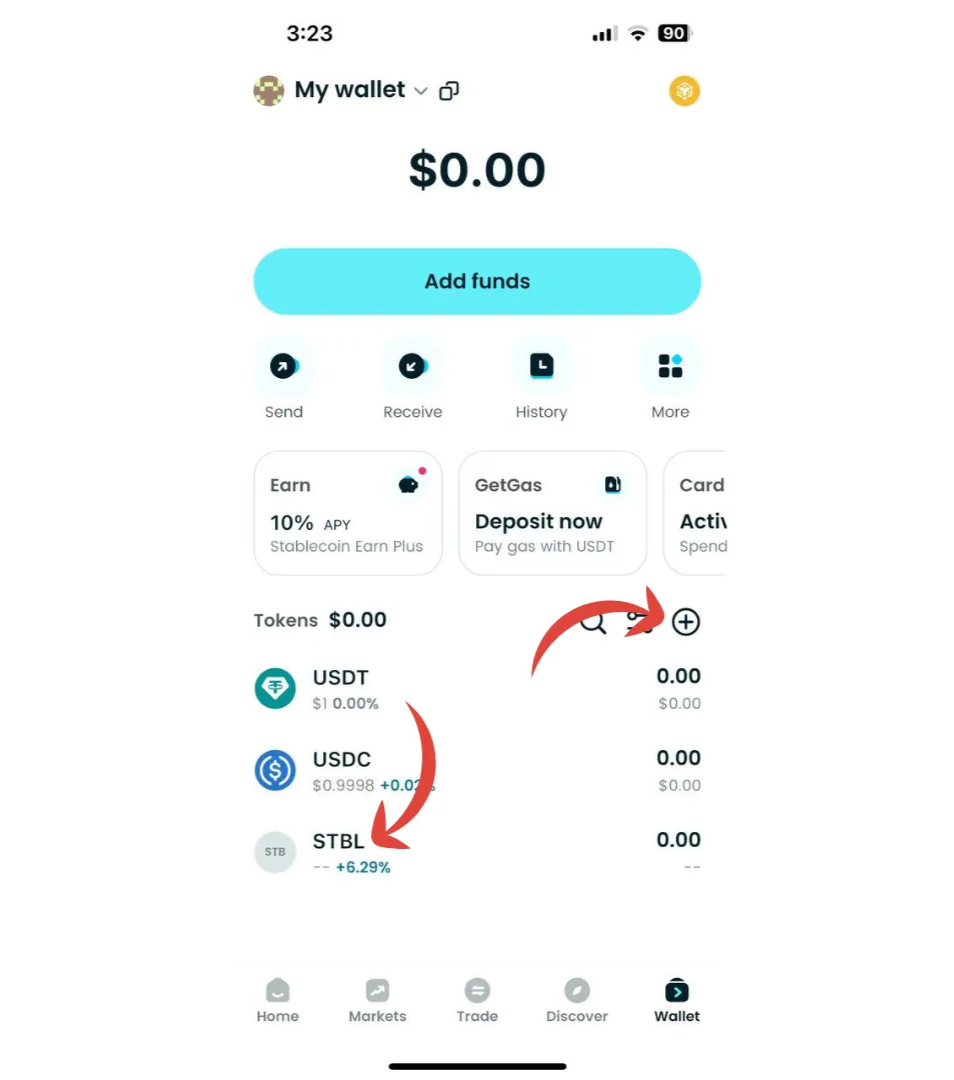

How to Buy STBL (STBL) on Bitget Wallet?

Trading STBL (STBL) is easy on Bitget Wallet. Follow these simple steps to get started:

Step 1: Create an Account

If you don't have an account, download the Bitget Wallet app. Sign up by providing the necessary information and verifying your identity.

Step 2: Deposit Funds

Once your account is set up, you need to deposit funds. You can do this by:

- Transferring Cryptocurrency: Send crypto from another wallet.

- Buying Crypto: Use a credit or debit card to purchase crypto directly on Bitget Wallet, ensuring you have enough funds for trading STBL (STBL).

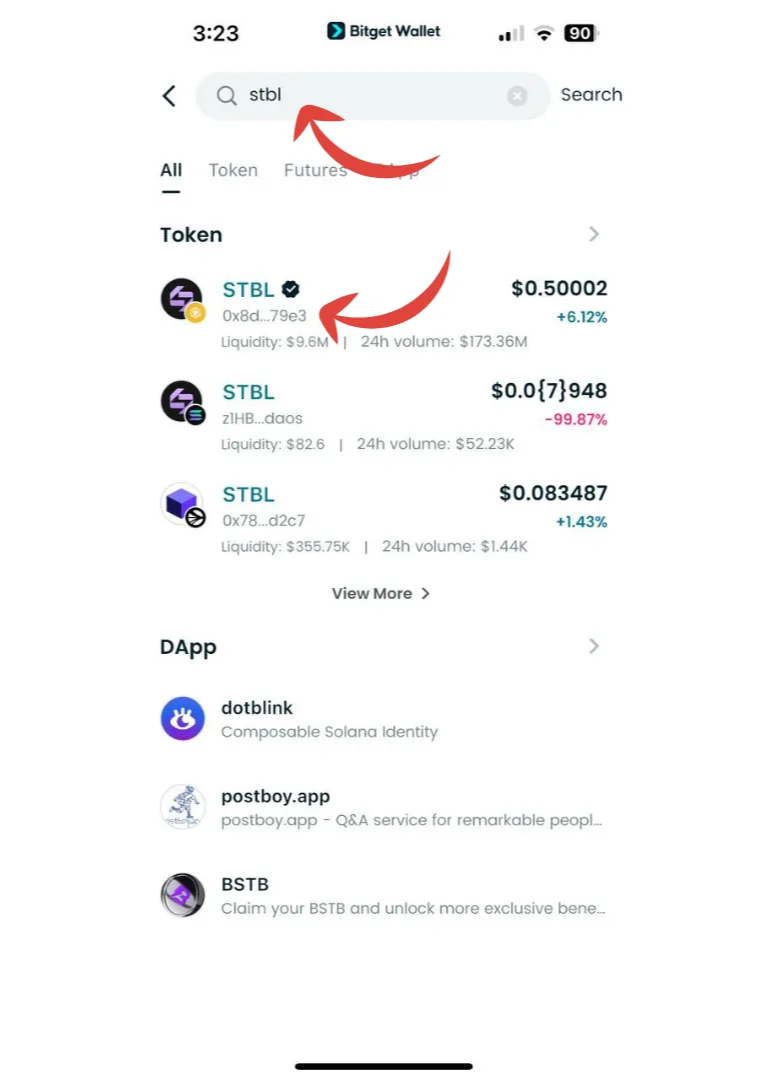

Step 3: Find STBL (STBL)

In the Bitget Wallet interface, navigate to the market section. Use the search bar to find STBL (STBL). Click on the token to view its trading page.

Since this token has not been listed yet, please refer to the final contract address provided by the project team after the token is officially listed.

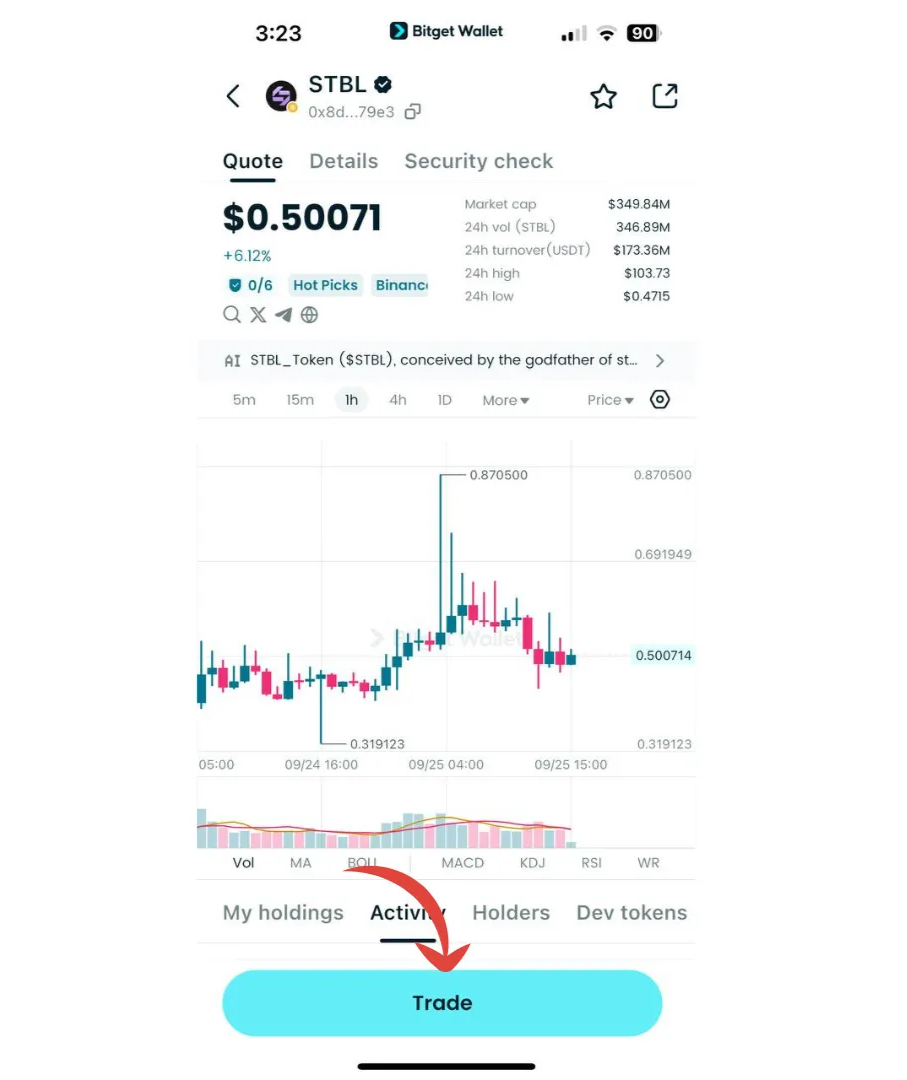

Step 4: Choose Your Trading Pair

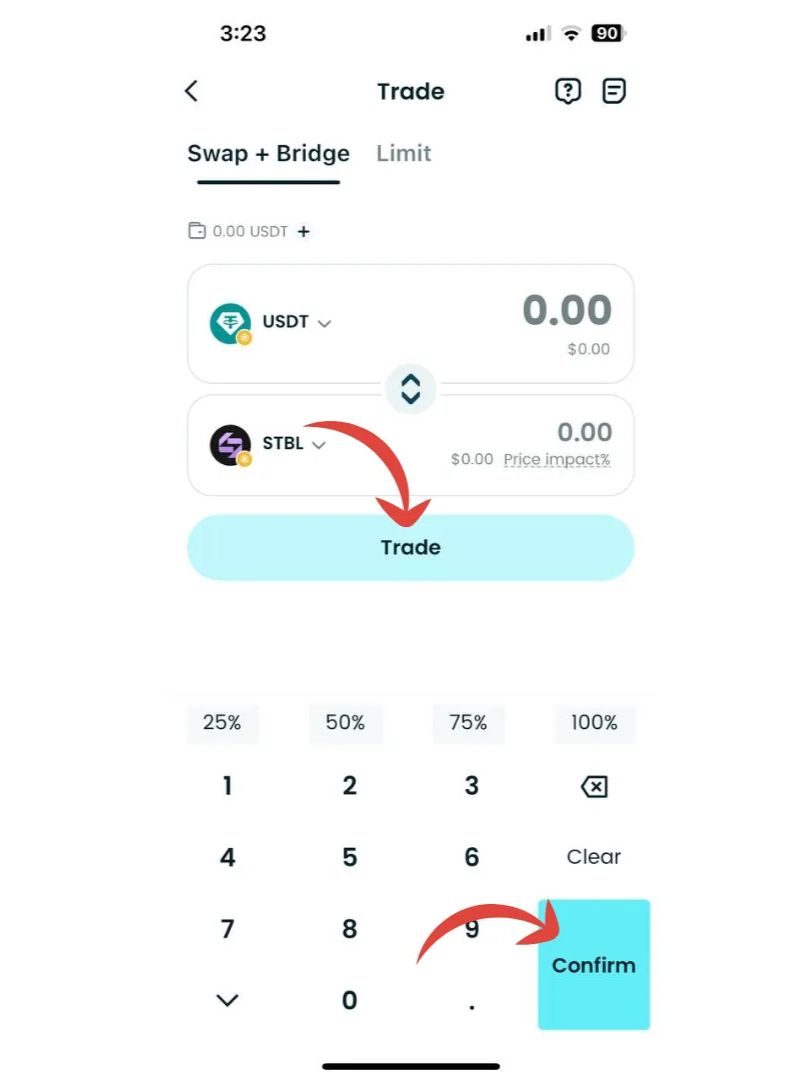

Select the trading pair you wish to use, such as STBL/USDT. This will allow you to trade STBL (STBL) against USDT or another cryptocurrency.

Step 5: Place Your Order

Decide whether you want to place a market order (buy/sell at the current market price) or a limit order (set your own price). Enter the amount of STBL (STBL) you wish to buy or sell, then confirm your order.

Step 6: Monitor Your Trade

After placing your order, you can monitor its status in the “Open Orders” section. Once the order is executed, you can check your balance to see your newly acquired STBL (STBL).

Step 7: Withdraw Your Funds (Optional)

If you wish to transfer your STBL (STBL) or any other cryptocurrency to another wallet, navigate to the withdrawal section, enter your wallet address, and confirm the transaction.

▶ Learn more about STBL (STBL):

Conclusion

STBL (STBL) positions itself as Stablecoin 2.0, blending stability, innovation, and yield opportunities into one ecosystem. With support from Tether’s co-founder and features like the USST yield-separation mechanism, STBL brings a fresh approach to the stablecoin and DeFi space. Its roadmap, staking model, and practical use cases show strong potential for long-term adoption and growth.

Buying STBL (STBL) through Bitget Wallet makes the process seamless and secure. Bitget Wallet offers fast cross-chain swaps, access to trending tokens, and beginner-friendly tools — giving users a reliable gateway to participate in STBL’s journey. For investors and crypto enthusiasts, combining STBL’s innovative design with Bitget Wallet’s ease of use creates a powerful advantage in navigating the digital asset market.

Manage all your tokens in one beginner-friendly app – download Bitget Wallet today.

Sign up Bitget Wallet now - grab your $2 bonus!

FAQs

1. What is STBL (STBL)?

STBL (STBL) is a next-generation stablecoin project on the BNB Chain, backed by Tether’s co-founder. It introduces a yield-separation mechanism (USST) that allows users to hold stable value while also earning returns.

2. Where can I buy STBL (STBL)?

You can trade STBL (STBL) on Bitget Wallet. Simply download the app, deposit funds, search for STBL, and trade it with pairs such as STBL/USDT.

3. What makes STBL (STBL) different from other stablecoins?

Unlike traditional stablecoins that only maintain stability, STBL incorporates yield opportunities through its USST model and staking features. This combination makes it both a store of value and an earning instrument.

Risk Disclosure

Please be aware that cryptocurrency trading involves high market risk. Bitget Wallet is not responsible for any trading losses incurred. Always perform your own research and trade responsibly.