Gold vs Bitcoin: Which Is the Better Investment in 2026 and Beyond?

Gold vs Bitcoin has become the defining investment debate of 2026. Both assets have dominated headlines as investors battle rising inflation, geopolitical tensions, and a weakening U.S. dollar. Gold continues to shine as the “ultimate safe haven,” while Bitcoin — often dubbed “digital gold” — has proven its resilience after 16 years of existence.

The question for investors is no longer academic: Is Bitcoin a better investment than gold, or should both coexist in a modern portfolio? This article compares their performance, volatility, inflation-hedge potential, and safe-haven credibility. It also examines why gold and Bitcoin have diverged so sharply in 2026.

And for everyday investors ready to participate in digital assets, access has never been easier — with platforms like Bitget Wallet, buying and storing Bitcoin is now as seamless as owning gold ETFs.

From stable savings to trending trades, Bitget Wallet makes it simple for beginners.

Key Takeaways

- Gold and Bitcoin continue to show different performance behaviors, with gold remaining steady as a safe haven while Bitcoin moves through higher-volatility cycles.

- Gold remains the traditional safe haven, trusted by central banks and backed by millennia of history.

- Bitcoin offers higher upside and accessibility through ETFs and wallets like Bitget Wallet, but volatility and regulation remain key risks.

What Makes Gold vs Bitcoin the Biggest Investment Debate in 2026?

Gold has a 5,000-year history as humanity’s universal store of value. Central banks, particularly in China and emerging markets, continue to buy gold in record amounts. Bitcoin, by contrast, has only existed since 2009 but has already matured into a trillion-dollar market with ETFs listed across major exchanges.

Until recently, both assets often moved in tandem. But as CME Group reports, from 2022 to 2024 they rose together — gold up +67% and Bitcoin up +400% — before decoupling in 2026: gold gained +16% while Bitcoin dropped –6%. This divergence has reignited the gold vs Bitcoin 2025 debate across markets.

How Do Gold and Bitcoin Compare as Safe Havens?

The safe haven debate defines much of the gold vs Bitcoin discussion. Gold has anchored wealth for millennia, while Bitcoin is pushing to prove itself as a modern alternative. Comparing both shows where tradition meets digital innovation in times of crisis.

Why Has Gold Been Trusted for Centuries?

Gold’s role as a safe haven rests on its intrinsic properties: it is scarce, durable, and universally recognized. It is also backed by systemic trust, with central banks holding over 35,000 tonnes. During periods of financial stress, gold consistently attracts flows, reinforcing its reputation as the ultimate safe haven.

Can Bitcoin Really Be “Digital Gold”?

Bitcoin advocates argue that its fixed supply of 21 million coins makes it the modern “digital gold.” BlackRock CEO Larry Fink even called Bitcoin “digital gold” after the success of U.S. spot ETFs. Unlike gold, Bitcoin is borderless and censorship-resistant. But its volatility and shorter history mean its role as a true safe haven remains contested.

Which Performs Better – Gold or Bitcoin Returns?

Performance is the heart of the gold vs Bitcoin debate. Gold has delivered steady, long-term gains, but Bitcoin’s explosive growth has outpaced nearly every other asset. Comparing returns across different timeframes reveals just how different their trajectories are.

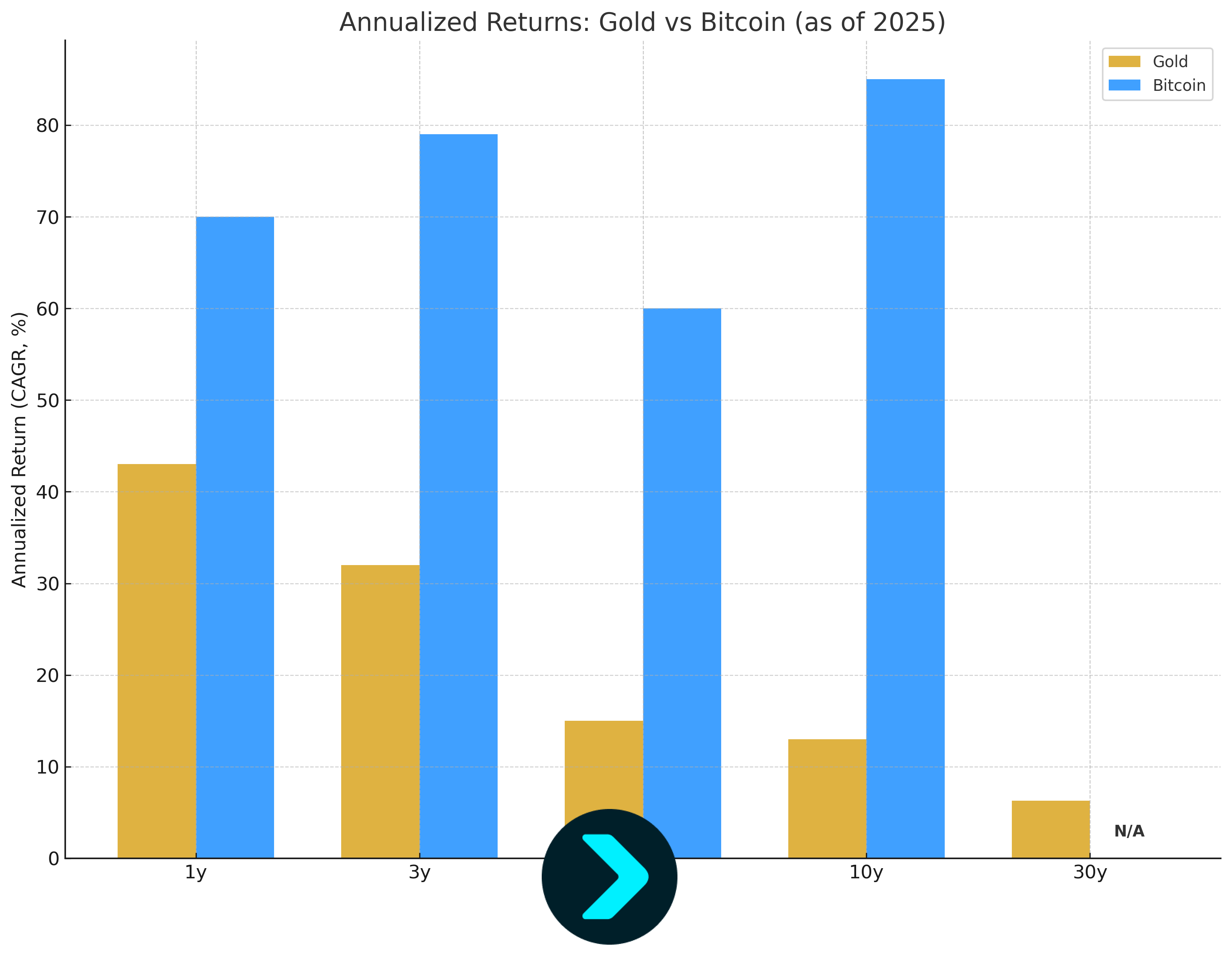

Annualized Returns (CAGR) Table — as of 2026

| Period | Gold (CAGR) |

Bitcoin (CAGR) |

| 1-year | ~43% | ~70% |

| 3-year | ~32% | ~79% |

| 5-year | ~15% | ~60% |

| 10-year | ~13% | ~85% |

| 30-year | ~6.3% | N/A (launched 2009) |

Note: CAGR (Compound Annual Growth Rate) is the smoothed yearly return that shows how an asset grew over a set period. Bitcoin has no 30-year data because it only launched in 2009 — gold, by contrast, has centuries of historical data.

Which Performs Better – Gold or Bitcoin Returns?

When it comes to performance, the numbers speak for themselves. Gold offers steady gains, but Bitcoin has delivered explosive returns that no other asset class can match. The key is understanding how both compare across different timeframes.

How Do Gold vs Bitcoin Returns Compare Across Timeframes?

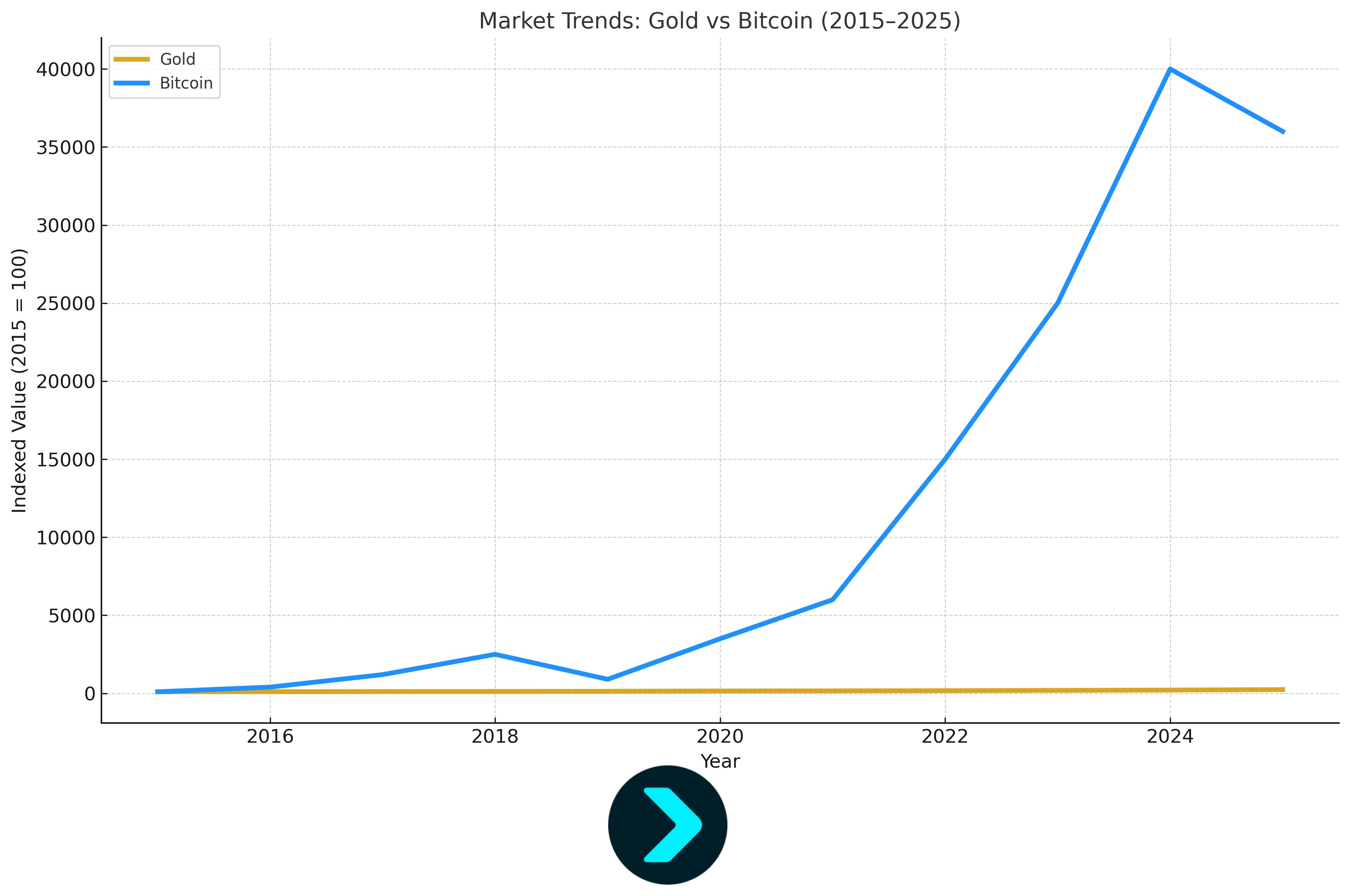

When it comes to raw performance, Bitcoin has dramatically outpaced gold. Over the last decade, Bitcoin delivered over +48,000%, compared to gold’s +234%. Even over five years, Bitcoin is far ahead, though 2026 has flipped the short-term story.

Here’s a snapshot of gold vs Bitcoin returns and volatility:

| Metric | Gold | Bitcoin |

| 10-Year Returns | +234% | +48,000% |

| 5-Year Returns | +45% | +1,200% |

| 1-Year Returns (2025) | +16% | –6% |

| Volatility (Annualized) | ~15% | ~60% |

Key Insight: Gold offers steady but modest growth with low volatility, while Bitcoin provides explosive upside with significantly higher risk.

How Volatile Are Gold and Bitcoin?

Volatility remains the defining difference in Bitcoin vs gold investment. Gold has historically averaged ~15% annualized volatility, while Bitcoin averages 60–80%. In crisis events (such as March 2020), Bitcoin plunged faster than gold but rebounded more aggressively, cementing its role as a high-beta asset.

How Does Gold vs Bitcoin Hedge Against Inflation?

Inflation is where the gold vs Bitcoin debate gets serious. Gold has a centuries-long record as a shield against rising prices, while Bitcoin’s fixed supply positions it as a potential modern hedge. The question is: which asset holds up better under inflationary pressure?

Why Has Gold Historically Protected Against Inflation?

Gold has long been a textbook inflation hedge. Over the last 30 years, gold rose nearly +900%, far outpacing the ~150% rise in U.S. CPI. Central banks buying gold as reserves is a clear sign of its continued role as an inflation buffer.

Has Bitcoin Proven Itself Against Inflation?

Bitcoin has generated staggering long-term returns — +48,000% in 10 years — but its inflation-hedge credentials are debated. Some investors see it as a superior hedge because of its fixed supply, while skeptics argue that it reacts more like a speculative tech stock. The gold vs Bitcoin inflation hedge question remains open.

What Explains the Divergence Between Gold and Bitcoin in 2026?

In 2025, gold rose +16% while Bitcoin fell –6%. This decoupling is driven by:

- Central Bank Demand: Heavy gold purchases by China and emerging markets.

- ETF Profit-Taking: Bitcoin ETFs drove inflows in 2024, but profit-taking cooled momentum.

- Correlation with Equities: Bitcoin continues to trade like a risk asset tied to Nasdaq moves.

- Safe-Haven Rotation: In market stress, flows move from Bitcoin into gold.

The result? Gold has reaffirmed its defensive role, while Bitcoin is still behaving more like a growth asset.

How Do Gold vs Bitcoin Compare on Liquidity and Accessibility?

Liquidity and accessibility often determine how easily investors can enter or exit a position. Gold has dominated this space for centuries, while Bitcoin is rapidly catching up through ETFs and wallets. Comparing both shows how traditional and digital markets are converging.

Why Is Gold Still the Most Liquid Asset?

Gold dominates global markets. The SPDR Gold Trust (GLD) has over $120 billion AUM, and daily volumes make it one of the most liquid assets in the world.

Is Bitcoin Becoming Easier to Access?

Yes — Bitcoin is catching up fast. BlackRock’s iShares Bitcoin Trust (IBIT) surpassed $86 billion AUM, marking a breakthrough for institutional adoption. For retail investors, crypto wallets like Bitget Wallet provide secure, multi-chain access, making Bitcoin more accessible than ever before.

What Are the Benefits and Risks of Investing in Bitcoin vs Gold?

Every investment comes with trade-offs, and gold vs Bitcoin is no exception. Gold brings stability and long-standing trust, while Bitcoin offers high growth with equally high volatility. Understanding their pros and cons helps you balance opportunity with risk.

What Are the Pros and Cons of Bitcoin?

- Pros: Fixed supply, massive long-term gains, borderless transactions, growing institutional adoption.

- Cons: Extreme volatility, regulatory uncertainty, higher correlation with equities.

What Are the Pros and Cons of Gold?

- Pros: Stability, universal trust, central bank support, reliable hedge.

- Cons: Limited upside, storage costs, slower growth.

| Asset | Pros | Cons |

| Bitcoin | Explosive long-term gains, digital gold narrative, accessible via wallets & ETFs | High volatility, regulatory risk, equity-like correlation |

| Gold | Stability, central bank trust, proven safe haven | Limited upside, storage & intermediary costs |

This comparison highlights that the gold vs crypto decision is not either/or — it’s about choosing stability versus growth.

Which Has Higher Long-Term Potential – Gold or Bitcoin?

Experts remain divided. Some argue Bitcoin could surpass gold’s $13 trillion market cap. Others — including Wharton economists — caution that Bitcoin lacks intrinsic value and could never fully replace gold.

Still, Bitcoin is maturing rapidly. With ETF adoption, institutional flows, and growing retail use, Bitcoin’s long-term potential is undeniable. Gold’s 5,000-year history guarantees it will remain relevant, but Bitcoin’s upside may exceed gold in a digital-first world.

Should You Invest in Gold or Bitcoin in 2026?

Choosing between gold and Bitcoin in 2026 isn’t about picking a winner, but about aligning with your goals and risk tolerance. Both assets serve different purposes — gold for stability, Bitcoin for growth — and the smartest portfolios often hold a mix of the two.

Is Diversification the Smartest Strategy?

Most experts agree: the wisest move is to own both. Michael Venuto summarized it perfectly: “Why not both?”. Gold anchors portfolios; Bitcoin adds asymmetric upside.

Why Are More Investors Leaning Toward Bitcoin?

Institutional ETFs, retail access, and wallets like Bitget Wallet make Bitcoin increasingly attractive. For younger investors, it represents not just diversification, but a stake in the future of money.

Conclusion

Gold vs Bitcoin represents two very different approaches to protecting wealth in 2026. Gold remains the traditional safe haven, trusted for stability and central bank backing. Bitcoin, meanwhile, is the growth engine: volatile, risky, but with transformative upside.

The smartest approach is diversification. Gold provides ballast; Bitcoin provides opportunity. And as the world digitizes, Bitcoin is increasingly viewed as digital gold.

For those ready to take part, Bitget Wallet offers a secure, simple way to buy, store, and manage Bitcoin. Download it today — and be part of the future of digital wealth.

Sign up Bitget Wallet now - grab your $2 bonus!

FAQs

Is Bitcoin a better investment than gold?

Bitcoin has delivered far higher returns but with extreme volatility. Gold offers stability with lower growth.

Should I invest in gold or Bitcoin in 2026?

Most experts recommend holding both for balance.

Does Bitcoin hedge inflation better than gold?

Bitcoin’s 10-year returns crush inflation, but gold has the longer proven track record as an inflation hedge.

How correlated are gold and Bitcoin?

In 2026, their correlation has dropped close to zero — they now behave like distinct asset classes.

Risk Disclosure

Please be aware that cryptocurrency trading involves high market risk. Bitget Wallet is not responsible for any trading losses incurred. Always perform your own research and trade responsibly.