What Is Lithos (LITH): Plasma DeFi Protocol With Community Revenue Sharing and Long-Term Price Forecast

What Is Lithos (LITH)? Rooted in the principles of sustainable tokenomics, Lithos (LITH) bridges governance innovation and long-term value alignment within the decentralized finance (DeFi) industry. It leverages blockchain and a ve(3,3) model to enhance participation in the digital economy, ensuring community-driven protocols remain relevant and resilient in a rapidly evolving financial landscape.

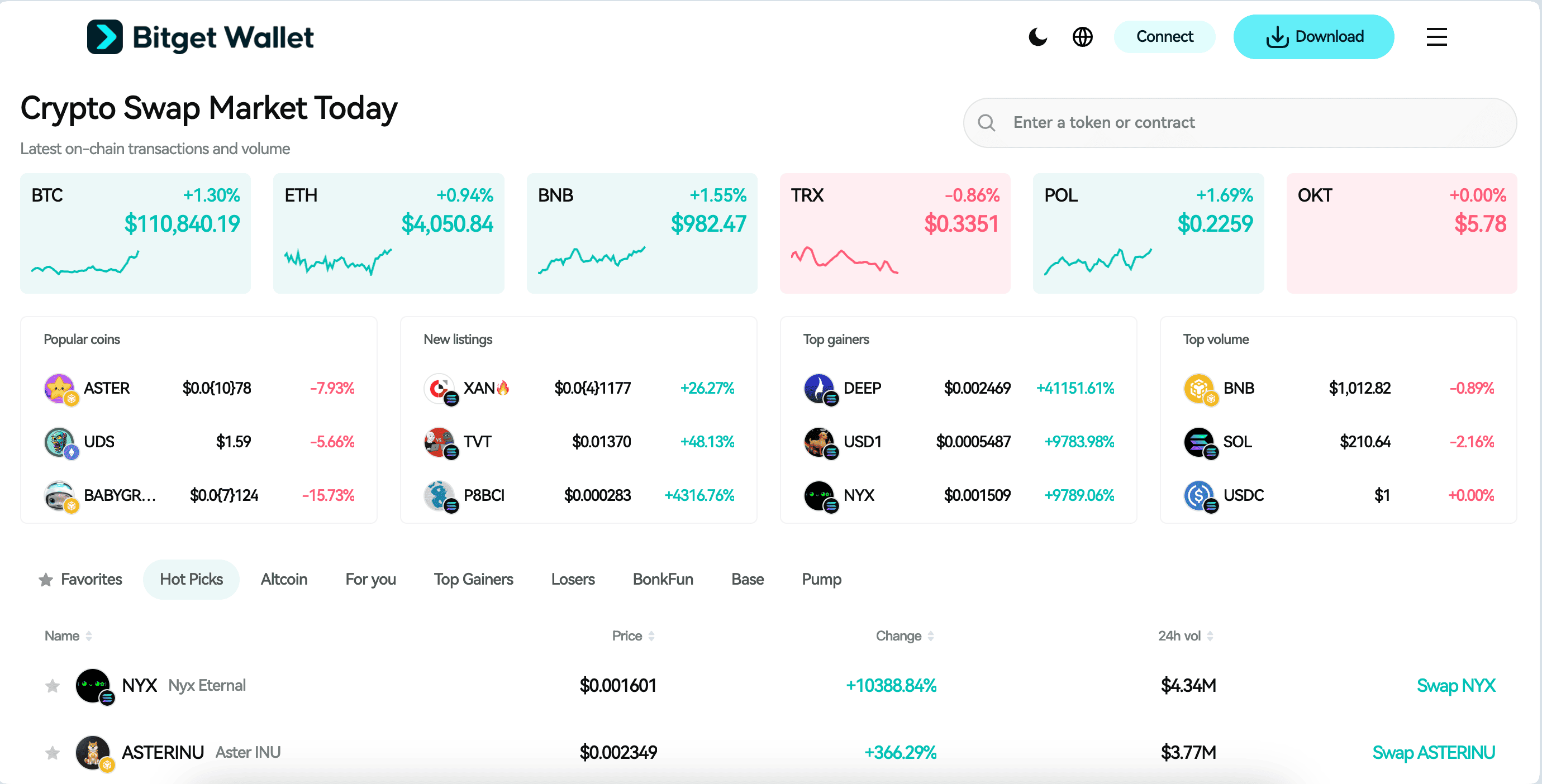

Thanks to the Plasma ecosystem and early DeFi collaborators, Lithos (LITH) is reshaping digital assets by enabling governance, incentives, and revenue sharing. More than just a token, it underpins liquidity, voting, and sustainable value in DeFi. Paired with Bitget Wallet’s secure stablecoin storage, hot memecoin trading, and seamless cross-chain experience, investors gain both innovation and reliability in one ecosystem.

Through this article, we explore Lithos (LITH), outlining its vision, unique characteristics, and market prospects. Whether you’re assessing its real-world functionality, investment potential, or broader impact, this guide helps you navigate its significance in the crypto space.

Key Takeaways

- Plasma-Native DeFi Protocol – Lithos leverages the Plasma ecosystem to deliver sustainable, governance-driven finance.

- ve(3,3) Tokenomics – Locking LITH into veLITH provides voting power, rewards, and protection against dilution.

- Revenue Sharing Model – Lithos distributes fees and emissions back to its community, aligning long-term value with participants.

What Is Lithos (LITH): What You Should Know?

Lithos (LITH) is a governance and utility token based on the Plasma blockchain that represents a modern version of sustainable, community-driven finance. The project embodies the following values:

- Sustainability – cash-flow based tokenomics with revenue sharing

- Governance – ve(3,3) model ensuring community-driven decision-making

- Incentive Alignment – rewards that protect long-term participants from dilution

Lithos (LITH) not only reflects the spirit of decentralized collaboration but also applies it to the DeFi industry, building a sustainable, trustworthy, and growth-oriented ecosystem.

Source: X

On October 1, 2025, Lithos (LITH) will launch its Genesis Event, introducing initial liquidity pools for XPL/USDT and USDe/USDT. These trading pairs are designed to bootstrap liquidity and expand market access for the Lithos ecosystem. By anchoring against stablecoins and Plasma-native assets, the new pairs aim to reduce slippage, attract early liquidity providers, and strengthen Lithos’s positioning as a Plasma-native DeFi protocol built on ve(3,3) tokenomics.

Read more: Plasma Listing Details: Launch Date and Where to Buy $XPL

Lithos (LITH) Listing Details and Launch Date

1. Key Listing Information

Here are the important details about the Lithos (LITH) listing:

- Exchange: To be announced

- Trading Pair: LITH/USDT

- Deposit Available: To be announced

- Trading Start: To be announced

- Withdrawal Available: To be announced

Don’t miss your chance to start trading Lithos (LITH) on upcoming exchanges and be part of this groundbreaking journey.

- Please refer to the official announcement for the most accurate schedule.

Lithos (LITH) Market Trends & Price Predictions 2025

Lithos (LITH)’s price is determined by market trends, ecosystem strength, and adoption levels. With its Plasma-native design and ve(3,3) governance model, Lithos (LITH) could follow a trajectory similar to comparable tokens such as Velodrome (VELO), Thena (THE), and Equalizer (EQUAL). Based on these parallels, LITH may maintain a price range of $0.02 – $0.10 in its early trading phase. Future expansion and deeper involvement in DeFi liquidity and governance may push its valuation to $0.20 – $0.30 in the longer term.

Factors Influencing the Price of Lithos (LITH)

Several crucial aspects contribute to the growth potential of Lithos (LITH):

- Market Trends: Overall DeFi sentiment, Bitcoin’s performance, and capital inflows into Layer-2 ecosystems will shape demand.

- Adoption & Real-World Utility: Locking LITH into veLITH for voting, rewards, and emissions protection drives participation and creates sticky demand.

- Project Advancements: Successful execution of liquidity pools, trading pairs, and governance features will enhance long-term confidence.

Long-Term Growth Potential

Should Lithos (LITH) continue its expansion in DeFi infrastructure and governance, demand could rise, resulting in higher valuations. Analysts comparing it to other ve(3,3) tokens believe sustained innovation and adoption could drive its price toward $0.20 – $0.30, but investors should remain mindful of regulatory risks, token dilution, and market volatility.

Source: Comparable ve(3,3) tokens (Velodrome, Thena, Equalizer)

Source: Bitget Wallet

Explore Lithos (LITH) easily with Bitget Wallet — offering Secure Stablecoin Storage, Hot Memecoin Trading, and a Seamless Multi‑chain Experience, all in one beginner‑friendly app.

Why Lithos (LITH) Stands Out: Essential Features

The standout features of Lithos (LITH) include:

-

ve(3,3) Governance Model

Lithos uses a vote-escrowed system where users lock LITH into veLITH to gain voting power, earn rewards, and protect themselves from dilution. This model ensures long-term alignment between token holders, liquidity providers, and protocol growth.

-

Revenue Sharing Flywheel

Trading fees and emissions are recirculated back to veLITH holders and liquidity providers, building a cash-flow-driven, sustainable ecosystem. This "flywheel effect" enhances participation and incentivizes reinvesting, making Lithos less dependent on short-term incentives.

-

Plasma-Native Infrastructure

As a DeFi protocol on the Plasma blockchain, Lithos enjoys high throughput, low cost, and interoperability. This provides it with a competitive advantage in offering effective liquidity solutions and governance instruments, while securing the value of the token through a developing L2 ecosystem.

The Lithos (LITH) Ecosystem: How It Functions?

Lithos (LITH) is a decentralized DeFi governance project designed to empower users through secure Plasma-native transactions, smart contract automation, and token-based incentives.

By leveraging blockchain technology, it enables seamless interactions such as staking, governance participation, and liquidity incentives. Below is a step-by-step overview of how the Lithos ecosystem works:

| Step | Process | Benefit |

| 1. Blockchain Integration | Lithos runs natively on Plasma, ensuring secure, scalable, and low-cost transactions. | Fast, decentralized, and user-friendly interactions |

| 2. Token Transactions | Users can buy, sell, and use $LITH for governance, trading, and liquidity incentives. | Expands utility and liquidity for participants |

| 3. Smart Contracts | Automates emissions, rewards, and fee distribution within the ve(3,3) model. | Efficiency, transparency, and reduced reliance on intermediaries |

| 4. Governance Participation | Token holders lock LITH into veLITH to vote on ecosystem rewards and upgrades. | Aligns incentives and gives users control of the protocol |

| 5. Staking & Yield Farming | Participants earn incentives by staking LITH and contributing to liquidity pools. | Generates passive income while strengthening ecosystem growth |

Lithos (LITH) Team: Leadership and Strategic Vision

Leadership

Lithos is developed by contributors within the Plasma and Ergo ecosystems, with expertise in DeFi tokenomics, governance, and smart contract infrastructure. The project has not formally published a core team roster, emphasizing instead its community-driven and decentralized development approach. This structure reflects its goal of aligning leadership with the same principles of transparency and incentive alignment that underpin the protocol.

Strategy

The strategic vision of Lithos centers on building a Plasma-native ve(3,3) DeFi protocol that rewards long-term participants and sustains liquidity without relying on mercenary capital. Its roadmap focuses on:

- Decentralizing mining pools with collateralized lending and Non-Interactive Share Proofs (NISPs).

- Strengthening governance by incentivizing veLITH locking and active voter participation.

- Expanding liquidity and adoption through stablecoin and Plasma-native trading pairs.

- Ensuring sustainable value capture via trading fee redistribution, protocol-owned liquidity, and emissions management.

By fusing DeFi mechanics with Plasma’s scalability, Lithos positions itself as more than a token — it aims to become a self-sustaining financial hub where governance, liquidity, and miner incentives converge.

Lithos (LITH): Practical Applications & Use Cases

Why Utility Matters for Lithos (LITH)?

Utility is at the core of Lithos (LITH)’s design. By anchoring governance, liquidity incentives, and revenue redistribution in its ve(3,3) model, the token ensures that holders are not only investors but also active participants in shaping the protocol. This utility creates long-term alignment between the community and the project’s sustainability.

Key Use Cases of Lithos (LITH)

- Governance Participation – Locking LITH into veLITH gives users voting power over liquidity incentives, emissions, and ecosystem decisions.

- Revenue Sharing – Holders benefit from redistribution of trading fees and emissions, turning LITH into a cash-flow-backed asset.

- Liquidity Incentives – LITH supports ecosystem growth by incentivizing stablecoin and Plasma-native trading pairs.

- Protocol-Owned Liquidity (POL) – The token underpins permanent liquidity reserves, ensuring depth and reducing dependence on mercenary capital.

What’s Next for Lithos (LITH)?

Lithos plans to expand its influence within the Plasma ecosystem by growing liquidity pools, deepening veLITH governance, and integrating new DeFi partnerships. With its emphasis on sustainable tokenomics and community-driven decision-making, Lithos aims to establish itself as a Plasma-native hub for governance, liquidity, and DeFi growth.

Lithos (LITH) Roadmap: What to Expect in 2025 and Beyond?

The roadmap for Lithos (LITH) outlines its first major milestone and signals future growth directions:

| Quarter | Roadmap |

| Q4 2025 | Genesis Event – launch of initial liquidity pools (XPL/USDT and USDe/USDT) to bootstrap the Plasma-native ecosystem. |

| 2026 (TBA) | Expansion of veLITH governance features, including voter-directed emissions and community-driven incentive allocation. |

| 2026 (TBA) | Development of Protocol-Owned Liquidity (POL) reserves and rollout of additional stablecoin and Plasma-native trading pairs. |

| Beyond 2026 | Ecosystem growth through cross-chain integrations, deeper DeFi partnerships, and scaling governance participation across the Plasma network. |

These milestones highlight the practical value of $LITH in the DeFi governance and liquidity sector, positioning it as a core pillar of Plasma’s decentralized finance ecosystem.

How to Buy Lithos (LITH) on Bitget Wallet?

Trading Lithos (LITH) is easy on Bitget Wallet. Follow these simple steps to get started:

Step 1: Create an Account

If you don't currently have an account, install the Bitget Wallet app. Register by inputting the required details and confirming your identity.

Step 2: Deposit Funds

After setting up an account, you must deposit money. You can do this by:

- Transferring Cryptocurrency: Transfer crypto from a different wallet.

- Purchasing Crypto: Utilize a credit or debit card to buy crypto directly from Bitget Wallet, making sure you have sufficient capital for trading Lithos (LITH).

Step 3: Find Lithos (LITH)

On the Bitget Wallet platform, go to the market area. Search for Lithos (LITH) using the search function. Click on the token to access its trading page.

As this token has not been listed yet, please look at the last contract address sent by the project team upon listing of the token.

Step 4: Choose Your Trading Pair

Select your trading pair you would like to deal with, for instance, LITH/USDT. By doing this, you will be able to exchange Lithos (LITH) for USDT or any other cryptocurrency.

Step 5: Place Your Order

Choose whether to carry out a market order—either buy or sell at the prevailing rate—or place a limit order at your desired price. Fill in the amount of Lithos (LITH) you want to exchange, then proceed to confirm in order to complete the trade.

Step 6: Monitor Your Trade

Once you have ordered, you can track the status of your order under "Open Orders." Upon completion of the order, you can view your balance to see the newly purchased Lithos (LITH).

Step 7: Withdraw Your Funds (Optional)

If you want to transfer your Lithos (LITH) or any other cryptocurrency to another wallet, go to the withdrawal section, provide your wallet address, and confirm the transaction.

Conclusion

What is Lithos (LITH)? Lithos (LITH) is a Plasma-native DeFi hub built on ve(3,3) tokenomics, designed to align governance, liquidity, and revenue sharing in a sustainable way. By redistributing fees to its community and rewarding long-term participation, Lithos stands out as more than just a token — it’s a protocol that empowers users to shape its direction and benefit from its growth.

Accessing Lithos through Bitget Wallet makes the journey seamless and secure. With multi-chain support, MPC-level protection, and integrated DeFi tools, Bitget Wallet allows you to buy, stake, and govern $LITH with confidence. The advantage is twofold: exposure to Lithos’s innovation, and the benefits of using one of the most trusted wallets in crypto.

Join the hype easily: trade the hottest tokens with Bitget Wallet, no experience needed.

Sign up Bitget Wallet now - grab your $2 bonus!

FAQs

1. What is Lithos (LITH)?

Lithos (LITH) is a Plasma-native DeFi protocol built on ve(3,3) tokenomics. It enables governance participation, liquidity incentives, and revenue sharing, making it a sustainable hub for decentralized finance.

2. How can I buy Lithos (LITH)?

You can buy $LITH through Bitget Wallet once the token is listed. Bitget Wallet supports multi-chain assets, secure trading, and direct access to DeFi tools, ensuring a smooth experience when purchasing and managing LITH.

3. What makes Lithos (LITH) different from other DeFi tokens?

Unlike many tokens that rely heavily on short-term incentives, Lithos emphasizes protocol-owned liquidity, fee redistribution, and ve(3,3) governance. This model rewards long-term participants, aligns community incentives, and reduces reliance on mercenary capital.

Risk Disclosure

Please be aware that cryptocurrency trading involves high market risk. Bitget Wallet is not responsible for any trading losses incurred. Always perform your own research and trade responsibly.

- What Is a Multi-Chain Wallet?2026-02-13 | 5 mins