What Is Pacifica ($PACIFICA): Solana PerpDex Token Driving the Next Wave of On-Chain Derivatives

Pacifica ($PACIFICA) is more than just another crypto token—it stands for precision, speed, and a trader-first approach. In the world of on-chain derivatives, it blends high-performance engineering with smart risk management, offering a fresh perspective on decentralized trading.

Supported by experienced exchange operators and an active Solana-native community, Pacifica ($PACIFICA) is shaping the next generation of decentralized perpetuals. Traders and early adopters can access, trade, and manage PACIFICA safely using Bitget Wallet, enjoying a smooth Web3 experience and full access to the token’s features. This guide will cover everything you need to know about PACIFICA so you can explore its potential and participate in its growing ecosystem.

Key Takeaways

- Pacifica is a Solana-based perpetual DEX focused on CEX-like speed and reliability.

- The PACIFICA token is designed to align incentives across traders, liquidity providers, and the protocol.

- Listing details are to be announced; follow official channels for premarket and mapping updates.

What is Pacifica?

Pacifica (PACIFICA) is a governance and utility token on the Solana blockchain powering Pacifica, a modern perpetuals exchange (PerpDex). The project embodies the following values:

- Performance: Low-latency order execution and high throughput on Solana.

- Trust and transparency: On-chain settlement with auditable risk parameters.

- Community alignment: Incentives for traders, makers, and long-term contributors.

Pacifica (PACIFICA) not only inherits the spirit of crypto-native transparency but also applies it to derivatives trading to build a sustainable, trustworthy, and collaborative community.

Pacifica’s mainnet PerpDex has launched with core markets like BTC, ETH, and SOL, emphasizing fast execution, cross/isolated margin, and a points-based early participation program. Further announcements regarding PACIFICA token listing, mapping, and rewards are expected in upcoming official updates.

What is PerpDex?

A PerpDex is a decentralized exchange for perpetual futures—derivative contracts without expiration. Traders can go long or short with leverage, pay or receive funding to keep perp prices in line with spot, and benefit from on-chain transparency. Compared with centralized exchanges, PerpDexes provide: • Self-custody and programmable risk controls. • Composable liquidity and settlement on public chains. • Open access without custodial account requirements.

Projector (token) Listing Details and Launch Date

1. Key Listing Information

Here are the important details about the Pacifica (PACIFICA) listing:

- Exchange: to be announced

- Trading Pair: PACIFICA/USDT

- Deposit Available: To be announced

- Trading Start: To be announced

- Withdrawal Available: To be announced

Don’t miss your chance to start trading Pacifica (PACIFICA) on Bitget / exchanges and be part of this groundbreaking journey.

- Please refer to the official announcement for the most accurate schedule.

2. Exclusive Campaigns and Rewards

To celebrate the listing, Bitget / exchanges may launch special campaigns for Pacifica (PACIFICA): • Campaign 1: Lock BTC or USDT to earn PACIFICA airdrop allocations. • Campaign 2: Buy PACIFICA with credit cards at 0% fees for a limited time through Bitget Wallet.

3. Campaign Highlights

- Early-bird rewards: Bonus allocations for verified early participants.

- Trading incentives: Maker rebates and fee discounts during the launch window.

Take advantage of these exclusive offers to maximize your Pacifica (PACIFICA) holdings.

Pacifica (PACIFICA) Premarket Trading and Mapping

Pacifica has entered premarket trading on selected platforms, with expected listing prices ranging between $0.00008 and $0.00012 at launch.

For early adopters, Bitget facilitated premarket trading of Pacifica Points (PP) to provide early access and price discovery.

Premapping Period

2025-09-20 10:00 UTC – 2025-09-27 10:00 UTC - Updating

Premarket Trading

- Start: 2025-09-21 12:00 UTC - Updating

- End: 2025-09-27 12:00 UTC - Updating

Mapping Details

Premarket trades executed with Pacifica Points (PP) will be mapped to Pacifica (PACIFICA) based on the confirmed total supply and the predetermined mapping ratio:

- Mapping Ratio: Pacifica Points (PP) : PACIFICA = [Ratio, e.g., 1:10]

For example, if a user holds 5,000 PP at 0.0008 USDT each, these will be converted to 50,000 PACIFICA at a price of 0.00008 USDT each, maintaining the original value and security deposit. Users are advised to check their account balances post-mapping.

No action is required for the mapping process, as it will be automatically handled by the system. Users should ensure sufficient spot balances to facilitate delivery after the premarket period.

Pacifica (PACIFICA) Price Prediction 2025

Predicting the price of any cryptocurrency relies heavily on market trends, project fundamentals, and community adoption. With backing from trade-centric design and growing traction as a Solana-based perpetual DEX, Pacifica (PACIFICA) could see the following trajectory in 2025:

-

Stabilization Range (2025): $0.00005 – $0.00020

This is the expected band where PACIFICA might oscillate under moderate adoption, volatility, and macro crypto trends.

-

Optimistic Projection: If Pacifica maintains strong growth—expanding liquidity, onboarding high-volume traders, integrating derivatives, and sustaining ecosystem incentives—PACIFICA could reach $0.00050 – $0.0010 by end-2025.

Source: Pacifia

Key Features of Pacifica (PACIFICA)

The standout features of Pacifica (PACIFICA) are designed to combine high performance, institutional-grade tools, and on-chain decentralization. Below are three core pillars:

-

High-Performance Perpetual DEX Infrastructure

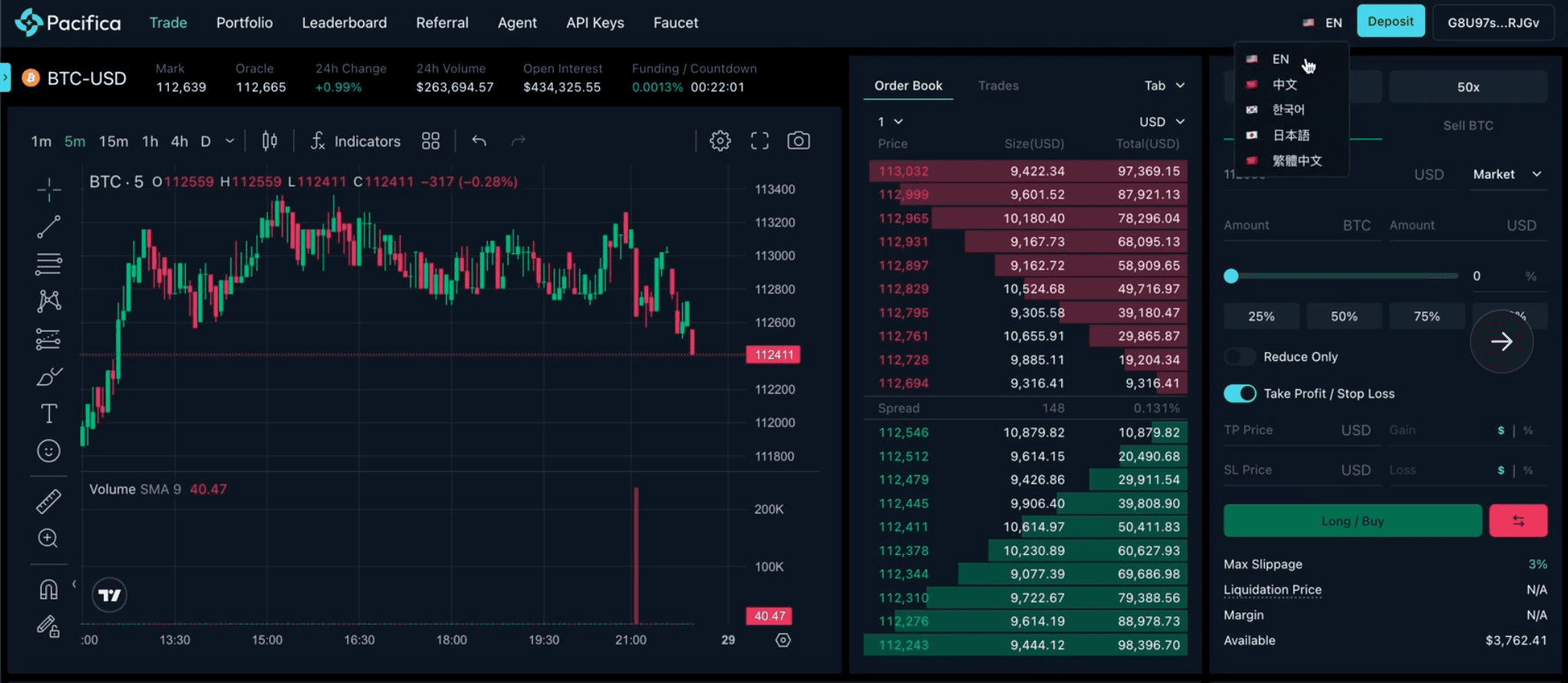

Pacifica is built to deliver CEX-like performance with DeFi-level trust. It supports trading of perpetual assets with margin & leverage (5× up to 50×), isolated and cross margin systems.

Its fee tiers are dynamically adjusted based on a trader’s 14-day volume, and sub-accounts benefit from shared tiers under a master account.

-

Advanced Order Types, APIs & Institutional Tools

Pacifica plans to support comprehensive order types (e.g. limit, stop-loss, trailing, etc.), catering to algorithmic traders and strategies.

Also, it offers REST and WebSocket APIs, empowering users to build bots, trading tools, or automation connected to real-time orderbooks.

Furthermore, sub-account capabilities allow institutional users or trading firms to segment risk per client or strategy.

-

Scalability, Throughput & Fee Efficiency

Pacifica leverages architecture improvements — for instance, via upgrades in the underlying SKALE “Pacifica” network — to enhance throughput, reduce confirmation times, and maintain low-cost execution.

The SKALE Pacifica V3 upgrade reportedly increases block mining speed by ~108% and transaction throughput by ~122%.

Also, it supports EIP-1559 style fee adjustment mechanisms for improved fee stability and predictability.

How Does Pacifica (PACIFICA) Work?

The operation of Pacifica (PACIFICA) is built around its innovative premarket → mapping → utility cycle, ensuring early adoption, liquidity, and long-term token sustainability.

-

Premarket Allocation via Pacifica Points (PP)

Before the official listing, users can acquire Pacifica Points (PP). These represent a premarket claim to PACIFICA tokens and allow early participants to establish exposure at an agreed value. This phase helps create early liquidity and sets expectations for the token price.

-

Automatic Mapping to PACIFICA

Once the listing goes live, all PP are automatically mapped to PACIFICA tokens at a fixed conversion ratio (e.g., 1:10). This ensures fair distribution while maintaining the original investment value. The mapping is handled entirely by the system—no user action is required—providing a seamless transition.

-

On-Chain Utility and Derivatives Settlement

After mapping, PACIFICA serves as a utility token within the ecosystem, powering decentralized derivatives trading. It can be used as collateral, for fee discounts, and as a governance/participation mechanism in the platform’s roadmap. Its integration with Bitget Wallet and partner DeFi platforms further enhances accessibility and liquidity.

Pacifica (PACIFICA)'s Team, Vision, and Partnerships

The Team

Pacifica (PACIFICA) is developed by a group of experienced builders and traders specializing in on-chain derivatives and decentralized exchange infrastructure. The team brings together expertise in blockchain scalability, liquidity design, and institutional-grade trading systems. Their mission goes beyond simply launching a token — they aim to make Pacifica a cultural and financial symbol of transparent, trader-first innovation in DeFi.

The Vision

At its core, Pacifica (PACIFICA) seeks to bridge the performance gap between centralized exchanges and DeFi protocols. By focusing on high-speed execution, low fees, and composable on-chain infrastructure, the project envisions a future where traders can access the same advanced features of CEXs while retaining self-custody and decentralization. The broader goal is to build a sustainable derivatives ecosystem that empowers both retail and institutional participants.

Partnerships

Pacifica (PACIFICA) has already begun forming strategic alliances with liquidity providers, infrastructure partners, and ecosystem projects to accelerate adoption. Integrations with Bitget Wallet, cross-chain bridges, and API partners expand accessibility and ensure smooth onboarding for users worldwide. These partnerships strengthen Pacifica’s position as a next-generation perpetual DEX project.

Key Use Cases of Pacifica (PACIFICA): How It’s Transforming the Derivatives / DeFi Industry

Pacifica (PACIFICA) serves several core purposes that illustrate its value in the on-chain derivatives / DeFi space:

-

Collateral & Margin Utility for Perpetuals

PACIFICA can be used as collateral in perpetual futures markets, allowing traders to open leveraged positions. Its integration into the perpetual DEX protocol gives it real functional demand beyond speculation.

-

Fee Discounts & Incentive Alignments

Traders holding PACIFICA may receive reduced trading fees, access to exclusive tiers or rebates, or bonus incentives. This encourages users to hold the token and aligns incentives with the ecosystem’s success.

-

Governance & Ecosystem Participation

PACIFICA could give holders voting rights for protocol upgrades, listing decisions, or roadmap adjustments. It also enables participation in staking or yield farming programs, deepening community control and alignment.

These applications highlight the practical value of $PACIFICA in the decentralized derivatives / DeFi sector by combining utility, incentive alignment, and governance power.

Roadmap of Pacifica (PACIFICA)

Here’s a sample roadmap layout (you’ll want to replace “milestone details” with your actual project’s schedule):

| Quarter | Milestone / Roadmap Item |

| Q1 2025 | Launch of Pacifica Points (PP) premarket, community onboarding, marketing campaigns |

| Q2 2025 | Token mapping & official listing on Bitget, first perpetual product launch |

| Q3 2025 | Expand supported perpetual assets, integrate advanced order types, launch staking / reward programs |

| Q4 2025 | Governance module, cross-chain bridges, strategic partnerships, ecosystem expansion |

How to Buy Pacifica (PACIFICA) on Bitget Wallet?

Trading Pacifica (PACIFICA) is simple and secure on Bitget Wallet. Follow these steps to get started:

Step 1: Create an Account

If you don't have an account, download the Bitget Wallet app. Sign up by providing the necessary information and verifying your identity.

Step 2: Deposit Funds

Once your account is set up, you need to deposit funds. You can do this by:

- Transferring Cryptocurrency: Send crypto from another wallet.

- Buying Crypto: Use a credit or debit card to purchase crypto directly on Bitget Wallet, ensuring you have enough funds for trading Pacifica (PACIFICA).

Step 3: Find Pacifica (PACIFICA)

In the Bitget Wallet interface, navigate to the market section. Use the search bar to find Pacifica (PACIFICA). Click on the token to view its trading page.

Since this token has not been listed yet, please refer to the final contract address provided by the project team after the token is officially listed.

Step 4: Choose Your Trading Pair

Select the trading pair you wish to use, such as PACIFICA/USDT. This will allow you to trade Pacifica (PACIFICA) against USDT or another cryptocurrency.

Step 5: Place Your Order

Decide whether you want to place a market order (buy/sell at the current market price) or a limit order (set your own price). Enter the amount of Pacifica (PACIFICA) you wish to buy or sell, then confirm your order.

Step 6: Monitor Your Trade

After placing your order, you can monitor its status in the “Open Orders” section. Once the order is executed, you can check your balance to see your newly acquired Pacifica (PACIFICA)

Step 7: Withdraw Your Funds (Optional)

If you wish to transfer your Pacifica (PACIFICA) or any other cryptocurrency to another wallet, navigate to the withdrawal section, enter your wallet address, and confirm the transaction.

▶Learn more about Pacifica (PACIFICA):

- What is Pacifica (PACIFICA)?

- Pacifica (PACIFICA) Airdrop Guide

- Pacifica (PACIFICA) Listing Date and How to Buy It

Conclusion

Pacifica (PACIFICA) is positioning itself as a promising project in the on-chain derivatives space, with strong fundamentals, innovative features, and a roadmap that highlights sustainable growth. Its focus on liquidity, trader-first design, and cultural relevance makes PACIFICA a token worth watching as the ecosystem matures.

Buying PACIFICA through Bitget Wallet offers users a seamless, secure, and efficient experience. With multi-chain support, easy fiat on-ramps, and industry-leading security, Bitget Wallet empowers investors to trade confidently and manage their digital assets in one place. By using Bitget Wallet to access PACIFICA, you not only gain exposure to a rising project but also enjoy the full benefits of a trusted Web3 gateway.

Sign up Bitget Wallet now - grab your $2 bonus!

FAQs

1. Where can I buy Pacifica (PACIFICA)?

You can buy PACIFICA on Bitget Wallet, a secure and user-friendly Web3 wallet that supports multi-chain trading. Simply download the app, deposit funds, and search for PACIFICA once the token is officially listed.

2. Is Pacifica (PACIFICA) a safe investment?

As with any cryptocurrency, PACIFICA carries market risks. However, the project’s focus on on-chain derivatives, strong community support, and growth roadmap make it a promising option for traders seeking exposure to innovative DeFi solutions. Always do your own research (DYOR) before investing.

3. Why should I use Bitget Wallet to buy PACIFICA?

Bitget Wallet offers multi-chain support, secure storage, fiat on-ramps, and easy token swaps, making it one of the best ways to trade PACIFICA. With its user-first design and integration with Web3 dApps, Bitget Wallet ensures you can buy, hold, and manage PACIFICA efficiently and securely.

Risk Disclosure

Please be aware that cryptocurrency trading involves high market risk. Bitget Wallet is not responsible for any trading losses incurred. Always perform your own research and trade responsibly.

- How to Buy 404 Coin in 2026: A Beginner’s Step-by-Step Guide to 404 Coin2026-02-20 | 5mins