What Is SolvBTC: A Complete Beginner’s Guide to Bitcoin in DeFi & Yield Markets

What Is SolvBTC? SolvBTC is a Bitcoin-backed liquid staking token created by Solv Protocol that bridges Bitcoin with DeFi. It allows BTC holders to earn yield and participate in decentralized markets while keeping full exposure to their Bitcoin. By converting idle BTC into a yield-bearing, cross-chain asset, SolvBTC activates Bitcoin within the broader digital-finance ecosystem.

What Is SolvBTC in practice? It’s a 1:1 BTC-backed liquid staking token that carries Bitcoin’s value into DeFi while unlocking yield, liquidity, and cross-chain mobility.

Developed by Solv Protocol to link DeFi, CeFi, and traditional finance, SolvBTC lets users deploy Bitcoin efficiently without compromising security. Each SolvBTC is backed 1:1 by Bitcoin held in audited reserves, verified through Chainlink Proof of Reserve for complete transparency. If you’ve ever asked What Is SolvBTC for everyday users, think “Bitcoin that can finally earn and move across DeFi without leaving BTC behind.”

Through cross-chain circulation on networks like Ethereum, BNB Chain, and Arbitrum, SolvBTC becomes a versatile instrument for yield generation, lending, and liquidity provision. Holders can securely manage and store SolvBTC via Bitget Wallet, gaining frictionless access to multi-chain DeFi opportunities that turn Bitcoin from a static store of value into an active, productive asset.

Own your Web3 journey easily with Bitget Wallet – secure, fast, and beginner-ready.

Key Takeaways

- SolvBTC = Bitcoin-backed liquid staking token built by Solv Protocol.

- Each SolvBTC Token represents verified Bitcoin reserves, enabling cross-chain liquidity and yield.

- Bridges Bitcoin with DeFi, enabling yield, lending, and liquidity use cases.

- 1:1 BTC-backed with on-chain verification through Chainlink Proof of Reserve.

- Circulates across Ethereum, BNB Chain, and Arbitrum for cross-chain access.

- Integrates with Bitget Wallet for secure, multi-chain management.

- What Is SolvBTC for investors: productive Bitcoin with audited backing and cross-chain yield.

What Exactly Is SolvBTC and How Does It Work?

SolvBTC serves as a gateway that transforms Bitcoin into a usable DeFi asset. The broader Solv Finance ecosystem supports Solv Protocol’s infrastructure, integrating institutional-grade compliance with transparent on-chain staking. Instead of holding BTC passively, users can mint SolvBTC — maintaining Bitcoin’s value while unlocking liquidity, staking, and borrowing potential across major blockchain ecosystems. It is the bridge between Bitcoin’s security and DeFi’s composability. In short, What Is SolvBTC? The bridge that lets Bitcoin stay Bitcoin while acting like a DeFi-native asset.

Source: X

How Does Solv Protocol Turn Bitcoin Into SolvBTC?

Users deposit BTC or wrapped BTC (WBTC) into the protocol’s platform. For every Bitcoin deposited, the system mints one SolvBTC token (1:1), representing full ownership of the underlying asset. Reserves are independently audited and tracked through Chainlink Proof of Reserve, ensuring transparency and solvency. This mint model answers What Is SolvBTC at a technical level: tokenized BTC that maintains 1:1 backing and on-chain solvency checks.

Once issued, SolvBTC can move seamlessly across Ethereum, BNB Chain, Arbitrum, and other supported networks, allowing holders to supply liquidity, stake, or trade while keeping exposure to Bitcoin’s price. This mint-and-redeem model makes SolvBTC a trust-minimized bridge connecting Bitcoin’s base layer with DeFi’s active yield markets. At a systems level, How Does SolvBTC Work across chains? Bridges and canonical deployments let the token circulate on Ethereum, BNB Chain, and Arbitrum.

What Role Does SolvBTC Play in Bitcoin DeFi?

SolvBTC is the missing liquidity link that plugs Bitcoin into the DeFi economy. It enables BTC holders to participate in lending, borrowing, and yield strategies without converting their Bitcoin into volatile alt-assets. Protocols such as Merlin Chain, Avalon Finance, and zkLink integrate SolvBTC for collateral, liquidity, and staking pools.

By introducing a standardized, audited form of Bitcoin liquidity, SolvBTC enhances DeFi composability, allowing Bitcoin to interact with multiple protocols across chains. It turns passive Bitcoin holdings into working capital — earning yields, supporting decentralized markets, and expanding Bitcoin’s relevance beyond simple storage.

How Does SolvBTC Generate Yield for Holders?

SolvBTC doesn’t just tokenize Bitcoin — it activates it. Once BTC is converted into SolvBTC, holders can deploy it across a network of on-chain yield markets and automated vaults designed to produce sustainable, BTC-denominated returns. These strategies operate transparently on-chain, allowing users to earn yield without relinquishing custody or selling their Bitcoin exposure. For anyone still asking What Is SolvBTC, it’s Bitcoin made usable for automated, on-chain yield.

The core principle behind SolvBTC Yield is simple: your Bitcoin keeps its underlying value while simultaneously participating in DeFi liquidity, lending, and staking protocols across chains like Ethereum, BNB Chain, and Arbitrum. This makes SolvBTC a bridge between passive Bitcoin holding and active yield generation — a hybrid model combining Bitcoin’s security with DeFi’s efficiency.

What Are SolvBTC Yield Markets and Vaults?

SolvBTC Yield Markets are decentralized liquidity venues where holders can allocate their SolvBTC into automated DEX LP vaults. These vaults use smart contracts to deploy liquidity on leading decentralized exchanges such as Uniswap and PancakeSwap, enabling participants to earn fees and incentives from trading activity.

Each vault follows a predefined, automated yield strategy optimized for capital efficiency and risk control. Rewards are denominated in Bitcoin terms, offering BTC-based APYs ranging between 1% and 23%, depending on the selected strategy and market conditions. Returns compound automatically, growing the user’s SolvBTC balance without requiring manual reinvestment. That’s What Is SolvBTC in DeFi terms: audited BTC exposure earning fees and incentives through transparent vault logic.

Importantly, SolvBTC vaults operate with no performance fees, and all activity is transparent on-chain, allowing users to monitor performance and liquidity movement in real time. This combination of automation, transparency, and Bitcoin-denominated yield positions SolvBTC vaults as a compliant, user-friendly entry point for BTC yield generation.

What Are the SolvBTC Liquid Staking Tokens (LSTs)?

SolvBTC extends Bitcoin Liquid Staking by offering specialized variants that map BTC to different underlying yield engines. These tokens expand the earning potential of SolvBTC while maintaining the same audited, Bitcoin-backed structure.

- SolvBTC.BBN — Connects to Babylon’s Bitcoin staking layer, providing early access rewards and shared network security incentives. It allows BTC holders to stake within Babylon’s ecosystem while keeping their position liquid through SolvBTC.BBN tokens.

- SolvBTC.ENA — Integrates with Ethena, a synthetic stablecoin platform that leverages delta-neutral trading strategies. It can achieve up to 10× leveraged yield by balancing long and short positions on Bitcoin derivatives, offering higher but risk-managed returns tied to stablecoin hedging mechanisms.

Both LST products operate under the protocol’s compliance framework, which includes a KYC requirement for participants and a 20% profit tax on realized yields — measures intended to align with global financial standards while preserving transparency.

Together, these LSTs redefine Bitcoin Liquid Staking, turning SolvBTC into a modular yield ecosystem where every token can earn, move, and compound value across DeFi.

How Is SolvBTC Backed and Secured?

The integrity of SolvBTC depends entirely on how safely its reserves are stored and verified. The protocol uses a multi-layered security framework that combines third-party audits, on-chain transparency, and decentralized governance. This ensures that every SolvBTC in circulation is fully backed 1:1 by real Bitcoin or wrapped Bitcoin and that all collateral movements can be independently tracked. From a security lens, What Is SolvBTC? A BTC derivative whose reserves, governance, and movements are independently verifiable.

By integrating Chainlink Proof of Reserve, decentralized governance, and multi-signature custody, the protocol builds confidence for institutional and retail participants alike. These measures form the backbone of SolvBTC Security, creating a verifiable bridge between Bitcoin and DeFi.

What Ensures the Safety of SolvBTC Reserves?

Every SolvBTC token is backed by Bitcoin or wrapped Bitcoin on a 1:1 reserve model, stored securely within institutional-grade wallets. These reserves undergo continuous third-party audits conducted by Quantstamp, CertiK, and SlowMist, ensuring the collateral matches the total supply of SolvBTC in circulation.

Security is further enhanced through Solv Guard, a specialized monitoring system that tracks all reserve movements in real time. The assets are managed within a multi-signature Safe wallet system, preventing any single party from accessing or transferring funds unilaterally.

Governance follows a Governor + Vault Guardian model. The Governor oversees protocol parameters and treasury decisions, while the Vault Guardian enforces custody integrity, acting as an internal watchdog to safeguard against operational or governance-level risks.

Together, these mechanisms establish a transparent and tamper-resistant infrastructure that makes the protocol one of the most rigorously audited ecosystems in Bitcoin DeFi.

What Is Chainlink Proof of Reserve in SolvBTC?

SolvBTC Proof of Reserve uses Chainlink’s decentralized oracle network to continuously verify that the Bitcoin collateral backing SolvBTC is equal to or greater than the total SolvBTC supply. This ensures real-time solvency and prevents over-minting or under-collateralization.

All reserve data is published directly on-chain — currently verified across the BNB Chain — allowing anyone to audit the total BTC holdings independently. This transparency has become a trust anchor for the ecosystem, supporting over $2 billion in total value locked (TVL) across the protocol’s integrated networks.

By combining institutional-grade audits, decentralized oracles, and transparent governance, SolvBTC Proof of Reserve guarantees the long-term stability and credibility of Bitcoin’s expansion into DeFi.

How Does SolvBTC Compare to WBTC and Other Bitcoin Tokens?

Within the expanding world of Bitcoin DeFi projects, several tokenized versions of Bitcoin compete to make BTC usable across decentralized ecosystems. While tokens like WBTC and BTCB have enabled Bitcoin transfers on other chains, their structure remains largely custodial and yield-inactive. SolvBTC, by contrast, introduces a decentralized, yield-bearing model with cross-chain liquidity and verifiable reserves. In short, SolvBTC vs WBTC comes down to audited yield and multi-chain utility versus a purely custodial wrapper. Put simply, What Is SolvBTC versus wrappers like WBTC? A yield-bearing, multi-chain, audit-forward alternative.

What Makes SolvBTC Different from WBTC or BTCB?

The key distinction lies in custody, functionality, and flexibility.

WBTC (Wrapped Bitcoin) is managed by BitGo, a centralized custodian that holds BTC and issues ERC-20 WBTC in return. While secure, it depends on a single trusted entity and does not provide native yield. Similarly, BTCB, issued on Binance Chain, follows a custodial model that limits DeFi composability outside its ecosystem.

SolvBTC, however, is semi-decentralized and yield-bearing. It operates through audited reserves, Chainlink Proof of Reserve, and on-chain governance, making it more transparent and accessible across multiple blockchains. Holders can use SolvBTC to earn Bitcoin-denominated yield in DeFi protocols, something neither WBTC nor BTCB natively supports.

| Token | Custody | Yield | Cross-Chain | Audited |

| WBTC | Centralized | ❌ | Limited | ✔️ |

| BTCB | Centralized | ❌ | Limited | ✔️ |

| SolvBTC | Semi-decentralized | ✅ | Multi-chain | ✔️ |

For users comparing wrappers, Bitcoin Liquid Staking via SolvBTC combines auditability with utility, unlike purely custodial bridges. This balance between decentralization, functionality, and transparency positions SolvBTC as one of the Best Bitcoin Staking Tokens for users who want both Bitcoin exposure and on-chain yield without relying entirely on centralized custodians.

How Can You Mint, Use, and Redeem SolvBTC?

Minting and using SolvBTC is designed to be intuitive and fully on-chain. The process allows Bitcoin holders to convert their BTC or wrapped BTC into SolvBTC with a 1:1 ratio, immediately unlocking access to yield opportunities across multiple chains. Once minted, holders can deploy their SolvBTC into staking, liquidity, or lending protocols to earn passive Bitcoin-denominated income. Operationally, What Is SolvBTC? A token you can mint 1:1 with BTC and immediately deploy for yield.

Redemption is equally straightforward, following a weekly cycle that balances liquidity and security. This framework ensures flexibility while maintaining the integrity of audited reserves, giving users transparent control over their Bitcoin-backed assets. How Does SolvBTC Work? By minting a 1:1 tokenized claim on BTC that remains usable across chains and DeFi markets.

How to Mint SolvBTC Step-by-Step

The minting process for SolvBTC is simple, transparent, and fully on-chain. It allows Bitcoin holders to transform their BTC or wrapped BTC (WBTC) into a yield-bearing version of Bitcoin that can move freely across DeFi ecosystems.

Step 1: Connect a Supported Wallet

Start by connecting a wallet that supports Bitcoin or wrapped BTC. A multi-chain wallet such as Bitget Wallet is recommended, as it allows smooth interaction across Ethereum, BNB Chain, and Arbitrum.

Source: Solv.Finance

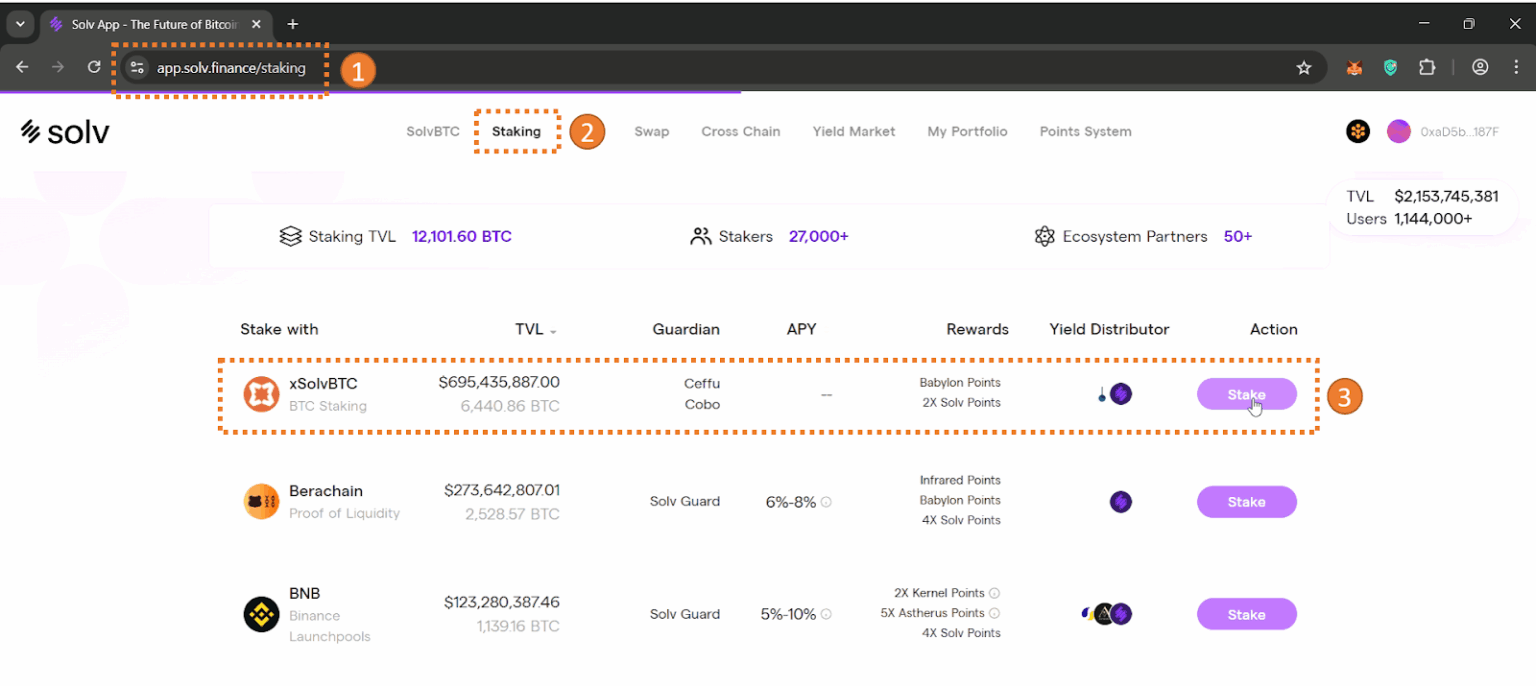

Step 2: Deposit BTC to Mint SolvBTC 1:1

Next, deposit your BTC or WBTC into the Solv Protocol minting interface. The system automatically mints SolvBTC at a 1:1 ratio—for every Bitcoin you lock, you receive an equivalent amount of SolvBTC in your wallet. Each token represents verifiable ownership of Bitcoin, backed by audited reserves and protected under Solv Protocol’s security framework.

Source: Rootstock

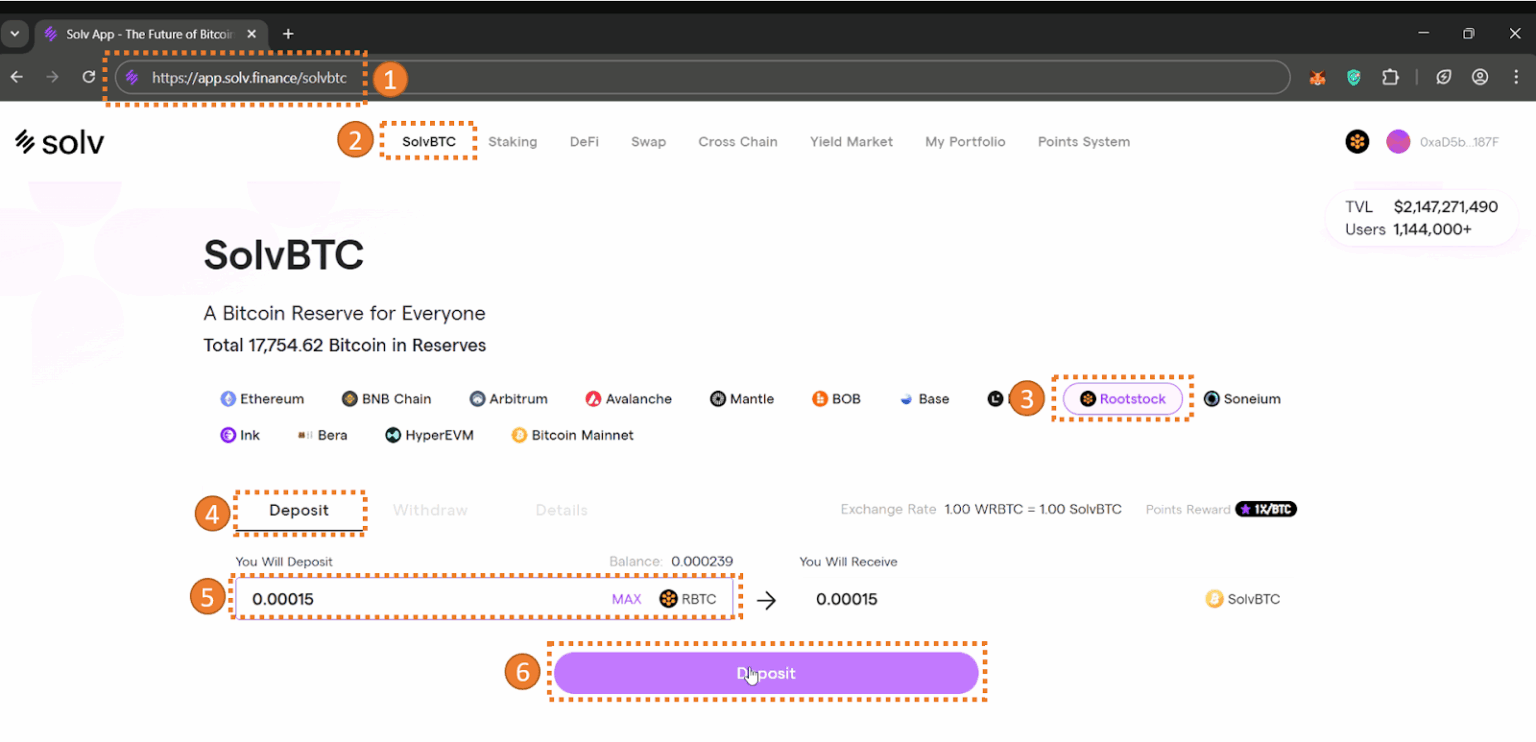

Step 3: Put Your SolvBTC to Work

Once minted, your SolvBTC can immediately be used for staking, liquidity provision, or lending within Solv’s integrated DeFi platforms. This is where SolvBTC begins generating yield, allowing your Bitcoin to earn while staying fully collateralized.

Source: Rootstock

Redemption Cycle

Redemptions follow a weekly schedule: requests made between Sunday and Saturday are processed every Monday. This ensures orderly liquidity management and transparent proof-of-reserve validation. There are no redemption fees, though normal blockchain gas or transaction fees may apply when minting or transferring.

Through this straightforward process, users can move effortlessly from passive Bitcoin holding to active yield participation—without compromising on transparency or control.

Where Can You Use SolvBTC in DeFi?

After minting, holders can use SolvBTC on BNB Chain, Ethereum, and Merlin Chain to earn yield through liquidity farming, staking, and lending. Deployed SolvBTC participates in on-chain yield markets that generate returns from decentralized exchange liquidity, lending interest, and reward pools.

Users can also provide SolvBTC liquidity to automated vaults, where smart contracts optimize compounding strategies and rebalance yields automatically. This gives participants Bitcoin-based APYs without the need for manual yield farming.

There are no redemption or performance fees, and all movements are recorded transparently on-chain. This combination of automation, yield efficiency, and transparent management makes SolvBTC Token one of the most practical tools for earning SolvBTC Yield across DeFi — especially for users operating on BNB Chain or other major Layer-2 networks.

What Are the Risks and Rewards of SolvBTC?

Like every innovation in Bitcoin DeFi, SolvBTC combines both opportunity and exposure. By transforming Bitcoin into a liquid, yield-bearing token, it opens doors to passive income and cross-chain participation — but it also introduces layers of smart-contract and custodial dependency that holders should understand before investing.

In short, SolvBTC offers attractive yield potential and financial flexibility, yet it operates within the evolving regulatory and technical landscape of DeFi. Awareness of both sides — the upside and the risks — is essential for any informed SolvBTC investment.

Why Do Bitcoin Holders Use SolvBTC?

Early participants can also benefit from upcoming SolvBTC Airdrop campaigns that reward users providing liquidity or staking SolvBTC across partner protocols — boosting engagement while expanding Bitcoin’s role in DeFi.

Bitcoin holders are drawn to SolvBTC for one simple reason: productivity. Instead of sitting idle, Bitcoin becomes an income-generating asset. With SolvBTC, users can stake, lend, or provide liquidity across ecosystems like Ethereum, BNB Chain, and Arbitrum, all while maintaining Bitcoin exposure and on-chain transparency.

The market’s momentum proves its value — over 19,000 BTC (worth $1.4B+) are already circulating through SolvBTC vaults, signaling trust and rapid adoption among DeFi users.

What Risks Should Users Know Before Investing?

Despite its strong fundamentals, SolvBTC carries certain risks inherent to DeFi and tokenized Bitcoin systems.

- Custodial Risk: Although SolvBTC uses a semi-decentralized model with multi-signature safeguards, portions of the reserve infrastructure still rely on bridges and custody layers that introduce potential vulnerabilities if mismanaged or exploited.

- Regulatory and Smart Contract Risk: As jurisdictions continue to evolve crypto oversight, future regulatory restrictions could impact yield operations or redemption processes. Additionally, smart-contract vulnerabilities or exploits within integrated DeFi protocols could lead to partial capital losses.

- Market and Liquidity Risk: Yield rates may fluctuate with on-chain liquidity demand, and redemption cycles could delay withdrawals during high network activity.

Investors should conduct independent due diligence, review audit reports, and monitor protocol updates through official Solv Protocol channels. Transparency remains high, but prudent risk management is essential in all DeFi participation.

How to Store and Manage SolvBTC Securely with Bitget Wallet

Once minted, SolvBTC can be stored, managed, and utilized through Bitget Wallet, a leading multi-chain, non-custodial DeFi wallet designed for secure cross-chain management. As SolvBTC operates across networks such as Ethereum, BNB Chain, and Arbitrum, using a wallet with built-in interoperability is essential.

Bitget Wallet provides holders with secure custody, easy swaps, and direct DeFi access—allowing SolvBTC to move freely between ecosystems without exposing users to centralized risk. Whether your goal is to stake, swap, or farm Bitcoin-based yield, Bitget Wallet simplifies every part of that process.

Why Use Bitget Wallet for SolvBTC Management?

Bitget Wallet is a multi-chain, non-custodial platform that fully supports SolvBTC and its related tokens across major networks, including Ethereum, BNB Chain, and Arbitrum. It enables users to store, transfer, and trade SolvBTC safely while maintaining self-custody of their private keys.

Beyond storage, Bitget Wallet integrates a complete DeFi toolkit:

- Seamless DeFi Access — Instantly swap, stake, and earn SolvBTC and other assets within the wallet interface.

- Stablecoin Vaults — Manage and earn from USDT and USDC vaults for diversified on-chain returns.

- Cross-Chain & Memecoin Trading — Access trending memecoin markets and execute cross-chain swaps directly, ensuring your SolvBTC portfolio remains liquid and flexible.

These features make Bitget Wallet a trusted hub for managing SolvBTC and interacting with the wider DeFi landscape, combining security, simplicity, and utility.

How to Buy SolvBTC (SolvBTC) on Bitget Wallet?

Trading SolvBTC (SolvBTC) is easy on Bitget Wallet. Follow these simple steps to get started:

Step 1: Create an Account

If you don't have an account, download the Bitget Wallet app. Sign up by providing the necessary information and verifying your identity.

Step 2: Deposit Funds

Once your account is set up, you need to deposit funds. You can do this by:

- Transferring Cryptocurrency: Send crypto from another wallet.

- Buying Crypto: Use a credit or debit card to purchase crypto directly on Bitget Wallet, ensuring you have enough funds for trading SolvBTC (SolvBTC).

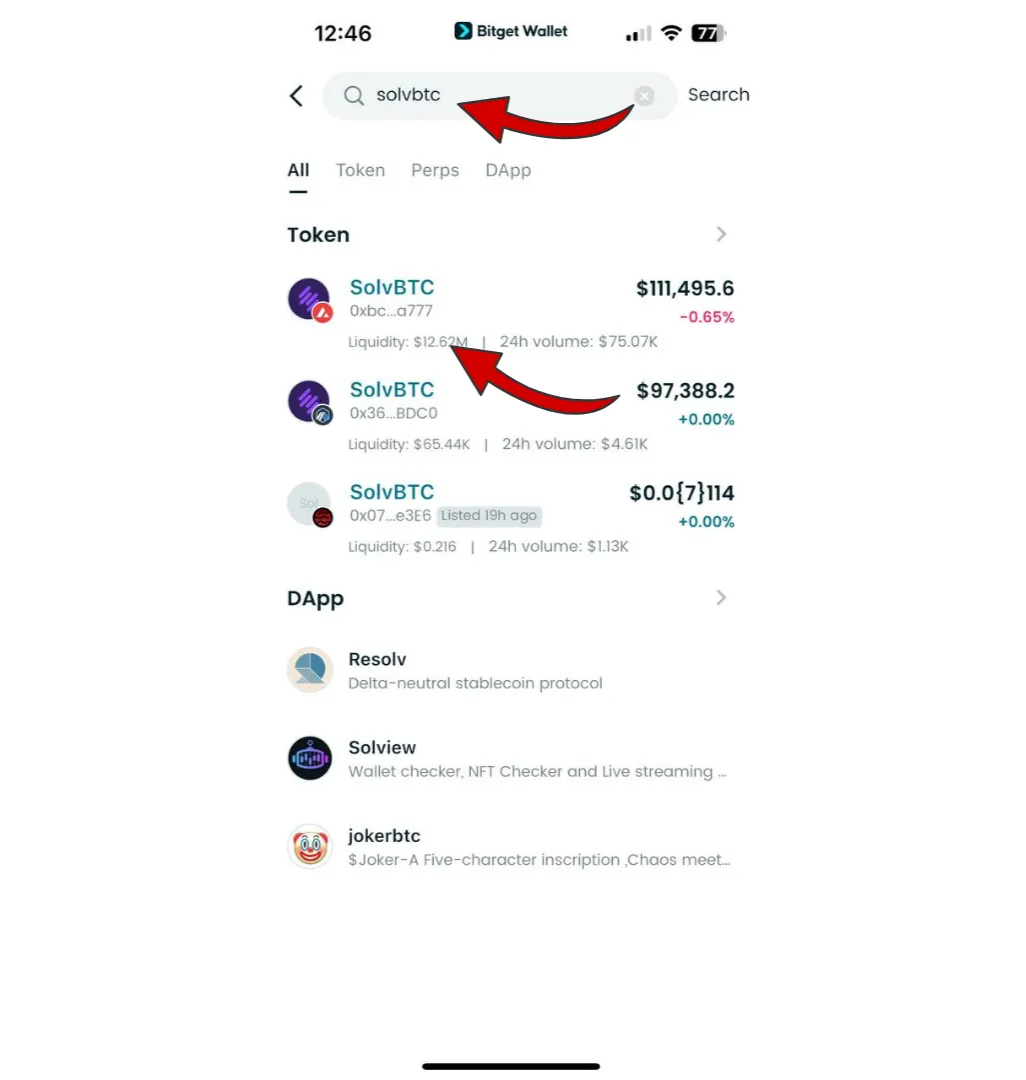

Step 3: Find SolvBTC (SolvBTC)

In the Bitget Wallet interface, navigate to the market section. Use the search bar to find SolvBTC (SolvBTC). Click on the token to view its trading page.

Since this token has not been listed yet, please refer to the final contract address provided by the project team after the token is officially listed.

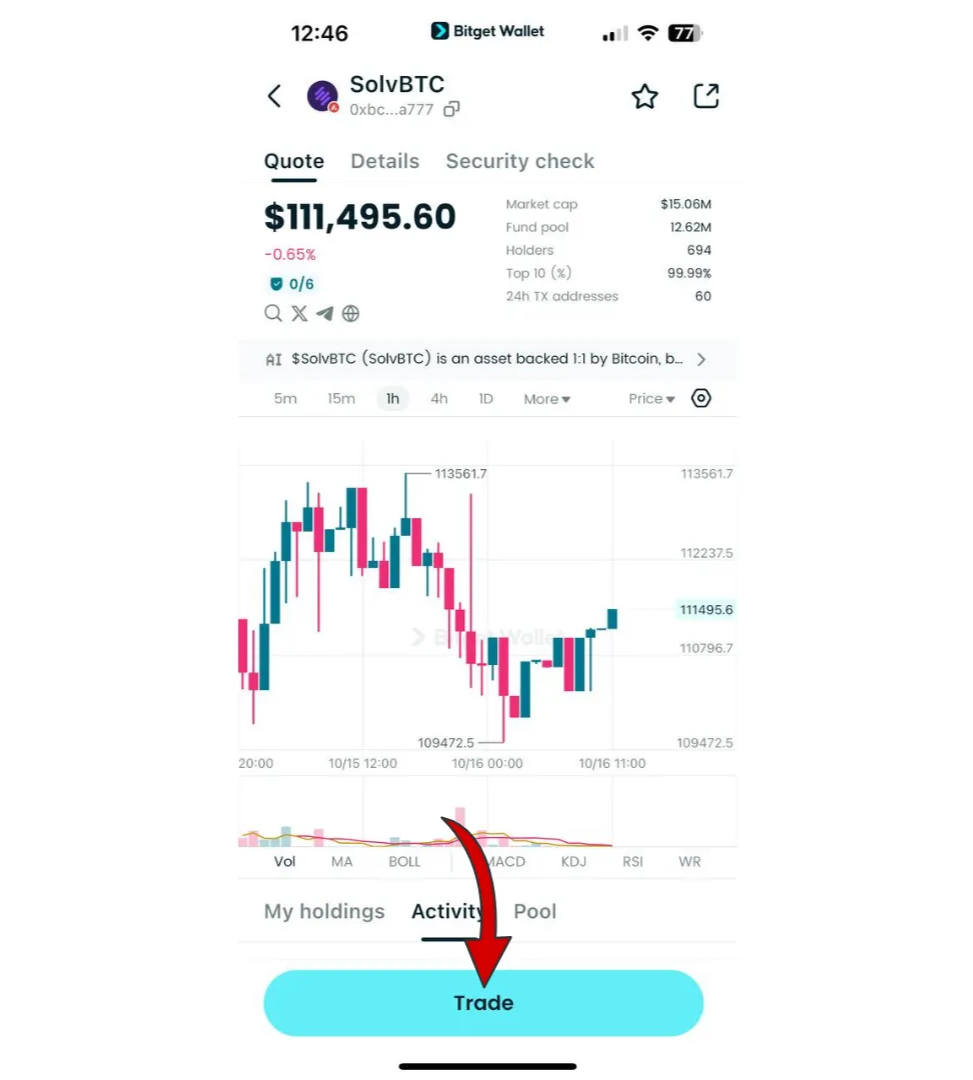

Step 4: Choose Your Trading Pair

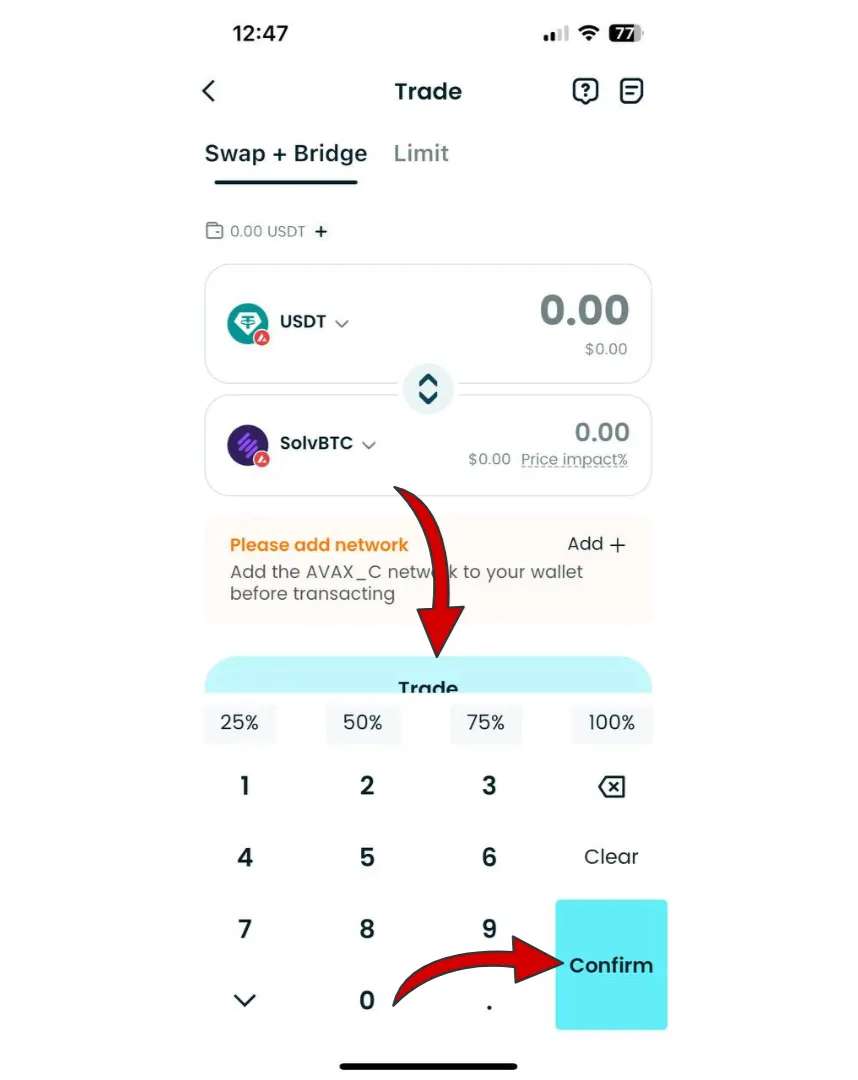

Select the trading pair you wish to use, such as SolvBTC/USDT. This will allow you to trade SolvBTC (SolvBTC) against USDT or another cryptocurrency.

Step 5: Place Your Order

Decide whether you want to place a market order (buy/sell at the current market price) or a limit order (set your own price). Enter the amount of SolvBTC (SolvBTC) you wish to buy or sell, then confirm your order.

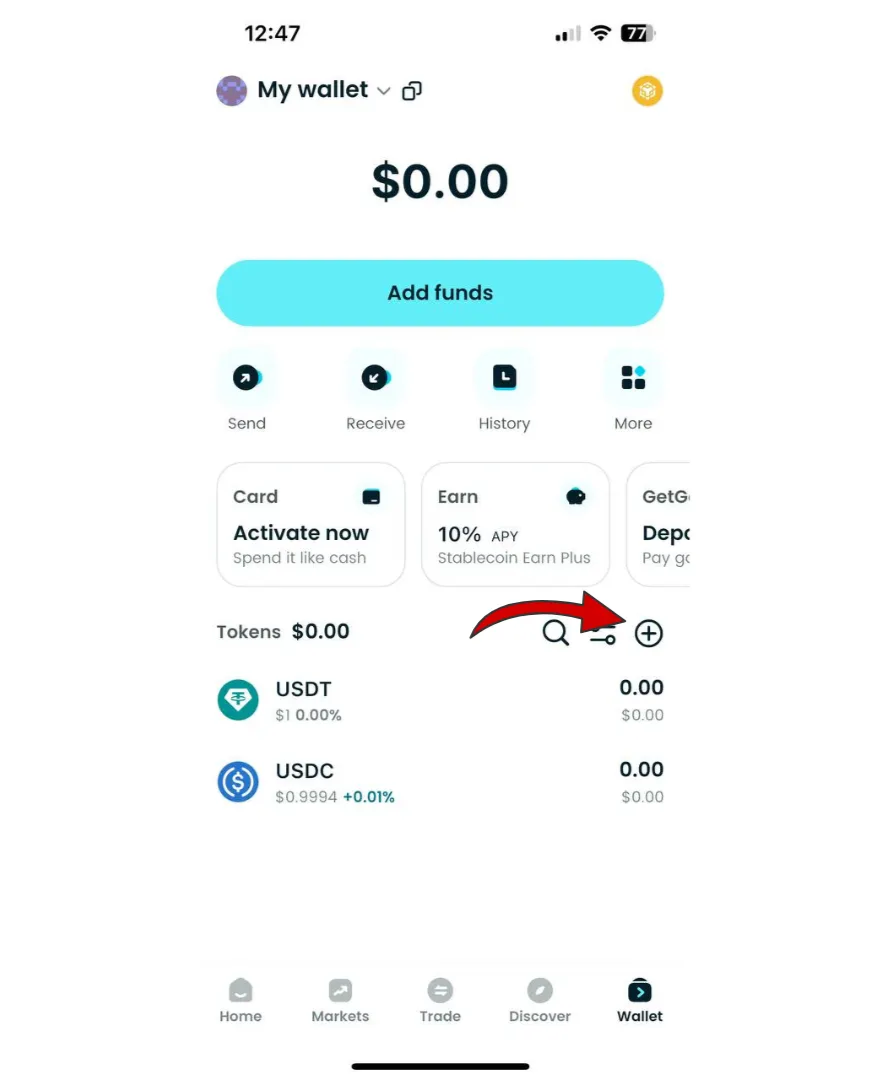

Step 6: Monitor Your Trade

After placing your order, you can monitor its status in the “Open Orders” section. Once the order is executed, you can check your balance to see your newly acquired SolvBTC (SolvBTC).

Step 7: Withdraw Your Funds (Optional)

If you wish to transfer your SolvBTC (SolvBTC) or any other cryptocurrency to another wallet, navigate to the withdrawal section, enter your destination wallet address, and confirm the transaction.

Conclusion

What Is SolvBTC? It is the bridge between Bitcoin and DeFi yield — a liquid, Bitcoin-backed token that lets holders earn passive income, access cross-chain liquidity, and retain full transparency over their reserves. Built by Solv Protocol, it merges institutional-grade auditing with user-controlled DeFi, making Bitcoin both secure and productive across Ethereum, BNB Chain, and Arbitrum.

With SolvBTC, users gain the best of both worlds: Bitcoin’s reliability and DeFi’s composability. Every token is transparently backed, governed, and accessible through a compliant, yield-driven framework.

To manage SolvBTC safely, trade seamlessly, and explore yield opportunities across chains, store it using Bitget Wallet — your all-in-one gateway to secure Bitcoin DeFi.

From stablecoin savings to trending Bitcoin yields, Bitget Wallet helps you unlock every DeFi opportunity in one secure place.

Sign up Bitget Wallet now - grab your $2 bonus!

FAQs

1. What Is SolvBTC in Simple Terms?

SolvBTC is a Bitcoin-backed liquid staking token created by Solv Protocol. It allows Bitcoin holders to earn yield and use their BTC across multiple DeFi ecosystems such as Ethereum, BNB Chain, and Arbitrum — without selling or giving up control of their Bitcoin.

2. How Is SolvBTC Different from WBTC or BTCB?

Unlike WBTC or BTCB, which are fully custodial, SolvBTC operates through a semi-decentralized, yield-bearing model. It’s audited, transparent, and supported by Chainlink Proof of Reserve, ensuring every token is backed 1:1 with Bitcoin. Plus, it generates yield through on-chain DeFi markets — something WBTC and BTCB don’t offer.

3. How Can I Mint SolvBTC?

You can mint SolvBTC by depositing BTC or WBTC into Solv Protocol’s minting interface. The system issues SolvBTC at a 1:1 ratio. Minting is followed by a weekly redemption cycle (Sunday–Saturday, processed Monday) for those who wish to convert back to BTC.

4. Where Can I Store or Trade SolvBTC?

Bitget Wallet is the preferred wallet for managing SolvBTC securely. It’s a multi-chain, non-custodial wallet that supports SolvBTC on Ethereum, BNB Chain, and Arbitrum. Users can swap, stake, and earn yield directly within the app.

5. What Are the Main Benefits of Holding SolvBTC?

- Cross-chain liquidity and DeFi access

- Bitcoin-denominated yield through automated vaults

- Audited reserves verified via Chainlink Proof of Reserve

- Full user control in a non-custodial environment

These features make SolvBTC one of the most trusted options for Bitcoin DeFi yield.

Risk Disclosure

Please be aware that cryptocurrency trading involves high market risk. Bitget Wallet is not responsible for any trading losses incurred. Always perform your own research and trade responsibly.