What Is Mutuum Finance (MUTM): Inside the DeFi Lending Platform and Investment Considerations

Mutuum Finance (MUTM) is a crypto project that focuses on financial things. It is, about people trusting each other being honest and letting everyone use financial services. Mutuum Finance is working in the area of lending and borrowing money without banks. It uses computer codes to help people lend, borrow and manage digital money on their own. This means people do not need to go through banks or other middlemen to do these things with Mutuum Finance. Mutuum Finance makes it possible for people to deal with assets in a simple way.

People who like DeFi are getting behind Mutuum Finance, which is also known as MUTM. Mutuum Finance is getting a lot of attention because it is a project that could be good for a long time. Mutuum Finance has some cool tools, like Bitget Wallet, that help users do things with MUTM. For example you can use Bitget Wallet to keep your Mutuum Finance safe trade it with things and use it in different ways. This is all possible because Bitget Wallet is easy to use and you are, in control of your Mutuum Finance, not someone.

Key Takeaways

- Mutuum Finance (MUTM) is a decentralized finance lending and borrowing system that wants to change the way people lend and borrow cryptocurrency. It does this by using pooled money and special computer codes called contracts. Mutuum Finance is really about making it easier for users to lend and borrow crypto using this system. The main goal of Mutuum Finance is to help people, with this process. Mutuum Finance lending and borrowing protocol is what makes it all work.

- The $MUTM token is really important for the project. It helps with a lot of things like making sure people get their dividends and letting them have a say, in how thingsre run with the projects $MUTM token.

- Mutuum Finance has a multi-phase roadmap with ongoing presale stages and plans for a V1 protocol launch, though users should conduct own research before participating.

What is Mutuum Finance (MUTM)?

Mutuum Finance (MUTM) is a utility token built on a smart-contract blockchain designed to support a decentralized lending and borrowing ecosystem. The project represents a modern interpretation of mutual finance, where users can lend, borrow, and earn yields without relying on centralized intermediaries.

At its core, Mutuum Finance is built around three key values:

- Mutual trust through transparent, on-chain transactions

- Financial accessibility for users across global markets

- Community-driven growth powered by decentralized governance

By combining these principles with blockchain technology, Mutuum Finance (MUTM) applies the idea of mutual cooperation to the DeFi lending and borrowing sector, aiming to build a sustainable, secure, and collaborative financial network.

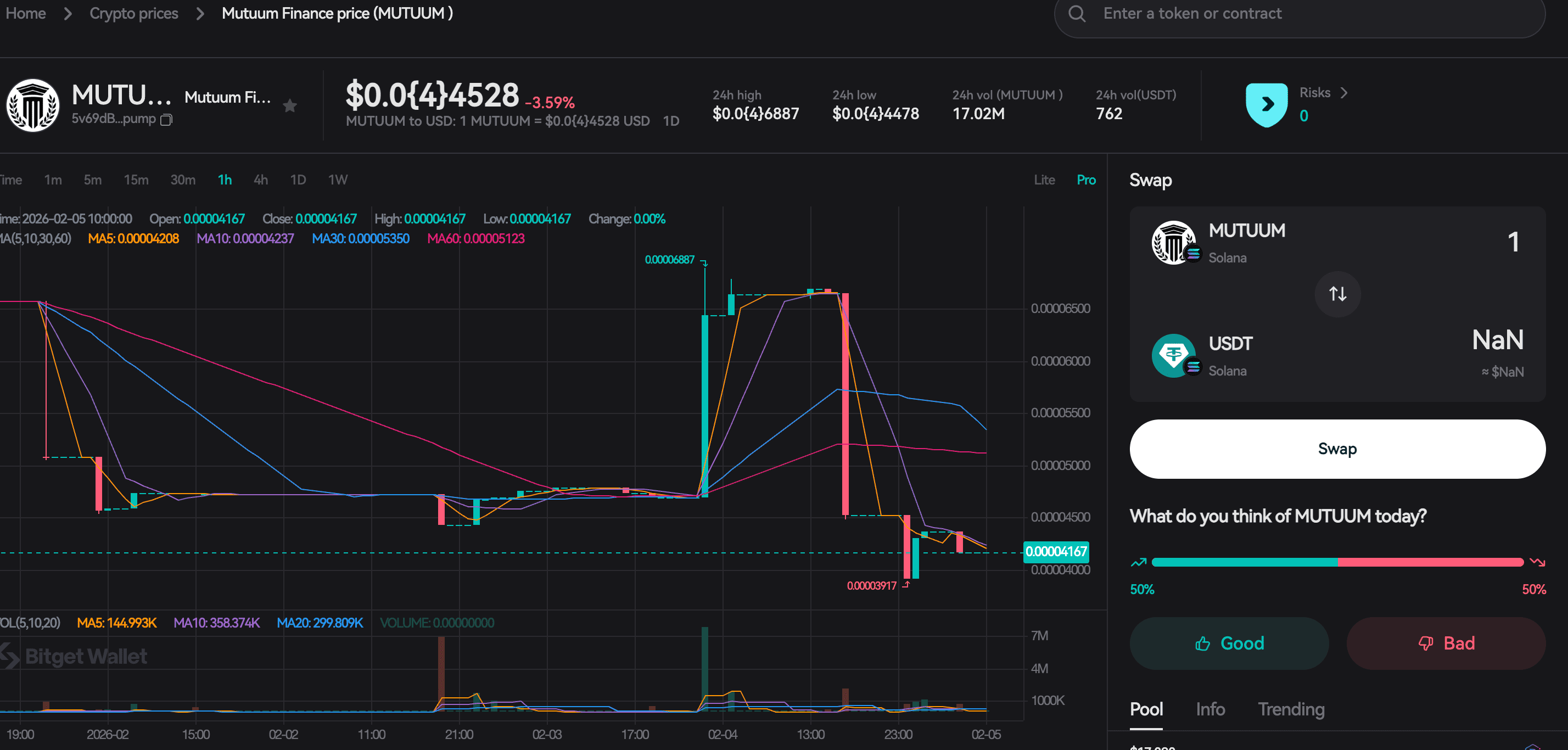

Source Bitget Wallet

Short News Update

Mutuum Finance (MUTM) has recently gained attention within the DeFi community as interest in decentralized lending protocols continues to grow. The project’s focus on transparency, user-controlled assets, and long-term utility has positioned it as an emerging name to watch in the evolving crypto finance landscape.

Mutuum Finance (MUTM) Listing Details and Launch Date

1. Key Listing Information

As of now, the official exchange listing details for Mutuum Finance (MUTM) have not been fully confirmed. Below is the currently available information, subject to updates from the project team and exchange announcements:

- Exchange: Bitget Wallet (to be officially announced)

- Trading Pair: MUTM/USDT (expected)

- Deposit Available: To be announced

- Trading Start: To be announced

- Withdrawal Available: To be announced

Once listed, users will be able to trade Mutuum Finance (MUTM) on Bitget Wallet , gaining access to deep liquidity and a user-friendly trading environment.

Please always refer to the official announcements from Mutuum Finance and Bitget for the most accurate and up-to-date schedule.

2. Exclusive Campaigns and Rewards

To celebrate the official listing of Mutuum Finance (MUTM), Bitget Wallet may introduce limited-time promotional campaigns, which could include:

- Trading rewards: Bonus MUTM tokens for users who complete spot trading tasks

- Fee promotions: Reduced or zero trading fees for MUTM/USDT during the launch period

Specific campaign mechanics and eligibility requirements will be announced closer to the listing date.

3. Campaign Highlights

- Early access opportunities for new and existing Bitget users

- Incentives designed to increase liquidity and community participation

These campaigns aim to help users engage with Mutuum Finance (MUTM) from the early stages while maximizing potential rewards.

Mutuum Finance (MUTM) Premarket Trading and Mapping

Prior to the official exchange listing, Mutuum Finance (MUTM) has been discussed across various premarket platforms, where early price discovery may take place. Initial market expectations suggest a launch price range that will be determined by demand and liquidity at listing.

For early participants, Bitget Wallet may support premarket trading mechanisms to facilitate transparent price discovery ahead of spot trading. Details regarding the premarket phase and any potential token mapping process will be announced officially.

- Premapping Period: To be announced

- Premarket Trading Start Time: To be announced

- Premarket Trading End Time: To be announced

Users are advised to monitor official channels closely and ensure sufficient balances if participating in any premarket or launch-related activities.

Mapping Details

Premarket trades executed with [stand-in token, e.g., [Token Points (TOKEN)]] will be mapped to Mutuum Finance (MUTM) based on the confirmed total supply and the predetermined mapping ratio:

-

Mapping Ratio:

[Stand-in Token] : [Token Name] = [Ratio, e.g., 1:10]

For example, if a user holds 5,000 [Stand-in Tokens] at 0.0008 USDT each, these will be converted to 50,000 $[Token Name] at a price of 0.00008 USDT each, maintaining the original value and security deposit. Users are advised to check their account balances post-mapping.

No action is required for the mapping process, as it will be automatically handled by the system. Users should ensure sufficient spot balances to facilitate delivery after the premarket period.

Mutuum Finance (MUTM) Price Prediction 2026

Price predictions in the crypto market depend heavily on broader market conditions, project fundamentals, and real user adoption. As an early-stage DeFi project, Mutuum Finance (MUTM) is still in its price-discovery phase, meaning volatility should be expected.

If Mutuum Finance continues to build its lending and borrowing infrastructure, attracts active users, and maintains steady development progress, MUTM could trade within a moderate consolidation range during 2026 as the market evaluates its long-term utility. This range will largely be influenced by overall DeFi sentiment, liquidity conditions, and platform adoption.

Source: Bitget Wallet

Key Features of Mutuum Finance (MUTM)

The core features of Mutuum Finance (MUTM) are designed to support a transparent and user-driven DeFi lending ecosystem:

- Decentralized Lending and Borrowing Mutuum Finance enables users to lend and borrow digital assets through smart contracts, removing the need for centralized intermediaries. All transactions are executed on-chain, ensuring transparency, automation, and trustless interaction between participants.

- Liquidity Pool–Based Model The protocol uses pooled liquidity, allowing lenders to earn yields by supplying assets while borrowers access liquidity instantly. Interest rates are dynamically adjusted based on supply and demand, helping maintain balance and efficiency within the system.

- Non-Custodial and User-Controlled Assets Mutuum Finance is built with a non-custodial architecture, meaning users retain full control over their assets at all times. Funds are managed via smart contracts rather than third parties, reducing counterparty risk and enhancing overall security.

How Mutuum Finance (MUTM) Works and Delivers Value?

The functionality of Mutuum Finance (MUTM) is centered on its decentralized lending and borrowing protocol, which is designed to operate transparently through smart contracts.

- On-Chain Lending and Borrowing Users can supply supported crypto assets into liquidity pools and earn interest, while borrowers can access liquidity by providing collateral. All lending and borrowing activities are executed automatically through smart contracts, reducing reliance on intermediaries.

- Dynamic Interest Rate Mechanism Interest rates on Mutuum Finance adjust based on real-time supply and demand within liquidity pools. This mechanism helps balance borrowing demand with available liquidity, creating a more efficient and self-regulating DeFi market.

- Protocol Utility and Incentives The MUTM token is designed to support the ecosystem by aligning user incentives with long-term platform growth. As protocol activity increases, token utility is expected to expand through governance participation, ecosystem incentives, and potential fee-related mechanisms.

By combining community participation, transparent on-chain logic, and decentralized financial infrastructure, Mutuum Finance (MUTM) aims to deliver sustainable value within the DeFi ecosystem.

Mutuum Finance (MUTM)'s Team, Vision, and Partnerships

The Team

Mutuum Finance (MUTM) is developed by a DeFi-focused team with experience in blockchain technology, smart contract development, and decentralized financial products. The team’s goal goes beyond launching a token—they aim to build a protocol that reflects the values of mutual trust, openness, and financial accessibility.

The Vision

At its core, Mutuum Finance seeks to democratize access to lending and borrowing services by removing centralized gatekeepers. The long-term vision is to create a sustainable DeFi ecosystem where users can interact with financial products transparently, securely, and without permission.

Partnerships

Mutuum Finance continues to explore collaborations across the DeFi and Web3 ecosystem, including infrastructure providers, wallet platforms, and community partners. These partnerships are intended to strengthen protocol security, usability, and long-term ecosystem growth as development progresses.

Key Use Cases of Mutuum Finance (MUTM): How It’s Transforming [Industry]

Mutuum Finance (MUTM) supports several practical use cases within decentralized finance, including:

-

Passive Yield Generation

Users can supply idle crypto assets to liquidity pools and earn yields without giving up custody of their funds.

-

Capital Efficiency for Borrowers

Borrowers can unlock liquidity by using crypto assets as collateral, enabling trading, investment, or liquidity management without selling holdings.

-

DeFi Portfolio Management

MUTM enables users to integrate lending and borrowing strategies into broader DeFi portfolios, especially when accessed through non-custodial tools like Bitget Wallet.

These use cases highlight the real-world utility of MUTM within the DeFi lending and borrowing sector, positioning Mutuum Finance as a functional protocol rather than a purely speculative asset.

Mutuum Finance (MUTM) Roadmap: Key Milestones and Future Developments

The Mutuum Finance (MUTM) roadmap focuses on progressive protocol development, security, and ecosystem expansion within decentralized finance.

| Roadmap Highlights | |

| Q1 2026 | Protocol testing and audits, smart contract optimization, early community onboarding |

| Q2 2026 | Initial protocol launch, core lending and borrowing features enabled, liquidity growth phase |

| Q3 2026 | Feature upgrades, improved risk management mechanisms, governance framework preparation |

| Q4 2026 | Ecosystem expansion, strategic integrations with wallets and DeFi tools, long-term scalability planning |

Each milestone is designed to strengthen protocol stability, user trust, and real-world usability, reinforcing the practical role of MUTM within the DeFi lending and borrowing ecosystem.

How to Buy Mutuum Finance (MUTM) on Bitget Wallet?

Trading Mutuum Finance (MUTM) is easy on Bitget Wallet. Follow these simple steps to get started:

Step 1: Create an Account

If you don't have an account, download the Bitget Wallet app. Sign up by providing the necessary information and verifying your identity.

Step 2: Deposit Funds

Once your account is set up, you need to deposit funds. You can do this by:

- Transferring Cryptocurrency: Send crypto from another wallet.

- Buying Crypto: Use a credit or debit card to purchase crypto directly on Bitget Wallet, ensuring you have enough funds for trading Mutuum Finance (MUTM).

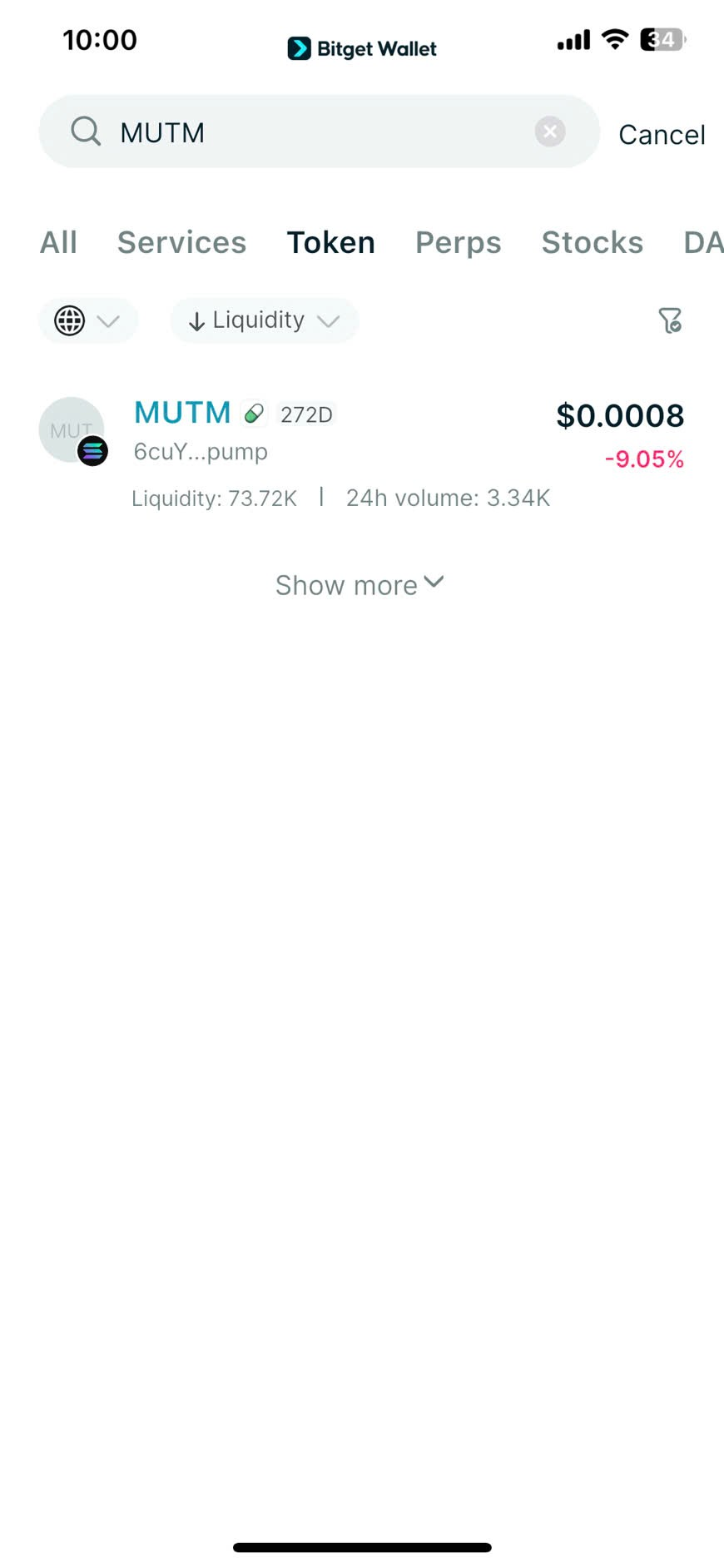

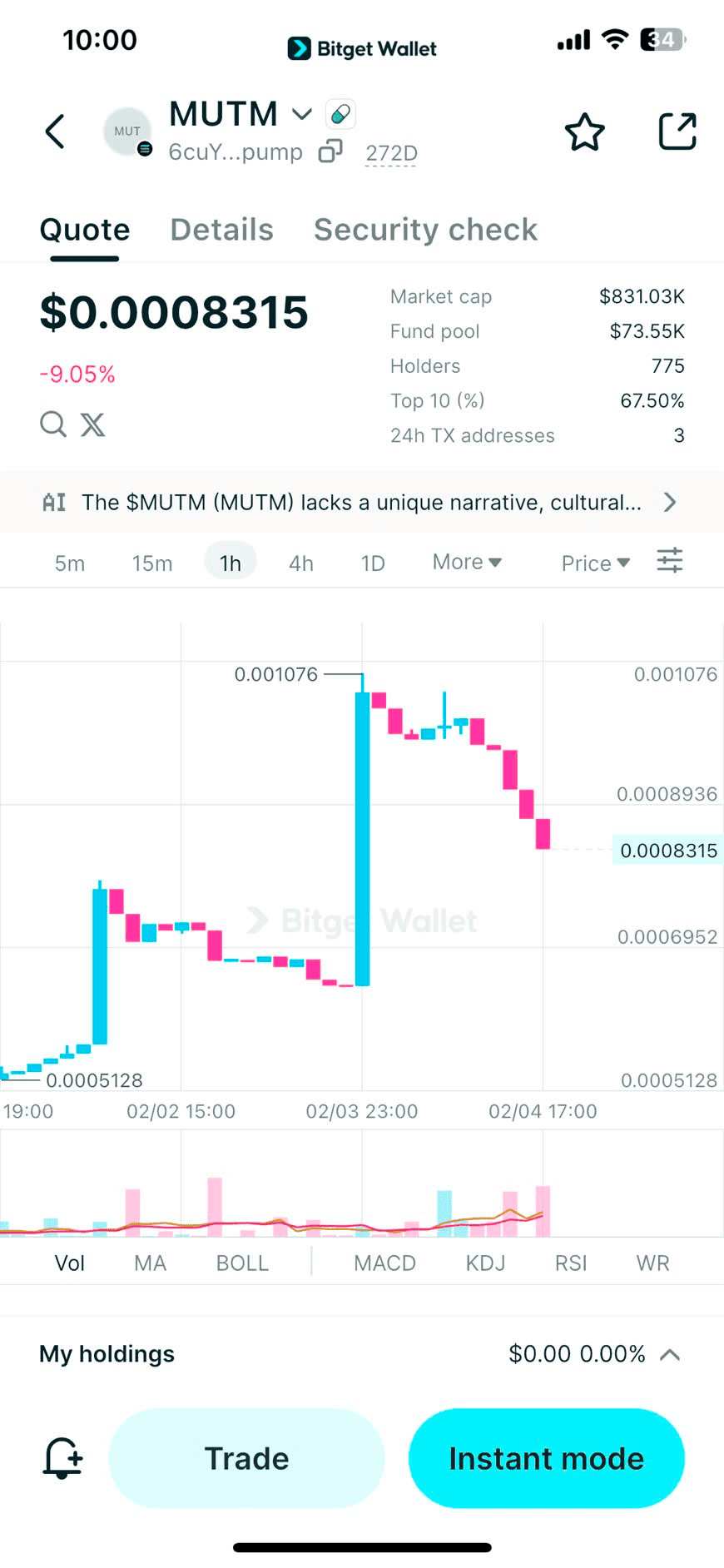

Step 3: Find Mutuum Finance (MUTM)

In the Bitget Wallet interface, navigate to the market section. Use the search bar to find Mutuum Finance (MUTM). Click on the token to view its trading page.

Since this token has not been listed yet, please refer to the final contract address provided by the project team after the token is officially listed.

Step 4: Choose Your Trading Pair

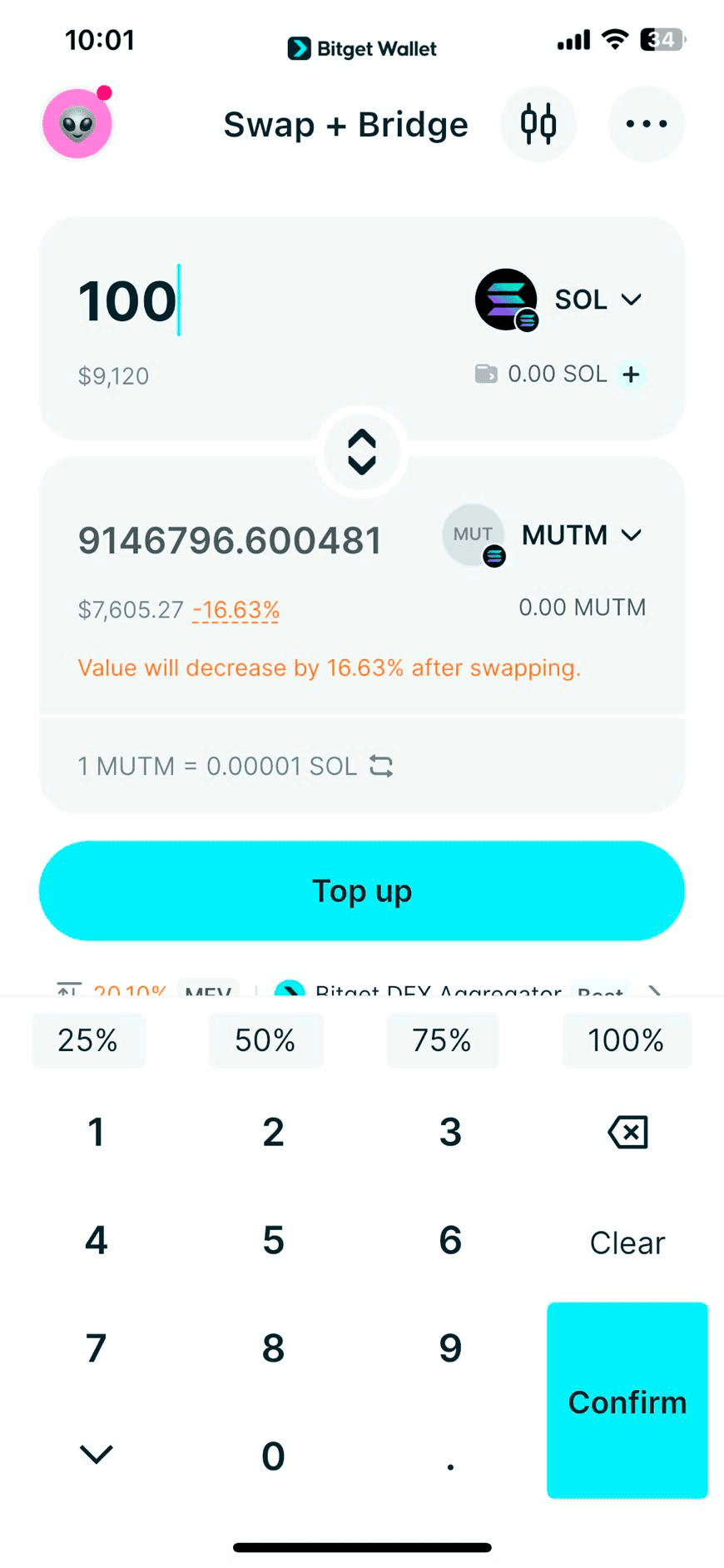

Select the trading pair you wish to use, such as [Token Name]/USDT. This will allow you to trade Mutuum Finance (MUTM) against USDT or another cryptocurrency.

Step 5: Place Your Order

Decide whether you want to place a market order (buy/sell at the current market price) or a limit order (set your own price). Enter the amount of Mutuum Finance (MUTM) you wish to buy or sell, then confirm your order.

Step 6: Monitor Your Trade

After placing your order, you can monitor its status in the “Open Orders” section. Once the order is executed, you can check your balance to see your newly acquired Mutuum Finance (MUTM).

Step 7: Withdraw Your Funds (Optional)

If you wish to transfer your Mutuum Finance (MUTM) or any other cryptocurrency to another wallet, navigate to the withdrawal section, enter your wallet address, and confirm the transaction.

▶Learn more about Mutuum Finance (MUTM):

- What is Mutuum Finance (MUTM)?

- Mutuum Finance (MUTM) Airdrop Guide

- Mutuum Finance (MUTM) Listing Date and How to Buy It

Conclusion

Mutuum Finance (MUTM) stands out as a DeFi project focused on transparent lending, borrowing, and user-controlled finance, rather than short-term hype. By leveraging smart contracts and a non-custodial model, the protocol aims to provide practical financial tools that align with the core values of decentralized finance—trust, openness, and accessibility.

For users looking to explore Mutuum Finance (MUTM) safely and efficiently, Bitget Wallet offers a reliable entry point. With non-custodial asset control, seamless token swaps, and integrated DeFi access, Bitget Wallet makes it easier to manage MUTM while maintaining full ownership of private keys. Combined with features like zero-fee swaps on select assets and a user-friendly interface, Bitget Wallet helps users participate in DeFi with greater confidence and flexibility.

Sign up Bitget Wallet now - grab your $2 bonus!

FAQs

1. What is Mutuum Finance (MUTM) used for?

Mutuum Finance (MUTM) is designed to support a decentralized lending and borrowing ecosystem. Users can lend assets to earn yields or borrow against collateral through smart contracts.

2. Is Mutuum Finance (MUTM) safe to use?

Like all DeFi protocols, Mutuum Finance carries smart contract and market risks. Users should always conduct their own research and use trusted non-custodial wallets such as Bitget Wallet for better asset control.

3. How can I buy or manage MUTM tokens?

Once available, MUTM can be purchased or swapped through supported platforms and managed using Bitget Wallet, which allows users to store, swap, and interact with DeFi tokens securely without giving up custody.

Risk Disclosure

Please be aware that cryptocurrency trading involves high market risk. Bitget Wallet is not responsible for any trading losses incurred. Always perform your own research and trade responsibly.

- How to Buy 404 Coin in 2026: A Beginner’s Step-by-Step Guide to 404 Coin2026-02-20 | 5mins